Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Fifteen startupsspent the day presenting onstage in São Paulo, Brazil. For the finalists, that meant presenting twice — once in the initial rounds, then again for our finalist judges.

This was all part of Startup Battlefield Latin America, an event that we put on in partnership with FacebookFB Start program. After a full day of pitches and panels, the judges have chosen a winner, who will receive $25,000 (equity free) and a trip for two to TechCrunch Disrupt San Francisco 2019.

Check back on TechCrunch tomorrow to watch the full videos of the presentation. In the meantime, our winner (all descriptions provided by the companies):

Olho do Dono

Olho do Dono offers software that uses a portable 3D camera to estimate cattle weight, allowing cattle owners to monitor livestock weight evolution in a frequent and stress-free manner.

And our runner up:

Unima

Unima developed a fast and low-cost diagnostic and disease surveillance technology that allows anyone, even people with no technical training, to diagnose a disease at the point of care, without using lab equipment, with results in 15 minutes and at $1 per test.

And our finalists:

1Doc3

1Doc3 has developed a platform that allows users to ask healthcare questions to doctors anonymously, and for free.

Agilis

Agilis is an online asset-backed lending platform, based in Argentina. Agilis monetizes customer assets to empower them with simple and fast access to convenient financing.

Cuenca

Cuenca offers a no fee, fast response banking service.

- Details

- Category: Technology

Read more: Olho do Dono is the winner of Startup Battlefield Latin America

Write comment (95 Comments)Vine — the much loved and mourned short video hosting platform — will return, kind of, sort of. Co-creator Dom Hofmann announced on Twitter today that its spiritual successor is set to arrive next spring.

Details We don&t have many. Though Hofmann did give us a name — Byte — and logo to match. From the sound out of, things will operate similarly to Vine, with short, looping videos. So far itgot a domain and a couple of admittedly clunky social media handles.

Twitter unceremoniously shuttered Vine two years back, after acquiring it back in 2016. There certainly appears to be some desire for the network lo these many years later, given that Vine compilations are still very much a thing on one-time competitors like YouTube. Hofmann is clearly among those who believes the idea of six-second videos still has some life left in it.

He has for some time now been discussing launching his own successor to the service, initially deeming it V2. He even went so far as to launch a logo for that service, and detail the offering.Earlier this year, however, Hofmann announced that he would be postponing its launch. Things have gone completely silent until now, and you would be forgiven if that roller coaster left you skeptical about Bytelaunch.

We were apprehensive too, and hoped to see more than just a logo and landing page before declaring Vine successor would actually become reality. In response to our tweet about what progress he&d actually made so far, he claims to have funding, a team and a product:

This planned return still leaves plenty of unanswered questions about who is on the team, how the product works, and where the funding comes from, the latter of which became an issue in earlier attempts to launch the service. The Byte name, meanwhile, is borrowed from an earlier tool created by Hofmann in the wake of the original Vine.

So how did Interspace and Byte turn into this new video app Hofmann tells TechCrunch, &We paused work on our previous project at Interspace and our entire team is all in on this. Interspace is VC-funded, and I put in a little bit as well.&

The reason this all matters at such an early stage is that Vine had an incredible impact on society despite its relatively small user base. Scores of popular memes, future YouTube/Snapchat/Instagram/Musically stars, and the sponsored social content craze all came out of the app. The massive outpouring of grief when Vine 1 shut down is evidence that if Byte can even offer a facsimile of its community vibe, the youth might flock back to Dom. In an age when social media increasingly is blamed for generating envy and inauthenticity, Vine was about pure entertainment. Itworth watching if it can be revived under a different name.

- Details

- Category: Technology

Read more: Vine co-founder plans to launch successor Byte in Spring 2019

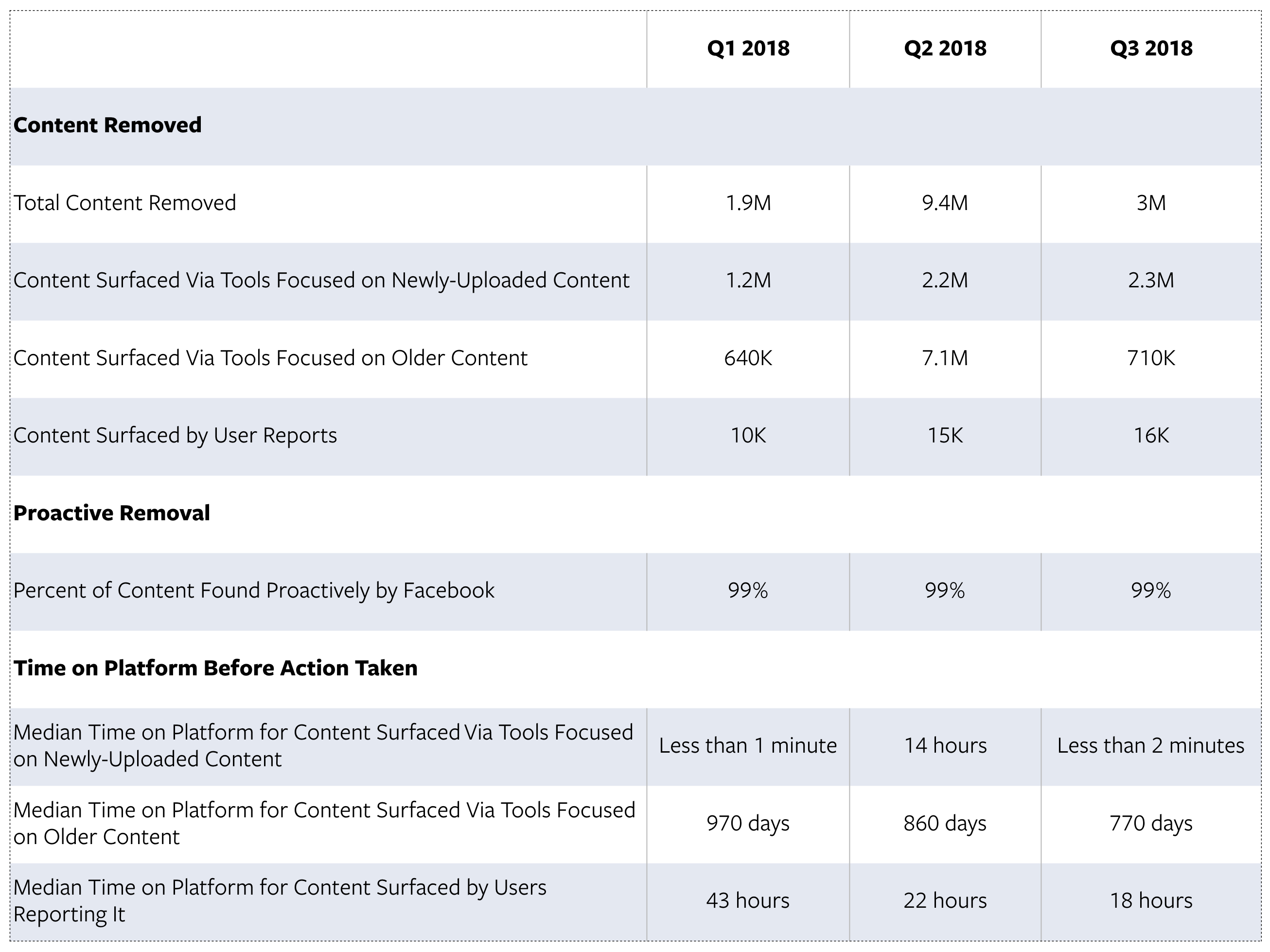

Write comment (100 Comments)Facebook must exert constant vigilance to prevent its platform from being taken over by ne&er-do-wells, but how exactly it does that is only really known to itself. Today, however, the company has graced us with a bit of data on what tools itusing and what results they&re getting — for instance, more than 14 million pieces of &terrorist content& removed this year so far.

More than half of that 14 million was old content posted before 2018, some of which had been sitting around for years. But as Facebook points out, that content may very well have also been unviewed that whole time. Ithard to imagine a terrorist recruitment post going unreported for 970 days (the median age for content in Q1) if it was seeing any kind of traffic.

Perhaps more importantly, the numbers of newer content removed (with, to Facebookcredit, a quickly shrinking delay) appear to be growing steadily. In Q1, 1.2 million items were removed; in Q2, 2.2 million; in Q3, 2.3 million. User-reported content removals are growing as well, though they are much smaller in number — around 16,000 in Q3. Indeed, 99 percent of it, Facebook proudly reports, is removed &proactively.&

Something worth noting: Facebook is careful to avoid positive or additive verbs when talking about this content, for instance it won&t say that &terrorists posted 2.3 million pieces of content,& but rather that was the number of &takedowns& or content &surfaced.& This type of phrasing is more conservative and technically correct, as they can really only be sure of their own actions, but it also serves to soften the fact that terrorists are posting hundreds of thousands of items monthly.

The numbers are hard to contextualize. Is this a lot or a little Both, really. The amount of content posted to Facebook is so vast that almost any number looks small next to it, even a scary one like 14 million pieces of terrorist propaganda.

It is impressive, however, to hear that Facebook has greatly expanded the scope of its automated detection tools:

Our experiments to algorithmically identify violating text posts (what we refer to as &language understanding&) now work across 19 languages.

And it fixed a bug that was massively slowing down content removal:

In Q2 2018, the median time on platform for newly uploaded content surfaced with our standard tools was about 14 hours, a significant increase from Q1 2018, when the median time was less than 1 minute. The increase was prompted by multiple factors, including fixing a bug that prevented us from removing some content that violated our policies, and rolling out new detection and enforcement systems.

The Q3 number is two minutes. Ita work in progress.

No doubt we all wish the company had applied this level of rigor somewhat earlier, but itgood to know that the work is being done. Notable is that a great deal of this machinery is not focused on simply removing content, but on putting it in front of the constantly growing moderation team. So the most important bit is still, thankfully and heroically, done by people.

- Details

- Category: Technology

By now, Brex, the young startup that is trying to reinvent corporate credit and charge cards, is well-known in Silicon Valley. The tender age of the companyco-founders, Henrique Dubugras and Pedro Franceschi, the big-name backers, the $125 million Series C announced last month, the aggressive billboard advertising in San Francisco and the companytorrid growth have all contributed to the swirl of attention. But, of course, it was the valuation at the last round — which placed Brex into the fintech unicorn club — that tops the list.

Recently, Brex offered up a new reason for chatter as it unveiled its new, generous rewards program that was purpose-built for the kind of entrepreneurs who aspire to match Brexsuccess. But lost in the buzz are the specifics of how Dubugras and Franceschi have approached the arcane challenge of building a payments startup.

To better understand that, chief executive Dubugras opened up about his and Franceschiprevious startup, Pagar.me, which was acquired by newly public Brazilian credit card processor StoneCo, the challenges of scaling quickly, how a Brex card compares to traditional corporate card products and the companyplan to navigate the ups and downs of business cycles. Finally, Dubugras spoke candidly but confidently about the considerable pressures facing the company now that everyone is watching.

Gregg Schoenberg: Itgood to connect again, Henrique. As you know, Brex has gotten a lot of press for having gone from from zero to fabulous in a short time. But for those who have missed the Brex story, what problems are you solving for startups

Henrique Dubugras: One is a case where the founder can&t get a credit card because they don&t have a FICO score or can&t provide a personal guarantee. Another case is when a founder can get a card, but doesn&t want to provide a personal guarantee.

GS: Which is understandable.

HD: Yes, I think itnot a very smart idea. Brex can solve that because we can issue them a card now without a personal guarantee. Finally, therethe founder who doesn&t care about the personal guarantee, but there are other things related to the experience of having a credit card that could be much better, and we&ve solved for that.

GS: The first two speak to a differentiated underwriting approach, but that third issue seems especially challenging.

HD: Yes. On the underwriting side, we take into consideration your cash balances, and the VCs that invested in you. Ita Silicon Valley way of underwriting that allows you to go from zero to a working card in like five minutes. But in terms of the third use case, yes, we had all of these people telling us, &Hey, itimpossible to rebuild credit card systems from scratch. No one has done it in the last 20 years.&

GS: Thatwhy I want to discuss Pagar.me, because I think it provides insight as to how you were able to disprove doubters.

HD: Well, we had built a payments company before, so we kind of knew how to do it and just decided to rebuild everything from scratch. You saw the Stone IPO, right

GS: I did, and buried deep in the footnotes of the S-1, it points out how much it spent on the remaining amount of Pagar.me for in 2016. So while you and Pedro built something that was a success, it wasn&t like you were able to buy an island with your proceeds.

HD: Thereanother part that wasn&t part of the IPO, but no, we still can&t buy an island.

GS: And this narrative that you and Pedro were able to come here from Brazil and in short order wave in all of this amazing funding because you had a huge exit is not accurate. Instead, I see two guys who navigated a very bureaucratic financial system…

HD: Yes.

We had this experience that was pretty unique compared to U.S. payment companies or ones from any other place.

GS: …and figured out a way to build something that was successful.

HD: Correct, but keep in mind that we built more than a product. We built an organization. It had over 100 people, was profitable, had substantial market share and it got acquired.

GS: To me, a big aspect is that you did it in a Brazilian fintech bootcamp of sorts, because building a payments company there, that achieved scale, when you did it, was hard.

HD: It was really hard. And volume-wise, Pagar.me is a big part of Stone today.

GS: You also had to deal with the regulators quite a bit

HD: Yes. The Central Bank decided to start regulating financial businesses around the time we started Pagar.me.

GS: Pagar.me provided the short-term financing to all of those merchants doing business online, right

HD: Correct. We had to raise debt in Brazil in order to factor the receivables to merchants, because prepayments are a big part of the market. We also rented an acquiring license instead of having one ourselves. So, yes, we had this experience that was pretty unique compared to U.S. payment companies or ones from any other place.

GS: I think it would&ve been very hard for someone in the U.S. payments ecosystem to have been confronted with that kind of diverse challenge and come out on top. It seems like a big part of how you hooked those early investors, people like Max [Levchin] saying, &I want to invest in you no matter what you build. I really like your talent.&

HD: Correct. And because Max understood payments so well, he could tell that we knew what we were doing in our area. The same is true for Ribbit Capital, which knew about Pagar.me.

GS: Seeing Max invest in a payments company is different than Max investing in a bunny rabbit startup. In a space like payments, I think it matters a lot that he was behind you early.

HD: True.

GS: So returning to Brex, I&m interested in the rewards program you just announced, which is paradigm-shifting. Your rewards are designed to be used on an ongoing basis as opposed to being accumulated, right

HD: Exactly. We want you to use all of the rewards, so that every single day you can have the best experience. Also, credit cards have these footnotes saying, &Hey, you can get up to these caps, restrictions and limits,& etc.

GS: Trying to prevent people from optimizing.

HD: Yes. We take a very different approach, where we&re like, &Hey, we&re not going to limit and punish good users and people who want to just use one credit card by adding all these limits and restrictions.&

GS: Whatthe Brex Exclusive concept

HD: The concept is that if Brex is your only card, you get all these benefits. But if itnot your only card, you can still use Brex, but then you just get reduced benefits.

GS: Couldn&t you argue that right now, Amex, or Chase, or Capital One doesn&t care about your rewards offering Itakin to the early days of the roboadvisor space. But as you get bigger, wider in scope and peskier, whatto stop Chase from introducing the unicorn card with a bounty of rewards

HD: One is the effect on their legacy technology. You can say, &Why don&t they just change their technology,& right Well, they have all these regulatory bodies that would say &No, you can&t change your entire technology system, because if you mess up, the whole U.S. financial system might be impacted.&

GS: Can you give a specific example of how this would play out

HD: Take the credit limit side. All these companies are built to have these static credit limits in which they set their credit limit today and they don&t look at it for two months, three months, six months, etc…

We don&t want to be the stupid company that raises a bunch of money and then starts doing all these stupid things.

GS: Right. But are you comparing a charge card versus a charge card, or a charge card versus a credit card

HD: Brex is a charge card, but it doesn&t really matter for this concept, because my point is the technology of changing the limit every single day based on real-time data versus the system they have. Implementing a real-time system would be a fundamental shift for them.

GS: What about this idea that you have credit limits that are 10 times the amount versus a traditional card Itcool, but you guys have access to lots of analytics and data, so you&re not really taking a huge amount of risk.

HD: Thatcorrect, which is why we have zero losses today.

GS: Today

HD: To date.

GS: Impressive. Lettalk about Sutton Bank, which is your issuer bank that you needed to access the Visa Network. What would you do if you got approached by another issuer bank that said, &I love what you&re doing, can we be an issuer bank too&

HD: It would be something we would consider, but itnot something we&re focused on right now. We use their license to issue, but we basically do everything. We do the underwriting. We do the technology and everything.

GS: You&ve been public about wanting to grow out of the startup world. Wherenext

HD: We do want to go to a more traditional businesses, a little bit more mature and outside of technology. Thatsomething that we&re going to probably do sometime next year, but we have to adapt our underwriting model and our product.

GS: Rewards too, right I can&t see a lot of traditional businesses caring as much about AWS credits.

HD: Therenothing besides cash back that matters to these companies. We&re going to adapt because thatwhat they care more about.

GS: What do you think of this whole blitzscaling ethos

HD: I&m reading the book right now, actually, but I haven&t reached a conclusion yet. All the examples in the book seem like two-side marketplaces with a lot of network effects and a winner-take-all. Thatnot us.

GS: Regardless of model, to say that you&re going to let some fires burn and ignore them… I don&t know if that flies in fintech or in financial services in 2018.

HD: Yes, fintech has this other aspect of it because itpeoplemoney. You can&t let buyers burn. But I think there are other aspects to it. Are we going to reach a plan for success or hedge for failure Are we going to hire faster or hire slower

GS: Everybody who has raised a big round like you is in hiring mode. Have you encountered recruitment challenges given your youth

HD: Not in the U.S. In Brazil, we&ve felt it. Thereso many examples of successful companies founded by very young people. I mean, maybe we&re one year younger than the other guy who did something really good.

GS: What about the idea of building a common culture, because the ink on your business cards is still sort of wet and you&re hiring all these people so quickly

HD: The question of what kind of culture we want to build is something we think about a lot. Some companies are on the Google or Airbnb side, like, &Hey, we&re a family.& Some are more like Netflix or Apple, which is more like a professional sports team. We&re definitely more towards Netflix or Apple than we are towards Google or Airbnb.

Building a 10- to 20-billion-dollar business is hard. Itreally, really hard.

GS: What do you mean by more professional

HD: More work-driven, and we&re not into the whole perks thing. Plus, we really like to pay people higher salaries and give them smaller stock grants, because a lot of people in Silicon Valley don&t believe in stock. We&ve said, &Yes, we&ll give you more cash,& and then we save the stock, not for the people who negotiate the best, but for the people who are performing the best over time.

GS: Whatyour thinking

HD: Therethis super premium given to risk, right Itfor the people who joined when we were nothing and nobody believed in us. That premium is too big, I think, compared to people who will work in this company for a long period of time. I think a lot more of the premiums should be for someone who has spent six, seven, eight years busting their ass and growing this company.

GS: Lettouch on where you going to put these people: Brazil or &Transaction Alley& in Atlanta

HD: We&re thinking about it. I think Vancouver is the main candidate for now.

GS: Why there

HD: You can get visas really quickly.

GS: Given your need for speed, are you worried about controlling your spending while you look to grow quickly

HD: Honestly, we have the opposite problem. Keep in mind that Pagar.me was built with $300,000. It was the only money we raised for that company.

GS: Really

HD: Yes. For us, not spending money is the default. But now we have a lot of money, and we need to invest it to grow faster, so we are constantly actively thinking of ways of spending more.

GS: It sounds like you&re struggling with this.

HD: Itjust hard because we don&t want to be the stupid company that raises a bunch of money and then starts doing all these stupid things. But we also need to invest to grow faster, so finding that balance…

GS: …acquiring customers can be expensive.

HD: Yes, but for us, thatnot even the thing because our market is so niche, I can&t just put a couple hundred grand on Google. It just doesn&t work because we&re so niche.

GS: Right.

HS: But we definitely have an issue of how to deploy capital more than we have and how not to do it.

GS: Well, I suppose you could just advertise on more billboards.

HS: Actually, thatcheap! There was an article about this. We spent $300,000 for three months for all of San Francisco.

GS: I&d like to close by talking about what it means to be one the hottest young startups in the Bay Area. And the fact that at some point, a recession is coming. To the first issue, are you concerned that given your rapid ascent, you can&t make mistakes quietly because everyone is watching you

HD: Yes. I definitely feel that pressure. But I feel more confident because we&re doing this for a second time, in a market that we know. And I really like our executive team. Plus, therea lot of stuff we&ve already figured out with Pagar.me in terms of management and culture and what the scale problems will look like.

I think that anyone who says they know how to deal with a recession, itnot true.

GS: Still, ita lot of pressure given your valuation and the expectations that come with it.

HD: Yes. I&m definitely scared because ita lot of responsibility, and I won&t consider Brex a success unless I give my investors a 10 to 20X return. Building a 10- to 20-billion-dollar business is hard. Itreally, really hard.

GS: You have to become the next Stripe… Letconclude by talking business cycles. When I talk to many CEOs, they will feed me a line like, &Actually, we&re going to be great in a recession — even better under a recession,& right While true in some cases, itmostly false.

HD: Yes.

GS: So what happens when the business cycle changes, there isn&t as much VC activity, and you still have to figure out how to grow

HD: I think that anyone who says they know how to deal with a recession, itnot true. Because every single recession is very different than the other. 2008 was completely different than 2001. Thereno one person who knows how to deal with all of them because they&re all very different.

GS: I agree.

HD: The only thing we can do is the big-picture playing, by one, raising more money than you need — which we did — and two, having levers of spending that you can cut very quickly.

GS: Perhaps this is where your Brazilian lineage helps, because you grew up in a country that had a lot of volatility.

HD: 100 percent.

GS: With prices changing on the store shelves from the morning to the evening.

HD: Well, we weren&t born in that time, but we heard our parents talk about it.

GS: Oh thatright. I forgot.

HD: The thing we learned most from that is that nothingdone until itdone. Coming from Brazil, this fact-oriented culture was ingrained in us. We didn&t even celebrate closing the round here before the wires hit.

GS: Last question: If you ultimately face a worthy competitor focused squarely in your space, will it be from another Henrique and Pedro, or will it be from a big player

HD: It would be a fintech company that adds this product. I don&t think it&ll be Amex or Chase. I think it will be a PayPal or a Square or an Adyen or a CyberSource. They are not the legacy guys, so they don&t have the problems that banks have.

GS: Gotcha.

HD: But I don&t think it&ll be another Henrique and Pedro, honestly. So…

GS: Well, I wish you luck on that.

This interview has been edited for content, length and clarity.

- Details

- Category: Technology

Read more: Charge card startup Brex aims for decacorn success

Write comment (90 Comments)When the initial buzz of Portal finally dies down, itthe timing that will be remembered most. Therenever a great time for a company like Facebook to launch a product like Portal, but as far as optics go, the whole of 2018 probably should have been a write-off.

Our followup headline, &Facebook, are you kidding& seems to sum up the fallout nicely.

But the company soldiered on, intent to launch its in-house hardware product, and insofar as its intentions can be regarded as pure, there are certainly worse motives than the goal of connecting loved ones. Thata promise video chat technology brings, and Facebooktechnology stack delivers it in a compelling way.

Any praise the company might have received for the productexecution, however, quickly took a backseat to another PR dustup. HereRecode with another fairly straightforward headline. &It turns out that Facebook could in fact use data collected from its Portal in-home video device to target you with ads.&

In a conversation with TechCrunch this week, Facebook exec Andrew &Boz& Bosworth claims it was the result of a misunderstanding on the companypart.

&I wasn&t in the room with that,& Bosworth says, &but what I&m told was that we thought that the question was about ads being served on Portal. Right now, Facebook ads aren&t being served on Portal. Obviously, if some other service, like YouTube or something else, is using ads, and you&re watching that you&ll have ads on the Portal device. Facebookbeen serving ads on Portal.&

Facebook is working to draw a line here, looking to distinguish the big ask of putting its own microphones and a camera in consumer living rooms from the standard sort of data collection that forms the core of much of the sitemonetization model.

&[T]he thing thatnovel about this device is the camera and the microphone,& he explains. &Thata place that we&ve gone overboard on the security and privacy to make sure consumers can trust at the electrical level the device is doing only the things that they expect.&

Facebook was clearly working to nip these questions in the bud prior to launch. Unprompted, the company was quick to list the many levels of security and privacy baked into the stack, from encryption to an actual physical piece of plastic the consumer can snap onto the top of the device to serve as a lens cap.

Last night, alongside the announcement of availability, Facebook issued a separate post drilling down on privacy concerns. Portal: Privacy and Ads details three key points:

- Facebook does not listen to, view or keep the contents of your Portal video calls. This means nothing you say on a Portal video call is accessed by Facebook or used for advertising.

- Portal video calls are encrypted, so your calls are secure.

- Smart Camera and Smart Sound use AI technology that runs locally on Portal, not on Facebook servers. Portalcamera doesn&t identify who you are.

Facebook is quick to explain that, in spite of what it deemed a misunderstanding, it hasn&t switched approaches since we spoke ahead of launch. But none of this is to say, of course, that the device won&t be collecting data that can be used to target other ads. Thatwhat Facebook does.

&I can be quite definitive about the camera and the microphone, and content of audio or content of video and say none of those things are being used to inform ads, full stop,& the executive tells TechCrunch. &I can be very, very confident when I make that statement.&

However, he adds, &Once you get past the camera and the microphones, this device functions a lot like other mobile devices that you have. In fact, itpowered by Messenger, and in other spaces itpowered by Facebook. All the same properties that a billion-plus people that are using Messenger are used to are the same as whathappening on the device.&

As a hypothetical, Bosworth points to the potential for cross-platform ads targeting video calling for those who do it frequently — a classification, one imagines, that would apply to anyone who spends $199 on a video chat device of this nature. &If you were somebody who frequently use video calls,& Bosworth begins, &maybe there would be an ad-targeting cluster, for people who were interested in video calling. You would be a part of that. Thattrue if you were using video calling often on your mobile phone or if you were using video calling often on Portal.&

Facebook may have painted itself into a corner with this one, however. Try as it might to draw the distinction between cameras/microphones and the rest of the software stack, therelittle doubt that trust has been eroded after months of talk around major news stories like Cambridge Analytica. Once that notion of trust has been breached, ita big lift to ask users to suddenly purchase a piece of standalone hardware they didn&t realize they needed a few months back.

&Certainly, the headwinds that we face in terms of making sure consumers trust the brand are ones that we&re all familiar with and, frankly, up to the challenge for,& says Bosworth. &Itgood to have extra scrutiny. We&ve been through a tremendous transformation inside the company over the last six to eight months to try to focus on those challenges.&

The executive believes, in fact, that the introduction of a device like Portal could actually serve to counteract that distrust, rather than exacerbate it.

&This device is exactly what I think people want from Facebook,& he explains. &It is a device focused on their closest friends and family, and the experiences, and the connections they have with those people. On one hand, I hear you. Ita headwind. On the other hand, itexactly what we need. It is actually the right device that tells a story that I think we want people to hear about, what we care about the most, which is the people getting deeper and more meaningful hashes of one another.&

If Portal is ultimately a success, however, it won&t be because the product served to convince people that the company is more focused on meaningful interactions versus ad sales before. It will be because our memories are short. These sorts of concerns fade pretty quickly in the face of new products, particularly in a 24-hour news environment when basically everything is bad all the time.

The question then becomes whether Portal can offer enough of a meaningful distinction from other products to compel users to buy in. Certainly the company has helped jumpstart this with what are ultimately reasonably priced products. But even with clever augmented reality features and some well-produced camera tracking, Facebook needs to truly distinguish this device from an Echo Show or Google Home Hub. Facebookearly goal for the product are likely fairly modest. In conversations ahead of launch, the company has positioned this as a kind of learning moment. That began when the company seeded early versions of the products into homes as part of a private beta, and continues to some degree now that the device is out in the world. When pressed, the company wouldn&t offer up anything concrete.

&This is the first Facebook-branded hardware,& says Bosworth. &Itearly. I don&t know that we have any specific sales expectations so much as what we have is an expectation to have a market thatbig enough that we can learn, and iterate, and get better.&

This is true, certainly — and among my biggest complaints with the device. Aside from the aforementioned video chat functionality, the Portal doesn&t feel like a particularly fleshed-out device. Therean extremely limited selection of apps pre-loaded and no app store. Video beyond the shorts offered up through Facebook is a big maybe for the time being.

During my review of the Portal+, I couldn&t shake the feeling that the product would have functioned as well — or even better, perhaps — as an add-on to or joint production with Amazon. However, that partnership is limited only to the inclusion of Alexa on the device. In fact, the company confirms that we can expect additional hardware devices over the next couple of years.

As it stands, Facebook says itopen to a broad spectrum of possibilities, based on consumer demand. Itsomething that could even, potentially, expand to on-device record, a feature that would further blur the lines of what the on-board camera and microphone can and should do.

&Right now, thereno recording possible on the device,& Bosworth says. &The idea that a camera with microphones, people may want to use it like a camera with microphones to record things. We wanted to start in a position where people felt like they could understand what the device was, and have a lot of confidence and trust, and bring it home. Therean obvious area where you can expand it. Therealso probably areas that are not obvious to us […] Itnot at all fair to say that this is any kind of a beta period. We only decided to ship it when we felt like we had crossed over into full finished product territory.&

From a privacy perspective, these things always feel like a death by a million cuts. For now, however, the company isn&t recording anything locally and has no definitive plans to do so. Given the sort of year the company has been having with regards to optics around privacy, itprobably best to keep it that way.

- Details

- Category: Technology

Read more: Facebook Portal isn’t listening to your calls, but may track data

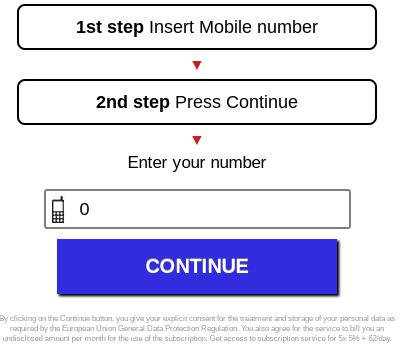

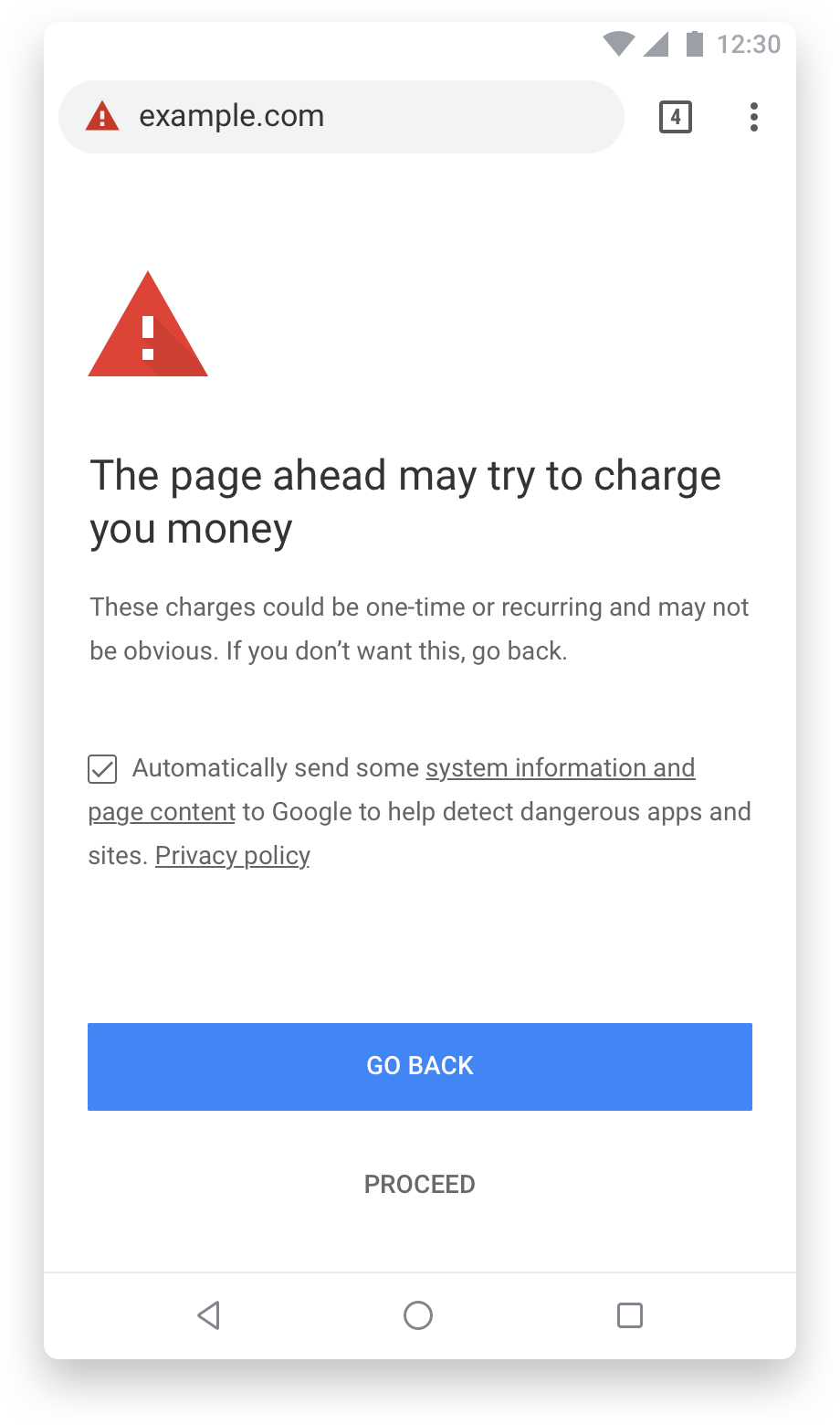

Write comment (98 Comments)Google today announced that Chrome will soon get a new feature that aims to stop mobile subscription scams. Those are the kind of sites that ask you for your phone number and that then, unbeknownst to you, sign you up for a mobile subscription thatbilled through your carrier. Starting with the launch of Chrome 71 in December, Google will pop up a prominent warning when a site doesn&t make it clear that users are signing up for a mobile subscription.

To make sure that developers who are legitimately using this flow to offer users a subscription don&t get caught up in this new system, Google also published a set of best practices for mobile billing today. Generally, developers are expected to make their billing information visible and obvious to users, display the actual cost and have a simple and straightforward fee structure.

If that information is not available, Google will throw up a prominent full-page warning, but users can always opt to proceed. Before throwing up the warning page, Google will notify webmasters in the Search Console when it detects a potential scam (therealways a chance for false positives, after all).

This new feature will be available on both mobile and desktop, as well as in AndroidWebView.

- Details

- Category: Technology

Read more: Chrome adds new security features to stop mobile subscription scams

Write comment (94 Comments)Page 3708 of 5614

20

20