Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Snapchat continued to shrink in Q3 2018 but its business is steadily improving. Snapchatdaily active user count dropped again, this time by 1 percent to 186 million, down from 188M and a negative 1.5 percent growth rate in Q2.User count is still up 5 percent year-over-year, though. Snapchat earned $298 million in revenue with an EPS loss of $0.12, beating Wall Streetexpectations of $283 million in revenue and EPS loss of $0.14, plus a loss of a half a million users.

Snap entered earnings with a $6.99 share price, close to its $6.46 all-time low and way down from its $24 IPO opening price. Snap lost $325 million this quarter compared to $353 million in Q2, so itmaking some progress with its cost cutting. That briefly emboldened Wall Street, which pushed the share price up 8.3 percent to around $7.57 right after earnings were announced.

But then Snapshare price came crashing down to -9.3 percent to $6.31 in after-hours trading. The stock had been so heavily shorted by investors that it only needed modest growth in its business for shares to perk up, but the fear that Snap might shrink into nothing has investors weary. Projections that Snap will lose users again next quarter further scared off investors.

Worringly, Snapchataverage revenue per user dropped 12.5 percent in the developing world this quarter. But strong gains in the US and Europe markets grew global ARPU by 14 percent. Snap projects $355 million to $380 million in holiday Q4 revenue, in line with analyst estimates.

In his prepared remarks, CEO Evan Spiegel admitted that &While we have incredible reach among our core demographic of 13- to 34-year-olds in the US and Europe, there are billions of people worldwide who do not yet use Snapchat.& He explained that the 2 million user loss was mostly on Android where Snapchat doesn&t run as well as on iOS. Noticibly absent was an update on monthly active users in the US and Canada. Snap said that was over 100 million monthly users last quarter, probably in an effort to distract from the daily user shrinkage. The company didn&t update that stat, but did say the &over 100 million& stat was still accurate.

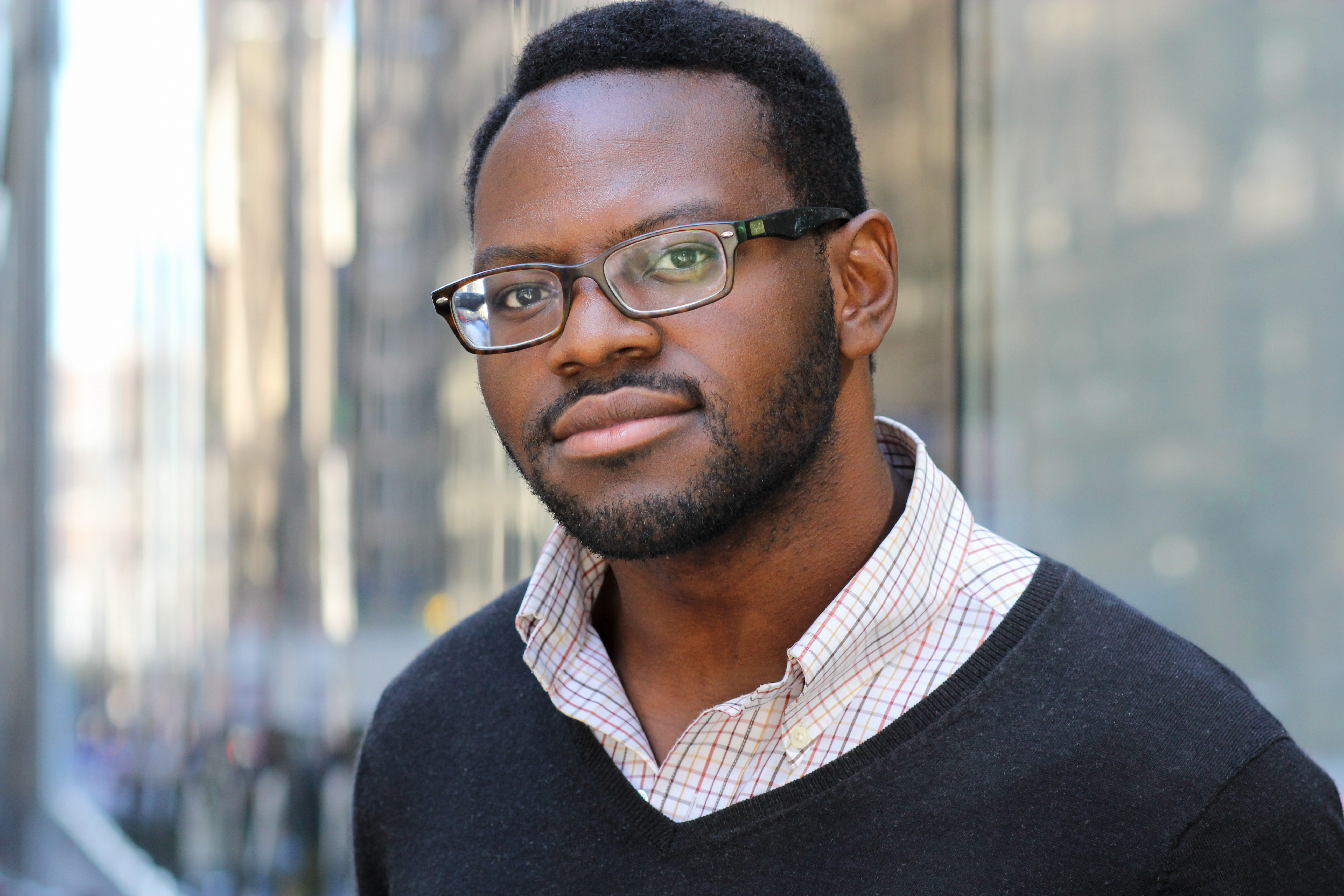

Snap CEO Evan Spiegel

Spiegel had said in a memo that his stretch goal was break-even this year and full-year profitability in 2019. But CFO Tim Stone said that &Looking forward to 2019, our internal stretch output goal will be an acceleration of revenue growth and full year free cash flow and profitability. Bear in mind that an internal stretch goal is not a forecast, and itnot guidance.&

During the call, Spiegel responded to questions about the Android overhaulschedule saying, &Quality takes time.We&re going wait until we get it right&. But analysts piled on with inquiries about how Snap would turn things around in 2019. He admitted Snaps created per day had dropped from 3.5 billion to 3 billion per day, but tried to reassure investors by saying over 60% of our users are still creating snaps every day.

Spiegel said that expanding beyond the 13 to 34-year-old age group in the US and Europe, plus scoring more users in the developing world via the improved Android app would be how it restores momentum.But the problem is that courting older users could sour the perception of its younger users who don&t want their parents, teachers, or bosses on the app.

Now down to $1.4 billion in cash and securities, Snap will need to start reaching more of those international users or improving monetization of those it still has to keep afloat without outside capital.

An Uphill Battle

Q3 saw Snapchatlaunch its first in-house augmented reality Snappable games, while plans for an third-party gaming platform leak. The Snappable Tic-Tac-Toe game saw 80 million unique users, suggesting gaming could be the right direction for Snap to move towards.

It launched Lens Explorer to draw more attention to developer and creator-built augmented reality experiences, plus its Storyteller program to connect social media stars to brands to earn sponsorship money. It alsoshut down its Venmo-like Snapcash feature. But the biggest news came from its Q2 earnings report where it announced it&d lost 3 million users. That scored it a short-lived stock price pop, but competition and user shrinkage has pushed Snapshares to new lows.

Snapchat is depending on the Project Mushroom engineering overhaul of its Android app to speed up performance, and thereby accelerate user growth and retention. Snap neglected the developing worldAndroid market for years as it focused on iPhone-toting US teens. Given Snapchat is all about quick videos, slow load times made it nearly unusable, especially in markets with slower network connections and older phones.

Looking at the competitive landscape, WhatsAppSnapchat Stories clone Status has grown to 450 million daily users while Instagram Stories has reached 400 million dailies — much of that coming in the developing world, thereby blocking Snapgrowth abroad as I predicted when Insta Stories launched.. Snap Map hasn&t become ubiquitous, SnapOriginal Shows still aren&t premium enough to drag in tons of new users, Discover is a clickbait-overloaded mess, and Instagram has already copied the best parts of its ephemeral messaging. Snap could be vulnerable in the developing world if WhatsApp similarly copies its disappearing chats.

At this rate, Snap will run out of money before itprojected to become profitable in 2020 or 2021. That means the company will likely need to sell new shares in exchange for outside investment or get acquired to survive.

- Details

- Category: Technology

Read more: Snapchat loses 2M more users in Q3 as shares sink to new low

Write comment (96 Comments)NBA legend Michael Jordan is playing the esports game now, leading a $26 million round of funding for the ownership group aXiomatic.

For Jordan and new co-investorDeclaration Capital—the family office investing the personal wealth of David Rubenstein, who co-founded and serves as co-executive chairman of the multi-billion-dollar private equity firm, The Carlyle Group— investing in esports looks like a slam dunk.

The company announced the investment from Jordan, Declaration Capital andCurtis Polk, the managing partner and alternate governor of Hornets Sports - Entertainment, and manager of the financial and business affairs of Michael Jordan and his related companies, earlier today. Bloomberg reported the $26 million figure.

As owners of the TeamLiquid esports franchise, which Forbes estimates as the second most valuable gaming team in the industry, aXiomatic has a solid base in the budding world of esports — an increasingly lucrative market.

Indeed, the most successful esports company, Cloud9, just raised $53.6 million in a new round of funding, according to documents filed with the Securities and Exchange Commission.

&I&m excited to expand my sports equity portfolio through my investment in aXiomatic. Esports is a fast-growing, international industry and I&m glad to partner with this great group of investors,& said Jordan, in a statement.

Athletes and owners of professional sports teams have flooded into the esports industry, plunking down $20 million to own teams in the officially sanctioned Overwatch League and placing similar-sized and smaller bets on companies developing services for the esports ecosystem.

The Philadelphia 76ers were among the first NBA teams to dip their toe in the esports waters when they acquired Team Dignitas in a deal that was rumored to be worth up to $15 million at the time. Earlier this year, Dignitas brought home a world championship in RocketLeague for the Sixers.

Now, the Golden State Warriors, Cleveland Cavaliers and Houston Rockets are all backing esports teams in Riot Games& League of Legends tournaments, according to a recent report in Bloomberg.

&The next generation of sports fans are esports fans,& said Ted Leonsis, co-executive chairman of aXiomatic and the founder, chairman, chief executive and majority owner of Monumental Sports - Entertainment (which owns the Washington Wizards, Capitals and the WNBA Mystics franchise), in a statement. &Esports is the fastest-growing sector in sports and entertainment, and aXiomatic is at the forefront of that growth. We are thrilled to welcome Michael and Declaration Capital to aXiomatic and look forward to working together on some truly cutting-edge opportunities.&

- Details

- Category: Technology

Read more: NBA All-Star Michael Jordan leads a $26 million round for esports group aXiomatic

Write comment (100 Comments)The podcast market will discover the answer to a foundational question about its future in the next few years. Will it continue along the path of music streaming, where all podcasts are available everywhere on free, ad-supported tiersOr, will it follow the path of streaming TV into paid subscription services with exclusive content

Today, effectively all of the industryrevenue is from advertising — at least in the United States. However, we&re seeing the first steps being taken toward paid subscriptions and exclusive content. Based on numerous discussions I&ve had with top figures in podcasting over the last month, itclear that popular shows are getting large offers for exclusivity on podcasting platforms, major Hollywood players are entering the market and some top VCs are willing to back new streaming platforms taking a Netflix approach to podcasts (like Luminary Media, which raised a $40 million seed round).

Many in the industry are deeply skeptical of that business model, and for good reason: We don&t have concrete evidence that consumers in the U.S. will pay for podcasts and ad revenue is becoming quite lucrative for the top shows as the format gains popularity.But that precedent has hardly been entrenched, as the sector is only just now gaining mainstream consumer interest and getting attention from Hollywood.

And, therea macro problem with betting on ads. The dominance of Facebook and Google over all digital ad spending has already driven a shift to subscriptions across music, video and publishing. Even with dramatic market growth, podcasting doesn&t have a comparative advantage in competing against the scale and ad-targeting of the duopoly.

Subscription tiers and exclusive shows (akin to Netflix Originals) can, on the other hand, provide a virtuous cycle of quality content and stable revenue, generating recurring revenue directly from consumers who might ultimately pay for multiple streaming subscriptions to access different shows.

Could podcasting go the direction of streaming TV, with subscription tiers and original series The breakout success ofHouse of Cards—the first Netflix Original— set the stage for Netflixdominance in streaming TV.

Podcastingfuture looks more like Hollywood than like NPR radio

The annual Infinite Dialsurvey by Edison Research tracked that the percent of Americans over age 12 who listen to a podcast in a given month grew steadily from 9 percent in 2008 to 26 percent (or 72 million people) in 2018. Fifty-four million Americans, or 17 percent of those over 12, are weekly podcast listeners with a mean weekly listening time over 6.5 hours.

The popularity of podcasts still exists primarily within a demographic niche, however. Roughly half of podcast listeners make $75,000 or more in annual income and a clear majority have a college degree (in fact, one-third have a masterdegree). This highlights how much potential for audience growth there still is. Podcasts are still mainly formatted like NPR radio shows, with hosts discussing politics, business or society and a particular audience demographic tuning in as a result.

But podcasting is just a content medium and should be filled with shows that appeal to all different types of people, just like music, TV, film, publishing sites and YouTube each have a vast range of content for everyone. Tom Webster, the SVP of Edison Research who co-authors that big annual survey on podcasting, highlighted in a recent blog post the discrepancy between the format and topics of the most popular podcasts and those of the most popular TV shows.

Addressing this gap in diverse show types is the thesis behind large new podcast production companies like Gimlet Media, Wonderyand Endeavor Audio. Endeavor Audio launched on September 13 as the podcast division of entertainment conglomerate Endeavor, dedicated to financing, developing and marketing podcasts made for as diverse a set of topics and styles as there are in TV: scripted dramas, competition shows, documentaries, etc. that appeal to different audiences. Endeavor also owns WME, the worldlargest talent agency, giving it distinct advantage in creating new shows that draw on the skills of top creative talent in Hollywood. The upcoming wave of podcasts crafted to be more like TV shows than radio shows is what could bring tens of millions new listeners into the podcast market.

That will only be accelerated through music streaming services& entry into the market and the rapid consumer adoption of smart speakers. Spotify, Pandora, iHeartRadio and others have made podcasts a priority over the last year, promoting shows to millions of users who aren&t already into podcasting. Smart speakers like the Amazon Echo and Google Home make it easier for people who hear about a podcast to try it (just ask Alexa to play it) and will likely increase podcast listening among those in age groups that have lower smartphone penetration (children and people over 55).

Advertising isn&t the best path forward

Last year the U.S. market size for podcast ad revenue was only $314 million and this year it will still be around $400 million (according to the IAB). Thatextraordinary annual growth for an industry, but itstill tiny in absolute value. Justine and Olivia Moore at VC firm CRV crunched the numbers to show that podcasting makes 10x less money per hours consumed than any other major content medium. Therea lack of monetization on the vast majority of podcasts: The minimum number of downloads per podcast needed to enroll in the industryad marketplaces or start discussions with most advertisers is 50,000. As they noted, this is attributable to a range of issues like lack of programmatic advertising, lack of analytics and lack of consistent measurement standards.

Life is admittedly getting good for the most downloaded shows now that the podcasting market is getting serious attention. One executive I discussed this with (who represents several top podcast creators) says there are a handful of podcasts generating eight-figures in ad revenue per year, a rapidly growing tier making seven-figures and a large &middle-class& making six-figures. Thatbefore income from touring, merchandise and book/film/TV deals. The going rate for ad spots is anywhere from $20-50+ CPMs and podcast ads tend to have a higher conversion rate than video ads.

As general manager of Endeavor Audio — the new podcasting division of entertainment conglomerate Endeavor — Moses Soyoola is overseeing a group thatbringing top Hollywood talent into the podcast space and financing new types of shows.

But near-term financial gains are not the primary reason that big names in Hollywood are getting interested in producing podcasts, according to Endeavor Audio general manager Moses Soyoola. When we spoke recently, he explained that while the income can reach into the seven figures on successful shows, thatstill less than what they can make in other creative projects. They see podcasting as a brand-building mechanism, however, and as an opportunity to understand a new storytelling format that could become even more lucrative in the future.

As with all ad-dependent content, the losers right now are those with passionate niche audiences and those producing big-budget shows that advertisers treat the same even if audiences find much deeper value. A creator with a devoted fan base of 30,000 listeners cannot currently tap into advertising nor easily turn to subscriptions as an alternative. Listening to an hourworth of news discussion that the hosts record over a couple hours day-of generates roughly the same ad revenue as listening to an hour installment of a show that takes months to produce.

With the growing number of narrative podcasts being created by Endeavor Audio and others, the need to include numerous ad spots throughout them is disruptive, pulling audiences out of the story. It constrains the format and limits content within the boundaries of family friendliness that major advertisers are comfortable with. This is like the historic difference between network TV shows and HBO shows, which — freed from ad breaks and advertiser concerns — became the crown jewel of TV dramas and went on to consistently top the Emmy Awards winner list.

Would people pay for podcasts

China is the inverse of the Western podcast market. The Chinese &podcast& market dwarfs that of the U.S. because it is the norm to have paid subscriptions for shows rather than rely on advertising. To my understanding, the definition of podcast here may be broader than the scope in the U.S. — by including audio courses — but the Chinese government estimated the market for paid podcasts alone as $7.3 billion in 2017.

We know consumers in the West are willing to pay subscriptions for film/TV and for ad-free streaming music, so why not for podcast streaming New content formats often start free, have lagging monetization, then as the audience grows enough and creators experiment enough, premium content rises up that people are willing to pay for. Podcasts have been around for two decades, but are just now going mainstream and seeing serious investment from Hollywood.

We saw with music streaming and satellite radio that many consumers are willing to pay in order to eliminate audio ads from music thatotherwise free to listen to. Spotify has made a big push into podcasts over the last few months; it creates branded podcasts in collaboration with advertisers but can&t remove ads that are within podcasts it distributes. As podcasts turn to programmatic advertising — and large streaming services like Spotify push them there in order to serve up the ads — it would be surprising if Spotify didn&t make podcasts ad-free for its Premium tier subscribers and encourage podcast listeners to go Premium.

Most podcasts aren&t worth paying for, just like most articles on the internet aren&t worth paying for. Paywalled content has to be exceptional to stand out from the noise and get consumers to open their wallets. The freemium model is most likely to become the norm in podcasting, with most podcasts available free and ad-supported but some particularly high-quality shows restricted to a paid subscription tier thatad-free.

Streaming competition will drive exclusivity

If we&re being honest, the existing podcast streaming services — and there are many — are all the same. They are simple utilities for searching for and playing a show. No one has cracked the nut of discoverability in a differentiated way: making podcasts easy to discover based on topic and style and having a personalized recommendation tool that works as well as Pandora and Spotify music recommendations do.

Streaming services of any content format struggle to differentiate on user interface alone. Users are there for the content — thatthe product they&re after. So ultimately, the way to differentiate is via exclusive content that audiences eagerly want. Thattrue whether the service has a paid subscription or not, but maintaining a profitable subscription tier is nearly impossible if onecompetitors are able to offer all the same content for cheaper. Differentiation requires differentiated content available in the subscription that can&t be gained elsewhere: high-quality original shows.

This past summer, Spotify launched its first Spotify Original Podcasts, including a $1 million deal with comedian Amy Schumer to develop &3 Girls, 1 Keith& (which it just renewed for a second season). Schumerpodcast isn&t exclusive to Spotify but iteasy to envision the streaming service signing future podcast deals as exclusives as its base of podcast listeners grows (it has rapidly become the second most popular podcast platform after ApplePodcasts app).

Each individual I&ve spoken to over the last few weeks who runs a leading podcast production company said they are getting approached by numerous streaming platforms about exclusive shows. Most aren&t taking the deals, at least not yet, but itclear the industry is about to run this experiment over the next couple years and see if consumers buy in.

A couple of the executives I met noted that the deals top podcast services are offering for exclusivity are quite lucrative, but when you factor in how much the reduced audience size that comes with being exclusive limits touring, merchandise sales and potential for a book/film/TV deal, ita tougher sell.

That has been true, but I think itquickly changing. Given how much consumer adoption of podcasts is poised to grow, the top few podcast streaming services (by monthly active users) could each enable an exclusive podcast to still reach an audience in the millions of listeners. In particular, I&m talking about Apple Podcast, Google Podcasts, Spotify, Pandora and iHeartRadio given their pre-existing install bases. Italso a rational decision for each of them to overpay for exclusivity of hit shows in these early days of the market — the short-term loss on a given show is an investment in becoming the preferred streaming service for millions of new podcast listeners.

The streaming platforms don&t have the leverage to negotiate ownership over exclusive podcasts — theretoo much competition between them and optionality for podcast creators — so creators will retain rights to develop touring, merchandise, book/film/tv deals and other revenue streams. As a successful TV producer explained to me, the consideration of turning a podcast into a TV show is the same as turning a book into a TV show: itabout whether ita captivating story that engages the audience; the existing audience size will affect deal terms but a hit podcast only being on iHeart or Spotify wouldn&t inhibit it from getting a deal.

If one company is uniquely positioned to offer exclusive shows without a paid subscription tier, itiHeartMedia (which acquired the Stuff Media podcast network in September). In addition to its iHeartRadio streaming service, it can syndicate shows across its radio stations, which reach 250 million Americans per month. That could generate more ad revenue than from a show existing solely across podcast apps and give it a bigger fan base to benefit touring and other revenue streams.

Looking at how exclusivity could impact consumers& experience, itnotable that people are typically on the hunt for just one podcast to listen to in a given session. With lengths typically 25-60 minutes, this is most similar to picking out a TV episode. Music services need full libraries of the worldsongs because people listen to a wide range of 3 to 4-minute songs in the same sitting and organize them into custom playlists of every imaginable combination. Having music divided between separate streaming platforms would be disruptive to the core experience of a music listening session. Switching apps to listen to a different podcast might not be any more inconvenient than doing so for TV shows on different streaming services.

Podcasting should embrace &listener revenue&

Direct &listener revenue& from paid subscription tiers enable a whole swath of niche content creators to make a living creating high-quality podcasts for a small, passionate audience and they enable worthwhile return-on-investment for big budget productions that audiences find deep value in. Importantly, subscription tiers across the major podcast streaming platforms would drive an industry-wide focus on shows that gain popular acclaim rather than shows that maximize initial downloads or streams (just like subscription publishing incentivizes quality over clickbait).

Breakout shows that receive pop culture buzz will be critical to any paid subscription tier in podcasting gaining traction, like the success of House of Cards and Orange is the New Black were critical to Netflix gaining respect for its Netflix Originals and differentiating from competitors. Such breakouts will likely involve a big name from Hollywood whose existing fan base drives a critical mass of initial listeners, and whose name recognition lends credibility to a potential paid tier subscriber. And it will almost certainly be a narrative format rather than another talk show.

Incumbents moving into podcasting from music streaming (or that are operating systems able to pre-install their app) have a distinct advantage here over startups dedicated to podcast streaming. Established players can expose millions of existing users to their own shows and bundle premium podcasts into existing subscription plans. Podcast streaming startups hoping to break through will need a lot of initial capital to develop their own shows and will need to seek bundling partnerships with companies that already have distribution — like mobile carriers and subscription video platforms. Luminary Media in NYC, founded by Matt Sacks of NEA, might be the first to launch with this approach: with a $40 million seed round, itaiming for a majority of content on its upcoming subscription streaming service to be its own originals within three years. Don&t be surprised if a couple other VC-backed podcast apps take this route in the year ahead as well.

It is likely we will see a combination of exclusive shows and paid subscription tiers develop on several platforms over a period of the next 18-36 months. It won&t happen overnight, but looking at the precedent set in other content formats and having spoken to two dozen senior figures in the industry during the past month, we seem to be in the early days of this shift, driven by the growth of podcasting from talk shows into a broader entertainment medium.

- Details

- Category: Technology

Read more: What’s next for podcasting

Write comment (95 Comments)Silicon Valley is waiting for the dust to settle in Saudi Arabia, but other headwinds are picking up

Itbeen painful, the silence of Silicon Valley with regards to Saudi Arabia, whose shifting accounts about the murder of journalist Jamal Khashoggi have nearly veered into slapstick.

He freely walked out the Saudi consulate in Istanbul. Actually, rogue killersgot to him. No, he was in a fist-fight and was subdued to death by Saudi officials. Fine. We did set out tobrutally murder him, just as Turkish officials said at the outset.

It isn&t hard to understand why the story of Khashoggifinal moments has finally come full circle. Why not just tell the truth when the world — including everyone in technology who has taken the regionmoney — is too cowardly or greedy to take a stand against it

In fairness, breaking up with Saudi Arabia, which has drenched the Bay Area in capital, is easier said than done. Forcing an investor to sell is practically impossible if it has a contractual right to be involved and isn&t interested in selling to other shareholders for a higher price. No doubt, too, many see little to gain by speaking ill of Crown Prince Mohammad bin Salman, or MBS, who is running the show and may be more menacing than they&d realized.In fact, while some in tech are using this moment to win points for not raising money from murderous regimes, nary a recipient of MBScapital has spoken publicly about why he or she won&t again accept funding from Saudi Arabia until MBS is removed from his powerful position. Not a single person.

Even SoftBank — whose $93 billion Vision Fund is anchored by a $45 billion commitment from MBS — looks likely to move forward with its relationship with the desert country, from what we&re hearing. Indeed, comments made last week by SoftBankCOO Marcelo Claure, who said there was &no certainty& that SoftBank will launch another Vision Fund, were probably overblown.

Many will be relieved if that second fund materializes, too. Still, if we were running a unicorn company, we wouldn&t get too comfortable. Even if the Vision Fund continues deploying billions of dollars with the help of MBS, it will take time to get his scent off future rounds.As analyst Chris Lane of Sanford C. Bernstein told Bloomberg earlier today, SoftBank will probably have to wait three to six months before starting to again cut major deals, owing to its ties to the prince.

In the meantime, the Khashoggi ordeal looks increasingly like one of numerous shocks that are bound to have a systemic effect — and make burn rates more important than ever to control.

Consider: While we&re busy obsessing over MBS, longer-term frictions with China — which has alsosoaked Silicon Valley in capital — grow more concerning by the day, from an ongoing trade war with the U.S., to allegations ofintellectual property theft, to Beijing&scontinued militarization of disputed islands in the South China Sea, to newer concerns over currency manipulation.

Therealso the performance of the U.S. stock market, which is reacting to these various pressures. Tech shares are pushing U.S. benchmark indexes back into positive territory today — one day after the yearstock market gains were completely wiped out. But these zigs and zags have U.S. endowments, foundations and pension fund managers feeling nervous. More worrying, these traditional &limited partners& to venture firms are already over-allocated to venture as an asset class because the cadence of fundraising has been faster than ever in recent years while exits have been comparatively slow.

&We keep stuffing the snake,&says Chris Douvos, an LP who has helped fund numerous seed-stage firms over the years, including First Round Capital. &But not as much is coming out the back end as coming in the front end. Thatleft everyone with a huge bubble& with which to contend.

Douvos isn&t sure how big an impact techsuddenly strained relationship with Saudi Arabia could have, but he thinks — as we do — that it could be the first shoe to drop. He thinks thatnot necessarily a terrible thing, either. While a flood of capital from around the world has changed how Silicon Valley builds companies, it might be time to rethink that process anew.

&Maybe being cash-flow negative until you&re a $100 billion company isn&t sustainable. Maybe you start building toward earlier profitability,& says a hopeful Douvos. &Thatvery much at odds with the traditional Silicon Valley ethos, but it starts to untangle the web of all this trapped capital.&

It would also give public shareholders an earlier crack at fast-growing companies and perhaps help Silicon Valley find its backbone.

More realistically, such headwinds may see U.S. companies that can&t stand on their own run even faster to Saudi Arabia. What they&re likely to find is a more emboldened young prince — his terms more cutthroat.

Above: Salah Khashoggi, a son of slain journalist Jamal Khashoggi, who has been banned from leaving Saudi Arabia and who was forced on Monday to visit the royal court and accept the condolences of MBS.

- Details

- Category: Technology

Ahead of Airbnb expected initial public offering sometime within the next two years, the accommodation rental business has brought on a new chief technology officer. Aristotle Balogh, formerly GoogleVP of engineering, application storage, indexing and serving, is starting at Airbnb in mid-November.

Airbnb co-founderNathan Blecharczyk previously served as the companyCTO up until January 2017, when he became chief strategy officer. Since then, Airbnb VP of Engineering Michael Curtis was tasked with overseeing all technical responsibilities. Now, with Balogh, whom Curtis helped select to serve as CTO, on board, Curtis is leaving the company.

&Ari stood out as someone driven by mission and values, and as a passionate technologist,& Curtis said in a statement.&We&ve worked together in the past and I&ve seen his leadership in action. He&ll bring great experience and perspective to Airbnb.&

Curtis has been thinking about leaving Airbnb for some time so that &he could focus on his family and other projects of interest,& Airbnb spokesperson Tim Rathschmidt told TechCrunch via email. &After discussing this change with Brian Chesky, they agreed that Mike would step down after helping the company choose his successor. &

In Baloghnew role at Airbnb, Balogh will report to Airbnb CEO Brian Chesky and be tasked with leading infrastructure, information security, IT, engineering for payments, trust and community support.

&I&m thrilled Ari is joining Airbnb as our CTO,& Chesky said in a statement. &He has a strong vision for keeping our community at the center of everything we do and every technical decision we make, and an incredible track record of developing leaders and nurturing an inclusive culture.&

Earlier this year, Airbnb had an executive shakeup with its Chief Financial Officer Laurence Tosi leaving the company, following some reported tension between Chesky and Tosi over the future of the company. Around the same time, Airbnb promoted Belinda Johnson, its former chief business affairs and legal officer, to the role of chief operating officer.

- Details

- Category: Technology

Read more: Airbnb is bringing on new CTO from Google

Write comment (95 Comments)The White House has actually provided a memorandum detailing the need for a new nationwide wireless connectivity technique; the document doesn & t actually establish anything brand-new, however does request lots of reports on how things are going. Oddly, what it proposes sounds a lot like what the FCC already does. The memorandum, heralded by a different post announcing that & America Will Win the Global Race to 5G, & is not precisely a statement of policy, though it does put a few things out there. Itactually more of an ask for details on which to base a future policy —-- obviously one that will win us a worldwide race that began years back. In fact, the U.S. has actually been pursuing a broad 5G policy for quite a while now, and under President Obama we were the first country to designate spectrum to the nascent standard. Considering that then development has actually stalled and we have actually been overtaken by the likes of South Korea and Spain in policy steps like spectrum auctions. After some talk about the & insatiable demand & for wireless spectrum and the economic importance of wireless communications, the memo gets to company. Reports are asked for within 180 days from numerous Executive branch departments and companies on & their expected future spectrum requirements, & along with reviews of their existing spectrum use. The Office of Science and Technology Policy is asked to report in the very same period on how emerging tech (wise homes and grids, for instance) might affect spectrum demand, and how research and development costs need to be assisted to enhance spectrum access. Another report from the Secretary of Commerce will discuss & existing efforts and planned near- to mid-term spectrum repurposing initiatives. &. Then, 270 days from today the different entities included here, consisting of the National Telecommunications and Information Administration and the FCC, will provide a & long-term National Spectrum Strategy & that strikes a variety of targets:. Increase spectrum access, security and openness. Create versatile spectrum management models, including standards, rewards and enforcement systems. & Develop innovative technologies & to improve spectrum gain access to and sharing. Improve the worldwide competitiveness of U.S. & terrestrial and space-related industries & (which appears to include all of them). Itnot precisely enthusiastic; the terms are vague enough that one would expect any new legislation or guidelines to accomplish or accommodate these things. One would barely desire a spectrum policy that reduced access and transparency. The previous administration released spectrum memos much like these, years ago. This fresh start might irritate those in government who are currently doing this work. The FCC has actually been pursuing 5G and brand-new spectrum policy for many years, and itbeen a particular focus of Chairman Ajit Pai. He proposed a bunch of guidelines months earlier, and simply the other day there was a proposal to bring Wi-Fi up to a more suitable and future-proof state. Itentirely possible that the agency may need to validate and re-propose things italready doing, or see those actions and guidelines questioned or modified by committees over the next year. From what I heard this entire effort from the White House was pursued without much participation from the FCC. I & ve called the Chairmanoffice for details (heout of the country currently and had no ready statement, which may provide you an idea of his level of participation). FCC Commissioner Jessica Rosenworcel was not enthusiastic about the memo. & We are ripping up what came previously and beginning with a brand-new wireless policy at some point late next year. The world isn & t going to wait for us, & she said in a statement supplied to TechCrunch. & Other nations are continuing with techniques they are implementing now while we & re headed to study hall —-- and in the interim we & re slapping big tariffs on the most necessary elements of 5G networks. If you stand back and study what is taking place, you see that we & re not expediting our 5G cordless management, we & re choosing that slow us down. &. Whether this brand-new effort will yield worthwhile outcomes, we & ll understand in 270 days. Till then the authorities currently attempting to make the U.S. the leader in 5G will continue doing what they & re doing.

- Details

- Category: Technology

Page 3839 of 5614

6

6