Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Many entrepreneurs assume that an invention carries intrinsic value, but that assumption is a fallacy.

Here, the examples of the 19th and 20th century inventors Thomas Edison and Nikola Tesla are instructive. Even as aspiring entrepreneurs and inventors lionize Edison for his myriad inventions and business acumen, they conveniently fail to recognize Tesla, despite having far greater contributions to how we generate, move and harness power. Edison is the exception, with the legendary penniless Tesla as the norm.

Universities are the epicenter of pure innovation research. But the reality is that academic research is supported by tax dollars. The zero-sum game of attracting government funding is mastered by selling two concepts: Technical merit, and broader impact toward benefiting society as a whole. These concepts are usually at odds with building a company, which succeeds only by generating and maintaining competitive advantage through barriers to entry.

In rare cases, the transition from intellectual merit to barrier to entry is successful. In most cases, the technology, though cool, doesn&t give a fledgling company the competitive advantage it needs to exist among incumbents and inevitable copycats. Academics, having emphasized technical merit and broader impact to attract support for their research, often fail to solve for competitive advantage, thereby creating great technology in search of a business application.

Of course there are exceptions: Time and time again, whether itdriven by hype or perceived existential threat, big incumbents will be quick to buy companies purely for technology.Cruise/GM (autonomous cars), DeepMind/Google (AI) and Nervana/Intel (AI chips). But as we move from 0-1 to 1-N in a given field, success is determined by winning talent over winning technology. Technology becomes less interesting; the onus is on the startup to build a real business.

If a startup chooses to take venture capital, it not only needs to build a real business, but one that will be valued in the billions. The question becomes how a startup can create a durable, attractive business, with a transient, short-lived technological advantage.

Most investors understand this stark reality. Unfortunately, while dabbling in technologies which appeared like magic to them during the cleantech boom, many investors were lured back into the innovation fallacy, believing that pure technological advancement would equal value creation. Many of them re-learned this lesson the hard way. As frontier technologies are attracting broader attention, I believe many are falling back into the innovation trap.

So what should aspiring frontier inventors solve for as they seek to invest capital to translate pure discovery to building billion-dollar companies How can the technology be cast into an unfair advantage that will yield big margins and growth that underpin billion-dollar businesses

Talent productivity: In this age of automation, human talent is scarce, and there is incredible value attributed to retaining and maximizing human creativity. Leading companies seek to gain an advantage by attracting the very best talent. If your technology can help you make more scarce talent more productive, or help your customers become more productive, then you are creating an unfair advantage internally, while establishing yourself as the de facto product for your customers.

Great companies such as Tesla and Google have built tools for their own scarce talent, and build products their customers, in their own ways, can&t do without. Microsoft mastered this with its Office products in the 1990s through innovation and acquisition, Autodesk with its creativity tools, and Amazon with its AWS Suite. Supercharging talent yields one of the most valuable sources of competitive advantage: switchover cost. When teams are empowered with tools they love, they will loathe the notion of migrating to shiny new objects, and stick to what helps them achieve their maximum potential.

Marketing and distribution efficiency: Companies are worth the markets they serve. They are valued for their audience and reach. Even if their products in of themselves don&t unlock the entire value of the market they serve, they will be valued for their potential to, at some point in the future, be able to sell to the customers that have been tee&d up with their brands. AOL leveraged cheap CD-ROMs and the postal system to get families online, and on email.

Dollar Shave Club leveraged social media and an otherwise abandoned demographic to lock down a sales channel that was ultimately valued at a billion dollars. The inventions in these examples were in how efficiently these companies built and accessed markets, which ultimately made them incredibly valuable.

Network effects: Its power has ultimately led to its abuse in startup fundraising pitches. LinkedIn, Facebook, Twitter and Instagram generate their network effects through internet and Mobile. Most marketplace companies need to undergo the arduous, expensive process of attracting vendors and customers. Uber identified macro trends (e.g. urban living) and leveraged technology (GPS in cheap smartphones) to yield massive growth in building up supply (drivers) and demand (riders).

Our portfolio company Zoox will benefit from every car benefiting from edge cases every vehicle encounters: akin to the driving population immediately learning from special situations any individual driver encounters. Startups should think about how their inventions can enable network effects where none existed, so that they are able to achieve massive scale and barriers by the time competitors inevitably get access to the same technology.

Offering an end-to-end solution: There isn&t intrinsic value in a piece of technology; itoffering a complete solution that delivers on an unmet need deep-pocketed customers are begging for. Does your invention, when coupled to a few other products, yield a solution thatworth far more than the sum of its parts For example, are you selling a chip, along with design environments, sample neural network frameworks and data sets, that will empower your customers to deliver magical products Or, in contrast, does it make more sense to offer standard chips, licensing software or tag data

If the answer is to offer components of the solution, then prepare to enter a commodity, margin-eroding, race-to-the-bottom business. The former, &vertical& approach is characteristic of more nascent technologies, such as operating robots-taxis, quantum computing and launching small payloads into space. As the technology matures and becomes more modular, vendors can sell standard components into standard supply chains, but face the pressure of commoditization.

A simple example is personal computers, where Intel and Microsoft attracted outsized margins while other vendors of disk drives, motherboards, printers and memory faced crushing downward pricing pressure. As technology matures, the earlier vertical players must differentiate with their brands, reach to customers and differentiated product, while leveraging whatlikely going to be an endless number of vendors providing technology into their supply chains.

A magical new technology does not go far beyond the resumes of the founding team.

What gets me excited is how the team will leverage the innovation, and attract more amazing people to establish a dominant position in a market that doesn&t yet exist. Is this team and technology the kernel of a virtuous cycle that will punch above its weight to attract more money, more talent and be recognized for more than itproduct

- Details

- Category: Technology

Read more: Building a great startup requires more than genius and a great invention

Write comment (90 Comments)Itamazing how quickly things can change. Exactly a week ago, we wondered if Saudi Arabiamoney might finally become radioactive in light of the disappearance of Saudi journalist and Washington Post columnist Jamal Khashoggi.Almost no one we reached for comment wanted to participate in the story, though behind the scenes, we heard the same things from different sources who have a vested interest in keeping the peace with the country and its Crown Prince Mohammed bin Salman:There is no proof.We&re waiting to see what happens.You&re naive if you think this is the only regime that both funds Silicon Valley and tortures its own people.I would rather scale my company using Saudi money then cap my opportunity by trying to ensure that my funding sources are pure.

In fairness, Silicon Valley companies are used to getting away with a lot. Outrage over one perceived calamity oftendissipatesquickly as itreplaced by another. No doubt a week ago, there was an expectation that the media would move on from the journalist who vanished inside the Saudi consulate in Turkey one October afternoon.

Yet the Khashoggi story has not faded away. In stark contrast, it just became so graphic that to ignore it is no longer an option. Consider: According to a senior Turkish official who earlier today described details from audio recordings to the New York Times, almost immediately after Khashoggi walked into the consulate, Saudi agents seized himand began to beat him and torture him, cutting off his fingers as he screamed, then cutting off his head and dismembering his body.According to this same Turkish official, it was suggested by a doctor of forensics who&d been brought along for the dissection that the agents put on headphones and listen to music as they worked.

That isn&t enough for President Trump, who has defended the crown prince, known as MBS, as having been unfairly accused. However, SoftBank — the Japanese conglomerate that has been shoveling billions of Saudi dollars into tech and other companies — seems to be having second thoughts. According to the Financial Times, SoftBankCOO Marcelo Claure has said for the first time that there is &no certainty& that SoftBank will launch another Vision Fund, the $93 billion vehicle it is currently investing and that received roughly half of its capital from MBS and company.

SoftBank is &watching developments& to &see where this goes,& Claure added.

If SoftBank or other recipients of Saudi Arabiacapital are hoping for a surprising turn of events, they should watch what they wish for. If therea twist at all, it may well be that a journalist who many in Silicon Valley had never heard of until two weeks ago causes its long economic boom to bust.

It may sound far-fetched; it isn&t. Ahuge percentage of the money flowing into Silicon Valley in recent years has come from the kingdom. Thatbeen just fine with founders and investors, who&ve grown fat and happy off that flow of capital. Indeed, while some have suggested these sophisticated businesspeople were somehow tricked by the charming prince, itmore likely they had a different rationale: that if and when the market turned, it would be Saudi Arabia left holding the bag.

In the meantime, that money has sustained countless startups with round after round of funding. In tandem, round sizes have gone up. The amount of money that VCs manage has gone up. The number of years that it takes venture-backed companies to go public has gone up. In many ways, Saudi Arabia has changed the very nature of the venture industry.

Without those riches — and itgoing to be pretty hard to return to that well anytime soon —startups will have to look elsewhere.

Some might try their luck on the public markets. Presumably, others will fail, at long last.

It could well be the end of an era, and how strange to think it started when one man entered a consulate to obtain marriage license papers, never to be seen again.

- Details

- Category: Technology

Read more: Silicon Valley hoped the Khashoggi story would go away; instead, it may end an era

Write comment (98 Comments)3D printing for manufacturing is one of those things that gets talked about a lot, but we&ve yet to see a lot of truly mainstream applications for the technology. A new partnership between Gillette and MIT-born startup Formlabs offers an interesting potential peek into such a future.

Granted, customized razor handles is probably more of a novelty than anything. Itnot exactly as game changing as, say, Invisalign braces, prostheses or even sneakers, but if the tech proves scalable it could add an extra level of customization to a product thata part of many of our day to day lives.

For now, Gillette3D-printed razor handle program is just a pilot the shaving giant is offering up in limited quantities. It starts at $19 and goes up to $45, depending on the materials used. Using the Razor Maker site, users can build their own distinct version. The handles are then printed on Formlabs machines at GilletteBoston headquarters.

- Details

- Category: Technology

Read more: Gillette partners with Formlabs to 3D print razor handles

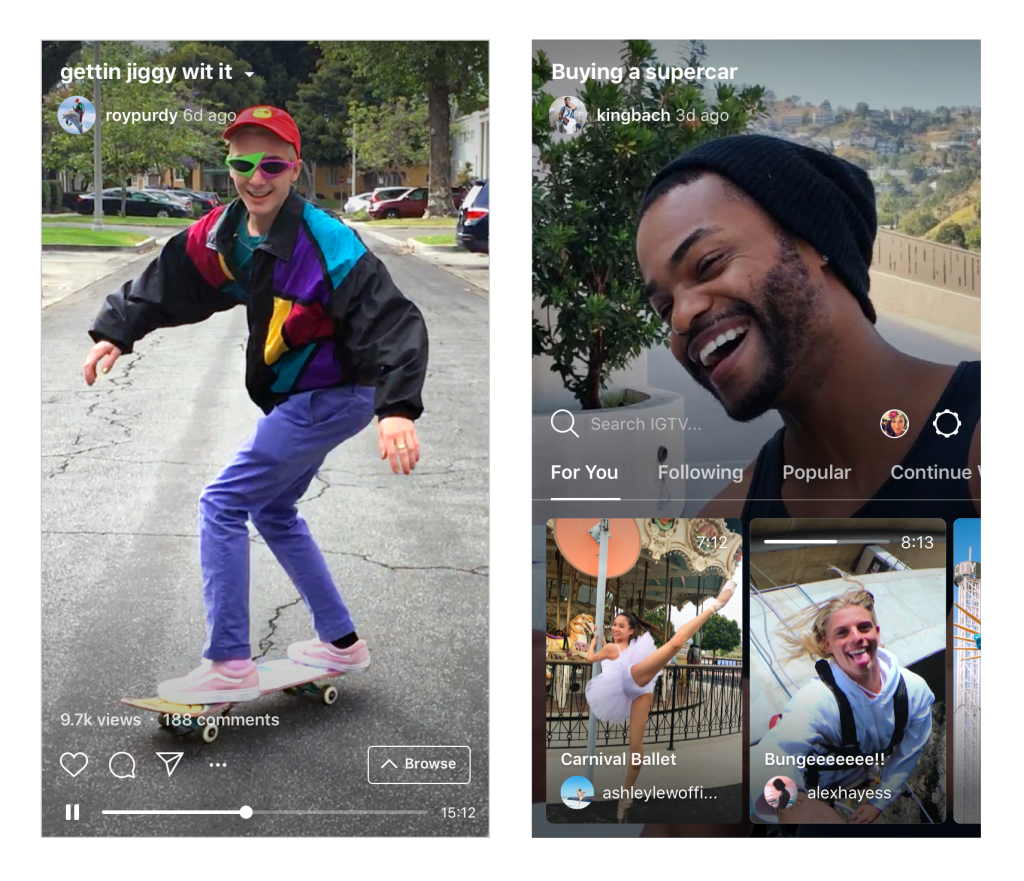

Write comment (98 Comments)Itbeen four months since Facebook launched IGTV, with the goal of creating a destination for longer-form Instagram videos. Is it shaping up to be a high-profile flop, or could this be the companynext multi-billion-dollar business

IGTV, which features videos up to 60 minutes versus Instagram normal 60-second limit, hasn&t made much of a splash yet. Since there are no ads yet, it hasn&t made a dollar, either.But, it offers Facebook the opportunity to dominate a new category of premium video, and to develop a subscription business that better aligns with high-quality content.

Facebook worked with numerous media brands and celebrities to shoot high-quality, vertical videos for IGTVlaunch on June 20, as both a dedicated app and a section within the main Instagram app. But IGTV has been quiet since. I&ve heard repeatedly in conversations with media executives that almost no one is creating content specifically for IGTV and that the audience on IGTV remains small relative to the distribution of videos on Snapchat or Facebook. Most videos on it are repurposed from a brandor influencerSnapchat account (at best) or YouTube channel (more common). Digiday heard the same feedback.

Instagram announced IGTV on June 20 as a way for users to post videos up to 1 hour long in a dedicated section of the app (and separate app)

Facebookgoal should be to make IGTV a major property in its own right, distinct from the Instagram feed. To do that, the company should follow the concept embodied in the &IGTV& name and re-envision what television shows native to the format of an Instagram user would look like.

Its team should leverage the playbook of top TV streaming services like Netflix and Hulu in developing original series with top talent in Hollywood to anchor their own subscription service, but in it a new format of shows produced specifically for the vertically oriented, distraction-filled screen of a smartphone.

Mobile video is going premium

Of the6+ hours per daythat Americans spend on digital media, the majority on that is now on their phone (most of it on social and entertainment activities) and video viewing has grown with it. In addition to the decline in linear television viewing and rise of &over-the-top& streaming services like Netflix and Hulu, we&ve seen the creation of a whole new category of video: mobile native video.

Starting at its most basic iteration with everyday users& recordings for Snapchat Stories, Instagram Stories and YouTube vlogs, mobile video is a very different viewing environment with a lot more competition for attention. Mobile video is watched as people are going about their day. They might commit a few minutes at a time, but not hour-long blocks, and there are distracting text messages and push notifications overlaid on the screen as they watch.

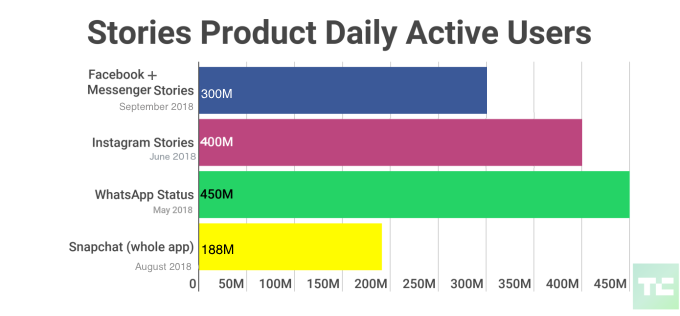

&Stories& on the major social apps have advanced vertically oriented, mobile native videos as their own content format

When I spoke recently with Jesús Chavez, CEO of the mobile-focused production company Vertical Networks in Los Angeles, he emphasized that successful episodic videos on mobile aren&t just normal TV clips with changes to the &packaging& (cropped for vertical, thumbnails selected to get clicks, etc.). The way episodes are written and shot has to be completely different to succeed. Chavez put it in terms of the higher &density& of mobile-native videos: packing more activity into a short time window, with faster dialogue, fewer setup shots, split screens and other tactics.

With the growing amount of time people spend watching videos on their social apps each day — and the flood of subpar videos chasing view counts — it makes sense that they would desire a premium content option. We have seen this scenario before as ad-dependent radio gave rise to subscription satellite radio like Sirius XM and ad-dependent network TV gave rise to pay-TV channels like HBO. What that looks like in this context is a trusted service with the same high bar for riveting storytelling of popular films and TV series — and often featuring famous talent from those — but native to the vertical, smartphone environment.

If IGTV pursues this path, it would compete most directly with Quibi, the new venture that Jeffrey Katzenberg and Meg Whitman are raising $2 billion to launch (and was temporarily called NewTV until their announcement at Vanity FairNew Establishment Summitlast Wednesday). They are developing a big library of exclusive shows by iconic directors like Guillermo del Toro and Jason Blum crafted specifically for smartphones through their upcoming subscription-based app.

Quibifunding is coming from the worldlargest studios (Disney, Fox, Sony, Lionsgate, MGM, NBCU, Viacom, Alibaba, etc.) whose executives see substantial enough opportunity in such a platform — which they could then produce content for — to write nine-figure checks.

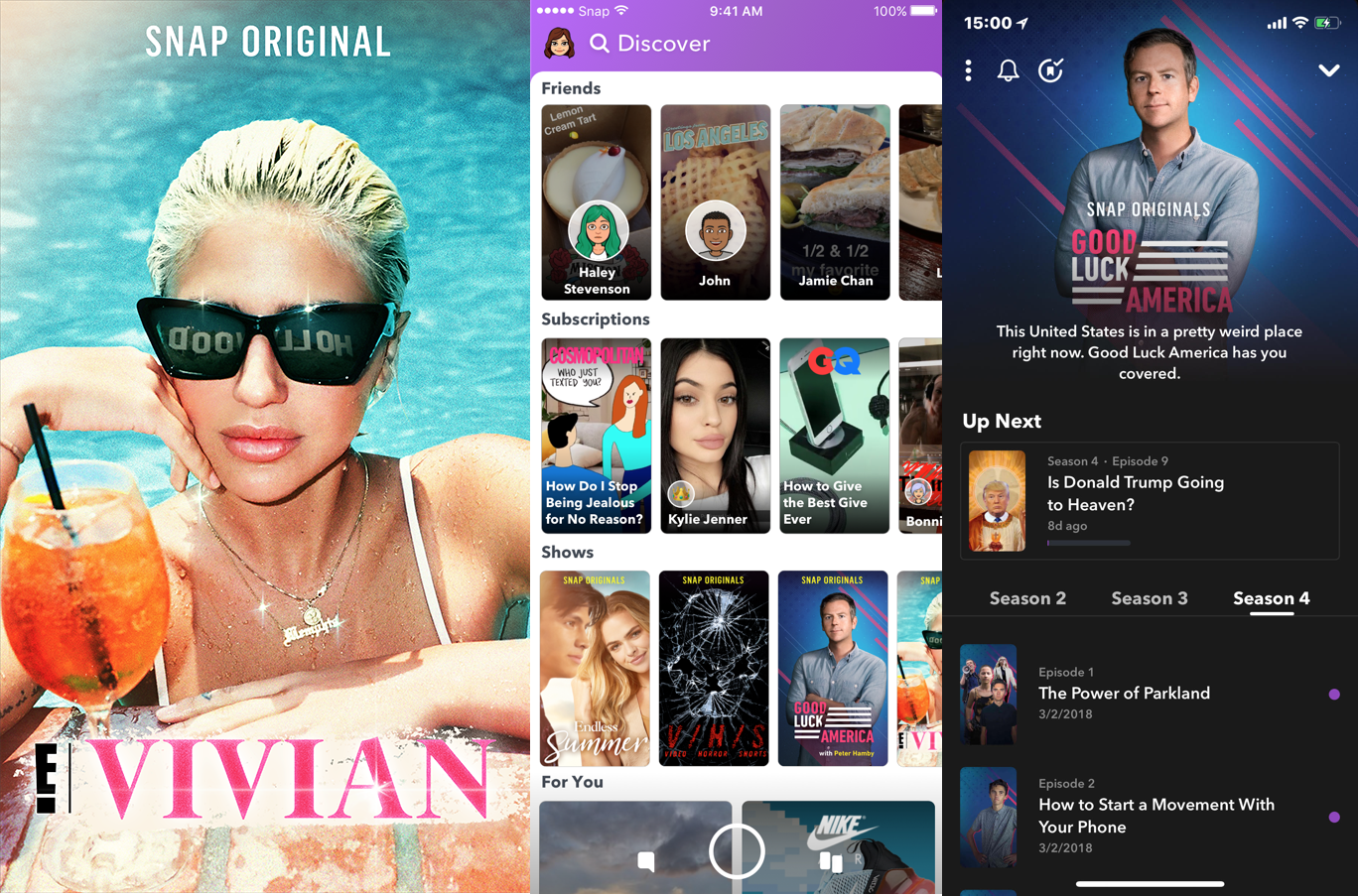

TechCrunchJosh Constine argued last year Snapchat should go in a similar &HBO of mobile& direction as well, albeit ad-supported rather than a subscription model. The company indeed seems to be stepping further in this direction with last weekannouncement of Snapchat Originals, although it has announced and then canceled original content plans before.

Snapchat announced its Snap Originals last week

Facebook is the best positioned to win

Facebook is the best positioned to seize this opportunity, and IGTV is the vehicle for doing so. Without even considering integrations with the Facebook, Messenger or WhatsApp apps, Facebook is starting with a base of more than1 billion monthly active users on Instagram alone. Thatan enormous audience to expose these original shows to, and an audience who don&t need to create or sign into a separate account to explore whatplaying on IGTV. Broader distribution is also a selling point for creative talent: They want their shows to be seen by large audiences.

The user data that makes Facebook rivaled only by Google in targeted advertising would give IGTVrecommendation algorithms a distinct advantage in pushing users to the IGTV shows most relevant to their interests and most popular among their friends.

The social nature of Instagram is an advantage in driving awareness and engagement around IGTV shows: Instagram users could see when someone they follow watches or &likes& a show (pending their privacy settings). An obvious feature would be to allow users to discuss or review a show by sharing it to their main Instagram feed with a comment; their followers would see a clip or trailer, then be able to click-through to the full show in IGTV with one tap.

Developing and acquiring a library of must-see, high-quality original productions is massively capital-intensive — just ask Netflix about the $13 billion itspending this year. Targeting premium-quality mobile video will be no different. Thatwhy Katzenberg and Whitman are raising a $2 billion war chest for Quibi and budgeting production costs of $100,000-150,000 per minute on par with top TV shows. Facebook has $42 billion in cash and equivalents on its balance sheet. It can easily outspend Quibi and Snap in financing and marketing original shows by a mix of newcomers and Hollywood icons.

Snap can&t afford (financially) to compete head-on and doesn&t have the same scale of distribution. It is at 188 million daily active users and no longer growing rapidly (up 8 percent over the last year, but DAUs actually shrunk by 3 million last quarter). Snapchat is also a much more private interface: it doesn&t enable users to see each others& activity like Facebook, Instagram, LinkedIn, YouTube, Spotify and others do to encourage content discovery. Snap is more likely to create a hub for ad-supported mobile-first shows for teens and early-twentysomethings rather than rival Quibi or IGTV in creating a more broadly popular Netflix or Hulu of mobile-native shows.

Ittime to go freemium

Investing substantial capital upfront is especially necessary for a company launching a subscription tier: consumers must see enough compelling content behind the paywall from the start, and enough new content regularly added, to find an ongoing subscription worthwhile.

There is currently no monetization of IGTV. It is sitting in experimentation mode as Facebook watches how people use it. If any company can drive enough ad revenue solely from short commercials to still profit on high-cost, high-quality episodic shows on mobile, itFacebook. But a freemium subscription model makes more sense for IGTV. From a financial standpoint, building IGTV into its own profitable P-L while making substantial content investments likely demands more revenue than ads alone will generate.

Of equal importance is incentive alignment. Subscriptions are defined by &time well spent& rather time spent and clicks made: quality over quantity. This is the environment in which premium content of other formats has thrived too; Sirius XM as the breakout on radio, HBO on linear TV, Netflix in OTT originals. The type of content IGTV will incentivize, and the creative talent they&ll attract,will be much higher quality when the incentives are to create must-see shows that drive new subscribers than when the incentives are to create videos that optimize for views.

Could there be a &Netflix for mobile native video& with shows shot in vertical format specifically for viewing on smartphone

The optimization for views (to drive ad revenue) have been the model that media companies creating content for Facebook have operated on for the last decade. The toxicity of this has been a top news story over the last year with Facebook acknowledging many of the issues with clickbait and sensationalism and vowing changes.

Over the years, Facebook has dragged media companies up and down with changes to its newsfeed algorithm that forced them to make dramatic changes to their content strategies (often with layoffs and restructuring). It has burned bridges with media companies in the process; especially after last January, how to reduce dependence on Facebook platforms has become a common discussion point among digital content executives. If Facebook wants to get top producers, directors and production companies investing their time and resources in developing a new format of high-quality video series for IGTV, it needs an incentives-aligned business model they can trust to stay consistent.

Imagine a free, ad-supported tier for videos by influencers and media partners (plus select &IGTV Originals&) to draw in Instagram users, then a $3-8/month subscription tier for access to all IGTV Originals and an ad-free viewing experience. (By comparison, Quibi plans to chargea $5/month subscription with ads with the option of $8/month for its ad-free tier.)

Looking at the growth of Netflix in traditional TV streaming, a subscription-based business should be a welcome addition to Facebookportfolio of leading content-sharing platforms. This wouldn&t be its first expansion beyond ad revenue: the newest major division of Facebook, Oculus, generates revenue from hardware sales and a 30 percent cut of the revenue to VR apps in the Oculus app store (similar to Applecut of iOS app revenue). Facebook is also testing a dating app which — based on the freemium business model Tinder, Bumble, Hinge, and other leading dating apps have proven to work — would be natural to add a subscription tier to.

Facebook is facing more public scrutiny (and government regulation) on data privacy and its ad targeting than ever before. Incorporating subscriptions and transaction fees as revenue streams benefits the company financially, creates a healthier alignment of incentives with users and eases the public criticism of how Facebook is using peopledata. Facebook is already testing subscriptions to Facebook Groups and has even explored offering a subscription alternative to advertising across its core social platforms. It is quite unlikely to do the latter, but developing revenue streams beyond ads is clearly something the companyleadership is contemplating.

The path forward

IGTV needs to make product changes if it heads in this direction. Right now videos can&t link together to form a series (i.e. one show with multiple episodes) and discoverability is very weak. Beyond seeing recent videos by those you follow, videos that are trending and a selection of recommendations, you can only search for channels to follow (based on name). Thereno way to search for specific videos or shows, no way to browse channels or videos by topic and no way to see what people you follow are watching.

It would be a missed opportunity not to vie for this. The upside is enormous — owning the Netflix of a new content category — while the downside is fairly minimal for a company with such a large balance sheet.

- Details

- Category: Technology

Read more: Why IGTV should go premium

Write comment (98 Comments)HTML5 almost ruined Facebook when baking in the mobile web standard to speed up development slowed down the performance of the social networkmain iOS and Android apps. For a brief moment in 2011, Facebook even tried to build an HTML5 gaming platform codenamed Sparta to escape the taxes of Apple and Googlemobile operating systems. But at the time, HTML5 wasn&t powerful enough for great gaming. Facebook eventually ditched HTML5, rebuilt the apps natively, and Facebook became one of the most powerful players in mobile.

Now Facebook is giving HTML5 another shot as a way to expand its Instant Games like Pac-Man and Words With Friends to the developing world through Facebook Lite, and to interest communities via Facebook Groups. With improvements to smartphone processing power and the underlying mobile browser app technology, HTML5 can now support snappy, graphically-complex games like Everwing seen below.

Instead of having to download separate apps for each game from the Apple App Store or Google Play, Instant Games launch in a mobile browser. That keeps Facebook Litefile size small to the benefit of international users with slow connections or limited data plans. And it lets Instant Games integrate directly into Groups so you can challenge not only friends but like-minded members to compete for high scores.

90 million people each month actively participate in 270,000 Facebook Groups about gaming, and now they&ll see Instant Games in the Groups navigation bar next to the About and Discussion tabs. Facebook is also considering making games an opt-in feature for non-gaming Groups.In Facebook Lite, Instant Games will appear in the More sidebar so they&re not too interruptive.

The expansion demonstrates how serious Facebook is about becoming a gaming company again. Back in its desktop days, the games platform dominated by developers like Zynga racked up tons of usage, virality, and in-game payments revenue for Facebook. That revenue declined for years after mobile usage began to dominate in 2014, but recently stabilized at around $190 million per quarter. Apparently someone is still playing FarmVille.

Facebook launched Instant Games in late-2016 to give people something to do while they&re waiting from friends to reply to their messages. Around the same time, Facebook launched Gameroom — a Steam-like desktop software hub for mid-core gamers, though therebeen less news on that product since. Instant Gamesrolled out worldwide in mid-2017, and opened to all developers in March of this year. Itsince been expanding monetization options for developers to make building Instant Games a sustainable business. That includes making Instant Games compatible with Facebookplayable ads that let developers lure in users from the News Feed.

Facebook won&t actually be earning money from in-app purchases on Instant Games on iOS where it doesn&t allow IAP due to Applepolicies, or on Android since it began forgoing its cut last month. It does take 30 percent on desktop though. But the bigger monetization play is in ads where Facebook is a juggernaut.

With Instant Games on Messenger, Facebookdesktop site and main mobile app via bookmarks,its new Fb.gg standalone gaming community app, and now Facebook Lite and Groups, the company is prioritizing the space again. That seems wise as gaming becomes more mainstream thanks to players livestreaming their commentary and phenomena like Fortnite. And with Facebookexpansion into hardware with the Portal smart screen and a forthcoming TV set-top box, it will have more places than ever for people to play or watch others duke it out.

- Details

- Category: Technology

Read more: Sidestepping App Stores, Facebook Lite and Groups get Instant Games

Write comment (91 Comments)The big accounting firms are under pressure from digital disruption just like every industry these days, but PwC is trying a proactive approach with a digital accelerator program designed to train employees for the next generation of jobs.

To do this, PwC is not just providing some additional training resources and calling it a day. They are allowing employees to take 18 months to two years to completely immerse themselves in learning about a new area. This involves spending half their time on training for their new skill development and half putting that new knowledge to work with clients.

PwCSarah McEneaney, digital talent leader at PwC was put in charge of the program. She said that as a consulting organization, it was important to really focus on the providing a new set of skills for the entire group of employees. That would take a serious commitment, concentrating on a set of emerging technologies. They decided to focus on data and analytics, automation and robotics and AI and machine learning.

Ray Wang, who is founder and principal analyst at Constellation Research says this is part of a broader trend around preparing employees inside large organizations for future skills. &Almost every organization around the world is worried about the growing skills gap inside their organizations. Reskilling, continuous learning and hand-on training are back in vogue with the improved economy and war for talent,& he said.

PwC program takes shape

About a year ago the company began designing the program and decided to open it up to everyone in the company from the consulting staff to the support staff with goal of eventually providing a new set of skills across the entire organization of 50,000 employees. As you would expect with a large organization, that started with baby steps.

Graphic:Duncan_Andison/Getty Images

The company designed the new program as a self-nomination process, rather than having management picked candidates. They wanted self starters, and about 3500 applied. McEneaney considered this a good number, especially since PwC tends to be a risk-averse culture and this was asking employees to leave the normal growth track and take a chance with this new program. Out of the 3500 who applied, they did an initial pilot with 1000 people.

She estimates if a majority of the companyemployees eventually opt in to this retraining regimen, it could cost some serious cash, around $100 million. Thatnot an insignificant sum, even for a large company like PwC, but McEneaney believes it should pay for itself fairly quickly. As she put it, customers will respect the fact that the company is modernizing and looking at more efficient ways to do the work they are doing today.

Making it happen

Daniel Croghan, a risk assurance associate at PwC decided to go on the data and analytics track. While he welcomed getting new skills from his company, he admits he was nervous going this route at first because of the typical way his industry has worked in the past. &In the accounting industry you come in and have a track and everyone follows the track. I was worried doing something unique could hinder me if I wasn&t following track,& he said.

Graphic:Feodora Chiosea/Getty Images

He says those fears were alleviated by senior management encouraging people to join this program and giving participants assurances that they would not be penalized. &The firm is dedicated to pushing this and having how we differentiate this against the industry, and we want to invest in all of our staff and push everyone through this,& Croghan said.

McEneaney says shea partner at the firm, but it took a change management sell to the executive team and really getting them to look at it as a long-term investment in the future of the business. &I would say a critical factor in the early success of the program has been having buy-in from our senior partner, our CEO and all of his team from the very start,& She reports directly to this team and sees their support and backing as critical to the early success of the program.

Getting real

Members of the program are given a 3-day orientation. After that they follow a self-directed course work. They are encouraged to work together with other people in the program, and this is especially important since people will bring a range of skills to the subject matter from absolute beginners to those with more advanced understanding. People can meet in an office if they are in the same area or a coffee shop or in an online meeting as they prefer.

Each member of the program participates in a Udacity nano-degree program, learning a new set of skills related to whatever technology speciality they have chosen. &We have a pretty flexible culture here…and we trust our people to work in ways that work for them and work together in ways that work for them,& McEneaney explained.

The initial program was presented as a 12-18 month digital accelerator tour of duty, Croghan said. &In those 12-18 months, we are dedicated to this program. We could choose another stint or go back to client work and bring those skills to client services that we previously provided.&

While this program is really just getting off the ground, ita step toward acknowledging the changing face of business and technology. Companies like PwC need to be proactive in terms of preparing their own employees for the next generation of jobs, and thatsomething every organization should be considering.

- Details

- Category: Technology

Read more: PwC staves off disruption with immersive emerging tech training

Write comment (99 Comments)Page 3908 of 5614

13

13