Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

This December a set of autonomous vehicles will start roaming the streets of Columbus, Ohio, in an effort to turn this bustling Midwestern community into the first smart city. The project, which is part of the Smart Columbus and DriveOhio initiatives, is the first step in launching a fully autonomous shuttle route in the city.

&We&re proud to have the first self-driving shuttle in Ohio being tested on the streets of Columbus,& said Mayor Andrew J. Ginther. &This pilot will shape future uses of this emerging technology in Columbus and the nation. Residents win when we add more mobility options to our transportation ecosystem & making it easier to get to work, school or local attractions.&

Michigan-based May Mobility provided the shuttles and the team is training the autonomous vehicles to navigate Columbus streets. May Mobility already launched their vehicles in Detroit and this is the second full implementation of the tech.

The six-seater electric shuttles will follow a 3 mile route through downtown Columbus and the vehicles will start picking up passengers on December 1. Rides are free. May Mobility has already performed over 10,000 successful trips in Detroit. In Columbus the shuttles will drive the Scioto Mile loop, a scenic route through the city and by the Ohio River. A large digital display will show system information and there will be a single operator to oversee the trip and take control in case of emergency.

Founder Edwin Olson is a robotics professor at the University of Michigan and his team won the original DARPA challenge in 2007.

&Cities are seeking cost-effective transportation services that will improve congestion in urban cores, and self-driving shuttles can offer a huge relief,& he said. &As we work toward a future where people can drive less and live more, we&re thrilled to be working with partners from Columbus to provide a new transportation experience that will make traveling through Columbus safe, reliable and personal.&

Columbus won the $40 million Smart City Challenge in June 2016 to test and implement smart city tech.

- Details

- Category: Technology

Read more: May Mobility puts autonomous shuttles on the streets of Columbus, Ohio

Write comment (90 Comments)Think Ethereum and other crypto coins are overvalued Now you can make money when their prices fall via Compound, which is launching its money market protocol for shorting cryptocurrencies today. The Coinbase and Andreessen Horowitz-funded startup today opens its simple web interface allowing users to borrow and short Ethereum, 0xZRX, BraveBAT, and AugurREP token, or lend them through Compound to earn interest.

Compoundprotocol isn&t just useful for crypto haters, or HODLers who want to generate interest instead of just having their coins gathering dust in a wallet. &If/whenCompoundscales, this will lead to some really interesting improvements in market structure, namely, fairer prices& Compound CEO Robert Leshner tells me.

The startup spent the summer completing a security audit by Trail Of Bits and adding 26 hedge fund partners who will trade with Compound, offering liquidity to independent investors looking to be matched with borrowers or lenders. Next, the startup wants to offer a stablecoin on its protocol, bring in big financial institutions to add even more liquidity, and partner with a wallet provider to make signup faster.

Compound users visit its site through a Web3 browser such as MetaMask or Coinbase Wallet and enter their Ethereum price. They can then view the interest rates for borrowing and shorting or lending and earning interest for each of the supported tokens. Compoundsecret sauce is that those interest rates are set algorithmically based on demand, though eventually it wants a community governance body to oversee this process. &It ranges from 5 percent to 45 percent APR depending on how scarce liquidity is . . . in general, we expect supply to outnumber borrowing about 5-1, and borrowing rates to be about 10 percent&.

To make sure no one thinks they&re getting scammed, Compound is also releasing a transparency dashboard users can view to check up on all the assets moving through the protocol and see what Compound is earning. It charges 10 percent of what borrowers pay in interest, with the rest going to the lender. That margin is what attracted the $8.2 seed round for Compound that also included Polychain Capital and Bain Capital Ventures.

It could also make crypto exchanges like Coinbase or Robinhood less attractive to users because leaving their coins there comes with the opportunity cost of not lending them for profit. Meanwhile, shorts could pop the volatile crypto bubble and push prices to more sensible and stable levels. Thatmarket health is a critical precursor to big banks and traditional investors diving into crypto.

[Disclosure: The author owns small positions in Bitcoin and Ethereum, but has no financial motive for writing this article, did not make trades in the week prior to this article, and doesn not plan to make trades in the 72 hours following publication.]

- Details

- Category: Technology

Read more: Compound launches easy way to short cryptocurrencies

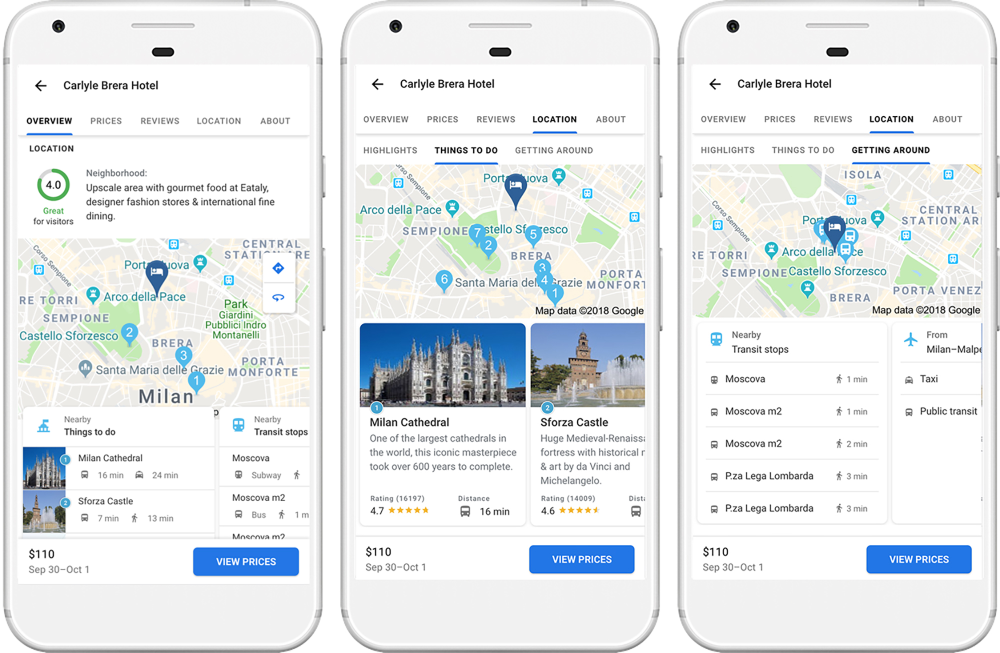

Write comment (93 Comments)Slowly but surely, Google is expanding its portfolio of travel offerings that now range from hotel- and flight-booking services to trip planning tools. Today, itlaunching yet another set of new travel features that focus on travel planning and hotel bookings.

Maybe the most interesting new tool, especially if you are planning to travel over the holidays, is a new landing page that shows you when to best book your flights ahead of Thanksgiving, the December holidays and New Yearbased on 2017price changes. The tool is a bit limited in the number of city pairs it supports, but if you plan to fly on one of the 25 supported routes, then it could definitely save you a few dollars (assuming this yearprice trends are comparable to last year&s).

The same page will also show you hotel deals, though thatmore of a lead-generation tool for Google Maps& hotel search feature, which many people probably don&t yet know about.

Once you have decided on a destination, Googlenew hotel location score can then help you find the neighborhood thatbest for you. The score summarizes information like nearby bars, landmarks and access to public transportation based on data from Google Maps. It&ll also tell you how to get to and from the airport, which is a smart addition.

Come October, Google will also launchYour Trips, a new feature that&ll help you organize your travel plans. Your Trips is not a new feature, but when this update goes live, it&ll collect all of your flight price tracking, hotel research and everything else you may have saved about a potential trip in one place. Ita bit like Inbox(RIP) trip bundles, but for trips that you are still planning.

And finally, if you perform a regular search for a popular travel destination in Google Search, the result page will automatically highlight these trip-planning features, including day plans and articles about the destination. Once you start booking a trip, these results will also include information about your bookings and additional information based on this data.

- Details

- Category: Technology

Read more: Google launches new travel-planning tools

Write comment (91 Comments)Troy Capital Group has closed its $200 million fund to provide loans to startup employees whose liquidity is locked up in company stock.

The fund, backed by the multi-billion-dollar private equity giant Oaktree Capital, is the latest investment vehicle from Troy Capital Partners, a four-year-old venture firm founded by MySpace co-founderJosh Berman; Samit Varma, a former partner at Anthem Ventures; and Brian Sullivan, the founder of the startup small business lender, ForwardLine.

Troy Capital Partners has roughly $140 million under management in a $20 million early-stage fund and a $120 million growth stage fund, according to Berman. This is the firmfirst foray into the lending business.

The new fund represents a brand new business opportunity for Oaktree, which manages $100 billion and invests heavily in credit and lending vehicles.

&We think equity compensation is a bit broken as companies stay private longer,& says fund principal Anthony Tucker. The problem for employees is that a lot of their net worth is locked up in stock that is illiquid except through secondary offerings, which requires them to relinquish their shares.

The lending product that Troy Capital offers comes with a 7 percent interest rate and means that employees don&t have to let go of their shares should they want to get some liquidity for their efforts. They simply take out a loan and get to keep the shares that could potentially be worth billions.

&As former operators of private technology companies, we understand the large and growing demand for early access to loans or liquidity, particularly as large, private technology companies stay private longer than ever,& said Varma in a statement. &TCGoffering provides an attractive solution for the many loyal and committed tech employees who want to be able to tap the value of their stock, but over the long-term want to keep their upside and stay closely aligned with their colleagues and leadership teams at these fast-growing, dynamic companies.&

For Troy, not only do the fund managers get access to a potentially lucrative new investment market, but they also gain a new pipeline for potential dealflow with the engineers and executives who may one day become founders in their own right.

According to Tucker, the market for this kind of product is in the tens of billions of dollars. &SoftBank did a tender with Uber and it was a $9 billion tender, which was oversubscribed two times.& That means there was an additional $9 billion of demand for that transaction alone, he said.

- Details

- Category: Technology

This summer, Microsoft pushed off the inevitable end of Skype Classic (7.0) support after a fair bit of user backlash. Nearly a month after the original September deadline, the company announced today that itgoing to pull the plug in November — for real this time.

The company is killing Skype 7 support on the desktop on November 1, following suit for mobile and tablets two weeks later on the 15th. The initial delay was motivated by vocal users unhappy by the changes brought on by Skype 8 in the name of simplification.

One user went so far as to launch a Change.org petition asking Microsoft to &Keep the desktop version of Skype alive for professional users.& The petition has since racked up in excess of 1,000 signatures, demanding the company keep enterprise features lost in the shuffle.

For its part, Microsoft says that itlistening and responding to the outcry over abandoned features.

&We&re continuing to work on your most requested features,& the company writes in an update to the original announcement. &Recently we launched call recording and have started to roll out the ability to search within a conversation. You&ll soon be able to add phone numbers to existing contacts, have more control over your availability status, and more.&

- Details

- Category: Technology

Read more: Microsoft will end support for Skype Classic in November

Write comment (95 Comments)WndrCo, the consumer tech investment and holding company founded by longtime Hollywood executive Jeffrey Katzenberg, has invested $30 million in The Infatuation, a restaurant discovery platform.

The Infatuation made waves earlier this year when itpurchased Zagat from Google,which had paid $151 million for the 40-year-old company in 2011.Despite efforts to makeover the Zagat app, the search giant ultimately decided to unload the perennialrestaurant review and recommendation service and focus on expanding its database of restaurant recommendations organically.

New York-based The Infatuation was founded by music industry vets Chris Stang and Andrew Steinthal in 2009. It has previously raised $3.5 million for its mobile app, events, newsletter and personalized SMS-based recommendation tool.

Stang told TechCrunch this morning that they plan to use a good chunk of the funds to develop the new Zagat platform, which will be kept separatefrom The Infatuation.

&The first thing we want to do before we build anything is spend a lot of time researching how people have used Zagat in the past, how they want to use it in the future, what a community-driven platform could look like and how to apply community reviews and ratings to the brand,& said Stang, The Infatuationchief executive officer. &Zagatroots are in user-generated content. … What we are doing now is thinking through what that looks like with new tech applied to it. What it looks like in the digital age. How [we can] take our domain expertiseand that legendary brand and make something new with it.&

The Infatuation will also expand to new cities beginning this fall with launches in Boston and Philadelphia. Italready active in a dozen or so U.S. cities including Los Angeles, Seattle and San Francisco. The startupfirst and only international location is London.

Katzenberg, who began his Hollywood career at Paramount Pictures, began raising up to $2 billion for WndrCo about a year ago. Since then, heunveiled WndrConew mobile video startup NewTV, which has raised $1 billion and hired Meg Whitman, the former president and CEO of Hewlett Packard, as CEO.

On top of that, WndrCo has invested inMixcloud,Axios,Node,Flowspace, Whistle Sports, TYT Network and others.

Given The Infatuation founders& experience in the entertainment industry, a partnership with Katzenberg was natural.

&We really felt like between content and technology they had … expertise on both sides,& Stang said. &TheInfatuation isat its best when great contentintersects with great technology, to find a fund that was perfectly suited to that was exciting.&

- Details

- Category: Technology

Page 4056 of 5614

11

11