Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

The Oculus Connect 5 conference kicks off tomorrow in San Jose where FB and company will let their latest virtual reality efforts loose and attempt to prove to the world that VR is coming at last and therenothing we can do to stop it.

Tomorrow is going to be a big day for hardware, though there might not be all that many surprises as Oculus has already been pretty vocal about some of its future plans. We&ll see.

Heresome of the stuff that we&re expecting to go down tomorrow.

Release date, price for Oculus &Santa Cruz& standalone

The still unnamed standalone, 6DoF headset with tracked controllers is more than likely coming early next year; the big question is really going to be its price.

While Oculus has been very aggressive with their $199 starting price for Oculus Go, it will be interesting to see where the pricing moves for whatever &Santa Cruz& ends up being called. The headset is still running a mobile chipset, though it will more than likely be a current-generation Snapdragon 845 as opposed to the much older 821, which is on the Oculus Go. The headset most notably will also sport positional tracking and hand controllers (which we&ll probably see an updated design for) at launch, features that will also surely add to the price.

I&m expecting pricing to sit around $349-$399; anything less would probably cannibalize Oculus Go sales and anything more would be a tough sell to consumers that have already proven a little reluctant to buy into VR right now.

A look at the next-gen Oculus Rift

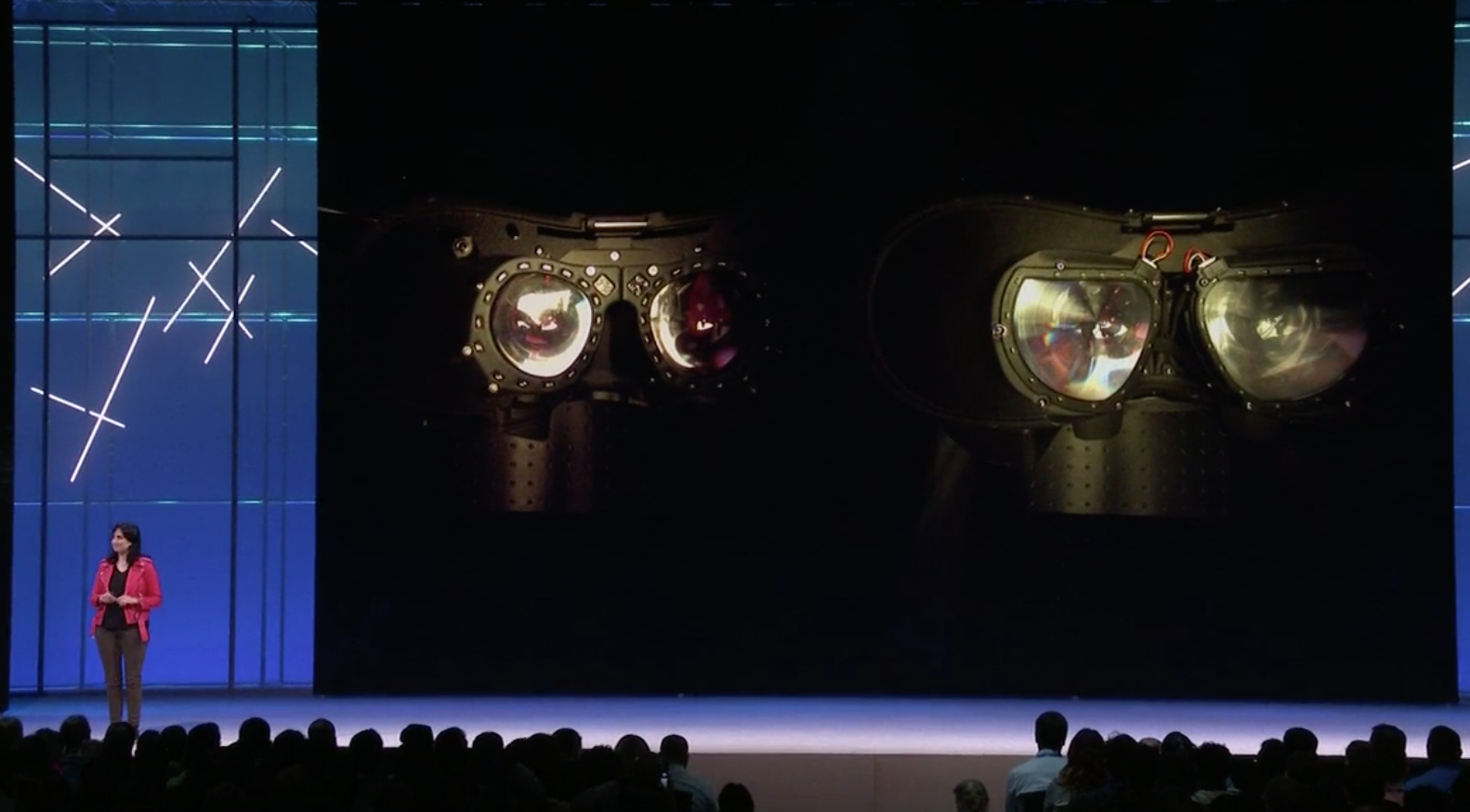

We got a peek at the Oculus &Half Dome& prototype at F8; my guess is we&ll see a lot more about it tomorrow and perhaps get some press demos of a feature prototype.

The companyRift headset is more than a couple of years old at this point so itprobably time to start thinking about the next generation of the PC-powered headset. There have been a lot of leaps in GPU power since the Rift was announced and now that Oculus has a few products rounding out the low-end, they may be freed up a bit more to have a PC professional tier that can get a bit more experimental.

The big deal with &Half Dome& is its new approach to the way the lenses focus on objects. With the old system, their fixed focal distance ensured you couldn&t really read anything within armlength; with the new system that uses motorized displays and eye-tracking, the headset will be able to act more like your eyes do, focusing on objects as you look at them dynamically. This is coupled with a new lens system that significantly widens the field-of-view. Itall really powerful stuff, but presents a lot of engineering challenges, so it&ll be interesting to hear more details from Oculus onstage.

Blurrier Oculus/Facebook division

Just as Instagram and WhatsApp have been sucked into the Facebook corporate hierarchy, we&ll likely see the results of deeper Oculus integration into FacebookVR division represented at the keynote.

After the big reorganization at the end of 2016, the Oculus exec structure has seen the co-founders downgraded while power has swelled to executives in Zuckerberginner circle. Hugo Barrajob title is still Facebook VP of VR, while Andrew Bosworth is the VP of AR/VR; we&ll likely hear quite a bit from them.In the conferenceearlier years, we saw an Oculus co-founder take to the stage for the big announcement, then last year Mark Zuckerberg opened things up and walked everyone through the big announcements.

This year, Oculus Research was renamed Facebook Reality Lab. It&ll be interesting to see where else Facebook makes inroads into the Oculus structure.

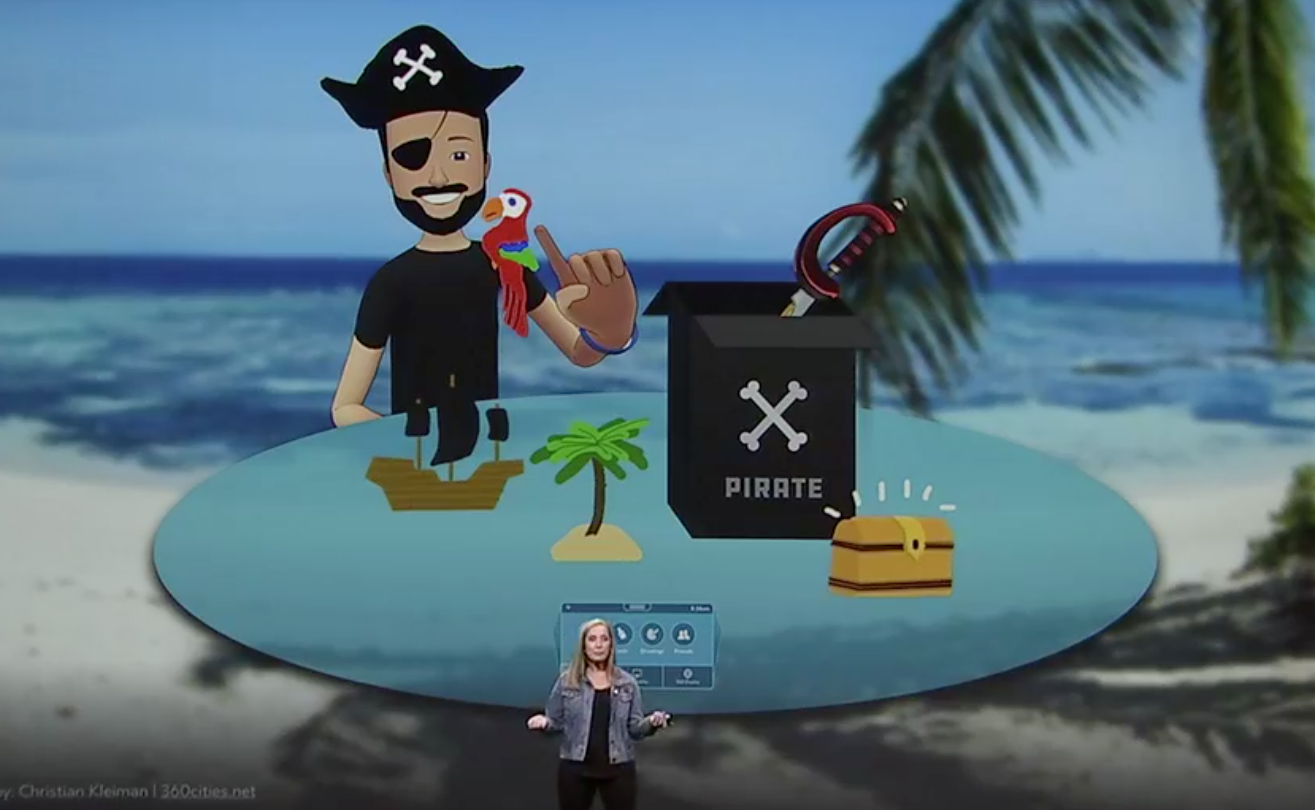

Facebook Spaces has gotten some air time for the past few years; itlikely the team will be back onstage sharing their latest feature updates. We&ll see whether the social app gains &Santa Cruz& support and whether it will grow to become a stock app or continue to live in its more experimental phase.

New AAA content

One thing we can certainly expect to hear a lot about tomorrow is new gaming titles available on the companyexisting platforms.

Oculus made a big deal last year about how itlooking to court AAA game publishers to develop for Rift; the Oculus Studios divisions will probably clue us into its next wave of titles with more of an emphasis on a few polished big-ticket releases rather than a wave of indie projects.

A couple of years back Oculus detailed that they had spent $250 million on content and were spending $250 million more, but we haven&t heard many updates on the dollar amounts pledged to games or experiences. Maybe we&ll hear a few more details about how substantial the companyinvestments have grown or where the company is looking to direct its investments next.

Oculus mixed reality

This one might be a stretch, but this could be the year we get to see some of the companyexperimentations with augmented reality that they&ve been lightly teasing over the past few years.

We know the team at the Facebook Reality Lab is working on AR headset technologies, but italso clear that itstill a very early, expensive time for the technology. Nevertheless, Microsoft is likely going to be showing off an updated HoloLens focused squarely on enterprise soonish and Magic Leap has already showcased their first big move into the consumer space.

Oculus showing its hand this early would be a bit surprising, but if Apple is as close to releasing a headset as reports have suggested, perhaps they want to clue people into what they&re working on.

Theregoing to be a lot happening over the next couple of days, especially at the keynote tomorrow morning at 10am PT. TechCrunch will be on the ground bringing you the best analysis and the quickest updates you can find on the world wide web.

- Details

- Category: Technology

Read more: What to expect from Facebook’s big Oculus Connect 5 keynote

Write comment (90 Comments)A dozen or so people accompanied by a 14-foot, 800-pound cage gathered in downtown San Francisco Tuesday morning to protest Salesforce&scontract with U.S. Customs and Border Patrol (CBP), the agency within the Department of Homeland Security responsible for enforcing the Trump Administration&szero-tolerance immigration policy.

Today is the first day ofDreamforce, Salesforceannual user conference that attracts some 200,000 people.The protesters claim Salesforce, whichsigned an agreement with CPB in March,is complicit in the actions of CBP and should be held accountable.

&Salesforce has a moral and ethical obligation to end this contract,& one protestor shouted.

The sign plastered to the front of the cage — a mock-up of those reportedly used in CBP facilities to hold separatedchildren of migrant families — read &Detention center powered by Salesforce.&

&Ithard to miss an 800-pound cage rolling down the street,& Jelani Drew, lead organizer of the demonstration and campaigner for the nonprofit advocacy group Fight for the Future, told TechCrunch. &They had to look and that was the goal.&

[gallery ids="1719937,1719939,1719940,1719941"]Almost 1,800 families were separated at the U.S.-Mexico border from October 2016 through February of this year, per Reuters. And another 2,342 children were separated from 2,206 parents between May 5 and June 9, according to Vox.

In late June, President Donald Trump signed an executive order to end family separation, though the zero-tolerance policy, which mandates that any persons entering the U.S. illegally be prosecuted,remains.

Salesforce chief executive officer Marc Benioff, who has a reputation for advocating for liberal causes and politics, has said the deal with CBP does not involveCBPU.S.-Mexico border policies. CBP, rather, uses some Salesforce cloud tools, specificallySalesforce Analytics, Community Cloud and Service Cloud, to bolster its recruiting process and to &manage border activities.&

When asked for comment, Salesforce told TechCrunch the cloud-computing company respects the right to protest and pointed us in the direction of Beniofftweets, which reaffirm the business doesn&t have an agreement with Immigration and Customs Enforcement (ICE) and that the CBP contract is unrelated to family separation.

That tweet, posted in July, was a response to a petition signed by 650 Salesforce employees, who took issue with the CBP contract, specifically CBPuse of Salesforce Service Cloud to manage activities at the border.

&We cannot cede responsibility for the use of the technology we create&particularly when we have reason to believe that it is being used to aid practices so irreconcilable to our values,& the employees wrote. &Those values often feel abstract, and it is easier to uphold them when they are not being tested. They are being tested now.

In addition to his tweet, Benioff wrote in a memo to employees at the time that he is &opposed to separating children from their families at the border.&

&It is immoral. I have personally financially supported legal groups helping families at the border. I also wrote to the White House to encourage them to end this horrible situation.&

Salesforce co-CEO Keith Block said the company woulddonate $1 million to organizations helping families separated at the U.S. border and that Salesforce would match employee donations. In his tweet, he did not specify which organizations the company would support.

Today, Block similarly took to Twitter to announce that the nonprofit arm of Salesforce would donate $18 million to &Bay Area causes.& The San Francisco Chronicle reportsthat the San Francisco and Oakland Unified School Districts will receive $15.5 million, Hamilton Families, Larkin Street Youth Services and the San Francisco Food Bank will receive$2 million and the San Francisco Park Alliance will receive $500,000.

Todayprotest was organized byFight for the Future, Color of Change, Demand Progress, Defending Rights and Dissent, Mijente, Presente.org, RAICES and Sum of Us. RAICES,The Refugee and Immigrant Center for Education and Legal Services, recently rejected a $250,000 donation from Salesforce because of its contract with CBP.

Benioff contacted RAICES executive director Jonathan Ryan over the summer to discuss the opposition to Salesforcecontract with CBP, according to a new report from The Guardian. The pair were scheduled to speak until Benioff canceled last minute. &I am sorry I&m scuba diving right now,& Benioff reportedly wrote to Ryan.

We&ve reached out to RAICES for comment.

Benioff and Salesforce are among several large tech companies that have struck controversial deals with government agencies. Employees at both Amazon and Microsoft have protested their companies& contracts with ICE.Googlereportedly decided not to renew a Pentagon contractafter employees resigned in protest of the search giantinvolvement with controversial AI research project Project Maven.

Jacinta Gonzalez, senior campaign organizer with Mijente, a national hub for Latinx organizers, told TechCrunch the she and the other protesters are hopeful tech companies will drop their contracts with both CBP and ICE.

&We&ve been incredibly concerned with corporations, particularly the tech corporations, that are facilitating ICE and border patroldestruction of immigrant communities,& Gonzalez said. &Ita matter of continuing to pressure these investors and executives at thesetech companies that are making billions at the expense of immigrants. They are profiting off the suffering of immigrants.&

- Details

- Category: Technology

Read more: Protesters call on Salesforce to end contract with border patrol agency

Write comment (96 Comments)A future dominated by autonomous vehicles (AVs) is, for many experts, a foregone conclusion. Declarations that the automobile will become the next living room are almost as common — but, they are imprecise. In our inevitable driverless future, the more apt comparison is to the mobile device. As with smartphones, operating systems will go a long way toward determining what autonomous vehiclesareand what theycould be. For mobile app companies trying to seize on the coming AV opportunity, their future depends on how the OS landscape shapes up.

By most measures, the mobile app economy is still growing, yet the time people spend using their apps is actually starting to dip. Arecent studyreported that overall app session activity grew only 6 percent in 2017, down from the 11 percent growth it reported in 2016. This trend suggests users are reaching a saturation point in terms of how much time they can devote to apps. The AV industry could reverse that. But justhow mobile apps will penetrate this market andwhowill hold the keys in this new era of mobility is still very much in doubt.

When it comes to a driverless future, multiplefactors are now converging. Over the last few years, while app usage showed signs of stagnation, the push for driverless vehicles has only intensified.More citiesare live-testing driverlesssoftwarethan ever, and investments in autonomous vehicle technology and software by tech giants like Google and Uber (measuredin thebillions) are starting to mature. And, after some reluctance, automakers have nowembracedthis idea of a driverless future. Expectations from all sides point to a &passenger economy& of mobility-as-a-service, which,by some estimates,may be worth as much as $7 trillion by 2050.

For mobile app companies this suggests several interesting questions: Will smart cars, like smartphones before them, be forced to go &exclusive& with a single OS of record (Google, Apple, Microsoft, Amazon/AGL), or will they be able to offer multiple OS/platforms of record based on app maturity or functionality Or, will automakers simply step in to create their own closed loop operating systems, fragmenting the market completely

Automakers and tech companies clearly recognize the importance of &connected mobility.&

Complicating the picture even further is the potential significance of an OSability tosupport multiple Digital Assistants of Record (independent of the OS), as we see with Google Assistant now working on iOS. Obviously, voice NLP/U will be even more critical for smart car applications as compared to smart speakers and phones.Even in those established arenas the battle for OS dominance is only just beginning. Opening a new front in driverless vehicles could have a fascinating impact. Either way, the implications for mobile app companies are significant.

Looking at the driverless landscape today there are several indications as to which direction the OSes in AVs will ultimately go. For example, after some initial inroads developing their own fleet of autonomous vehicles, Googlehas now focusedalmost all its efforts on autonomous driving software while strikingnumerous partnership deals with traditional automakers. Some automakers, however, are moving forward developing their own OSes. Volkswagen, for instance, announced thatvw.OS will be introduced in VW brand electric cars from 2020 onward, with an eye toward autonomous driving functions. (VW also plans to launch a fleet of autonomous cars in 2019 to rival Uber.)Tesla,a leader in AV, is building its own unifiedhardware-software stack. Companies like Udacity, however, are building an &open-source& self-driving car tech.Mobileyeand Baidu have apartnershipin place to provide software for automobile manufacturers.

Clearly, most smartphone apps would benefit from native integration, but there are several categories beyond music, voice and navigation that require significant hardware investment to natively integrate. Will automakers be interested in the Tesla model If not, how will smart cars and apps (independent of OS/voice assistant) partner up Given the hardware requirements necessary to enable native app functionality and optimal user experience, how will this force smart car manufacturers to work more seamlessly with platforms like AGL to ensure competitive advantage and differentiation And, will this commoditize the OS dominance we see in smartphones today

Itclearly still early days and — at least in the near term — multiple OS solutions will likely be employed until preferred solutions rise to the top. Regardless, automakers and tech companies clearly recognize the importance of &connected mobility.& Connectivity and vehicular mobility will very likely replace traditional auto values like speed, comfort and power. The combination of Wi-Fi hotspot and autonomous vehicles (let alone consumer/business choice of on-demand vehicles) will propel instant conversion/personalization of smart car environments to passenger preferences. And, while questions remain aroundthe howand thewhoin this new era in mobile, itnot hard to see thewhy.

Americans already spend an average of 293 hours per year inside a car, and the average commute time has jumped around 20 percent since 1980. In a recent survey (conducted by Ipsos/GenPop) researchers found that in a driverless future people would spend roughly a third of the time communicating with friends and family or for business and online shopping. By 2030, itestimated the autonomous cars&will free up a mind-blowing 1.9 trillion minutes for passengers.& Another analysis suggested that even with just 10 percent adoption, driverless cars could account for $250 billion in driver productivity alone.

Productivity in this sense extends well beyond personal entertainment and commerce and into the realm of business productivity. Use of integrated display (screen and heads-up) and voice will enable business multi-tasking from video conferencing, search, messaging, scheduling, travel booking, e-commerce and navigation. First-mover advantage goes to the mobile app companies that first bundle into a single compelling package information density, content access and mobility. An app company that can claim 10 to 15 percent of this market will be a significant player.

For now, investors are throwing lots of money at possible winners in the autonomous automotive race, who, in turn, are beginning to define the shape of the mobile app landscape in a driverless future. In fact, what we&re seeing now looks a lot like the early days of smartphones with companies like Tesla, for example, applying an Apple -esque strategy for smart car versus smartphone. Will these OS/app marketplaces be dominated by a Tesla — or Google (for that matter) — and command a 30 percent revenue share from apps, or will auto manufacturers with proprietary platforms capitalize on this opportunity Questions like these — while at the same time wondering just who the winners and losers in AV will be — mean investment and entrepreneurship in the mobile app sector is an extremely lucrative but risky gamble.

- Details

- Category: Technology

Read more: The new era in mobile

Write comment (92 Comments)The worlds of augmented reality and VR theoretically represent a boundless expanse for startups looking to create a new digital future. Realizing that future is the tough part, and doing so while Google, Facebook, Microsoft and Apple all look to plant their flags is even harder.

While plenty of investors have taken a look at AR/VR companies in the years following Facebook acquisition of Oculus VR, for many, the prospect of buying in at a stage where the consumer interest is so uncertain has proven a bit too risky. At TechCrunchone-day Sessions AR/VR event on October 18 at UCLA, we&ll chat with investors from top venture capital firms about where they&re seeing potential in the market and how they are approaching investments in AR/VR in 2018.

We&ll be joined by Niko Bonatsos from General Catalyst, Catherine Ulrich from FirstMark Capital and Jacob Mullins from Shasta Ventures on a panel discussing the ins and outs of AR/VR investing.

Bonatsos was an early investor in Snap and has also backed AR cloud startup 6D.ai (which will also be joining us), Ulrichfirm FirstMark has made investments in AR/VR startups like Sketchfab and Mullins runs Shasta Ventures& Camera Fund focused on early-stage AR investments.

The future of consumer AR/VR may be a bit murky for the time being, but these investors are looking to peer through the smoke and mirrors and find the startups that will stand resilient.

Get an inside look into the AR/VR investment landscape when you purchase a ticket today. Early-bird sales were extended til this Friday, September 28. Don&t miss out! Student tickets are just $45 and can be purchased through this link.

- Details

- Category: Technology

Read more: Hear from investors at General Catalyst, FirstMark and Shasta at TC Sessions: AR/VR

Write comment (100 Comments)Of the 100 most-watched live telecasts in the US in 2005, 14 were sporting events; in 2015, sporting events comprised 93 of the top 100 telecasts. That shift occurred because TV shows are shifting to online or on-demand viewing, and live broadcasts of the biggest sports are the main thing TV networks have left to draw in live audiences. But the need to keep those sports on TV and off streaming services is only accelerating the rate at which young people are tuning into other sports leagues instead.

The rapid adoption of subscription video streaming services like Netflix and Hulu and of social live streams on Facebook, YouTube, and Twitch is enabling massive growth by sports leagues that you won&t normally see on TV. In the streaming era, more sports & and new types of sports like esports & keep thriving while interest in traditional pro leagues like the NFL and MLB declines.

OTT is where the growth is

The central narrative in the global film/TV industry right now is the response of incumbent companies to the growing dominance of Netflix, Amazon, and other streaming (aka &OTT& or over-the-top) services. The incumbents are merging to consolidate ownership of must-have shows onto a smaller number of new OTT services that will each be stronger.

The majority of American households have a Netflix subscription (i.e. access to one of Netflix56M US accounts), another 20M have a Hulu subscription, the number of OTT-only households has tripled in 5 years, and 50% of US internet users use a subscription OTT service at least weekly. Almost one-third (29%) of Americans say they watch more streaming TV than linear TV, and among those age 18-29 it54% (with 29% having cut the cord on linear TV entirely). People, especially young people, want to watch shows on their own time and on any device, and they get more value from a few $8-40 per month subscription platforms than a $100+ per month cable bill.

Meanwhile, social live-streaming platforms that got their start enabling people to either vlog or watch video gaming are expanding to all sorts of live broadcasting: Twitch averaged 1 million viewers at any given point of day in January, and there were 3.5 billion broadcasts over Facebook Live in the first two years after it launched (with 2 billion users viewing at least one).

We&ve hit the pivot point where media is streaming-first. Netflix is now the leading studio in Hollywood, spending $13 billion this year on content. Linear TV viewing is declining: every major cable network (except NBC Sports) has declining viewership and aging viewers. Between 2007 and 2017, the median age of primetime viewers on ABC, CBS, NBC, and Fox went up 8-11 years and are all in the 50s or 60s.

Major pro sporting events are the last bastion of TV networks because the dominant brands are, for the most part, only available live on TV. Beyond those, the only content getting large audiences to tune in simultaneously are a couple Hollywood awards shows and premieres or finales of a couple hit shows (Big Bang Theory and NCIS).

The exclusive broadcast rights to those live sports events & particularly the NFL, NBA, MLB, and top NCAA basketball and football games & are the last defense for major broadcast networks. They are the reason for younger Americans to not cut the cord. ESPN makes $7.6 billion per year in carriage fees from cable companies paying for the right to carry the main ESPN channel (the other ESPN channels add another $1 billion); that number is increasing even as ESPNviewership is declining.

Disney (ESPNowner) and other leading broadcasters don&t want to let people watch major sporting events online instead (at least not easily or cheaply) because doing so would pull the rug out from under their traditional revenue stream and OTT revenue (subscription + ads) won&t make up for it quickly enough. This problem is only exacerbated by the fact that TV networks are paying record sums for exclusive broadcast rights to top sports leagues out of fear that losing them to a rival could be a nail in their coffin.

This strategy is delaying, not stopping the shift in consumption habits. More and more young people are tuning out (or never tuning in) to the major pro sports on TV, and the median age of their audiences shows that: 64 for the PGA Tour, 58 for NASCAR, 57 for MLB, 52 for NCAA football and menbasketball, and 50 for the NFL…and all are getting older. (Cable news networks, the other holdouts who are still doing well on live TV face the same situation: the average age of Fox News, MSNBC, and CNN viewers is now 65, 65, and 61 respectively.)

The major pro sports staying on linear TV has expanded the market opening for new sports to fill the open space with young people who mainly consume content online. In fact, a growing marketplace of different sports leagues (including esports) developing their own fanbases is an inevitability of the shift to OTT video as it lowers the barrier to entry to near-zero and letgeographically dispersed fans unify in one place.

1. Lower barrier to entry for distribution

Lawn bowling is no longer your grandfathersports league. Mint Images/Getty Images

Niche sports leagues & or frankly, even big sports leagues that just aren&t at the scale of professional football, baseball, basketball, and hockey & have always had a hard time getting coverage on television. But you can produce and distribute video for an online audience more cheaply than for a television audience.

In fact with Facebook Live and Twitch, you can stream live video for free, and you can share clips across every social channel to attract interest. To launch your own OTT service or partner with an existing one, you don&t need to start with a massive audience from the beginning and you don&t need millions of dollars from sponsors just to break even.

Having signed over 150 new deals this year alone for its 20+ sports verticals (which will stream 2,500 live events in 2018), Austin-based FloSports has established itself as the go-to OTT partner for sports leagues with an established, passionate following that aren&t massive enough to garner regular ESPN-level coverage.

From rugby, track - field, and wrestling to bowling, competitive marching band, and ballroom dance, millions of Americans have participated in these activities in their youth and through clubs as adults but rarely see them on television. In fact, the rare instances when such sports are on TV & like their national championships & the league is usually paying large sums (potentially hundreds of thousands of dollars) for that airtime rather than getting paid by the broadcasters.

FloSports gives a home to the superfans of its partner leagues, with full coverage of the sport and commentary meant for real fans. It produces events in the manner best fit to highlight the action and turns superfans & who generally pay a subscription & into evangelists who recruit friends. There are numerous sports that have millions of participants yet no active, high-quality event coverage; those are underserved markets.

By tapping into this, FloSports properties (like FloWrestling, FloTrack, etc.) have gained hundreds of thousands of subscribers and created a surge of interest in teams like Oklahoma Statewrestling team, which saw an 144% increase in live stream viewing and 68% growth in event attendance after joining FloWrestling (leading to them to set an all-time attendance record in the universitybasketball arena of 14,059 people). In the first half of 2018, FloSports& various Instagram accounts collectively received 307M video views, more than the collective accounts of Fox Sports or of all NFL teams (and NFL Network).

2. Going global right away.

Johanne Defay of France at a World Surf League event. Mark Ralston/AFP/Getty Images

The top pro sports leagues have geographically concentrated fan-bases that fit the geographic restrictions of TV broadcasters, which end at a countryborder. Online streaming empowers sports that have large fan bases who aren&t geographically concentrated to aggregate in the digital sphere with enough eyeballs (and paying subscriptions) to drive engagement with the sportcontent through the roof.

Since being acquired in 2015 and renamed World Surf League, the governing body of professional surfing has developed a large global following & with 6.5M Facebook fans and 2.9M Instagram followers & through the launch of live streams and on-demand video on its website and mobile app, plus partnering with third-parties like Bleacher ReportOTT service B/R Live. Only 20-25% of WSLviewers are in the US but since its competitions are streamed direct-to-consumer online, they were able to reach surfers around the world right away. After seeing WSLFacebook Live streams garner over 14M viewers in 2017, Facebook paid up to become the exclusive live-stream provider for WSL competitions for two years, beginning this past March.

3. Immediate data on audience engagement.

As with all offline-to-online shifts, OTT video streaming captures dramatically more data on audience demographics and engagement than television does, and it does it in real-time. This makes it easier for emerging sports leagues to partner with advertisers and show immediate ROI on their sponsorships, plus it informs their understanding of how to produce their particular type of sporting event for maximum audience engagement.

Karate Combat is a year-old league that builds off the existing base of karate participants and fans around the world (numbering in the tens of millions) with a new competition format specifically intended for OTT. The league allows full-contact fighting and sets the match in a pit (rather than a traditional fighting ring) for better camera angles. It also replaces the traditional focus on having a big in-person audience (which is expensive) and instead sets the fights in exotic locations (like the fight this coming Thursday night on top of the World Trade Center).

Like many emerging sports leagues, Karate Combat is vertically integrated: the league organizing the competitions is also the one producing and streaming the event coverage over its website, mobile apps, and social channels. This not only means it captures the content-related revenue from subscribers, advertisers, and numerous OTT distribution partners, but it sees every data point about fans& viewing behavior and their interaction with various dashboards (like biometrics on each fighter) so they can optimize both online and offline aspects of the production.

4. Online means interactive

Jujitsu fighting is now an OTT service. South_agency/Getty Images

Online viewing creates the opportunity for functionality you can&t achieve with linear TV: interactive displays overlayed on or next to live video. Viewers can pull up and click through real-time stats, change camera views, or switch overlays (think the the yellow first-down line in NFL broadcasts or coloring around a hockey puck to help you track it on the ice). Ultimately, a more interactive experience means a more social and more entertaining experience (and the sort of deep engagement advertisers value too).

FloSports& ju-jitsu live streams (FloGrappling) give subscribers multiple live cameras each covering simultaneous matches on different mats so they can click between them. This is a more personalized experience than passively watching one broadcast on TV and it gets that subscriber actively engaged, with their behavior providing valuable data points for FloSports and their deeper interaction likely more compelling to event sponsors.

The display might also highlight live comments from friends or friends-of-friends in order to draw viewers into a more social experience. Discussion of a specific live stream with others watching it has been a central feature for Twitch and Facebook Live and enables the league or team streaming the event to directly engage with fans around the world.

An exception to the OTT-first strategy may be in sports that are entirely new and have zero existing base of participants or fans. Karate, surfing, and video-gaming all have millions of passionate participants around the world, going back decades. A new league like the 3-year-old Drone Racing League (DRL), which has raised $21M in venture capital to develop the sport of competitive drone racing, has to artificially stimulate the development of a fanbase if it doesn&t want to wait years for grassroots competitions to create a critical mass of fans even for a niche OTT service. Itunsurprising then that DRL has focused on striking TV deals with ESPN, Sky Sports, ProSiebenSat.1, and others to thrust it in front of large audiences from the start, like a new game show hoping its format will entice enough people to take interest.

Power is in the hands of the league owners

Ari Emanuel, chief executive officer of William Morris Endeavor Entertainment. Jonathan Alcorn/Bloomberg via Getty Images

The best position to be in right now is the owner of a sports league thatrapidly growing in popularity. The competition for audience by both traditional media companies and tech platforms leaves a long list of distribution partners eager for must-have, exclusive content & especially content like sports events that fans want to want live together & and willing to pay up.

Moreover, vertical integration to control your fans& content viewing experience and own your relationship with them has never been easier. There are direct subscriptions, advertisers, event sponsors, event tickets, a portfolio of possible OTT distribution deals, and merchandising. The potential revenue streams a league can develop are only more numerous when you add in launching a fantasy sports league & like World Surf League has done & and the recent nationwide legalization of sports betting in the US.

Endeavor, the parent company of Hollywoodpowerful WME-IMG talent agency, seems to have recognized this and is an early mover in the space. It bought two sports leagues that have relied on TV deals and event attendance revenue & UFC for $4B and the smaller but rapidly growing Professional Bull Riders for $100M & and, since they each own their content, launched direct-to-consumer subscription platforms (UFC Fight Pass and PBR Ridepass) for super-fans and cord-cutters. (Endeavor also paid $250M to acquire Neulion, the technology company whose infrastructure powers the OTT services of the UFC, PBR, World Surf League, and dozens of others.)

Thereopportunity for new streaming platforms focused on being the media partner for these emerging sports leagues. Inevitably, the opportunity for bundling will consolidate many of the niche subscriptions onto a small number of leading sports OTT platforms, and thata powerful market position for those platforms.

What is unclear is if they can defend themselves as the incumbent media and tech companies come around to this phenomenon and commit billions toward capturing the market. The leading sports broadcasting companies all have OTT offerings and want to make them as compelling to potential subscribers as possible even if they exclude content from the biggest pro sports. A larger company that can afford to spend huge sums on exclusive sports streaming rights (like Disney with ESPN/ABC, Comcast with NBC/Sky Sports, CBS with CBS Sports Network, or Discovery with Eurosport) might opt to buy a company like FloSports as part of their deep dive into the space or they might just aim to outbid them when a leaguecontract comes up for renewal.

The hope for an independent OTT platform devoted to emerging sports leagues is they get big enough, fast enough that they can afford to keep winning the rights to emerging leagues as those leagues grow and offers from competitors bid prices up. These dedicated OTT services will likely have to secure long-term & think ten years & streaming rights deals or acquire control of some popular new sports leagues outright to hold their own.

Like online distribution triggered an explosion of digital publishing brands and social influencers for every imaginable niche, the rise of high-quality live streaming and subscription OTT services will allow a lot more sports leagues to build an audience and revenue base substantial enough to thrive. Theremore variety for consumers and resources than ever for those with a rapidly growing league to attract fans worldwide.

- Details

- Category: Technology

Read more: Live streams of karate and niche sports are terrifying major sports leagues

Write comment (99 Comments)Photokina is underway in London and the theme of the show is &large.& Unusually for an industry that is trending towards the compact, the cameras on stage at this show sport big sensors, big lenses, and big price tags. But though they may not be for the average shooter, these cameras are impressive pieces of hardware that hint at things to come for the industry as a whole.

The most exciting announcement is perhaps that from Panasonic, which surprised everyone with the S1 and S1R, a pair of not-quite-final full frame cameras that aim to steal a bit of the thunder from Canon and Nikonentries into the mirrorless full frame world.

Panasoniccameras have generally had impressive video performance, and these are no exception. They&ll shoot 4K at 60 FPS, which in a compact body like that shown is going to be extremely valuable to videographers. Meanwhile the S1R, with 47 megapixels to the S124, will be optimized for stills. Both will have dual card slots (which Canon and Nikon declined to add to their newest gear), weather sealing, and in-body image stabilization.

The timing and inclusion of so many desired features indicates either that Panasonic was clued in to what photographers wanted all along, or they waited for the other guys to move and then promised the things their competitors wouldn&t or couldn&t. Whatever the case, the S1 and S1R are sure to make a splash, whatever their prices.

Panasonic was also part of an announcement that may have larger long-term implications: a lens mount collaboration with Leica and Sigma aimed at maximum flexibility for the emerging mirrorless full-frame and medium format market. L-mount lenses will work on any of the groupdevices (including the S1 and S1R) and should help promote usage across the board.

Leica, for its part, announced the S3, a new version of its medium format S series that switches over to the L-mount system as well as bumping a few specs. No price yet but if you have to ask, you probably can&t afford it.

Sigma had no camera to show, but announced it would be taking its Foveon sensor tech to full frame and that upcoming bodies would be using the L mount as well.

This Fuji looks small here, but itno lightweight. Itonly small in comparison to previous medium format cameras.

Fujifilm made its own push on the medium format front with the new GFX 50R, which sticks a larger than full frame (but smaller than &traditional& medium format) sensor inside an impressively small body. Thatnot to say itinsubstantial: Fujicameras are generally quite hefty, and the 50R is no exception, but itmuch smaller and lighter than its predecessor and, surprisingly, costs $2,000 less at $4,499 for the body.

The theme, as you can see, is big and expensive. But the subtext is that these cameras are not only capable of extraordinary imagery, but they don&t have to be enormous to do it. This combination of versatility with portability is one of the strengths of the latest generation of cameras, and clearly Fuji, Panasonic and Leica are eager to show that it extends to the pro-level, multi-thousand dollar bodies as well as the consumer and enthusiast lineup.

- Details

- Category: Technology

Read more: Big cameras and big rivalries take center stage at Photokina

Write comment (99 Comments)Page 4070 of 5614

17

17