Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

A draft executive order circulating around the White House &is not the result of an official White House policymaking process,& according to deputy White House press secretary, Lindsay Walters.

According to a report inThe Washington Post,Walters denied that White House staff had worked on a draft executive order that would require every federal agency to study how social media platforms moderate user behavior and refer any instances of perceived bias to the Justice Department for further study and potential legal action.

Bloombergfirst reported thedraft executive order and a copy of the document was acquired and published byBusiness Insider.

Herethe relevant text of the draft (from Business Insider):

Section 2. Agency Responsibilities. (a) Executive departments and agencies with authorities that could be used to enhance competition among online platforms (agencies) shall, where consistent with other laws, use those authorities to promote competition and ensure that no online platform exercises market power in a way that harms consumers, including through the exercise of bias.

(b) Agencies with authority to investigate anticompetitive conduct shall thoroughly investigate whether any online platform has acted in violation of the antitrust laws, as defined in subsection (a) of the first section of the Clayton Act, 15 U.S.C. § 12, or any other law intended to protect competition.

(c) Should an agency learn of possible or actual anticompetitive conduct by a platform that the agency lacks the authority to investigate and/or prosecute, the matter should be referred to the Antitrust Division of the Department of Justice and the Bureau of Competition of the Federal Trade Commission.

While there are several reasonable arguments to be made for and against the regulation of social media platforms, &bias& is probably the least among them.

That hasn&t stoppedthe steady drumbeat of accusations of bias under the guise of &anticompetitive regulation& against platforms like Facebook, Google, YouTube, and Twitter from increasing in volume and tempo in recent months.

Bias was the key concern Republican lawmakers brought up when Mark Zuckerberg was called to testify before Congress earlier this year. And bias was front and center in Republican lawmakers& questioning of Jack Dorsey, Sheryl Sandberg, and Googleempty chair when they were called before Congress earlier this month to testify in front of the Senate Intelligence Committee.

The Justice Department has even called in the attorneys general of several states to review the legality of the moderation policies of social media platforms later this month (spoiler alert: they&re totally legal).

With all of this activity focused on tech companies, itno surprise that the administration would turn to the Executive Order — a preferred weapon of choice for Presidents who find their agenda stalled in the face of an uncooperative legislature (or prevailing rule of law).

However, as thePostreported, aides in the White House said therelittle chance of this becoming actual policy.

… three White House aides soon insisted they didn&t write the draft order, didn&t know where it came from, and generally found it to be unworkable policy anyway. One senior White House official confirmed the document had been floating around the White House but had not gone through the formal process, which is controlled by the staff secretary.

- Details

- Category: Technology

The Roomhas been ranked with Plan 9 From Outer Spaceas a strong contender for the &best& worst movie ever made— and itnow available in its entirety on YouTube.

Written, directed, and starring Tommy Wiseau, The Room belongs in the same category as Plan 9, and Coven (which was immortalized in the 1999 documentary American Movie) as a paean to moviemaking by people who have no idea how to make a movie.

The combination of passion and ineptitude is what made The Room a cult classic after its release, and what made The Disaster Artist— the James Franco film it inspired so compelling (Ed Wood, the biopic from Tim Burton about the director behind Plan 9 is also amazing).

Writer, actor, and director Tommy Wiseau in a still from &The Room&

In &The Room& Wiseau plays Johnny, an investment banker caught in a bizarre love triangle with his best friend, Mark, played by Greg Sestero, and his fiancee, Lisa, played by Juliette Danielle.

It was Sesterobook on the making of the film, &The Disaster Artist&, that inspired the eponymous movie directed by Franco and starring his brother Dave and Seth Rogen.

According to The Daily Dot,Sestero and Wiseau are now promoting a straight-to-digital follow-up to their feature debut — a two-part black comedy called &Best F(r)iends&.

Viewers might just be better off watching the original contender for best worst movies,Plan 9, which isalso available on YouTube (and below).

- Details

- Category: Technology

Read more: Cinematic train wreck, “The Room”, is now on YouTube in its entirety

Write comment (97 Comments)Comcast has outbid Twenty-First Century Fox for the UKSky, a final step in whatbeen a years-long takeover battle between the two media conglomerates.

Comcastfinal offer gives Sky a roughly $39 billion price tag.

The acquisition of Sky, which has 23 millionsubscribers in the UK, Ireland, Germany, Austria and Italy, will give Comcast a much stronger foothold in the international market and much-needed ammo to compete with Amazon and Netflix in the streaming wars.

Both companies upped their offers for Sky at the settlement auction Saturday, with Comcast offering £17.28 per Sky ordinary share and Fox offering £15.67 per share. Comcast initially priced Skyshares at £14.75 apiece. Foxoriginal offer was £14 per share.

Both companies will reveal their revised bids on Monday. Skyboard will make its official recommendation by October 11.

Sky operates several brands including Sky News, Sky Sports and Sky Cinema.

- Details

- Category: Technology

Read more: Comcast outbids Fox in $40B battle for Sky

Write comment (94 Comments)Many corporations are pinning their futures on their venture investment portfolios. If you can&t beat startups at the innovation game, go into business with them as financial partners.

Though many technology companies have robust venture investment initiatives—Alphabetventure funding universeandIntel Capitalprolific approach to startup investment come to mind—other corporations are just now doubling down on venture investments.

Over the past several months, several big corporations committed additional capital to corporate investments. For example, defense firmLockheed Martin addedan additional $200 millionto its in-house venture group back in June. Duck-represented insurance firmAflacjust bumped its corporate venture fundfrom $100 million to $250 million, andCignalustlaunched a $250 million fund of its own. This is to say nothing of financial vehicles likeSoftBank&struly enormous Vision Fund, into which the Japanese telecom giant invested $28 billion of its own capital.

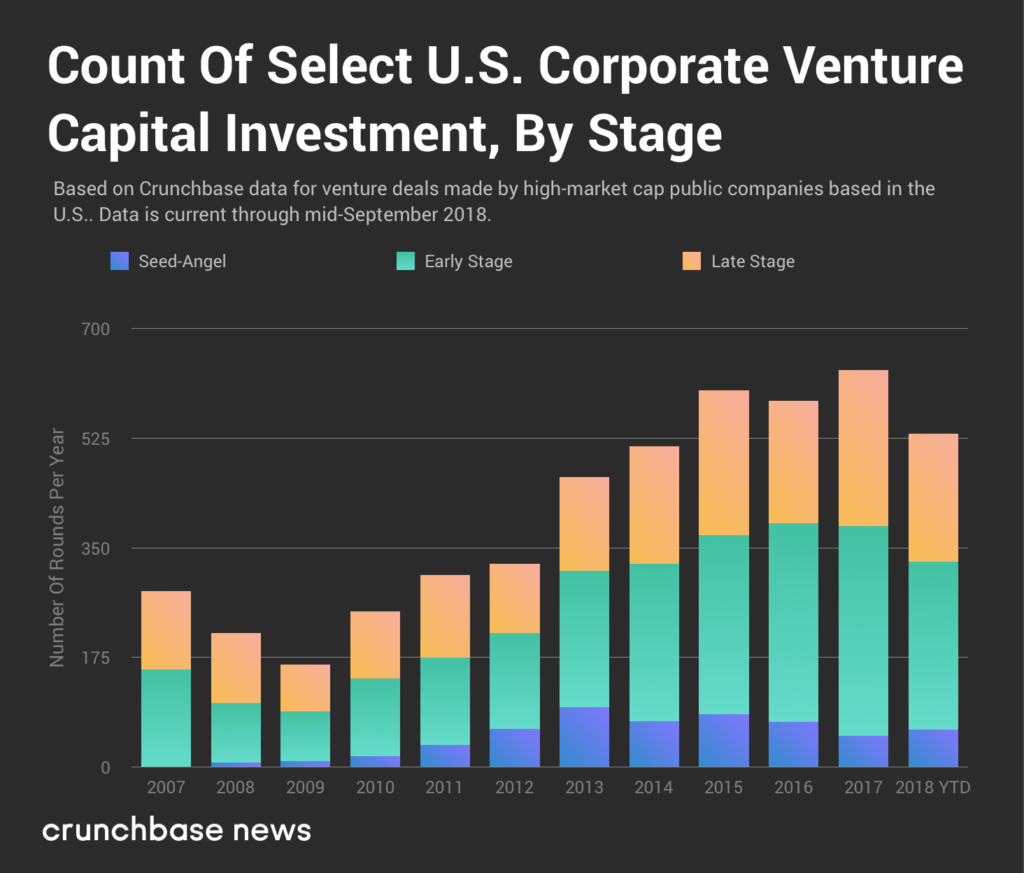

And 2018 is on track to set a record for U.S. corporate involvement in venture deals. We come to this conclusion after analyzing corporate venture investment patterns of the top 100 publicly traded, U.S.-based companies (as ranked by market capitalizations at time of writing). The chart below shows that investing activity, broken out by stage, for each year since 2007.

A few things stick out in this chart.

The number of rounds these big corporations invest in is on track to set a new record in 2018. Keep in mind that therea little over one full quarter left in the year. And although the holidays tend to bring a modest slowdown in venture activity over time, thereprobably sufficient momentum to break prior records.

The other thing to note is that our subset of corporate investors have, over time, made more investments in seed and early-stage companies.In 2018 to date, seed and early-stage rounds account for over 60 percent of corporate venture deal flow, which may creep up as more rounds get reported. (Therea documented reporting lag in angel, seed, and Series A deals in particular.) This is in line with the past couple of years.

Finally, we can view this chart as a kind of microcosm for blue-chip corporate risk attitudes over the past decade. Itpossible to see the fear and uncertainty of the 2008 financial crisis causing a pullback in risk capital investment.

Even though the crisis started in 2008, the stock market didn&t bottom out until 2009. You can see that bottom reflected in the low point of corporate venture investment activity. The economic recovery that followed, bolstered by cheap interest rates that ultimately yielded the slightly bloated and strung-out market for both public and private investors We&re in the thick of it now.

Whereas most traditional venture firms are beholden to their limited partners, that investor base is often spread rather thinly between different pension funds, endowments, funds-of-funds, andhigh-net-worth family offices. With rare exception, corporate venture firms have just one investor: the corporation itself.

More often than not, that results in corporate venture investments being directionally aligned with corporate strategy. But corporations also invest in startups for the same reason garden-variety venture capitalists and angels do: to own a piece of the future.

A note on data

Our goal here was to develop as full a picture as possible of a corporationinvesting activity, which isn&t as straightforward as it sounds.

We started with a somewhat constrained dataset: the top 100 U.S.-based publicly traded companies, ranked by market capitalization at time of writing. We then traversed through each corporationnetwork of sub-organizations as represented in Crunchbase data. This allowed us to collect not just the direct investments made by a given corporation, but investments made by its in-house venture funds and other subsidiaries as well.

Ita similar method to what we did when investigating Alphabetinvesting universe. Using Alphabet as an example, we were able to capture its direct investments, plus the investments associated with its sub-organizations, and their sub-organizations in turn. Except instead of doing that for just one company, we did it for a list of 100.

This is by no means a perfect approach. Itpossible that corporations have venture arms listed in Crunchbase, but for one reason or another, the venture arm isn&t listed as a sub-organization of its corporate parent. Additionally, since most of the corporations on this list have a global presence despite being based in the United States, itlikely that some of them make investments in foreign markets that don&t get reported.

- Details

- Category: Technology

Read more: Corporate venture investment climbs higher throughout 2018

Write comment (95 Comments)Singapore Blockchain Week happened this past week. While there have been a few announcements from companies, someof the most interesting updates have come from regulators, and specifically, the Monetary Authority of Singapore (MAS). The financial regulator openly discussed its views on cryptocurrency and plans to develop blockchain technology locally.

For those who are unfamiliar, Singaporehistorically has been a financial hub in Southeast Asia, but now has also gradually become the crypto hub of Asia. Compared to the rest of Asia and the rest of the world, the regulators in Singapore are well-informed and more transparent about their views on blockchain and cryptocurrency. While regulatory uncertainties still loom over Korea and Japan, in Southeast Asia, theMAS has already released its opinion &A Guide to Digital Token Offering& that illustrates the application of securities laws to digital token offerings and issuances.Singaporeanregulators have arguably been pioneering economic and regulatory standards in Asia since the early days of the countryfounding by Lee Kuan Yew in 1965.

Singapore is the first stop for foreign companies in crypto

In the past,I&ve said that Thailand is one of the most interesting countries in crypto in Southeast Asia.Nonetheless, for any Western or foreign company looking to establish a footing in Asia, or even for any local company in any Asian country looking to establish a presence outside of their own country, Singapore should be the firststop.It has become the go-tocrypto sandbox of Asia.

There are a number of companies all over Asia, as well as in the West, that have already made moves into the country. And the types of cryptocurrency projects and exchanges that go to Singapore vary widely.

A few months ago, a Korean team called MVL introduced Tada, or the equivalent of&Uber& on the blockchain, inSingapore.Tada is an on-demand car sharing service that utilizes MVLtechnology. The Tadaapp is built on MVLblockchain ecosystem, which is specifically designed to serve the automotive industry, adjacent service industries, and their customers.In this case, MVL was looking to test out its blockchain projects in a progressive, friendly jurisdiction outside of Korea, but still close enough to its headquarters. Singapore fulfilled most of these requirements.

Relatedly, Didi, Chinaride-sharing company, has also looked to build out its own blockchain-based ride-sharing program, called VVgo. VVgo&slaunch is pending, and its home is intended to be in Toronto, Singapore, Hong Kong or San Francisco. Given Singaporegeographic proximity and the transparency of its regulators, it would likely be agoodtesting ground for Didi as well.

This week, exchanges such as BinanceandUpbitfrom Korea have also announced their plans to enter the Singaporean market. A few days ago, Changpeng Zhao,CEO ofBinance, the worldlargest cryptocurrency exchange, announced the launch of a fiat currency exchange that will be based in Singapore. He also mentioned his companyplan to launchfive to ten fiat-to-crypto exchanges in the next year, with ideally two per continent.Dunamu, the parent company of South Korealargest crypto exchangeUpbit, also just announcedthe launch ofUpbitSingapore, which will be fully operational by October.

The team at Dunamu mentions how they areencouraged by MASattitude towards cryptocurrency regulation and the vision of the countrygovernment to establish a strong crypto and blockchain sector. They also believeSingapore could be a bridge between Korea and the global cryptocurrency exchange market.

From a high level, the supply of crypto projects and trading volume in Singapore is certainly strong, and the demand also appears abundant.Following China&sICO ban in late 2017, Singaporehas become hometo many financial institutions that can serve as potential investors for ICOs.

As recently featured on the China Money Network, Li Dongmei wrote that:

What is supporting such optimism is the quiet preparation of capital on a massive scale getting ready to act the &All In Crypto& mantra. &In recent months, there have been over a thousand foundations being established in Singapore by Chinese nationals,& said Chen Xianhui, an agent specialized in helping Chinese clients to register foundations in Singapore. Most of these newly established foundations are used setting up various token investments funds.

Singaporehas become thefirst choice whencrypto companies from both the West and the East are initially scoping out their market strategies in Asia, and companies want an overarching idea of whatgoing on in the cryptocurrency world inthe region.

In fact,itoften the case that Southeast Asian crypto companies and leaders gather inSingaporebefore they go off and do crypto businesses in their own countries.Itthe place for one wants to tap all of the Asian crypto markets in one single physical location. The proof is in the data: in 2017, Singapore ascended to the number three market for ICO issuancebased on thenumberof funds raised, trailing the United States and Switzerland.

Crypto is thriving due to regulator openness

The Monetary Authority of Singapore (MAS) takes a very practical approach to crypto. Currently,MAS divides digital tokens into utility tokens, payments tokens, and securities. In Asia, only Singapore and Thailand currently have such detailed classifications.

While speaking at Consensus Singapore this week, Damien Pang, Singapore&sTechnology Infrastructure Office under the FinTech - Innovation Group (FTIG),said that &[MAS does]not regulate technology itself but purpose,& when in conversation discussing ICOs in Singapore.&The MAS takes a close look at the characteristics of the tokens, in the past, at the present, and in the future, instead of just the technology built on&.

Additionally, Pang mentioned that MAS does not intend to regulate utility tokens.Nevertheless, they are looking to regulate payment tokens that have a store of value and payment properties by passing a service bill by the end of the year.They are also paying attention to any utility or payment tokens with security features (i.e. a promise of future earnings, which will be regulated as such).

On the technology front, since 2017, Singaporeauthorities have been looking to use distributed ledger technology to boost the efficiency of settling cross-bank financial transactions. They believe thatblockchain technology offers thepotential to make trade finance safer and more efficient.

When compared to other Asia crypto hubs like Hong Kong, Seoul, or Shanghai,Singaporecanexposeone to the Southeast Asia market significantly more. I believe market activity will likely continue to thrive in the region as the country continues to act as the springboard for cryptocurrency companies and investors, and until countries like Korea and Japan establish a clear regulatory stance.

- Details

- Category: Technology

Read more: Singapore is the crypto sandbox that Asia needs

Write comment (90 Comments)Fintech promises to be one of the hottest topics at Disrupt Berlin 2018, and you can take that to the bank—see what we did there On 29-30 November thousands of attendees will descend on Berlin, and what better way to get your fintech business in front of them than to exhibit in Startup Alley

Oh wait, we know a better way — apply to be a TechCrunch Top Pick and exhibit at Disrupt Berlin for FREE! Our highly discerning editors will review every application and choose up to five of the absolute best early-stage fintech startups. Each TC Top Pick receives one freeStartup Alley Exhibitor Package along with prime real estate in Startup Alley where they can strut their stuff in front of influential technologists and investors, potential collaborators and customers.Itan opportunity you can&t afford to miss, so don&t wait —apply before the 28 September deadline.

Herewhat you get with a Startup Alley Exhibitor Package.

- One-day exhibit space

- Three Disrupt Berlin Founder Passes

- Access toCrunchMatch(our free investor-to-startup matching platform)

- Access to the Disrupt press list

- A chance to be selected as one of theStartup BattlefieldWild Card companies (and you might even compete in our $50,000 startup-pitch competition)

Exhibiting in Startup Alley can help you build connections and relationships you might not otherwise make. Consider Zeroqode, a company that exhibited in Startup Alley at Disrupt Berlin 2017.

Startup Alley attendees chose Zeroqode as a Wild Card company on day three, which earned them a five-minute interview with TechCrunch editor John Biggs on the Startup Alley Showcase Stage. Whatmore, TechCrunch shot that interview and promoted it, along with an article penned by Biggs, across its social media platforms.

Herewhat Vlad Larin, the companyco-founder, had to say about the experience.

&Exhibiting in Startup Alley was a massively positive experience. It gave us the chance to show our technology to the world and have meaningful conversations with investors, accelerators, incubators, solo founders and developers. The publicity we received from the on-stage interview brought a lot of people to our website. We had a huge spike in traffic, and we&re still feeling the positive business effects of that interview.&

You&ll also have the opportunity to hear some of Europefintech movers and shakers speak from the Main Stage. People like Anne Boden, the founder and CEO of Starling Bankand Ricky Knox, the CEO and co-founder of Tandem Bank.

Disrupt Berlin 2018takes place on 29-30 November. If you want a shot at being one of the fintech TC Top Picks and exhibiting for free in Startup Alley, then apply here before 28 Sept. We can&t wait to see you in Berlin!

- Details

- Category: Technology

Read more: Fintech startups: Apply to exhibit for free as a TC Top Pick at Disrupt Berlin 2018

Write comment (98 Comments)Page 4104 of 5614

11

11