Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

The last few months haven&t been easy for crypto investors. Following the dizzying highs of crypto trading late last year, which saw Bitcoin reach a peak of $19,276 and a market cap of $323 billion and Ether reach $1,152 with a market cap of more than $112 billion, prices have crashed. Today, Bitcoin trades at around $6,500, and Ether at $204. Their combined market caps have shed about $300 billion in value.

Thatbasically five Bernie Madoffs worth of losses.

The situation has put crypto investors in quite the bind. As one indicative example, The Wall Street Journal profiled wunderkind crypto investor Olaf Carlson-Wee, who founded Polychain Capital. The fund, which has seen dizzying growth over the past few years turning a few thousand dollars into tens of millions in returns, has lost about 40 percent of its $800 million in capital through investment losses and investor withdrawals.

Itclear the second blockchain bubble is now complete (the first was the run-up in Bitcoin prices in 2013). The question is: Whatnext for blockchain

Blockchaintwo narratives& problem

I have previously argued that blockchainrise is a dual parallel to that of the internet. On one side that I dubbed the 1960s narrative, the technology is extraordinarily nascent, with limited use cases and almost no ability to scale. The other side is the 1990s narrative — that this is a groundbreaking new technology that should be invested in immediately for maximum returns.

Blockchainstory so far is the freakish combination of these two narratives. The enthusiasm of the &1990s& crypto investors on valuation never matched the enthusiasm of the &1960s& crowd of crypto researchers and core blockchain designers, who focused on the potential of these technologies over the vagaries of price. As conversations with leaders like Vitalik Buterin can attest, many of the core engineers are hyper-aware of just how much work remains to be done to see blockchain become a foundational technology.

Indeed, the interaction between these two groups explains much of the kerfuffle this week over Buterincomments around the lack of &1000x& potential with blockchain. While the media has painted his comments in a deeply negative light, and he has been criticized by crypto acolytes, I think it is clear that his pragmatism stems from his engineering background rather than his investment focus.

The simple answer is that the 1960s crowd is right, and the 1990s crowd is just too early. Much more development is needed to get blockchain where it needs to be, and much more analysis is going to have to be done to figure out where the investment returns are going to be. Search and social ended up being the killer apps for the internet, but the winners in those categories hardly emerged instantly.

Real innovation is slower than we always expect

The pace of innovation may have accelerated over the past two centuries, but there is still a ceiling on how fast things can change. The cell phone took almost two decades from its original launch in the 1980s to the launch of the iPhone in 2007. The internet took roughly three decades from its conception at ARPA to what we now understand as the world wide web.

Blockchain is almost certainly on a similar timeline. While the tech has antecedents going back to the digital gold of the 1990s, we can start the clock with the launch of Bitcoin in 2009. That means we aren&t even finished with the first decade of understanding this technology, building up a theory of how it works, or thinking through its use cases in a scalable way. In short, there is so much more work to be done to harness this tech for our own purposes.

The good news is that the massive infusion of investment from crypto traders over the past few years should help to rapidly accelerate blockchaindevelopment. Some of these projects, which wouldn&t have gotten funding even from a university laboratory, are sitting on a ridiculous level of seed funding. They could create a lot of progress in this space, assuming that these projects use their funds effectively.

The downside to the onrush of capital is that morale has certainly been shaken for many participants, and morale is critical to seeing through complex new projects to completion. There are going to be ups and downs with the design of any new technology on the frontier of engineering — but morale and stubbornness can do a lot to keep the momentum up.

Where should we focus

To me, several veins of research and development around blockchain remain deeply exciting, if we have the patience to see them through. They are:

- Identity: I&ve written about projects like Element and Learning Machines before. There are incredible challenges around how to offer portable and secure identities to every human on earth, to say nothing of every animal and physical object. Blockchain seems like technology that might be able to help here, if we are able to figure how to connect the digital world to the analog one. Facebook was once considered to be the identity layer of the internet — a claim that it has failed to live up to. Blockchain may ultimately arrive to complete that mission.

- Decentralized web: I was fortunate to catch up with Jutta Steiner of Parity Technologies last week at TechCrunch Disrupt and also host her at our event in Zug this past July. She and others like Gavin Wood have done a lot of work to start thinking through how chains can interact, as well as how to rebuild our modern web infrastructure in a decentralized way. Their ideas — like everything in this new world — are very early and inchoate, but they are inspiring in their potential. While centralized servers have huge performance advantages over decentralized technologies today, thereno reason why that gap has to be permanent. Web3 and other projects could lead the way to pushing this model forward.

- Security Tokens: Can blockchain technologies help us build a safer, more efficient financial system I am reminded of the piece by Matt Levine of Bloomberg on the shareholder votes to take Dell private and the massive level of indirection and complication it illuminated when it comes to ownership in our modern economy. Security tokens could provide a means to manage that complexity in a much more fluid way, particularly in a world where sharing is increasingly the norm around fixed assets (autos and Uber, homes and Airbnb, etc.)

I use &may& and &could& for each of these examples because we have no idea what we are going to discover on the frontier of blockchain. The good news is that these are rich directions to investigate, and even if we don&t discover something specifically in these areas, we are likely to discover something that moves the technologies forward along the way.

All this is to say that we need to stop reading the latest token prices every 10 minutes, and get back to the real work of building up this new technology and turning it into the revolution it one day could be.

- Details

- Category: Technology

Read more: The second blockchain bubble is now complete — what’s next

Write comment (98 Comments)Looking for funding as a startup in Latin America is a lot like looking for a watering hole in the middle of the desert. You know itout there, but finding it in time is a life or death situation.

Granted, venture capital investment in the region is at an all-time high, with leading firms like Andreessen Horowitz, Sequoia Capital and Accel Partners having made inaugural investments in markets like Colombia, Brazil and Mexico, respectively. But, at the same time, while startup founders might be tantalized by the news of big investments happening around them, as many of them get closer to the funding stage themselves, they often realize itnothing but a mirage.

And this isn&t just a problem in Latin America. All over the world, startups are struggling to find investment, as VCs are investing more money in fewer deals in the endless search for the next unicorn. Due to a dwindling number of VC deals in both the United States and Europe, even entrepreneurs in established ecosystems are having to look further afield for the resources they need to build their businesses, bringing many of them to emerging markets like Latin America.

Fortunately, whether you&re a local or foreign founder in an emerging market, there is a way to quench your thirst for the international investment that you need to scale your company. Herewhat we recommend to the startups that are part of our UTEC Ventures accelerator program in Peru, and what we&d recommend to you, too.

Find local seed money first

As a startup in an emerging market, the prospect of finding local investment can seem challenging. In fact, this is probably why you&re looking for international investment in the first place. But the truth is, finding local seed money to get started is really the first prerequisite for securing international funding later on.

Last year in Peru, for example, US$7.2 million of seed capital was invested in the countrystartups, with barely over US$1 million coming from international funds. This goes to show that international investors peeking into emerging markets are less active in seed rounds, and more interested in later-stage rounds once a company has better demonstrated its worth.

If you want to attract international investors, you need to be an international startup.

As such, we advise all startups to raise a first or second seed round locally in Peru, and then seek international investors. The same can go for other emerging markets, as well.

To raise these initial rounds, the most important thing is to show that you have a solid team, a business idea that works and has traction with clients chasing your product and that you&re better than any local competition. If you can demonstrate that you meet these requirements, finding local seed capital shouldn&t be too difficult; all you need is a good pitch deck and some patience when networking within local angel groups or at investor events.

Replicate success in a bigger, more competitive market

If you want to attract international investors, you need to be an international startup. In other words, you need to demonstrate that you can sell your product in a bigger, more competitive market before turning the heads of international investors. For startups in Peru and other emerging markets in Latin America, that means successfully expanding to the regionmost developed markets in Mexico, Brazil or Argentina.

Consider, for example, the Colombian courier service Rappi. It wasn&t until after the company expanded its operations to Mexico at the beginning of 2016 that it secured its first major international investment, led by Andreessen Horowitz. The company then went on to close a Series B round just one month later, in addition to a US$130 million venture round at the beginning of this year, led by a German food delivery service with participation from a number of U.S.-based investors.

The same idea goes for emerging markets outside of Latin America, too. In Eastern Europe, which lags behind its western counterpart in terms of VC funding, many entrepreneurs will either set up their businesses in Western European countries from the get-go, or expand there as soon as they&ve achieved product/market fit and demonstrated success in their home countries.

This is a clear demonstration of the broader fact that if you want to start raising money from more developed markets, you generally need to be based in those markets, or at least a market of comparable size. Accordingly, your primary focus when seeking international funding should be to first succeed locally, and then replicate that success in a more developed market — whether that be in the United States, Mexico, Western Europe or anywhere else.

Remember, not all international funding comes from international VCs

While iteasy to be distracted by the glitz and glamour of securing a round from international VCs, startups have a number of other options at their disposal to secure international funding.

Foreign governments in emerging markets are increasingly stepping up their game with programs designed to bolster their local startup ecosystems as an engine for economic growth. As such, a number of foreign governmental programs have emerged, offering support in the form of equity-free cash to entrepreneurs who decide to set up shop in a given country.

Corporate capital has taken on a very important role in many emerging markets like Latin America.

There are plenty of examples in Latin America alone. Start-Up Chile, for example, offers entrepreneurs up to US$80,000 to launch their businesses in Chile as a launch pad to reach the rest of the world; Parallel18 in Puerto Rico offers entrepreneurs up to US$75,000 to do the same thing; and the Peruvian government plans to announce a similar program to help startups soft launch in Peru with up to US$40,000 at the upcoming Peru Venture Capital Conference.

Startups have another option, as well. Corporate capital, or startup investment from major corporations, has taken on a very important role in many emerging markets like Latin America. In fact, Qualcomm Ventures, the investment arm of U.S.-based tech giant Qualcomm, is the most active global corporate investor in Latin America. Naspers, American Express Ventures and other corporate funds have taken an active interest in the regionstartups, as well.

Together, the growing support of foreign governments and interest from international corporations highlights the fact that securing international funding is in fact possible, and not as hard as you&d expect. Knowing that there are options besides getting an international VC on board, you should take the time to find out which alternatives are available in the markets to which you&re hoping to expand.

So, no matter whether you&re a local or foreign entrepreneur in an emerging market, thereno reason to give up hope on finding international funding. The key is to think globally and use technology to solve real-world challenges. Then, demonstrate success at home first, and duplicate it later in a bigger market. Resources are available to help you when taking your first step abroad, and if you do it well, you&ll find that the investment wells aren&t dry after all.

- Details

- Category: Technology

Read more: The funding mirage: How to secure international investment from emerging markets

Write comment (92 Comments)Watching the current price madness is scary. Bitcoin is falling and rising in $500 increments with regularity and Ethereum and its attendant ICOs are in a seeming freefall with a few &dead cat bounces& to keep things lively. What this signals is not that crypto is dead, however. It signals that the early, elated period of trading whose milestones including the launch of Coinbase and the growth of a vibrant (if often shady) professional ecosystem is over.

Crypto still runs on hype. Gemini announcing a stablecoin, the World Economic Forum saying something hopeful, someone else saying something less hopeful & all of these things and more are helping define the current market. However, something else is happening behind the scenes that is far more important.

As I&ve written before, the socialization and general acceptance of entrepreneurs and entrepreneurial pursuits is a very recent thing. In the old days & circa 2000 & building your own business was considered somehow sordid. Chancers who gave it a go were considered get-rich-quick schemers and worth of little more than derision.

As the dot-com market exploded, however, building your own business wasn&t so wacky. But to do it required the imprimaturs and resources of major corporations & Microsoft, Sun, HP, Sybase, etc. & or a connection to academia & Google, Netscape, Yahoo, etc. You didn&t just quit school, buy a laptop, and start Snapchat.

It took a full decade of steady change to make the revolutionary thought that school wasn&t so great and that money was available for all good ideas to take hold. And take hold it did. We owe the success of TechCrunch and Disrupt to that idea and I&ve always said that TC was career pornography for the cubicle dweller, a guilty pleasure for folks who knew there was something better out there and, with the right prodding, they knew they could achieve it.

So in looking at the crypto markets currently we must look at the dot-com markets circa 1999. Massive infrastructure changes, some brought about by Y2K, had computerized nearly every industry. GenXers born in the late 70s and early 80s were in the marketplace of ideas with an understanding of the Internet the oldsters at the helm of media, research, and banking didn&t have. It was a massive wealth transfer from the middle managers who pushed paper since 1950 to the dot-com CEOs who pushed bits with native ease.

Fast forward to today and we see much of the same thing. Blockchain natives boast about having been interest in bitcoin since 2014. Oldsters at banks realize they should get in on things sooner than later and price manipulation is rampant simply because it is easy. The projects we see now are the Kozmo.com of the blockchain era, pie-in-the-sky dream projects that are sucking up millions in funding and will produce little in real terms. But for every hundred Kozmos there is one Amazon .

And thatwhat you have to look for.

Will nearly every ICO launched in the last few years fail Yes. Does it matter

Not much.

The market is currently eating its young. Early investors made (and probably lost) millions on early ICOs but the resulting noise has created an environment where the best and brightest technical minds are faced with not only creating a technical product but also maintaining a monetary system. There is no need for a smart founder to have to worry about token price but here we are. Most technical CEOs step aside or call for outside help after their IPO, a fact that points to the complexity of managing shareholder expectations. But what happens when your shareholders are 16-year-olds with a lot of Ethereum in a Discord channel What happens when little Malta becomes the de facto launching spot for token sales and you&re based in Nebraska What happens when the SEC, FINRA, and Attorneys General from here to Beijing start investigating your hobby

Basically your hobby stops becoming a hobby. Crypto and blockchain has weaponized nerds in an unprecedented way. In the past if you were a Linux developer or knew a few things about hardware you could build a business and make a little money. Now you can build an empire and make a lot of money.

Crypto is falling because the people in it for the short term are leaving. Long term players & the Amazons of the space & have yet to be identified. Ultimately we are going to face a compression in the ICO and, for a while, itgoing to be a lot harder to build an ICO. But give it a few years & once the various financial authorities get around to reading the Satoshi white paper & and you&ll see a sea change. Coverage will change. Services will change. And the way you raise money will change.

VC used to be about a team and a dream. Now itabout a team, $1 million in monthly revenue, and a dream. The risk takers are gone. The dentists from Omaha who once visited accelerator demo days and wrote $25,000 checks for new apps are too shy to leave their offices. The flashy VCs from Sand Hill have to keep Uber and Airbnb plates spinning until they can cash out. VC is dead for the small entrepreneur.

Which is why the ICO is so important and this is why the ICO is such a mess right now. Because everybody sees the value but nobody & not the SEC, not the investors, not the founders & can understand how to do it right. There is no SAFE note for crypto. There are no serious accelerators. And all of the big names in crypto are either goldbugs, weirdos, or Redditors. No one has tamed the Wild West.

They will.

And when they do expect a whole new crop of Amazons, Ubers, and Oracles. Because the technology changes quickly when theremoney, talent, and a way to marry the two in which everyone wins.

- Details

- Category: Technology

Read more: It’s the end of crypto as we know it and I feel fine

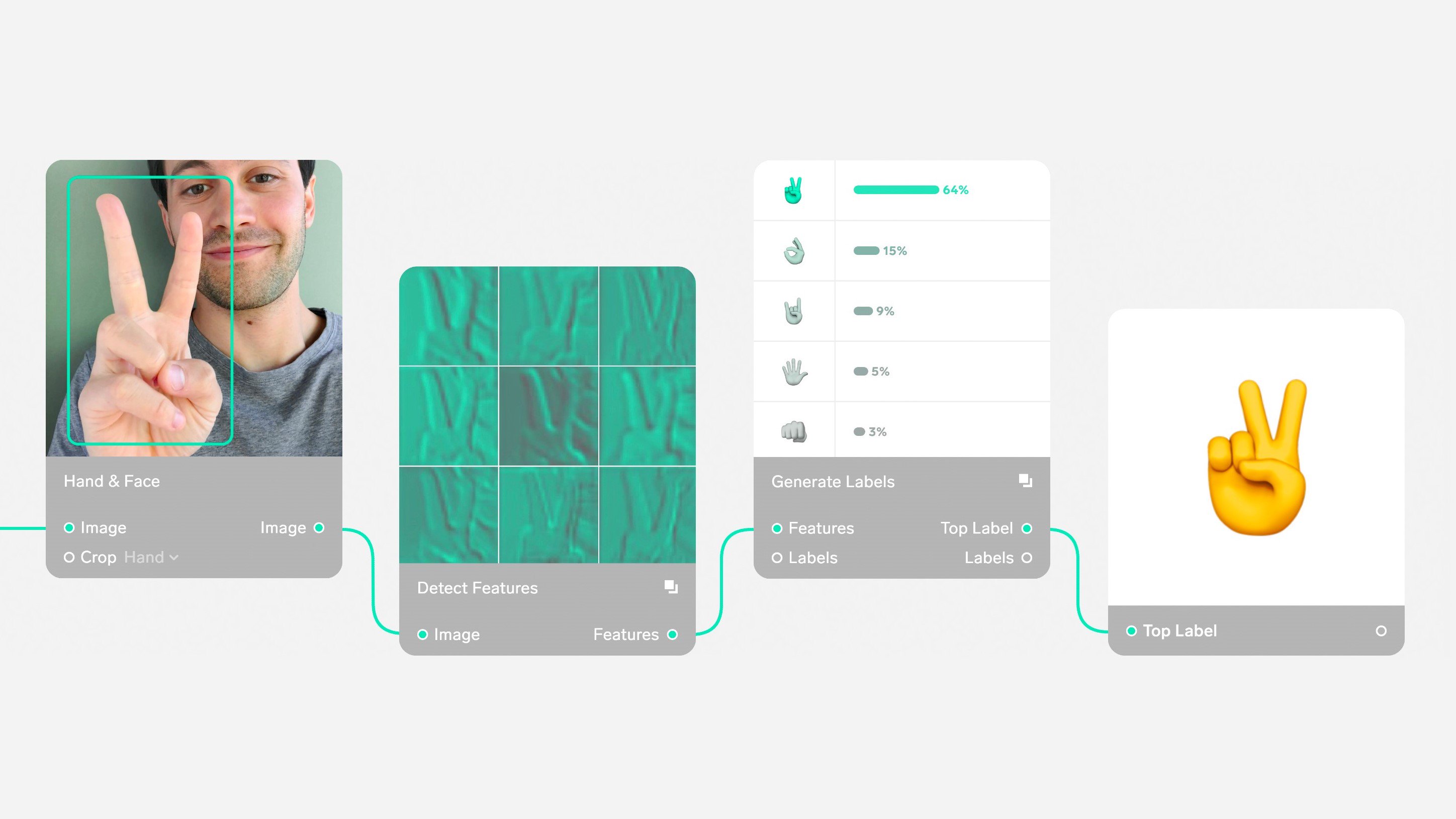

Write comment (92 Comments)Microsoft today announced that is has acquired Lobe, a startup that lets you build machine learning models with the help of a simple drag-and-drop interface. Microsoft plans to use Lobe, which only launched into beta earlier this year, to build upon its own efforts to make building AI models easier, though, for the time being, Lobe will operate as before.

&As part of Microsoft, Lobe will be able to leverage world-class AI research, global infrastructure, and decades of experience building developer tools,& the team writes. &We plan to continue developing Lobe as a standalone service, supporting open source standards and multiple platforms.&

Lobe was co-founded by Mike Matas, who previously worked on the iPhone and iPad, as well as FacebookPaper and Instant Articles products. The other co-founders are Adam Menges and Markus Beissinger.

In addition to Lobe, Microsoft also recently bought Bonsai.ai, a deep reinforcement learning platform, and Semantic Machines, a conversational AI platform. Last year, it acquired Disrupt Battlefield participant Maluuba. Itno secret that machine learning talent is hard to come by, so itno surprise that all of the major tech firms are acquiring as much talent and technology as they can.

&In many ways though, we&re only just beginning to tap into the full potential AI can provide,& MicrosoftEVP and CTO Kevin Scott writes in todayannouncement. &This in large part is because AI development and building deep learning models are slow and complex processes even for experienced data scientists and developers. To date, many people have been at a disadvantage when it comes to accessing AI, and we&re committed to changing that.&

Itworth noting that Lobeapproach complements Microsoftexisting Azure ML Studio platform, which also offers a drag-and-drop interface for building machine learning models, though with a more utilitarian design than the slick interface that the Lobe team built. Both Lobe and Azure ML Studio aim to make machine learning easy to use for anybody, without having to know the ins and outs of TensorFlow, Keras or PyTorch. Those approaches always come with some limitations, but just like low-code tools, they do serve a purpose and work well enough for many use cases.

- Details

- Category: Technology

Read more: Microsoft acquires Lobe, a drag-and-drop AI tool

Write comment (94 Comments)The incredible agility of the common house or fruit fly puts every drone and robot to shame, but devices inspired by them are beginning to catch up. A new four-winged flapping robot not only successfully imitates the fruit flyhyper-agile flying method, but can travel for up to a kilometer before running out of juice.

Robotics researchers at the Delft University of Technology wanted to create a flying platform that could imitate and test theories on how insects fly the way they do, but without tethers or non-animal propulsion like propellers.

Itnot just that they want a cool robot: The way insects respond to things like gusts of wind or an imminent slapping hand demonstrate incredible reaction times and control feedback, things that could inform autonomous craft like drones or even small airplanes. Wouldn&t it be nice to know your jet could autonomously and smoothly dodge a lightning bolt

The trouble is that when you get much bigger than an insect, that method of flying doesn&t always work any more due to the differences in mass, drag and so on. As the researchers put it in their paper, which made the cover of Science:

Because of technological challenges arising from stringent weight and size restrictions, most existing designs cannot match the flight performance of their biological counterparts; they lack the necessary agility, sufficient power to take off, or sufficient energy to fly for more than a minute.

Not only that, but tiny robots like the Robobee require a wired power connection, and other tiny flapping craft require manual piloting. Can&t have that! So rather than slavishly imitate the biology of a single animal, the team focused on how to achieve similar flight characteristics at a realistic scale.

The four-winged, tailless style of their creation, the DelFly Nimble, is novel but evidently effective. Their robot can go 7 meters per second, or about 15 MPH, hover in place or perform all kinds of extreme motions like dives and rolls smoothly. Itno joke doing that using rotors with continuous thrust, let alone via coordinated wing movement. You can see it perform a few more capers in the video here.

The four-winged, tailless style of their creation, the DelFly Nimble, is novel but evidently effective. Their robot can go 7 meters per second, or about 15 MPH, hover in place or perform all kinds of extreme motions like dives and rolls smoothly. Itno joke doing that using rotors with continuous thrust, let alone via coordinated wing movement. You can see it perform a few more capers in the video here.

Perhaps most amazing is its range; the robot can travel for a kilometer on a single charge. That sort of spec is the kind that military R-D directors love to hear about.

But the DelFly Nimble is already producing interesting scientific data, as lead researcher Matěj Karásek explains:

In contrast to animal experiments, we were in full control of what was happening in the robot‘brain.& This allowed us to identify and describe a new passive aerodynamic mechanism that assists the flies, but possibly also other flying animals, in steering their direction throughout these rapid banked turns.

Development is continuing, and no doubt biologists and three-letter agencies have tendered letters of interest to the Dutch inventors.

- Details

- Category: Technology

Read more: This insect-inspired robot can fly a kilometer on a charge with its flappy wings

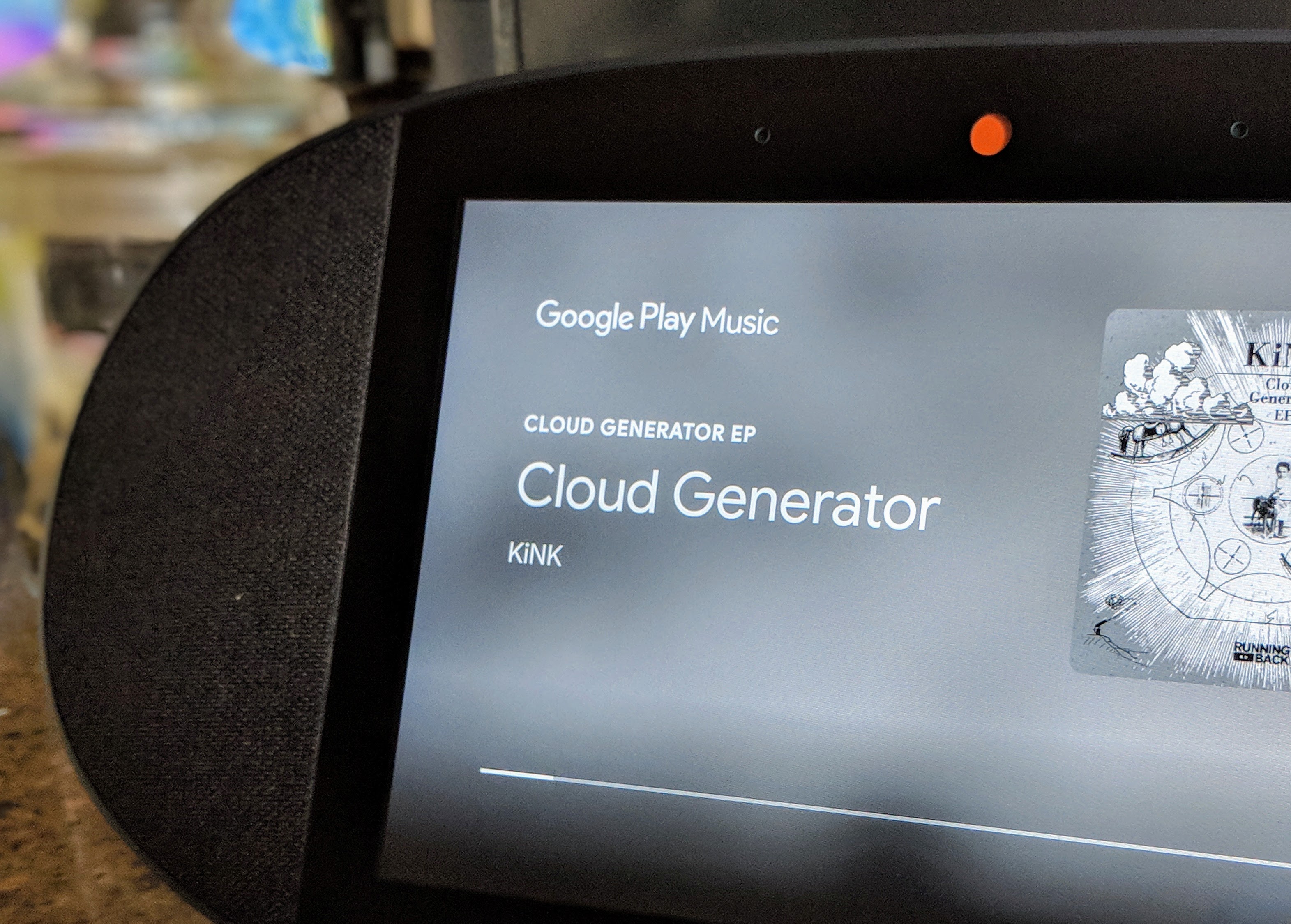

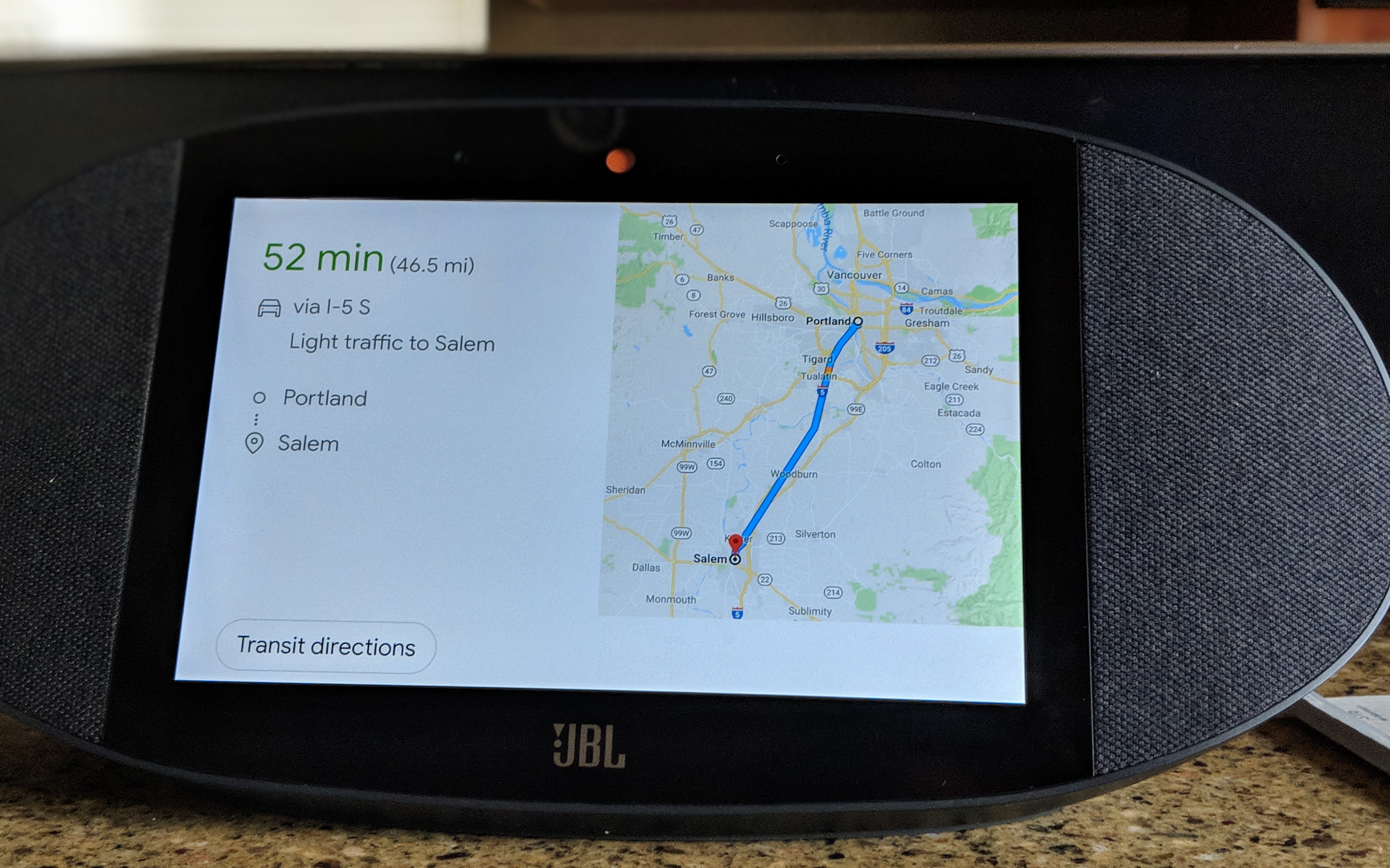

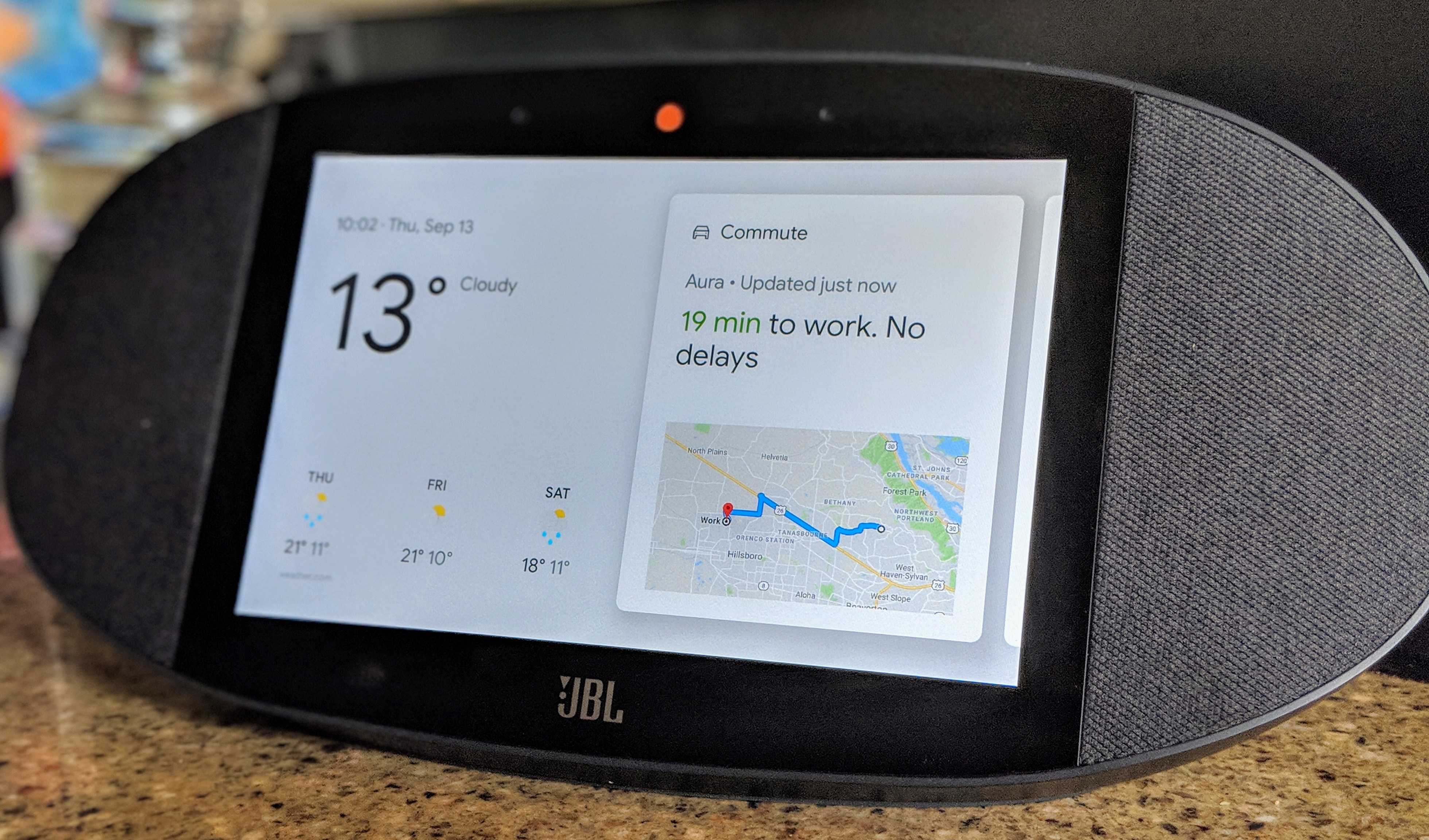

Write comment (97 Comments)If you&re looking for a smart display thatpowered by the Google Assistant, you now have two choices: the Lenovo Smart Display and the JBL Link View. Lenovo was first out of the gate with its surprisinglystylish gadget, but it also left room for improvement. JBL, given its heritage as an audio company, is putting the emphasis on sound quality, with stereo speakers and a surprising amount of bass.

In terms of the overall design, the Link View isn&t going to win any prizes, but its pill shape definitely isn&t ugly either. JBL makes the Link View in any color you like, aslong as thatblack. It&ll likely fit in with your home decor, though.

The Link View has an 8-inch high-definition touchscreen that is more than crisp enough for the maps, photos and YouTube videos you&ll play on it. In using it for the last two weeks, the screen turned out to be a bit of a fingerprint magnet, but you&d expect that given that I put it on the kitchen counter and regularly used it to entertain myself while waiting for the water to boil.

At the end of the day, you&re not going to spend $250 on a nice speaker with a built-in tablet. What matters most here is whether the visual side of the Google Assistant works for you. I find that it adds an extra dimension to the audio responses, no matter whether thatweather reports, a map of my daily commute (which can change depending on traffic) or a video news report. Googleinterface for these devices is simple and clear, with large buttons and clearly presented information. And maybe thatno surprise. These smart speakers are the ideal surface for its Material Design language, after all.

As a demo, Google likes to talk about how these gadgets can help you while cooking, with step-by-step recipes and videos. I find that this is a nice demo indeed, and thought that it would help me get a bit more creative with trying new recipes. In reality, though, I never have the ingredients I need to cook what Google suggests. If you are a better meal planner than I am, your mileage will likely vary.

What I find surprisingly useful is the displayintegration of Google Duo. I&m aware that the Allo/Duo combo is a bit of a flop, but the display does make you want to use Duo because you can easily have a video chat while just doing your thing in the kitchen. If you set up multiple users, the display can even receive calls for all of them. And don&t worry, there is a physical slider you can use to shut down the camera whenever you want.

The Link View also made me appreciate GoogleAssistant routines more (and my colleague Lucas Matney found the same when he tried out the Lenovo Smart Display). And itjust a bit easier to look at the weather graphics instead of having the Assistant rattle off the temperature for the next couple of days.

Maybe the biggest letdown, though (and this isn&t JBL&s, fault but a feature Google needs to enable) is that you can&t add a smart display to your Google Assistant groups. That means you can&t use it as part of your all-house Google Home audio system, for example. Itan odd omission for sure, given the Link Viewfocus on sound, but my understanding is that the same holds true for the Lenovo Smart Display. If this is a deal breaker for you, then I&d hold off on buying a Google Assistant smart display for the time being.

You can, however, use the display as a Chromecast receiver to play music from your phone or watch videos. While you are not using it, the display can show the current time or simply go to blank.

Another thing that doesn&t work on smart displays yet is Googlecontinued &conversation feature,& which lets you add a second command without having to say &OK, Google& again. For now, the smart displays only work in English, too.

When I first heard about these smart displays, I wasn&t sure if they were going to be useful. Turns out, they are. I do live in the Google Assistant ecosystem, though, and I&ve got a few Google Homes set up around my house. If you&re looking to expand your Assistant setup, then the Link View is a nice addition — and if you&re just getting started (or only need one Assistant-enabled speaker/display), then opting for a smart display over a smart speaker may just be the way to go, assuming you can stomach the extra cost.

- Details

- Category: Technology

Read more: JBL’s smart display combines Google smarts with good sound

Write comment (95 Comments)Page 4176 of 5614

10

10