Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Starry, a Boston startup, wants deliver high-speed 5G internet in major cities at a reasonable price. Today, it announced it is expanding service from its initial launch in Boston to New York City. The company also announced a deal with Related Companies, a large national affordable housing owner, to host Starry equipment on its buildings and offer Starry service to its tenants.

The Starry solution consists of three parts: The beam sits on a high roof. The point sits on a lower roof and the consumer gets a Starry Station, which acts as a modem of sorts to deliver the internet service to the home. As they put it, internet access becomes an extension of the property.

Diagram: Starry

While the hardware solution is impressive in itself, it allows Starry to offer high-speed internet to consumers at a more affordable price point than traditional large providers. Company founder and CEO Chet Kanojia says his company can provide up to 200 Megabits per second service, up and down, for just $50 a month with no data caps or long-term contracts. Installation is free and the company includes 24/7 customer care at no additional cost.

While ithard to compare pricing across services, Starry should appeal to cord cutters, who have dropped cable TV for more affordable streaming alternatives and have been looking for a way to free themselves from large internet service providers. Itfair to say thatno other provider offers this kind of speed up and down for that price.

The solution requires high rooftops to place the enabling infrastructure and the arrangement with Related is particularly interesting in this context. The deal is good for both parties, giving Starry the infrastructure it needs to place its equipment in major cities, while providing Related tenants with low-cost internet access starting later this year.

&Our first strategic partnership is with Related Properties, which is a big property ownership company in all the major cities. It allows us to basically extend our network using their infrastructure, rooftops and buildings,& Kanojia said.

The startup plans to provide service to other New York City residents starting in parts of Manhattan and Brooklyn this fall, and expanding to other parts of the city over time. They have further plans to expand to Washington and LA later this year with 18 other cities coming on board in the next year.

The company launched in 2014 and spent a couple of years developing the hardware part of the solution. It has raised $163 million, according to data supplied by the company. The most recent round was $100 million Series C in July. Itworth noting that their new partner, Related joined that most recent investment.

Kanojia helped launched Aereo, a startup that wanted to deliver low-cost television by placing antennas on rooftops and letting consumers view broadcast TV over the internet. That idea was shot down by the US Supreme Court when broadcasters sued for copyright violations, and the company went out of business soon after. Starry could be seen as an extension of that idea, but delivering internet instead of the TV signals themselves.

- Details

- Category: Technology

Read more: Starry wants to put high-speed 5G internet in reach of everyone

Write comment (96 Comments)The Wall Street Journal is reporting that Tim Armstrong is in talks to leave Verizon as soon as next month.

Armstrong heads up the carrier giantdigital and advertising division, Oath (formerly AOL, prior to the Yahoo acquisition and the subsequent merger of the two units). Oath also happens to be TechCrunchparent, of course.

We reached out to our corporate overlords for a confirm or deny on the newspaper report. A Verizon spokesperson told us: &We don&t comment on speculation and have no announcements to make.&

The WSJ cites &people familiar with the matter& telling it Armstrong is in talks to leave, which would mean heset to step away from an ongoing process of combining the two business units into a digital content and ad tech giant.

Though he has presided over several rounds of job cutsalready, as part of that process.

Verizon acquired Armstrong when it bought AOL in 2015. The Yahoo acquisition followed in 2017 — with the two merged to form the odd-sounding Oath, a b2b brand that Armstrong seemingly inadvertently outted.

Building an ad giant to challenge Google and Facebook is the underlying strategy. But as the WSJ points out there hasn&t been much evidence of Oath moving Verizongrowth needle yet (which remains tied to its wireless infrastructure).

The newspaper cites eMarketer projections which have Google taking over a third of the online ad market by 2020; Facebook just under a fifth; and Oath a mere 2.7%.

Meanwhile, Verizonappointment of former Ericsson CEO, Hans Vestberg, as its new chief exec in June, taking over fromLowell McAdam (who stepped down after seven years), suggests pipes (not content) remain the core focus for the carrier — which has the expensive of 5G upgrades to worry about.

A cost reduction program, intending to use network virtualization to take $10BN in expenses out of the business over the next four years, has also been a recent corporate priority for Verizon.

Given that picture, itless clear how Oathmedia properties mesh with its plans.

The WSJsources told the newspaper there were recent discussions about whether to spin off the Oath business entirely — but said Verizon has instead decided to integrate some of its operations more closely with the rest of the company (whatever ‘integrate& means in that context).

There have been other executive changes at Oath earlier this year, too, with the head of its media properties, Simon Khalaf, departing in April — and not being replaced.

Instead Armstrong appointed a COO, K Guru Gowrappan, hired in from Alibaba, who he said Oathmedia bosses would now report to.

&Now is our time to turn the formation of Oath into the formation of one of the worldbest operating companies that paves a safe and exciting path forward for our billion consumers and the worldmost trusted brands,& Armstrong wrote in a staff memo on Gowrappanappointment obtained by Recode.

&Guru will run day to day operations of our member (consumer) and B2B businesses and will serve as a member of our global executive team helping to set company culture and strategy. Guru will also be an important part of the Verizon work that is helping both Oath and Verizon build out the future of global services and revenue,& he added, saying he would be spending more of his time &spread across strategic Oath opportunities and Verizon… leading our global strategy, global executive team, and corporate operations&.

At the start of the year Oath also named a new CFO,Vanessa Wittman, after the existing officer, Holly Hess, moved to Verizon to head up the aforementioned cost-saving program.

Reaction to the rumour of Armstrongimminent departure has sparked fresh speculation about jobs cuts on the anonymous workplace app Blind — with Oath/AOL/Yahoo employees suggesting additional rounds of company-wide layouts could be coming in October.

Or, well, that could always just be trolling.

- Details

- Category: Technology

Read more: Verizon declines to comment on WSJ report saying Tim Armstrong is in talks to leave Oath

Write comment (97 Comments)Sonatype, a cybersecurity-focused open-source company, has raised $80 million from investment firm TPG.

The company said the financing will help extend its Nexus platform, which it touts as an enterprise ready repository manager and library, which among other things tracks code and helps to keep everything in the devops pipeline up-to-date and secure.

Itthat kind of technology that Sonatype says can prevent another Equifax -style breach of over 147 million consumers& data. Earlier this year, the company found over dozens of Fortune Global 100 companies that downloaded outdated and vulnerable versions of Apache Struts, which Equifax failed to patch or update.

Sonatypechief executive Wayne Jackson his company can help prevent those type of breaches.

&We monitor literally millions of open source commits per day,& he told TechCrunch. &Last year hundreds of billions of components were downloaded by software developers, 12 percent of which had known security defects.&

The funding will go to extend the companyNexus platform, Jackson said.

The company said ithad an 81 percent increase in year-over-year sales in the first-half of the year, and 1.5 million users added to its flagship Nexus platform since January. In all, the company has more than 10 million software developers and 1,000 enterprises on Nexus worldwide.

Sonatypelast round of funding was in 2016, led by Goldman Sachs, snagging $30 million.

- Details

- Category: Technology

Read more: Sonatype raises $80 million to build out Nexus platform

Write comment (90 Comments)The music business is littered with stories about songwriters or studio contributors and session musicians who never get the credit — or money — they&re often due for their work on hit songs.

And for every storied session musician in &The Wrecking Crew& there are perhaps hundreds of other contributors who aren&t getting their just desserts.

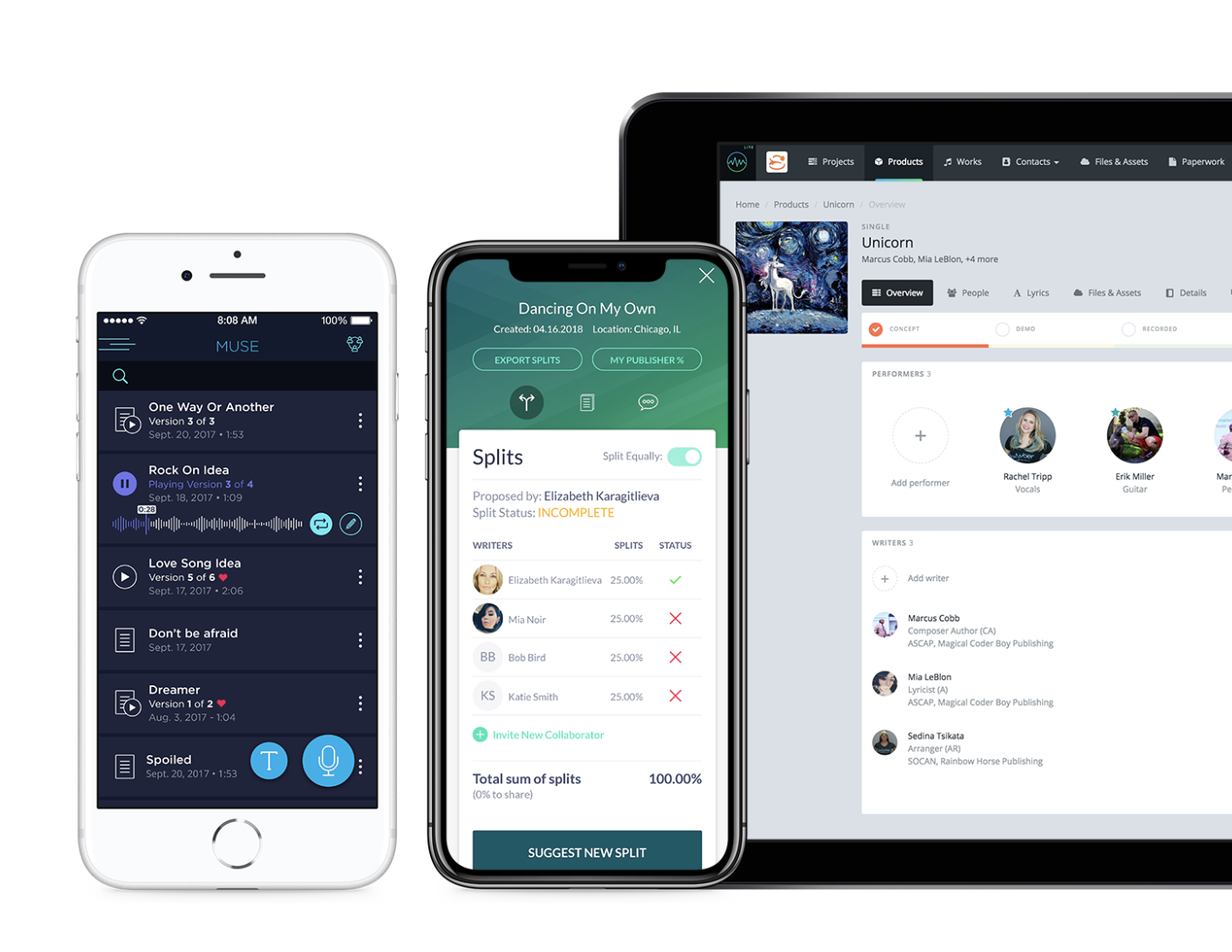

Thatwhere Jammber comes in. The five-year-old company co-founded by serial entrepreneur Marcus Cobb has developed a suite of tools to manage everything from songwriting credits and rights management to ticketing and touring all from a group of apps on a mobile phone. And has just raised $2.4 million in funding to take those tools to a broader market.

Jammber &Muse&gives collaborators a single platform to exchange lyrics and song ideas, while the company&Splits&app tracks ownership and credits of any eventual product from a collaboration. The companynStudio tracks songwriting credits to assist with chart and Grammy submission — through a partnership with Nielsen Music— and its &PinPoint&helps organize touring. The recording applications even have a presence feature so session musicians, songwriters and artists can actually be tagged in the studio while they&re working.

&I think we need to get attribution and monetization closer to the creators,& Cobb has said. &Why aren&t we doing that The industry is growing and thriving. Are we making sure that performers and creators of all different tiers are being equally compensated&

The answer, sadly, for many in the music industry is no. In fact, while Cobb had originally set out to make a networking tool for creatives with Jammber he wound up shifting the service to the management toolkit after visiting the offices of a music label.

Jammber chief executive Marcus Cobb

&I saw stacks and stacks of payroll checks that were returned to sender,& Cobb, told CrainChicago Business. &These checks were taking three months to two years to print, and they were wrong addresses, or there were stage names instead of legal names.&

That experience convinced Cobb of the demand, but it was Nashville that gave the serial entrepreneur the crucible within which to develop the full suite of tools that now make up Jammbersoup-to-nuts platform.

Cobb likes to say that Jammber was conceived in Chicago (where the company spun up from the citymassively influential 1871 entrepreneurship center) and born in Nashville — the home of the multi-billion-dollar American country music industry. All of the tools in Jammber, Cobb says, were created with input from a local musician, producer, artist and repertoire person or a label executive.

In 2015, the company came down to Nashville as part of the first batch of companies in Project Music,a joint venture between the Country Music Association and the Nashville Entrepreneur Center meant to encourage the development of technology for the music industry.

- Details

- Category: Technology

Read more: Managing the music business from a mobile phone, Jammber is making the industry sing

Write comment (94 Comments)As the number of competitors in the ride-hailing industry dwindles, geographic expansion is emerging as the next proving ground to determine who will be the victor in the ride-hailing market.

The race for control of the industry, which is estimated by Goldman Sachs to grow eightfold to $285 billion by 2030, is escalating with ChinaDidi Chuxing already surpassing Uber as the most valuable startup in the world. With a recent valuation of approximately $56 billion, compared to Uber$48 billion, Didi is posing a real threat to Uberoperations and shows no signs of slowing down. Cementing its position as the top ride-hailing service in China, Didi is now turning its attention to another region of the world that is still filled with vast opportunities and not yet dominated by a single taxi alternative: Latin America.

While many ride-hailing and sharing services have already sprung up and faced regulation in cities across Latin America such as Mexico City, Montevideo, and São Paulo, the region still presents an enormous opportunity for the companies that can adapt and move fast enough.

The current opportunities in Latin America

Unlike many other regions of the world, Latin America is still very much reliant on traditional forms of public transportation such as buses, trains, and subway systems. Whatmore, larger cities such as São Paulo, Mexico City, and Bogota simply cannot support any more vehicles on the road without an infrastructure overhaul. Large metro areas are already at or above maximum capacity during peak hours, making owning and commuting with a car more of a hassle than a luxury. As a result, many commuters across Latin America are putting less importance on owning a vehicle and opting to use alternative modes of transportation and on-demand services instead.

Beyond the rising demand for alternative transportation options, italso worth noting that Latin America is the worldsecond-fastest-growing mobile market. In a region of approximately 640 million people, there are more than 200 million smartphone users. By 2020, predictions say that 63% of Latin Americapopulation will have access to the mobile Internet. Latin American smartphone users have quickly adopted global apps, such as Uber and Facebook. However, tech companies have yet to fully tap into the regionpotential.

Chilean taxi drivers demonstrate along Alameda Avenue against US on-demand ride service giant Uber, in Santiago, on July 10, 2017.Uber smartphone app has faced stiff resistance from traditional taxi drivers the world over, as well as bans in some places over safety concerns and questions over legal issues, including taxes. (MARTIN BERNETTI/AFP/Getty Images)

The key players

Uber

According to a Dalia survey, Latin Americans with smartphones that live in urban areas are the most likely to have used a ride-hailing app or site. Overall, 45% have used an app, with Mexico taking the top position in the region at 58%.

Uber entered Latin America in 2013 and claims to have more than 36 million active users in the region, proving employment for more than a million drivers. The company quickly dominated Mexico, which is now its second-largest market after the U.S. In fact, up until recently Uber claimed a near monopoly on ride-sharing in Mexico with few competitors. Uber also has operations in more than 16 Latin American countries.

99 (formerly 99Taxis)

With an urban population of approximately 180 million, Brazil is the ultimate prize for ride-hailing and taxi companies with several services competing for market share. Most notably, 99 (formerly &99Taxis&) was able to gain momentum early on with exclusive services that extended beyond basic ride-hailing (such as its 99 TOP and 99 POP services) and better tools for its drivers.

With over 200,000 drivers and 14 million users, 99 attracted the attention of investors worldwide, including that of ChinaDidi Chuxing. Didi invested $100 million into 99 in January 2018 before acquiring 99 entirely months later for nearly $1 billion to take on Uber in Latin America, shortly after it acquired Uberoperations in China.

Easy Taxi

Rocket Internet -backed taxi booking service, Easy Taxi, started in Latin America in 2011, two years after Uber first started in San Francisco. The company provides an easy way to book a taxi and track it in real-time. Today, the company is owned by Maxi Mobility, which acquired the company from Rocket Internet in 2017 for an undisclosed amount. Maxi Mobility also owns Cabify, and operates across many Latin American markets, including Argentina, Mexico, Bolivia, Panama, Brazil, Peru, and Chile, in addition to a handful of markets elsewhere.

To solidify its position in the region, Easy Taxi merged with Colombian taxi-booking app Tappsi in 2015. Tappsi launched in Bogotá in 2012 and was doing quite well in the Colombian market. The merger allowed the companies to pool their resources just as other competitors, such as Uber, began entering the region.

Easy Taxi maintains impressive traction, raising more than $75 million to date. But as the ride-hailing battle in Latin America pushes forward, the company is rumored to be a likely investment or acquisition target for Uber, Didi, or the largest global investor in this space, Softbank.

Cabify

Cabify is a Spanish company that provides private vehicles for hire via its smartphone app. Although founded in Madrid, Cabify has always positioned itself as a Latin American company, investing heavily across the region. The company was able to gain a strong foothold due to some significant funding raised by its parent company, Maxi Mobility. In January 2018, Maxi Mobility raised another $160 million and said the funding would be used to accelerate both of its companies, Cabify and Easy Taxi, in the 130 cities where they operate throughout Spain, Portugal, and Latin America.

Cabify reported it has over 13 million users and grew its installed-base by 500% between 2016 and 2017, tripling its user base and fulfilling six times more trips in 2017.

Cabify competes directly with Uber, 99, and Easy Taxi in Brazil; however, it reportedly has around 40% market share in Sao Pãolo, one of the largest cities in all of Latin America.

Smaller players to watch

Beat (Formerly Taxibeat)

Beat is a profitable ride-hailing service founded in Athens, Greece that also operates in Peru. Beat is slowly expanding its operations across Latin America, though expansion appears to be limited to Chile for now.

As of January 2017, Beat had around 15,000 drivers and 800,000 customers in Peru.

Nekso

Toronto-based Nekso bet on the Latin American taxi-hailing market before its home market with a pilot launch in Venezuela in 2016. Nekso was able to gain acceptance from the taxi industries in Venezuela, Dominican Republic, Ecuador, and Panama with its slightly different approach to ride-hailing.

The company connects a network of 550+ licensed taxi companies with thousands of drivers and allows users to flag down a cab off the street and without using in-app requests. Nekso also uses artificial intelligence technology to offer drivers real-time updates on weather, events, and traffic data to predict areas of a city which may need more drivers. The company claims taxi drivers can spend up to two-thirds of their day looking for or waiting for riders and that Nekso technology helps drivers increase their daily rides by more than 25% percent.

At the end of 2017, Nekso boasted around 150,000 users and facilitated approximately 400,000 rides per month. Now, the company plans to make its debut in Canada as well as expand to more countries in South America, including Argentina, Colombia, Chile, and Peru.

Didi, 99, and the next phase

99new owner, Didi, which dominates the Asian market and was able to defeat Uber in China, has big plans for international expansion. Its acquisition of 99 reveals the potential it sees in Latin America but also adds to the complicated web of global ride-hailing services.

After Didi shut down and acquired Uberassets in China, it also bought a stake in Uber for $1 billion. Uber, Didi, and 99 are all backed by Softbank. However, everywhere outside of China, Didi and Uber are competing with each other. Didifull plans for 99 are not yet obvious, but the company has already set up an office in Mexico and begun poaching staff from Uber in Mexico.

With an infusion of capital, Latin Americaride-hailing industry is multiplying. That said, companies that want to compete in the region will need to use an aggressive and strategic approach that can withstand the uniqueness of commuters and transportation options in the region. Itonly a matter of time until we see if these companies continue ramping up their operations for geographic domination, or if we see more and more partner up to advance their technologies and address other looming threats & such as bike sharing, scooter sharing, and even autonomous vehicles.

Two of the founders of 99, who sold their company to Didi, have already launched a dockless bike sharing startup called Yellow in Brazil and raised $9 million to grow its operations. No other scooter company has taken the plunge into Latin America yet besides Grin Scooters in Mexico City, but other larger cities such as Buenos Aires, Bogota, Santiago, and Lima would be ideal markets if the companies can figure out pricing as well as security and safety issues first.

Didiactivity in Brazil and Mexico is sure to trigger a new wave of competition between existing ride-hailing players and create an even more tangled web of alliances and acquisitions. Whether or not these companies can adapt and move fast enough to rise to the top, and deal with the other looming alternative modes of transportation, remains to be seen.

- Details

- Category: Technology

Read more: Latin America is the next stage in the race for dominance in the ride-hailing market

Write comment (98 Comments)A popular top-tier app in Apple Mac App Store was found pilfering browser histories from anyone who downloads it.

Yet still, at the time of writing, the rogue app — Adware Doctor — stands as the No.1 grossing paid app in the app storeutilities categories. But Apple was warned weeks ago and did nothing to pull the app offline.

Now it seems Apple has pulled the app. Apple would not comment on the record.

Applewalled garden approach to Mac and iPhone security is almost entirely based on the inability to install apps outside the app store, which Apple monitors closely. While itnot uncommon to hear of dangerous apps slipping into GooglePlay store, itnearly unheard of for Apple to face the same fate. Any app that doesn&t meet the companystrict security and sometimes moral criteria will be rejected, and users won&table to install it.

This app promises to &keep your Mac safe& and &get rid of annoying pop-up ads& — and even &discover and remove threats on your Mac.& But what the app won&t tell you is that for just a few bucks it&ll steal and download your browser history — including all the sites you&ve searched for or accessed — to servers in China run by the appmakers.

Thanks in part to a video posted last month on YouTube and with help from security firm Malwarebytes, itnow clear what the app is up to.

Security researcher Patrick Wardle, a former NSA hacker and now chief research officer at cybersecurity startup Digita Security, dug in and shared his findings with TechCrunch.

Wardle found that the downloaded app jumped through hoops to bypass AppleMac sandboxing features, which prevents apps from grabbing data on the hard drive, and upload a userbrowser history on Chrome, Firefox and Safari browsers.

Wardle found that the app, thanks to Appleown flawed vetting, could request access to the userhome directory and its files. That isn&t out of the ordinary, Wardle says, because tools that market themselves as anti-malware or anti-adware expect access to the userfiles to scan for problems. When a user allows that access, the app can detect and clean adware — but if found to be malicious, it can &collect and exfiltrate any user file,& said Wardle.

Once the data is collected, itzipped into an archive file and sent to a domain based in China.

Wardle said that for some reason in the last few days the China-based domain went offline. At the time of writing, TechCrunch confirmed that the domain wouldn&t resolve — in other words, it was still down.

&Letface it, your browsing history provides a glimpse into almost every aspect of your life,& said Wardlepost. &And people have even been convicted based largely on their internet searches!&

He said that the appaccess to such data &is clearly based on deceiving the user.&

Apple was contacted weeks ago. The email it responded with, in not so many words, said &we can&t tell you anything,& but forwarded the feedback.

A meagre $4.99 for the app may not seem much to the average user, but ita heavy price to pay for having the app steal your browser history — which users will never get back. And given that Apple makes a 30 percent cut of every purchase of this popular app, there isn&t much financial incentive to withdraw the app from the store.

Updated at 9:05am PT: with confirmation that the app has been pulled.

- Details

- Category: Technology

Read more: A top-tier app in Apple’s Mac App Store stole your browser history

Write comment (94 Comments)Page 4238 of 5614

8

8