Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

UK founded startup Funding Circle, a p2p lending platform which focuses on the underserved small business market, has announced a &potential intention& to float on the London Stock Exchange.

In a press releasetoday, announcing the publication of a Registration Document for a possible future IPO, Funding Circle says that should it proceed with floating on the stock market it would be looking to raise around £300 million (~$387M). According to the document the business is being valued at up to £1.65BN (~$2.1BN).

Heartland A/S, the private holding company of Danish billionaire businessman, Anders Holch Povlsen, hasagreed, as part of the potential IPO Offer, to purchase 10% of the issued ordinary share capital at a range of valuations (but Funding Circle notes thiscommitment falls away if the equity valuation prior to the issue of new Shares pursuant to the Offer exceeds £1.65BN).

Funding Circle has raisedmore than $373M to date since being founded back in 2010. The founders had the idea to help small businesses obtain loans after the retrenching of traditional financing sources after the 2008 financial crash.

The global lending platform now connects investors in the U.K., U.S., Germany and the Netherlands with small businesses wanting to borrow money for growth. More than 80,000 retail investors, banks, asset management companies, insurance companies, government-backed entities and funds have lent more than £5BN to over 50,000 businesses globally since the platformlaunch in 2010.

In a statement on the IPO announcement, Samir Desai, CEO and co-founder, said:&At Funding Circle our mission is to build a better financial world. Todayannouncement is the start of the next stage in our exciting and transformational journey. Over the last eight years, we have worked hard to build a platform that is number one in every market we operate in.

&By combining cutting-edge technology with our own proprietary credit models and sophisticated data analytics, we deliver a better deal for small businesses and investors around the world. I am very proud of the team and culture we have created at Funding Circle, both of which have been integral to our success to date&.

A year and half agoDesai told us that while the business had&no current plans to IPO& that was the longer term aim. &We&ve always said that we&d like Funding Circle to be a listed business, in line with the things that we care about deeply like transparency and being a tech platform versus being a lender ourselves,& he said then.

Should it now go ahead with floating the business,Funding Circle says it will use the proceeds to enhance its balance sheet position — which it says would help grow trust in the business with investors, borrowers and regulators, as well as supportit pursuing growth over profitability in the medium term.

It also says going public would give it strategic flexibility and let it take advantage of opportunities &either in current markets or new geographies&.

The registration document describes Funding Circle as a high growth business, revealing it had revenue in the year ended 31 December 2017 of £94.5M compared to £50.9M in the year ended 31 December 2016.

It also highlights an improving financial profile, flagging up strong growth in revenue — with 78% CAGR from 2015 to 2017 (excluding property loans), primarily driven by an increase in loan originations from £607M in 2015 to £1,631M in 2017 (both excluding property loans).

Funding Circle exited the property loans business in 2016, tightening its focus on small business financing.

According to the registration document, repeat business is growing, with approximately 40% of Funding Circlerevenue generated from existing customers in 2017 (again excluding property loans).

It also says that attractive unit economics are driving expanded margins, with the margin per loan in 2017 rising from approximately 20% for the first loan, to ~57% for repeat loans in the UK. And it adds that the path to superior margins is driven by operational leverage.

The business is targeting in excess of 40% revenue growth in the medium term and longer term, and adjusted EBITDA margins of 35% or above.

Commenting on Funding Circleannouncement in a statement,Neil Rimer, partner at Index Ventures and a Funding Circle board member, said:&Just as banks have become more reluctant lenders, Funding Circle has become an indispensable source of financing for small businesses in the UK, the US and in continental Europe; directly supporting the growth of the most critical engines of the economy.

&It is a prime example of a new breed of financial services companies, who by making their products more transparent and more convenient, have democratised access to valuable services and increased economic activity.

Rimer added: &Funding Circle has a broad impact on the growing businesses it funds, the employees they hire, the communities they operate, their customers and the countries they operate in. This is an important milestone that will allow the company to support tens of thousands of additional small businesses: something everyone should celebrate.&

Index isFunding Circlelargest shareholder and has been a backer of the business since its Series A funding round in 2011 — when it became the 2010 founded UK startupfirst institutional investor. Itjust posted ablog post to coincide with Funding Circleannouncement — taking an inside look at the company mission and ethos.

Index also has several other fintech investments in its portfolio, including the likes of Adyen, iZettle, Revolut and Robinhood. Though the VC firm did not take an investment in UK-based payday loans firm Wonga, which collapsed into administration last week.

TechCrunchSteve O&Hear contributed to this report

- Details

- Category: Technology

Read more: Funding Circle, a P2P SME lending platform, steps towards an IPO

Write comment (100 Comments)Countingup, the U.K. fintech that provides a business bank account that combines bookkeeping, has raised £2.3 million in seed funding. Leading the round is Forward Partners, with participation from previous backer Frontline Ventures, and JamJar Investments.

Founded last year by Tim Fouracre, who previously founded cloud accounting software Clear Books, Countingup wants to simplify the life of sole traders and other small businesses by reinventing the business current account. Fouracrevision is that for small enterprises, business banking and accounting software should be merged so that bookkeeping and filing accounts can be a lot more automated.

&If you are running a business then bookkeeping is a chore, wastes your time and is boring,& the Countingup up founder told me last year. &Your bank surprises you with hidden fees and you&ve probably lost faith in their customer service. Countingup is making starting and running a business really simple… We&re doing that by combining accounting and banking into one simple smartphone app&.

After downloading the Countingup for iOS or Andriod, you are able to open a current account on your smartphone in a claimed 5 minutes. The account comes with a U.K. sort code/account number and a contactless Mastercard. The accounting functionality currently includes a profit and loss report, bookkeeping categorisation and the ability to attach receipts to transactions.

However, the big feature that will be launched later this year is invoicing, while things like &automated receipt scanning,& and tax calculations and filing are also in the 2018 roadmap.

Fouracre says Countingup wants to be the financial platform for 1 million U.K. small businesses. It already has four thousand customers and I&m told is signing up new users at a rate of 1,500 businesses per month.

- Details

- Category: Technology

Read more: Countingup, the business bank account that combines bookkeeping, raises £2.3M seed

Write comment (92 Comments)We&re excited to head to Beirut, Lebanon, on October 3rd for TechCrunch Startup Battlefield MENA 2018. Yes, we&re bringing our premier startup pitch competition to the Middle East / North Africa, and as well as launching 15 of the hottest startups in MENA on stage for the first time, we&ll also be joined by some leading lights of the scene.

Tickets to this event — our first in this part of the world — cost $29 (including VAT), and you can buy your tickets right here.

Startup Battlefield consists of three preliminary rounds with 15 teams — five startups per round — who have only six minutes to pitch and present a live demo to a panel of expert technologists and VC investors. After each pitch, the judges have six minutes to grill the team with tough questions. This is all after the free pitch-coaching they receive from TechCrunch editors.

One startup will emerge the winner ofTechCrunch Startup Battlefield MENA 2018 — and receive a US$25,000 no-equity cash prize and win a trip for two to compete in the Startup Battlefield at TechCrunch Disrupt in 2019 (assuming the company still qualifies to compete at the time).

Joining us on stage will be the following speakers, drawn from many of the key founders and investors in the region. Here are the speakers so far for TechCrunch Startup Battlefield MENA 2018 and there are more to come!

Mai Medhat Eventus Mai Medhat is the CEO and co-founder of Eventtus; an events engagement platform and the leading event app provider in the Middle East. Mai is an Egyptian tech entrepreneur holds a Computer Engineering degree from Ain Shams University. She co-founded Eventtus in 2012 with a mission to mobilize events after a personal experience at some events that used to be managed manually. The company successfully served 10,000 events since then and is growing into 35+ cities. Mai was named &Entrepreneur of the year& by Arabian Business in 2016 and she has been recognized by the Global Entrepreneurship Summit 2016 as one of the most promising MENA entrepreneurs.

Ameer Sheerif

Wuzzuf

Ameer Sherif is CEO and Co-founder of WUZZUF & Egypt#1 Online Recruitment Platform. Having co-founded WUZZUF 5 years ago, Ameer managed to bootstrap for 3 years during the tough revolution years until reaching profitability and then successfully fundraising from top angel investors in Egypt as well as top VCs in Silicon Valley & making WUZZUF the 1st startup from Egypt to join the [500 Startups] accelerator program in San Francisco. Now, WUZZUF helps 150,000+ people looking for jobs each month and serves 4,000+ companies. A total of 40,000+ Egyptians got hired directly through the platform so far.

Ameer Sheerif

Wuzzuf

Ameer Sherif is CEO and Co-founder of WUZZUF & Egypt#1 Online Recruitment Platform. Having co-founded WUZZUF 5 years ago, Ameer managed to bootstrap for 3 years during the tough revolution years until reaching profitability and then successfully fundraising from top angel investors in Egypt as well as top VCs in Silicon Valley & making WUZZUF the 1st startup from Egypt to join the [500 Startups] accelerator program in San Francisco. Now, WUZZUF helps 150,000+ people looking for jobs each month and serves 4,000+ companies. A total of 40,000+ Egyptians got hired directly through the platform so far.

Paul Chucrallah

Managing Director

BeryTech Fund

Paul Chucrallah is managing director at BeryTech Fund II. Prior to this, he was the business - strategy senor advisor at BeryTech. He was previously executive director at BeryTech Technology and Health.

Paul Chucrallah

Managing Director

BeryTech Fund

Paul Chucrallah is managing director at BeryTech Fund II. Prior to this, he was the business - strategy senor advisor at BeryTech. He was previously executive director at BeryTech Technology and Health.

Henri Asseily Managing Partner Leap Ventures Henri Asseily is a managing partner at Leap Ventures, a late-stage venture capital firm based in Beirut and Paris. For the previous 20 years he was a serial entrepreneur focused on internet-related businesses, and he has particular expertise in algorithmics and computer science. He is the founder of Bizrate.com / Shopzilla, acting as CTO until its sale in 2005 for $569 million. He was designing flat models before they were called NoSQL, and led the creation of the first product-centric online search engine.

Omar Gabr Instabug Omar started Instabug in 2012 right after graduating from college. He studied Computer Science at the Cairo University in Egypt. Instabug is an Egyptian based company that empowers mobile-first companies to iterate faster and enhance their app quality. Instabug is currently serving over one billion users worldwide and being used by the top apps in world including eBay, Lyft, Electronic Arts and thousands more.

- Details

- Category: Technology

Read more: Here are the speakers so far for TechCrunch Startup Battlefield MENA 2018

Write comment (91 Comments)

We were expecting smart home technology to dominate IFA 2018, but were surprised to see smartphones and wearables eliciting the most excitement. That being said, we did see a lot of really innovative smart home gadgets at the conference, with smart speakers prevailing over other connected smart home gear.

If you're looking to upgrade your home

- Details

- Category: Technology

Read more: Best smart home gear of IFA 2018

Write comment (97 Comments)

While business has always innovated and embraced new technology for a competitive edge, these days, the pace of this has hastened to breakneck speed. Witness such innovations as mobile Gigabit connections, autonomously driven cars, and smart homes - all on the cutting edge, and the stuff of science fiction just a decade or so ago. An important

- Details

- Category: Technology

Read more: What is digital business automation

Write comment (90 Comments)

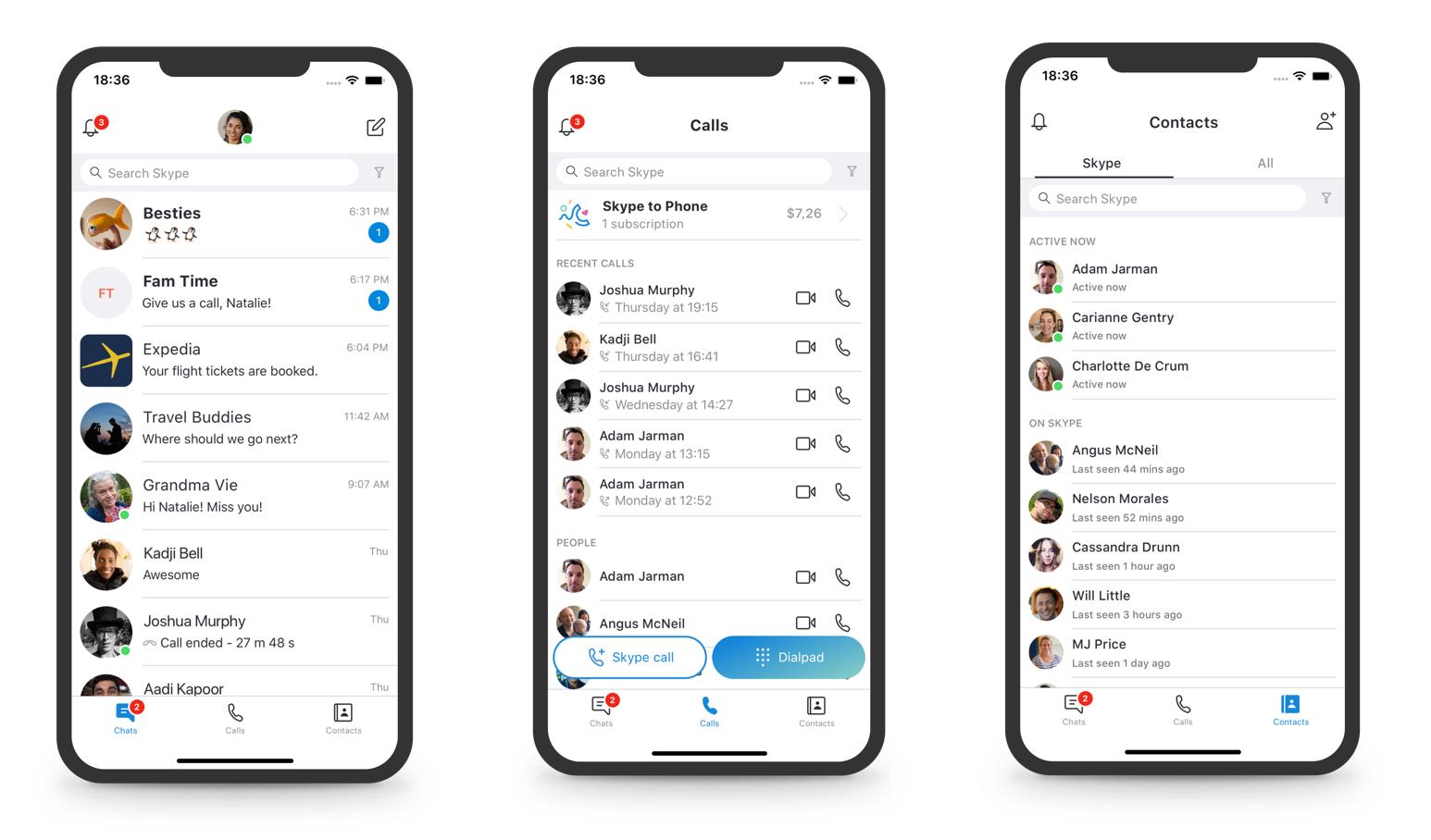

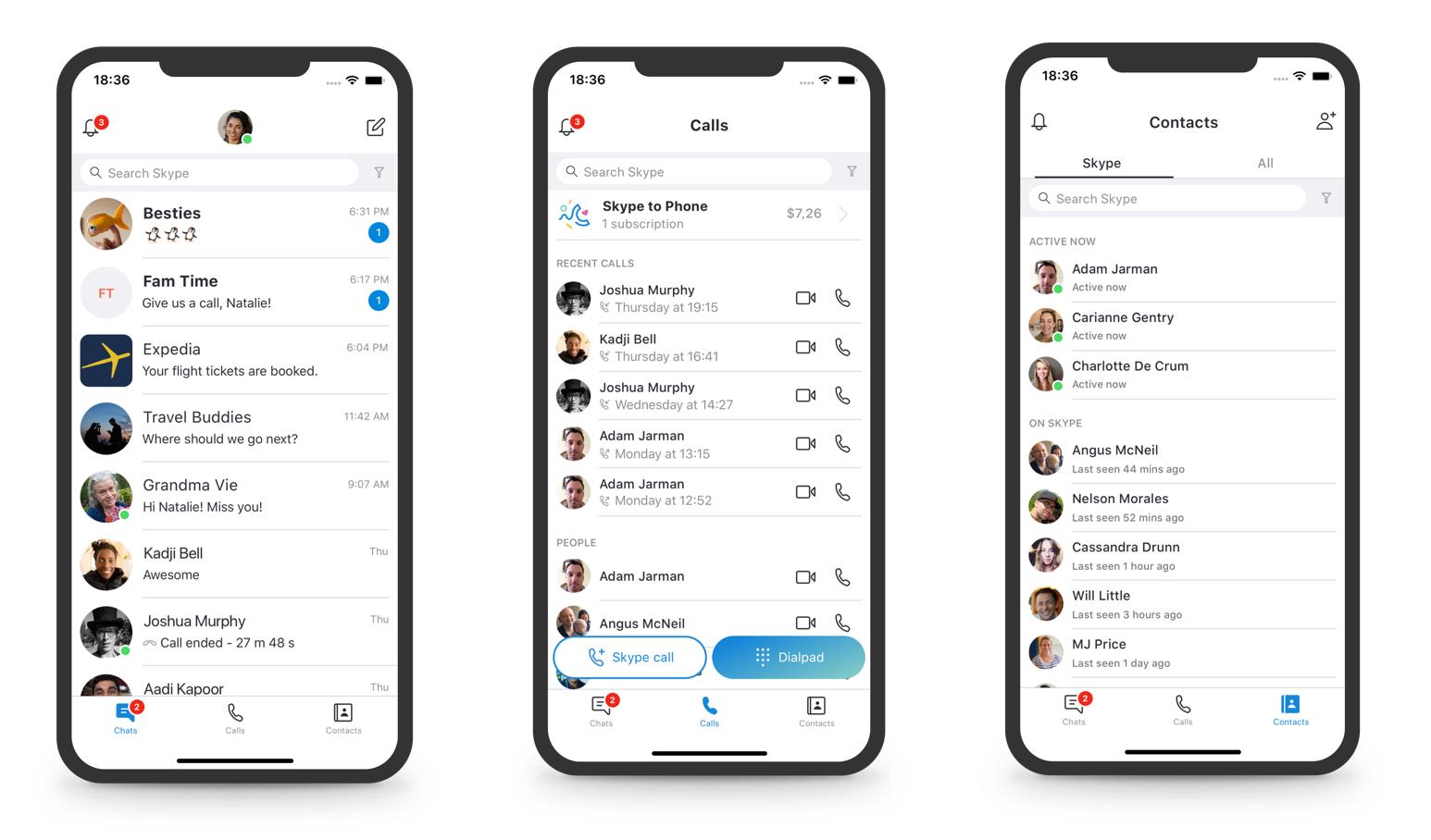

Skype's desktop and mobile apps are getting another design overhaul, aimed at appeasing users who weren’t happy with the previous one.

Since acquiring the online messaging service in 2011 Microsoft has rolled out several redesigns and new features, although not always to much fanfare.

Last year saw a new Highlights feature seemingly styled after Snap

- Details

- Category: Technology

Read more: Microsoft is redesigning the Skype app, again

Write comment (92 Comments)Page 4278 of 5614

10

10