Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Mike Rothenberg, infamous Silicon Valley venture capitalist and founder of Rothenberg Ventures, has been formally charged by the Securities and Exchange Commission for overcharging investors to fund personal projects.

Itimportant to note a formal charge is not proof of guilt and Rothenberg has not made any admission of guilt under these proceedings. However, Rothenberg has been under investigation by the SEC for the last several years.

The SEC now alleges in a statement the investor and his firm had misappropriated up to $7 million dollars for personal enjoyment, meanwhile claiming the funds were from his own coffers to pay for lavish parties, hotels and sporting events.

Rothenberg has settled the charges with the SEC and tells TechCrunch through a statement from his communications team that he is stepping down.

&Mr. Rothenberg takes great pride in the portfolio of innovative start-up companies he has selected for investors. But he has determined it would best serve his investors to bring this matter to a close, and has thus decided to resolve the SEC action without admitting or denying the allegations. Separately, Rothenberg Ventures today filed suit against Silicon Valley Bank to vindicate the interests of its funds and investors,& says the statement.

As part of the settlement, Rothenberg has agreed to be barred from the brokerage and investment advisory business with a right to reapply after five years.

We&ve reached out to several LPs in the fund and have found, regardless of the charges or several news reports surrounding possible misdeeds, Rothenberg still seems to have loyalty among some whom he would have harmed.

&I wanted to help hold the ship together, not only for the sake of the investments but because Mike was in desperate need of help and it was hard to see someone abandoned like that, even if he had messed up somehow,& investor Nathan N. Hudson told TechCrunch in a statement.

You may recall our series of initial reports on the rise and fall of Rothenberg Ventures starting in 2016, including a mass exodus at the firm by not only top brass but most of the employees, former employeeclaims of overspending on hot-ticket items such as an executive-produced video for Coldplay, a race-car and driver and an alleged $200,000 suite at the Super Bowl meant to woo investors.

Rothenberg was later caught up in several lawsuits, including one from Transcend VR for fraud and breach of contract, which ended in a settlement. Another suit between Rothenberg and his former CFO, David Haase, ended with Rothenberg being ordered to pay $166,000 in damages.

Through it all, Rothenberg has still managed to make some good investment picks, which have supposedly helped keep him afloat during the government inquiry. According to one investor in the fund, Rothenberg$100,000 Robinhood investment is now worth $20 million.

&Venture capital investors provide important funding for start-ups but there are risks, including potential harm to investors from unscrupulous managers who defraud them, as we allege Rothenberg did in this case,& C. Dabney O&Riordan, co-chief of the Enforcement DivisionAsset Management Unit said in a statement.

Rothenberg has made no admission of any wrongdoing throughout the settlement and could practice in investing after five years are up with a clean record. The SEC stands by their allegations.

- Details

- Category: Technology

Read more: The SEC has charged Mike Rothenberg with fraud

Write comment (100 Comments)Venezuela has just taken drastic and unprecedented steps to stabilize its currency as it grapples with hyperinflation and other economic issues. The countrycurrency has not only been massively devalued and renamed, but is now tied to a state-issued cryptocurrency called the Petro, which itself fluctuates based on oil prices. Hardly anyone knows what to expect out of this.

The Petro is not new; it arrived earlier this year in the form of a stepped offering to private and then public buyers, raising more than $3 billion from foreign governments and presumably some private buyers. President Trump forbade the U.S. from taking part.

It is supposed to be a liquid asset reflective of the price of oil, and there is of course a whitepaper that describes the system in broad strokes, though it lacks almost any real technical detail. But the countryown national assembly called the state-issued cryptocurrency unconstitutional, blockchain industry experts have called it a scam and there are Russian machinations to consider as well. Bloomberg has a good roundup of official communications about the token.

The scheme originated in the administration of Venezuelan President Nicolas Maduro and seems to be an attempt to lend some credibility and stability to the countrycurrency. The strong bolivar, which has lost more than 90 percent of its value over the last decade, has been renamed the sovereign bolivar and artificially returned to pre-inflation values. In practical terms that means a loaf of bread that cost 100 bolivars in 2012 and 100,000 last week will now, theoretically, cost around 100 again. Whether that will actually happen — the black market rates are probably more influential — is anyoneguess.

In case it isn&t clear, I&m not an economist and don&t plan to become one. But this is an historic moment in the blockchain world in that it is the first time an official fiat currency has been pegged to a state-run cryptocurrency. That makes it of interest to the international community for many reasons, although obviously this is far from the ideal method by which one might want to demonstrate such a system.

Although this whole situation is nominally of interest, it seems unlikely to benefit the people on the ground in Venezuela who have no use for oil-based cryptocurrencies and just want to buy some bottled water, a package of diapers and a train ticket out of the country. How this all plays out will no doubt be instructive, but letnot lose sight of the humanitarian crisis playing out on the streets. Here as elsewhere, donations can help.

- Details

- Category: Technology

Read more: Venezuela ties its currency to a state-run cryptocoin

Write comment (93 Comments)Amazon is today rolling out a set of new features to its Echo Dot Kids Edition devices — the now $70 version of the Echo Dot smart speaker that ships with a protective case and a yearsubscription to Amazon FreeTime, normally a $2.99 per month subscription for Prime members. Now joining the Kids Editionparental controls and other exclusive content are new skills from Disney, Hotel Transylvania and Pac-Man, as well as a calming &Sleep Sounds& skill for bedtime.

There are now four new skills that play sounds of thunderstorms, rain, the ocean or a babbling brook, as well as an all-encompassing &Sleep Sounds& skill that offers 42 different soothing options from which to choose. New parents may be glad to know that this includes baby-soothing sounds like cars, trains and the vacuum (don&t knock it until you try it, folks — it works).

Amazon clarified to us that while there is a version of sleep sounds in the Skill Store today, this version launching on the Kids Edition is a different, child-directed version.

Also new to the Kids Edition is &Disney Plot Twist,& which is like a Disney version of Mad Libs, where players change out words and phrases in short adventure stories. The skill features popular Disney characters like Anna, Olaf and Kristoff as the narrators and is exclusive to Kids Edition devices.

The new movie &Hotel Transylvania 3: Summer Vacation& is featured in another new skill, DracPack, which includes monster stories, songs and jokes.

Meanwhile, Pac-Man Stories is a skill that includes interactive stories for the whole family that work similar to choose-your-own-adventures — that is, the decisions you make will affect the ending.

Both of these are broadly available on Alexa, meaning they don&t require a Kids Edition device to access.

Stories, however, does appear to be one of the areas Amazon is investing in to make its Alexa-powered speakers more appealing to families with young children. The company recently decided to stop working on its chat stories app Amazon Rapids, saying it will instead continue to adapt those Amazon Rapids stories for the Alexa platform.

Amazon also tries to market the Echo Dot Kids Edition to families by making some kid-friendly content, like Disney Plot Twist, available exclusively to device owners.

For example, it already offers with this device exclusive kid skills like Disney Stories, Loud House Challenge, No Way ThatTrue, Funny Fill In, Spongebob Challenge, Weird but True, Name that Animal, This or That, Word world, Ben ten, Classroom thirteen, Batman Adventures and Climb the Beanstalk.

But the Kids Edition can also be confusing to use, because the exclusive skills come whitelisted and ready to go, while other kid-safe skills have to be manually whitelisted through a parentdashboard. And there isn&t enough instruction either from Alexa or in the Alexa app on this process, at present, we found when testing the device earlier.

Unless therea specific exclusive skill that parents really want their kids to have, the savings are also minimal when buying the Kids Edition Dot/FreeTime bundle, versus buying a regular Dot and adding FreeTime separately.

- Details

- Category: Technology

Read more: Amazon’s Echo Dot Kids Edition gains new skills from Disney and others

Write comment (94 Comments)Magnetic resonance imaging is an invaluable tool in the medical field, but italso a slow and cumbersome process. It may take fifteen minutes or an hour to complete a scan, during which time the patient, perhaps a child or someone in serious pain, must sit perfectly still. NYU has been working on a way to accelerate this process, and is now collaborating with Facebook with the goal of cutting down MRI durations by 90 percent by applying AI-based imaging tools.

Itimportant at the outset to distinguish this effort from other common uses of AI in the medical imaging field. An X-ray, or indeed an MRI scan, once completed, could be inspected by an object recognition system watching for abnormalities, saving time for doctors and maybe even catching something they might have missed. This project isn&t about analyzing imagery thatalready been created, but rather expediting its creation in the first place.

The reason MRIs take so long is because the machine must create a series of 2D images or slices, many of which must be stacked up to make a 3D image. Sometimes only a handful are needed, but for full fidelity and depth — for something like a scan for a brain tumor — lots of slices are required.

The FastMRI project, begun in 2015 by NYU researchers, investigates the possibility of creating imagery of a similar quality to a traditional scan, but by collecting only a fraction of the data normally needed.

Think of it like scanning an ordinary photo. You could scan the whole thing… but if you only scanned every other line (this is called &undersampling&) and then intelligently filled in the missing pixels, it would take half as long. And machine learning systems are getting quite good at tasks like that. Our own brains do it all the time: you have blind spots with stuff in them right now that you don&t notice because your vision system is filling in the gaps — intelligently.

The data collected at left could be &undersampled& as at right, with the missing data filled in later

If an AI system could be trained to fill in the gaps from MRI scans where only the most critical data is collected, the actual time during which a patient would have to sit in the imaging tube could be reduced considerably. Iteasier on the patient, and one machine could handle far more people than it does doing a full scan every time, making scans cheaper and more easily obtainable.

The NYU School of Medicine researchers began work on this three years ago and published some early results showing that the approach was at least feasible. But like an MRI scan, this kind of work takes time.

&We and other institutions have taken some baby steps in using AI for this type of problem,& explained NYUDan Sodickson, director of the Center of Advanced Imaging Innovation and Research there. &The sense is that already in the first attempts, with relatively simple methods, we can do better than other current acceleration techniques — get better image quality and maybe accelerate further by some percentage, but not by large multiples yet.&

So to give the project a boost, Sodickson and the radiologists at NYU are combining forces with the AI wonks at Facebook and its Artificial Intelligence Research group (FAIR).

NYU School of MedicineDepartment of Radiology chair Michael Recht, MD, Daniel Sodickson, MD, vice chair for research and director of the Center for Advanced Imaging Innovation and Yvonne Lui, MD, director of artificial intelligence, examine an MRI

&We have some great physicists here and even some hot-stuff mathematicians, but Facebook and FAIR have some of the leading AI scientists in the world. So itcomplementary expertise,& Sodickson said.

And while Facebook isn&t planning on starting a medical imaging arm, FAIR has a pretty broad mandate.

&We&re looking for impactful but also scientifically interesting problems,& said FAIRLarry Zitnick. AI-based creation or re-creation of realistic imagery (often called &hallucination&) is a major area of research, but this would be a unique application of it — not to mention one that could help some people.

With a patientMRI data, he explained, the generated imagery &doesn&t need to be just plausible, but it needs to retain the same flaws.& So the computer vision agent that fills in the gaps needs to be able to recognize more than just overall patterns and structure, and to be able to retain and even intelligently extend abnormalities within the image. To not do so would be a massive modification of the original data.

Fortunately it turns out that MRI machines are pretty flexible when it comes to how they produce images. If you would normally take scans from 200 different positions, for instance, itnot hard to tell the machine to do half that, but with a higher density in one area or another. Other imagers like CT and PET scanners aren&t so docile.

Even after a couple years of work the research is still at an early stage. These things can&t be rushed, after all, and with medical data there are ethical considerations and a difficulty in procuring enough data. But the NYU researchers& ground work has paid off with initial results and a powerful data set.

Zitnick noted that because AI agents require lots of data to train up to effective levels, ita major change going from a set of, say, 500 MRI scans to a set of 10,000. With the former data set you might be able to do a proof of concept, but with the latter you can make something accurate enough to actually use.

The partnership announced today is between NYU and Facebook, but both hope that others will join up.

&We&re working on this out in the open. We&re going to be open-sourcing it all,& said Zitnick. One might expect no less of academic research, but of course a great deal of AI work in particular goes on behind closed doors these days.

So the first steps as a joint venture will be to define the problem, document the data set and release it, create baselines and metrics by which to measure their success, and so on. Meanwhile, the two organizations will be meeting and swapping data regularly and running results past actual clinicians.

&We don&t know how to solve this problem,& Zitnick said. &We don&t know if we&ll succeed or not. But thatkind of the fun of it.&

- Details

- Category: Technology

Read more: NYU and Facebook team up to supercharge MRI scans with AI

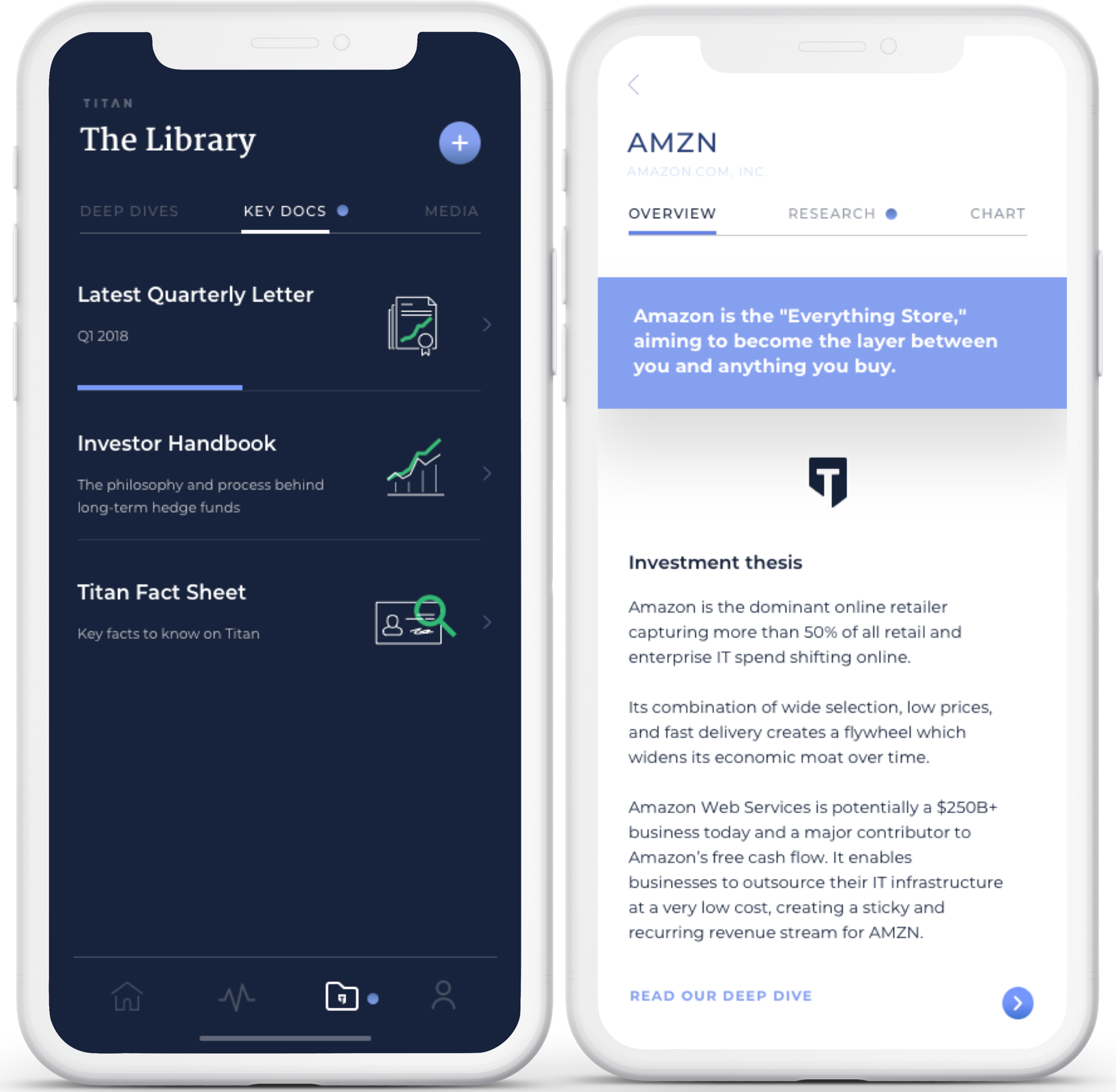

Write comment (90 Comments)What Robinhood did to democratize buying individual stocks, Titan wants to do for investing in a managed portfolio. Instead of being restricted to rich accredited investors willing to pour $5,000 or even $500,000 into a traditional hedge fund that charges 2 percent fees and 20 percent of profits, Titan lets anyone invest as little as $1,000 for just a 1 percent fee on assets while keeping all the profits. Titan picks the top 20 stocks based on data mined from the most prestigious hedge funds, then invests your money directly in those with personalized shorts based on your risk profile.

Titan has more $10 million under management after quietly spinning up five months ago, and this week the startup graduates from Y Combinator. Now Titan is ready to give upscale millennialsa more sophisticated way to play the markets.

This startup is hot. It refused to disclose its funding, likely in hopes of not tipping off competitors and incumbents to the opportunity itchasing. But itthe buzz of YC, with several partners already investing their own money through Titan. When you consider Stanford-educated free stock-trading app Robinhoodstunning $5.6 billion valuation thanks to its disruption of E*Trade, iteasy to imagine why investors are eager to back Titanattack on other financial vehicles.

&We&re all 28 to 30 years old,& says co-founder Clayton Gardner about his team. &We want to actively invest and participate in the market but most of us who don&t have experience have no idea what we&re doing.& Most younger investors end up turning to family, friends or Reddit for unreliable advice. But Titan lets them instantly buy the most reputable stocks without having to stay glued to market tickers, while using an app to cut out the costs of pricey brokers and Wall Street offices.

Titan co-founders (from left): Max Bernardy, Joe Percoco,Clayton Gardner

&We all came from the world of having worked at hedge funds and private equity firms like Goldman Sachs. We spent five years doing that and ultimately were very frustrated that the experiences and products we were building for wealthy people were completely inaccessible to people who weren&t rich or didn&t have a fancy suit,& Gardner recalls. &Instead of charging high fees, we can use software to bring the products directly to consumers.&

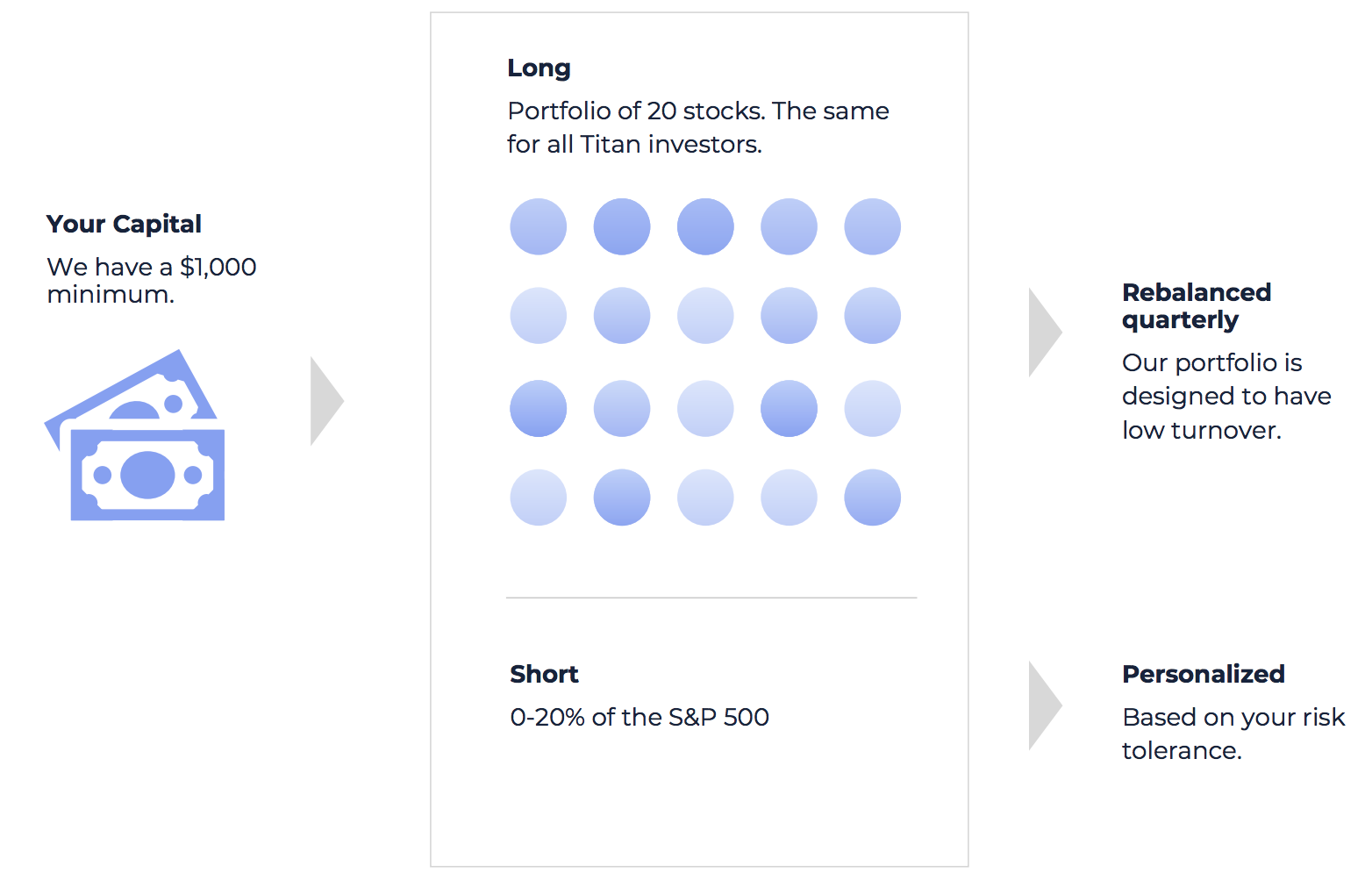

How Titan works

Titan wants to build BlackRock for a new generation, but its origin is much more traditional. Gardner and his co-founder Joe Percoco met on their first day of business school at UPennWharton (of course). Meanwhile, Titanthird co-founder, Max Bernardy, was studying computer science at Stanford before earning a patent in hedge fund software and doing engineering at a few startups. The unfortunate fact is the world of finance is dominated by alumni from these schools. Titan will enjoy the classic privilege of industry connections as it tries to carve out a client base for a fresh product.

&We were frustrated that millennials only have two options for investing: buying and selling stocks themselves or investing in a market-weighted index,& says Gardner. &We&re building the third.&

Titanfirst product isn&t technically a hedge fund, but itbuilt like one. It piggybacks off the big hedgies that have to report their holdings. Titan uses its software to determine which are the top 20 stocks across these funds based on turnover, concentration and more.All users download the Titan iOSor Android app, fund their account and are automatically invested into fractional shares of the same 20 stocks.

Titan earns a 1 percent annual fee on what you invest. There is a minimum $1,000 investment, so some younger adults may be below the bar.&We&re targeting a more premium millennial for start. A lot of our early users are in the tech field and are already investing,& says Gardner.

For downside protection, Titan collects information about its users to assess their risk tolerance and hedge their investment by shorting the market index 0 to 20 percent so they&ll earn some if everything crashes. Rather than Titan controlling the assets itself, an industry favorite custodian called Apex keeps them secure. The app uses 256-bit encryption and SSL for data transfers, and funds are insured up to $500,000.

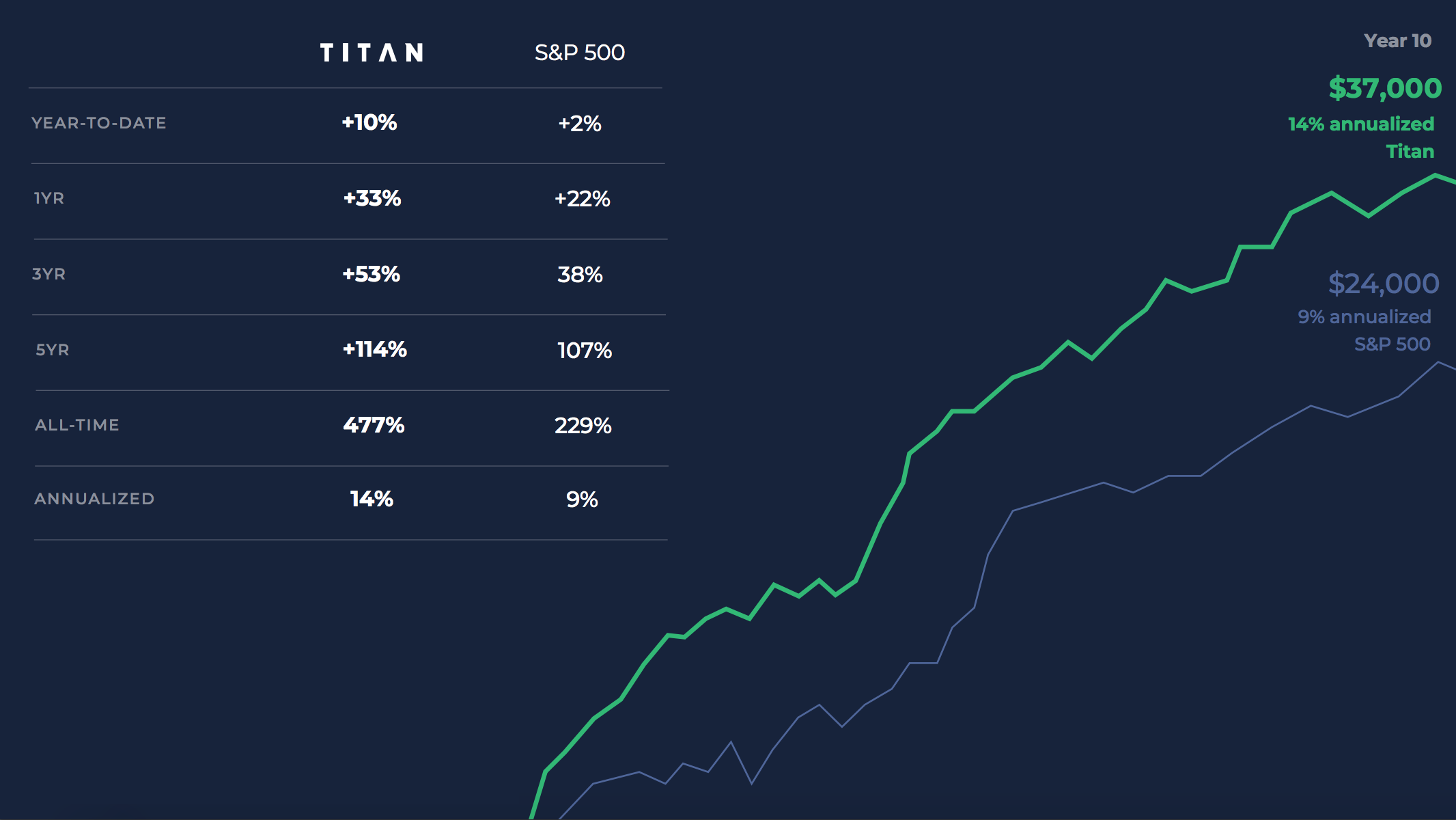

How have its bets and traction been doing &We&ve been pleasantly surprised so far,& Gardner beams, noting Titanthousands of clients. It claims itup 10 percent year-to-date and up 33 percent in one year compared to the S-P 5002 percent year-to-date and 22 percent in one year. Since users can pull out their funds in three to four business days, Titan is incentivized to properly manage the portfolio or clients will bail.

But beyond the demographic and business model, itthe educational elements that set Titan apart. Users don&t have to hunt online for investment research. Titan compiles it into deep dives into top stocks like Amazon or Comcast, laying out investment theses for why you should want your money in &the everything store& or &a toll road for the Internet.& Through in-app videos, push notifications and reports, Titan tries to make its users smarter, not just richer.

With time and funding, &Eventually we hope to launch other financial products, including crypto, bonds, international equities, etc.,& Percoco tells me. That could put Titan on a collision course with Wealthfront, Coinbase and the recently crypto-equipped Robinhood, as well as direct competitors like asset managers BlackRock and JP Morgan.

&If we fast-forward 10 to 20 years in the future, millennials will have inherited $10 trillion, and at this rate they&re not equipped to handle that money,& says Gardner. &Financial management isn&t something taught in school.&

Worryingly, when I ask what they see as the top threats to Titan, the co-founders exhibited some Ivy League hubris, with Gardner telling me, &Nothing that jumps out…& Back in reality, building software that reliably prints money is no easy feat. A security failure or big drop could crater the appbrand. And if its education materials are too frothy, they could instill blind confidence in younger investors without the cash to sustain sizable losses. Competitors like Robinhood could try to swoop in an offer managed portfolios.

Hopefully if finance democratization tools like Titan and Robinhood succeed in helping the next generations gather wealth, a new crop of families will be able to afford the pricey tuitions that reared these startups& teams. While automation might subsume laborwages and roll that capital up to corporate oligarchs, software like Titan could boost financial inclusion. To the already savvy, 1 percent might seem like a steep fee, but it buys the convenience to make the stock market more accessible.

- Details

- Category: Technology

Read more: Titan launches its mobile ‘not a hedge fund’

Write comment (93 Comments)As a teenager in Nigeria, I tried to build an artificial intelligence system. I was inspired by the same dream that motivated the pioneers in the field: That we could create an intelligence of pure logic and objectivity that would free humanity from human error and human foibles.

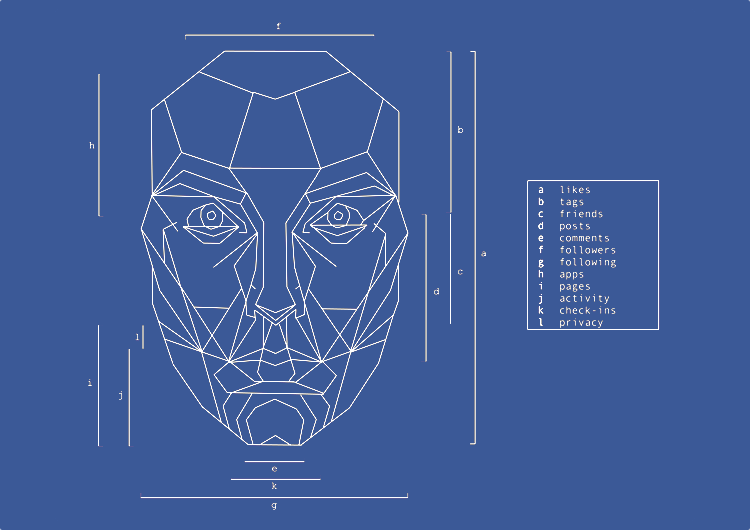

I was working with weak computer systems and intermittent electricity, and needless to say my AI project failed.Eighteen years later— as an engineer researching artificial intelligence, privacy and machine-learning algorithms — I&m seeing that so far, the premise that AI can free us from subjectivity or bias is also disappointing. We are creatingintelligence in our own image. And thatnot a compliment.

Researchers have known forawhilethat purportedly neutral algorithms can mirror or even accentuate racial, gender and other biases lurking in the data they are fed. Internet searches on names that are more often identified as belonging to black people were found to prompt search engines to generate ads for bail bondsmen. Algorithms used for job-searching were more likely to suggest higher-paying jobs to male searchers than female. Algorithms used in criminal justice also displayed bias.

Five years later, expunging algorithmic bias is turning out to be a tough problem. It takes careful work to comb through millions of sub-decisions to figure out why the algorithm reached the conclusion it did. And even when that is possible, it is not always clear which sub-decisions are the culprits.

Yet applications of these powerful technologies are advancing faster than the flaws can be addressed.

Recent researchunderscores this machine bias, showing that commercial facial-recognition systems excel at identifying light-skinned males, with an error rate of less than 1 percent. But if you&re a dark-skinned female, the chance you&ll be misidentified rises to almost 35 percent.

AI systems are often only as intelligent — and as fair — as the data used to train them. They use the patterns in the data they have been fed and apply them consistently to make future decisions. Consider an AI tasked with sorting the best nurses for a hospital to hire. If the AI has been fed historical data — profiles of excellent nurses who have mostly been female — it will tend to judge female candidates to be better fits. Algorithms need to be carefully designed to account for historical biases.

Occasionally, AI systems get food poisoning. The most famous case wasWatson, the AI that first defeated humans in 2011 on the television game show Jeopardy. Watsonmasters at IBM needed to teach it language, including American slang, so they fed it the contents of the online Urban Dictionary. But after ingesting that colorful linguistic meal, Watson developed a swearing habit. It began to punctuate its responses with four-letter words.

We have to be careful what we feed our algorithms. Belatedly, companies now understand that they can&t train facial-recognition technology by mainly using photos of white men. But better training data alone won&t solve the underlying problem of making algorithms achieve fairness.

Algorithms can already tell you what you might want to read, who you might want to date and where you might find work. When they are able to advise on who gets hired, who receives a loan or the length of a prison sentence, AI will have to be made more transparent — and more accountable and respectful of societyvalues and norms.

Accountability begins with human oversight when AI is making sensitive decisions. In an unusual move,Microsoft president Brad Smithrecently called for the U.S. government to consider requiring human oversight of facial-recognition technologies.

The next step is to disclose when humans are subject to decisions made by AI. Top-down government regulation may not be a feasible or desirable fix for algorithmic bias. But processes can be created that would allow people to appeal machine-made decisions — by appealing to humans. The EUnewGeneral Data Protection Regulationestablishes the right for individuals to know and challenge automated decisions.

Today people who have been misidentified — whether in an airport or an employment data base — have no recourse. They might have been knowingly photographed for a driverlicense, or covertly filmed by a surveillance camera (which has a higher error rate). They cannot know where their image is stored, whether it has been sold or who can access it. They have no way of knowing whether they have been harmed by erroneous data or unfair decisions.

Minorities are already disadvantaged by such immature technologies, and the burden they bear for the improved security of society at large is both inequitable and uncompensated. Engineers alone will not be able to address this. An AI system is like a very smart child just beginning to understand the complexities of discrimination.

To realize the dream I had as a teenager, of an AI that can free humans from bias instead of reinforcing bias, will require a range of experts and regulators to think more deeply not only about what AI can do, but what it should do — and then teach it how.

- Details

- Category: Technology

Read more: Keeping artificial intelligence accountable to humans

Write comment (97 Comments)Page 4398 of 5614

6

6