Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

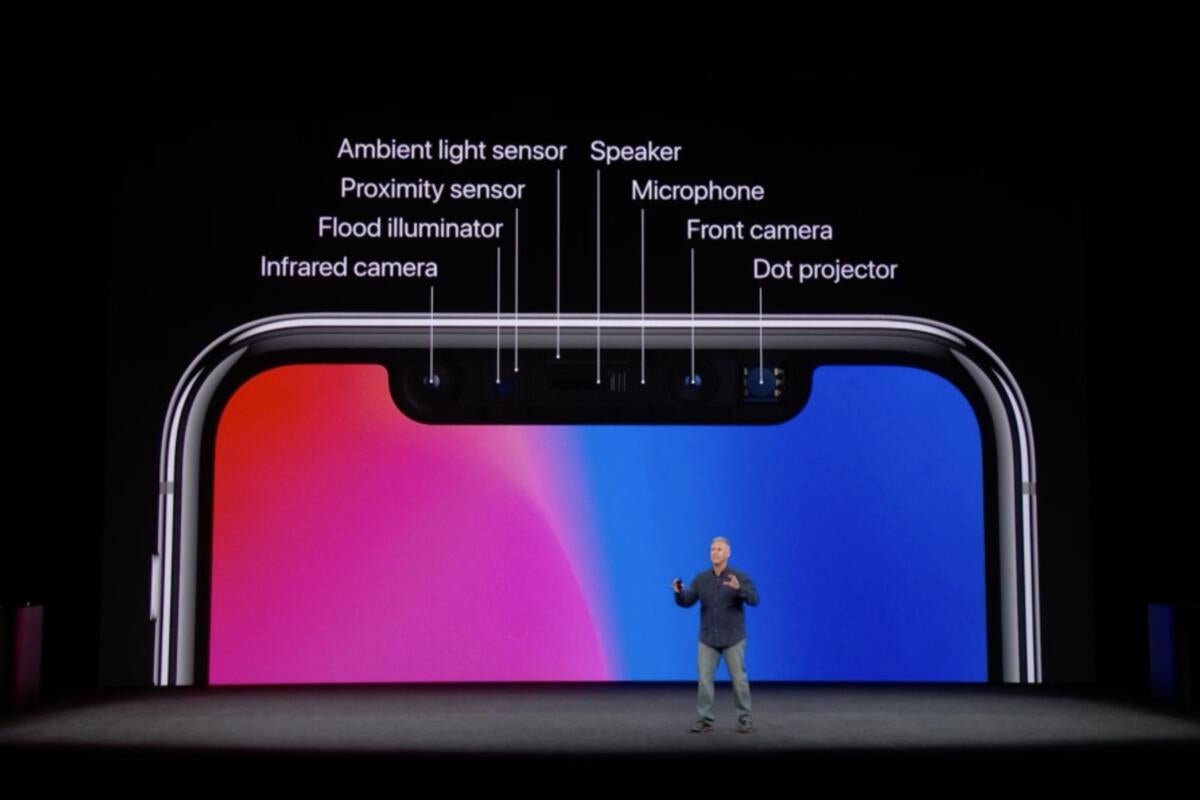

Applesmartphones are the best-selling mobile device models in the world, particularly among enterprise users, so what should we expect when the company announces new models this season

Faster processors

Appleexisting iPhone 8, 8 Plus and X models are reportedly fasterthan Samsunglatest Galaxy range, and this advantage grows once again this year with the company expected to put a new 7-nanometer chip inside iPhones. TSMC began mass production of these back in April. Applesmartphone speed advantage is becoming so significant the company recently ran a TV ad (Unleash) to celebrate it. The new models should boast up to 4GB RAM.

- Details

- Category: Technology

Read more: The summer 2018 iPhone refresh speculation round-up

Write comment (94 Comments)

July 2018 patches for both Windows and Officebrought bugs and bugs of bugs— many of which haven&t been solved, even now. We have even reached the unprecedented stage where the .NET teamopenly warned people against installing buggy updates, and the Monthly Rollup previews got shoved down the Automatic Update chute to fix bugs in the primary Monthly Rollup.

July was more galling than most months because the patches caused widespread problems for many, while plugging security holes for exactly zero widespread infections.

- Details

- Category: Technology

Read more: Patch Tuesday’s coming: Block Windows Update and pray we don’t get fooled again

Write comment (100 Comments)

Google this week started rolling out a change to Chrome 68 on Windows 10 that uses the operating system's native notification center to post messages from the browser.

According to Peter Beverloo, a staff software engineer who leads the team responsible for, among other things, Chrome's notifications, half of version 68's users have had the native support switched on in their browsers. The remainder will have it enabled, Beverloo said, "in a week or so."

[ Further reading: Google's Chromium browser explained ]Chrome 68 launched July 24. The browser must be running on Windows 10 1607 - the mid-2016 feature upgrade also named "Anniversary Update" - or later.

- Details

- Category: Technology

Read more: Chrome 68 takes notifications native in Windows 10

Write comment (92 Comments)A top four tech company recently approached the CEO of one of our B2B portfolio companies with a tremendous offer. This company, with buy-in from its world-famous CEO, believes the startupcore technology could help them catch up to a rival in an incredibly important space and wanted to discuss a $20M investment on extremely favorable terms. This partnership would allow the startup to grow 10X in a year and would provide invaluable validation.

The founder was elated. I was terrified. This kind of deal is a classic &whale hunt,& and most of the startups who engage in them are doomed to end up like Captain Ahab.

While itimmensely gratifying to receive this kind of validation from a market leader, the startup is at an early and important developmental stage. I&ve seen many promising startups blown up by ill-advised business development deals that swelled teams in a bout of euphoria only to see them wither if interest and focus from their partner wanes.

In my experience, arrangements that pair a behemoth megacorp with a Seed/Series A stage startup have a success rate well below 50%. I didn&t tell the founder to decline the offer outright, but I did suggest that the management team consider a few questions before pursuing it.

How much MRR will it add to your business The project with the large company is in line with the startuplong-term vision, but ita departure from their current focus. A $20M investment is very nice indeed, but once that money is spent, what will the ongoing revenue be And what is the opportunity cost of not supporting the current business plan What discount rate will you apply to compensate for the small probability of this deal working out My advice was that if he couldn&t satisfactorily answer those questions, it was probably the right move to turn the deal down. Even if the deal was structured as $20M in revenue rather than equity I&d hesitate.

How, in detail, will this project help your core business Therean argument for entering into an agreement like this even if the immediate revenue contribution is low. If the project will allow the startup to speed up the development of a core technology that is generally applicable to other customers, it would seem far more worthy of consideration but beware our human ability to rationalize (first and foremost to ourselves).

These projects more often end up as bespoke development engagements where despite the initial intention, the startup is producing a custom application for the big co. Founders will rationalize the deviations from their product roadmap, but ultimately sell out their future for a long-shot opportunity to integrate with a worldwide leader.

My advice is to not think magically about product/market fit, and instead, to try pre-selling it to other customers as a form of market development. If you can sell the product, great! If not, you&re probably using venture capital to subsidize the R-D budget of a company worth hundreds of billions of dollars.

What happens if this doesn&t work out Iteasy to visualize success, but what happens if the deal doesn&t lead anywhere In this scenario, imagine the big tech company decides to change its priorities and abandons the initiative. SaaS startups face a similar failure mode when they go to great lengths to impress big companies during pilot programs only to see their project die due to lack of interest. When considering a high-risk, high-reward partnership, founders need to spend time envisioning a gruesome demise.

● What will your pitch be for a bridge round of financing when you have no revenue, you just came up short during a prolonged engagement with the best possible customer in your industry

● How will you reassure your most talented team members that you know what you&re doing when the deal fails, and capital is running short

● How quickly can you reorient the company to focus on other customers and how quickly will you start generating revenue from them

Image courtesy of Flickr/Felipe Campos

How well do you understand the Big Company Founders with little exposure to big companies are susceptible to misreading cues. My partner Eric Paley wrote about how entrepreneurs regularly misread their likelihood of getting funding from VCs, and the pattern is similar with this kind of business development deal.

When I started an ISP in South Africa in the 1990s, I had the chance to pitch the executive team at the countryequivalent to Walmart . We were talking about the upcoming Olympic Games, which they were sponsoring. I asked if they were bringing their biggest customers to the events. One of the VPs looked at me, bewildered, and said: &Your mother may well be our biggest customer.&

I instantly realized they didn&t have big customers; they were a big customer. Their suppliers took them to the Games and fancy dinners. I felt silly at the moment but learned a valuable lesson about B2B power dynamics. Here are some other dynamics to be cautious of:

Are You Aware of the Work Pace Differential

Startups measure their survival quarter to quarter while big companies plan in five-year increments. Itoften shocking how slowly big company partners move on everything from email to product roll-outs. Decisions made by gut feel at startups have to navigate a maze of meetings and committees at a big company. Startups often drown in the number of process leviathans require to make the smallest of improvements.

Who are the Internal Champions

Promising projects can die on the vine because the internal champion gets reassigned or leaves the company. Successful partnerships will involve multiple high-level people from the larger organization. They also typically involve the startup being paid a fair market rate or are paired with a strategic investment to help defray the burden of non-recurring expenses. If not, beware.

Most sponsors will say their project is critical to the company, but itthe startups CEOjob to check that out. Founders should reference the opportunity in the same way they would reference an investor. This kind of deal is often an all or nothing bet on your company, don&t make it too blithely.

Is the Project a Priority for the CXO/VP

Partnerships between startups and big companies work best when it solves the problem of a VP or CXO level executive. Below that level, we&ve seen startups spend large sums and risk their future on what amounts to a proof of concept project for a mid-level director with no real juice.

This is especially common with startups who sell to retailers. Theoretically, the brick and mortar shops need a bulwark against Amazon, but in reality, we&ve seen many of them default to more focused on protecting their physical retail turf rather than truly investing in online sales. They&ll run pilots to assure investors that they have their eye on the future when in reality the efforts are more PR than a business plan.

Do you Understand Big Company Logic

A $20M investment to a small startup is a massive deal. For a big company, itessentially the size of an acquihire and can be shut down with no repercussions. In the context of a half-billion dollar company, $20M bets actually fail far more than a startup may appreciate.

Are you competing with another startup

Is this project a &bake-off& where multiple companies are competing The most dangerous kind of whale hunting is when a startup is competing with one or more competitors to win a large book of business. Founders considering this kind of arrangement should give serious thought to skipping the process and building out a less concentrated revenue base with fewer impediments while your competitors fight to the death.

Do you have a deep bench of vetted candidates ready to be hired Founders often underestimate the challenge of growing 3-5X in short order. Every successful startup has to do this, but it usually happens more organically over time. The kind of business development deal our portfolio CEO is considering will change the company overnight.

Entrepreneurs need to ask if they have a long list of former co-workers, peers, vetted candidates eager to join their company If not, massively scaling the company to meet the demands of a major partner will likely lead to sub-par hires to fill an urgent need while slowly poisoning the companyculture. Money is rarely the most challenging part of hiring. Hiring fast when you control your destiny is hard enough, doing so in an uncertain arrangement can be very detrimental.

Beyond hiring, itimportant to view a partnership through the lens of Activity Based Costing.

How much time will this take up 50% 80% More Will you have to drop existing customers or products to make the project work Are you still able to grow the business outside of this partnership or is it genuinely all-consuming

Are You Ready for the Hunt

If you can answer these questions confidently, then you may be ready to go whale hunting. When these projects work, they can be the first domino in a cascade that leads to growth and good places. More often, it results in a startup spending a year and a large chunk of its capital on a high-risk business development deal that more often fails to pan out. Chart your course accordingly.

- Details

- Category: Technology

Read more: Startups should read this checklist before they go “whale hunting” for big partners

Write comment (90 Comments)Facebook is making it easier for kids to add their friends on its under-13 chat app, Messenger Kids. Starting today, the company is rolling out a new feature that will allow kids to request parents& approval of new contacts. To use the feature, parents will turn on a setting that creates a four-word passphrase thatused generate these contact requests, the company says.

Parents can opt to use this feature, which is not on by default.

Once enabled, Facebook will randomly generate a four-word phrase thatuniquely assigned to each child. When the child wants to add a friend to their appcontacts list in the future, they will show this phrase to the friend to enter in their own app.

Both parents will then receive a contact request from their child & and both have to approve the request before the kids can start chatting. In other words, this doesn&t represent a loosening of the rules around parental approvals & all contact requests still require parents& explicit attention and confirmation, as before.

However, it does make it easier for kids to friend one another when their parents aren&t Facebook friends themselves. Thatbeen an issue with the app for some time, and one Facebook first started to address in May when it made a change that finally no longer required parents to be friends, too.

While most parents will at least want to know who their child is texting with, there are plenty of times when parents are friendly with someone on a more casual basis & like through the childschool or their extracurricular activities. But just because two people are neighbors or fellow soccer moms and dads, that doesn&t necessarily mean they&re also Facebook friends.

The change introduced in May allowed parents to do a search for the childfriendparents, then invite them to the app so the kids could connect. But this still required parents to take the initial steps (at the urging of the child, of course). It was also confusing at times, we found when we tried it for ourselves & some parents we connected with couldn&t figure out how the approval process worked, for example.

That being said, it may have helped to give the appinstall base a big boost, along with its expansion outside the U.S. According to data from Sensor Tower, Messenger Kids saw a sizable increase in installs in the beginning of early June and it has just now passed 1.4 million downloads across both iOS and Android. In addition, its daily downloads are around 3x what they were at the end of May.

The passphrase solution will make things a bit easier on parents, because contact requests will be initiated by the kids. Parents will only have to tap a big &Approve& button to confirm the request (or deny it, if the request is inappropriate for some reason.)

The four-word passphrase will only be visible to the child in the Messenger Kids app, and to the parent in their ParentPortal.

Itworth noting that Facebook opted for a passphrase instead of a scannable QR code, as is common in other messaging apps including Facebook Messenger, Snapchat and Twitter, for instance. Facebook says this is so kids can exchange the passphrase without the device being present.

Messenger Kids is a controversial app, but its adoption is growing, the data indicates. Parents have been starved for an app like this & one allowing for conversation monitoring (you just install your own copy) and contact approvals. Whether this will actually indoctrinate a new generation of Facebook or Messenger users is more questionable. Itlikely that when kids outgrow Messenger Kids, they&ll still be switching over to FacebookInstagram and Snapchat instead.

The passphrase feature is rolling out starting today on the Messenger Kids mobile app.

- Details

- Category: Technology

Read more: Messenger Kids rolls out passphrases so kids can initiate friend requests themselves

Write comment (96 Comments)Being stuck on the phone with call centers is painful. We all know this.Observe.AI is one companythat wants to make the experience more bearable, and itraised $8 million to develop an artificial intelligence system that it believes will do just that.

The funding round was led byNexus Venture Partners, with participation fromMGV, Liquid 2 Ventures and Hack VC. Existing investorsEmergent Ventures and Y Combinator also took part —Observe.AI was part of the YCwinter 2018 batch.

The India-U.S. startup was founded last year with the goal of solving a very personal problem for founders Swapnil Jain (CEO), Akash Singh (CTO) and Sharath Keshava (CRO): making call centers better. But, unlike most AI products that offer the potential to fully replace human workforces,Observe.AI is setting out to help the humble customer service agent.

The companyfirst product is an AI that assists call center workers byautomating a range of tasks, from auto-completing forms for customers to guiding them on next steps in-call and helping find information quickly.Jain told TechCrunch in an interview that the product was developed following months of consultation with call center companies and their staff, both senior and junior. That included a stint in Manila, one of the worldcapitals for offshoring customer services anda city well known toKeshava, who helped healthcare startup Practo launch its business in the Philippines& capital.

That effort to know call center operates directly has also shaped how Observe.AI is pitching its services. Rather than going to companies, it is tapping the root of the tree by offering its services to the call centers who manage customer support for well-known businesses behind the curtain. Uber, for example, is one of many to use Philippines-based support centers, but the Observe.AI thesis is that going directly to thesource is easier than navigating large companies for business.

One such partneris Concentrix, one of the worldlargest customer support providers with over 100,000 staff and offices dotted around the globe, while the startup said it has tapped Philippinestelco PLDT for infrastructure.

In addition to helping understand the problems and generating business, working directly with these companies also gives Observe.AI access to and use of data, which is essential for developing any AI and natural language processing-based systems.

Beyond improving its customer service assistant — which Jain likens to an ‘Alexa for call centers& — Observe.AI is working to develop a virtual assistant of its own that can handle the more basic and repetitivecalls from customers to help free up agents for callers who need a human on the other end of the line.

&We aim toeventually automate a large part of the call center experience,& Jain explained in an interview. &Agood set [of customer calls] are complex but a large set can be fairly automated as they are simple in nature.&

The startup is aiming to introduce ‘voicebots& before March 2020, with a beta launch targeted at the end of 2019.

&The kind of company that will disrupt call centers will come from the east —we truly understand the call center life,& Jain told TechCrunch.

He explained that, while Silicon Valley isa hotbed for tech development, understanding the problemsthat need to be solved requires spending time in markets like India and the Philippines.

&That knowledge is super, super valuable… someone in the U.S. can&t even think about it,& he added.

That said, Observe.AI is headquartered in theU.S., in Santa Clara. ThatwhereKeshava, the company CRO, is based with a growing team that is dedicated pre- and post-sales and to building relationships with major software platforms used by call center companies. The idea with the latter is that they can provide an avenue into new business by working withObserve.AI to add AI smarts to their product.

In one such example,Talkdesk, a U.S. startup that offers cloud-based contact center services, has addedObserve.AIservices to what it offers to its customers. Talkdesk CEO Tiago Paiva called the addition &ahuge opportunity for call center efficiency and improving the caller experience.&

The startupIndia-based team isBangalore and it handles technology, which includes the machine learning component. Total headcount is 16 people right now but the founding team expects that will at least double before the end of this year.

- Details

- Category: Technology

Read more: Observe.AI raises $8M to use artificial intelligence to improve call centers

Write comment (98 Comments)Page 4466 of 5614

13

13