Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Itnot just inciting violence, threats and hate speech that will get Facebook to remove posts by you or your least favorite troll. Endangering someone financially, not just physically, or tricking them to earn a profit are now also strictly prohibited.

Facebook today spelled out its policy with more clarity in hopes of establishing a transparent set of rules it can point to when it enforces its policy in the future. That comes after cloudy rules led to waffling decisions and backlash as it dealt with and finally removed four Pages associated with Infowars conspiracy theorist Alex Jones.

The company started by repeatedly stressing that it is not a government — likely to indicate it does not have to abide by the same First Amendment rules.

&We do not, for example, allow content that could physically or financially endanger people, that intimidates people through hateful language, or that aims to profit by tricking people using Facebook,& its VP of policy Richard Allen published today.

Web searches show this is the first time Facebook has used that language regarding financial attacks. We&ve reached out for comment about exactly how new Facebook considers this policy.

This is important because it means Facebookpolicy encompasses threats of ruining someonecredit, calling for people to burglarize their homes or blocking them from employment. While not physical threats, these can do real-world damage to victims.

Similarly, the position against trickery for profit gives Facebook a wide berth to fight against spammers, scammers and shady businesses making false claims about products. The question will be how Facebook enforces this rule. Some would say most advertisements are designed to trick people in order for a business to earn a profit. Facebook is more likely to shut down obvious grifts where businesses make impossible assertions about how their products can help people, rather than just exaggerations about their quality or value.

The added clarity offered today highlights the breadth and particularity with which other platforms, notably the wishy-washy Twitter, should lay out their rules about content moderation. While there have long been fears that transparency will allow bad actors to game the system by toeing the line without going over it, the importance of social platforms to democracy necessitates that they operate with guidelines out in the open to deflect calls of biased enforcement.

- Details

- Category: Technology

Read more: Facebook now deletes posts that financially endanger/trick people

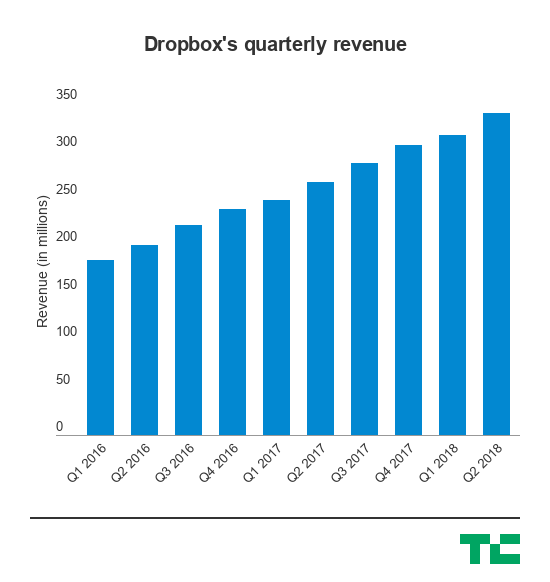

Write comment (97 Comments)Back when Dennis Woodside joined Dropbox as its chief operating officer more than four years ago, the company was trying to justify the $10 billion valuation it had hit in its rapid rise as a Web 2.0 darling. Now, Dropbox is a public company with a nearly $14 billion valuation, and it once again showed Wall Street that itable to beat expectations with a now more robust enterprise business alongside its consumer roots.

Dropboxsecond quarter results came in ahead of Wall Streetexpectations on both the earnings and revenue front. The company also announced that Dennis Woodside will be leaving the company. Woodside joined at a time when Dropbox was starting to figure out its enterprise business, which it was able to grow and transform into a strong case for Wall Street that it could finally be a successful publicly traded company. The IPO was indeed successful, with the companyshares soaring more than 40 percent in its debut, so it makes sense that Woodside has essentially accomplished his job by getting it into a business ready for Wall Street.

&I think as a team we accomplished a ton over the last four and a half years,& Woodside said in an interview. &When I joined they were a couple hundred million in revenue and a little under 500 people. [CEO] Drew [Houston] and Arash [Ferdowsi] have built a great business, since then we&ve scaled globally. Close to half our revenue is outside the U.S., we have well over 300,000 teams for our Dropbox business product, which was nascent there. These are accomplishments of the team, and I&m pretty proud.&

The stock initially exploded in extended trading by rising more than 7 percent, though even prior to the market close and the company reporting its earnings, the stock had risen as much as 10 percent. But following that spike, Dropbox shares are now down around 5 percent. Dropbox is one of a number of SaaS companies that have gone public in recent months, including DocuSign, that have seen considerable success. While Dropbox has managed to make its case with a strong enterprise business, the company was born with consumer roots and has tried to carry over that simplicity with the enterprise products it rolls out, like its collaboration tool Dropbox Paper.

Herea quick rundown of the numbers:

- Q2 Revenue: Up 27 percent year-over-year to $339.2 million, compared to estimates of $331 million in revenue.

- Q2 GAAP Gross Margin: 73.6 percent, as compared to 65.4 percent in the same period last year.

- Q2 adjusted earnings: 11 cents per share compared, compared to estimates of 7 cents per share.

- Paid users: 11.9 million paying users, up from 9.9 million in the same quarter last year.

- ARPU: $116.66, compared to $111.19 same quarter last year.

So, not only is Dropbox able to show that it can continue to grow that revenue, the actual value of its users is also going up. Thatimportant, because Dropbox has to show that it can continue to acquire higher-value customers — meaning itgradually moving up the Fortune 100 chain and getting larger and more established companies on board that can offer it bigger and bigger contracts. It also gives it the room to make larger strategic moves, like migrating onto its own architecture late last year, which, in the long run could turn out to drastically improve the margins on its business.

&We did talk earlier in the quarter about our investment over the last couple years in SMR technology, an innovative storage technology that allows us to optimize cost and performance,& Woodside said. &We continue to innovate ways that allow us to drive better performance, and that drives better economics.&

The company is still looking to make significant moves in the form of new hires, including recently announcing that it has a new VP of product and VP of product marketing, Adam Nash and Naman Khan, respectively. Dropboxnew team under CEO Drew Houston are tasked with continuing the companypath to cracking into larger enterprises, which can give it a much more predictable and robust business alongside the average consumers that pay to host their files online and access them from pretty much anywhere.

In addition, there are a couple executive changes as Woodside transitions out.Yamini Rangan, currently VP of Business Strategy - Operations, will become Chief Customer Officer reporting to Houston, and comms VP Lin-Hua Wu will also report to Houston.

Dropbox had its first quarterly earnings check-in and slid past the expectations that Wall Street had, though its GAAP gross margin slipped a little bit and may have offered a slight negative signal for the company. But since then, Dropboxstock hasn&t had any major missteps, giving it more credibility on the public markets — and more resources to attract and retain talent with compensation packages linked to that stock.

&Our retention has been quite strong,& Woodside said. &We see strong retention characteristics across the customer set we have, whether itlarge or small. Obviously larger companies have more opportunity to expand over time, so our expansion metrics are quite strong in customers of over several hundred employees. But even among small businesses, Dropbox is the kind of product that has gravity. Once you start using it and start sharing it, it becomes a place where your business is small or large is managing all its content, it tends to be a sticky experience.&

- Details

- Category: Technology

As a relentless swarm of successful cyber attacks severely disrupt companies in every industry and require enormous expenditures to repair the damage, what typically gets lost in the shuffle is that some industries are victimized more than others — sometimes far more. The corporate victim that almost always grabs this dubious spotlight is the healthcare industry — the second-largest industry in the U.S. and one in which hacker meddling of operations not only costs lots of time, money and operational downtime, but threatens lives.

The healthcare industry itself is partly responsible. In a seemingly admirable quest to maximize the quality of patient care, tunnel vision gives short shrift to other priorities, specifically cybersecurity.

In aggregate, healthcare organizations on average spend only half as much on cybersecurity as other industries. For this and other reasons, such as the unusually high value of stolen patient records on the black market, attracting extra-large flocks of hackers, hospitals especially find themselves in a never-ending cyber war zone. FortiGuard Labs, a major security protection firm,reports that in 2017, healthcare saw an average of almost 32,000 intrusion attacks per day per organization as compared to more than 14,300 per organization in other industries.

Some attacks are outright deadly. For example, MedStar Health, a huge, Maryland-based healthcare system, was severely incapacitated by a ransomware attack that made national headlines when, among other things, it threatened lives. Compromised by a well-known security vulnerability, MedStar Health was not only forced to shut down its email and vast records database, but was unable to provide radiation treatment to cancer patients for days.

Such trouble typically starts when a doctor or other healthcare worker is persuaded to open an email sent by an attacker and click a link or attachment that downloads malware to his computer, a so-called &phishing& attack. The attacker can then use this software to gain access to the healthcare organizationfinancial, administrative and clinical information systems.

Attackers also can use the health network to spread into connected medical devices and equipment, such as ventilators, X-ray and MRI machines, medical lasers and even electric wheelchairs.

Any medical device connected to a network is potentially at risk from being taken over and exploited by hackers.

Hospitals and other healthcare providers must practice better cybersecurity hygiene.

Compounding the threat are prevalent and vulnerable Internet of Medical Things (IoMT) devices, which integrate components and software from dozens of suppliers with minimal concern for security. Even individual patients can be targeted. A few years ago, former U.S. Vice President Dick Cheneydoctors disabled his pacemakercapabilities because there were concerns about reports that attackers could hack such devices and kill the patient.

Ita dire situation that must be addressed. Hospitals and other healthcare providers must practice better cybersecurity hygiene. For starters, healthcare organizations must improve the speed and thoroughness of software patching and update processes. As much as possible, organizations also need to use threat intelligence and automation, as well as institute cyber-awareness training programs to protect against social media attacks and other attack vectors.

As IoMT devices proliferate, more elaborate network segmentation and inspection is required. A segmented strategy enables organizations to institute checks and policies at various points of the network to control users, applications and data flow and to more quickly identify and isolate security threats. And on the network visibility front, healthcare organizations need more insight throughout the network, including the cloud.

Hospitals and other healthcare organizations must do a better job of protecting patientrecords, as well. Since the transformation from paper records to digitized Electronic Health Records (EHRs), records are commonly updated and then sent by doctors to specialists in other hospitals. The problem is that hospitals are not banks, where financial information is locked up and not shared. This unencrypted information is vulnerable to profit-hungry hacker attacks.

A solution to this is likely to behomomorphic encryption, an impressive technology that allows for the encryption of data-in-use and that has tremendous potential to lock down the most valuable medical information. Specifically, this technology can secure and protect sensitive medical records and personally identifiable information (PII), often the target of cyber thieves.

Notwithstanding the fact that data-rich healthcare records are worth more than 10 times a credit card on the black market,this would shut down the most aggressive &data-focused& hackers.

These improvements will not occur without substantial monetary investment and effort. Itcommendable that hospitals focus overwhelmingly on day-to-day quality of care, but times change, and they must look at their mission with a broader perspective. Because they fail to do so, hospitals typically pay up in almost non-stop ransomware attacks, minimizing the possibility of additional health threats while systems are down.

Among the obstacles that hospitals face in pursuing the path toward change is intensifying merger and acquisition activity in the healthcare sector. IT integration challenges, including different medical technologies, create additional vulnerabilities, as does the need to share information between newly merged organizations.

The reputation of and trust in healthcare organizations depends on their understanding of the true extent of threats and taking sufficient measures to guard against them. The healthcare industry has no choice but to improve its capabilities regarding security. Nothing short of our lives are at stake.

- Details

- Category: Technology

Read more: The healthcare industry is in a world of cybersecurity hurt

Write comment (98 Comments)One of the early backers of Musical.ly, the short video app that was acquired for $1 billion, is making a major bet that internet radio is one of the next big trends in media.

Goodwater Capital, one of a number of backers that won big when ByteDance acquired Musical.ly last year, has joined forces with Korean duo Softbank Ventures andKB Investment to invest $17 million into KoreaSpoon Radio. The deal is a Series B for parent companyMykoon, which operates Spoon Radio and previously developed an unsuccessful smartphone battery sharing service.

Thatmuch like Musical.ly, which famously pivoted to a karaoke app after failing to build an education service.

&We decided to create a service, now known as Spoon Radio, that was inspired by what gave us hope when [previous venture] ‘Plugger& failed to take off. We wanted to create a service that allowed people to truly connect and share their thoughts with others on everyday, real-life issues like the ups and downs of personal relationships, money, and work.

&Unlike Facebook and Instagram where people pretend to have perfect lives, we wanted to create an accessible space for people to find and interact with influencers that they could relate with on a real and personal level through an audio and pseudo-anonymous format,& MykoonCEO Neil Choi told TechCrunch via email.

Choi started the company in 2013 with fellow co-foundersChoi Hyuk jun and Hee-jae Lee, and today Spoon Radio operates muchlike an internet radio station.

Users can tune in to talk show or music DJs, and leave comments andmake requests in real-time. The service also allows users to broadcast themselves and, like live-streaming, broadcasters — or DJs, as they are called — can monetize by receiving stickers and other virtualgifts fromtheir audience.

Spoon Radio claims 2.5 million downloads and &tens of millions& of audio broadcasts uploaded each day. Most of that userbase is in Korea, but the company said it is seeing growth in markets like Japan, Indonesia and Vietnam. In response to that growth— which Choi said is over 1,000 percent year-on-year — this funding will be used to invest in expanding the service in Southeast Asia, the rest of Asia and beyond.

Audio social media isn&t a new concept.

SingaporeBubble Motion raised close to $40 million from investors but it was sold in an underwhelming and undisclosed deal in 2014. Reportedly that was after the firm had failed to find a buyer and been ready to liquidate its assets. Altruist, the India-based mobile services company that bought Bubble Motion has done little to the service. Most changes have been bug fixes and the iOS app, for example, has not been updated for nearly a year.

Things have changed in the last four years, with smartphone growth surging across Asia and worldwide. That could mean different fortunes but there are also differences between the two in terms of strategy.

Bubbly was run like a social network — a ‘Twitter for voice& — whereas Spoon Radio is focused on a consumption-based model that, as the name suggests, mirrors traditional radio.

&This is mobile consumer internet at its best,& Eric Kim, one of Goodwater Capitaltwo founding partners, told TechCrunch in an interview. &Spoon Radio istaking an offline experience that exists in classic radio and making it even better.&

Kim admitted that when he first used the service he didn&t see the appeal — he claimed the same was true for Musical.ly — but he said he changed his tune after talking to listeners and using Spoon Radio. He said it reminded him of being a kid growing up in the U.S. and listening to radio shows avidly.

&Ita really interesting phenomenon taking off in Asia because of smartphone growth and people being keen for content, but not always able to get video content. It was a net new behavior that we&d never seen before…Musical.ly was in the same bracket as net new content for the new generation, we&ve been paying attention to this category broadly,& Kim — whose firmother Korean investments include chat app giant Kakao and fintech startup Toss— explained.

- Details

- Category: Technology

Read more: Musical.ly investor bets on internet radio with $17M deal for Korea’s Spoon Radio

Write comment (91 Comments)While automakers and startups continue to hone the technology for self-driving cars for individuals, a second track of development in the area of autonomous buses is also taking shape. Today, Navya, a French company that has been a leader in developing autonomous shuttles, announced that it has raised an additional €30 million ($34 million) from the European Investment Bank to continue building out its business.

The investment comes on the heels of another significant financial event in the life of the company. On July 24, Navya (first founded in 2014) went public on the Euronext exchange in Paris and raised €38 million ($44 million). Ithad a somewhat lacklustre early performance: the companymarket cap is currently at €188.8 million, compared to a debut at €190 million.

The company has in total raised €80 million this year, it said. &Navya thus has extensive resources to strengthen its technological leadership, to expand its sales and marketing teams and to invest in strategic adjacent markets, while pursuing further international expansion,& the company said of the financing round.

The EIB has backed a number of other fast-moving startups in Europe, including the payments startup iZettle, which later got acquired by PayPal. Its funding for Navya will come in two tranches of €15 million, with the second dependent on the company meeting (unspecified) targets.

The opportunities (and challenges) in fully autonomous cars are vast, and we are still likely many years away from seeing a full-scale roll of them anytime soon, as carmakers and their partners continue to work on safer and more accurate AI systems to run them on the seemingly endless number of permutations of roads, routes and driving scenarios; and that is before you considerthe best usage models to underpin these businesses.

Autonomous shuttles, on the other hand, have had some interesting progress that points to their services coming to a stop near you, possibly sooner than you think. One of the reasons for this is that a lot of the deployments are focused on specific loops, often in closed environments where movement might be more easily predicted.

In May, it was reported that Apple had signed a deal with Volkswagen on a fleet of autonomous staff shuttles (and that it might also be partnering, with Mercedes-Benz and BMW, on self-driving cars). Daimler and Boschare working on a self-driving shuttle service for San Francisco. There is now an autonomous shuttle in Times Square in New York(courtesy of Coast).

Navya itself has been involved in a year-long trial in Las Vegas, offering rides to passengers in a half-mile loop around the center of the city, along with a number of projects in its home market, using a version of its flagship Autonom shuttle. It says that 100 of these shuttles have been produced to date, with 89 of them already sold across 17 countries, including the US, France, Germany, Switzerland, Japan and Australia. Italso now developing a smaller version called the Autonom Cab that will begin tests shortly.

This is on top of earlier efforts from IBM, which has a Watson-powered shuttle built with Local Motors calledOlli,and Yandex, the Russian search giant that has repositioned itself as a mobile and machine learning company, is alsobuilding a shuttle bus.

- Details

- Category: Technology

Open worlds have been a staple of gaming for a long time, but recent titles like Breath of the Wild and Horizon: Zero Dawn have significantly pushed the boundaries of what players expect from their environments. Rockstar, of Grand Theft Auto fame, is looking to make them all look like toys with Red Dead Redemption 2 and its wild west frontier that looks to be not just huge, but refreshingly real.

Rockstar is certainly best known for the immensely popular GTA series; but itarguable its most beloved game is actually 2010Red Dead Redemption, which, though a sequel, so spectacularly transplanted the run-and-gun outlaw freedom of GTA to the American West that gamers have been clamoring for a sequel for years.

RDR2 was teased back in late 2016, but only recently have we seen hints of what it will actually look like. And today brings the first of a series of videos from the developer detailing the world, character and gameplay systems.

The natural beauty of the frontier is, of course, simply amazing to see rendered in such fidelity, and Rockstarartists are to be commended. And it is realism that seems to be defining the project as a whole — which makes it a departure from other games whose creators bruit a living, breathing open world to explore.

Take Far Cry 5, which came out last year to mixed reviews: The natural landscape of fictional Hope County in Montana was roundly agreed to be breathtaking, but the gameplay and story were criticized as artificially and(strange juxtaposition) monotonously intense. Itclear that Far Cry 5, like other Ubisoft games, was a sandbox in which interesting but unrealistic situations were bred by the developers — a helicopter crashing on the person you&re rescuing from bandits, and then a cougar mauling the pilot.

Horizon: Zero Dawn and Breath of the Wild were both praised for the depth and extent of their worlds and gameplay, but they both had the significant advantage of being fantasies. A mechanical dinosaur or ancient killing machine (same thing) arrests the eye and imagination, but because one can&t really compare them to reality, they can stay definitively unrealistic. Creating a compelling sci-fi or fantasy world has its own significant challenges, but on the whole itconsiderably easier than creating a convincing replica of the real world.

RDR2seems to be attempting real realism in its game, to the extent that itpossible. Take for example the fact that your items and cargo actually take up space on your horse. Your horse isn&t 20 more grid spaces of inventory — you can tie a deer you hunted on top, but then it can&t run. There are loops for two long guns but not three, and you can&t carry an arsenal yourself.

The flora and fauna are real frontier flora and fauna; they&ll react realistically. Encounters can be approached in multiple ways, peaceful or violent. Your fabulous hide coat gets dirty when you fall in the mud. You get new things to do by getting to know people in your gang.

Many of these have been seen before in various games, but what Rockstar is going for appears — and for now only appears — to be taking them to a new level. It will of course have the expected cartoonish violence and occasionally eye-roll-worthy dialogue of any game, but the attempt to realistically, and at this level of fidelity, represent such a major and well-known portion of history is an undertaking of gargantuan proportions.

Will the game be as good as the amount of work that has clearly been put into it We&ll find out later this year when it comes out.

- Details

- Category: Technology

Read more: Red Dead Redemption 2 sees Rockstar raising the bar for realism in open-world games

Write comment (99 Comments)Page 4494 of 5614

18

18