Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Sonos opened its first day of trading at $15 a share though quickly gained 20% as trading began. As of publication, Sonos, trading under SONO, is around $18.50 a share.

Sonos priced its initial shares at $15 a share, below the expected range of $17 to $19. At this price Sonos is valued at just under $1.5 billion and will raise $208.5 million by going public. If the stock price maintains its current levels, Sonos will end its first day of trading up and in the expected range. Pricing their initial shares under the expected range resulted in the company raising as much money, but it also provided a bit of cushion in case Wall Street traders disagreed with the pricing. Itnever a good look to end a companyfirst day of trading in the red.

Sonos& Michael Groeninger, VP of Corporate Finance, tells me the company priced its IPO price under the expected range in response to recent market movement. As examples he pointed to the volatile market environment caused by multiple down days including Facebookbig drop in stock price. Sonos, Giannetto said, is more concerned about where the stock price is in three to five years rather than on the first day of trading.

To celebrate its Nasdaq listing, Sonos updated the sound of the Nasdaq bell where it will be used going forward to open and close the daytrading.

Sonos is nicely positioned as a third-party option in an ecosystem thatgetting increasingly crowded by proprietary speakers from the larger companies that own voice assistants like the Echo, HomePod and Google Home. But Sonos has been around for a considerable amount of time and has clearly built up a significant following to ensure that it could find itself operating as an independent public company. In its fiscal 2017 year, Sonos said it brought in nearly $1 billion in revenue, an increase of 10 percent year-over-year. The initial filing indicated that the company had sold a total of 19 million products in 6.9 million households, with customers listening to 70 hours of content each month.

I spoke briefly with long-time Sonos employee Nick Millington who is now the companyChief Product Office. He sees Sonos as a unique offering in todayconsumer market. He explained that the companythree pillars of focus — openness, quality, and cohesive product family (he called it systemness) — is what makes Sonos unique. He pointed out that because of those three areas of focus, 90% of the products Sonos ever sold are still in operation today. Sonos& biggest competitor isn&t speakers from Amazon or Apple, but rather a silent home, he said. Because the company has long worked with outside services, it is committed to brining Alexa, Siri and Google Assistant to its products.

Still, ithard to ignore the facing increasing competition from the electronic giants of Apple, Google and Amazon — all which want a spot for their own speaker in peoplehomes. Sonos responded by building-in AmazonAlexa personal assistant into several products. Its most recent product, the $399 Beam sound bar, has Alexa built-in and lets users ask AppleSiri to control music on Sonos systems. Google Assistant compatibility is expected to come later this year.

- Details

- Category: Technology

Read more: Sonos sees modest gains on first day of trading

Write comment (91 Comments)Stampli, an invoice management platform, announced today the closing of a $6.7 million Series A funding roundled by SignalFire, with participation from Bloomberg Beta, Hillsven Capital and UpWest Labs.

If you&ve ever freelanced for a company, you know that the long, instant ramen-filled days between filing an invoice and having it completed can be grueling. Brothers Eyal and Ofer Feldman launched Stampli in 2015 to help solve this problem and bridge the communication gap between accountants, related internal departments and vendors. Aimed at mid to large-size companies, to date Stampli has helped a wide range of companies (from fashion to tech) manage more than $4 billion in invoices through its AI-driven interface.

&Invoice management is like an elephant,& co-founder and CEO Eyal Feldman told TechCrunch. &One person sees the head, one person sees the tail, one person sees the legs. Ita process that different people see different versions of but the whole picture should include everybody. The ability for all of these people to be involved is really the core of the process.&

Traditional invoice management between vendors and internal departments in a company can be a tangled mess of email exchanges, lost messages and ultimately delayed payments. But, Stampliinterface (which can be integrated directly into a companyenterprise resource planning software likeNetSuite, Intuit QuickBooks or SAP) allows for every step of the invoicejourney to have a central landing page on which every relevant party can collaborate.

&We found that 85 percent of our users are not accounting people,& said Feldman. &[They] are all the managers around and all the other people involved. What we found in our research is that when the process works for them is when accounting is happy.&

This landing page not only provides easy access to pertinent information between departments, but Stamplibuilt-in AI, Billy the Bot, helps invoice managers fill in relevant information by first learning the structure of the invoice and then learning through observation the userbehavior and work flow. When Billy passes an 80 percent confidence threshold for its decision, it goes ahead and auto-fills the information. But, if itfeeling unsure about its choice, Billy will leave it as a suggestion instead to avoid introducing any errors to the paperwork.

The more invoices users process through Stampli, the more Billy learns how to best streamline the process for that company.

In the arena of invoice management, Stampli faces competition from companies like Determine and Concur, which also offer all-in-one platforms for invoice management and, in the case of Concur, also incorporate machine learning to capture invoices.

According to Feldman, what helps Stampli stand apart from the competition is its emphasis on company collaboration and its no-fee installation of the software. With no upfront cost, the company only charges per invoice.

- Details

- Category: Technology

Read more: Stampli raises $6.7M in Series A funding to streamline invoice management

Write comment (90 Comments)Rent the Runway today announced that it has partnered with Temasek for a $200 million credit facility.

Founded in 2009, Rent the Runway lets users rent items of clothing for special events or occasions, bringing runway styles to folks without the cash to purchase the clothing outright.

Rent the Runway started out by letting users rent their wares for about 10 percent of the itemprice. But in 2017, RTR introduced a subscription model, giving users unlimited rentals for $89/month.

The model has already been proven by other businesses. RTR started giving users access to fashion in the same way that Netflix gives users access to video, Spotify gives access to music, or even the way ClassPass gives users access to studio fitness classes.

Since the subscription launch, RTRsubscription business is up 150 percent year over year, and represents 50 percent of the companyoverall revenue.

According to the release, RTR will use the new funds to continue growing its subscription business, expand operations, and refinance its existing debt facility. As part of the deal, Temasek has received an observer seat on the board of directors.

In response to the question around why Rent The Runway chose a credit facility over traditional VC investment, CFO Scarlett O&Sullivan had this to say via email:

We are very pleased that the company has demonstrated the kind of business model, growth prospects and financial discipline that make it possible to access a credit facility of this size with an equity-minded long-term partner like Temasek & they have a proven track record of supporting disruptive high-growth companies.

We were specifically looking for debt for three key reasons:

1 & This facility gives us the ability to access more financing & we can draw capital as we need to, giving us flexibility to grow our subscription business more quickly

2 & We improved the terms of our prior facility which we refinanced with a portion of these funds — and debt for us is a lower cost option to finance the business

3 & It is less dilutive to our existing shareholders & we believe there will be significant value creation over the next several years as we continue to change consume behavior and help women put their closet in the cloud

Before this latest deal, Rent the Runway had raised more than $200 million in funding from investors such as Bain Capital, KPCB, Highland Capital, TCV, and more.

- Details

- Category: Technology

Read more: Rent the Runway inks $200 million credit facility with Temasek

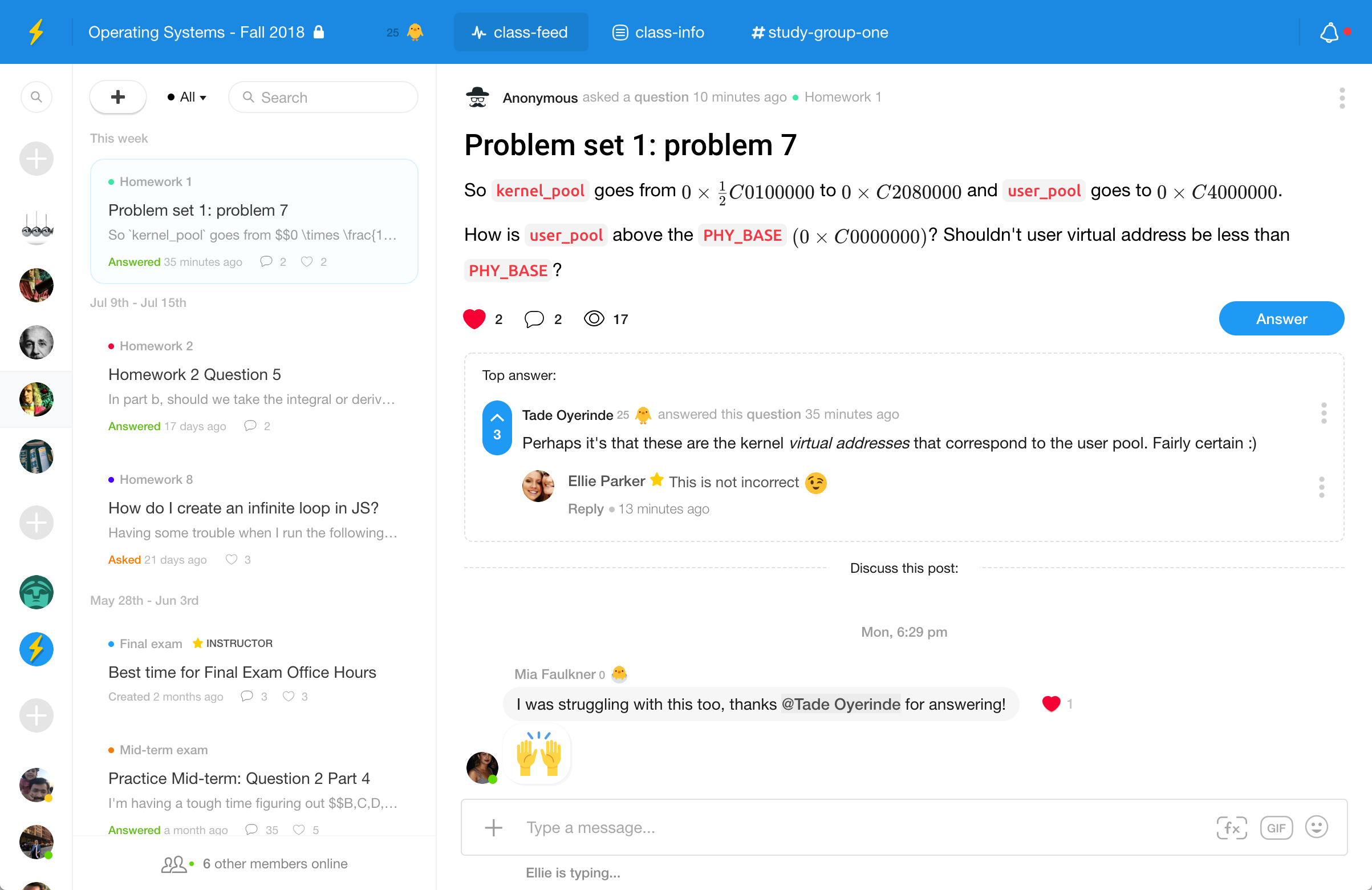

Write comment (90 Comments)Tade Oyerinde is obsessed with communications inside educational institutions. A few years ago, while studying at Leeds University in England, he founded Gleepost, a Craigslist-like service targeting college campuses.

The startup flopped, so Oyerinde moved on to build with his college roommate and twin brother Uniroulette, a Chatroulette clone but limited to people with .edu email addresses. It was here that he got a searing introduction to product design and also learned how to become a social hacker, using design choices to drive conversations and engagement. &With Uniroulette… we needed to have about 20 kids concurrently on just to make it work,& he explained to me. To get those numbers, the startup officially opened at 8pm each evening, and anyone who tried to login earlier was given a countdown timer.

To further drive engagement, Oyerinde created dozens if not hundreds of Facebook pages around the concept of love and missed connections targeting different campuses, such as Leeds Crushes or Bodleian Library Secrets. Students were hooked — and also getting carefully calibrated advertising messages to spend more time on Uniroulette. He raised $250k from angels in London, but ultimately, the startup lost traffic and eventually twinkled out.

Oyerinde hopes that the third time is a charm with his new project, Campuswire. The platform, launching publicly today, is designed to maximize the efficiency of classroom conversations, even among different disciplines from math to English. The product is certainly inspired from Slack and other current campus communications tools, but with an intense focus on saving the time of teachers and faculty.

&Seventy percent of the things that students need to communicate in a college class is asking a question,& Oyerinde said. &You need a balance of synchronous and asynchronous communications, and we had a bunch of experience with this.&

The challenge for campuses these days is that the methods by which faculty and students communicate couldn&t be more different. Existing incumbents like Blackboard have forums features, but the community is often moribund. Professors use email, which is asynchronous, but not easily shared among students attending a class. Meanwhile, todaystudents are obsessed with SMS, Instagram, and YouTube as channels for communication. Campuswiregoal is to meet everyone halfway.

Campuswireplatform allows students to ask questions and upvote answers, creating community in a lecture

There were several design decisions that make Campuswire unique. One is that students can post questions anonymously in their classes. &40% of students were never going to ask questions unless they can do it anonymously,& Oyerinde said. He noted that they have had limited issues with trust and safety issues since class discussions are closed to non-enrolled students.

Most importantly, the design of the product is driven by efficiency. Questions are easy to surface for students, helping teachers limit repetitive answers. The other side of efficiency is encouraging students to chime in with their own answers. We wanted to &incentivize the top 5% of students to help each other out,& Oyerinde explained. &They literally jump in, so professors have to do less work.& Thatcritical in classes where the number of students can be in the hundreds if not thousands.

The platform has been in beta since last fall at UCLA, and usage in the initial set of classes has been heavy. &Users use us over five hours per day in three out of the four classes in UCLA, and in all of them it was over three hours per day on average,& Oyerinde said. He also said that &we had over 75% 10-week retention.& The team chose UCLA because of its quarterly schedule, &so it meant we had twice the iteration half-life.&

Campuswire debuts just as the kickoff for the new school season gets underway. We are going to &continue with the student outreach and getting a wide cross-section of classes this fall,& he said. The startup now has a team of six based in New York City.

- Details

- Category: Technology

Read more: Campuswire launches to redesign classroom communications

Write comment (97 Comments)As a result of the larger cord-cutting trend, more consumers are watching TV streamed over the internet. And the size of this streaming TV audience is rapidly growing. According to a new report from Conviva, out this morning, streaming TV content consumption has more than doubled over the last 12 months, and is continuing to accelerate, with streaming TV viewing hours up 115 percent in Q2 2018 compared with the same time last year.

In addition, the World Cup had a remarkable impact on metrics like viewing hours, plays, and peak concurrent plays, the firm found. 7.9 million people tuned in for the World Cup online, which led to a 118 percent growth in peak concurrent plays over Q2 2017.

But the metrics aren&t just up year-over-year because of this special event. When Conviva pulled out the views attributed to the World Cup, it still found that peak concurrency was up by 45 percent year-over-year, to reach 5.3 million concurrent plays. This occurred during another large sporting event & the 7th game of the NBA Western Conference Finals.

The report also indicated that North America remains the largest and fastest-growing audience for streaming TV. In this market, plays were up 124 percent and viewing hours were up 139 percent year-over-year, as of Q2.

Asia, for comparisonsake, saw a 63 percent increase in plays but more modest growth in viewing hours at 22 percent year-over-year. Also of note, while China drives much of the traffic, it had one of the lowest percentages in terms of long-form content viewing at 8 percent, versus 14 percent for short-form, and 16 percent for live event viewing.

Different types of content is being viewed on different devices, the report found. Streaming TV, in general, is shifting away from PCs (24% of plays) to mobile devices (49% of plays), especially for short-form content. But connected TVs (51% of viewing hours) are favored for long-form content. This supports findings from individual streaming TV providers as well & for example, Hulu recently said that 78 percent of its viewing takes place in the living room.

The new research additionally supports earlier reports that put Roku in the lead of other TV platforms. According to Conviva, Roku accounted for 22 percent of all viewing hours on connected TVs, and 8 percent of all plays. Fire TV is the fastest growing, with a 140 percent increase year-over-year.

Other platforms & including SonyPlayStation, GoogleChromecast, and AmazonFire TV & all gained as well, and combined saw more than two times video consumption, versus the year-ago period. Some of their growth is coming from the decline of native TV platforms, like Samsungsmart TV, as consumers shifted to Roku, Chromecast, and Fire TV.

The full report delves into the metrics in more detail, and includes stats on video quality, which is also increasing in North American and European markets.

Convivacustomer base includes a large number of streaming TV, subscription video and other providers, including names like Hulu, Sky, Sling TV, HBO, AT-T, Playstation Vue, and many more.

- Details

- Category: Technology

Read more: Streaming TV consumption more than doubled since last year, report says

Write comment (92 Comments)

Rumors have been swirling ahead of Samsung’s Galaxy Note 9 launch about a wireless charging pad known as the Duo, and now Amazon has all but confirmed this unreleased product.

As the name should imply, the Samsung Wireless Charger Duo is capable of charging two devices simultaneously, whether that’s the upcoming Note 9 and Galaxy Watch, or a pair

- Details

- Category: Technology

Read more: Samsung Duo wireless charger accidentally leaked by Amazon

Write comment (90 Comments)Page 4554 of 5614

7

7