Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

In a newsroom post Tuesday, Facebook revealed that it has detected evidence of &coordinated inauthentic behavior& designed to influence U.S. politics on its platform.

According to Facebook head of Cybersecurity, Policy Nathaniel Gleicher, the company first identified the activity two weeks ago. So far, the activity encompasses eight Facebook Pages, 17 profiles and seven accounts on Instagram. Facebook stated that the activity &violate[s] our ban on coordinated inauthentic behavior.&

Facebook has declined to attribute the new findings to the Russian government-linked Internet Research Agency (IRA), but an IRA account was found to be a co-admin on one of the newly outed fake events &for only seven minutes.&

Facebook has been in contact with Congress and law enforcement about the discovery, which suggests that social platforms should expect to again detect the kind of coordinated disinformation campaigns that targeted the 2016 election around U.S. midterm elections this November. The company stated that more than 290,000 accounts followed one of the Pages it identified. The Pages in question were created starting in March 2017 and most recently in May of 2018.

The most popular Pages displaying this kind of behavior were &Aztlan Warriors,& &Black Elevation,& &Mindful Being& and &Resisters.& The other Pages had less than 10 followers each and the Instagram account did not have any followers. That does not necessarily discount other kinds of potential activity, like commenting and messaging.

Like the fake Russia-linked ads and Pages formerly released through the House and Senate, the new content specifically amplifies American tensions around race. The examples released by Facebook appear to mostly target the US political left. Some examples contain explicitly anti-Trump content, but most offer appeals to racial identity targeting black and Mexican-American Facebook users.

According to Facebook, &They ran about 150 ads for approximately $11,000 on Facebook and Instagram, paid for in US and Canadian dollars& between April 2017 and June of this year. The Pages also made around 30 Facebook events.

As Gleicher writes in the post, these accounts are operating more cautiously than the infamous Russian disinformation accounts around the 2016 election:

For example they used VPNs and internet phone services, and paid third parties to run ads on their behalf. As we&ve told law enforcement and Congress, we still don&t have firm evidence to say with certainty whobehind this effort. Some of the activity is consistent with what we saw from the IRA before and after the 2016 elections. And we&ve found evidence of some connections between these accounts and IRA accounts we disabled last year, which is covered below. But there are differences, too. For example, while IP addresses are easy to spoof, the IRA accounts we disabled last year sometimes used Russian IP addresses. We haven&t seen those here.

Still, the newly discovered wave of activity pushing polarizing political content on Facebook strongly echoes previous content linked to the IRA. The evidence is sufficient for Senate Intelligence Committee Vice Chairman Mark Warner, a prominent figure in the investigation into techculpability in disseminating of Russian disinformation, to make the connection.

&Todaydisclosure is further evidence that the Kremlin continues to exploit platforms like Facebook to sow division and spread disinformation, and I am glad that Facebook is taking some steps to pinpoint and address this activity,& Warner said in a statement provided to TechCrunch.

- Details

- Category: Technology

Read more: Facebook finds evidence of Russia-linked influence campaigns targeting US midterms

Write comment (99 Comments)Istio, the service mesh for microservices from Google, IBM, Lyft, Red Hat and many other players in the open-source community, launched version 1.0 of its tools today.

If you&re not into service meshes, thatunderstandable. Few people are. But Istio is probably one of the most important new open-source projects out there right now. It sits at the intersection of a number of industry trends, like containers, microservices and serverless computing, and makes it easier for enterprises to embrace them. Istio now has more than 200 contributors and the code has seen more than 4,000 check-ins since the launch of version 0.1.

Istio, at its core, handles the routing, load balancing, flow control and security needs of microservices. It sits on top of existing distributed applications and basically helps them talk to each other securely, while also providing logging, telemetry and the necessarypolicies that keep things under control (and secure). It also features support for canary releases, which allow developers to test updates with a few users before launching them to a wider audience, something that Google and other webscale companies have long done internally.

&In the area of microservices, things are moving so quickly,& Google product manager Jennifer Lin told me. &Andwith the successofKubernetesandthe abstraction aroundcontainer orchestration, Istio wasformed as an open-source project to really take the next step in terms of a substrateformicroservice developmentas well as a path for VM-based workloads to move into more ofaservice management layer. So it&s really focused around the right level of abstractionsfor services and creatingaconsistent environment for managing that.&

&In the area of microservices, things are moving so quickly,& Google product manager Jennifer Lin told me. &Andwith the successofKubernetesandthe abstraction aroundcontainer orchestration, Istio wasformed as an open-source project to really take the next step in terms of a substrateformicroservice developmentas well as a path for VM-based workloads to move into more ofaservice management layer. So it&s really focused around the right level of abstractionsfor services and creatingaconsistent environment for managing that.&

Even before the 1.0 release, a number of companies already adopted Istio in production, including the likes of eBay and Auto Trader UK. Lin argues that this is a sign that Istio solves a problem that a lot of businesses are facing today as they adopt microservices. &A number of more sophisticated customers tried to build their own service management layer and while we hadn&t yet declared1.0, we hard a number of customers — including a surprising number of large enterprise customer — say, ‘you know, even though you&re not 1.0, I&m very comfortable putting this in production because what I&m comparing it to is much more raw.'&

IBM Fellow and VP of Cloud Jason McGee agrees with this and notes that &our mission sinceIstiolaunch has been to enable everyone to succeed with microservices, especially in the enterprise. This is why we&ve focused the community around improving security and scale, and heavily leaned our contributions on what we&ve learned from building agile cloud architectures for companies of all sizes.&

A lot of the large cloud players now support Istio directly, too. IBM supports it on top of its Kubernetes Service, for example, and Google even announced a managed Istio service for its Google Cloud users, as well as some additional open-source tooling for serverless applications built on top of Kubernetes and Istio.

Two names missing from todayparty are Microsoft and Amazon. I think that&ll change over time, though, assuming the project keeps its momentum.

Istioalso isn&t part of any major open-source foundation yet. The Cloud Native Computing Foundation (CNCF), the home of Kubernetes, is backing linkerd, a project that isn&t all that dissimilar from Istio. Once a 1.0 release of these kinds of projects rolls around, the maintainers often start looking for a foundation that can shepherd the development of the project over time. I&m guessing itonly a matter of time before we hear more about where Istio will land.

- Details

- Category: Technology

Read more: The Istio service mesh hits version 1.0

Write comment (93 Comments)The dream of a startup founder can often be summarized by the following well-intentioned, and mostly delusional, quote:&We&ll raise a few rounds and in a few years we&ll IPO on Nasdaq.&

But a more likely scenario looks something like this:

You invest a few years of hard work to build something of value. One day you receive an acquisition offer out of the blue. You&re elated. And you&re not prepared. You drop everything to focus on this opportunity. Exclusive due diligence starts. Your company is a mess (IP, contracts, burn). Days become weeks; weeks become months. You&ve neglected business and fundraising. You&re running out of money. M-A is now your one and only option. The buyer says they found a bunch of cockroaches in the walls and drops the price. Now what

Sound unlikely

This is still a favorable situation: You had an offer! Think about how much time you invested in your various funding rounds. The hundreds of names and Google spreadsheet or Streak-powered quasi-CRM process.

Have you spent even a fraction of that on understanding exit paths If you&d rather not live the situation described above, read along.

The E-word: A strange taboo

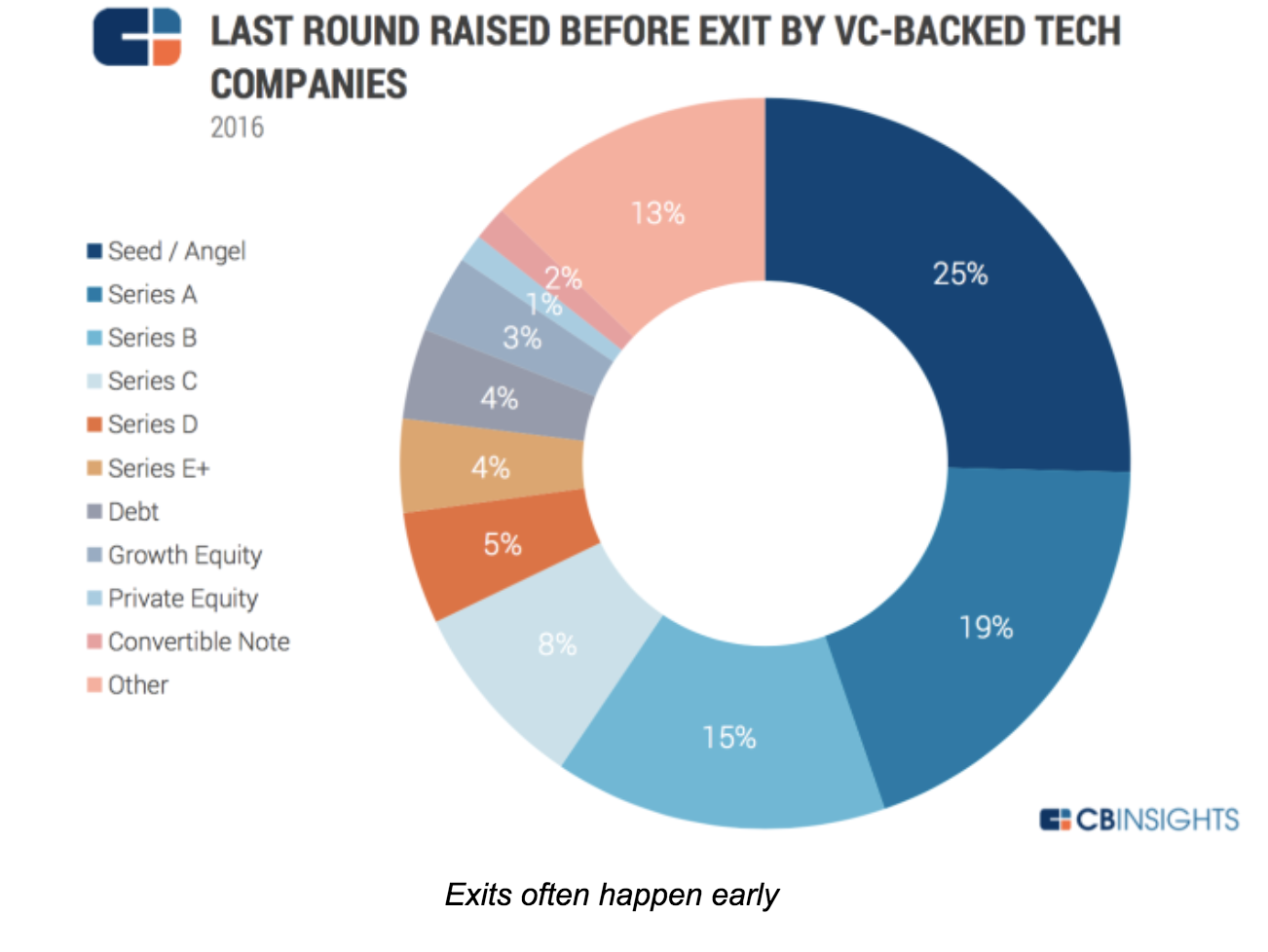

Investors live by exits, but many founders keep dreaming of unicornization and avoid the &E-word& until ittoo late. Yet, in 2016, 97 percent of exits were M-As. And most happened before Series B.

Exits matter because thatwhen you, your team and your investors get paid. Oddly enough, and to use a chess metaphor, we hear a lot about the &opening game& (lean startup) and the &mid-game& (growth), but very little about this &end game.&

As a result, founders miss opportunities or leave money on the table. This is a shame. Our fundhas more than 700 companies in portfolio. We want the best possible exit for each of them. And fortune favors the prepared! Now, how to get 700 exits (and counting)

To explore the topic, we organized a series ofMaster Classes tappingcorporate buyers, bankers, investors, lawyers and startup CEOs with M-A or IPO experience in San Francisco. It was a group thatincluded the founders of Guitar Hero— bought by Activision; JUMP Bikes— a SOSV portfolio company bought by Uber, Ubiquisys— bought by Cisco and Withings— bought by Nokia. Each one for hundreds of millions.

Their observations can be summarized below.

Maximize optionality

&Founders must be aware of what contributes to an exit. This means understanding partnerships and how they are formed in the business space the entrepreneur is working in,& said one Master Class participant.

As founders, you build your product, your company and… optionality. You need to understand the options open to your company, and take steps to enable them.

The most likely one is an acquisition, but there are others like IPO (including small cap), RTO, SBO, LBO, Equity Crowdfunding and even ICO.

&Exit is not a goal per se, but as a CEO it is something you should think about as early in your cycle as possible, while being business-focused,& said the London-based investor Frederic Rombaut, of Seraphim Capital.

Indeed, most participants said that exits should always be on the chief executiveagenda, no matter how early in the process.&Exits should be on the CEO agenda. Not front and center, but on the agenda. M-A is a by-product of a great business and targeted BD. IPOs are always an option once you&ve built significant cashflow forecasting.&

Itimportant to ask questions like: How many &strategic engagements& with potential buyers have you had this month Is your message and value clear in their eyes Have you considered an acquisition track in parallel to a fundraise

It doesn&t stop there:

- Equity crowdfunding might help close some gaps at seed stage.

- Early IPOs on smaller exchanges can be an option to raise over $10 million — the robotics startup Balyo went public and raised €40 million on Euronext to get rid of a critical &right of first refusal& option held by one of its corporate investors.

- Reverse mergers can work too: the medical exoskeleton company EKSO Bionics went public this way.

One thing is sure: The time to exit is not when you&re running out of money.

Companies are bought, not sold

Unicorn or not, the most likely exit is an acquisition.

As George Patterson, managing director at HSBC in New York said, &Good tech companies are bought, not sold. The question is thus: how to get bought&

Patterson says itimportant to understand how mergers and acquisitions actually work; how to prepare a startup for an exit; and how to develop a &feel& for the market you&re exiting through and into.

How M-A works

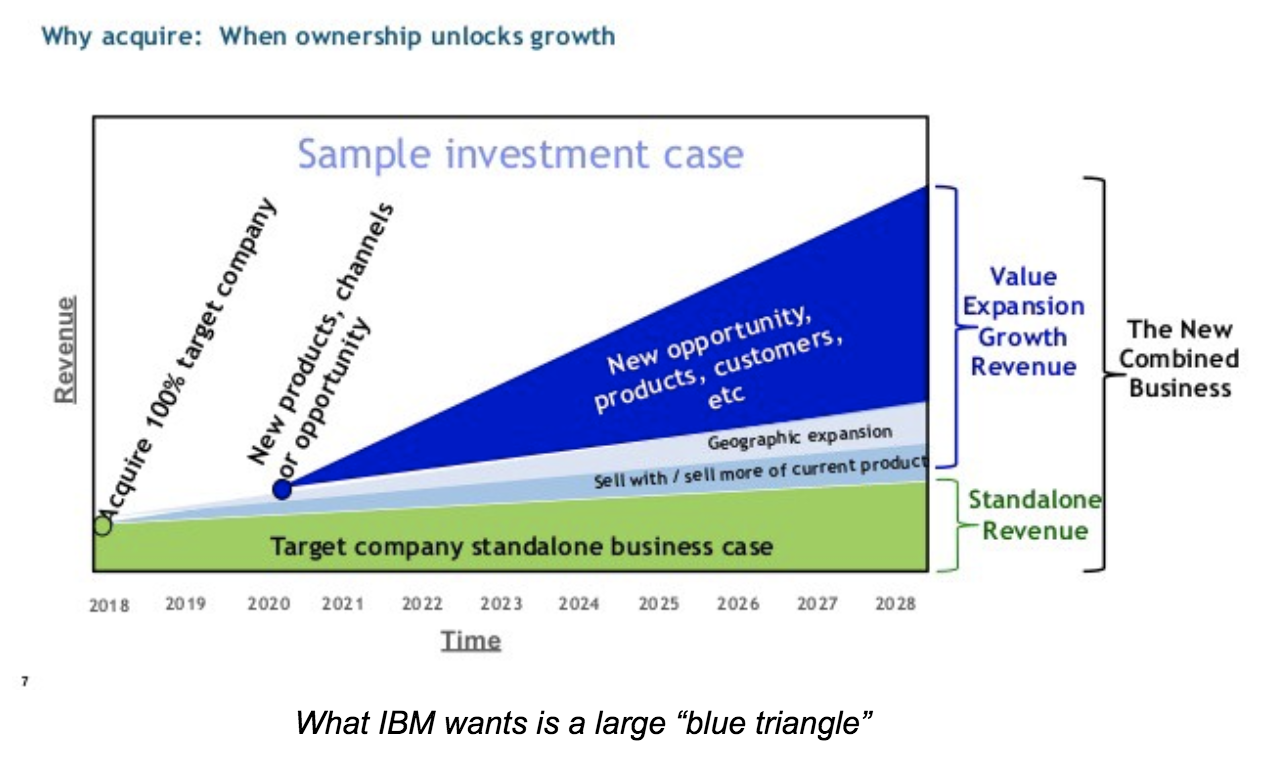

Hearing from corp dev veterans from Cisco, Logitech, Dassault and IBM, a few key ideas emerged:

Motivations vary

It could be from least to most expensive, or as a mix, as listed by Mark Suster, managing partner at Upfront Ventures:

- Talent hire ($1 million/dev as a rule of thumb — location matters)

- Product gap

- Revenue driver

- Strategic threat (avoid or delay disruption)

- Defensive move (can&t afford a competitor to own it)

How corporates find you

Corporates find deals via the development of partnerships, investment (CVC), their business units, corp dev research, media and investor connections.

Asked about the best approach, ToddNeville, manager of Corporate Business Development and Strategy at IBM (who gave the most detailed description of the corp dev process), said, &Do something cool to one of the IBM customers. If they rave about even a POC, we&re interested.&

In other words, business development is corporate development.

Get the house in order

Buyers typically want to know three things:

- Is your IP really yours

- Is your team capable

- Will your customers stick around

For IP, they will check your contracts (staff and contractors), and run some automated code analysis for proprietary code and open source use. They will evaluate potential IP infringement. No point buying you if you end up costing more in lawsuits!

For your team skills: Sitting down with your engineers will tell them plenty enough without understanding the details of this or that algorithm. The last thing a corporate wants is to be accused of stealing!

Lawyers engaged early can help. The later the clean-up, the more costly and painful.

Develop a feel for your &market&

Develop relationships and create champions within corporates. It will help promote your deal when the time comes, and will let you keep your finger on the pulse of corporate strategy to time your moves.

Do you read the earning calls of Cisco or IBM (or others relevant to you) This is where strategies are presented. Are your keywords coming up there or in their press releases

Chris Gilbert, former CEO of Ubiquisys (sold to Cisco for more than $300 million) was very deliberate in planning his exit.

&Selling starts on day one and is a leadership-only function — work out who will be your buyer. Only the CEO can do this. Constantly articulate why a company should buy you,& Gilbert said. Bring clear messages into the acquiring company so it can be presented upwards: give them the presentation you would like them to show their boss! When the time is right, force decisions through competition. If you know they have to buy you, your starting position is strong.&

The dark art of price discovery

There are dozens of formulas (from DCF to comparables) to evaluate a deal — which also means none is &correct.& What matters is: How much would you sell for, and how much is the buyer ready to pay

Gilbert, at Ubiquisys, described how close interactions with his banker helped drive the price up among the bidders assembled.

Just like buyers, we meet bankers and lawyers too rarely at startup events, but there is much to learn with them. They make deals happen, avoid value erosion and optimize price. They often also make introductions before you engage them, to build goodwill and earn your business.

And if you worry about fees, the right banker handsomely pays for itself by finding more bidders and playing &bad cop& for you, avoiding direct confrontation with your future employer. Do you want a slice of the watermelon or the whole grape

Final twist: Exits are not exits

When asked about what happens after an M-A or IPO, buyers said they generally hoped the founders would stay with them for many years. Often using re-vesting, earn-outs or shares of the acquiring company to incentivize them. Neville, from IBM, mentioned a security company they acquired whose founder is now the head of one of the largest IBM divisions.

In the case of IPOs, supposedly the ultimate &exit,& any block of shares sold by founders would face extreme scrutiny and might cause a price drop.

So whoexiting during those deals Investors (and not always).

Eventually, if the average age of a startup at exit is 8-10 years, the active duty period of founders (if not replaced in the meantime) extends even more. Better love the problem you&re solving, and your customers!

Thanks to speakers, participants and supporters of this Master Class series:

London: Frederic Rombaut (Seraphim Capital), Joe Tabberer (FirstBank), Chris Gilbert (Ubiquisys), Jonathan Keeling (Crowdcube), Fred Destin, Tony Fish (AMF Ventures, James Clark (London Stock Exchange), Denise Law (SGCIB).

Paris: Frederic Rombaut (Seraphim Capital), Manuel Gruson (Dassault Systemes), Pierre-Henri Chappaz (Rothschild Global Advisory), Christine Lambert-Goue (All Invest), Olivier Younes (EXPEN), Eric Carreel (Withings), Fabien Bardinet (Balyo), Xavier Lazarus (Elaia Partners), Pierre-Eric Leibovici(Daphni). Jean de La Rochebrochard (Kima Ventures), Jeremy Sartre (SmartAngels), Gwen Regina Tan (Entrepreneur First).

San Francisco: Natasha Ligai (Logitech), Matt Cutler (Cisco),Will Hawthorne, (CODE Advisors), Ryan Rzepecki (JUMP Bikes), Charles Huang (Guitar Hero), Jeff Thomas (Nasdaq), Shahin Farshchi (Lux Capital), Ammar Hanafi (Moment Ventures), Adam J. Epstein (Third Creek Advisors), Nathan Harding (EKSO Bionics), Kate Whitcomb, Anthony Marino and Ethan Haigh (SOSV).

New York: Todd Neville (IBM), George Patterson (HSBC), Ryan Rzepecki (JUMP Bikes), Aaron Kellner (SeedInvest), Jeremy Levine (Bessemer Venture Partners), Taylor Greene (Collaborative Fund), Adam Rothenberg (BoxGroup), Eli Curi(Fenwick - West), Ian Engstrand and Salil Gandhi (Goodwin), Warren Spar(Sparring Partners Capital), Duncan Turner, Vivian Law and Sheng Ge (SOSV).

- Details

- Category: Technology

Read more: What every startup founder should know about exits

Write comment (100 Comments)Marc Piette had a revelation as he buzzed in and out of the Palo Alto Airport in pursuit of his pilotlicense. Instead of freedom, he saw restraint. He also saw potential.

&It became pretty apparent that there were major issues with the general aviation industry with smaller aircraft,& Piette said in a recent interview with TechCrunch. &And yet it had enormous potential to change the way people moved around.&

Now, Piettetwo-year-old autonomous-aviation startup Xwing is ramping up to unlock that potential. The company, which has kept a low profile since its founding, isn&t building autonomous helicopters and planes. Instead, itfocused on the software stack that will enable pilotless flight of small passenger aircraft.

The company announced Tuesday that it has raised $4 million in a seed round led byEniac Ventures. Array Ventures, along with Stripe foundersJohn and Patrick Collison and Nat Friedman of Xamarin, Microsoft and GitHub, also participated in the round.

The funding will be used by the San Francisco-based company to scale operations and continue to hire aerospace and software talent.

The startup has about a dozen employees, including some uniquely talented folks who have experience withoptionally piloted vehicles, unmanned systems and certified avionics. For example, the companyCTO, Maxime Gariel, worked on autonomous-aviation projects such as DARPA Gremlins and the AgustaWestland SW4 Solo autonomous helicopter. Other members of the small team previously worked at Rockwill Collins, with the Naval Research Lab, Google, and McKinsey.

Piette, whose last company Locu was acquired by GoDaddy, sees several restraints to small passenger aircraft: the skill level required to fly a plane and the cost of earning a pilotlicense and accessing a plane. The relatively puny sales volume of small aircraft — just3,293 general aviation aircraft, including helicopters, were delivered last year worldwide, in contrast to more than 80 million cars — has depressed innovation and kept prices high.

And even when people have both a license and an aircraft, they still must travel from a small airport to their final destination.

The company is focusing on the key functions of autonomous flight, such as sensing, reasoning and control.

Xwing isn&t pinned to one kind of aircraft. Piette said the system is designed to work across different kinds of aircraft. For instance, the company spent 18 months testing on a subscale fixed-wing aircraft. It tested on a helicopter more recently.

Xwing is developing and integrating those technologies for rotorcraft, general aviation fixed-wingand the emerging electric vertical takeoff and landing (known as eVTOL) aircraft.

The companysensor integration software enables aircraft to perceive the world around it andreliably detect ground-based and airborne hazards and precisely determine the vehicleposition.

Thisperception technology is the building block for autonomous aircraft, and also can be used to increase the operational envelope of current-day piloted aircraft, according to Xwing.

From here, the companyAutonomy Flight Management System (AFMS) allows the aircraft to act upon the information from its surroundings. The system will integrate with air traffic control, generate flight paths to navigate the airspace, monitor system health and address all contingencies to ensure passenger safety, the company says.

Now, Xwing is in discussion with various, and still unnamed, large companies about integrating the system into their aircraft.

- Details

- Category: Technology

Read more: Autonomous-aviation startup Xwing takes flight with $4 million in funding

Write comment (91 Comments)

In the lead up to the launch of its Pixel 3 smartphone line-up (which allegedly includes a notch-sporting Pixel 3 XL), Google has posted a Developers Blog entry detailing its rules for display cutouts and how they will be supported on its upcoming Android P operating system.

According to Android System UI product manager Megan Potoski, Google's

- Details

- Category: Technology

Read more: Google sets down ground rules for notch support on Android P

Write comment (98 Comments)

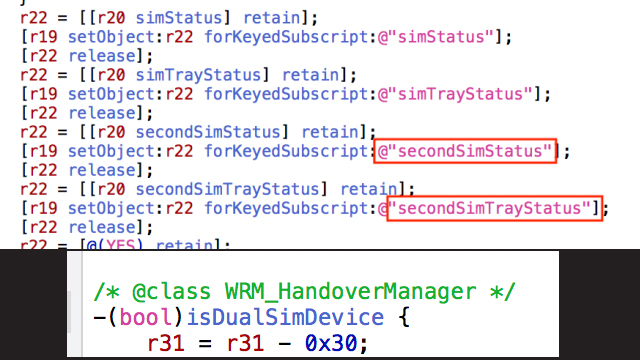

The latest version of the iOS 12 developer beta (release 5) has allowed for some interesting discoveries that support existing rumors and raise some new ones.

While Android handsets are typically rather generous in offering a dedicated slot for a second SIM card, this feature has been notably absent from Apple’s handsets over the last ten years.

How

- Details

- Category: Technology

Read more: Apple likely to include dual-SIM support in upcoming iPhones

Write comment (93 Comments)Page 4579 of 5614

11

11