Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

A UK government backed drone innovation project thatexploring how unmanned aerial vehicles could benefit cities — including for use-cases such as medical delivery, traffic incident response, fire response and construction and regeneration — has reported early learnings from the first phase of the project.

Five city regions are being used as drone test-beds as part of NestaFlying High Challenge— namely London, the West Midlands, Southampton, Preston and Bradford.

While five socially beneficial use-cases for drone technology have been analyzed as part of the project so far, including considering technical, social and economic implications of the tech.

The project has been ongoing since December.

Nesta, the innovation-focused charity behind the project and the report, wants the UK to become a global leader in shaping drone systems that place peopleneeds first, and writes in the report that: &Cities must shape the future of drones: Drones must not shape the future of cities.&

In the report it outlines some of the challenges facing urban implementations of drone technology and also makes some policy recommendations.

It also says that socially beneficial use-cases have come out as an early winner over of cities to the potential of the tech — over and above &commercial or speculative& applications such as drone delivery or for carrying people in flying taxis.

The five use-cases explored thus far via the project are:

- Medical delivery within London— a drone delivery network for carrying urgent medical products between NHS facilities, which would routinely carry products such as pathology samples, blood products and equipment over relatively short distances between hospitals in a network

- Traffic incident response in the West Midlands — responding to traffic incidents in the West Midlandsto support the emergency servicesprior to their arrival and while they are on-site, allowing them to allocate the right resources and respond more effectively

- Fire response in Bradford— emergency response drones for West Yorkshire Fire and Rescue service. Drones would provide high-quality information to supportemergency call handlersandfire ground commanders, arriving on the scene faster than is currently possible and helping staff plan an appropriate response for the seriousness of the incident

- Construction and regeneration in Preston— drone services supporting construction work for urban projects. This would involve routine use of drones prior to and during construction, in order to survey sites and gather real-time information on the progress of works

- Medical delivery across the Solent— linking Southampton across the Solent to the Isle of Wight using a delivery drone. Drones could carry light payloads of up to a few kilos over distances of around 20 miles, with medical deliveries of products being a key benefit

Flagging up technical and regulatory challenges to scaling the use of drones beyond a few interesting experiments, Nest writes:&In complex environments, flight beyond the operatorvisual line of sight, autonomy and precision flight are key, as is the development of an unmanned traffic management (UTM) system to safely manage airspace. In isolation these are close to being solved — but making these work at large scale in a complex urban environment is not.&

&While there is demand for all of the use cases that were investigated, the economics of the different use cases vary: Some bring clear cost savings; others bring broader social benefits. Alongside technological development, regulation needs to evolve to allow these use cases to operate. And infrastructure like communications networks and UTM systems will need to be built,& it adds.

The report also emphasizes the importance of public confidence, writing that: &Cities are excited about the possibilities that drones can bring, particularly in terms ofcritical public services,but are also wary of tech-led buzz that can gloss over concerns of privacy, safety and nuisance. Cities want to seize the opportunity behind drones but do it in a way that responds to what their citizens demand.&

And the charity makes an urgent call for the public to be brought into discussions about the future of drones.

&So far the general public has played very little role,& it warns. &There is support for the use of drones for public benefit such as for the emergency services. In the first instance, the focus on drone development should be onpublicly beneficialuse cases.&

Giving the combined (and intertwined) complexity of regulatory, technical and infrastructure challenges standing in the way of developing viable drone service implementations, Nesta is also recommending the creation of testbeds in which drone services can be developed with the &facilities and regulatory approvals to support them&.

&Regulation will also need to change: Routine granting of permission must be possible, blanket prohibitions in some types of airspace must be relaxed, and an automated system of permissions — linked to an unmanned traffic management system — needs to be put in place for all but the most challenging uses. And we will need a learning system to share progress on regulation and governance of the technology, within the UK and beyond, for instance with Eurocontrol,& it adds.

&Finally, the UK will need to invest in infrastructure, whether this is done by the public or private sector, to develop the communications and UTM infrastructure required for widespread drone operation.&

In conclusion Nesta argues there is &clear evidence that drones are an opportunity for the UK& — pointing to the &hundreds& of companies already operating in the sector; and to UK universities with research strengths in the area; as well as suggesting public authorities could save money or provide &new and better services thanks to drones&.

At the same time it warns that UK policy responses to drones are lagging those of &leading countries& — suggesting the country could squander the chance to properly develop some early promise.

&The US, EU, China, Switzerland and Singapore in particular have taken bigger steps towards reforming regulations, creating testbeds and supporting businesses with innovative ideas. The prize, if we get this right, is that we shape this new technology for good — and that Britain gets its share of the economic spoils.&

You can read the full report here.

- Details

- Category: Technology

Read more: Drone development should focus on social good first, says UK report

Write comment (99 Comments)As increasing numbers of electric vehicles are expected to hit the streets, thanks to new models from big automakers soon hitting the market, charging networks likeVolta Chargingare raising new cash to meet the expected demand.

The company today said it raised $35 million from investors led by the Invenergy Future Fund, the technology investment arm of renewable energy project developer Invenergy and Activate Capital(a relatively new $200 million investment fund raised by clean tech veterans including Raj Atluru, Michael DeRosa, Anup Jacob, and David Lincoln).

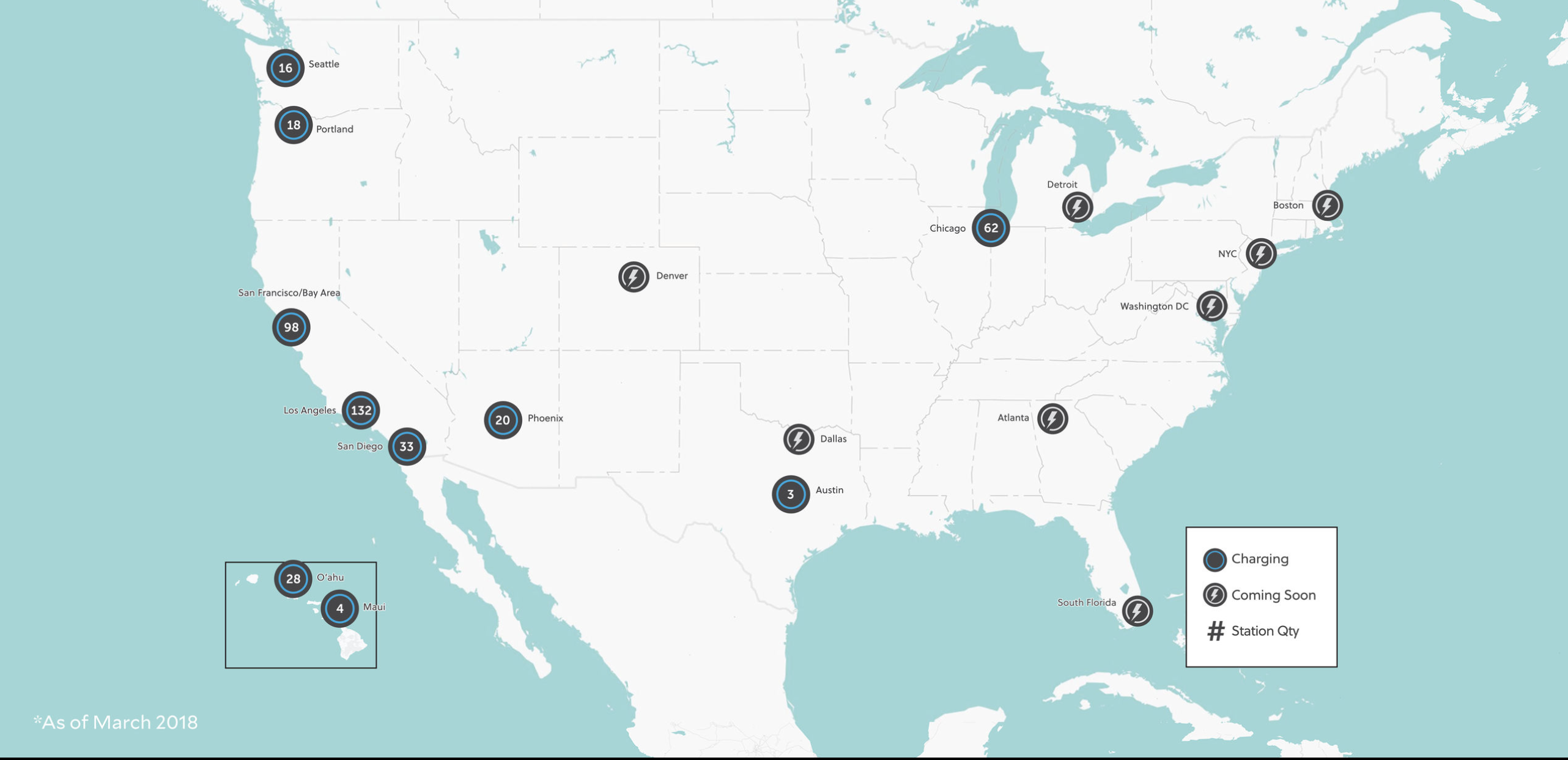

The San Francisco-based company combines outdoor digital advertising with charging stations to give electric vehicle owners free power. It has already rolled out a network of 1,000 charging stations that are open for sponsorship, and hopes to reach 2,000 by the end of 2018, according to a statement from the company.

Thereprobably nothing more 2018 than ad-supported electric vehicle charging, but Volta may be sitting at the intersection of a few trends that could give the company a charge. Outdoor advertising is one of the only growth markets in the ad-business thatnot online, and itone that investors are beginning to sink dollars into (I wrote about AdQuick, which is another startup looking to take advantage of the newfound interest).

Meanwhile, a study published jointly by the International Energy Agency, the Clean Energy Ministerial and the Electric Vehicles Initiative predicts that the number of electric light-duty vehicles on the road will reach at least 125 million by 2030. More optimistic figures could boost those numbers to 220 million, the study says.

Thata lot of cars that are going to need a lot of charging stations.

Volta rolled out its initial charging stations in Hawaii, but now has expanded its network to include the top 10 media markets in the U.S. (valuable real estate for any would-be advertiser). So far the companysponsored charging stations have given away 22 million miles worth of juice, or the equivalent of 9 million pounds of carbon dioxide emissions.

&Volta distills the surrounding complexity and accelerates the market by executing on consumer preferences that won&t change: free charging in premier convenient locations,& said John Tough, a partner at the Invenergy Future Fund in a statement.

That sentiment was echoed across the companyinvestor base, which has grown with the $35 million Series C round to include a slew of new investors including:GE Ventures, Orsted Venture, Nautilus Venture Partners, and Idinvest all join as new investors.

Initial investorsVirgo Investment Group and Autotech Ventures, also returned to put capital into the company. In allVolta has raised $60 million since it was founded in 2010.

&Volta brings us an opportunity to elegantly advance the intersection of two of our most important sectors & energy and transportation,& said Anup Jacob, Managing Director, Activate Capital. &By leveraging sponsorship to underwrite free charging and infrastructure, Volta has created a unique model to accelerate the future of mobility.&

- Details

- Category: Technology

Read more: Volta’s ad-supported electric vehicle charging service raises $35 million

Write comment (95 Comments)Ola, Uber chief rival in India, is planning to go public potentially as soon as in three years time, according to its CEO.

Co-founder and chiefexecutive officer Bhavish Aggarwal told the audience at an event inBengaluru last week that seven-year-old Ola is poised to become a cash flow positive business — having recently hit operational profitability — and thata key driver towards a listing. Thatdespite intense rumors of a tie-up with Uber following a spree of global exits from the U.S. firm, most recentlyin Southeast Asia where it struck a deal with local player Grab.

&The ambition for both me and [fellow co-founder]Ankiti[Bhati]has always been to build a sustainable, long-term independent institution,&Aggarwal said atIndia Business Summit & Leaders Speak, a Bengaluru event from ICICI Bank and CNBC-TV18. &In that direction, we are definitely going to IPO. Our goal is to aim for an IPO in about three to four years. We are on that path, our focus on building a sustainable business model [and] a profitable business builds into that ambition.&

Notably, he didn&t specify where a listing might take place for Ola, which was most recently valued at $7 billion following an investment last year.

Doubling down on his belief in building a sustainable and independent business,Aggarwal made a sly dig at Uber in suggesting that the U.S. company is preoccupied with short-term strategies in India.

&The Indian market, which I believe many internet companies don&t fully appreciate, especially the ones who are not Indian, if you give consumers a lot of free things they&ll take it. But the focus has to be to build a long-term sustainable business model… consumers are not price-conscience in India, consumers are value-conscious,& he said.

Despite that, he did acknowledge the role of a strong rival in building Olabusiness over the years. Thereno clear metric to judge which company is ahead, but with its coverage of more than 100 cities and towns in India, Olanumbers are higher than Uber, which has stuck to tier-one and -two locations. Although, anecdotally, the gap is slim in urban areas of the country.

&Competition makes you stronger, we don&t fear competition,&Aggarwal claimed. &We have a much stronger business, strong market position and we&re getting to aplace where we can list the company.&

A deal with Uber has been consistently mooted as part of Uberglobal exitsthat seemed aimed at cleaning up its balance sheet in preparation for a public listing of its own, which CEO Dara Khosrowshahi said is likely in 2019. Then,of course, therethe SoftBank factor. The Japanese firm is a shareholder in both companies, as was the case with Grab, where it is believed to have pushed for a deal with Uber.

While there have been talks, sources on both sides have confirmed to TechCrunch,Aggarwal said, somewhat tongue-in-cheek, that &so far nobodymade an [acquisition] offer I can&t refuse.&

Uber, on its side, has said it has no interest in more minority deals — which see it leave a market in exchange for equity in the local rival — but that could be gamesmanship or a hint that, in the event of a deal in India, Uber intends to make Ola the minority partner.

Is Ola genuinely aiming for an IPO in three to four years, or are these tactics aimed at dissuadingUber, SoftBank and others from forcing a union with its big rival Thatunclear. Aggarwal reiterated that Softbank is merely an investor, one of many Ola investors, but the questions are sure to continue either way. We&re all just going to have to get used to the speculation.

Article updated to note the name of the event

- Details

- Category: Technology

Read more: Uber’s Indian rival Ola is aiming for an IPO in 3-4 years

Write comment (96 Comments)Latin America faces a unique opportunity to develop the next generation of tech startup stars. Market conditions such as Internet and mobile Internet user growth outpace the US. And a GDP of 9.5T is bigger than India and almost the same as China. Also, banks and industrial complexes still dominate the market, leaving plenty of space to conquer the future. We could argue that these are obvious assumptions and that not much has changed. But something has changed.

VC funding records in the region

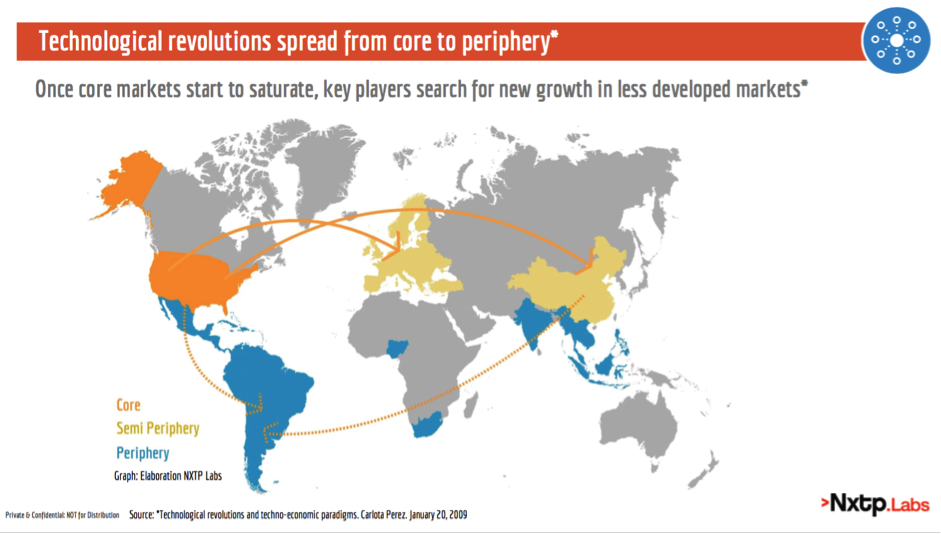

We&re currently going through the maturity phase of the Internet technological revolution. According toCarlota Perez& work,this is the moment when core markets become saturated and the set of technologies and financial capital moves towards the periphery: towards the less advanced countries.

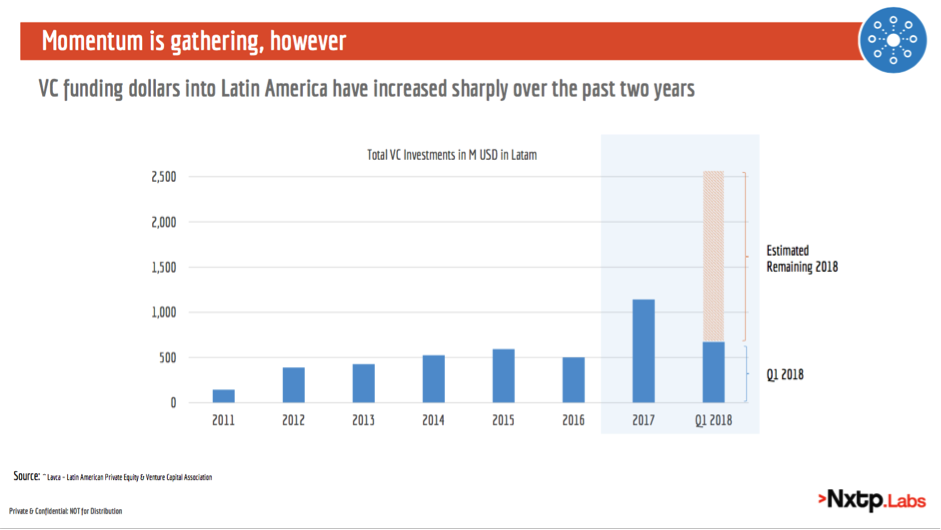

And recent changes in the regional investment landscape suggest this is happening. In 2017,VC tech investment in the region had an all time high of $1.1B. A major breakthrough when we compare it to the five previous years, which had remained steady at around $500M. This trend continues today, with over $600M invested only during the first quarter of 2018.

Mega rounds are real

The funding record can be partially explained by the appearance of mega rounds in the region. For the first time, companies are raising rounds of $100M plus. 99 (acquired by Didi Chuxing), Nubank and Rappi, have all raised mega rounds in the past two years. Others have raised large rounds, such as Selina and Movile, with plus $90M plus, or Auth0 (part of our portfolio), with plus$50M rounds in 2018.But the increase in dollar amounts is not only driven by mega rounds. More than 30 transactions of $3M or more happened in 2017, which is triple in amount of rounds of that figure when compared to 2016. This shows a market maturity not seen before]=

International VCs presence grows

Global VC firms have timidly invested in the region for the past years. But this is has also changed. There are several new players and old suspects looking for opportunities. Some of those are Andreessen Horowitz, Sequoia Capital, Accel Partners and Softbank, not to mention strategic investors such as Didi Chuxing.In 2017 alone, more than 25 new global VC firms entered the region.

Ecosystem development

To make the most out of the maturity phase of technological revolutions, VC dollars are not enough. Other complimentary conditions must be met. Conditions that can amplify the impact of a new flow of capital.As Perez& says: physical, social and technological infrastructure and the existence of competent and demanding local clients must also be met. As mentioned before, conditions such as Internet usage and wealth are a reality. Also, amount of smartphone users and e-commerce buyers are reaching US levels. But one other condition has changed: institutional support.

Institutional Support

In the 2010regional ecosystems were boosted by the appearance of new VC firms and accelerators. Together they created a fertile ecosystem that gave birth to a new class of Latin American startups. As time passed, local Governments and institutional investors support also became a reality. Through different programs, funding lines and regulatory changes, they now support the development of local ecosystems. A few examples areStartup Chile,MexicoFund of Funds,BrazilBNDES, and the recentEntrepreneurs Lawbill passed in Argentina. Also, Institutional Investors such asIADBorCAFare active in the region, both as LP&s, as direct investors and through different lines of credits and grants.

Wrapping up

Maturity signs are observed in Latin America for the first time. Increased funding, liquidity events, a solid entrepreneurial base, and increased institutional support are a reality. Public tech companies are catching up old incumbents: Mercadolibre, Despegar, Globant and B2W doubled their combined market cap in 2017 to USD 34B. And new rising tech startup stars such as 99 and Nubank are born. This is a unique time. And a unique opportunity. Latin America is poised for a new wave of tech companies to become market leaders. And this is just the beginning.

- Details

- Category: Technology

Read more: The tech investment wave has reached Latin America

Write comment (96 Comments)The UK government has set out a package of measures ithoping will futureproof domestic networks and boost international competitiveness by supporting a nationwide rollout of full fiber broadband and 5G mobile technology.

TheFuture Telecoms Infrastructure Review, published today, follows the announcement of a market review last year as part of the governmentIndustrial Strategy as it seeks to chart a technology-enabled course for growth and competitiveness.

Yet, at the same time, the UK seriously lags several European competitors on the fiber broadband front — so the strategy is also intended to try to reboot current poor performance.

The government says its telecoms plan emphasizes greater consumer choice and initiatives to promote quicker rollout — and an eventual full switch over — from copper to fiber.

It wants full fibre broadband to reach15 millionpremises (up from the &10M over the next decade& set out in the Conservative party manifesto) by 2025, and also 5G mobile network coverage to reachthe majority of the population.

By 2033, it wants full fiber broadband coverage to reach across all of the UK.

Currently the UK only has 4% full fiber connections, which compares dismally to 71% in Spain and 89% in Portugal. While Francehas around 28% — which the government notes is &increasing quickly&.

Included in the governmentstrategy ispublic investment in full fiber for rural areas; and new legislation to guarantee full fiber connections in new build developments; as well as a series of regulatory reformsintended to drive investment and competition — which it says will be tailored to different local market conditions.

Italso planning for an industry-led switch over from copper to full fiber — to avoid businesses being saddled with the expense and burden of running copper and fiber networks in parallel.

Thereno fixed timing for this, as the government says it will depend on the pace of fiber rollouts and take-up, but it suggests it&realistic to assume that switchover could happen in the majority of the country by 2030&.

To boost competition to drive commercial fiber rollouts, the government is proposing regulatory reform to allow for &unrestricted access& to Openreach ducts and poles — i.e. the wholly BT-owned companyown physical infrastructure where fiber can be laid — for both residential and business broadband use, including for essential mobile infrastructure.

It also wants to open up other avenues for laying broadband fiber, saying other existing infrastructure (including pipes and sewers) owned by other utilities such as power, gas and water, should be &easy to access, and available for both fixed and mobile use&.

And it says it will shortlypublish consultations on the proposed legislative changes to streamline wayleaves and mandate fiber connections in new builds.

Another key recommendation in the review, given that the expense of digs to lay fiber remains one of the biggest barriers to broadband upgrades, is for a new nationwide framework aimed at reducing the costs, time and disruption caused by street-works by standardising the approach across the country.

With its planned regulatory tweaks, the government reckons that market competition will be able to deliver full fiber networks across the majority of the UK (~80%) — leaving around ~20% which itexpecting will require &bespoke solutions to ensure rollout of networks&. And for around half of that fifth it also expects taxpayer funding will be needed to deliver a fiber/5G upgrade.

It estimates that nationwide availability of ‘full fiber& is likely to require additional (public) funding of around £3BN to £5BN to support commercial investment in the final ~10% of areas that would otherwise be overlooked — stressing that these &often rural areas must not be forced to wait until the rest of the country has connectivity before they can access gigabit-capable networks&.

So itplanning to pursuean &outside-in& strategy, allowing network competition to serves commercially viable areas while laying down government support investment in parallel on what it describes as &the most difficult to reach areas&.

&We have already identified around £200M within the existing Superfast broadband programme that can further the delivery of full fibre networks immediately,& it notes on that.

Although itnot clear at this stage how the government intends to fund the full proposals for a taxpayer-funded broadband bill running to multiple billions.

On the mobile connectivity front, itproposingincreased access to spectrum for &innovative 5G services&, and says it will allow mobile network operators to make far greater use of government buildings to boost coverage across the UK.

&We should consider whether more flexible, shared spectrum models can maintain network competition between MNOs while also increasing access to spectrum to support new investment models, spurring innovation in industrial internet of things, wireless automation and robotics, and improving rural coverage,& it writes on that.

Over the longer term it says is expecting to see a more converged telecoms sector — so itleaving itself some ‘last mile& wiggle room on the ‘full fiber& push, for example by pointing out that: &Fixed fibre networks and 5G are complementary technologies, and 5G will require dense fibre networks. In some places, 5G may provide a more cost-effective way of providing ultra-fast connectivity to homes and businesses.&

&We want everyone in the UK to benefit from world-class connectivity no matter where they live, work or travel,& said the newSecretary of State for digital, culture, media and sport, Jeremy Wright, commenting on the review in a statement, and dubbing it a &radical new blueprint for the future of telecommunications in this country&.

&[The strategy] will increase competition and investment in full fiber broadband, create more commercial opportunities and make it easier and cheaper to roll out infrastructure for 5G,& he added.

The UKincumbent telco, BT, which owns and operates the countrylargest broadband network, has long pursued the opposite strategy to the one the government is here pursuing: i.e. by seeking to eke out its own ex-monopoly copper infrastructure, such as by applying technologies that speed up fiber to the cabinet technology, instead of making the major financial commitment to invest in substantially expanding full fiber to the home coverage (and thereby futureproof national network infrastructure).

For years competitors (and, indeed, frustrated consumers) have also accused the company of foot-dragging on providing access to its network — thereby undermining other commercial players& ability to fund and build out next-gen network coverage.

Last yearBT agreed with telecoms watchdog Ofcom to legally separate its network division Openreach — around a decade after a functional separation has been imposed by the regulator. Albeit, itstill not the full structural separation some have called for.

&It is too early to determine whether legal separation will be sufficient to deliver positive changes on investment in full fibre infrastructure,& writes the government in its review, adding that it will &closely monitor legal separation, including Ofcomreports on the effectiveness of the new arrangements&.

&The Government will consider all additional measures if BT Group fails to deliver its commitments and regulatory obligations, and if Openreach does not deliver on its purpose of investing in ways that respond to the needs of its downstream customers,& it adds.

Commenting on the governmentstrategy, an Openreach spokesperson told us:&We&re encouraged by the Governmentplan to promote competition, tackle red tape and bust the barriers to investment. As the national provider, we&re ambitious and want to build full fibre broadband to 10 million premises and beyond — so itvital that this becomes an attractive investment without creating digital inequality or a lack of choice for consumers and businesses across the country. As the Government acknowledges, the economics of building digital infrastructure remain challenging for everyone, and we believe a review of the current business rates regime is necessary to stimulate the whole sector.

&We&re already building full fibre to around 10,000 homes and businesses every week, and by 2020 we&ll have reached 3 million,& the spokesperson added. &We have a huge, world class engineering team and wherever we build, we&ll deliver the best quality network with the highest levels of service and built-in competition and choice.&

One aspect of the strategy the government is not trumpeting quite so loudly in its PR around the announcement is an intent to promote what it describes as &stable and long-term regulation& as part of its strategy to drive increased competition and unlock business investments.

On this it writes that the overarching strategic priority to &promote efficient competition and investment in world-class digital networks& should be &prioritised over interventions to further reduce retail prices in the near term, recognising these longer-term benefits&.

In the review it suggests moving to longer, five year review periods, for instance — saying this &could provide greater regulatory stability and promote investment&. It also writes that it wants Ofcom to publish guidance that &clearly sets out the approach and information it will use in determining a ‘fair bet& return&.

Ittherefore possible that UK consumers could end up paying twice over to help fund national fiber broadband infrastructure upgrades; i.e. not just via direct subsidies to fund rural rollouts but also, potentially, via higher broadband prices too. Albeit, the government says that in its view &the interests of consumers are safeguarded as fiber markets become more competitive&.

Though in less commercially attractive areas, where there could be a greater risk of price inflation, the governmentsmall print does include the recognition that regulatory interventions — such as price controls — may indeed be required. Though of course any such controls would only come in after consumers had been being stung…

&For areas where there is actual or prospective effective competition between networks, Government would not anticipate the need for regulation,& it writes. &For other areas, we would expect the regulatory model for to evolve over time as networks are established. If market power emerges, regulated access (including price controls) may be needed to address competition concerns. These detailed regulatory decisions will be for Ofcom to take.&

This report was updated with comment from Openreach

- Details

- Category: Technology

Read more: UK sets out plan to spend billions on fiber and 5G broadband for all

Write comment (99 Comments)

The enormously popular open source office suite LibreOffice has appeared in the Microsoft Store – with an alarming surprise. LibreOffice is an open source project and has always been free to download, even for commercial use, but the app in the Microsoft Store carries a price tag of $2.99/£2.49.

The app description suggests this is just a way for

- Details

- Category: Technology

Read more: The Microsoft Store's LibreOffice app requests cash and webcam access

Write comment (100 Comments)Page 4653 of 5614

18

18