Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Like any other line of work, tech journalists tend to get fixated on details. When Apple showed off its new MacBook Pros at an event this week, the company (and a small army of creative professionals) had a lot to say about specs. A majority of our questions, however, revolved around that third-generation keyboard.

To answer all of your no doubt burning questions on that front, I can say definitively that the keyboard is noticeably quieter than its predecessor. I wasn&t able to get a side by side comparison yet (we&ll have to save that for the inevitable review), but as someone who uses a Pro with the second-gen keyboard every day, I can confirm that the improvement is immediately apparent.

That addresses one of the key complaints with the system and should make life a little easier for users who regularly bring their MacBooks into meetings — or worse yet, the library. If John Krasinski was using last year&s MacBook in that quiet film, he almost certainly would have been eaten by one of the murder monsters or whatever that movie is about (no spoilers). The new Pros should give him a bit more of a fighting chance.

Otherwise, therereally no difference with the new keyboards from a mechanical perspective. The butterfly switches are the same, and they offer the same amount of key travel as their predecessors. The company won&t actually say what itdone here to lower the clickity-clack (thatgoing to be a job for some teardown artists), but itcertainly an improvement.

Why the company didn&t go all-in on a keyboard overhaul is anyoneguess. There are a number of possibilities. For one thing, the issues of key failure only really came to a head fairly recently, which might not have given the company enough lead time to do a ground-up rethink of the technology. Also, in spite of some criticism, the new keyboards do have their fans — in fact, we&ve got a number of them on staff (I won&t call any out by name… yet).

Most relevant of all, perhaps, the instances of true keyboard failure do seem to be relatively rare in the overall context of the Apple user base. The company has since acknowledged the black eye and agreed to free fixes for those with impacted systems. I wouldn&t be too surprised to see an overhaul of the tech at some point in the not too distant future. In the meantime, the new version is definitely an improvement.

- Details

- Category: Technology

Read more: The new MacBook Pro keyboards are quieter, but otherwise unchanged

Write comment (90 Comments)After years of producing cases for the iPhone and iPad, Apple finally got into the laptop sleeve business late last year. The leather case sported &high-quality European leather with a soft microfiber lining,& along with the obligatory Apple logo and &designed by Apple in California& guarantee. For whatever reason, however, it was a MacBook-only proposition.

That changes today, however. Todaynew MacBook Pros mean new MacBook Pro sleeves. They&re essentially the same leather/microfiber combo as the standard MacBooks, albeit altered to fit the larger notebooks& footprint.

And like their predecessors, they come in Brown and Midnight Blue — though Applealso tossed in a Black version for good measure. Like the new MacBook Pros, they&re available starting today for those who want to keep repping Cupertino even when stashing their laptops away from the dangerous world outside.

- Details

- Category: Technology

Read more: The MacBook Pro gets its own official Apple leather sleeve

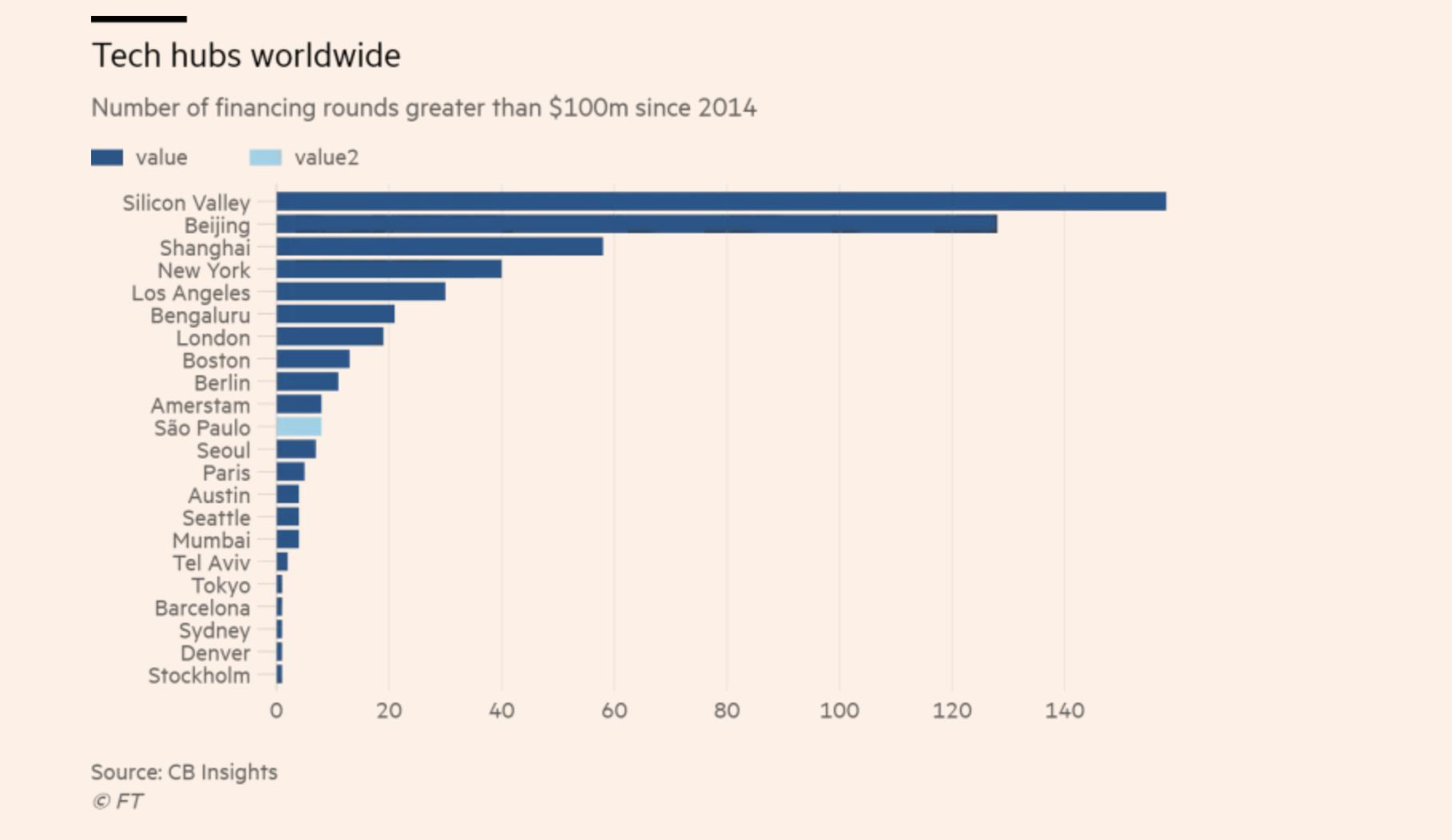

Write comment (95 Comments)Brazilmacroeconomic picture may be gloomy, but technology investors still see hope in the nationburgeoning technology sector — and a recent $124 million financing for the mobile conglomerate Movile is the latest proof that the pace of investment isn&t slowing down.

Brazil was already the hottest spot for technology investment throughout Latin America — with Sao Paulo drawing in the majority of the record-breaking $1 billion in financing that the regionstartups attracted in 2017. And with this latest funding for Movile, led by Naspers, that trend looks likely to continue.

Indeed, Naspers investments in Movile (supplemented by co-investors like Innova, which participated in the most recent round) have been one of the driving forces sustaining the Brazilian startup community. In all, the South African technology media and investment conglomerate has invested $375 million into Movile over the course of several rounds that likely value the company at close to $1 billion.

Another Brazilian tech company, the financial services giant Nubank, has raised around $528 million (according to Crunchbase) and is valued at roughly $2 billion, putting it squarely in the &unicorn club&, as the Latin American Venture Capital Association noted, earlier this year.

Both chief executive Fabricio Bloisi and a spokesperson from Naspers declined to comment on Movilevaluation. &My dream is not to become a unicorn my dream is to become much bigger than that,& Bloisi said in an interview.

Nubank and Movile are the two most recent privately held independent companies to achieve or approach unicorn status in Brazil, but they&re not alone in reaching or approaching the billion dollar threshold in Latin America. MercadoLibre was an early runaway success for the region (hailing from Argentina) and the ride hailing service 99Taxis was acquired by the Chinese ride-hailing behemoth Didi for a roughly $1 billion dollar valuation last year.

All of this points to an appetite for Latin American tech that Movile is hoping it can seize upon with its new $124 million in financing.

The company is looking to expand its food delivery business iFood, its payment company, Zoop, and its ticketing platform, Sympla.

Both Movile and Naspers look to Chinese companies as their model and inspiration for growth, with Bloisi saying that heeyeing the eventual public offering for Meituan — the Chinese online retailer as the company to emulate in the market these days.

&The Chinese companies are doing extremely well and Movile is very similar to a Chinese company,& says Bloisi. And the companybuy and build strategy certainly mirrors that of a tech business in the worldlargest emerging market economy moreso than it does a typical U.S. startup.

That extends to Movileinvestment in the tech ecosystem in its native Brazil and the broader Latin American region. Already the company boasts 150 million users per month across its application ecosystem. Through on-click payment services provided by Zoop, Movile offers a WePay and WeChat like experience for buyers in Latin America, Bloisi said.

Ita playbook that the companybackers have run before — with WeChat. Naspers came to prominence and untold riches by being an early backer of Tencent whoWeChat and WePay applications have become the backbone of mobile commerce in China.

Now itlooking to replicate that with Movile in Brazil and beyond. Like its Chinese counterparts, Movile is more than just one of the largest startup companies in the Brazilian ecosystem… italso a big investor. Indeed, subsidiaries like iFood began as small investments the company made in promising businesses.

It was with its last $82 million round of financing from Naspers and other co-investors that Movile backed Mercadoni, a Colombian grocery business, and its payment services play in Brazil — Zoop (which is one of the companymain areas of interest going forward).

For Bloisi, that future outlook seems pretty bright. &Our confidence is extremely high,& he says of the recent financing. &For me itan indicator that things are growing. There was a hot moment in Latin America in 2010-2012. Then there was a recession, now while Movile is raising more there are also many more players,& who are coming to market with convincing offerings for investors.

Movile itself isn&t afraid to let its checkbook do the talking for it when it comes to confidence in the market for online retail and commerce in Brazil. Bloisi estimates that his company has made nearly 35 transactions over the past few years, and will continue to invest heavily in the sector.

&Many of our business are growing at over 100% per year,& Bloisi said.

Investors like Martin Tschopp the chief executive of Naspers can&t complain about that kind of growth across multiple business units.

As the executive said in a satement:

&Naspers has been a long-term partner of Movile because of its ability to build transformative mobile businesses in Latin America and beyond. Movile has great expertise in identifying high-potential companies in consumer segments with opportunity for massive growth, including food delivery with iFood, which is why we continue to support the company.&

That sentiment, an optimism about the future of technology enabled businesses in Brazil and the broader Latin American region has captured investors& imagination from billionaire backed offices like the Russian investment firm DST and large multinational U.S.-based players like Goldman Sachs.

As HIllel Moerman, head of Goldmanprivate capital investment group told The Financial Times,&The [venture capital] ecosystem is still nascent compared to the US and other international markets — therefore there is a large opportunity for start-ups.&

Beyond the relative maturity of the venture community, there are macroeconomic forces at play that continue to make the Brazilian market attractive.

&Brazil has a large market, a pretty tech savvy population with attractive demographics and decent engineering and computing talent. You have all the right ingredients for an ecosystem to develop,& Tom Stafford, an investor with DST Global, told the British paper in an interview.

- Details

- Category: Technology

Netskope, a company that focuses on security in the cloud, announced today it has acquired Sift Security, a startup launched in 2014 to help secure cloud infrastructure services like Amazon, Microsoft and Google using machine learning.

The company did not share terms of the deal, but Sift10 technical employees will become part of Netskope500+ person team and Sift CEO Neil King will lead the Netskope IaaS product management team moving forward.

While Netskope provides comprehensive cloud and website security from a single interface, Sift uses machine learning to provide breach detection and automated response for Infrastructure as a Service environments, even across multiple clouds.

Netskope founder and CEO Sanjay Beri says together the two companies can offer more security visibility than they had previously. &Sift Security enhances Netskopeability to uniquely gather and visualize the richest set of contextualized data on transactions across nearly all of the services provided by the Netskope Security Cloud — including transaction visibility, DLP (data loss prevention), threat protection, adaptive access control and anomaly detection,& he explained.

As with many deals these days involving companies with machine learning expertise, while Netskope clearly values the Sift Security technology, it also is getting a technical team with machine learning chops in the bargain.

&Sift Security has robust deep machine learning and behavioral analytics capabilities that help with the detection, correlation and response. Sift engineers also bring valuable expertise in machine learning and anomaly detection to Netskopegrowing team of data scientists,& Beri said.

Beri explained that it was ultimately more than a pure technology purchase or talent acquisition because at the end of the day the two companies have to work together. That requires a good cultural fit too. &Neil King — SiftCEO and now head of IaaS Product Management for Netskope — and I met and started talking early in the year and over time through many discussions (and over time having our engineering teams meet and spend time together) realized that together our companies would be a great fit,& Beri wrote in a blog post announcing the deal.

While the infrastructure cloud vendors do a good job of securing their data centers against attack, Beri says best practices point to a &shared responsibility model&, which holds that both cloud providers and their customers play a role in overall security.

&Public cloud vendors are the first to tell [their customers] that they themselves are also responsible for protecting their data. For instance, companies should not rely on public cloud vendors for application level security; nor can they rely on public cloud companies to centralize the governance of multiple IaaS platforms,& Beri says. Thatwhere a company like his comes in.

Netskope was founded in 2012 and has raised over $231 million. Sift Science was founded in 2014 and raised over $3 million in seed capital. The deal closed last month.

- Details

- Category: Technology

Read more: Netskope nabs Sift Security to enhance infrastructure cloud security

Write comment (96 Comments)Finding the right talent is a make-or-break situation for any company — especially smaller ones, which might not have the robust tools (or pocket books) of larger companies like Google that have a complete system in place. Recruiting platform Greenhouse hopes to make that process a little bit easier, and it has caught the attention of investors.

The company said it has raised a new $50 million financing round from Riverwood Capital, bringing its total funding to $110 million. Greenhouse definitely isn&t the only company thatstarting to pick up a significant amount of funding recently by trying to crack open the process of talent acquisition and make it a little more data-driven. But as the cost and difficulty of collecting enormous amounts of data on different kinds of human activity has dropped with the emergence of new machine learning tools, the problems behind recruiting may also be one that can get a lot of help from employing the same data science rigor that powers a smart Google search result.

&Hiring tools and software in the market had been built for the previous generation, with an applicant tracking mindset to cover the basics of collecting resumes on your website,& Greenhouse CEODaniel Chait said. &We saw that winning companies in the talent market were ones who were able to attract the right talent, identify difference makers in a sea of LinkedIn profiles, make really smart decisions in who to hire, deliver winning experiences, use data to optimize. They needed tools to accomplish those goals and much broader than the recruiting software.&

The typical consumerexperience with Greenhouse has probably been a bunch of job listings on a website somewhere, where an employee can submit an application or additional information that the company wants. Under the hood, Greenhouse provides companies with ways to find the right funnels for their applications — whether thatsomething like GlassDoor or smaller niches on the Internet with more isolated pockets of talent — and discover the right employees for the roles that are available. Data is collected on all this behavior, which in turn helps Greenhouse give better recommendations for companies as to where to find potential recruits that fit their needs.

All that has to be packaged together with a generally nice user experience, both for the typical consumer and for the companies. That can boil down to actually understanding the right questions to ask, the right requirements to post in a job listing, and also making sure the process is pretty quick for people that are applying for jobs. Greenhouse implements scorecards to help interviewers — which can turn out to be a big group, depending on the position — determine whether or not candidates are the right person for the job in a more rigorous manner. And Greenhouse also hopes to work with companies with its tools to eliminate bias in the recruiting process to produce a more diverse set of hires.

&Companies are continuing to invest in recruiting and talent acquisition software,& Chait said. &As issues of talent and hiring have become more central at the C-suite, companies continue to invest in this area. Companies are starting to see the difference between HR and talent acquisition as its own specialty. If you&re a big company that has an all-in-one HR suite, itall well and good to have payroll and benefits in your org chart in one place, but when it comes to hiring, itvery dynamic.&

Greenhouse is still pretty dependent on its partners, but the startup has a wide array of companies that it works with to ensure that all the right tools are available to clients to find the right candidates. If a change is coming on LinkedIn — one of the biggest homes of candidate profiles on the planet — Greenhouse is going to work with the company to ensure that nothing breaks, Chait said. Greenhouse provides an API-driven ecosystem to ensure that its tools reach all the right spots on the Internet to help companies find the best talent.

But Greenhouse isn&t the only recruiting-driven company to attract a significant round of funding. It isn&t even the only one to do so in the last month — Hired, another recruiting platform, said it raised $30 million just weeks ago to create a sort of subscription model to help funnel the right candidates to companies. But all this interest, including Greenhouse, is a product of attempts to try to find the right talent in what might be unexpected spots powered by machine learning tools that are now getting to the point where the predictions are actually pretty good.

- Details

- Category: Technology

Read more: Intelligent recruiting platform Greenhouse picks up another $50M

Write comment (90 Comments)

Google's Android Wear had a shaky start, but it's now an increasingly mature platform thanks to the Android Wear 2.0 update and the more recent switchover to the Wear OS name.

We originally ranked the best Android Wear watches you can buy, but we've now changed this list since Google rebranded its smartwatch platform to Wear OS in early 2018.

The

- Details

- Category: Technology

Page 4766 of 5614

7

7