Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

As Jack Dorsey announced his company Twitter would drop all political ads, Facebook CEO Zuckerberg doubled-down on his policy of refusing to fact check politicians& ads. &At times of social tension there has often been an urge to pull back on free expression . . . We will be best served over the long term by resisting this urge and defending free expression.&

Still, Zuckerberg failed to delineate between freedom of expression, and freedom of paid amplification of that expression which inherently favors the rich.

During todayQ3 2019 earnings call where Facebook beat expectations and grew monthly users 2% to 2.45 billion, Zuckerberg spent his time defending the social networklenient political ad policy. You can read his full prepared statement here.

One clear objective was to dispel the idea that Facebook was motivated by greed to keep these ads. Zuckerberg explained &We estimate these ads from politicians will be less than 0.5% of our revenue next year.& For reference, Facebook earned $66 billion in the 12 months ending Q3 2019, so Facebook might earn around $330 million to $400 million in political ads next year. [Update: It wasn&t clear if issue ads and PAC ads were counted in Facebook0.5% figure, but now the company says that number is just for ads run directly by politicians.]

Zuckerberg also said that given Facebook removed 50 million hours per day of viral video watching from its platform to support well-being which hurt ad viewership and the companyshare price, Facebook clearly doesn&t act solely in pursuit of profit.

FacebookCEO also tried to bat down the theory that Facebook is allowing misinformation in political ads to cater to conservatives or avoid calls of bias from them. &Some people say that this is just all a cynical political calculation and that we&re acting in a way that we don&t really believe because we&re just trying to appease conservatives& he said, responding that &frankly, if our goal was that we&re trying to make either side happy then we&re not doing a very good job because I&m pretty sure everyone is frustrated.&

Instead of banning political ads, Zuckerberg voiced support for increasing transparency about how ads look, how much is spent on them, and where they&re run. &I believe that the better approach is to work to increase transparency. Adson Facebook are already more transparent than anywhere else. We have a political ads archive so anyone can scrutinize every ad that&s run.&

He mentioned that political ads are run by &Google, YouTube, and most internet platforms&, seeming to stumble for a second as he was likely prepared to cite Twitter too until it announced it would drop all political ads an hour earlier. He omitted that Pinterest and TikTok have also banned political ads.

It doesn&t help that hundreds of Facebookown employees have called on their CEO to change the policy. He concluded that no one could accuse Facebook of not deeply thinking through the question and its downstream ramifications. Zuckerberg did leave himself an out if he chooses to change the policy, though. &I&ve considered whether we should not [sell political ads] in the past, and I&ll continue to do so.&

Dorsey had tweeted that &We&ve made the decision to stop all political advertising on Twitter globally. We believe political message reach should be earned, not bought.& Democrat Representative Alexandria Ocasio-Cortez expressed support for Twittermove while Trump campaign manager Brad Parscale called it &a very dumb decision&

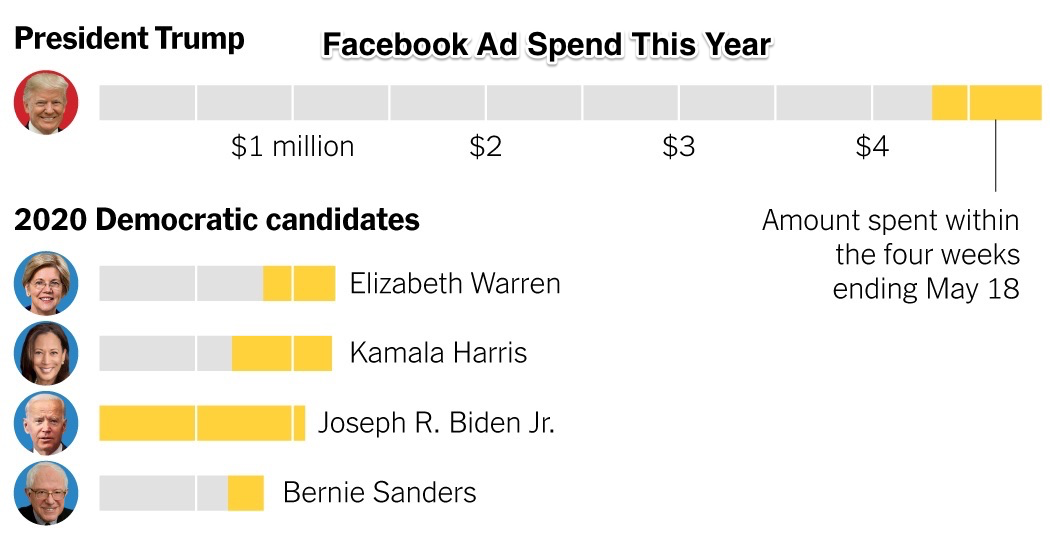

TwitterCEO took some clear swipes at Zuckerberg, countering his common arguments for allowing misinformation in politicianads. &Some might argue our actions today could favor incumbents. But we have witnessed many social movements reach massive scale without any political advertising. I trust this will only grow.& Given President Trump had outspent all Democratic candidates on Facebook ads as of March of this year, itclear that deep-pocketed incumbents could benefit from Facebookpolicy.

Trump continues to massively outspend Democratic rivals on Facebook ads. Via NYT

Miming Facebookposition, Dorsey tweeted &It‘s not credible for us to say: ‘We&re working hard to stop people from gaming our systems to spread misleading info, buuut if someone pays us to target and force people to see their political ad…well…they can say whatever they want!&

Twitter doesn&t earn much from political ads, citing only $3 million in revenue from the 2018 mid-term elections, or roughly 0.1% of its $3 billion in total 2018 revenue. That means there will be no major windfall for Facebook from Twitter dropping political ads. But now all eyes will be on Facebook and Google/YouTube. If Sundar Pichai and Susan Wojcicki move in line with Dorsey, it could make Zuckerberg even more vulnerable to criticism.

$330 million might not be a big incentive for Facebook or Zuckerberg, but it still sounds like a lot of money to earn from ads that potentially lie to voters. I respect Facebooklenient policy when it comes to speech organically posted to users, organizations, or politicians& own accounts. But relying on the candidates, press, and public to police speech is dangerously idealistic. We&ve seen how candidates will do anything to win, partisan press will ignore the truth to support their team, and the public aren&t educated or engaged enough to consistently understand whatfalse.

Zuckerberg greatest mistakes have come from overestimating humanity. Unfortunately, not everyone wants to bring the world closer together. Without safeguards, Facebooktools can help tear it apart. Ittime for Facebook and Zuckerberg to recognize the difference between free expression and paid expression.

- Details

- Category: Technology

Read more: Zuckerberg defends politician ads that will be 0.5% of 2020 revenue

Write comment (100 Comments)

Apple iPhone sales still make up over half of its quarterly revenues, but they are slowly shrinking in importance as other divisions in the company pick up speed.

Applestock remained largely unchanged after-hours following the release of its Q4 earnings. The company delivered earnings per share of $3.03 versus the streetestimate of $2.84 on revenue of $64 billion compared with expectation at $62.99 billion.

The big story continues to be major growth in Services, iPad and Wearables while iPhone and Mac sales continue to shrink year-over-year.

As you&ll remember, Apple no longer reports unit sales of its iPhone, Mac and iPad lines, something that is largely the result of declining unit sales and higher average selling prices. Services, Wearables and Other, and iPad saw year-over-year gains, while the iPhone and Mac lines are still seeing revenue slumps.

- iPhone sales were down 9% year-over-year, to $33.36 billion

- Services were up 18% YoY, to $12.5 billion

- Mac sales were down 5% YoY, to $6.99 billion

- &Wearables, Home, and Accessories& were up 54% YoY, to $6.52 billion

- iPad sales were up 17% YoY, to $4.66 billion

The company is continuing to add to some of its highest-growth businesses. The company announced the release of a new high-end set of AirPods yesterday, which will likely increase average selling prices among its wearables division. The company also has a number of paid services, including Apple TV+, that will be launching soon.

- Details

- Category: Technology

Read more: Apple beats on Q4 earnings after strong quarter for wearables, services

Write comment (93 Comments)Brazil continued to churn out unicorns this month, with Curitiba-based Ebanx becoming the first startup from the southern part of the country to top a $1 billion valuation. U.S.-based FTV Capital provided the investment but did not disclose the amount invested nor the exact valuation of Ebanx after the investment.

Ebanx is an end-to-end payment processor that helps international companies receive payments in the Latin American market, similar to Stripe. Their clients include Airbnb, AliExpress, Pipedrive, Spotify, Uber and Wish, and more than 50 million Latin Americans have conducted transactions with more than 1,000 companies through the Ebanx platform. This investment comes on the heels of exciting partnerships with Uber Pay, Shopify, Spotify and Visa to expand cross-border payment processing across the region.

Ebanx has operations in Brazil, Mexico, Argentina, Colombia, Chile, Peru, Ecuador and Bolivia, and will expand their local payment solution, Ebanx Pay, into Colombia in 2020. The company has grown its user base by offering a full-service product that includes market research, 24/7 customer service and anti-fraud technology.

The Ebanx investment is part of a growing interest in Latin American payments startups. BrazilPagSeguro and StoneCo had successful IPOs last year, while MexicoConekta and EcuadorKushki have raised large rounds to try to unite the region under a single processor as Latin America rapidly adopts e-commerce.

Uber acquires Cornershop, takes off where Walmart left off

The acquisition of the Chilean-Mexican grocery delivery startup Cornershop has been an emotional roller coaster for Latin American entrepreneurs and investors throughout 2019. First Walmart announced a $225 million deal that would be one of the bigger exits of the region, then the acquisition was blocked by Mexican antitrust institution COFECE. This announcement dealt a blow to the ecosystem as entrepreneurs and VCs had eagerly awaited this boost in liquidity in the local market.

Last-mile delivery and logistics became a very competitive space in Latin America in 2018.

Then in mid-October 2019, Uber announced it would take a 51% stake in Cornershop for a reported $450 million, quadrupling the startupvalue in the four months since the COFECE decision. This deal will consist of cash, investment in Cornershopgrowth and stock in Uber, which IPO&d earlier this year.

However, this deal must also be approved by the Chilean and Mexican antitrust boards, which are expected to release their decisions within the next two weeks. In the meantime, Cornershop will continue its expansion into the Colombian market after it added Peru and Canada in 2019.

Last-mile delivery and logistics became a very competitive space in Latin America in 2018, and many of the players are sitting on enormous pools of capital. ColombiaRappi raised $1 billion from SoftBank in early 2019, breaking records for startup investment for the region. BraziliFood raised $500 million from Naspers at the end of 2018. However, delivery continues to be a cash-intensive business, with many of these companies burning through capital quickly to gain market share. Cornershop was an exception and had raised less than $50 million before the acquisition.

BrazilBuser, Olist, raise funding from SoftBank

Despite the WeWork crash, SoftBank has continued investing consistently in Brazilian startups. In early October 2019, the Japanese investor led an undisclosed Series B round for Brazilian collaborative bus chartering startup Buser. Buserteam will invest more than $73 million in growth over the next 12 months to create new alliances for their network of operating partners.

Buser helps coordinate groups of people to charter buses at convenient times and lower prices, disrupting the bureaucratic, anti-competitive and inefficient bus system. The company has grown 1,500% over the past nine months and serves more than 3,000 people per day. While Buser has been popular with locals, traditional bus drivers are calling for regulation to slow the companymeteoric growth. Buser plans to add more than 100 direct jobs in 200 cities over the next 12 months, and SoftBankmost recent investment will help power this growth.

Brazile-commerce marketplace integrator Olistalso received investment from SoftBank for its Series C, coming in around $46 million. Redpoint eVentures and Valor Capital also participated in the round.

This investment signals the increased interest by traditional retailers in startups that are slowly chipping away at their market share across the region.

Olist connects small businesses to larger product marketplaces to help entrepreneurs sell their products to a larger customer base. They will reportedly use this investment to investigate the development of financial products and look for collaboration with SoftBankother companies, like Rappi and Loggi. Based in Curitiba, Olist was founded in 2015 to help small merchants gain market share across the country through a SaaS licensing model to small brick and mortar businesses.

Today, Olist has more than 7,000 customers and uses a drop-shipping model to send products directly from stores to clients around the country, allowing them to grow with a capital-light model. They will use the investment to add up to 100 new employees.

Carrefour Brazil acquires 49% of Ewally

Grocery chain Carrefour acquired a large stake in Brazil-based Ewally after it completed

Ewally improves financial inclusion in Brazil through a mobile wallet app that allows unbanked clients to pay bills and make purchases online through the blockchain. Carrefour will reportedly use the acquisition to accelerate digital transformation and improve online payment mechanisms throughout Brazil.

Carrefour did not disclose the amount invested and the deal is still subject to approval by Brazilian financial regulation authorities. However, this investment signals the increased interest by traditional retailers in startups that are slowly chipping away at their market share across the region.

News and Notes: Early-stage rounds are getting bigger

Startups in Brazil, Colombia and Argentina raised several rounds this month, ranging from $1.5 million to $13 million. BrazilXerpa, ColombiaSempli, BrazilGorilla and ArgentinaBitso and Worcket were among those that raised capital from local and international investors in October 2019.

Brazilian human resource management platform Xerparaised $13 million from Vostok Emerging Finance to continue to help companies like MercadoLibre, iFood and QuintoAndar provide benefits for their employees. Previous investors include NubankDavid Velez, Kaszek Ventures and QED Investors.

Sempli, an online lending platform for small businesses in Colombia, raised an $8 millionSeries A from new investors Oikocredit and Incofin CVSO, as well as previous investors BID LAB, XTPI Fund, Generación Exponencial, and Impulsum Ventures. To date, Sempli has raised more than $24 million in equity funding. The founders will use this round to grow their portfolio and improve their risk assessment technology to provide more small business loans in Colombia.

BrazilQuicko, an alternative mobility startup that uses big data, raised $10 million in October from Brazilian transport company CCR. Quickotechnology integrates all mobility options — from bicycles to Uber and 99 — to help people get where they need to go as quickly and inexpensively as possible.

Also in Brazil, startup Gorilla Invest raised $8.4 millionfrom Ribbit Capital, Monasheesand Iporanga. Gorilla aggregates financial assets so that investors can review all their commitments in one place, and currently manages more than $1.2 billion for 40,000 clients.

Mexican cryptocurrency exchange Bitso raised an undisclosed round from Argentine startup Ripple to expand into the Southern Cone, especially Argentina and Brazil. Other investors in the round included Pantera Capital, Digital Currency Group, Jump Capital and Coinbase.

Looking ahead to November, with unsettled politics in several countries across the region, tech startups are growing despite governmental changes. Some of these changes will likely have a positive effect on the regional ecosystem as people push for more sustainable and equal economic growth.

What to watch next? Last year, Q4 was marked by a wave of large investments as funds and startups look to end the year strong. IFood raised its record-breaking $500 millionround in December 2018. We may well see a similar uptick this year as mega-funds like SoftBank have been consistently investing multi-million dollar rounds since June. There is no sign international investment in Latin America will slow through the end of the year, so we can likely look forward to several more growth-stage rounds before the year is out.

- Details

- Category: Technology

Read more: Latin America Roundup: Uber acquires Cornershop, SoftBank invests in Buser and Olist

Write comment (92 Comments)Despite ongoing public relations crises, Facebook kept growing in Q3 2019, demonstrating that media backlash does not necessarily equate to poor business performance.

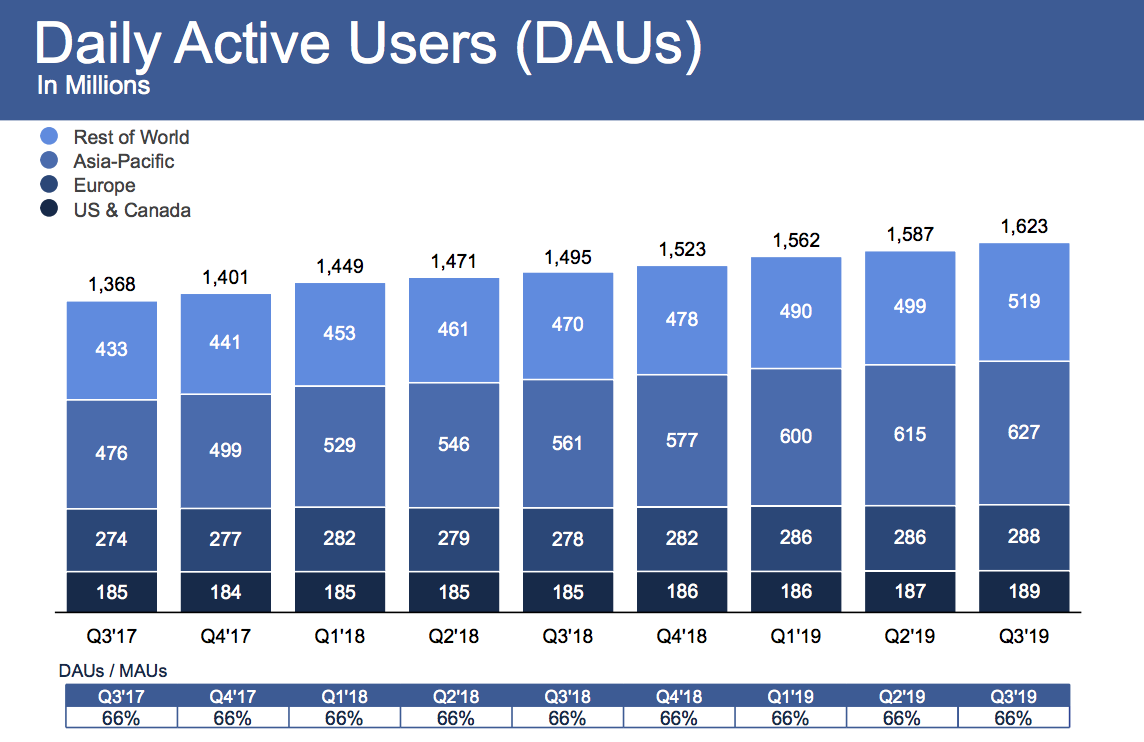

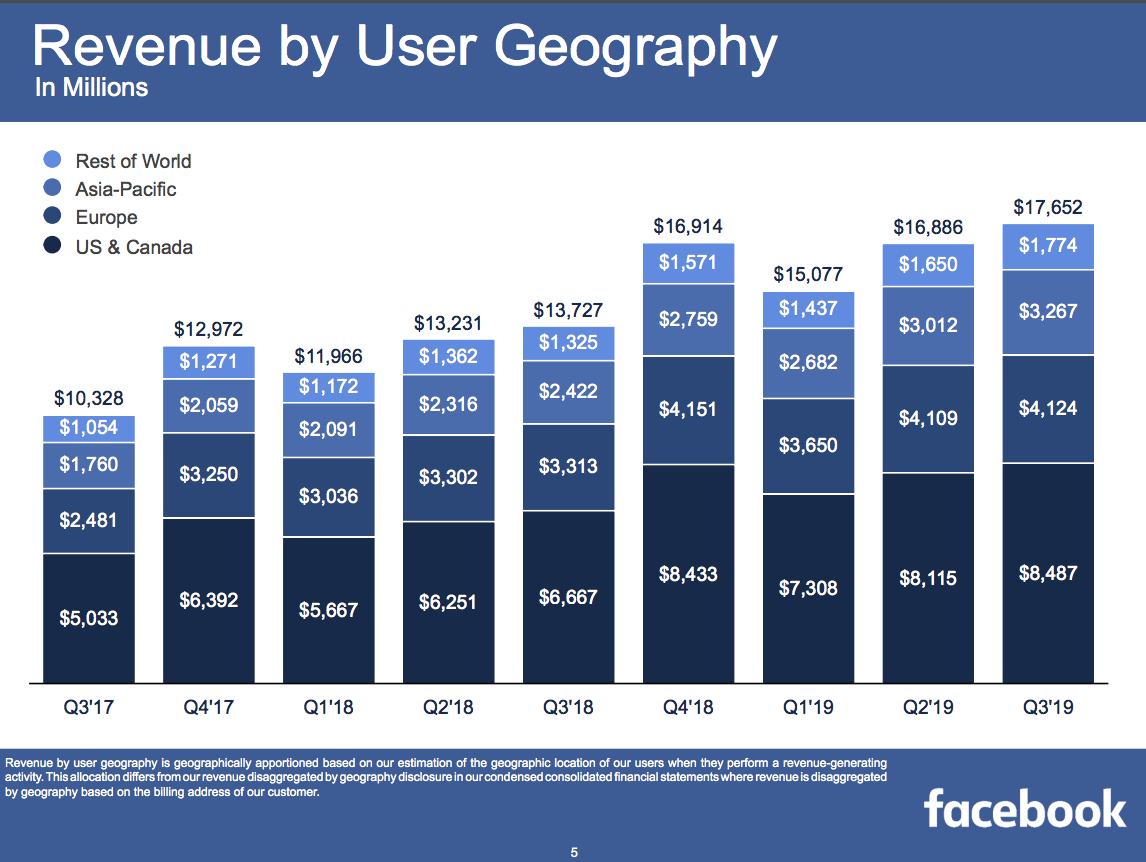

Facebook reached 2.45 billion monthly users, up 1.65%, from 2.41 billion in Q2 2019 when it grew 1.6%, and it now has 1.62 billion daily active users, up 2% from 1.587 billion last quarter when it grew 1.6%. Facebook scored $17.652 billion of revenue, up 29% year-over-year, with $2.12 in earnings per share.

Facebookearnings beat expectations compared to Refinitivconsensus estimates of $17.37 billion in revenue and $1.91 earnings per share. Facebookquarter was mixed compared to Bloombergconsensus estimate of $2.28 EPS. Facebook earned $6 billion in profit after only racking up $2.6 billion last quarter due to its SEC settlement.

Facebook shares rose 5.18% in after-hours trading, to $198.01 after earnings were announced, following a day where it closed down 0.56% at $188.25.

Notably, Facebook gained 2 million users in each of its core U.S. - Canada and Europe markets that drive its business, after quarters of shrinkage, no growth or weak growth there in the past two years. Average revenue per user grew healthily across all markets, boding well for Facebookability to monetize the developing world where the bulk of user growth currently comes from.

Facebook says 2.2 billion users access Facebook, Instagram, WhatsApp or Messenger every day, and 2.8 billion use one of this family of apps each month. Thatup from 2.1 billion and 2.7 billion last quarter. Facebook has managed to stay sticky even as it faces increased competition from a revived Snapchat, and more recently TikTok. However, those rivals might more heavily weigh on Instagram, for which Facebook doesn&t routinely disclose user stats.

Zuckerberg defends political ads policy

Facebookearnings announcement was somewhat overshadowed by Twitter CEO Jack Dorsey announcing it would ban all political ads — something TechCrunch previously recommended social networks do. That move flies in the face of Facebook CEO Mark Zuckerbergstaunch support for allowing politicians to spread misinformation without fact-checks via Facebook ads. This should put additional pressure on Facebook to rethink its policy.

Zuckerberg doubled-down on the policy, saying &I believe that the better approach is to work to increase transparency. Ads onFacebook are already more transparent than anywhere else,& he said. Attempting to dispel that the policy is driven by greed, he noted Facebook expects political ads to make up &less than 0.5% of our revenue next year.& Because people will disagree and the issue will keep coming up, Zuckerberg admitted itgoing to be &a very tough year.&

Facebook also announced that lead independent board member Susan D. Desmond-Hellmann has resigned to focus on health issues.

Earnings call highlights

Facebook expects revenue deceleration to be pronounced in Q4. But CFO David Wehner provided some hope, saying &we would expect our revenue growth deceleration in 2020 versus the Q4 rate to be much less pronounced.& That led Facebookshare price to spike from around $191 to around $198.

However, Facebook will maintain its aggressive hiring to moderate content. While the company has touted how artificial intelligence would increasingly help, Zuckerberg said that hiring would continue because &There&s just so much content. We do need a lot of people.&

Regarding Libraregulatory pushback, Zuckerberg explained that Facebook was already diversified in commerce if that doesn&t work out, citing WhatsApp Payments, Facebook Marketplace and Instagram shopping.

On anti-trust concerns, Zuckerberg reminded analysts that Instagramsuccess wasn&t assured when Facebook acquired it, and it has survived a lot of competition thanks to Facebookcontributions. In a new talking point we&re likely to hear more of, Zuckerberg noted that other competitors had used their success in one vertical to push others, saying &Apple and Google built cameras and private photo sharing and photo management directly into their operating systems.&

Scandals continue, but so does growth

Overall, it was another rough quarter for Facebookpublic perception as it dealt with outages and struggled to get buy-in from regulators for its Libra cryptocurrency project. Former co-founder Chris Hughes (who I&ll be leading a talk with at SXSW) campaigned for the social network to be broken up — a position echoed by Elizabeth Warren and other presidential candidates.

The company did spin up some new revenue sources, including taking a 30% cut of fan patronage subscriptions to content creators. Italso trying to sell video subscriptions for publishers, and it upped the price of its Workplace collaboration suite. But gains were likely offset as the company continued to rapidly hire to address abusive content on its platform, which saw headcount grow 28% year-over-year, to 43,000. There are still problems with how it treats content moderators, and Facebook has had to repeatedly remove coordinated misinformation campaigns from abroad. Appearing concerned about its waning brand, Facebook moved to add &from Facebook& to the names of Instagram and WhatsApp.

It escaped with just a $5 billion fine as part of its FTC settlement that some consider a slap on the wrist, especially since it won&t have to significantly alter its business model. But the company will have to continue to invest and divert product resources to meet its new privacy, security and transparency requirements. These could slow its response to a growing threat: Chinese tech giant ByteDanceTikTok.

- Details

- Category: Technology

Read more: Facebook shares rise on strong Q3, users up 2% to 2.45B

Write comment (93 Comments)CEO Jack Dorsey just announced, via tweet, that Twitter will be banning all political advertising — albeit with &a few exceptions& like voter registration.

&We believe political message reach should be earned, not bought,& Dorsey said.

While itnot totally clear how broad those exceptions will be, it sounds like the ban will apply to both ads endorsing candidates and ads advocating a position on political issues.

Dorsey said the company will share the final policy by November 15, and that it will start enforcing that policy on November 22.

&Internet political ads present entirely new challenges to civic discourse: machine learning-based optimization of messaging and micro-targeting, unchecked misleading information, and deep fakes,& he wrote. &All at increasing velocity, sophistication, and overwhelming scale.&

So why not continue accepting ads while trying to stamp out misinformation? He argued that the company &needs to focus our efforts on the root problems, without the additional burden and complexity taking money brings.&

A blanket policy could also help Twitter avoid the headache and controversy of making these determinations of truthfulness on a case-by-case basis.

This comes after Facebook, in particular, has faced heavy criticism around its refusal to fact-check political advertising (even as it took steps to fight election-related misinformation elsewhere), withFacebook employees writing an open letterobjecting to the companystance.

At the same time, one of the ads that prompted the recent controversy — in which the Trump campaign promoted a conspiracy theory about Joe Biden — also ran on YouTube and Twitter(and on some TV networks, although CNN refused to air it).

So even though the discussion has focused on Facebook, the broader questions of permissiveness and responsibility are ones that all the major internet platforms have to face.

Over the summer, in fact, Twitter said it would start blocking state-run media outlets from running ads on its platform after it identified an operation to &sow political discord& around the protests in Hong Kong, whichinvolved hundreds of accounts linked to the Chinese government.

The idea that Facebook should just ban all political ads is a solution thatbeen floated by a number of pundits, including our own Josh Constine. Before today, that might have seemed like an extreme or unrealistic step. Suddenly, it looks much more possible — or at least like Mark Zuckerberg will have to keep answering questions about this for a while.

Dorsey didn&t mention Facebook by name in his tweets, but he seemed to allude to the companyposition when he wrote, &For instance, it‘s not credible for us to say: ‘We&re working hard to stop people from gaming our systems to spread misleading info, buuut if someone pays us to target and force people to see their political ad…well…they can say whatever they want!  '&

'&

Italso interesting that Twitter chose to announce this just as Facebook released its latest earnings report.

Dorsey also acknowledged that Twitter is &a small part of a much larger political advertising ecosystem,& but he said, &We have witnessed many social movements reach massive scale without any political advertising. I trust this will only grow.&

In a statement, eMarketer senior analyst Jasmine Enberg said the move is &in stark contrast to Facebook,& but also noted &itlikely that political advertising doesn&t make up a critical part of Twittercore business.&

- Details

- Category: Technology

Read more: Jack Dorsey says Twitter will ban all political ads

Write comment (94 Comments)Page 485 of 5614

8

8

(@jack) October 30, 2019

(@jack) October 30, 2019