Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Plum, the fintech startup co-founded by early TransferWise employee Victor Trokoudes, is continuing its mission to help you manage your finances and save money. The AI-powered Messenger chatbot already offers savings functionality, including round-ups and regular savings, and today is launching an investment tool that lets you choose fund investments based on themes, such as ethical companies or technology.

Similar to competitors Cleo and Chip, Plum connects to your bank accounts and its algorithm then analyses your spending patterns to work out how much you can afford to set aside. It is able to identify things like income and bills, and can take a number of actions on your behalf.

This includes ‘micro-savings& — rounding up any purchases you make — and other forms of regular saving, in which money is moved from your bank account to a segregated Plum savings account. From there you&re able to optionally put money into RateSetter, the peer-to-peer lending platform, if you wish to earn interest.

However, savings is only one pillar of Plumthree pillar strategy. The other two are investments and spotting when you are paying too much for things like credit or utilities. Investing is getting an official launch today (having been announced in wait-list form a few months ago), and Trokoudes tells me energy switching, in partnership with green energy company Octopus, has been live for a while. If Plum detects that a user could reduce their home energy bill, it sends them a message offering to initiate the switch on their behalf.

Along with letting you invest at three different risk levels, Plumnew investment tool provides theme-based investing. At launch these are ‘Tech&, ‘Emerging Markets&, and ‘Ethical Companies&. Other themes the platform will add in the coming months include ‘AI&, ‘Nutrition&, and ‘Robotics&. You can invest from as little as £1.

Notably, Plum is charging a monthly fee of £1 for accessing the feature, along with 0.15 percent annually on the amount you have invested. If you choose the themed fund option there is an additional fund fee. However, Trokoudes says investing via Plum is still one of the cheapest options on the market, where higher percentage annual management fees soon add up.

Plum is also disclosing its latest user numbers. In the last year, the chatbot has grown from 22,000 users to 130,000. Thatarguably decent growth for what was quite a limited product feature-wise, so it will be interesting to see the take up for Plumnew investment tool and what effect that has on overall user numbers. As a comparison, competitor Cleo — which offers a raft of functionality but not yet investing — hit 200,000 users in April and said at the time it was growing by 3,000 users per day.

Meanwhile, Plum isn&t the only savings or PFM-type app that lets you invest based on themes Oval Money (see our previous coverage) has quietly launched an investment marketplace, starting with three funds.

The &Women at the Table& fund will allow investors to support companies that ensure that at least 20 percent of board members are women. A &Belong but Work Remote& fund promotes the growing &flexible jobs economy&. Lastly, &Generation Millennials& will track leading consumer brands that are particularly popular with millennials.

The move is said to reflect research Oval Money has conducted into the &increasing appetite younger savers have to invest in causes they believe in, rather than basing decisions only on traditional risk-return factors&.

- Details

- Category: Technology

Read more: Plum, the fintech chatbot that helps you save, adds theme-based investing

Write comment (91 Comments)Razer, the gaming hardware company that went public in Hong Kong last year, is resuming its investment strategy after it led a $3.3 million deal for Australia-basedEsports Mogul.

Esports Mogul is, as the name suggests, focused on e-sports. The company operates a platform for organizing e-sports competitions — called Mogul Arena — and a gaming news website. The firm is focused on Asia and Latin America and it went public in Australia via a reverse listing that raised it $7 million.

The new money will go towards developing Mogul Arena for mobile, and funding user acquisition and monetization pushes, Esports Mogul said.

Razer already works with Esports Mogul, and now this deal will increase the collaboration which will focus on integrating Razerpayment system, which itself was created by the recent acquisition of MOL, according to both companies.

Others in the round includeSingaporeCloud Alliance, which develops software systems for gamers. It recentlyraised $15 million from an ICO and it said it plans to work more closely with Esports Mogul and Razer going forward.

Esports Mogul said the round was over-subscribed, with existing investors and local Australian institutionsalso taking part. The deal is priced at AU$1.8 per share, which represents a20.55 percent discount on the company&svolume-weighted average share price over the last 15 days. Esports Mogul shares were priced just below $2 when it joined the ASX in late 2016.

- Details

- Category: Technology

Read more: Razer leads $3.3 M investment in Australia's Esports Magnate

Write comment (90 Comments)Companies spend a lot of time and money manually transferring data between services, while developer resources are constantly in demand. Firms like Mulesoft, Informatica, Boomi, Tibco, Workato, Zapier and others via for business against the likes of Informatica, Boomi and Mulesoft.

UK/US startup tray.io, a next-generation cloud integration provider, raised a $5m in a Series A two years ago.

The startup has now raised a $14.3 million round investment led by GGV Capital, bringing the companytotal financing to $21 million. Additional investors include True Ventures, Mosaic Ventures, and AngelPad. Glenn Solomon, Managing Partner, GGV Capital will join the companyboard of directors.

The company&General Automation Platform& claims to put complex integrations and enterprise-scale automation into the hands of businesses. This is, supposedly, &drag-and-drop ease-of-use.& The solution is built in a severless environment and is entirely API driven, affording the ability to scale faster. It says itnow working with companies like Segment and Udemy.

The funds will support Tray.iostrategic hiring initiatives and drive continued development of its integration and automation platform.

Commenting, Glenn Solomon of GGV Capital said: &The success of Tibco, Webmethods and the recent $6.5 billion Mulesoft acquisition by Salesforce shows the pivotal role of integration in todaycloud-based world. The talented Tray.io team has tapped into the demand for bespoke integrations and has established itself as a clear leader in this category.&

- Details

- Category: Technology

Read more: Tray.io raises a $14.3M funding round led by GGV Capital

Write comment (95 Comments)French startup Zenaton raised $2.35 million from Accel and Point Nine Capital, with the Slack Fund, Kima Ventures, Julien Lemoine and Francis Nappez also participating. The company wants to take care of the most tedious part of your application — asynchronous jobs and background tasks.

While it has never been easier to develop a simple web-based service with a database, building and scaling workflows that handle tasks based on different events still sucks.

Sometimes your background task fails and itgoing to take you days before you notice that your workflow stopped working. Some workflows might require so much resources that you&ll end up paying a huge server bill to get more RAM to handle those daily cron jobs and performance spikes.

And yet, many small companies would greatly benefit from adding asynchronous jobs. For instance, you could improve your retention rate by sending email reminders. You could try to upsell your customers with accessories if you&re running an e-commerce website. You could ask for reviews a few hours after a user found a restaurant through your app.

&We work hard to make it super easy & as a developer, you just have to install the Zenaton agent on your worker servers. Thatall. Specifically, you&ll no longer have to maintain a queuing system for your background jobs, thereno more cron, no more database migrations to store transient states,& co-founder and CEO Gilles Barbier told me. Barbier previously worked at The Family and Zenaton is part of The Familyportfolio.

Zenaton is already working with a big client and handles millions of workflow instances for them. You can try Zenaton for free if you execute less than 250,000 tasks per month. After that, plans start at $49 per month and you&ll pay more depending on how much RAM you consume with your workflows.

For now, you can integrate Zenaton with a PHP and a Node application, but the company is working on more languages, starting with Python, Ruby and Java. Itclear that the product is still young.

But it sounds like a promising start. If you have a small development team, it could make sense to use Zenaton and a workflow-as-a-service approach.

- Details

- Category: Technology

Read more: Zenaton lets you build and run workflows with ease

Write comment (91 Comments)The ongoing shift of emphasis in the cyber security industry from defensive, reactive actions towards pro-active detection and response has fueled veteran Finnish security company F-Secure acquisition of MWR InfoSecurity, announced today.

F-Secure is paying £80 million(€91,6M) in cash to purchase all outstanding shares in MWR InfoSecurity, funding the transaction with its own cash reserves and a five-year bank loan.In addition, the terms include an earn-out of a maximum of £25M (€28,6M) in cash to be paid after 18 months of the completion subject to the achievement of agreed business targets for the period from1 July, 2018, until31 December, 2019.

F-Secure says the acquisition will enable it to offer its customers access to the more offensive skillsets needed to combat targeted attacks — specialist capabilities that most companies are not likely to have in-house.

It points to detection and response solutions (EDR) and managed detection and response services (MDR) as one of the fastest growing market segments in the security space. And says the acquisition makes it the largest European single source ofcyber security services and detection and response solutions, positioning it to cater to both mid-market companies and large enterprises globally.

&The acquisition brings MWR InfoSecurityindustry-renowned technologies to F-Secure making our detection and response offering unrivaled,& said F-Secure CEOSamu Konttinen in a statement. &Their threat hunting platform (Countercept) is one of the most advanced in the market and is an excellent complement to our existing technologies.&

As well as having experts in-house skilled in offensive techniques, MWR InfoSecurity — a UK company that was founded in 2002 — is well known for its technical expertise and research.

And F-Secure says it expects learnings from major incident investigations and targeted attack simulations to provide insights that can be fed directly back into product creation, as well as be used to upgrade its offerings to reflect the latest security threats.

MWR InfoSecurity also has a suite of managed phishing protection services (phishd) which F-Secure also says will also enhance its offering.

The acquisition is expected to close in early July, and will add around 400 employees to F-Secureheadcount. MWR InfoSecuritymain offices are located in theUK, the US,South AfricaandSingapore.

&I&m thrilled to welcome MWR InfoSecurityemployees to F-Secure. With their vast experience and hundreds of experts performing cyber security services on four continents, we will have unparalleled visibility into real-life cyber attacks 24/7,& added Konttinen. &This enables us to detect indicators across an incredible breadth of attacks so we can protect our customers effectively. As most companies currently lack these capabilities, this represents a significant opportunity to accelerate F-Securegrowth.&

&We&ve always relied on research-driven innovations executed by the best people and technology. This approach has earned MWR InfoSecurity the trust of some of the largest organizations in the world,& added MWR InfoSecurity CEO,Ian Shaw, who will be joining F-Secureleadership team after the transaction closes. &We see this approach thriving atF-Secure, and we look forward to working together so that we can break new ground in the cyber security industry.&

The companies will be holding a webcast to provide more detail on the news for investors and analysts later today, at13:30 EEST.

- Details

- Category: Technology

Read more: F-Secure to buy MWR InfoSecurity for ~$106M+ to offer better threat hunting

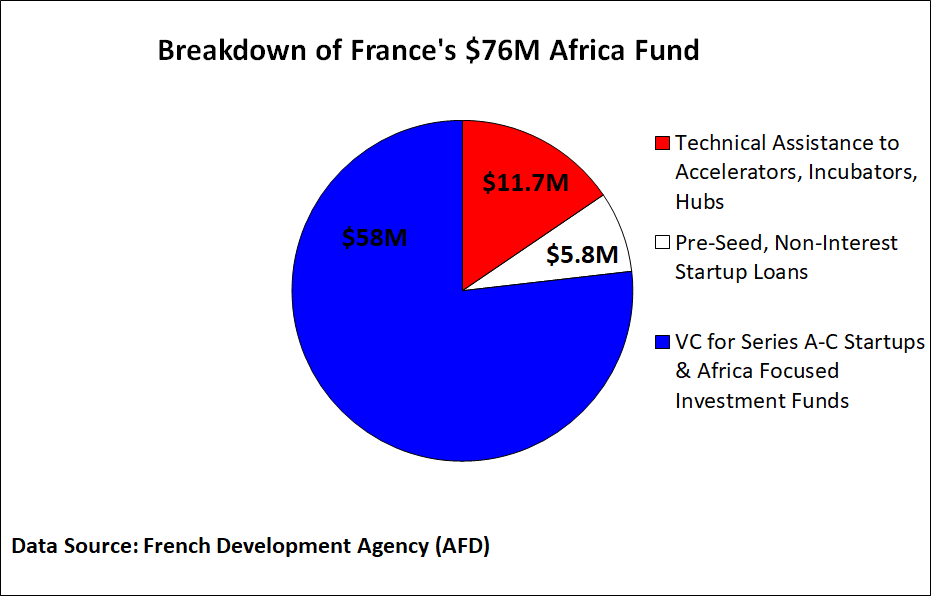

Write comment (95 Comments)Weeks after French President Emmanuel Macronunveiled a $76M African startup fundat VivaTech 2018, TechCrunch paid a visit to theFrench Development Agency(AFD) — who will administer the new fund — to get more details on howle noveau fondswill work.

The $76M (or€65M) will divvy up into three parts, according to AFD Digital Task Team LeaderChristine Ha.

&There are €10M [$11.7M] for technical assistance to support the African ecosystem… €5M will be available as interest free loans to high potential, pre seed startups…and…€50M [$58M] will be for equity-based investments in series A to C startups,& explained Ha during a meeting in Paris.

The technical assistance will distribute in the form of grants to accelerators, hubs, incubators, and coding programs. The pre-seed startup loans will issue in amounts up to $100K &as early, early funding to allow entrepreneurs to prototype, launch, and experiment,& said Ha.

The $58M in VC startup funding will be administered throughProparco, a development finance institution—orDFI—partially owned by the AFD. The money will come &from Proparcobalance sheet&…and a portion &will be invested in VC funds active on the continent,& said Ha.

Proparco already invests in Africa focused funds such asTLcom CapitalandPartech Ventures. &Proparco will take equity stakes, and will be a limited partner when investing in VC funds,& said Ha.

Startups from all African countries can apply for a piece of the $58M by contacting any ofProparcoAfrica offices(including in Casablanca, Abidjan, Douala, Lagos, Nairobi, Johannesburg).

And what will AFD (and Proparco) look for in African startup candidates &We are targeting young and innovative companies able to solve problems in terms of job creation, access to financial services, energy, health, education and affordable goods and services…[and] able to scale up their venture on the continent,& said Ha.

The $11.7M technical assistance and $5.8M loan portions of Francenew fund will be available starting 2019. On implementation, AFD is still &reviewing several options…such as relying on local actors through [France&s] Digital Africa platform,& said Ha.

Digital Africa—a broader French government initiative to support the African tech ecosystem—will launch a new online platform in November 2018 with resources for startup entrepreneurs.

So thatthe skinny on Francenew Africa fund. It adds to a load of VC announced for the continent in less than 15 months, including$70 for Partech Ventures, TPG Growth$2BN Rise Fund, and$40M at TLcom Capital

Though $75M (and these other amounts) may pale compared to Silicon Valley VC values, ita lot for a startup scene that — at rough estimate—attracted only$400M four years ago.African tech entrepreneurs, you now have a lot more global funding options, including from France.

- Details

- Category: Technology

Read more: Breaking down France’s new $76M Africa startup fund

Write comment (97 Comments)Page 5019 of 5614

10

10