Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

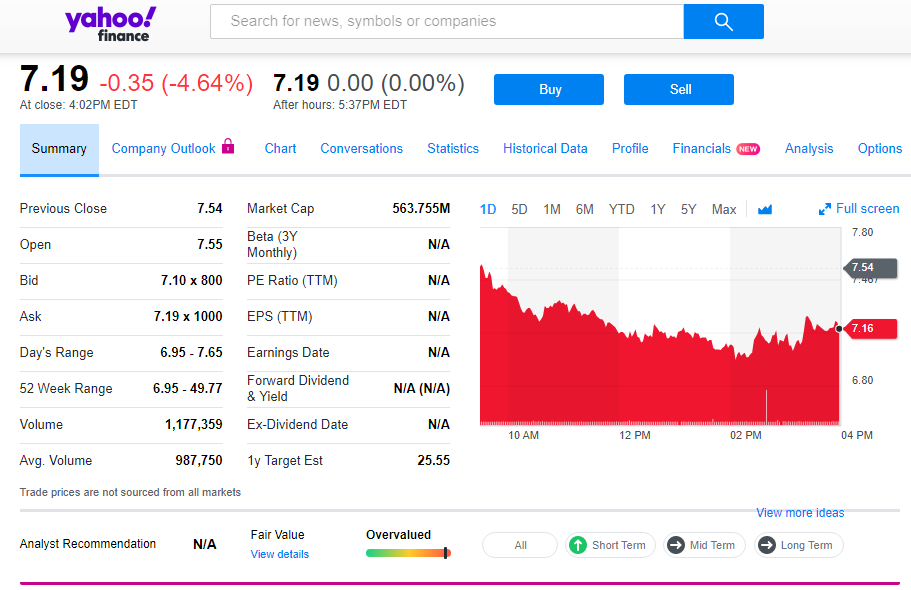

Shares of Africa focused e-commerce company Jumia dropped 4% the day after the lockup period expired for its April IPO on the New York Stock Exchange.

The lockup provision prevents major shareholders — namely those who purchased equity pre-public listing — from selling their shares for a specified number of days following the IPO.

Jumiastock price began Thursday at $7.54, fell to an all-time low of $6.98 by 2pm, and then closed 35 cents down from opening, at $7.19. Jumiatrading volume on Thursday moved up 19 percent over the daily average since the company went public.

Sites that track SEC Form 4 trades, or sales by insiders, aren&t showing anything (at the moment) for Jumia.

Sites that track SEC Form 4 trades, or sales by insiders, aren&t showing anything (at the moment) for Jumia.

What does this all mean? It appears there wasn&t an immediate big stock sell by Jumiaearly and large shareholders post lockup expiry. There was some speculation these investors could drop the company after several rough and tumble months for Jumia post IPO.

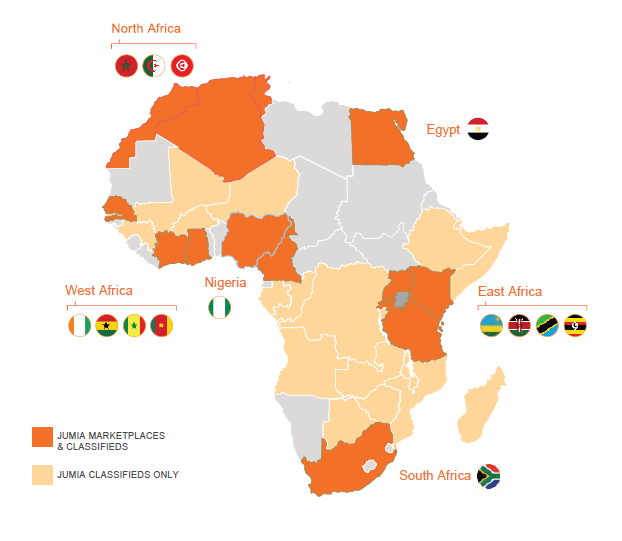

Founded in Lagos in 2012, Jumia currently operates multiple online verticals in 14 African countries — from B2C consumer retail to travel bookings.

For Jumia, going public has been an up and down affair. After becoming the first tech startup operating in Africa to list on a major exchange, the company saw its share price rise 70% after listing on the NYSE in April at $14.50.

Then in May, Jumiastock tumbled when it came under assault from a short-seller, Andrew Left, who accused the company of fraud in its SEC filings.

Jumialatest earnings reporting — delivered in August — had some downside beyond losses. The company did post second-quarter revenue growth of 58% (≈$43 million) and increased its customer base to 4.8 million from 3.2 million over the same period a year ago.

But Jumia also posted greater losses for the period, 67.8 million euros, compared to 42.3 million euros in 2018.

On top of that, Jumia opened up about a sales related fraud (that it has reported in its original SEC IPO filing) committed by some of its employees and members of its JForce program &to benefit from differences between commissions charged to sellers and higher commissions paid to JForce agents,& according to a Jumia statement.

&The transactions in question generated approximately 1% of our GMV in each of 2018 and the first quarter of 2019 and had virtually no impact on our 2018 or 2019 financial statements,& the statement continued.

Collectively, this has added up to influence Jumiashare-price falling some 50% from its opening price of $14.50 and 80% from its high of $46.99 on May 1.

As a public company now, the most direct way for Jumia to revive its share-price would be reducing its losses while maintaining or boosting revenues. Of course, thatthe common prescription for many a tech company.

Jumia believes expanding and generating more revenue through its JumiaPay product (with better margins than B2C e-commerce transactions) could help close the revenue vs. loss gap.

Investors and the market at large will be able to track Jumiaprogress during its next (Q3) earnings call, scheduled for November 12, Jumia confirmed to TechCrunch.

- Details

- Category: Technology

Read more: Africa e-tailer Jumia’s shares fall 4% day after IPO lockup expiration

Write comment (97 Comments)SAP CEO Bill McDermott today announced that he wouldn&t seek to renew his contract for the next year and step down immediately after nine years at the helm of the German enterprise giant.

Shortly after the announcement, I talked to McDermott, as well as SAPnew co-CEOs Jennifer Morgan and Christian Klein. During the call, McDermott stressed that his decision to step down was very much a personal one, and that while henot ready to retire just yet, he simply believes that now is the right time for him to pass on the reins of the company.

To say that todaynews came as a surprise is a bit of an understatement, but it seems like itsomething McDermott has been thinking about for a while. But after talking to McDermott, Morgan and Klein, I can&t help but think that the actual decision came rather recently.

I last spoke to McDermott about a month ago, during a fireside chat at our TechCrunch Sessions: Enterprise event. At the time, I didn&t come away with the impression that this was a CEO on his way out (though McDermott reminded me that if he had already made up his decision a month ago, he probably wouldn&t have given it away anyway).

&I&m not afraid to make decisions. Thatone of the things I&m known for,& he told me when I asked him about how the process unfolded. &This one, I did a lot of deep soul searching. I really did think about it very heavily — and I know that itthe right time and thatwhy I&m so happy. When you can make decisions from a position of strength, you&re always happy.&

He also noted that he has been with SAP for 17 years, with almost 10 years as CEO, and that he recently spent some time talking to fellow high-level CEOs.

&The consensus was 10 years is about the right amount of time for a CEO because you&ve accomplished a lot of things if you did the job well, but you certainly didn&t stay too long. And if you did really well, you had a fantastic success plan,& he said.

In &the recent past,& McDermott met with SAP chairman and co-founder Hasso Plattner to explain to him that he wouldn&t renew his contract. According to McDermott, both of them agreed that the company is currently at &maximum strength& and that this would be the best time to put the succession plan into action.

SAP co-CEO Jennifer Morgan.

&With the continuity of Jennifer and Christian obviously already serving on the board and doing an unbelievable job, we said letcontrol our destiny. I&m not going to renew, and these are the two best people for the job without question. Then they&ll get a chance to go to Capital Markets Day [in November]. Set that next phase of our growth story. Kick off the New Year — and do so with a clean slate and a clean run to the finish line.

&Very rarely do CEOs get the joy of handing over a company at maximum strength. And today is a great day for SAP. Ita great day for me personally and Hasso Plattner, the chairman and [co-]founder of SAP. And also — and most importantly — a great day for Jennifer Morgan and Christian Klein.&

Don&t expect for McDermott to just fade into the background, though, now that he is leaving SAP. If you&ve ever met or seen McDermott speak, you know that heunlikely to simply retire. &I&m busy. I&m passionate and I&m just getting warmed up,& he said.

As for the new leadership, Morgan and Klein noted that they hadn&t had a lot of time to think about the strategy going forward. Both previously held executive positions in the company and served on SAPboard together for the last few years. For now, it seems, they are planning on continuing on a similar path as McDermott.

&We&re excited about creating a renewed focus on the engineering DNA of SAP, combining the amazing strength and heritage of SAP — and many of the folks who have built the products that so many customers around the world run today — with a new DNA thatcome in from many of the cloud acquisitions that we&ve made,& Morgan said, noting that both she and Klein spent a lot of time over the last few months bringing their teams together in new ways. &So I think for us, that tapestry of talent and that real sense of urgency and support of our customers and innovation is top of mind for us.&

SAP co-CEO Christian Klein

Klein also stressed that he believes SAPcurrent strategy is the right one. &We had unbelievable deals again in Q3 where we actually combined our latest innovations — where we combined Qualtrics with SuccessFactors with S/4 [Hana] to drive unbelievable business value for our customers. This is the way to go. The business case is there. I see a huge shift now towards S/4, and the core and business case is there, supporting new business models, driving automation, steering the company in real time. All of these assets are now coming together with our great cloud assets, so for me, the strategy works.&

Having co-CEOs can be a recipe for conflict, but McDermotttime as CEO also started out as co-CEO, so the company does have some experience there. Morgan and Klein noted that they worked together on the SAP board before and know each other quite well.

Whatnext for the new CEOs? &There has to be a huge focus on Q4,& Klein said. &And then, of course, we will continue like we did in the past. I&ve known Jen now for quite a while — there was a lot of trust there in the past and I&m really now excited to really move forward together with her and driving huge business outcomes for our customers. And letnot forget our employees. Our employee morale is at an all-time high. And we know how important that is to our employees. We definitely want that to continue.&

Ithard to imagine SAP with McDermott, but we&ve clearly not seen the last of him yet. I wouldn&t be surprised if we saw him pop up as the CEO of another company soon.

Below is my interview with McDermott from TechCrunch Sessions: Enterprise.

- Details

- Category: Technology

Read more: SAP’s Bill McDermott on stepping down as CEO

Write comment (95 Comments)Three years ago, the founder of LendingClub, Renaud Laplanche, took the wraps off his second act, a consumer lending venture called Upgrade that now employs 350 people, has lent roughly $2 billion to 200,000 people, and has raised $142 million from outside investors.

At the time, it was jumping into a crowded market that has only become more frenzied, with a growing number of fintech startups that market themselves as more thoughtful alternatives to established banks and traditional credit card companies. While giants like Visa and MasterCard charge interest and late fees for overdue payments, for example, the Swedish unicorn company Klarna — which allows shoppers to buy now and pay later — makes money through retailer transaction fees and late fees but doesn&t charge interest fees. Similarly, Max Levchinlending company, Affirm, doesn&t charge late fees when its customers rack up big charges but it does charge interest rates — sometimes as high as 30 percent.

Upgrade is slightly different in that that it doesn&t invite customers to defer their payments when they buy something using dollars from Upgrade. But it still largely fits into the same mold in that it markets itself as better for lending customers and more mindful of them. Its flagship personal loans product, for example, is largely used by customers to pay off credit cards and it features credit health tools that ostensibly teach people how to improve their credit scores.

It also charges up to 35.89% interest annually to a small percentage of users.

A brand-new credit product — the Upgrade Card — takes things even further on the feel-good front. As Laplanche explains it, the card &basically combines the payments capabilities of a credit card with the low cost of a bank loan into one single product.&

Adds Laplanche of this hybrid creation: &Lending Club created a $100 billion industry with personal loans 12 years ago; I think this is 10 times bigger — and 10 times cheaper for consumers.

We&re inherently skeptical of most lending products being good — or &cheap& — for customers. But herehow it works: instead of asking a cardholder to pay a minimum amount each month from the balance they owe on their card, Upgrade breaks down the balance into an installment plan with equal monthly payments — plus an interest payment — that can be completed in a year to three years& time.

&Itlike a mortgage or a car loan with a clear payment schedule,& says Laplanche. &You can budget for it and it sort of forces you to pay down the balance over a reasonable period,& unlike credit cards where customers can run a balance for as long as they like — which can wind up costing them an arm and a leg in interest payments alone over time.

There is no prepayment penalty and the card replenishes as it is paid off. More, unlike many credit cards that reward users for spending with cash back and other perks, Upgrade customers receive 1% cash back each time they make a payment toward their balance.

Still, there is an annual percentage rate as with most credit cards, and itnot much kinder than other alternatives, with a span of 6.49% to upwards of 29.99%. (In fairness, the highly hyped Apple Card comes with a starting APR of 13%.)

Laplanche further concedes that, as with any lending product, customers who miss payments or start with a lower credit score are more likely to confront a higher interest rate than someone who is able to pay off their card as they use it.

Upgrade partnered with Cross River Bank on its new offering. The 11-year-old, Fort Lee, N.J.-based institution has itself raised at least $128 million over the years, including via a $100 million round led by KKR that closed late last year and a $28 million round put together in 2016 with funding from Battery Ventures, Andreessen Horowitz, and Ribbit Capital, among others. In fact, Cross River has become the go-to institution for a lot of fintech startups, including Affirm, Transferwise, and Coinbase — startups that want to stay compliant with consumer protection regulations and that might have wanted to steer clear of large banks, especially when starting out.

Upgrade, which closed its last round, is probably due for a new funding round itself, having closed its $62 million Series C round in August of last year. Asked about this, however, Laplanche says only that, &We&re good.&

In the meantime, itplanning ahead with the resources it has. Beyond the Upgrade Card, the San Francisco-based company expects to introduce a savings account in the first quarter of next year, a move similar to that which Robinhood announced earlier this week when it unveiled a high-yield cash management account.

It makes sense. If the economy turns — and it seems likely, given the ongoing spat between China and the U.S., not to mention other unanswered questions — consumers will increasingly look for safe havens like savings and cash management accounts.

Whether the moves are enough to insulate Upgrade or these other fintech startups in a serious downturn remains to be seen. But Laplanche has weathered worse before.

Though LendingClub was among the first peer-to-peer lenders and enjoyed a splashy debut on the public market in the summer of 2014, by the spring of 2016, Laplanche was asked to resign and was soon after charged by the SEC with fraudulently inflating the companyreturns.

He settled with the agency last year without admitting wrongdoing. He also paid a fine and agreed to be barred from the securities industry for three years.

- Details

- Category: Technology

&Orphan Black& ended its five-season run back in 2017, but Serial Box is currently continuing the story with &Orphan Black: The Next Chapter,& a weekly series of e-books and audiobooks.

While spin-ff novels and licensed fiction are nothing new, I was particularly interested in this revival because Serial Box is a venture-backed startup bringing back the tradition of serialized fiction. Plus, &The Next Chapter& feels particularly official because the audio version is narrated by Tatiana Maslany, whose starring turn as the showvarious clones was so central to its appeal.

So for a bonus episode of the Original Content podcast, I spoke to Malka Older, the head writer of &Orphan Black: The Next Chapter.&

Older was a fan of the series, and she explained that by jumping several years ahead in the &Orphan Black& timeline, the writing team could &give the original series space to breathe& and find a new approach to its big themes.

While Older noted that she has no problem depicting large corporations as villains — something shedone in her own novels — she wanted to do something new here:

We started thinking more about governments. And particularly when you come to these questions of biotechnology and genetics, governments are increasingly getting involved and trying to figure out what their role is in regulating them — or facilitating them for economic reasons. And then we&re also seeing security questions and things like biometric security become much more pervasive. So to start thinking about how that would effect the lives of these clones was just a really rich seam to open up.

We also cover some topics that should be interesting to non-&Orphan Black& fans, like the appeal of serialized fiction versus binge-watching. Older noted that if you wait for all the weekly installments to come out, you can still binge &The Next Chapter,& but she also said, &Not all of us have the opportunity to really binge everything. And itnot always bad to have structural constraints on how much you can consume at one time.&

You can listen to the interview in the player below, subscribe using Apple Podcastsor find us in your podcast player of choice. If you like the show, please let us know by leaving a review on Apple. You can also send us feedback directly. (Or suggest shows and movies for us to review!)

- Details

- Category: Technology

SAP today announced that Bill McDermott, its CEO for the last nine years, is stepping down immediately. The company says he decided not to renew his contract. SAP Executive Board members Jennifer Morgan and Christian Klein have been appointed co-CEOs.

McDermott, who started his business career as a deli owner in Amityville, Long Island and recently spoke at our TechCrunch Sessions: Enterprise event, joined SAP in 2002 as the head of SAP North America. He became co-CEO in 2008 and the companysole CEO in 2014, making him the first American to take on this role at the German enterprise giant. Under his guidance, SAPannual revenue and stock price continued to increase. He&ll remain with the company in an advisory role for the next two months.

Itunclear why McDermott decided to step down at this point. Activist investor Elliott Management recently disclosed a $1.35 billion stake in SAP, but when asked for a comment about todaynews, an Elliott spokesperson told us that it didn&t have any &immediate comment.&

Italso worth noting that the company saw a number of defections among its executive ranks in recent months, with both SAP SuccessFactors COO Brigette McInnis-Day and Robert Enslin, the president of its cloud business and a board member, leaving the company for Google Cloud.

&SAP would not be what it is today without Bill McDermott,& said Plattner in todayannouncement. &Bill made invaluable contributions to this company and he was a main driver of SAPtransition to the cloud, which will fuel our growth for many years to come. We thank him for everything he has done for SAP. We also congratulate Jennifer and Christian for this opportunity to build on the strong foundation we have for the future of SAP. Bill and I made the decision over a year ago to expand Jennifer and Christianroles as part of a long-term process to develop them as our next generation of leaders. We are confident in their vision and capabilities as we take SAP to its next phase of growth and innovation.&

McDermottbiggest bet in recent years came with the acquisition of Qualtrics for $8 billion. At our event last month, McDermott compared this acquisition to Appleacquisition of Next and Facebookacquisition of Instagram. &Qualtrics is to SAP what those M-A moves were to those wonderful companies,& he said. Under his leadership, SAP also acquired corporate expense and travel management company Concur for $8.3 billion and SuccessFactors for $3.4 billion.

&Now is the moment for everyone to begin an exciting new chapter, and I am confident that Jennifer and Christian will do an outstanding job,& McDermott said in todayannouncement. &I look forward to supporting them as they finish 2019 and lay the foundation for 2020 and beyond. To every customer, partner, shareholder and colleague who invested their trust in SAP, I can only relay my heartfelt gratitude and enduring respect.&

Updating…

- Details

- Category: Technology

Read more: Bill McDermott steps down as SAP’s CEO

Write comment (94 Comments)Udacity, the online education company founded by Sebastian Thrun, is launching a new scholarship initiative as part of the Pledge to AmericaWorkers job training initiative undertaken by the administration of President Donald Trump.

Under the leadership of newly minted chief executive Gabe Dalporto, Udacity is committing to giving away free introductory technology training classes to 20,000 applicants every year.

The program is focused on teaching front-end web development, mobile app development and data analytics. There are no prerequisites for applicants, but the scholarships are reserved for low-income individuals looking to learn programming skills.

This initiative is reserved for low-income individuals looking to learn the in-demand skills needed to land higher-paying jobs and advance their careers.

New initiatives to train American workers in tech-related fields couldn&t come at a better time. According to McKinsey, 38.6 million people in the United States will potentially be displaced and need to change their jobs by 2030. Meanwhile companies are telling consulting organizations like Gartner that a shortage of available talent is their top concern.

Udacity will roll out the program in two phases. The first is the 100,000 &challenge scholarships,& which provide access to the companyintroductory classes open to any skill level that require a few hours of work per week over a two to three-month period.

These students will get access to Udacity mentors and Community Managers and have a chance to qualify for one of Udacityfull Nanodegree programs. The top 10,000 students (based on their progress through the first phase of the program and overall contributions to the Udacity community) will have their Nanodegrees paid for.

Each Udacity Nanodegree costs $399 per month, and students typically graduate within five months. According to data from the company, roughly half of students who have gotten jobs through the Udacity program have increased their salaries by an average of 38%.

Image courtesy of Getty Images/DeanDrobot

&I hope every one of these students gets a better, higher-paying job,& Dalporto says. &The challenge is that — as you know — education equals opportunity in this country, and so many people have been left out of the traditional education system in this country.&

For Dalporto, the decision to launch this scholarship initiative was inspired by his experiences seeing how technology and economic transformation had hollowed the economy in his home state of West Virginia. The evolution of an automated economy changed the nature of the state — impacting everyone, not just the blue-collar workers that most people think of when they worry about the risks of automation.

&We are trying to get as broad a range of people into these programs as possible,& says Dalporto. To that end, Dalporto says Udacity will partner with local leaders to customize the programs to specific geographies &to have the maximal impact.&

The biggest shift for the company is to offer its introductory classes as a separate program. Typically, Udacity has used those intro courses as an onramp into its more robust Nanodegree program.

Dalporto says the company would also consider offering certification to people who complete the initial training as a way to indicate achievement and flag skills that could be meaningful to potential employers.

&These courses are quite full of content and they&re quite challenging. [Completing one] shows that someone has a lot of determination and critical thinking skills and logical thinking skills,& says Dalporto. &If you graduate from one of our courses or Nanodegrees ita high indicator that you would be successful in other types of courses.&

In all, the program will cost Udacity tens of millions of dollars, Dalporto says.

Dalporto sees the new initiative as an extension of the companyenterprise business. The newer business model launched only a few years ago and already represents a third of Udacityrevenue (growing at 100% year-over-year).

&Returning to my hometown in West Virginia, I see first-hand the hardship caused when entire industries disappear and automation displaces workers,& Dalporto wrote on the Udacity blog. &But with the right skills-based learning programs, career advancement can become accessible to absolutely everyone. I&m confident that Udacitytech and analytics scholarships will provide every recipient with the chance to learn new skills, launch or advance their career, and unlock their potential in careers that will remain in demand as technology continues to evolve.&

- Details

- Category: Technology

Page 663 of 5614

16

16