Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Group Nine — the digital media company formed by the merger of Thrillist, NowThis, The Dodo and Seeker — just announced that it has reached an agreement to acquire womenlifestyle publisher PopSugar.

The financial terms of the deal were not disclosed, but The Wall Street Journal reports that itan all-stock transaction that values PopSugar at more than $300 million.

PopSugar was founded by husband-and-wife Brian and Lisa Sugar in 2006, and previously raised $41 million in funding from Sequoia Capital and IVP. Group Nine, meanwhile, just announced a fresh $50 million in funding from its backers Discovery and IVP, which it said would be used to grow its commerce business and for strategic acquisitions.

Brian and Lisa Sugar are both joining Group Nineexecutive team. Brian Sugar and SequoiaMichael Moritz are also joining Group Nineboard of directors.

Earlier this year, there were reports that Group Nine wasin talks to acquire a different womenlifestyle publisher, Refinery29, which was ultimately acquired by Vice Mediainstead.

In a statement, Group Nine CEO Ben Lerer (pictured above) said:

When we started Group Nine almost three years ago by combining Thrillist, NowThis, The Dodo, and Seeker, we foresaw the impending consolidation of the industry and set out to create a model for the next-generation media company with significant scale, deeply loyal and engaged audiences, multiplatform expertise, and highly diversified revenue. POPSUGAR hugely expands our reach within an important demographic, bringing us a community that deeply loves the POPSUGAR brand and a company with the proven ability to diversify their revenue across premium advertising, affiliate, direct-to-consumer commerce, licensing, and experiential channels.

In the acquisition announcement, Group Nine says the combined organizations will reach an audience of more than 200 million social media followers and also points to PopSugarcommerce offerings — including its quarterly subscription Must Have Box and its Glow marketplace for fitness content and merchandise — as a good fit for its broader ambitions in this market.

- Details

- Category: Technology

Read more: Group Nine acquires PopSugar

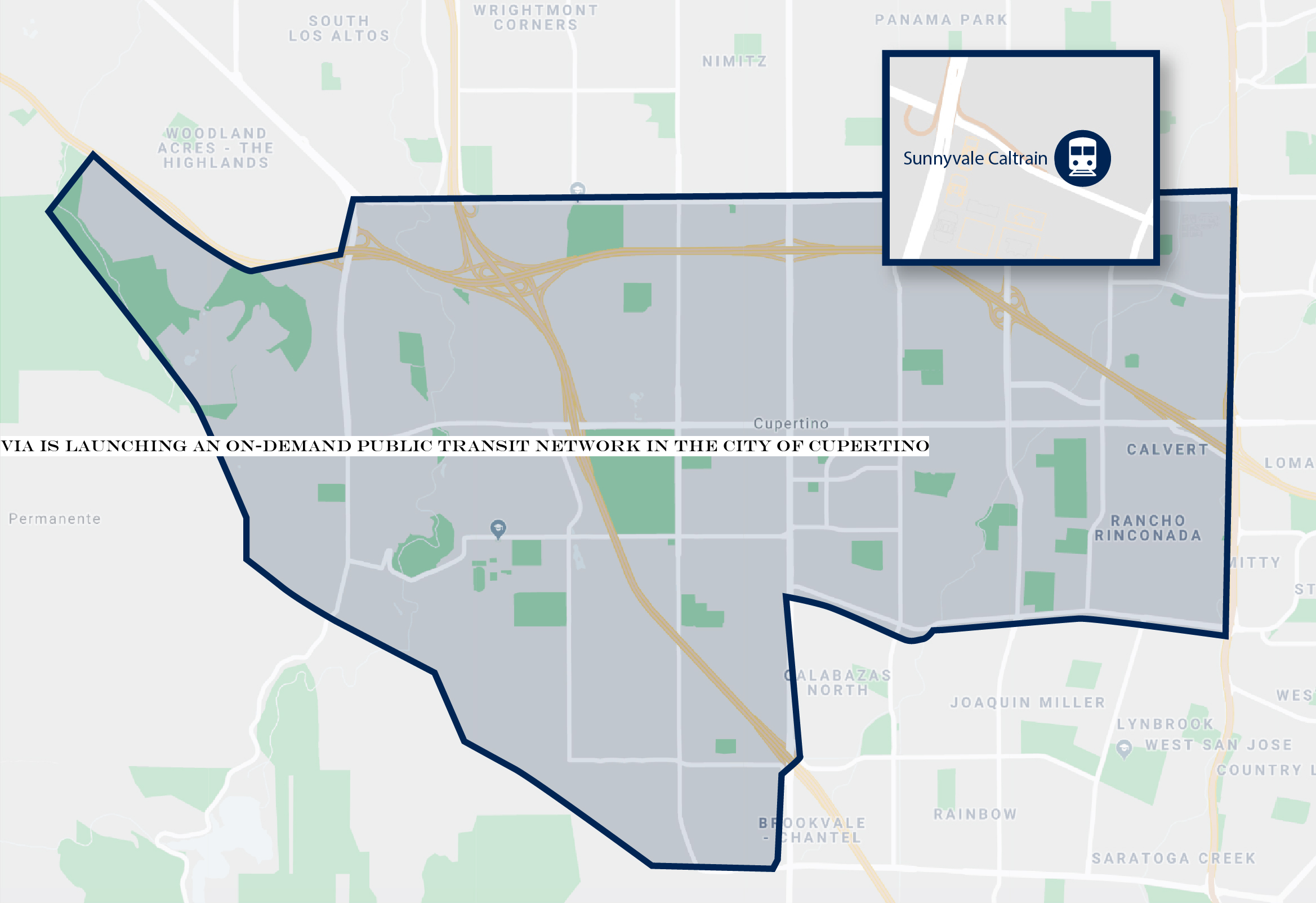

Write comment (99 Comments)Shuttle startup Via and the city of Cupertino are launching an on-demand public transportation network, the latest example of municipalities trying out alternatives to traditional buses.

The aim is for these on-demand shuttles, which will start with six vans branded with the city of Cupertino logo, to provide more efficient connections to CalTrain and increase access to public transit across the city.

The on-demand shuttle service, which begins October 29, will eventually grow to 10 vehicles and include a wheelchair-accessible vehicle. Avis Budget Group, another partner in this service, is the fleet management service that will maintain the vehicles.

In Cupertino, residents and commuters can use the Via app or a phone reservation system to hail a shuttle. The network will span the entire 11-square-mile city with a satellite zone surrounding the Sunnyvale CalTrain station for commuters, Via said Monday. Cupertino Mayor Steven Scharf views the Via on-demand service as the next generation of &what public transportation can be, allowing us to increase mobility while taking a step toward our larger goal of reducing traffic congestion.&

The service, which will run from 6 a.m. to 8 p.m. weekdays and 9 a.m. to 5 p.m. Saturdays, will cost $5 a ride. Users can buy weekly and monthly passes for $17 and $60, respectively.

Via has two sides to its business. The company operates consumer-facing shuttles in Chicago, Washington, D.C. and New York.

Via also partners with cities and transportation authorities, giving clients access to their platform to deploy their own shuttles. The city of Cupertino, home to Apple, SeaGate Technologies and numerous other software and tech-related companies, is one example of this. AustinCapital Metropolitan Transportation Authority also uses the Via platform to power the cityPickup service. And Viaplatform is used by ArrivaBus UK, a Deutsche Bahn Company, for a first- and last-mile service connecting commuters to a high-speed train station in Kent, U.K.

In January, Via announced it was partnering with Los Angeles as part of a pilot program that will give people rides to three busy public transit stations. Via claims it now has more than 80 launched and pending deployments in more than 20 countries, providing more than 60 million rides to date.

While city leaders appear increasingly open to experimenting with on-demand shuttles, success in this niche business isn&t guaranteed. For instance, Chariot, which was acquired by Ford, shut down its operations in San Francisco, New York and the U.K. in early 2019.

- Details

- Category: Technology

Read more: Via is launching an on-demand public transit network in the city of Cupertino

Write comment (94 Comments)By now, you&ve probably heard about the tweet heard ‘round the world, or at least, the part of the world where Mandarin is spoken. The GM of the Houston Rockets basketball franchise wrote a tweet — since deleted — supporting the democracy protesters that have lit up Hong Kong these past few weeks.

As Eben Novy-Williams of Bloomberg wrote, &Through decades of painstaking deal-making, the NBA created a multibillion-dollar opportunity in China, the worldsecond-largest economy. Now a single swiftly deleted tweet has put all that time and money in jeopardy.&

Ita situation thatbecoming increasingly typical for American companies, technology or not. Apple pulled the Taiwanese flag emoji from keyboards in Hong Kong and Macau this weekend, lest it lose its lucrative, mostly-iPhone market that accounted for $10 billion in revenues in its last quarter. US-headquartered airliners had to change the pulldown options in their checkout flows to avoid mentioning Taiwan last year, lest they lose access to Chinese airspace.

One wonders what kind of a business empire can collapse with a single dropdown menu item?

Or a single emoji?

Or a single tweet?

Businesses are not supposed to be this brittle, but American companies continue to approach the mirage of the Chinese economy as if it is open for the taking, and that the American consumer (and their representatives in Washington) are going to continue to ignore the &authoritarian straddle& these companies have to undertake to appease Beijing while trying to not displease Washington.

Despite all evidence to the contrary that such a straddle is impossible though, they keep on coming.

Just this past week, PayPal announced that it was entering mainland China through its acquisition of GoPay, becoming the first foreign payments provider in the highly-digitalized economy. Over the past year, MSCI, the creator of some of the most important stock indices in the world, has increasingly shifted weight to Chinese stocks, sending billions of dollars to mainland companies.

What is surprising is that this whole rise-and-fall, can-we-get-in-and-stay-in story was already written by Google almost exactly a decade ago. Google worked hard for years to cement itself on the mainland, but following a series of hacks that targeted political dissidents using its Gmail service, Google announced that it was leaving the country in 2010, redirecting users to its Hong Kong search engine.

Since that decision, Google has had very little access to mainland China, nor have any other prominent American tech companies. The one notable exception has been LinkedIn, which has engaged in aggressive censoring of speech in China in order to keep the lights on (although, given the speech I read on LinkedIn, one wonders whether a complete blackout in America wouldn&t do us all a favor).

As much as Googleexecutives (and its shareholders) may have wanted to re-enter China though, it seems obvious that the enforced lack of access has ultimately been a godsend for the companypolicy decisions. For a decade, it barely had to handle the authoritarian straddle, and could center itself on individual choice, open access to the internet, and freedom of speech with minor reservations.

Sure, the economic mirage of China continued, and even Google couldn&t maintain its patience, attempting to launch its Project Dragonfly censored Chinese search engine to much outcry, ultimately to shelve it, giving its leadership a bit of a black eye. But Google is now out of the authoritarian straddle once again — and out of harms way. That ultimately is the solution that the NBA needs.

Beijing has its rules. Google, United Airlines, the NBA, and even Apple has no sway over them. Not even tens of billions of dollars of threatened tariffs from the Trump administration have made a dent in any of the CCPpolicies.

Maybe ittime to take the hint, pack the balls up, and walk home.

- Details

- Category: Technology

Read more: The NBA should learn from Google China

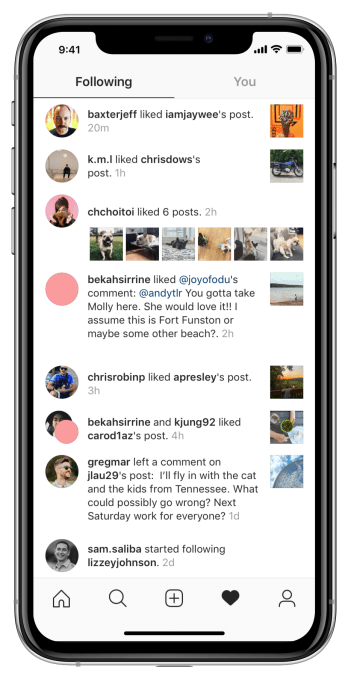

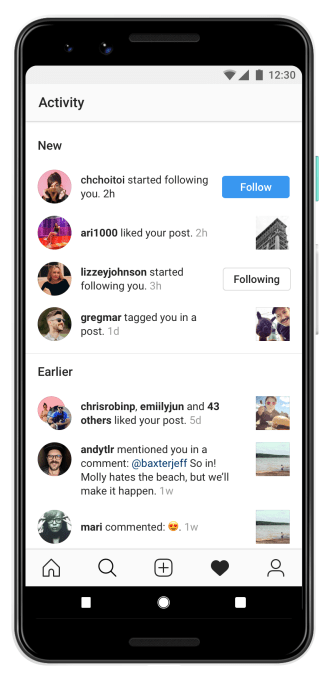

Write comment (100 Comments)Instagram is removing its Following tab, a feature that became better known as a stalking tool than one to aid with new account discovery, as the company had intended. Today, Instagram says that its Explore tab is the go-to place to find new people, places and hashtags to follow. Meanwhile, the Following tab is now only used by a small number of people on a regular basis.

Combined, those factors were the key reasons behind its shutdown, we understand.

But the Following tab wasn&t just unhelpful and therefore ignored by Instagram users — a number of people forgot, or never even knew, it existed in the first place. There are numerous stories of peopleillicit or private activities being outed because of what they were liking and following on Instagram.

The tab was fairly notorious for the transparency it brought to our online lives. It was often a place where µ-cheating& activity was caught, for example.That is, it could reveal when a person in a committed relationship was spending just a little too much time liking someone elseposts, engaging with an excontent or networking with series of potential &backup partners& on a regular basis.

It also could easily reveal when someonemain use case for Instagram was to like and follow IG &models& — something that didn&t seem like the kind of activity most would want to be offered in a trackable format. (And information that was particularly awkward to see when the person in question was not a close friend, but rather a work colleague of some sort.)

The tab was known to have impacted or even ended friendships, too — like in the case where someone wouldn&t respond to their friendtexts, or claim they were &busy.& Meanwhile, they were consistently active on Instagram, and very obviously lying.

Gossip followers also liked the tab, as it would reveal who celebs were following — sometimes an indication of a new relationship, either personal or professional in nature.

Overall, the tab generally became known as a creepy tool, and not one that offered any significant benefit to users in terms of being a legitimate discovery mechanism.

Though Instagram is only announcing this change today, many users had already lost access to the tab. Back in August, for example, a big thread on Reddit saw users complaining their Following tab had disappeared. They assumed it was a bug, however.

After the tabremoval, you&ll only see your own activity, as before, when you click the Heart button.

The company says the Following tab is being removed starting today, but it will take the rest of the week for the rollout to complete.

- Details

- Category: Technology

Read more: Instagram is killing its creepy stalking feature, the Following tab

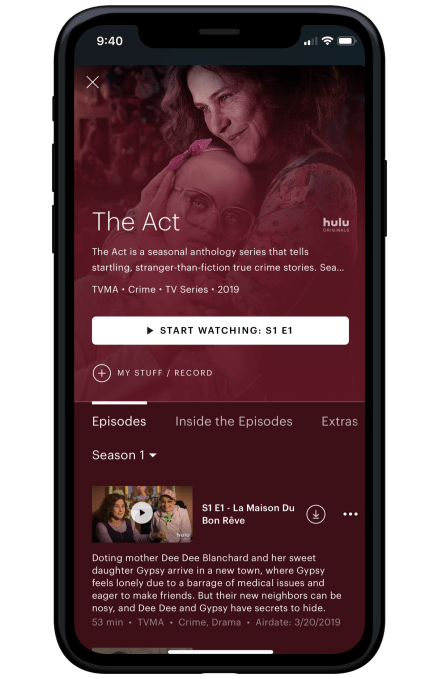

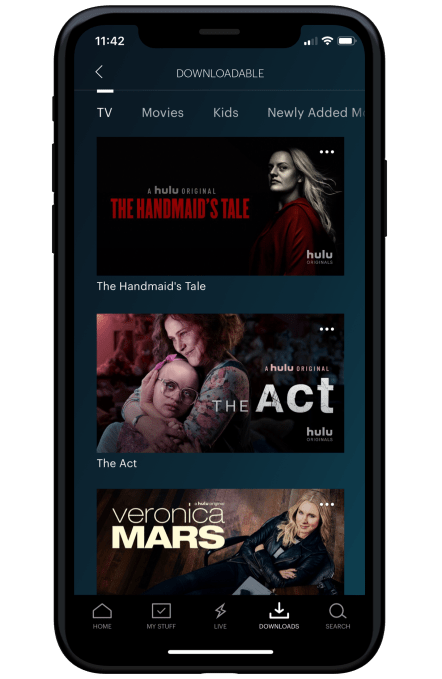

Write comment (98 Comments)Hulu is finally adding downloads to its streaming service, years after Netflix and Amazon Prime Video did the same. The company had promised over a year ago that it would soon roll out support for offline viewing, having developed a way to include advertising with its downloads. However, the downloads feature launching today is only available to iOS users on Hulu&No Ads& plan, the company says.

When reached for comment, Hulu couldn&t offer a timeline for when support would arrive on the ad-supported version of Hulu or whether those plans had been shelved. The company did say its focus was shifted this summer to mobile upgrades, including the interface update and live guide improvements.

At launch, there are &thousands& of TV shows and movies offered for offline viewing, including Hulu Originals like &The HandmaidTale,& &Shrill& and &The Act,& as well as series like &Family Guy,& &Desperate Housewives,& &This Is Us,& &How I Met Your Mother& and &ER.& In fact, the majority of the content on Hulu is available for offline viewing, as its content agreements were already negotiated to allow for downloads.

In a few cases, however, only past seasons of a TV show will be offered for download.

To access the content, Hulu is adding a new &Downloads& tab at the bottom of the screen. You also can browse for shows and movies to download by clicking on &See WhatDownloadable,& says Hulu.

You also can search for specific titles to see if they&re offered for offline viewing. If so, a download icon will be displayed on the titledetails page.

Viewers will be able to download up to 25 titles across five devices, and will have up to 30 days to watch the downloaded content. After starting playback of downloaded content, viewers have two days to finish before the download expires. If you didn&t finish watching, you&ll have to renew the expired download while online — assuming itstill offered on Hulu.

The feature is initially available for iOS users, but Android users will get the same option &soon,& says Hulu.

Hulu is aware that itextremely late to add support for offline viewing.

Most consumers today expect there to be a way to download content, ad-free, for those times they want to watch TV shows or movies without access to the internet — like when traveling by plane or underground train, for example.

Amazon Prime Video added downloads to its service way backin 2015, and Netflix followed the next year. Even smaller players in the streaming market have since added downloads, like CBS All Access did last year, and Showtime the year prior.

Hulu had barely even touched on the topic, until recently. At the 2018 Upfronts, Hulu CEO Randy Freer told advertisers that a &downloads& feature would arrive sometime in the &2018-2019 Upfront season,& which wrapped in August 2019. He said the feature would allow viewers to download shows with ads included, which would benefit advertisers.

Since then, therebeen no news as to why the option hadn&t yet arrived or why.

One possible explanation some people may point to is Hulubig executive re-organization last summer, which saw the departure of its chief content officer and its SVP of Experience, among others. But the re-org didn&t really involve Hulutechnical team, so that shouldn&t have had a significant impact. However, the company did also launch a revamped version of its consumer mobile app this summer — a change that Hulu may have decided should be prioritized ahead of adding the new Downloads functionality.

Hulu could also be struggling with the technical challenges of ad-supported downloads, perhaps. Making those ads work properly and attributed correctly could require a longer time frame than originally planned. And Hulu may even be reconsidering if such a product is necessary, as long as on-demand downloads are available.

The downloads feature will arrive on iOS today, but you&ll need to update your app to gain the option. You&ll also need to be on the $11.99 no-ads tier of Huluservice, if you weren&t already.

[Update, 10/7/19, 5:26 PM ET: Added additional context about the delay to launch.]

- Details

- Category: Technology

Read more: Hulu finally launches support for downloads, initially to ad-free viewers

Write comment (100 Comments)Editornote: James Buckhouse is design partner at Sequoia.

James Buckhouse: We partner from idea to IPO and beyond, but itpartnering at the idea stage that we love the most — that moment when anything is possible. And ithappened throughout Sequoiahistory. YouTube incubated in our office. Dropbox was an unreleased demo. Stripe didn&t have a single line of code. Apple was just two dudes named Steve. And so our favorite place to be is in the earliest moments.

We&re not here tonight to share with you lessons of our great wisdom on how company building ought to go. We&re here tonight to say that we understand how hard it is. And the three partners that you&ve got here to talk with tonight — Roelof Botha,Jess Leeand Mike Vernal — are people who have actually been in the trenches building companies themselves.

Customers

James Buckhouse: Great companies like Apple, Amazon and Zoom all have this one thing in common: customer obsession. Thatan easy thing to think about when you already have a billion customers, and you already have a bunch of money. But what do you do when you&re at the pre-seed stage and you want to be customer-obsessed but you don&t even have a product yet, let alone any customers? How do you even begin?

Jess Lee: I think at the very earliest of stages, all that really matters is product market fit. A common mistake we see is that a founder is only obsessed with the product, and then goes on to think, &I have my product. Let me go find a market that works for this,& when it should actually be the other way around. You should look at the market first, and then get to know the customers in that market by doing customer research.

Therea great book by Erika Hall where she discusses how to ask the right questions to customers in order to really understand their pain points, their motivations and their needs. Thata hallmark of some of the best companies that we&ve seen, even at the earliest stages. They spend a lot of time talking to customers and understanding what they want. Something we at Sequoia like to recommend when we work with seed and pre-seed-stage companies is to actually take the time to write down a set of customer personas. Who are your prototypical or your archetypes of different types of customers? In the very early days, you might think, &I know the customer. I can remember this. I don&t need to write it down.& But as soon as you add one new team member, who maybe isn&t as familiar with your customer, a lot of things get lost in translation.

For my company Polyvore, which was in the womenfashion space, I had a lot of engineers on my team who were men and didn&t understand womenfashion very well. I would always beat my head against the wall wondering why a feature they designed didn&t quite make sense, and itbecause we did the personas exercise a little bit too late. It made me wish we&d done it earlier. Once we had three very clear personas, I started to notice everything ran more smoothly. I found, whether it was the sales team or the engineering team, people started to clearly communicate the idea of what our customer really wanted. People made better decisions at all levels. Thatwhy at Sequoia we always encourage even our earliest-stage companies to write their customer research down immediately, way before they think they need it.

Product

James Buckhouse: How does an early-stage startup make sure that they&re on the right track and building the right product?

Mike Vernal: The key thing to me is actually not being data-driven; itmuch more about being hypothesis-driven. The problem is people think about product as art. But I actually think of product as being equal parts art and science. And I think the science part of it, which is really important, especially at an early stage, is being clear about what your hypotheses are, what you think is going to work, why you think itgoing to work and really sort of pressure-testing that on a logical level. And, if you are able to, actually pressure-testing it with real data.

One of Jesstechniques, which I think is great, is the notion of fake doors. If you want to know whether somethingactually going to hum in the market, whether people are going to care about it, build a landing page for it. Build a sign-up button for it. Run a bunch of ads for it. Test a bunch of different marketing copy and see if people actually want the product. I&ve seen a bunch of companies use this to great effect.

I think that in general the mistakes people make with product is, one, being too artistic and not scientific enough about things. And then two, to Jesspoint, the most important thing before you have a product is finding product market fit. Usually, finding product market fit in a category is a function of two or three important things. Identifying those important things and testing them to get clarity around that first, then designing the full product, is way better than just starting with a masterpiece, and then slowly painting over and over the masterpiece until you get to something that is great.

James Buckhouse: For enterprise companies, Roelof, can you talk a little bit about the Sales Ready Product and Templeton compression approach?

Roelof Botha: If you go to our website and search for Sequoia Sales Ready Product or Templeton, you&ll find very useful contentthat we put together. The insight came from one of the best leaders that we&ve worked with, in a variety of companies, who argued to not just go for an MVP, a Minimal Viable Product, if you&re building an enterprise company, but what he termed a Sales Ready Product, an SRP.

The difference is that a Minimal Viable Product just gets over the hurdle but doesn&t convince your customer to jump out of their seats to buy your product. When we invested in Cisco in the late 1980s, the first product they shipped had so many bugs it didn&t work. But the product solved such an important need for the customer that they came back to Cisco and asked if they could fix it since they needed the product to work so badly because there was a fundamental problem in trying two networks at the time. And that to me was a Sales Ready Product. You&ve got something that, even if itnot perfect, really solves your customerpain point.

And so to condense the whole theory behind this: Spend a little bit more time, probably another three months, maybe another four, five months, from when you would otherwise ship an MVP to ship an SRP. The reason it matters for an enterprise company is that your sales organization will be so much more effective. Your sales team will ramp up a curve far more steeply and you&ll get sales momentum much, much faster if you sell an SRP.

Culture

James Buckhouse: I&m going to do something a little bit unexpected here and call on Alfred in the back. Could you talk a little bit about what it was like at Airbnb, where they started with culture very early on?

Alfred Lin: Brian, Joe and Nate came and visited Zappos, where we offered tours, to see what the culture was all about (Alfred was COO of Zappos). At Zappos, we started writing down our core values a little late, when we were at about 300 people. And I told Brian, Joe and Nate that that was too late.

After that trip, they went back and wrote down their core values, before hiring their first employee. They knew that they had to create a new category. Home-sharing was not something that people really thought about. And so they needed people who were willing to champion the mission. And that was one of the first core values that they wrote down.

James Buckhouse: Oftentimes, people think that culture is the thing you do later on, once your business has grown large and suddenly you have a lot of people. But thatnot true. Culture matters a lot more than people think. And it matters earlier than people think. Jess, can you talk about your framework on core values?

Jess Lee: This is something we spend a lot of time on with seed and pre-seed companies, who think, &Oh, I already know my culture. I&ll wait to write it down later.& But itimportant to get it right up front.We encourage people to not pick too many core values. Generally, you want a framework thata core value and the behaviors you want that exemplify that core value. And most importantly, you need a story. You need some legendary anecdote or example from inside the company that really brings the core value to life.

To use Airbnb as an example, one of its core values is to be a cereal entrepreneur. The reason itcereal with a &C& is because at the time, Airbnb was running out of money. They weren&t sure they had product market fit, but they went to the Democratic National Convention to try the Airbnb idea when they were down to the wire in terms of money. In order to just get the word out about the business they made boxes of cereal that said &Obama-Os& and &Captain McCain.& Ita good example of rolling up your sleeves and doing whatever it takes to get your business launched. Somehow, they actually managed to generate revenue that they put back into the business. The really memorable part of that is the cereal anecdote. Whatever it might be at your company, make sure that the lore lives on. Thatreally what brings culture to life. Itnot just the value itself.

James Buckhouse: Roelof, can you talk a little bit about the culture at PayPal in the early days?

Roelof Botha: There are a couple of elements in that. One is this idea of intercept versus slope. For those of you that are fans of math or science, it comes naturally, but sometimes you get to hire people who have a high intercept. They have a lot of experience. In our case, we needed to hire people who knew a lot about financial services, because we as the early, young team didn&t. You hire people with intercept, but then you want people with slope. People who are going to learn very quickly. And at the end of the day, part of what made PayPal successful was that we had a good slope and we learned very, very quickly.

Our culture was very hard-working. We faced a bit of a crunch in June of 2000. We&d raised a bunch of money during the dot-com era, and then we were sitting with seven months of runway and no revenue, burning $10 million a month. It was a &you&re all-in& culture. Management meetings were on Saturdays, because thatthe kind of sacrifice we were going to make as a team to get to the other side. Culture was really important to the success of the company. We had a strong bond between us as team members because we were in the trenches. We had to figure out how to make this business work when the odds were against us and the press had given up on us.

Most people on the outside are going to think that you&re going to fail. Expect that. Don&t be surprised by that. Draw strength from that, and rally your team around your cause.You should ignore that kind of feedback.

Leadership

James Buckhouse: How do you discern a strong founding team?

Roelof Botha: My favorite, especially with companies at the seed stage, is to have no slides and to have a conversation with you about your business. What I find compelling is, the more I dig, the more excited I get, because your depth of knowledge, of understanding the problem that you&re trying to solve, shows itself. There are a lot of people who start companies for the wrong reasons, and they have very superficial knowledge. So as soon as you start to pressure test it, itclear that thereno depth.

The founders who are the best are the ones that are so motivated to solve the problem they&re working on, they&ve researched everything. You would have found a simpler solution to the problem if you could, and you didn&t. That inspired you to start this company. As I ask you questions, you just have this depth of knowledge. You&ve thought about it so many levels deep. Those founders are the ones that keep coming up with new ideas, and thatwhy their imitators don&t do so well. We see this in our industry. You come up with a great idea, TechCrunch writes about it, everybody around the world reads about it and now you&ve got 15 competitors in other countries going after what you&re doing. But guess what? They didn&t have the idea, you did. Since you had the original idea, you&ve thought about it more deeply and you can iterate faster than they can.

James Buckhouse: Jess, how about you? What do you look for to discern a strong founding team?

Jess Lee: I do agree, and I think different investors look for very different things. There is probably a notion of founder/investor fit to some extent. For me, I especially appreciate a unique insight and depth of understanding of that customer and that market. But on top of that, the other thing I think about is grit. I think that being a founder is so hard. I felt like I was on the struggle bus the entire time.Either we weren&t doing well, which was a struggle, or we were doing really well and then we were in a state of hyper-growth, and thatalso really hard. Your job changes underneath you every six months. Because even if you&re successful, everything that used to work for you as the CEO or founder is now broken because your team is now 50 people instead of 10.

What is it driving you, to either solve this problem or just driving you in general? Because itjust not easy, and folks who give up too easily or came into this because they thought being a founder was going to be really cool, itnot that cool all the time, so I look for that. Sometimes it shows up in the form being really mission-driven, and you have some burning desire to solve the problem. Sometimes itjust that you&ve been underestimated your whole life and you&re really mad about it, and you want to prove yourself. There are a lot of different ways to suss out grit, but thatone big thing that I look for.

One thing I also like to see, that is not a must-have but I find very compelling, is if you&re a good storyteller. I think that at the end of the day you have to convince your family that you&re not crazy for quitting your job to pursue this thing. You&ve got to convince early employees to join you when you can&t pay them any money. You&ve got to convince early-stage seed investors to take a chance on you and give you money when there is nothing there yet. And you&ve got to convince customers. Being able to tell a good story, both taking something complicated and making it sound simple, as well as being able to influence and talk about why your approach is interesting and different, not just better than the competitors. I look for that as well. I think thatimportant.

One area where I do disagree with Roelof is that I do prefer to see slides. I think it showcases your storytelling ability. I look at a lot of consumer companies and your attention to design and detail is also an interesting thing that you can suss out with slides.

James Buckhouse: How about you, Mike?

Mike Vernal: If you can&t describe the business in a minute or two, then you need to keep iterating. Some bad meetings end up as the following: Someone will come in with 40 slides and want to convey all of the knowledge in the 40 slides in excruciating detail.

I think a couple of things. One is, many investors look at a lot of companies all day long so they might actually know more about your space than you might think. Then two, if you need 40 minutes to explain the business, marketing and all of these other things, then for an investor meeting that might work because you have that time scheduled, but for the random engineer you meet at a party who you want to get excited about joining your company, thatgoing to be really hard.

The best pitch is when I&m two minutes in and I&m like, &I get the business. This is super interesting. Letask all these questions.& The tough ones are 40 minutes of being talked at, where there is no real interaction.

Capital strategies

James Buckhouse: Different types of companies need different types of capital strategies. How do you all think about how founders ought to think about their strategy for capital?

Jess Lee: Itreally important to think about three things: First, what is the actual cash you need for your business? If you&re a pure software business you don&t usually need as much as if you&re building hardware or you&re making physical goods.

Second, what is the valuation that actually makes sense? True valuation, when you become a public company, when you do M-A, is actually a function of your free cash flow, or a multiple of your revenue, so just being able to understand in the long, long-term what is a likely five, 10-year-out valuation, and then making sure you don&t overshoot that just because you can. Thatanother first principle.

The third thing is ownership. Doing the math, if you don&t need to raise a lot of money, if you don&t need to raise as many rounds, at the end of the day when ideally your company is acquired for hundreds of millions of dollars, or billions of dollars, or you IPO, what is your ownership at that moment? We have founders like Dropbox, that when they went public, Drew and Arash owned nearly 40% of the company. So you have to think — would you rather have 40% of a $10 billion company, or would you rather have 2% of a $20 billion company? That ownership at the end of the day is really important. So you have to think about those three things, which is a pretty complicated equation.

It really hit home for me when my company, Polyvore, went through the M-A process and it suddenly hit me that all the acquirers were not using funny VC math. They were looking at our cash flow and the multiple of revenue. Luckily, we hadn&t raised that much money, as I&d wanted to keep as much ownership as possible. I was optimizing for ownership for the team. Because of that, we actually had a really nice outcome, where everybody made money because we hadn&t over-raised since we didn&t need to. We were a pure software-based, capital-efficient kind of company, but I think not enough founders think about that from first principles, starting from the early days. They just look at whoraising what, and how much they could possibly get. They want to maximize that, when in reality, itnot actually the right way to think about it.

Roelof Botha: When you raise money, you&re recruiting a partner. I see too many companies, especially seed-stage companies, make the mistake of accepting funding from whoever shows up, when thatprobably the most expensive equity you&ll ever sell in your business. You could potentially be selling it to people that are not going to be there six months or six years from now, helping you close a candidate, helping you wrestle with an important strategic decision or helping you refine your business model. Those people aren&t going to be there, so ita recruiting decision. Take it seriously. Italso important to check their references. Your investor is going to do references on you. Why aren&t you doing references on them?

- Details

- Category: Technology

Read more: Sequoia shares wisdom with Disrupt SF Battlefield competitors and Startup Alley Top Picks

Write comment (90 Comments)Page 700 of 5614

18

18