Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

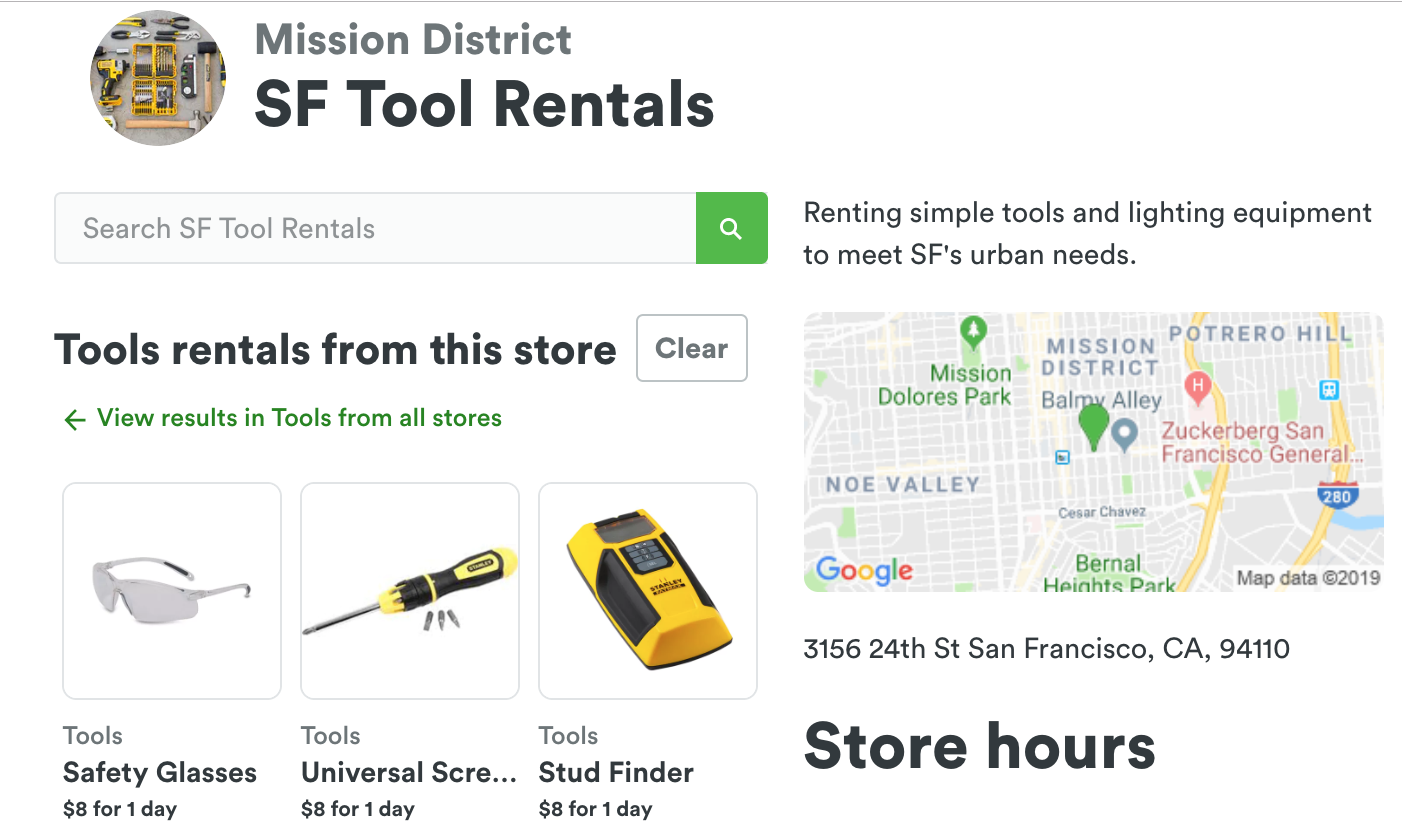

Physical storage-turned-rentals startup Omni is dealing with layoffs today, two sources familiar with the situation tell TechCrunch. Omni just shed seven operations team members. The startup is in talks to sell its engineering team to Coinbase after also receiving interest from Thumbtack.

Omnirental business was doing poorly without enough users paying a few bucks to borrow a tent, bike or power drill. Omni had planned to launch a white-labeled platform allowing brick-and-mortar merchants to operate and market their own rental business.

But despite having plenty of cash left after raising $25 million from cryptocurrency company Ripple early last year, Omni feared the new platform would flop too and its prospects would worsen.

The company is in talks with Coinbase to hire some of the engineering staff, who would have them work on Coinbase Earn, which rewards users with cryptocurrency for completing online educational programs. Some employees are interviewing at Coinbase today. However, a Coinbase spokesperson told me therecurrently no official deal — before noting that there is nothing on the record they can share. Omni promised TechCrunch a statement but then refused to talk on the record.

Omni got its start in on-demand storage, where it would come to your home, pick up and tag your stuff, store it in a warehouse and bring it back whenever you wanted it. It grew popular in San Francisco and started to scale out to other cities. In April, Omni began allowing users to earn money by renting out their stored goods to other Omni customers.

But by May, Omni was selling its storage business to SoftBank-funded competitor Clutter, and the transition was rocky. Users complained about changing prices and misplaced items, alarmed that suddenly a different startup had control of their possessions.

I was formerly a happy Omni customer of its storage business, but the transition to Clutter was botched and shook faith that users& stuff would be taken care of. At one point they lost some of my belongings, until C-level executives stepped in to figure out what happened.

Going forward, instead of storing goods itself, Omni would rely on local storefronts for pickup and drop-off of rentals. But many users balked at the hassle of rentals when Amazon makes buying so easy.

One source said that Omni had discussed telling rental partners in two weeks that it would be shutting down the rental service, though TechCrunch cannot confirm that. Another source said Omni was frantically trying to stop members of its team from talking to the press today.

Omnivision of cloud storage for the physical world and access over ownership had attracted capital from Flybridge, Highland, Allen - Company, Founders Fund, Precursor and a wide array of angels. But efforts to change user behavior and operate a logistically complicated business, matched with spotty execution, led the startup to hit the skids and seek a soft landing.

- Details

- Category: Technology

Read more: $35M-funded Omni rentals in acqui-hire talks with Coinbase

Write comment (91 Comments)

On September 17, HTC announced that cofounder Cher Wang would be stepping down as CEO. In her place, Yves Maitre stepped into the role of Chief Executive, after more than a decade at French telecom giant, Orange.

Ita tough job at an even tougher time. The move comes on the tail of five consecutive quarterly losses and major layoffs, including a quarter of the companystaff, which were let go in July of last year.

Ita far fall for a company that comprised roughly 11 percent of global smartphone sales, some eight years ago. These days, HTC is routinely relegated to the &other& column when these figures are published.

All of this is not to say that the company doesn&t have some interesting irons in the fire. With Vive, HTC has demonstrated its ability to offer a cutting edge VR platform, while Exodus has tapped into an interest in exploring the use of blockchain technologies for mobile devices.

Of course, neither of these examples show any sign of displacing HTConce-booming mobile device sales. And this January$1.1 billion sale of a significant portion of its hardware division to Google has left many wondering whether it has much gas left in the mobile tank.

With Wang initially scheduled to appear on stage at Disrupt this week, the company ultimately opted to have Maitre sit in on the panel instead. In preparation for the conversation, we sat down with the executive to discuss his new role and future of the struggling Taiwanese hardware company.

5G, XR and the future of the HTC brand

- Details

- Category: Technology

Read more: HTC’s new CEO discusses the phonemaker’s future

Write comment (97 Comments)When Elizabeth Warren took on Mark Zuckerberg and Facebook earlier this week, it was a low moment for what New Yorker writer Andrew Marantz calls &techno-utopianism.&

That the progressive, populist Massachusetts Senator and leading Democratic Presidential candidate wants to #BreakUpBigTech is not surprising. But Warrenchoice to spotlight regulating and trust-busting Facebook was nonetheless noteworthy, because of what it represents on a philosophical level. Warren, along with like-minded political leaders, social activists, and tech critics, has begun to offer the first massively popular alternative to the massively popular wave of aggressive optimism and &genius& ambition that characterized tech culture for the past decade or two.

&No,& Warren and others seem to say, &your vision is not necessarily making the world a better place.& This is a major buzzkill for tech leaders who have made (positive) world-changing their number one calling card — more than profits, popularity, skyscrapers like San Franciscostriking Salesforce Tower, or any other measure.

Enter Marantz, a longtime New Yorker staff writer and Brooklyn, N.Y. resident who has recently trained his attention on tech culture, following around iconic figures on both sides of what he sees as the divide of our time — not between tech greats whose successes make us all better and those who would stop them, but between the alternative figures on the &new right& and the self-understood liberals of Silicon Valley who, according to Marantz, have both contributed to &hijacking the American conversation.&

Image via Penguin Random House

Marantzfirst book, &Antisocial: Online Extremists, Techno-Utopians, and the Hijacking of the American Conversation,& will be released next week, and I recently had a chance to talk with him for this series the ethics of technology.

Greg Epstein: Congratulations on your absolutely fascinating new book Antisocial, and on everything you&ve been up to.

- Details

- Category: Technology

Read more: How ‘the Internet broke America’ with The New Yorker’s Andrew Marantz

Write comment (100 Comments)PayPal has become the first company to walk away officially from FacebookLibra, a cryptocurrency and related association that it announced earlier this yearwith a chain of nearly 30 big names behind the effort to help build and operate services around it.

&PayPal has made the decision to forgo further participation in the Libra Association at this time and to continue to focus on advancing our existing mission and business priorities as we strive to democratize access to financial services for underserved populations,& PayPal said in an emailed statement to TechCrunch. &We remain supportive of Libraaspirations and look forward to continued dialogue on ways to work together in the future. Facebook has been a longstanding and valued strategic partner to PayPal, and we will continue to partner with and support Facebook in various capacities.&

A high-profile, would-be partner like PayPal backing out from the effort before iteven gotten off the ground is a big blow to Facebook and the Libra Association, which has been struggling under the weight of speculation that some of the big organizations, initially interested in collaborating on Libra, are now on the fence about the project, put off by wave of negative reaction from regulators and others that might lead to problems launching and ultimately growing the service.

In response, the Libra Association has come out with an understated but scathing statement of its own in response to PayPalannouncement. (Facebook had referred our questions to the group and did not comment directly.)

&It requires a certain boldness and fortitude to take on an endeavor as ambitious as Libra & a generational opportunity to get things right and improve financial inclusion,& said a spokesperson. &The journey will be long and challenging. The type of change that will reconfigure the financial system to be tilted towards people, not the institutions serving them, will be hard. Commitment to that mission is more important to us than anything else. We&re better off knowing about this lack of commitment now, rather than later.&

PayPal is the first firm to walk away from the Libra Association, but it comes at a difficult time for the project, even before it has launched.

Both regulators and other government bodies on both sides of the Atlantic — already scrutinizing Facebook and cryptocurrency as separate issues — have honed in on the project with concerns of how a Facebook-backed and promoted currency could lead to anti-competitive behavior.

Facebook and other members of the Libra Association are due to meet this month in Geneva to appoint its first board of directors, but ahead of that itbeen reported that the government scrutiny has started to spook some who have only nominally backed the project at this point.

The WSJ reported earlier this week that Mastercard, Visa and other companies may join PayPal in backing away from the Libra project. Mastercard has not responded to a request for comment, but Visa CEO Al Kelly has made public statementsthat underscore Visaprovisional support for Libra — a position we understand remains unchanged as of today, provided regulatory and other issues do not get in the way.

&Itimportant to understand the facts here and not any of us get out ahead of ourselves,& Kelly said in the companymost recent earnings call. &So we have signed a nonbinding letter of intent to join Libra. We&re one of & I think it27 companies that have expressed that interest. So no one has yet officially joined.We&re in discussions and our ultimate decision to join will be determined by a number of factors, includingobviously the ability of the association to satisfy all the requisite regulatory requirements… It&sreally, really early days and therejust a tremendous amount to be finalized. But obviously, giventhat we&ve expressed interest, we actually believe we could be additive and helpful in the association.&

As we reported when Libra first launched, Facebook doesn&t control the Libra organization or currency, but gets a single vote alongside the remaining partners. Those that have endorsed the association currently include, alongside Mastercard and Visa, Stripe, Uber and the VC firm Andreessen Horowitz. Each Libra Association partner invests at least $10 million in the project and the association will promote the open-sourced Libra Blockchain.

The partners would not only pitch the Libra Blockchain and developer platform with its own Move programming language, but sign up businesses to accept Libra for payment and even give customers discounts or rewards.

Facebook has a lot riding on the success of the Association beyond just its Libra stake. The company has also launched a subsidiary company called Calibra that handles crypto transactions on its platform that would use the Libra blockchain. (Itbeen quietly developing this alongside the Libra effort, including making acquisitions to expand the functionality around how it will work.)

Governments around the world have been up in arms because they are concerned that, with Libra, Facebook and its partners will try to make an end run around existing financial services and their corresponding regulations.

Perhaps in response to these pressures and how they might play out, earlier this month, Facebook chief executive Mark Zuckerberg indicated that the company would be willing to delay the launch of the cryptocurrency — it is currently planned for 2020 — in an interview with the Japanese Nikkei news service. &Move fast and break things& won&t be getting applied here.

- Details

- Category: Technology

Read more: PayPal is the first company to drop out of the Facebook-led Libra Association

Write comment (96 Comments)

We&re excited to announce a new partnership with Amazon Web Services for annual members of Extra Crunch. Starting today, qualified annual members can receive $1,000 in AWS credits. You also must be a startup founder to claim this Extra Crunch community perk.

AWS is the premier service for your application hosting needs, and we want to make sure our community is well-resourced to build. We understand that hosting and infrastructure costs can be a major hurdle for tech startups, and we&re hoping that this offer will help better support your team.

Whatincluded in the perk:

- $1,000 in AWS Promotional Credit valid for 1 year

- 2 months of AWS Business Support

- 80 credits for self-paced labs

Applications are processed in 7-10 days, once an application is received.Companies may not be eligible for AWS Promotional Credits if they previously received a similar or greater amount of credit. Companies may be eligible to be &topped up& to a higher credit amount if they previously received a lower credit.

In addition to the AWS community perk, Extra Crunch members also get access to how-tos and guides on company building, intelligence on whathappening in the startup ecosystem, stories about founders and exits, transcripts from panels at TechCrunch events, discounts on TechCrunch events, no banner ads on TechCrunch.com and more. To see a full list of the types of articles you get with Extra Crunch, head here.

You can sign up for annual Extra Crunch membership here.

Once you are signed up, you&ll receive a welcome email with a link to the AWS offer. If you are already an annual Extra Crunch member, you will receive an email with the offer at some point today. If you are currently a monthly Extra Crunch subscriber and want to upgrade to annual in order to claim this deal, head over to the &my account& section on TechCrunch.com and click the &upgrade& button.

This is one of several new community perks we&ve been working on for Extra Crunch members. Extra Crunch members also get 20% off all TechCrunch event tickets (email This email address is being protected from spambots. You need JavaScript enabled to view it. with the event name to receive a discount code for event tickets). You can learn more about our events lineup here. You also can read about our Brex community perk here.

- Details

- Category: Technology

Read more: Annual Extra Crunch members can receive $1,000 in AWS credits

Write comment (100 Comments)At age 27, Jordan Fudge is quietly making a splash in the VC world.

Fudge is the managing partner of Sinai Ventures, a multi-stage VC fund that manages $100 million and has more than 80 portfolio companies including Ro, Drivetime, Kapwing, and Luminary. His 2017 investment in Pinterest — a secondary shares deal from his prior firm that was rolled into Sinai when he spun out — will have returned the value of SinaiFund I by itself once the lockup on shares expires next week.

Fudge and co-founder Eric Reiner, a Northwestern University classmate, hired staff in New York and San Francisco when Sinai launched in early 2018. Today, they&re centralizing the team in Los Angeles for its next fund, a bet on the rising momentum of the local startup ecosystem and their vision to be the cityleading Series A and B firm.

Fudge and Reiner have intentionally stayed off the radar thus far, wanting to prove themselves first through a track record of investments.

Jordan Fudge. Image via Sinai Ventures

A part-time film financier who also serves on the board of LGBT advocacy non-profit GLAAD, Fudge describes himself as an atypical VC firm founder, an edge heusing to carve out his niche in a crowded VC landscape.

I spoke with Fudge to learn more about his strategy at Sinai and what led to him founding the firm. Herethe transcript (edited for length and clarity):

Eric Peckham: Tell me the origin story here. How did Sinai Ventures get seeded?

Jordan Fudge: I was working for Eagle Advisors, a multi-billion dollar family office for one of the founders of SAP, focused on the tech sector across public markets, crypto, and eventually VC deals. Two years in, I pitched them on spinning out to focus on VC and they seeded Sinai with the private investments like Compass and Pinterest I had done already, plus a fresh fund to invest out of on my own. It was $100 million combined.

- Details

- Category: Technology

Read more: As Sinai Ventures returns first fund, partner Jordan Fudge talks new LA focus

Write comment (99 Comments)Page 716 of 5614

12

12