Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Today at TCDisrupt show in San Francisco, we took the stage with David Krane, a longtime veteran of Google who took the reins as the CEO of its venture arm, GV, three years ago but hasn&t spoken publicly since. We asked him why hebeen in hiding before diving into some questions about Uber — one of GV most lucrative bets to date — and trying to understand better how GV is organized under his leadership.

Krane, who earlier in his career was Googleglobal head of PR, is accustomed to deflecting reporters& questions and he was circumspect about some things, but he did let drop some interesting information. For example, he told us that GV has plugged a whopping $5 billion into startups since it was formed 10 years ago. Krane also joked that Alphabetfamous founders don&t steer entirely clear of the organization. And he suggested that GV — which sold a meaningful part of its Uber stake to SoftBank last year — might sell the rest of its Uber stake when the ride-share companylock-up period expires in November. (His team has a &decision to make,& he said.)

Following is some of our chat, edited lightly for length and clarity:

TC: Itbeen three years since you took the role of CEO. Why has it taken you so long to come out of hiding?

DK: Well, I haven&t been in hiding, I&ll tell you that we&ve been really busy. When you have a second act at Google, which is remarkably different from your first act, you actually kind of have to stay focused on that. So we&ve been busy building an extremely large scale venture firm, which this year is celebrating our 10th birthday. And I&ve been doing that [from its outset].

TC: Therea lot to chat about. Lettalk quickly about one of your highest-profile deals, which was investing in Uber. I&ve long heard that you are the one who was agitating to lead this $250 million dollar Series C round, which, at the time, was a very big deal. It was also a brilliant investment. Do you think Uber is also a good investment now for public shareholders?

DK: This is a special company. This company has an unmistakable brand. It operates in countries around the world. It has scaled, it ha a moat around it, ittouched by almost no one in the category. So honestly, we&re long term. We&re bullish on this. And I think it is an interesting investment opportunity. And it happens to be on sale today.

TC: Itobviously getting into new business lines, which is interesting. But you&d also told me that GV had sold part of its stake to SoftBank last year, when the conglomerate came in and wanted to buy up a substantial percentage of the company. Can you say how much of your stake you sold?

DK: Itprobably best not to, but I&d say it was a great transaction. Working with SoftBank was quite pleasant. And I think there were a number of shareholders that did [the same].

TC: Uberlockup period is coming up quickly. Will you sell the rest of your stake?

DK: I think itnot clear yet, to be honest with you. We&re paying attention to the market, which is a bit unstable, to say the least. But yeah, in about a month, we&re going to have a decision to make.

SAN FRANCISCO, CALIFORNIA & OCTOBER 03: (L-R) GV CEO - Managing Partner David Krane speak and TechCrunch Silicon Valley Editor Connie Loizos onstage during TechCrunch Disrupt San Francisco 2019 at Moscone Convention Center on October 03, 2019 in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

TC: When you invested in Uber in 2013, you were investing in a different founder: Travis Kalanick, who was pressured to resign in 2017. Ita little bit reminiscent of what happened with Adam Neumann of WeWork, who had grown the company over the last nine years and was last week pressured to resign.

Are we in agreement that maybe the investors could have done something sooner? These are two founders whose management styles were very well-known. Why suddenly was it problematic? And why didn&t someone do something sooner?

DK Well, probably the best advice that I could offer there is it would have been prudent to curb some of Adamcreativity little bit sooner. . . . But therevery little similarity between Travis and Adam. Travis is a founder that in his peak at Uber was incredibly enviable, and someone that we chased very aggressively to try and be involved with.

TC: Lettalk about GV. I think we all want to know more about GV under David Krane. One thing that I noticed is that in the firmearly days, it would announce these discrete pools of capital it was investing. One year, it was ‘We&ve raised $300 million.& The next it was ‘We&ve been allocated $500 million.& Is is still the case that you&re getting these yearly allocations? And if so, what are you investing right now?

DK: When we started GV, we had the opportunity to look at several decades of venture capital experience and pick some of the greatest attributes and to do our best to steer away from some things that weren&t optimized. So one of the things that we set up structurally was that yes, we would engage with our single [investor], Alphabet, and figure out whata reasonable pool of capital that our team could deploy each year. When we started 10 years ago, we started with literally a $50 million fund. Now 10 years later, we&re investing many hundreds of millions per year.

TC: How much has been allocated [to startups] altogether to this point?

DK: Total? We&re looking after nearly $5 billion.

TC: Thatastonishing. Itnot like Alphabet needs the money, but you did in invest in Uber — good for you. You invested in Nest Labs, which Google bought for $3.2 billion a few years ago. Can you talk about your returns? What percentage of that money has come back to Alphabet?

David Krane, CEO - managing partner of GV, at TechCrunch Disrupt SF 2019 on October 3, 2019

DK: As you know, this is a business often measured in decades. We&re 10 years old this year. And I&ll tell you, kind of directionally, that we&re incredibly happy with the financial performance of the fund. I will say, we&re backed by an investor that has a lot of bravery that puts its shoulder into risk and often tells us, ‘Do something more complex& ‘Do something more crazy next time.& I mean, it wouldn&t be unimaginable that [cofounder] Sergey ]Brin] would walk in and say, ‘Why don&t you do the space elevator next time?& So sometimes those sorts of businesses may take a lot longer to return. But all in all, we&re incredibly happy with what we&ve returned so far.

TC: When I interviewed your predecessor, Bill Maris, a few years ago, he told me that every decision felt to him and him alone, following what were wide-ranging discussions with the staff whose opinions factored in heavily. But he said, that ultimately, GV is ¬ like a democracy in any way.& Are you the ultimate arbiter of what gets funded now at GV?

DK: I would say, technically speaking, we don&t run remarkably differently. That said, our success, and really, the excitement that we bring every day, is really playing a meaningful ‘meta& team ball. So the experience for the entrepreneur is not so unusual [than] going to any other Sand Hill pitch room, where the entrepreneur would come in and spend an hour or two with us, we would have a dialogue afterwards, we would take some data, we would consult some data, and a discussion with sort of ensue.

Technically, yeah, I can come in and have a little bit of influence on whathappening. But because we&re scaling what we&re doing, my objective as often as I can is to green-light as many investments as make sense.

TC: How many investments are you green-lighting here?

DK: I think this year we&ll do 100 deals, in total, in 10 years, we have an active portfolio of more than 300 companies. And I think if memory serves me correctly, we&ve done over 600 deals in 10 years.

TC: How many people are in staff at this point?

DK: Ninety people full time.

TC: It seems like therebeen more focus on elevating women through the ranks.

DK: Absolutely, ita big focus for us. We usea page out of the Google playbook that has served the company incredibly well for goal setting and product and engineering called OKRs, for objectives and key results. And we learned that OKRs are actually extensible to diversity and inclusion. So we set some goals a couple of years ago to, most importantly, go out to the market with more focus and do our best to fund a meaningful number of new and underrepresented founders. And I&d say in the last 18 months, we&ve deployed about $200 million into underrepresented founders.

And conversely, we&ve used that same framework to improve the diversity of our team as well. And I think we&ve made some great progress there.

TC: Is the sort of compensation structure within GV the same as with traditional venture funds, with management fees and carry involved?

DK: We have a single LP, thatprobably one of the most distinctive attributes. But we&re set up mostly like Sand Hill firms, so we have access to all kinds of opportunities to run the business, with carry on our outcomes, [so] all interests are aligned. So ita really attractive place to be able to do venture.

TC: When Google formed this unit, 10 years ago, there was also a lot of talk about the data driven nature of investing that you would do. So can you tell me a little bit about the algorithms that you&re relying on and how they help you identify promising companies?

DK: I don&t think it would be Google Ventures without putting some emphasis on the Google part of that name. So using data machine learning has been something thatvery common in our practice for many years. We&ve got a team of something on the order of a dozen [to] focus on technology and how technology can frankly make humans smarter — and we don&t think itan either or, we think itan and. So we look at technology as an opportunity to analyze deals, discover new opportunities, but really, most importantly, to look at the portfolio at large and ensure that we&ve got the right exposure, we&ve got the right balance, to do our best to capture industry leading returns.

TC: Have you ever gone rogue and defied the data?

DK: We go rogue all the time, Data is there to help us Itthere to make us smarter. But it doesn&t singularly dictate what we do in terms of investment decisions.

TC: What are some of examples of [deals you&ve led that contradicted] the data?

DK: So An example would be a follow-on investment in a company. There may be some some tension between how the data signal will present its view, how other attributes may be more important. And itimportant for us to continue to show support to an entrepreneur, which we try to do as often as we can.

David Krane, CEO - managing partner of GV, at TechCrunch Disrupt SF 2019 on October 3, 2019

TC: You also have a big team here. You also have a team in Europe, but it seems like you&re predominantly still doing venture in the U.S.. Is that accurate?

DK: Thatcorrect. Yeah, most of our team is situated in a set of offices across the U.S. We&ve got a small team in London, Most of the dollars we invest go into U.S.-based companies and a wide variety of sectors. We do some investing in Europe. We don&t invest in Asia. We don&t invest in Latin America.

TC: Which is so interesting, especially Asia, given thereso much going on there. In fact, you had told me that you&d invested in a company as a called FreshToHome thattrying to tackle the fragmented perishable goods market in India.

How much personal investing do you do outside of GV and also, if that company takes off, is there a risk that Larry or Sergey would say, ‘Hey, David, why aren&t we in that deal?&

DK: Well, therecertainly a chance if that company breaks out and we choose to expand our scope to investing in India that GV could look at it, no question about it. Today, we don&t have plans to invest there. So in markets where GV isn&t investing, we&re happy to support our partners& personal interests,

I do a little bit of personal investing in categories that honestly have nothing to do with the main line of GV. I invested in a menoutdoor professional lacrosse League, for example, called PLL, thatprobably not something that GV would do but itan area of passion for me; my children play lacrosse.

TC: Why not Asia, though?

DK: I think itinevitable that over time as we evolve, will consider taking on a new geography, but focus again, is a feature for our business, too. And I think we have a lot more opportunity to continue to further establish ourselves here.

TC: Shifting gears, lettalk about bigger-picture stuff. We talked a little bit about Uber. You think Uber is still on sale and an attractive investment; obviously, some people disagree, we&ll see what happens with that company. But more broadly, are companies staying private too long?

DK: No. Itinteresting. There is so much capital in the market right now that there isn&t the burden to put oneself in a position thatremarkably different from the control, the privacy, that one has is private. So itvery company specific, your question, but I&d say in general, the market has changed so meaningfully in the last two years that there isn&t that pressure to seek capital in the public markets. You have many, many options to stay private. And for lots of companies, thata good thing.

TC: But is it good for Americans? So much wealth has been created before these companies go out, as with Uber, that once they go public, therenot huge upside [for public market investors]. Taking yourself out of GV, does this [point] resonate at all?

DK: It resonates to some degree. Entrepreneurship is certainly one of the growth factors in this economy. And so we want to see it thrive. We want to see people in the public markets have an opportunity to experience growth and ride the evolution of these companies. But again, I think itreally a very company specific question.

TC: What about direct listings, which seem to be top of mind, thanks to a confab organized earlier this week by VCs Bill Gurley and Mike Moritz. Since these aren&t fundraising events for companies, ithard for me to see these being widely adopted but what do you think?

DK: I think we heard on the stage yesterday from the founder of Slack that direct listings are not quite as clear as some of the benefits have been presented. As you noted, the company doesn&t always get capital. But I think therea lot of thinking right now about how to do a direct listing [to] ensure that employees and shareholders on the cap table can get some liquidity, but the company can also seek financing as well.

We were very fortunate to be part of Slackdirect listing [and] had a great outcome with that. And as an investor, itgreat not to have a lock-up one day one.

TC: But do you think they&ll they&ll pick up momentum or will these be relegated to very special companies?

DK: I think directionally, therea huge opportunity to continue to innovate and enhance on on many aspects of how companies [obtain] liquidity. I think they&re promising but we need [more] examples of them. I think ita little bit early to tell.

TC: Before you go, therea lot of talk about regulating your parent company. Should it be broken up?

DK: I&ve read the same fear and and focused news articles that you have about this topic. I would say honestly, I&ve been a Google 20 years, It lives inside my veins. I&m very proud of what the company has built. I&m proud to have played a part of that. But I&d say for the last 10 years, having focused on venture capital, I&m really not the most authoritative expert in how Google should think about those sorts of issues. So I&m actually going to take a pass on that one, because we&re focused on something totally different.

TC: Okay. Do you think Facebook should be regulated?

DK: [Laughs.] We can if you like. You know, these are companies that do have a lot of power, they do have a lot of control. But also, the sum of those pieces can be very valuable for consumers and for partners as well. So again, these are these are big, complicated questions. I think these companies will have a lot of questions to answer in the coming months, and we&ll see what happens.

- Details

- Category: Technology

Read more: GV is weighing the sale of its stake in Uber at the end of its lockup period next month

Write comment (90 Comments)

NASA will fly a crewed X-plane, one of the experimental aircraft it creates to test various technologies, for the first time in two decades in the near future. This X-plane, the X-57 Maxwell to be exact, is significant for another reason, too: Itthe first fully electric experimental plane that NASA will fly.

The delivery of the X-57 Maxwell to NASAArmstrong Flight Research Center in California means that they can begin ground testing, which will then be followed by flight testing once they confirm through the ground testing phase that itflight-ready.This all-electric X-57 is just one of a number of modified vehicles that will not only help NASA researchers test electric propulsion systems for aircraft, but will also help them set up standards, design practices and certification plans alongside industry for forthcoming electric aerial transportation options, including the growing industry springing up around electric vertical take-off and landing aircraft for short-distance transportation.

NASA plans to share the results of its testing and flights of the all-electric X-57, as well as its other modified versions, with industry and other agencies and regulatory bodies. The X-plane project also provides another way for NASA to work towards a number of technical challenges that will have big benefits in terms of everyday commercial aerial transportation, like boosting vehicle efficiency and lowering noise to develop planes that are far less disturbing to people on the ground.

- Details

- Category: Technology

Read more: NASA’s first all-electric experimental X-plane is ready for testing

Write comment (92 Comments)Whatthe opposite of a green thumb?

Whatever it is, I have that. My house and yard are full of succulents not because they&re trendy, but because anything else I try to plant dies within a month. When I turn to Google to figure out why my zucchini plant randomly turned white and fell over (did I over water it? Under water it? Plant it on the wrong side of my house? Look at it the wrong way too many times?), I fall into a rabbit hole of forum posts with a million different answers, get overwhelmed, and go back to buying my zucchini from the store like a chump.

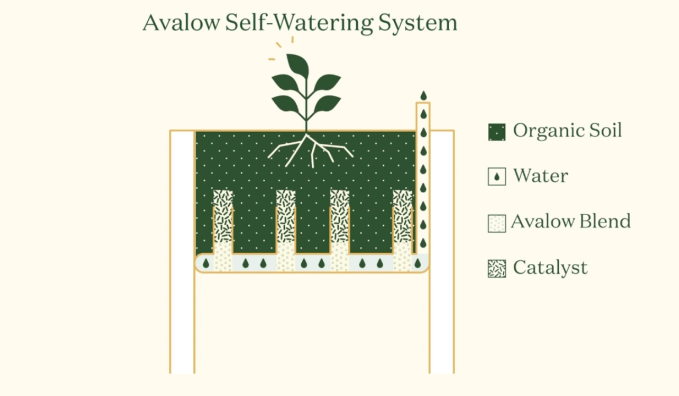

Avalow, a company presenting in the TechCrunch Disrupt SF Startup Battlefield today, wants to help would-be gardeners like myself with a solution that50% hardware and 50% online coaching.

Unlike most of the hardware that hits the stage at Disrupt, you don&t plug Avalonhardware into anything. Thereno Bluetooth, WiFi, batteries, or robotic arms involved.

Instead, they&ve built a self-watering, sub-irrigation-based, raised planter bed. You fill a water reservoir about once a week, and your plants pull up water through the soil by way of capillary action. By letting the plants pull up just the water they need, the company says their planter requires about 30x less water than top-down gardening might.

Their planter costs $400, which might seem a bit wild to anyone whoused to growing things at the cost of digging a hole in the ground. For comparison, a basic, all-wood raised planter box of similar dimensions (without the self-watering reservoir) would cost you $50-$150 from a big box store. Avalowbed is built to last — the company says it should hold up for at least 25 years, though some parts like the self-watering systemwicks should be replaced every 5 years or so. Italso insulated to keep your plantroots safe through weather hot and cold.

The companyfounders tell me they&ve shipped about 400 units so far during its pre-launch pilot program.

But therea bit more to Avalow than a fancy planter. That feeling of disappointment that comes when you go out to check your plants and find that, after 5 weeks of careful watering and care, your little plant friend has suddenly dropped dead? They want to help you avoid it — and if something does go wrong, help you figure out exactly what happened.

To do this, Avalow is also selling a gardening coaching service. At around $120 per season (or roughly $33 per month if bought annually), their experts will help you figure out what you should grow (based on where you are, the local climates, and your personal goals), when to harvest, etc. When your plant does something funky — be it mystery spots on the leaves, sudden plant death, or anything in between — you can chat with your gardening coach for advice, sending them pictures that might help them figure out whatgoing on. They&ll send you the soil and seedlings to get started, plus whatever soil amendments they recommend to make things grow best from season to season. Itlike having a really, really smart gardener friend on speed dial, except they don&t get annoyed when you call them about your zucchini for the seventh time.

Avalow partners with expert gardeners and hires them as coaches. Their coaching team currently includes plant biologists from UC Berkeley, orchard managers, and master certified gardeners. With decades of experience, they&re able to adapt their advice across regions and climates.

As someone who finds himself thinking &I should totally grow some vegetables!& once a year only to end up disappointed and hungry… I totally get this. Having your plant die randomly six weeks into the process sucks and is super demotivating. Having someone who can say &Oh! Thatnot your fault, you just need more [whatever] in the soil!& would be real nice. I don&t know that I&d sign up for it season after season, but I can definitely see myself using it to get things going (/growing.)

- Details

- Category: Technology

Read more: Avalow wants to be your gardening coach

Write comment (92 Comments)Facebook plans to challenge Europetop court, which today ruled that EU countries can order Facebook to globally remove content that violates local laws. Facebook currently complies with proper legal requests to remove content that breaks a nationlaws, but can leave it up for global viewers if the post doesn&t violate its Community Standards.

But today during a livestreamed Q-A with Facebook employees, CEO Mark Zuckerberg said that &This is something I expect us and other companies will be litigating.&

Zuckerberg explained that Facebook had &successfully fought& overly broad takedown requests in the past. He also noted that &a lot fo the details about exactly how [the ruling gets] implemented will depend on national courts across Europe.&

Facebook told TechCrunch in a statement today that:

&This judgement raises critical questions around freedom of expression and the role that internet companies should play in monitoring, interpreting and removing speech that might be illegal in any particular country.

At Facebook, we already have Community Standards which outline what people can and cannot share on our platform, and we have a process in place to restrict content if and when it violates local laws. This ruling goes much further.

It undermines the long-standing principle that one country does not have the right to impose its laws on speech on another country. It also opens the door to obligations being imposed on internet companies to proactively monitor content and then interpret if it is &equivalent& to content that has been found to be illegal.

In order to get this right national courts will have to set out very clear definitions on what &identical& and &equivalent& means in practice. We hope the courts take a proportionate and measured approach, to avoid having a chilling effect on freedom of expression.&

Zuckerberg hadn&t done a livestreamed Q-A recently, but holds them weekly inside Facebook. Yet after The VergeCasey Newton published two-hours of leaked audio from Facebook internal all-hands meetings, Zuckerberg is trying to show he has nothing to hide.

During pre-question remarks, Zuckerberg also discussed the US Attorney General Bill Baropen letter from the US, UK, and Australia demanding that Facebook halt the expansion of encryption across all its messaging apps. &We get that there are real concerns with doing that & Zuckerberg said. &There are these different equities we try to balance&, specifically safety needs like catching child abusers and terrorists versus privacy and protecting political dissidents as well as normal citizens.

The CEO argued Facebook could still police encrypted apps, noting the &Therea lot we can do with detecting patterns& including linking accounts together so it can shut down the WhatsApp accounts of bad actors on Facebook, and that Facebook can &find it upstream& by analyzing suspicious activity outside of the messages threads themselves. He also mentioned that iMessage is the top US messaging app and itencrypted too, showing Facebook isn&t the only one pushing private messaging and clearly users want it.

Queried about Bernie Sanders& statement that &billionaires shouldn&t exist&, Zuckerberg said &no one deserves to have that much money&. Thatdespite having a fortune north of $60 billion, though much of it is dedicated to the Chan Zuckerberg Foundation that works on social and science causes.

Zuckerberg was asked about concerns that his comments regarding Facebook would likely sue to stop an attempt by regulators to break it up. He&d discussed how Presidential candidate Elizabeth Warren had made the break-up a core piece of her policy slate, which led to questions about whether Facebook might try to minimize the reach of her statements or avoid voter registration that could aid.

Zuckerberg crystallized the question, saying &If Facebook is worried about Elizabeth Warren becoming president because of that thing, …how can we be trusted to be impartial and make sure she and other people get a voice?& He said that &Even when people disagree with what I think would be good…I still want to give them a voice . . . We need to be able to put what people want to express…above our preferences all the time.&

Todaysession certainly felt more guarded than the leaked Q-As. At one point Zuckerberg noted he wouldn&t share stats on Facebook Dating because it wasn&t a private discussion. Yet the talk still helped clarify critical Facebook policy positions are a tumultuous time for the company.

Zuckerberg joked at the beginning of the Q-A that hemaking this one publicly available because &I do such a bad job in interviews that itlike, what do we have to lose?&

- Details

- Category: Technology

Read more: Zuckerberg says Facebook will sue to stop EU’s global content takedowns

Write comment (91 Comments)

One of the most senior officials tasked with protecting U.S. critical infrastructure says that the lack of security professionals in the U.S. is one of the leading threats to national cybersecurity.

Speaking at TechCrunch Disrupt SF, Jeanette Manfra, the assistant director for cybersecurity for the Homeland SecurityCybersecurity and Infrastructure Security Agency (CISA), said that the agency was making training for new cybersecurity professionals a priority.

&Ita national security risk that we don&t have the talent regardless of whether itin the government or the private sector,& said Manfra. &We have a massive shortage that is expected that will grow larger.&

Homeland Security is already responding, working on developing curriculum for potential developers as soon as they hit the school system. &We spend a lot of time invested in K-12 curriculum,& she said.

The agency is also looking to take a page from the the tech industryplaybook and developing a new workforce training program thatmodeled after how to recruit and retain individuals.

For Manfra, itimportant that the tech community and the government agencies tasked with protecting the nationcritical assets work more closely together, and the best way to do that is to encourage a revolving door between cybersecurity agencies and technology companies. That may raise the hackles of privacy experts and private companies, given the friction between what private companies wish to protect and what governments wish were exposed — through things like backdoors — but Manfra says close collaboration is critical.

Manfra envisions that government will pay for scholarships for cybersecurity professionals who will spend three to five years in government before moving into the private sector. &It builds a community of people with shared experience [and] in security we&re all trying to do the same things,& she said.

Priorities for Homeland Security are driving down the cost of technologies so that the most vulnerable institutions like states, municipalities and townships or the private companies that are tasked with maintaining public infrastructure — that don&t have the same money to spend as the federal government — can protect themselves.

&When you think about a lot of these institutions that are the targets of nation sates… a lot of them have resources at their disposal and many of them do not,& said Manfra. &[So] how do we work with the market to build more secure solutions — particularly with industrial control systems.&

The public also has a role to play, she said. Because itnot just the actual technological infrastructure that enemies of the U.S. are trying to target, but the overall faith in American institutions — as the Russian attempt to meddle in the 2016 election revealed.

&Italso about building a more resilient and aware public,& said Manfra. &And adversaries have learned how they can manipulate the trust in these institutions.&

- Details

- Category: Technology

Read more: The lack of cybersecurity talent is ‘a national security threat,’ says DHS official

Write comment (99 Comments)

Naspers, a South African internet company that has become a major investor in a wide range of digital commerce companies, has in recent years drawn comparisons to the Japanese conglomerate SoftBank. For one thing, Naspers, like SoftBank, is very global in nature, with investments in more than 90 countries. Naspers, like SoftBank, doesn&t shy from writing big checks, as happened a few years ago when it plugged $100 million into LetGo, a New York-based company whose app aims to make it as easy to sell something as it is to throw it away.

Naspers also goes after startups at a variety of stages with the promise that it can help them expand around the world. LetGo, for example, is now available to users in more than 35 countries.

Yet most meaningfully, both are largely associated with early and exceedingly lucrative investments in Chinese companies. In SoftBankcase, it made an early bet on the Chinese giant Alibaba, and even while it has pared its stake slightly, that holding is valued at more than $100 billion. Similarly, Naspers made an early bet on the Chinese giant Tencent, and it retains a 31% percent stake in the business that its CEO, Bob van Dijk, said today onstage at Disrupt it has no intention of selling any time soon. That stake is also valued at more than $100 billion.

Still, van Dijk made clear that the comparisons should stop there. Asked how Naspers differentiates itself from SoftBank and whether it would ever form a Vision Fund-esque vehicle to invest money even more aggressively into startups, the answers were that a) the two are very different and b) no.

Said van Dijk, &I&ve met [CEO] Masa [Son] and many of his team over the years and they&re an impressive bunch of people. I think what they&ve done is unprecedented and had a big impact on the industry.& Still, Naspers is ¬ a fund,& he noted; ita holding company, and, as such, it can invest for 20 years if it needs. And &that helps, he said. &It allows you to think [about investments] over a long amount of time.& He said this was particularly important around food delivery, into which Naspers has plugged $5 billion in recent years and van Dijk feels strongly has vast potential, even while he acknowledged that for the foreseeable future, the industry is likely to remain hugely unprofitable.

As for SoftBank, he continued, &They are great investors.& But they are also &broad in their approach,& whereas Naspers is &more focused. We invest in what we really know. What has served us well is to build up expertise, then go bigger. But we couldn&t deploy $100 billion in things that I don&t understand.&

As for how he would judge the performance of SoftBankstrategy, van Dijk was unsurprisingly democratic. &We co-invested in Flipkart, and we had the same vision of an attractive India market with great growth and great founders.&

Added van Dijk, &They&ve taken a bigger volume approach, and I hope it works out.&

You can catch the entire conversation — in which van Dijk also noted Naspersgrowing interest in U.S. startups and shared some insights into a new holding company that Naspers recently took public in Europe — below.

- Details

- Category: Technology

Page 730 of 5614

9

9