Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Another consumer finance business is lining up investors for its largest cash infusion yet.

Affirm, founded by PayPalMax Levchin, is said to be raising as much as $1.5 billion in a combination of debt and equity, according to people with knowledge of the companyfundraising activities. Josh KushnerNew York venture capital firm Thrive Capital is said to be leading the financing, with participation from the San Francisco outfit Spark Capital.

Sources familiar with Affirm, which gives consumers an alternative to personal loans and credit by financing online purchases at point-of-sale, presume the round will be made up largely of a line of credit from a large financial institution, known as a warehouse facility.

Affirm recently raised a $300 million Thrive-led Series F round in April at a valuation of $3 billion. Fintech companies focused on payments and lending, however, require a vast amount of capital to sustain operations. Those capital requirements coupled with the frothiness of the venture capital market justify this additional cash infusion.

To date, Affirm has raised $1.03 billion in funding from Ribbit Capital, Founders Fund, Andreessen Horowitz, Khosla Ventures, Lightspeed Venture Partners and more, according to PitchBook. Fellow fintech ‘unicorns& Brex, Stripe, SoFi and Kabbage, for context, have collectively raised roughly $5 billion in debt and equity to date.

Affirm offers installment plans to online shoppers, a method of delayed payment historically reserved for large purchase like vehicles or luxury electronics. Using Affirm, consumers can create personalized installment plans for purchases as small as a pair of sneakers sold by StockX or as large as a diamond engagement ring from Diamond Nexus, for example.

Affirm, serving as an alternative to a credit card charge, requires no paperwork, minimum credit score or income. The company, however, makes money the same way as a credit card provider, with interest rates for Affirmloans falling between 10% and 30%.

Affirmfundraising efforts come as more and more companies are devoting ample resources to consumer and B2B lending. Affirm, doubling down on the opportunity in B2B, spun out a new financial services business focused entirely on business lending earlier this year. The company, Resolve, provides a &buy now, pay later& option tailored to B2B sales flow.

&Traditional B2B financing is slow, inaccurate and limits a businesspotential for growth because of an over reliance on email, call centers, faxes and manual invoicing processes,& Resolve wrote in an April press release. &Today, many companies offer a standard net 30-day payment plan only to their best and longest tenured customers, leaving others in need of financing to rely on credit cards or installment loans.&

Meanwhile, companies like Stripe and Square are making a concerted effort to explore other financial frontiers, with the former launching a lending tool as well as a corporate credit card this month. Square, for its part, recently introduced a new debit card, called the Square Card, allowing businesses to withdraw and spend money they&ve collected through Square payments.

Venture investment in fintech companies headquartered in the U.S. is poised to reach new highs this year. In the first eight months of 2019, $10.5 billion was funneled into the sector, following a record high of $11.6 billion in 2018. Globally, fintech investment is increasing, too, with nearly $20 billion deployed this year, per PitchBook.

Competition in the fintech space has accelerated growth and innovation, as consumer-friendly, frictionless tools permeate the conservative and highly-regulated finance industry.

Following a year of fintech mega-rounds, we expect to seem a series of fintech initial public offerings as soon as next year. Affirm, Robinhood, Stripe, SoFi, Coinbase, we&re looking at you.

- Details

- Category: Technology

Read more: Max Levchin’s Affirm seeks capital amid surge in fintech funding

Write comment (96 Comments)Voyage, the autonomous vehicle startup that spun out of Udacity, announced Thursday it has raised $31 million in a round led by Franklin Templeton.

Khosla Ventures, Jaguar Land-RoverInMotion Ventures, and Chevron Technology Ventures also participated in the round. The company, which operates a ride-hailing service in retirement communities using self-driving cars supported by human safety drivers, has raised a total of $52 million since launching in 2017. The new funding includes a $3 million convertible note.

Voyage CEO Oliver Cameron has big plans for the fresh injection of capital, including hiring and expanding its fleet of self-driving Chrysler Pacifica minivans, which always have a human safety driver behind the wheel.

Ultimately, the expanded G2 fleet and staff are just the means towards Camerongrander mission to turn Voyage into a truly driverless and profitable ride-hailing company.

&Itnot just about solving self driving technology,& Cameron told TechCrunch in a recent interview, explaining that a cost effective vehicle designed to be driverless is the essential piece required to make this a profitable business.

The company is in the midst of a hiring campaign that Cameron hopes will take its 55-person staff to more than 150 over the next year.Voyage has had some success attracting high-profile people to fill executive-level positions, including CTO Drew Gray, who previously worked at Uber ATG, Otto, Cruise and Tesla, as well as former NIO and Tesla employee Davide Bacchet as director of autonomy.

Funds will also be used to increase its fleet of second-generation self-driving cars (called G2) that are currently being used in a 4,000-resident retirement community in San Jose, Calif., as well as The Villages, a 40-square-mile, 125,000-resident retirement city in Florida. VoyageG2 fleet is 12. Cameron didn&t provide details on how many vehicles it will add to its G2 fleet, only describing it as a &nice jump that will allow us to serve consumers.&

Voyage used the G2 vehicles to create a template of sorts for its eventual driverless vehicle.This driverless product — a term Cameron has used in a previous post on Medium— will initially be limited to 25 miles per hour, which is the driving speed within the two retirement communities in which Voyage currently tests and operates. The vehicle might operate at a low speed, but they are capable of handling complex traffic interactions, he wrote.

&It won&t be the most cost effective vehicle ever made because the industry still in its infancy, but it will be a huge, huge, huge improvement over our G2 vehicle in terms of being be able to scale out a commercial service and make money on each ride,& Cameron said.

Voyage initially used modified Ford Fusion vehicles to test its autonomous vehicle technology and then introduced in July 2918 Chrysler Pacifica minivans, its second generation of autonomous vehicles. But the end goal has always been a driverless product.

TechCrunch previously reported that the company has partnered with an automaker to provide this next-generation vehicle that has been designed specifically for autonomous driving. Cameron wouldn&t name the automaker. The vehicle will beelectric and it won&t be a retrofit like the ChryslerPacifica Hybrid vehicles Voyage currently uses or its first-generation vehicle, a Ford Fusion.

Most importantly, and a detail Cameron did share with TechCrunch, is that the vehicle it uses for its driverless service will have redundancies and safety-critical applications built into it.

Voyage also has two deals in place with Enterprise rental cars and Intact insurance company to help it scale.

&You can imagine leasing is much more optimal than purchasing and owning vehicles on your balance sheet,& Cameron said. &We have those deals in place that will allow us to not only get the vehicle costs down, but other aspects of the vehicle into the right place as well.&

- Details

- Category: Technology

Read more: Voyage raises $31 million to bring driverless taxis to communities

Write comment (96 Comments)

Anti-fraud startup Shape Security has tipped over the $1 billion valuation mark following its latest Series F round of $51 million.

The Mountain View, Calif.-based company announced the fundraise Thursday, bringing the total amount of outside investment to $173 million since the company debuted in 2011.

C5 Capital led the round along with several other new and returning investors, including Kleiner Perkins, HPE Growth, and Norwest Ventures Partners.

Shape Security protects companies against automated and imitation attacks, which often employ bots to break into networks using stolen or reused credentials. Shape uses artificial intelligence to discern bots from ordinary users by comparing known information such as a userlocation, and collected data like mouse movements to shut down attempted automated logins in real-time.

The company said it now protects against two billion fraudulent logins daily.

C5 managing partner André Pienaar said he believes Shape will become the &definitive& anti-fraud platform for the worldlargest companies.

&While we while we expect a strong financial return, we also believe that we can bring Shapeplatform into many of the leading companies in Europe who look to us for strategic ideas that benefit the entire value-chain where B2C applications are used,& Pienaar told TechCrunch.

Shapechief executive Derek Smith said the $51 million injection will go towards the companyinternational expansion and product development — particularly the capabilities of its AI system.

He added that Shape was preparing for an IPO.

- Details

- Category: Technology

Read more: Shape Security hits $1B valuation with $51M Series F

Write comment (91 Comments)Nintendo has been at the crossroads of video games and fitness since the famous Power Pad for the NES, and the Switch is the latest to receive a game powered by physical activity: Ring Fit Adventure. And it actually looks fun!

In the game, you&ll jog in place to advance your character, and perform various movements and exercises to avoid obstacles and defeat enemies. Your quest is to defeat an &evil body-building dragon& who has disrupted the peaceful, apparently very fit world of the protagonist. Sure.

The game comes with a pair of accessories: a ring and leg strap, each of which you slot a Joy-Con into. The two controllers work together to get a picture of your whole body movement, meaning it can be sure you&re keeping your arms out in front of you when you do a squat, and not phoning it in during leg raises.

The ring itself is flexible and can tell how hard you&re squeezing or pulling it— but don&t worry, it can be calibrated for your strength level.

Interestingly, the top button of the controller appears to be able to be used as a heart rate monitor. That kind of came out of left field, but I like it. Just one more way Nintendo is making its hardware do interesting new things.

There look to be a ton of different movements you&ll be required to do, focusing on different areas of the body: upper, lower, core, and some sort of whole-body ones inspired by yoga positions. Ingeniously, some enemies are weak to one or another, and you&ll need to use different ones for other scenarios, so you&re getting a varied workout whether you like it or not.

Meanwhile your character levels up and unlocks new, more advanced moves — think a lunge instead of a squat, or adding an arm movement to a leg one — and you can get closer to the goal.

There are also minigames and straight-up workouts you can select, which you can do at any time if you don&t feel like playing the actual game, and contribute to your characterlevel anyway.

The idea of gamifying fitness has been around for quite a while, and some titles, like Wii Fit, actually got pretty popular. But this one seems like the most in-depth actual game to use fitness as its main mechanic, and critically it is simple and easy enough that even the most slothful among us can get in a session now and then at their own pace.

Ring Fit Adventure will be available October 18 — no pricing yet, but you can probably expect it to be a little above an ordinary Switch game.

You can watch the full-length walkthrough of the game below, but beware — the acting is a little off-putting.

- Details

- Category: Technology

Read more: Nintendo shows off exercise-powered RPG for Switch, Ring Fit Adventure

Write comment (95 Comments)

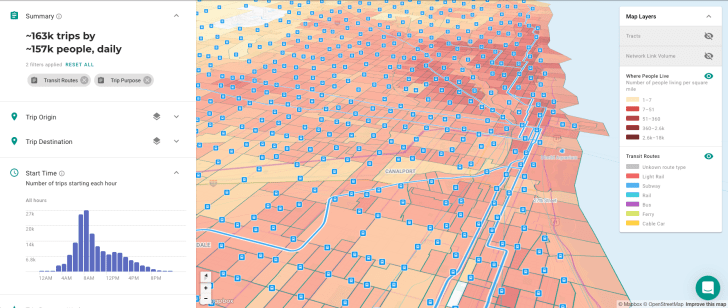

Replica, the data-gathering tool created within Sidewalk Labs that maps the movement of people in cities, is now a company.

The newly formed company, which is headed by Nick Bowden, also announced Thursday it has raised $11 million in a Series A funding round from investors Innovation Endeavors, Firebrand Ventures, and RevolutionRise of the Rest Seed Fund. The capital will be used to accelerate Replicagrowth through new hires beyond its existing 13-person staff, expansion to new cities and investment in its technology.

Replica will remain connected toSidewalk Labs, the smart city technology firm owned by Googleparent company Alphabet. Both Sidewalk Labs and Innovation Endeavors will be on the companyboard.

Replica, which is headquartered in Kansas City with an engineering office in San Francisco, plans to launch in several new regions. Replica is already working with Kansas City, Portland, Chicago and Sacramento, with more cities to come this year.

The Replica tool, which has drawn the ire of some privacy advocates, grew out of Model Lab, a project started two years ago to investigate modeling as a way to address urban problems. Early work focused on meeting with public agencies throughout the world to learn more about the data, processes and other tools they used.

The Replica planning tool was born out what they discovered: public agencies don&t have all the information needed to understand the link and interdependence between transportation and land use. The upshot is a an incomplete picture of how people move within cities, leaving public agencies ill-equipped to make decisions about how land is used and what transportation is needed and where, the company says.

&Answering questions like who uses the street, in which way and why, are critical for city planners as they work to make transit and land use more efficient and sustainable,& Bowden wrote. &But current resources available to city planners to analyze peopletravel in urban areas are less than satisfactory.&

The Replica modeling tool uses de-identified mobile location data to give public agencies a comprehensive portrait of how, when, and why people travel. Movement models are matched to a synthetic population, which has been created using samples of census demographic data to create a broad new data set that is statistically representative of the actual population. The result, Bowden says, is a model that is both privacy-sensitive and extremely useful for public agencies.

Bowden tried to quell privacy worries Thursday in a blog post emphasizing that the data has been &de-identified,& meaning that an individuallocation data would be identifiable.The company says itnot interested in the movement of individuals. Instead, the modeling tool is used to see and understand patterns of movement.

&For this reason, we only start with data that has been de-identified,& Bowden wrote Thursday. &This data is then used to train a travel behavior model — basically, a set of rules to represent the movement in a particular place.&

- Details

- Category: Technology

Read more: Sidewalk Labs spins out urban data-gathering tool Replica into a company

Write comment (91 Comments)Patreon, the platform for independent content creators to operate membership businesses for their core fans, announced it is selling the assets of Kit.com to localized affiliate link service GeniusLink.

Founded in 2015, Kit is a social-shopping platform where influencers curate bundles of products (&kits&) they recommend. When their fans buy products they featured in a kit, the influencer earns an affiliate fee commission. Kit has 2.3 million monthly web visitors, according to SimilarWeb.

Among the most notable content creators on Kit, YouTuber Casey Neistat curated a kit featuring his favorite camera gear and author Tim Ferriss curated kits featuring his favorite podcasting equipment and the health products recommended by interviewees in his Tools for Titans book.

Screenshot of Kit.comprofile site for Tim Ferriss

Patreon acquired Kit in June 2018 in what PatreonSVP Product Wyatt Jenkins described to me during my in-depth series on the company as &close to an acqui-hire,& adding that &although Kit is a good revenue source for a lot of creators — so itnot a shut-down of Kit — we&re maintaining it but not iterating on it.&

Kit had previously raised $2.5 million in venture capital from backers like Social Capital, #Angels, Precursor Ventures, Expa, and Ellen Pao. While the Kit site remained active, the team behind it was reassigned to lead product development for Patreonmerch offering.

It is unsurprising that Patreon found a new home for the asset. While Kit is a tool for creators to monetize, it doesn&t enhance paid memberships for fans and thatPatreonexclusive focus right now. Even Patreonmerch product is only for offering merch as a benefit for membership tiers, not for managing an e-commerce store with one-time transactions.

In a blog post today announcing the acquisition, GeniusLink wrote that &The first order of business for Geniuslink is to migrate Kit to the Geniuslink infrastructure and work to improve speed and reliability while our operations team dives into user support. We look forward to adding additional functionality for creators to monetize their kits in the coming months.&

GeniusLink launched in 2009, originally branded as GeoRiot. The bootstrapped company has 13 employees headquartered in Seattle.

Social commerce is a popular trend right now, with other social platforms testing e-commerce integrations for users (particularly influencers) to feature products. YouTube now has a built-in merch section for a creator to sell products under their videos and Instagram lets influencers sell products directly in the app. These have the advantage of providing influencer-curated shopping experiences right where influencers and their fans already are.

Those features assume an influencer is selling their own products, however, or at least the products of a brand they&ve formally partnered with. For Kit and its affiliate link model, the focus is on influencers as trusted curators for their fans. The influencer can feature a much wider variety of products and do so immediately, without negotiating a deal with each brand.

Thatalso why the model likely doesn&t make sense for many popular influencers — they want more money for their endorsement of a product than a standard affiliate link fee, and recommending lots of products they don&t have formal deals to promote may undercut them in their negotiations with brands.

As GeniusLink adds more monetization features to Kit, perhaps it will make it a more lucrative business activity for small and large influencers alike.

- Details

- Category: Technology

Read more: Patreon sells product curation site Kit to GeniusLink

Write comment (94 Comments)Page 919 of 5614

19

19