Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

YouTube has long been the key to Vevomusic syndication services, and in a blog post today, the company announced plans to focus even more on the site. The effort, which finds Vevo, &focused on engaging the biggest audiences and pursuing growth opportunities,& also involves trimming away some of the elements it deems unnecessary to that strategy.

On the chopping block are VevoiOS, Android and Windows apps, along with the consumer-facing side of its own site. &To be most effective in achieving those goals,& Vevo writes, &we will phase out elements of our owned and operated platforms.&

Those who have been viewing servicecontent through its proprietary offering will get access to tools for importing things like playlists to YouTube. Of course, the Universal/Sony/Warner Music-owned service is doing this precisely at the moment that YouTube is launching its own music service to compete with the likes of Spotify.

That ultimately could put a hamper on the companyplans to essentially put all of its eggs into the YouTube basket. The company hasn&t yet announced what non-YouTube platforms will ultimately be key to its strategy moving forward, though Variety notes that, for now, at least, the company is continuing to offer apps for some smart TVs.

Amazonunannounced YouTube competitor could be on the list, as the company looks to provide its own video platform for the Echo. For now, however, Vevo will continue to focus on advertising and original content, as it leans even more heavily on Googlevideo service.

- Details

- Category: Technology

Read more: Vevo will shutter apps, in order to focus on YouTube

Write comment (98 Comments)

Google earlier this year rebranded all of its payment services under Google Payto help it double down on making transactions across its platform more frictionless (and more used). Now comes another development: PayPal and Google are kicking off a deep integration, where users who add their PayPal details to their Google Play accounts will be able to pay bills and for other items, using PayPal, without logging in and without leaving the Google services.

The integration, when it goes live later this year, will cover apps like Gmail, YouTube, Google Store and any services using Google Pay — and it will include not just payments but also peer-to-peer transfers.

This is not the first time that Google and PayPal have worked together — the latter has been a payment option in Google Playsince 2014, in-store, and in online transactions that were managed by Google and a Google Pay option since last year. And similarly, Google itself has a number of other partners from the payments world, including Braintree, Sripe, Cybersource, Vantiv, Visa and Mastercard.

This new phase of the relationship is interesting for how it benefits both sides. For Google, it will mean that users are less likely to leave Google sites to complete a transaction, potentially never to return; and will give users one more option for how to pay for things, making Googleown sales more likely to be completed rather than abandoned. For PayPal, it will give users one more easy option for using its rails when buying things, and that will translate into more transaction revenues for PayPal.

We&re in an interesting phase in the world of payments at the moment. The challenge is no longer getting people used to the idea of paying online: a substantial proportion of consumers in developed markets are willing and able to pay for items on digital platforms. The problem is one of trying to capture and keep users& attention: there are potentially now too many payment options, and too many places for us to visit too easily. The struggle for app publishers, platform owners, and others now is to keep people engaged in yourproduct, rather than migrating elsewhere, which could lead to people abandoning their purchases and also leaving your service for another one.

This is part of the reason why Amazon is so effective: it provides a very seamless and quick way for people to browse and buy things, even more so if you are a Prime subscriber.

In payments, this is translating into a new wave of services where transactions are being enabled at the point at which you need them, with minimal friction: no log-ins, no jumping to new sites or apps, no additional steps. Google and PayPal are not the only ones who are now knitting all of this together more tightly.

Just earlier this month, Microsoft integrated its own answer to Google Pay, Microsoft Pay, into Outlook precisely for this reason, with Stripe as one of the first active integration partners. And PayPal itself is buying mobile payments company iZettle to close the loop better on point of sale payments in markets like Europe.

I asked Bill Ready, the EVP and COO of PayPal (and previously the co-founder and head of Braintree), why ittaken this long to get this integration in place on Google. I didn&t get a direct answer, but a hint that although tighter integration is the goal, itnot always that easy to stitch together services from different silos:

&We are always looking for ways to improve the experience and to make payments even more seamless and secure for our customers wherever they want to pay,& he said. &After the successful launch with Android Pay last year, which built on our existing integration with Google Play, our teams came together to enable this new experience, which will allow customers in the U.S. who addPayPalto any one of Googleservices to be able to pay across the Google ecosystem, anywhere thatPayPalis offered as a payment method, with only minimal setup.&

- Details

- Category: Technology

Pornhub is diversifying. The most popular site that no one you know will admit to frequenting, is launching its very own VPN service today, called, get this: VPNHub. The app, which is available on Android, iOS, MacOS and Windows, is primarily designed to offer &free and unlimited bandwidth,& according to its creators.

Itan attempt to circumvent ISP throttling, a potential boon for those who frequently visit sites with lot of video. Sites like, well, PornHub. &With 90 million visitors a day, the vast majority of whom are using devices on the go, itespecially important that we continue to ensure the privacy of our users,& VP Corey Price said in a statement.

The app is free on the aforementioned mobile platforms, but therea premium for desktop users. Another higher tier will drop ads, offer faster connection speeds and provide logins in additional countries, according to the company. That one runs either $13 a month or $90 for a full year subscription.

Of course, there are some privacy concerns to contend with, including some security issues that have arisen in recent months. This WTF is a VPN primer should good you a good overview of what you&re contending with a bit more broadly.

&Assume that all the free VPN apps that you see in the App Store and Google Play are free for a reason,& Romain wrote in the piece. &They&ll analyze your browsing habits, sell them to advertisers, inject their own ads on non-secure pages or steal your identity. You should avoid free VPNs at all costs.&

So, keep that in mind.

If you want to take the leap, however, the service is available now. Therealso a free seven-day trial for the premium version.

- Details

- Category: Technology

Read more: Pornhub has its own VPN now

Write comment (98 Comments)Sinemia is further differentiating itself from its main competitor, MoviePass. The moviegoing startup is launching a new feature today that gets rid of the need for people to have a physical card in order to purchase movie tickets. This comes after a number of new Sinemia customers reported long wait times for their debit cards to arrive.

&TheCardless feature was in our product pipeline but we accelerated it due to strong demand and issues that it brought,&Sinemia founder and CEO Rifat Oguz said in a statement to TechCrunch.

Following Sinemialaunch of new plans that cost as little as $4.99 a montha few weeks ago, interest and demand has skyrocketed, according to the company. That resulted in longer wait times for debit cards.

&We&ve seen incredible demand for our movie ticket subscription service, with many customers wanting to dive right in and buy movie tickets without waiting for a physical card to be shipped to them,& Oguz said in a press release. &At Sinemia, we strive to provide the best moviegoing experience possible while driving the industry forward, and this is just one example of how we&re moving quickly to address our customers& needs. Sinemia Cardless makes it easier than ever for people to get their movie tickets in advance.&

MoviePass, on the other hand, requires a physical card that you have to use in person at the theater. That means advanced ticketing is not an option with MoviePass. Sinemiacardless feature will not just be available to new customers, but to everyone in the U.S., Canada, the U.K. and Australia. Meanwhile, MoviePass is on the struggle bus and might not have enough money to make it through the summer.

- Details

- Category: Technology

Read more: Sinemia, a MoviePass competitor, launches cardless ticketing

Write comment (94 Comments)WorkFusion, a business process automation software developer, has raised $50 million in a new, strategic round of funding as it prepares to start adding new verticals to its product suite.

The companynew cash came from the large insurance company, Guardian; healthcare services provider New York-Presbyterian; and the commercial bank, PNC Bank. Venture investor Alpha Intelligence Capital, which specializes in backing artificial intelligence-enabled companies, also participated in the new financing.

Certainly WorkFusion seems to have come a long way since its days hiring crowdsourced workers to train algorithms how to automate the workflows that used to be done manually. The company has raised a lot of money — roughly $121 million, according to Crunchbase —which is some kind of validation, and in its core markets of financial services and insurance itattracted some real fans.

&Guardian uses data to better understand and serve customers, and WorkFusion will bring new data-driven intelligence capabilities into the company,& said Dean Del Vecchio, executive vice president, chief information officer and head of Enterprise Shared Services at Guardian, in a statement. &We look to invest in and deploy RPA and AI technology that can help us leap forward in operations and improve outcomes — WorkFusion has that potential.&

According to chief executive Alex Lyashok, the company now intends to begin looking at acquisition opportunities that can &complement our technology,& he said. &WorkFusion today is focused on banking, financial services and insurance. This problem [of automation] is not endemic to those industries.&

Particularly of interest to the New York-based company are those industries that missed out on the first wave of automation and digitization. &Industries that have already invested in digitization are being very aggressive, but companies that have been very manual and then have not developed a technology program internally,& also represent a big opportunity, Lyashok said.

- Details

- Category: Technology

Read more: WorkFusion adds $50 million from strategic investors as it bulks up for acquisitions

Write comment (92 Comments)

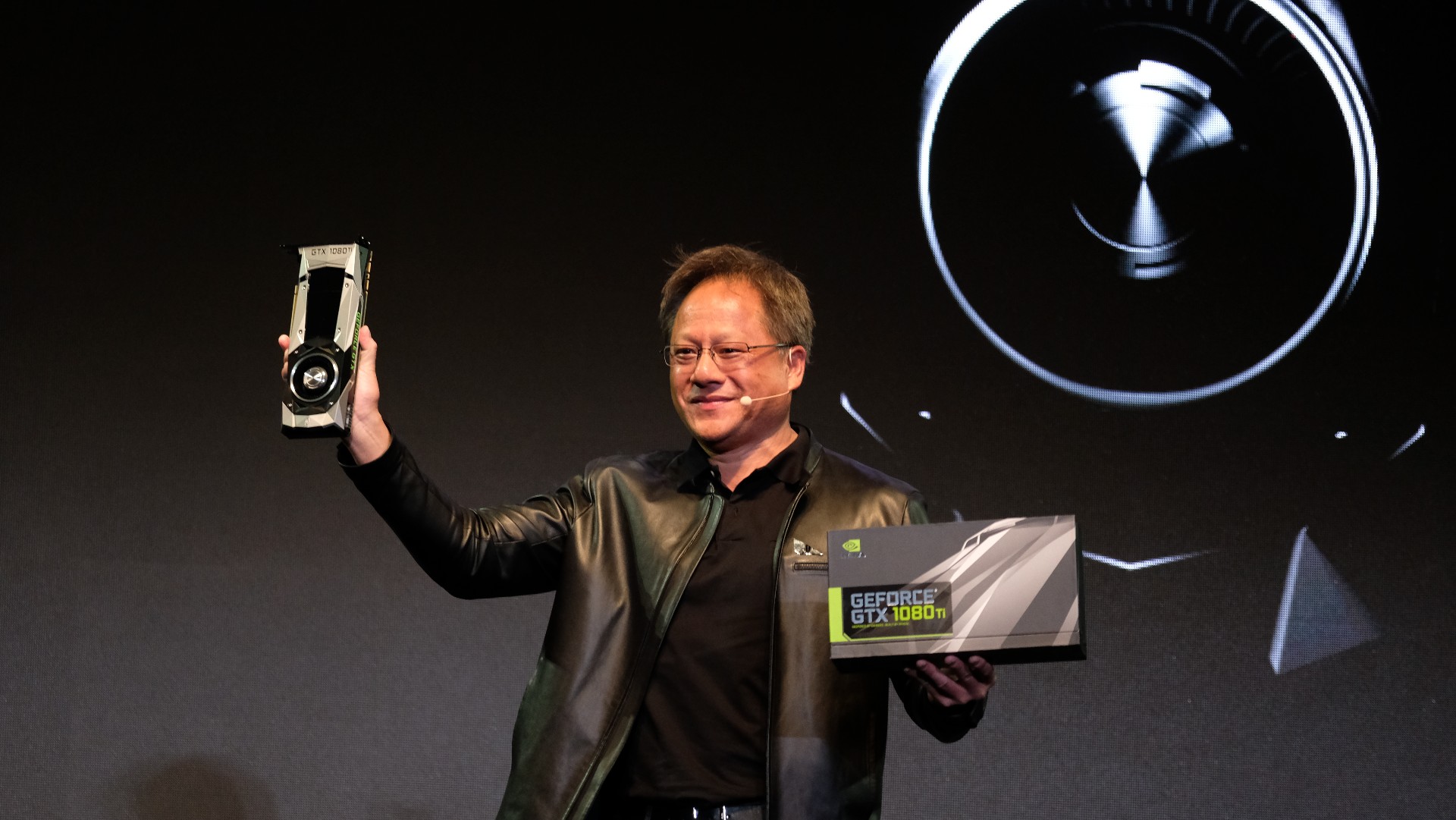

It’s been a while since Nvidia has released a new generation of graphics cards. Over the last year or so, we’ve been at the edge of our seats following three separate GPU architectures between Volta, Ampere and Turing, just waiting for Nvidia to reveal the real next-generation graphics architecture.

Thankfully, that wait is nearly over.

Over the

- Details

- Category: Technology

Read more: Nvidia GeForce GTX 1180 release date, news and rumors

Write comment (100 Comments)Page 5273 of 5614

19

19