Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

People really love getting their coffee more quickly. Starbucks, which has operated its own mobile payments service since 2011, is the market leader in terms of mobile payments users, beating out Apple Pay, Google Pay, and Samsung Pay, according to a new reporter from eMarketer out this morning. However, Starbucks& lead over Apple Pay is only a small one & in 2017, it had 20.7 million U.S. users compared with Apple Pay19.7 million. And that gap will remain small this year, with 23.4 million using Starbucks& mobile payments compared with 22 million using Apple Pay.

The wide adoption of the Starbucks mobile payment service is not only due to speed and convenience that the barcode-based payment system offers & italso because payments are tied to loyalty, and the Starbucks app is where customers can monitor and manage their card balance and their &star rewards.& In addition, Starbucks has the benefit of being able to offer a consistent payments experience across its stores & therenever a question in consumers& minds as to whether they can use its mobile payments service. They know they can.

Other mobile proximity payment services don&t have the same advantage, as many retailers still don&t offer payment terminals that support the tap-to-pay services like Apple Pay and Google Pay.

According to eMarketerforecast, 23.4 million people ages 14 and older will use the Starbucks app to make a point-of-sale purchase at least once every six months, compared with 22 million who will use Apple Pay, 11.1 million who will use Google Pay, and 9.9 million who will use Samsung Pay.

Those numbers will increase across the board through 2022, but the rankings will remain the same & with Starbucks then seeing 29.8 million users to Apple Pay27.5 million.

However, this forecast appears to be discounting the impact of the recent expansion of Apple Pay, which will allow users to send payments to friends through iMessage. When you receive this money, itadded to an Apple Pay Cash card in your iPhoneWallet, which can then be used in stores, in addition to in apps or online. This built-in payments service inside one of the largest messaging platforms could prompt more users to adopt Apple Pay, even if they hadn&t before.

Another note: it seems which services are more popular than others is also tied to how long they&ve been around.

Apple Pay launched before Samsung and Google Pay, and is now accepted at more than half of U.S. merchants. Google Pay isn&t as widely accepted, but is pre-installed on Android, which will help it grow. Samsung Pay, meanwhile, has the lowest adoption in terms of users, but is most accepted by merchants, says eMarketer.

The rankings of the various payment services wasn&t the only notable finding from eMarketernew report.

The analysts also found that this year, for the first time, more than 25 percent of U.S. smartphone users ages 14 and older, will have used a mobile payment service at least once every six months. The number of payments users will increase by 14.5 percent to reach 55 million by the end of 2018, the firm estimates.

But over the next several years, these top four services will see their share of the mobile payments drop, even as their user numbers grow. Thatbecause they&ll face increased competition from other new payment apps, including those from merchants themselves.

&Retailers are increasingly creating their own payment apps, which allow them to capture valuable data about their users. They can also build in rewards and perks to boost customer loyalty,& eMarketer forecasting analyst Cindy Liu says.

eMarketerforecast(paywalled) is based on an analysis of third-party data, including Forrester, Juniper Research, and Crone Consultingdata on U.S. mobile payments users.

Note: Updated after publication to clarify the data is focused on U.S. mobile users

- Details

- Category: Technology

Read more: Starbucks’s mobile payment service is slightly outpacing Apple’s

Write comment (98 Comments)

After confirming the Mi 8 moniker for the upcoming flagship smartphone model on Tuesday, Xiaomi has announced that they will introduce the next iteration of their proprietary MIUI ROM — MIUI 10 alongside at the event on 31 May.

Xiaomi has released a teaser on Weibo touting the MIUI 10 to be lightning fast.

The company kicked off the development

- Details

- Category: Technology

Read more: MIUI 10 now has a confirmed release date

Write comment (91 Comments)

Apple's A12 chip, expected to be at the heart of the new iPhone XI and iPhone 9 for 2018, is now in mass production, according to a new report today.

The A12 chipset is said to be faster, yet smaller than previous generation chips, with a 7-nanometer design from Taiwanese supplier TSMC, reports Bloomberg.

Its the smaller package that will allow this

- Details

- Category: Technology

Read more: New iPhone 2018's A12 chip reportedly smaller, faster and in-production

Write comment (97 Comments)

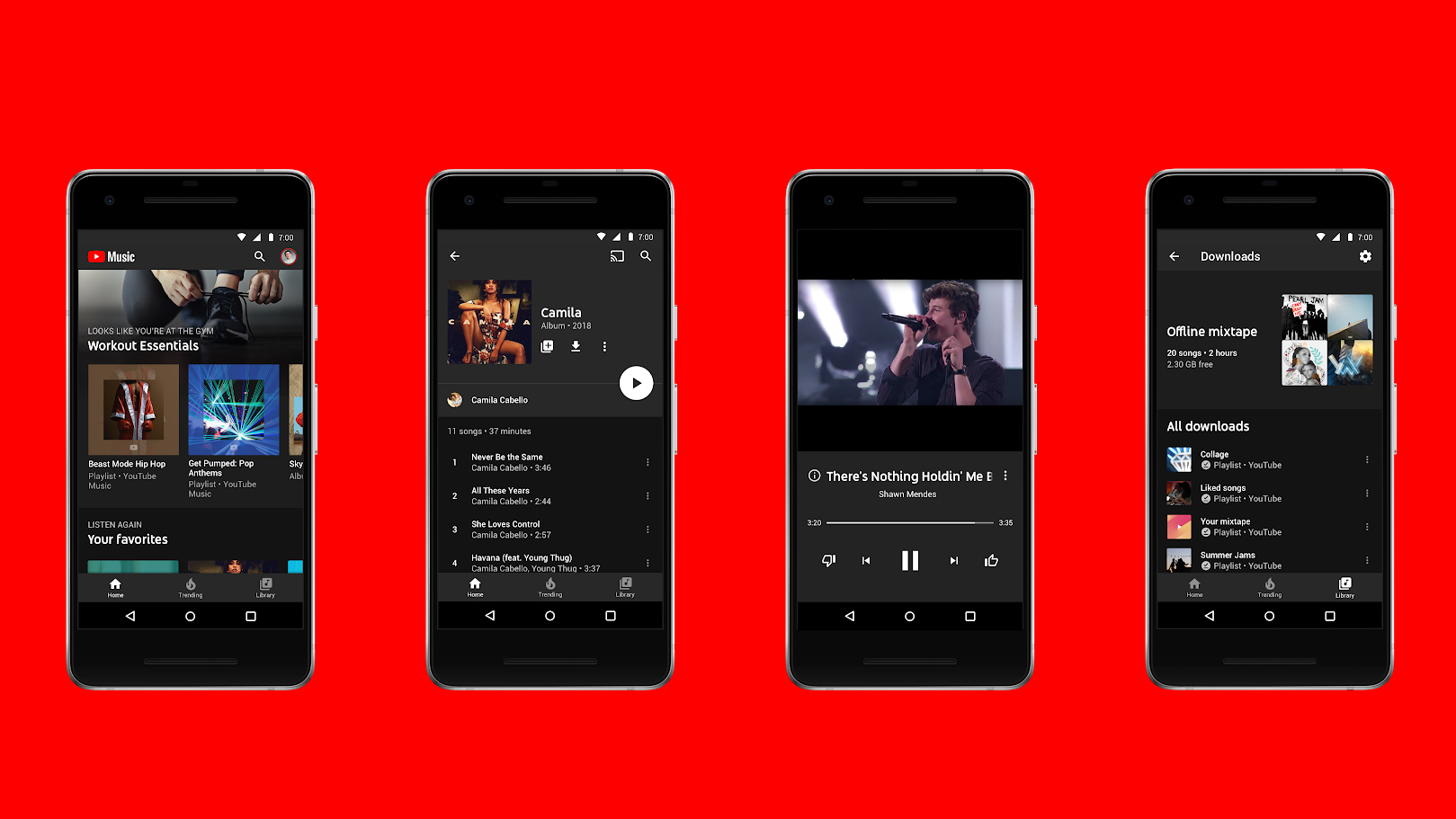

YouTube is changing today with the rollout of both YouTube Music and YouTube Premium, a pair of services that could alter the way that you consume content from the video giant.

If you spend a lot of time on YouTube - especially if that time is spent watching music videos, listening to singles and playlists, or seeking out covers and remixes - then

- Details

- Category: Technology

Read more: YouTube Music: 5 things you need to know before signing up

Write comment (95 Comments)

Not long after its March launch last year, it was revealed that a GPU exploit in the Nintendo Switch could be used to run unofficial software, like pirated games and homebrew ROMs. Since then, the Switch's hacking community has grown, and the discovery of a new 'unpatchable' exploit last month has only made the console more attractive to pirates

- Details

- Category: Technology

Read more: Nintendo Switch hackers are being banned from online services

Write comment (96 Comments)

In recent years, data capture has followed a ‘quantity over quality’ approach resulting in acres of premature data taking up space and causing a headache if and when we actually needed to delve into it. However, GDPR forces a return to the idea of ‘quality over quantity’ and actually creates an opportunity: GDPR offers us the chance to start aga

- Details

- Category: Technology

Read more: Turning GDPR into an experience benefit

Write comment (100 Comments)Page 5312 of 5614

10

10