Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Valimail helps businesses ensure that nobody can impersonate them over email. Thatnot a sexy business to be in, but very much a necessary one. The companyemail authentication service, which uses standards like SPF, DKIM and DMARC, is currently in use by the likes of Yelp, Uber, Fanni Mae and WeWork. Today, the company announced that it has raised a $25 million Series B round led by Tenaya Capital, with participation from Shasta Ventures, Flybridge Capital Partners and Bloomberg Beta.

This round brings Valimail total amount of funding to $38.5 million, including the company$12 million Series A round in 2016.

&Authentication is at the root of trusted communications,& Valimail CEO and co-founder Alexander Garcia-Tobar told me. &You must be able to trust the authenticity of who/what is on the other side, or the communication is meaningless. For example, no retailer would never accept a credit card without swiping it first (either physically or virtually). What happens in the credit card world needs to happen for communications.&

The funding round is coming at an important time for email authentication. The DMARC standard is now supported by over 5 billion inboxes, according to Valimail. Over the course oft he last six month, domain owners have also published more DMARC records than in the five previous years combined. In addition, all federal agencies must implement this standard, too.

Valimail promises to take care of all the hassles of setting up support for these authentication standards.

&After attempting email authentication with other solutions, I was amazed at the level of automation Valimail provides,& said JJ Agha, VP of information security at WeWork. &It eliminates the need for two FTEs, so my staff can focus on other key priorities. I consider it a ‘set it and forget it& solution for ensuring that our employees and executives can&t be impersonated and that our email is trusted.&

- Details

- Category: Technology

Read more: Valimail raises $25M in additional funding for its email authentication service

Write comment (98 Comments)Madrona Venture Group typically flies under the radar of Silicon Valley reporters, partly because itin Seattle. But the 23-year-old, early-stage venture firm has been having a pretty good run of late — success it just used to close its seventh fund with $300 million, the same amount it raised for its sixth fund in 2015.

Among its investors: Bezos Expeditions, Vulcan Capital, and billionaire John Stanton, who is the chairman of the board of Trilogy International Partners (as well as the majority owner of the Major League Baseball team the Seattle Mariners).

Madronamomentum didn&t build overnight. Four Madrona portfolio companies that have IPO&d over the last 20 months — the cloud software companies Smartsheet, Apptio, the real estate site Redfin, and the RFID chip maker Impinj — took on average 12 years to get into the hands of public market investors.

Madrona, the firm is quick to note, was there from the start, writing seed and Series A checks that today range from $200,000 to upwards of $5 million to $7 million. (The firm has, on rare occasion, invested upwards of$30 million in a single company over the life of its investment.)

Yet those four now-public companies share another trait in common; they&re all based in the Pacific Northwest, which includes greater Seattle but also cities like Portland, Ore.; Vancouver, British Columbia; and Spokane, Wa.

Thatno accident. About 90 percent of Madronadeals are local, where the startup scene has seemingly expanded dramatically in recent years. In addition to Madrona and other local venture shops, Google, Facebook, Alibaba and Snowflake Computing have each opened engineering offices. Meanwhile, the University of Washington Computer Science Department — last year renamed the Allen School — is finishing another major building to expand its ability to graduate more CSE students. (A $40 million gift from Paul Allen, who cofounded Microsoft before establishing Vulcan Capital, helped toward that end.) .

Asked how fundraising went this time around, Madronateam describes it as smooth, crediting those IPOs as well as investors& greater appreciation that two of the four largest companies in the world — Amazon and Microsoft — are based in its backyard.

As for how many startups the firm will look to back with its new fund, it suggests the number will be around 40, which is how many startups it backed from its fourth fund.

One of those earlier startups isPulse Labs, a Seattle-based startup that helps brands understand how real people interact with their voice apps and raised $2.5 million in January, led by Madrona.Another is XNOR, a two-year-old, Seattle-based artificial intelligence startup that announced $12 million in Series A funding just last week led by Madrona. We wrote about it here.

Generally speaking, it tells us, when Madrona invests, itlooking to either leverage its growing expertise in cloud computing and machine learning, or itlooking to leverage its relationships with previous Madrona entrepreneurs and partners.

Given how many years it has been in business at this point, thatnow a sizable circle.

- Details

- Category: Technology

Read more: For Madrona Venture Group, four IPOs in 20 months and a brand-new fund

Write comment (96 Comments)A new U.K. self-driving car startup founded by Amar Shah and Alex Kendall, two machine learning PhDs from University of Cambridge, is de-cloaking today. Wayve — backed by New York-based Compound, EuropeFly Ventures, and Brent HobermanFirstminute Capital — is building what it describes as &end-to-end machine learning algorithms& to make autonomous vehicles a reality, an approach it claims is different to much of the conventional thinking on self-driving cars.

Specifically, as Wayve CEO Shah explained in a call last week, the young company believes that the key to making an autonomous vehicle that is truly just that (i.e. able to drive safely in any environment it is asked to), is a much greater emphasis on the self-learning capability of its software. In other words, self-driving cars is an AI problem first and foremost, and one that he and co-founder Kendall argue requires a very specific machine-learning development skill set.

&Wayve is building intelligent software to decide how to control a vehicle on all public roads,& he tells me. &Rather than hand-engineering our solution with heavily rule-based systems, we aim to build data-driven machine learning at every layer of our system, which would learn from experience and not simply be given if-else statements. Our learning-based system will be safer in unfamiliar situations than a rule-based system which would behave unpredictably in a situation it has not seen before&.

To explain his thinking in laymenterms, Shah points to the way a human who is relatively proficient in driving in one city can quickly adapt to the differences in a completely new city, without having to be given extra training or instruction beforehand. It may take around 30 minutes or even a few hours to become fully climatized to new driving conditions or environment, but humans don&t need very much new data to do so.

&Humans have a fascinating ability to perform complex tasks in the real world, because our brains allow us to learn quickly and transfer knowledge across our many experiences,& he says. &We want to give our vehicles better brains, not more hardware&.

To problem, thus far, the pair argue, is that companies like Google and Uber are throwing an engineering mindset at making vehicles autonomous, in the sense of designing rule-based systems that try to pre-empt and deal with every edge case, whilst in tandem adding more sensors and capturing more data. This might produce encouraging results in the specific, narrow setting it has been engineered for, but won&t have maximum payoff longer term.

&Right now, big tech companies have cars with many different sensors of a handful of different types. Their attitude is to have more and more sensors to do more and more difficult driving tasks,& says Shah. &If I ask you to do a difficult athletic obstacle course, something like Ninja warrior, having more eyes isn&t really going to help you much. What you need is better coordination & itthe mind-muscle connection thatthe limiting factor. In driving, itreally the way you use your sensory information thatkey (the AI-wheel connection in the car), not the number of cameras and radars and LIDARs&.

But if a more sophisticated machine-learning approach is the correct one, surely Google (which has several AI efforts under its parent company, including being the owner of DeepMind), would already be going down that avenue, too

&The big teams are distracted by getting something working because they have stakeholders who have been investing for a decade into autonomous driving. They are getting impatient,& the Wayve co-founder pushes back. &How will Alphabet tell their shareholders ‘we&ve invested X billion USD into Waymo and its predecessor with a team of 1,000s, but we are now throwing that approach all down the drain and hiring more AI people to solve driving&. Ita hard sell having spent billions and when they are close to a simple product. Same reason politicians make bad long-term decisions… their output is only short-term&.

&Wayve has a very differentiated technical approach versus most other autonomous vehicle startups,& echoes Fly Ventures& Gabriel Matuschka. &Ita 10x improvement over the rules-based approach taken from legacy robotics to hard-code the driving actions that the vehicle takes once it understands what it sees. Wayve uses end-to-end machine learning to drive cars autonomously, with little data, in novel environments. This means that their software enables a car to drive itself using only understanding of what it can see, just like humans do&.

To that end, the ten-person Wayve is said to be made up of experts in robotics, computer vision and artificial intelligence from both Cambridge and Oxford universities, who have previously worked at the likes of NASA, Google, Facebook, Skydio and Microsoft. Their work ranges from using deep learning for visual scene understanding to autonomous decision-making in uncertain environments. Noteworthy also is that Professor Zoubin Ghahramani, Chief Scientist of Uber, is an investor in Wayve.

&There are very few teams out there with the academic background and technical capabilities to at all have a credible shot at this. Wayve is one of them,& adds Matuschka. &Some people in the industry question if Wayvenovel approach will work. You only stand a chance to compete against Google, Uber, et al. if you try, and are able to do something that the large players haven&t done so far or don&t believe in yet. Then you can have a head start&.

- Details

- Category: Technology

Read more: This UK startup thinks it can win the self-driving car race with better machine learning

Write comment (97 Comments)The growth of ChinaBytedance, an ambitious $30 billion tech firm, and its highly addictive Toutiao news aggregator app has set off a search for services with similar growth potential across the world.

India, second in population only to China with rapidly growing internet access, is an obvious place to look, and would-be pretender to the Toutiao crown has been found in the shape of NewsDog, a Chinese company that stumbled on success in India. Today, NewsDog announced a $50 million Series C round led by Chinese internet giant Tencent.

Toutiao is a phenomenon in China. The app has around 200 million daily users, and it is one of the few new tech products to emerge in a China where Tencent and Alibaba dominate the consumer app landscape. Point in case, it is so mainstream now that it has even run into issues with Chinainternet censors.Toutiao is essentially a news aggregation service that lets consumers catch their daily reads and discover stories with an experience tailored to their habits and likes.

Thatvery much the style of NewsDog, which claims over 50 million users. The service has branched out to cover 10 of Indians many languages, while it recently established a platform — ‘WeMedia& — that augments its content aggregation by allowing users to submit stories, too.

This round is a major milestone for the company. In a competitive environment, it is the largest fundraising round from a news app company in India while it more obviously brings Tencent, the $500 billion tech giant, on board with its experience and support. Other investors include Chinese VCs Danhua Capital (DHVC) and Legend Capital as well as Chinese mobile app firmDotC United.

NewsDogcompetition includes Dailyhunt— which is backed by Toutiao-owner Bytedance — Inshorts, which counts Tiger Global among its investors, and NewsPoint, which is owned by media firm Times Internet.

One other competition is UC News, a service from Alibaba-owned UC Web, which, like NewsDog, is Chinese.

NewsDog was launched in 2016 by CEO Forrest Chen Yukun,a computer science graduate from Tsinghua University graduate, and Yi Ma, who holds a PhD from Princeton University and previously worked at Baidu and Goldman Sachs .

Data from App Annie shows that NewsDog is the top news app in the Google Play Store in India — Android is the countrydominant operating system — ahead of Dailyhunt andNewsPoint in second and third, respectively. According to Sensor Tower, another app download analytics service, the app has 43 million installs and its downloads grew 76 percent year-on-year in the first quarter of the year.

NewsDog plans to use this new funding to pull further ahead of the competition by focusing on adding more languages and deepening its content library.

The company said it is already using machine learning to help produce an experience that is customized to users — the experience that Toutiao pioneered in China — and it plans to double down on that.

&Poly culture and multiplelanguages make content matching an incredibly hard problem,& Chen said in a statement. &So far, we have made goodinitial progress but content business is like an endless journey. There is no finish line,you have to just keep running.&

NewsDog is aiming to reach 100 million users as its next milestone as Indiainternet population surges. The country is tipped to reach 500 million internet users by June 2018, according toa report from the Internet and Mobile Association of India (IAMAI) and Kantar IMRB. Thatup from 481 million six months prior, but internet penetration in rural areas is at just 20 percent compared with 65 percent in urban India which indicates even more growth potential.

For Tencent, meanwhile, this investment is another upping of its pace in India.

Initially, the company was slow to put money to work in India, where Alibaba entered early to buy stakes in the likes of Paytm, but gradually Tencent has got its checkbook out. Its most notable India-based deals include WhatsApp challenger Hike, healthcare platform Practo, andmusic service Gaana. This year, it is reportedly focusing on finding promising early-stage startups where it can invest $5-15 million.

In NewsDog, Tencent will hope to jump on the news aggregator train that it missed in China, giving Bytedance an opportunity to become a major Chinese consumer brand.

- Details

- Category: Technology

Read more: Tencent leads $50M investment in NewsDog, an app vying to be India’s Toutiao

Write comment (90 Comments)Letbe honest, the RED Hydrogen One is destined to be a niche product. With a &holographic display& and a $1,200 starting price point, the thing wasn&t really designed with mainstream consumers in mind. An announcement of a forthcoming camera from the company doesn&t do a lot to change that, but it does shed a bit more light on who, precisely, the company is targeting here.

In a press release, RED announced a partnership with 3D camera manufacturer Lucid for an upcoming product that will make interesting use of the upcoming phone. The as-yet unnamed RED camera will utilize Lucidtech to create 8K, 3D video, using dual 4K cameras and a beam splitter.

Whatmost interesting, here, however, is that the camera will output that content to the Hydrogen One in real-time, essentially letting the phone double as a viewfinder for the camera. The company assures us that, much like the Hydrogen One itself, the unnamed camera is very much a real product.

In fact, it will be available through RED and retail partners at some point during Q4 of this year — likely months after the phone itself arrives in August. The company even showed off a preview of the product at an event last week.

Pricing, like the name, is still TBD. This being RED, however, I don&t imagine itgoing to come cheap — even with the $1,200 viewfinder sold separately.

- Details

- Category: Technology

Read more: RED’s new camera will use its Hydrogen One phone as a viewfinder

Write comment (100 Comments)

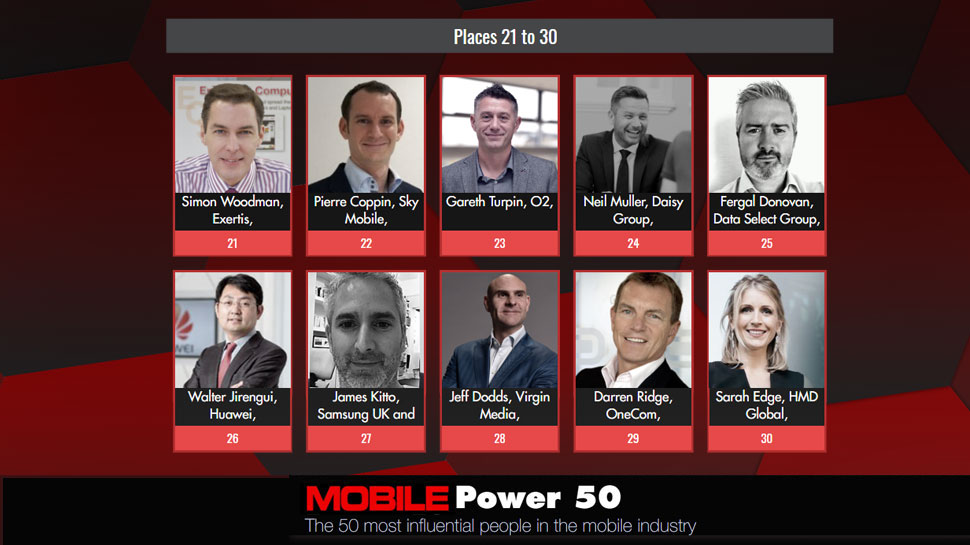

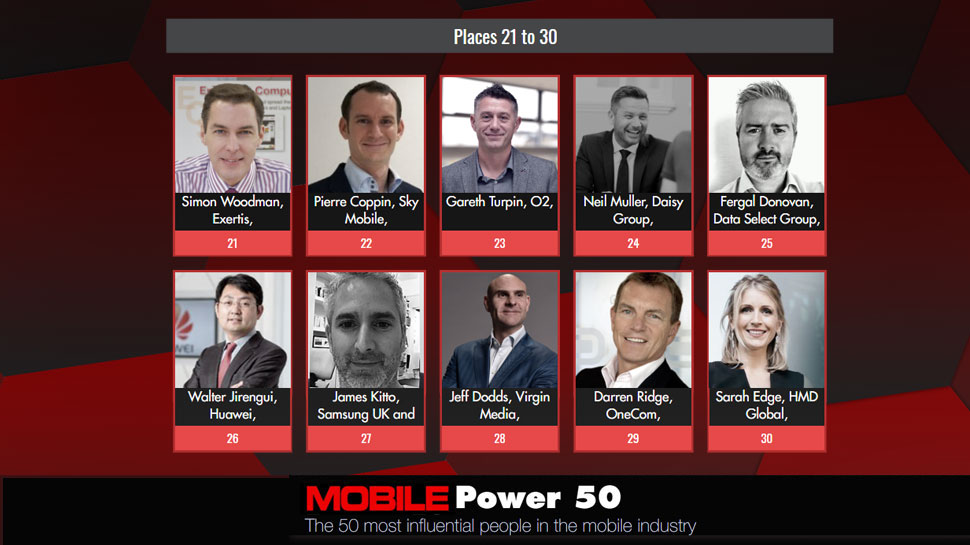

Following months of research and nominations we are delighted to confirm the first selections for the 2018 Mobile Power 50 list

All members of our Mobile Power 50 have meet our criteria as individuals who we feel influence beyond their existing roles, in addition to imbuing their businesses with their values and serve as an inspiration to the rest

- Details

- Category: Technology

Read more: Mobile Power 50 - 30 to 21 official rankings announced

Write comment (97 Comments)Page 5318 of 5614

12

12