Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Ceph is an open source technology for distributed storage that gets very little public attention but that provides the underlying storage services for many of the worldlargest container and OpenStack deployments. Itused by financial institutions like Bloomberg and Fidelity, cloud service providers like Rackspace and Linode, telcos like Deutsche Telekom, car manufacturers like BMW and software firms like SAP and Salesforce.

These days, you can&t have a successful open source project without setting up a foundation that manages the many diverging interests of the community and so itmaybe no surprise that Ceph is now getting its own foundation. Like so many other projects, the Ceph Foundation will be hosted by the Linux Foundation.

&While early public cloud providers popularized self-service storage infrastructure, Ceph brings the same set of capabilities to service providers, enterprises, and individuals alike, with the power of a robust development and user community to drive future innovation in the storage space,& writes Sage Weil, Ceph co-creator, project leader, and chief architect at Red Hat for Ceph. &Todaylaunch of the Ceph Foundation is a testament to the strength of a diverse open source community coming together to address the explosive growth in data storage and services.&

Given its broad adoption, italso no surprise that therea wide-ranging list of founding members. These include Amihan Global, Canonical, CERN, China Mobile, Digital Ocean, Intel, ProphetStor Data Service, OVH Hosting Red Hat, SoftIron, SUSE, Western Digital, XSKY Data Technology and ZTE. Itworth noting that many of these founding members were already part of the slightly less formalCeph Community Advisory Board.

&Cephhas a long track record of success what it comes to helping organizations with effectively managing high growth and expand data storage demands,& said Jim Zemlin, the executive director of the Linux Foundation. &Under the Linux Foundation, the Ceph Foundation will be able to harness investments from a much broader group to help support the infrastructure needed to continue the success and stability of the Ceph ecosystem.&

Ceph is an important building block for vendors who build both OpenStack- and container-based platforms. Indeed, two-thirds of OpenStack users rely on Ceph and ita core part of Rook, a Cloud Native Computing Foundation project that makes it easier to build storage services for Kubernetes-based applications. As such, Ceph straddles many different worlds and it makes sense for the project to gets its own neutral foundation now, though I can&t help but think that the OpenStack Foundation would&ve also liked to host the project.

Todayannouncement comes only days after the Linux Foundation also announced that it is now hosting the GraphQL Foundation.

- Details

- Category: Technology

Read more: The Ceph storage project gets a dedicated open-source foundation

Write comment (100 Comments)

Ryan Smith of Qualtrics speaks onstage during TechCrunch Disrupt SF 2015

Enterprise software giant SAP announced today that it has agreed to acquire Qualtrics for $8 billion in cash, just before the survey and research software company was set to go public. The deal is expected to be completed in the first half of 2019. Qualtrics last round of venture capital funding in 2016 raised $180 million at a $2.5 billion valuation.

This is the second-largest ever acquisition of a SaaS company, after Oraclepurchase of Netsuite for $9.3 billion in 2016.

In a conference call, SAP CEO Bill McDermott said Qualtrics& IPO was already oversubscribed and that the two companies began discussions a few months ago. SAP claims its software touches 77 percent of the worldtransaction revenue, while Qualtrics& products include survey software that enables its 9,000 enterprise users to gauge things like customer sentiment and employee engagement.

McDermott compared the potential impact of combining SAPoperational data with Qualtrics& customer and user data to Facebookacquisition of Instagram. &The legacy players who carried their ‘90s technology into the 21st century just got clobbered. We have made existing participants in the market extinct,& he said. (SAPcompetitors include Oracle, Salesforce.com, Microsoft, and IBM.)

SAP, whose global headquarters is in Walldorf, Germany, said it has secured financing of €7 billion (about $7.93 billion) to cover acquisition-related costs and the purchase price, which will include unvested employee bonuses and cash on the balance sheet at close.

Ryan Smith, who co-founded Qualtrics in 2002, will continue to serve as its CEO. After the acquisition is finalized, the company will become part of SAPCloud Business Group, but retain its dual headquarters in Provo, Utah and Seattle, as well as its own branding and personnel.

According to Crunchbase, the company raised a total of $400 million in VC funding from investors including Accel, Sequoia, and Insight Ventures. It had intended to sell 20.5 million shares in its debut for $18 to $21, which could have potentially grossed up to about $495 million. This would have put its valuation between $3.9 billion to $4.5 billion, according to CrunchBaseAlex Wilhelm.

This year, Qualtrics& revenue grew 8.5 percent from $97.1 million in the second-quarter to $105.4 million in the third-quarter, according to its IPO filing. It reported third-quarter GAAP net income of $4.9 million. That represented an increase from the $975,000 it reported in the previous quarter, as well as its net profit in the same period a year ago of $4.7 million. Qualtrics grew its operating cash flow to $52.5 million in the first nine months of 2018, compared to $36.1 million during the same period in 2017.

In todayannouncement, Qualtrics said it expects its full-year 2018 revenue to exceed $400 million and forecasts a forward growth rate of more than 40 percent, not counting the potential synergies of its acquisition by SAP.

Qualtrics& main competitors include SurveyMonkey, which went public in September.

- Details

- Category: Technology

The second wave of Internet-era travel companies has captured the attention of venture capitalists.

In the last five years, travel companies have raised more than $1 billion in venture capital funding. That includes short-term rental startups, travel and tourism apps, marketplaces for &experiences& and other travel or hospitality tech platforms. Airbnb, a $38 billion company and an anomaly in the category, has raised $3 billion in that same time frame, according to PitchBook.

In the last few months alone, aspiring Concur-competitor TripActions and travel activities platform Klook entered the &unicorn& club with large venture rounds that valued both of the businesses at more than $1 billion. Meanwhile, luggage maker Away raised $50 million at a $400 million valuation and smaller startups in the space like Freebirds, IfOnly, KKDay, Duffel and RedDoorz all closed modest funding rounds.

&Something is really happening in the industry; something bigger than us,& TripActions co-founder Ariel Cohen said in a recent conversation with TechCrunch about his company$154 million Series C financing. &Different startups are identifying the opportunity here and the fact that companies want to make sure their employees are happy while they are on the go. Thatwhy you see investments in companies likeBrexand like TripActions.&

Brex, though not classified as a travel startup, lets startup employees earn extra points on business travel with its corporate credit card for startups. It recently raised a $125 million Series C at a $1.1 billion valuation.

Global travel and tourism is one of the most valuable industries worth some $7 trillion. The online travel market, in particular, is expected to grow to$817 billionby 2020. VCs are hunting for tech-enabled startups poised to dominate that slice.

&You have a new wave of businesses where all of that digital infrastructure is set up, so the focus can be on things like efficiency, improved customer service, scale and growth — you have a ton of companies popping up catering to those needs,& Defy Partners co-founder Neil Sequeira told TechCrunch.Sequeira was a managing director at General Catalyst when the firm made its first investment in Airbnb.

On the other hand, you have a whole cohort of travel business founded amid the dot-com boom that are looking to technology startups for a much-needed infusion of innovation. Many of those larger companies have become active acquirers, fueling VC interest in the space. SAP Concur, for example, acquired the formerly VC-backed travel-booking startup Hipmunk in 2016. Before that, it bought travel planning company TripIt for $120 million,among others.

Expedia has gobbled up a number of travel brands too, like travel photography community Trover;Airbnb-competitor HomeAway, which it paid a whopping $3.9 billion for in 2015; and most recently, both Pillow and ApartmentJet.

Many of these acquisitions are for peanuts, which is far from ideal for a venture-funded company. And building a travel business is cash intensive, hence the $4.4 billion Airbnb has raised to date or even TripActions& $236 million in total VC funding. To keep momentum in the space, companies need to be striking larger M-A deals.

It doesn&t help that many in and around the venture capital industry are predicting an imminent turn in the market. Travel companies, which are reliant upon a consumertendency to spend excess cash, will be among the first sectors to be impacted by hostile economic conditions.

&If the market turns, people aren&t going to spend $10,000 on a trip to Zimbabwe,&Sequeira said, referencing companies like IfOnly, which sells curated experiences.

Travel startups should raise now while the market is hot. The conditions may not remain favorable for long.

- Details

- Category: Technology

Read more: Travel startups are taking off

Write comment (93 Comments)Just a few years ago, Li Mengqi could not have imagined shopping on her own. Someone needed to always keep her company to say aloud what was in front of her, whobeen blind since birth.

When smartphones with text-to-speech machines for the visually impaired arrived, she immediately bought an iPhone. &Though it was expensive,& Li, a 23-year-old who grew up in a rural village in eastern ChinaZhejiang province, told me. Cheaper smartphone options in China often don&t have good accessibility features.

Screen readers opened a plethora of new opportunity for those with visual impairments. &I felt liberated, no longer having to rely on others,& said Li, who can now shop online, WeChat her friends, and go out alone by following her iPhone compass.

Reading out everything on the screen is helpful, but it can also be overwhelming. Digital readers don&t decipher human thoughts, so when Li gets on apps with busy interfaces, such as an ecommerce platform, shebombarded with descriptions before she gets to the thing she wants.

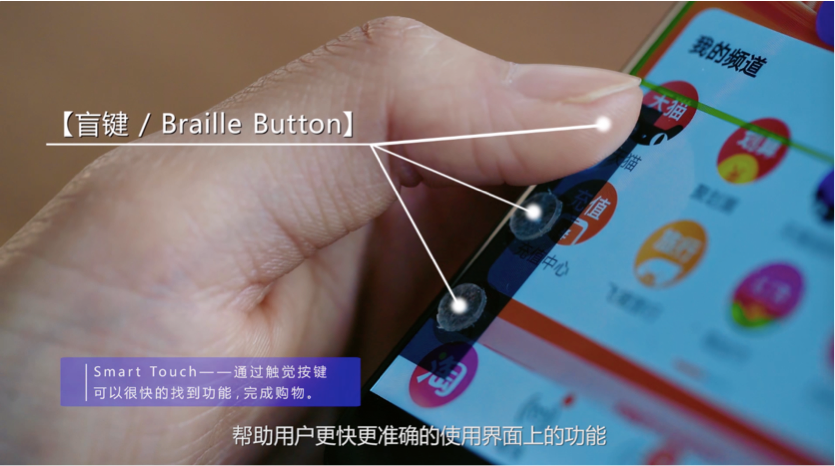

Over the past two years, Alibaba$15 billion R-D initiative Damo Academy has been working to improve smartphone experience for the blind. Its latest answer, a joint effort with Chinaprestigious Tsinghua University, is a cheap silicone sheet that goes on top of smartphone screens.

Li is among the first one hundred visually impaired or blind users to trial the technology. Nothing stands out about the plastic film & which cost RMB 0.25 or 3.6 American cents each to produce & until one has a closer look. There are three mini buttons on each side. They are sensory-enabled, which means pressing on them triggers certain commands, usually those that are frequently used like &go back& and &confirm&.

&Itmuch easier to shop with the sheet on,& said Li. Having button shortcuts removes the risk of misclicking and the need for complex interactions with screens. Powering Smart Touch is human-machine interaction, the same technology that makes voice control devices possible.

Alibaba$1 &Smart Touch& plastic sheet helps smoothen smartphone experience for the visually impaired. / Photo credit: Alibaba

&We thought, human-machine interaction can&t just be for sighted people,& Chen Zhao, research director at Damo Academy told TechCrunch. &Besides voice, touch is also very important to the blind, so we decided to develop a touch feature.&

Smart Touch isn&t just for fingers. It also works when users hold their phones up to the ears. This lets them listen to textquickly in public without having to blast it out through speakers or headphones. Early trials of ear touch show a 50 percent reduction in time needed to complete tasks like taking calls and online shopping, Alibaba claims.

Emotions also matter. People with visual disabilities tend to be more cautious as they fumble through screens, so Smart Touch takes that into account. For instance, users need to double-click on the silicone button before a command goes through.

At the moment, Smart Touch works only on special editions of Alibabatwo flagship apps, e-commerce marketplace Taobao and payment affiliate Alipay . The buttons automatically take on different functions when users switch between apps.

But Zhao said she wanted to make the technology widely available. Some tinkering with existing apps will make Smart Touch compatible. The smart film requires more testing before it officially rolls out early 2019, so Damo and Tsinghua have been recruiting volunteers like Li for feedback.

&Unlike with regular apps, ithard to beta test Smart Touch because the blind population is relatively small,& observed the researcher, but embedding the technology in popular apps could speed up the iteration process.

Therealso the issue with distributing the physical sheets. According to state census, China had around 13 million visually impaired people in 2012. Thatabout one in a hundred people. However, they are rarely seen in public, as a post on Chinaequivalent of Quora points out.

One oft-cited obstacle is that most roads in China aren&t disability-friendly, even in major cities. (In my city Shenzhen, blind lanes are common but they often get cut off abruptly to make way for a crossing or a bus stop.)

Damo doesn&t plan to monetize the initiative, according to Zhao. She envisions a future where her team could give out the haptic films — which can be mass produced at low costs — for free through Alibabaexpanding network of brick-and-mortar stores.

Time will tell whether the accessibility scheme is more than public relations fluff. Initiatives around corporate social responsibility have mushroomed in China in recent years. They havecome under fire,however, for being transient because manymerely pander to the governmentdemand(link in Chinese) for corporate ethics overlook long-term impact.

&The technology is ready. It just takes time to test it on different smartphones and bring to users at scale,& said Zhao.

- Details

- Category: Technology

Read more: Alibaba made a smart screen to help blind people shop and it costs next to nothing

Write comment (97 Comments)This month marks the 5-year anniversary of Aileen Leelandmark article, &Welcome To The Unicorn Club&.

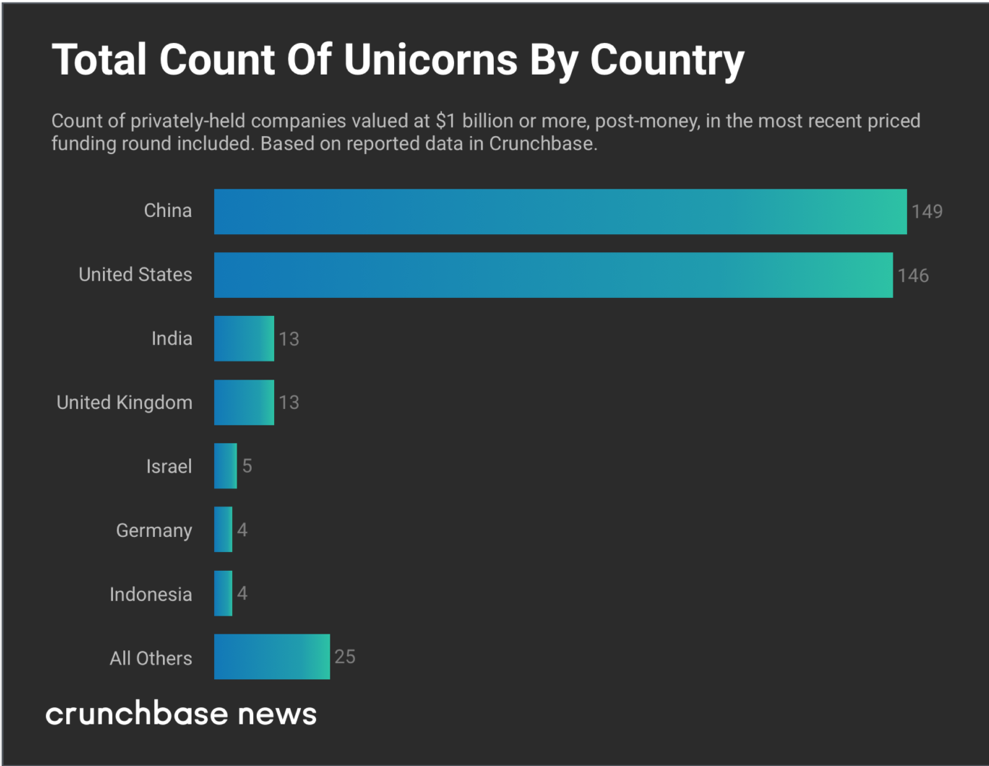

At the time, the piece defined a new breed of startup — the $1 billion privately held company. When Lee did her first count, there were 39 &unicorns&; an improbable, but not impossible number.. Today, the once-scarce unicorn has become a global herd with 376 companies on the roster and counting.

But the proliferation of unicorns begs raises certain questions. Is this new breed of unicorn artificially created Could these magical companies see their valuations slip and fall out of the herd Does this indicate an irrational exuberance where investors are engaging in wish fulfilment and creating magic where none actually existed

List of &unicorn& companies worth more than $1 billion as of the third quarter of 2018

Therea new &unicorn& born every four days

The first change has been to the geographic composition and private company requirement of the list. The original qualification for the unicorn study was &U.S.-based software companies started since 2003 and valued at over $1 billion by public or private market investors.& The unicorn definition has changed and here is the popular and wiki page definition we all use today: &A unicorn is a privately held startup company with a current valuation of US$1 billion or more.&

Beyond the expansion of the definition of terms to include a slew of companies from all over the globe, therebeen a concurrent expansion in the number of startup technology companies to achieve unicorn status. There is a tenfold increase in annual unicorn production.

Indeed, while the unicorn is still rare but not as rare as before. Five years ago, roughly ten unicorns were being created a year, but we are approaching one hundred new unicorns a year in 2018.

As of November 8, we have seen eighty one newly minted unicorns this year, which means we have one new unicorn every four days.

There are unicorn-sized rounds every day

These unicorns are also finding their horns thanks to the newly popularized phenomena of mega rounds which raise $100 million or more. These deals are ten times more common now, than they were only five years ago.

Back in 2013, there were only about four mega rounds a month, but now there are forty mega rounds a month based on Crunchbase data. In fact, starting from 2015, public market IPO has for the first time no longer been the major funding source for unicorn size companies.

Unicorns have been raising money from both traditional venture capital but also more from the non-traditional venture capital such as SoftBank, sovereign wealth funds, private equity funds, and mutual funds.

Investors are chasing the value creation opportunity. Most people probably did not realize that Amazon, Microsoft, Cisco, and Oracle all debuted on public markets for less than a $1 billion market cap (in fact only Microsoft topped $500 million), but today they together are worth more than $2 trillion dollars

It means tremendous value was created after those companies came to the public market. Today, investors are realizing the future giantvalue creation has been moved to the &pre-IPO& unicorn stage and investors don&t want to miss out.

To put things in perspective, investors globally deployed $13 billion in almost 20,000 seed - angel deals, and SoftBank was able to deploy the same $13 billion amount in just 2 deals (Uber and WeWork). The SoftBank type of non-traditional venture world literally redefined &pre-IPO& and created a new category for venture capital investment.

Unicorns are staying private longer

That means the current herd of unicorns are choosing to stay private longer. Thanks to the expansion of shareholders private companies can rack up under the JOBS Act of 2012; the massive amount of funding available in the private market; and the desire of founders to work with investors who understand their reluctance to be beholden to public markets.

Elon Musk was thinking about taking Tesla private because he was concerned about optimizing for quarterly earning reports and having to deal with the overhead, distractions, and shorts in the public market. Even though it did not happen in the end, it reflects the mentality of many entrepreneurs of the unicorn club. That said, most unicorn CEOs know the public market is still the destiny, as the pressure from investors to go IPO will kick in sooner or later, and investors expect more governance and financial transparency in the longer run.

Unicorns are breeding outside of the U.S. too

Finally, the current herd of unicorns now have a strong global presence, with Chinese companies leading the charge along with US unicorns. A recent Crunchbase graph indicated about 40% of unicorns are from China,, 40% from US, and the rest from other parts of the world.

Back in 2013, the &unicorn& is primarily a concept for US companies only, and there were only 3 unicorn size startups in China (Xiaomi, DJI, Vancl) anyways. Another change in the unicorn landscape is that, China contributed predominantly consumer-oriented unicorns, while the US unicorns have always maintained a good balance between enterprise-oriented and consumer-oriented companies. One of the stunning indications that China has thriving consumer-oriented unicorns is that China leads US in mobile payment volume by hundredfold.

The fundamentals of entrepreneurship remain the same

Despite the dramatic change of the capital market, a lot of the insights in Lee5-year old blog are still very relevant to early stage entrepreneurs today.

For example, in her study, most unicorns had co-founders rather than a single founder, and many of the co-founders had a history of working together in the past.

This type of pattern continues to hold true for unicorns in the U.S. and in China. For instance, the co-founders of Meituan (a $50 billion market cap company on its IPO day in September 2018) went to school together and had co-founded a company before

There have been other changes. In the past three months alone, four new US enterprise-oriented unicorns have emerged by selling directly to developers instead of to the traditional IT or business buyers; three China enterprise-oriented SaaS companies were able to raise mega rounds. These numbers were unheard of five years ago and show some interesting hints for entrepreneurs curious about how to breed their own unicorn.

The new normal is reshaping venture capital

Once in a while, we see eye-catching headlines like &bubble is larger than it was in 2000.& The reality is companies funded by venture capital increased by more than 100,000 in the past five years too. So the unicorn is still as rare as one in one thousand in the venture backed community.

Whatchanging behind the increasing number of unicorns is the new normal for both investors and entrepreneurs. Mega rounds are thenew normal; staying private longer is the new normal; and the global composition of the unicorn club is the new normal.

Just look at the evidence in the venture industry itself. Sequoia Capital, the bellwether of venture capital, raised a whopping $8 billion global growth mega fund earlier this year under pressure from SoftBank and its $100 billion mega-fund. And Greylock Partners, known for its focus and success in leading early stage investment, recently led a unicorn round for the first time in its 53-year history.

Itproof that just as venture capitalists have created a new breed of startups, the new startups and their demands are reshaping venture capital to continue to support the the companies they&ve created.

- Details

- Category: Technology

Read more: In venture capital, it’s still the age of the unicorn

Write comment (97 Comments)The kids in MadridEl Retiro Park are loving their new on-demand joyriding toys. Lime launched its scooters in the Spanish capital this summer.

Spending a weekend in the city center last month the craze was impossible to miss. Scooters parked in clusters vying for pay-to-play time. Sometimes lined up tidily. All too often not.

The bright Lime rides really stood out, though itnot the only brand in town.Scooter startups have been quick to hop on the international expansion bandwagon as they gun for growth.

Grandly proportioned El Retiro clearly makes a great spot for taking a scooter for a spin. Test rides beget joyrides, and so the kids were hopping on. Sometimes two to one.

The boulevard linking the Prado with the Reina Sofia was another popular route to scoot.

While a busy central bar district was a hot ride-ditching spot later on. Lines of scooters were vying for space with the vintage street bollards.

The appeal was obvious: Bowl up to the bar and drink! No worries about parking or how to get your ride home afterwards. But for Saturday night revellers there was suddenly a new piece of street furniture to lurch around, with slouching handlebars sticking up all over the place. Anyone trying to navigate the pavement in a wheelchair wouldn&t have had much fun.

In another of Spainbig tourist cities the scooter story is a little different: Catalan capital Barcelona hasn&t had an invasion of on-demand scooter startups yet but scooters have crept in. In recent years locals have tapped in of their own accord — buying not renting.

Rides are a front-of-store sight in electronics shops, big and small — costing a few hundred euros. Even for a flashy Italian design…

Electronic scooters

Take a short walk in one of the more hipster barrios and chances are you&ll pass someone whobought into the craze for nipping around on two wheels.Therelots of non-electric scooters too but e-scooters do seem to have carved out a growing niche for themselves with a certain type of Barcelona native.

Again, you can see the logic: Well-dressed professionals can zip around narrow streets that aren&t always great for finding a place to (safely) lock up a bike.

Thereactually a pretty wide variety of wheeled e-rides in play for locals with the guts to get on them. Some with seats and/or handles, others with almost nothing. (The hands-in-pockets hipsters on self-balancing unicycles are quite the sight.)

In both of these Spanish cities itclear people are falling for — and, well, sometimes off — the micro-mobility trend.

But the difference between the on-demand scooters being toyed with in Madrid vs Barcelonalocally owned two wheelers is a level of purpose and intent.

The Lime rides in Madridcenter seemed mostly a tourist novelty. At least for now, having only had a couple of months to bed in.

Whereas the organic growth of scooters in Barcelona barrios is about people who live there feeling a need.

Even the unicycling hipsters seem to be actually on their way somewhere.

Hop on

What does this mean for scooter startups Itanother example of how technologyutility and wider societal impacts can vary when you parachute a new thing into a market and hope people jump on board vs growth being organic and more gradual because itled by real-world demand.

And itessential to think about impacts where scooters and micro-mobility is concerned because all this stuff must piggyback on shared public spaces. No one has the luxury of being able to avoid whatbuzzing up and down their street.

Thatwhy lots of on-demand scooters have ended up trashed and vandalized — as residents make their feelings known (having not been asked about the alien invaders in the first place).

In Europe therea further twist because the spaces scooter startups are seeking to colonize are already well served with all sorts of public transport options. So therea clear and present danger that these new kids on the block won&t displace anything. And will just mean more traffic and extra congestion — as happened with ride-hailing.

In Madrid, the first tranche of on-demand scooters seems to be generating pretty superficial and additive use. Offering a novel alternative to walking between sights or bars on a trip to-do list. Just possibly they&re replacing a short taxi or metro hop.

In the park, they were being used 100% for fun. Perhaps takings are down at the boating lake.

Barcelona has plenty of electro-powered joyriding down at the beach front in summer — where shops rent all sorts of wheels to tourists by the hour. But away from the beach locals don&t seem to be wasting scooter charge riding in circles.

They&re stepping out for regular trips like commuting to and from work.In other words, scooters are useful.

Given all this activity and engagement micro-mobility does seem to offer genuine transformative potential in dense urban environments. At least where the climate doesn&t punish for most of the year.

This is why investors are so hot on scooters. But the additive nature of micro-mobility underlines a pressing need for the technology to be properly steered if cities, residents and societies are to get the best benefits.

Scooters could certainly replace some moped trips. Even some local car journeys. So they could play an important role in reducing pollution and noise by taking trips away from petrol- and diesel-powered vehicles.

Because they offer a convenient, low-barrier-to-entry alternative with populist pull.

Not being too high speed also means, in and of themselves, they&re fairly safe.

If you&re just barrio hopping or can map most of your social life across a few city blocks thereno doubting their convenience. Novelty is not the only lure.

Hop off

Though, equally, the local-level journeys that scooters are best suited for could just as easily be completed on foot, by bike or via public transit options like a metro.

And Barcelonacongested streets don&t look any less packed with petrol engines — yet.

Which means scooters are both an opportunity and a risk.

If policymakers get the regulations right, a smart city could leverage their fun factor to nudge commuters away from more powerful but less environmentally friendly vehicles — with, potentially, some very major gains up for grabs.

Subsidized scooters coupled with a framework of congestion zones that levy fees on petrol/diesel engines is one simple example.

A clever policy could open the possibility of excluding cars almost entirely from city centers — so that streets could be reclaimed for new leisure and retail opportunities that don&t demand masses of parking space on tap.

Pollution is a chronic problem in almost all large cities in the world. So reshaping city centers to be more people-centric and less toxic to human health by displacing cars would be an incredible win for micro-mobility.

Even as the hop on, hop off ease of scooters offers a suggestive glimpse of whatpossible if we dare to rethink urban architecture to put people rather than four-wheeled vehicles first.

Yet get the policy wrong and scooters could end up — at very best — a frivolous irrelevance. A joyride thatdisrupts going nowhere. Yet another nuisance on already choked streets. An optional extra that feels disposable and gets rudely discarded because no one feels invested.

In this scenario the technology is not socially transformative. Itmore likely an antisocial nuisance. And a pointless drain on resources because itdoing no more than disrupting walking.

Scooter startups have already run into some of these issues. And thatnot surprising given how fast they&ve been trying to grow. Their early expansionist playbook does also risk looking like Uber all over again.

Yet Ubercould have pioneered micro-mobility itself. But being ‘laser focused on growth& seemingly gave the company tunnel vision. Only now, under a new CEO, itall change. Now Uber wants to be a one-stop platform forall sorts of transport options.

But how many years did it waste missing the disruptive potential of micro-mobility coming down the road because it was too busy trying to fit more cars into cities — and ignoring how residents felt about that

An obsession with growth at all costs may well be a side effect of major VC dollars flooding in. But for startups it really does pay to stay self-aware, perhaps especially when you&re rolling in money. Else you might find your investors funding your biggest blind spot — if you end up missing the next even more transformative disruption.

The really clever trick to pull off is not ‘scale fast or die trying&; itsmart growth thatpredicated upon applying innovative technologies in ways that bring whole communities along with them. Thattrue transformation.

For scooters that means not just dumping them on cities without any thought beyond creaming a profit off of anything that moves. But getting residents and communities engaged with the direction of travel. Partnering with people and policymakers on the right incentives to steer innovation onto its best track.

Move people around cities, yes, and shift them out of their cars.

Therelittle doubt that Uberold ‘growth at any cost& playbook was hugely wasteful and damaging (not least to the companyown reputation). And now ithaving to retrofit a more inclusive approach at the same time as unpicking an ‘environmentally insensitive& legacy that original playbook really doesn&t look so smart.

Scooter startups are still young and have made some of their own mistakes trying to chase early scale. But there are reasons to be cheerful about this new crop of mobility startups too.

Signs they see value and opportunities in being pro-actively engaged with the environments they&re operating in. Having also learnt some hard early lessons about the need to be very sensitive to shared spaces.

Bird announced a program this summer offering discounted rides to people on low incomes, for example. Lime has a similar program.

These are small but interesting steps. Herehoping we&re going to see a lot more.

- Details

- Category: Technology

Read more: A tale of two scooter cities

Write comment (92 Comments)Page 3682 of 5614

5

5