Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Media playback is unsupported on your device

Internet giant Alibaba has set new sales records on Sunday for its biggest shopping day, the annual Singles Day.

The Chinese company hit a record $1bn (£774m; €883m) in sales in 85 seconds, and then just shy of $10bn in the first hour of the 24-hour spree.

- Details

- Category: Technology

Read more: Alibaba Singles Day sales frenzy surpasses records

Write comment (100 Comments)

Thirty-five days after Microsoft withdrew the Windows 10 October 2018 Update from all distribution, the Redmond, Wash. company has yet to restart delivery.

The delay has no precedent in Windows 10 and has gone on significantly longer than instances in prior editions when updates, most of them security fixes, had to be pulled and then later re-released.

[ Related: Windows 10 October 2018 Update: Key enterprise features ]Microsoft debuted the fall feature upgrade, also known as 1809 in the firm's yymm format, on Oct. 2. Four days later - Oct. 6 - it retracted the release by yanking it from the Windows Update service and warning users who had downloaded it to trash the disk image. The reason: Some users - Microsoft said 1/100th of 1% - reported that the upgrade deleted all files in several folders, including the important Documents and Photos directories.

To read this article in full, please click here

- Details

- Category: Technology

Read more: Windows 10 rollout snafu: Day 35

Write comment (100 Comments)Earlier this week in a new experimental newsletter I&ve been helping Danny Crichton on, we briefly discussed transit pundit Jarrett Walkerarticle in The Atlantic arguing against the view that ridesharing and microtransit will be the future of mass transit. Instead, his thesis is that a properly operated and well-resourced bus system is much more efficient from a coverage, cost, space, and equality perspective.

Consider this an ongoing discussion about Urban Tech, its intersection with regulation, issues of public service, and other complexities that people have full PHDs on. I&m just a bitter, born-and-bred New Yorker trying to figure out why I&ve been stuck in between subway stops for the last 15 minutes, so please reach out with your take on any of these thoughts: @This email address is being protected from spambots. You need JavaScript enabled to view it..

From an output perspective, Walker argues that by operating along variable routes based on at-your-door pick ups, microtransit actually takes more time to pick up fewer people on average. Walker also gives buses the edge from a cost and input perspective, since labor makes up 70% of transit operating costs in a pre-autonomous world and buses allow you to service more customers for the price of one driver.

&The drivertime is far more expensive than maintenance, fuel, and all the other costs involved. In almost every public meeting I attend, citizens complain about seeing buses with empty seats, lecturing me about how smaller vehicles would be less wasteful. But thatnot the case. Because the cost is in the driver, a wise transit agency runs the largest bus it will ever need during the course of a shift. In an outer suburb, that empty big bus makes perfect sense if it will be mobbed by schoolchildren or commuters twice a day.&

But transit is not solely an issue of volume and unit economics, but one of managing public space. Walker explains that to ensure citizens don&t use more than their fair share of space, cities can either provide vehicles that are only marginally bigger than a human body, i.e. bikes and scooters, or have many people share large-scale vehicles, i.e. mass transit. Doing the latter through a mass fleet of on-demand microtransit solutions, Walker argues, increases congestion and makes it harder to manage scheduling and allocate infrastructure.

While the article offers an effective comparison of unit economics and acts as a useful primer on the various considerations for city transit agencies, some of the conclusions are a bit binary. The discussion is a bit singular in its focus of microtransit as a replacement of public transit rather than an additive service and doesn&t give much credit to the trip planning and space management capabilities of many microtransit services, nor changes in consumer expectations towards transportation.

But despite some of the gaps in the piece, Walker highlights two ideas that spill over to some broad areas that have caught my interest lately: Tolls and Parking.

Tolls

Photo by Michael H via Getty Images

&To succeed, microtransit would have to help people get around cities better, not just make them feel good about hailing a ride on a phone. Full automation of vehicles, if indeed it ever arrives, might solve the labor problem—although it would put thousands of drivers out of work. But the congestion problem will remain.&

Like many, Walker argues that ridesharing aggravates city traffic rather than alleviates it. Even though ridesharinglong-term impact on traffic is widely contested, nearly everyone agrees that a solution to urban congestion is desperately needed.

Whatinteresting is that regardless of the discourse that surrounds them, trends in US tolling mechanisms seem to suggest American cities may be moving closer to congestion pricing methods.

As an example, solutions to congestion are top of mind behind the New York state election that saw Democrats taking control of both state legislative houses. Though it seems like the argument resurfaces every few years, the elections have brought renewed debate over the possible implementation of congestion pricing in New York City. In essence, congestion pricing is a system where drivers would pay higher prices for using high-traffic streets or entering high-traffic zones, allowing cities to better dictate the flow of drivers and reduce congestion.

Outside of the obvious political tension created by effectively implementing a new tax, some lawmakershave pushed back on the effectiveness of a congestion pricing policy,with some arguing that it can aggravate income inequality or that a policy addressing construction and pedestrians, rather than vehicles, would have a bigger impact on traffic.

However, over the past year or so, an increasing number of states have been rolling out highway tolls that are priced dynamically, instead of using traditional fixed-price tolls. The exact drivers behind the toll prices vary, with some cities charging prices based on traffic conditions and others charging varying prices for the use of express and HOV lanes.

Several new technologies and companies have also made it easier for local governments to implement more sophisticated, adjustable toll pricing or congestion fees at a much lower cost. In the past, congestion pricing systems around the world have required physical detection systems that can be extremely costly to implement.

Now, companies like ClearRoad are helping governments use a wide range of connected vehicle technologies to establish and collect road usage pricing from any location without the need for physical infrastructure. Oregon is one geography working with ClearRoad to manage its new opt-in road usage program where the state is able to calculate drivers& usage of certain roads and their gas consumption, and then reimburse them for gas taxes they&re paying.

So even though people are still screaming at each other in state capitols, it seems like we may be closer to seeing congestion pricing in major cities than we think. And while executing these programs can be difficult and painfully slow (often needing to satisfy city regulations and tax laws forty layers deep), if these smaller-scale programs we&re seeing in the US are actually effective, congestion pricing may be a solution to plug chunky budget gaps, better finance infrastructure projects and replace lost gas tax revenue in an electric vehicle future.

Parking

In his piece, Walker goes back to some basic principles of urban design, highlighting that at their core, functioning cities come down to how millions of people share a comparatively tiny amount of space.

Walker explains that city dwellers that travel with cars and solo rideshare trips rather than with large-scale shared transitare effectively taking up more than their fair share of public space. While the argument is made in the context of ridesharing and congestion, the same idea applies to the less-discussed impact mass-transit ridesharing can have on city parking.

At least in the near-term, certain cities have seen ridesharing actually increase vehicle usage rather than reduce it (a claim rideshare companies dispute), resulting in an even wider gap between the supply and demand for available parking spots. And if people are using ridesharing but still choosing to own cars regardless, in an indirect fashion, they are similarly reducing the stock of available parking space by more than their fair share.

And while it makes sense that rideshare vehicles should receive a larger portion of the parking stock, given that it serves more passengers, the use of available parking by these vehicles can and has caused tension with local residents that have to store their cars further away.

There are companies like the mobility-focused data platform, Coord, that are working on tools geared towards helping cities and citizens more effectively allocate and plan parkingstrategies for the future multi-modal transportation network. And theoretically, ridesharing should reduce the number of vehicles in search of parking in the long-term. But at least for now, the impact on parking congestion is just another unintended consequence that weakens the argument for ridesharing as mass transit.

And lastly, some reading while in transit:

- A Smart City Is an Accessible City & The Atlantic, Aimi Hamraie

- The DEA and ICE Are Hiding Surveillance Cameras in Streetlights & Quartz, Justin Rohrlich - David Gershgron

- When Amazon Happens to Good Cities & Planetizen, James Brasuell

- In the Age of A.I., Is Seeing Still Believing & The New Yorker, Joshua Rothman

- The Social Responsibility of WakandaGolden City & CityLab, Nicole Flatow

- Details

- Category: Technology

Read more: How issues of microtransit, congestion and parking are closing in on cities

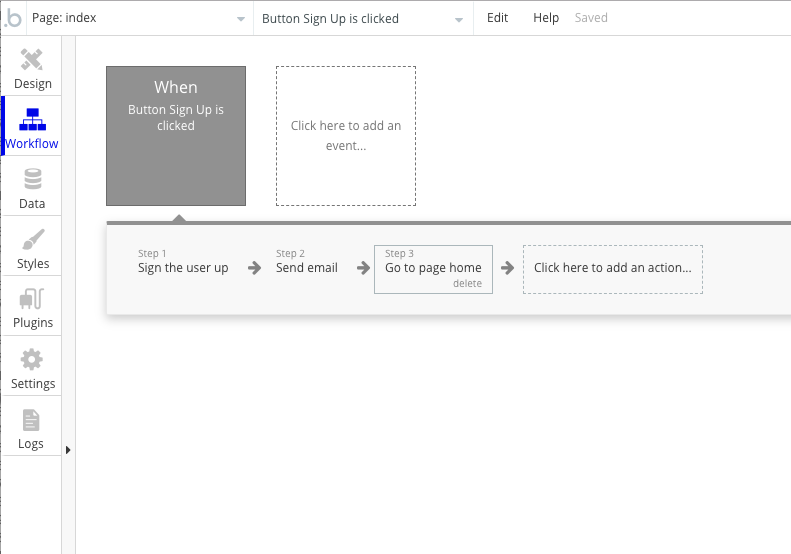

Write comment (95 Comments)Meet Bubble a bootstrapped startup that has been building a powerful service that lets you create a web application even if you don&t know how to code. Many small and big companies rely on Bubble for their website.

I have to say I was quite skeptical when I first heard about Bubble. Many startups have already tried to make coding as easy as playing with Lego bricks. But italways frustratingly limited.

Bubble is more powerful than your average website building service. It recreates all the major pillars of web programming in a visual interface.

It starts with a design tab. You start with a blank canvas and you can create web pages by dragging and dropping visual elements on the screen. You can put elements wherever you want, resize maps, text boxes, images and more. You can click on the preview button to see the development version of your time whenever your want.

In the second tab, you can create the logic behind your site. It works a bit like Automator on the Mac. You add blocks to create a chronological action. You can set some conditions within each block.

In the third tab, you can interact with your database. For instance, you can create a sign up page and store profile information in the database. At any time, you can import and export data.

There are hundreds of plugins that let you accept payments with Stripe, embed a TypeForm, use Intercom for customer support via chat, use Mixpanel, etc. You can also use your Bubble data outside of Bubble. For instance, you can build an iPhone app that relies on your Bubble database.

Many small companies started using Bubble, and itbeen working fine for some of them. For instance, Plato uses Bubble for all its back office. Qoins and Meetaway run on Bubble. Dividend Finance raised $365 million and uses Bubble.

The startup takes care of hosting your application for you. Every time you resize your instance as your application gets bigger, you pay more.

Even though the company never raised any money, it already generates $115,000 in monthly recurring revenue. Bubble is still a small startup, which can be scary for bigger customers. But the company wants to improve the product so that customers don&t see the limitations of Bubble. Now, the challenge is to grow faster than customers& needs.

- Details

- Category: Technology

Read more: Bubble lets you create web applications with no coding experience

Write comment (91 Comments)If geographies were companies, Silicon Valley and New York would be the incumbents — successful today and possibly impregnable — and, like all incumbents, their outsized advantages obscure significant vulnerabilities. Not least of these are high pricesand entrenched thinking that can make adapting to new situations difficult.

A dozen venture capitalists spent three days in the South — Charlotte, Columbia, and Atlanta — to learn what it might take to begin investing in the region as an alternative. It was the sequel to a trip some of us took earlier this year to the heartland. And yet again, we saw places and met people with assets Silicon Valley can only dream about.

The cities we visited represent a new breed of challenger to the geographic dominance of venture capitalleading centers, who — if they can cover the table stakes — bring advantages the Valley may struggle to capture.

First; diversity. It helps startups to bring people together with a range of life experiences, so places like Columbia, Charlotte, and Atlanta should be natural winners. Racial diversity, yes — anchored in part by the strong presence of historically black colleges and universities, of which we visited several — and also diversity of their economies.

In Atlanta (the second-largest majority-black metro in the country) in particular, therea wide range of corporate partners (read: customers for startups). Atlanta has the third-most Fortune 500 companies of any city, and you need to go down to #11 before you get any two in the same industry. (Think UPS, Coca-Cola, Delta, Home Depot, and so forth.)

Second; these places have a history of overcoming adversity. Many students we met were first-generation college kids, whose parents and grandparents learned to climb over the brick wall of racism and passed on that grit. The startups that thrive despite the rocky soil become less fragile, less precariously perched on the peak of this monthhype cycle.

If a startup can make it in Orangeburg, SC, a manufacturing town with a median household income of $29k, it can make it anywhere. Many founders in Silicon Valley have had it so good they can no longer smell money. Startups, unlike many other kinds of projects (like learning to play music), simply require the right timing and dosage of adversity.

What will it take for these places to realize their potential

Their engines are warm and running. We were floored by the consistently exceptional quality of the startups marshalled by Kathryn Finney at Atlantadigital undivided, and felt right at home with the founders who Collective HustleSam Smith gathered around a table in Charlotte.

A few drops of mentorship and capital will crystallize even more progress. We met students who devoured every word of the tech blogs we all read, and still craved someone with first-hand knowledge, to warn them away from dead ends or confirm their intuitions. Several of us said we&d be happy to videoconference in to classes, or come back again and visit.

We invited our hosts in the South to spend a few days with us in the bubble. We realize that providing mentorship at scale is another matter, and we&re thinking about how to do that. We did notice that big technology companies — Google, Microsoft, Bloomberg — have already done a good job of showing up for recruiting or startup-support programs.

While there are angel investors in every market, itclear that most rich people (understandably) need a basic understanding of that strange bird of startup investing. We heard story after story of angels who focus on safe bets (good luck!), ask for control over startups in modest five-figure investments, and fail to take advantage of the worthwhile standards from more developed ecosystems. Even the local angel groups, where they exist, tended to reinforce bad behavior as often as they shared good ones (as organized angel groups often do).

Government participates more actively in these ecosystems — starting with the hosts of our trip, Representatives Tim Ryan (OH), Ro Khanna (CA), and Jim Clyburn (SC). Creating an environment for startups is a completely different beast than traditional &smokestack chasing& economic development (where a city tries to lure big employers to bring a massive facility).

Itmore about identifying individual champions (one mayor struggled to tell us who the active investors were in their community), creating the living conditions that technology employees want (art, food, and fast, reliable internet among others), and protecting the green shoots that bust their way through the concrete. Governments can use the bully pulpit to draw attention to nascent victories at zero cost to taxpayers.

Investors from Silicon Valley or New York need to stop asking founders to relocate. So many founders had heard the tired &I&ll consider investing… if you move& story. This is borderline bad behavior — asking a founder to uproot their life because itmore convenient for the investor. While investors might believe they&re making a recommendation in the companybest interest (&iteasier to succeed in a more established place&), founders have unfair home court advantages (knowing talent, customers, etc.).

What will we investors need to learn, if we&re to participate in the growth of these markets

We need to watch the assumptions our words reveal. People who live in coastal cities talk like a duck. We&ll benefit from reading the room when words like &SaaS& or &LP& need explanation. Getting &ramen profitable& may assume a founder has family with whom they can live — one founder told us that &it feels like you need $500k in funding to even try to do that.&

Often the first step is something other than a direct investment. Investors might participate in a few local events, or encourage a portfolio company to open a second office (as one did from our last trip to South Bend), or build relationships through mentoring and coaching. Direct investments can start small — we had founders asking for investment rounds in the tens of thousands of dollars, i.e., with one fewer zero than the smallest rounds in bubbleland.

We&ll need to embrace the communities that hold these places together: Churches are especially important outside the coasts. More than one founder told us about the role The Creator plays in their startupcreation. Baptist, AME, and Methodist churches have long undergirded economic development in these cities. Startups harness those trusted networks to find teammates and customers. Investors who see the importance of churches will find deals. (Silicon Valleyatheist streak makes this a new muscle for us out-of-towners.)

Every place has its own shape. Charlotte, despite being near Research Triangle, gets relatively little flow of talent from Raleigh-Durham. The economic boom there also, ironically, can make it harder for a startup to compete for talent and attention. In Orangeburg, we saw a strong startup that planned to move to Baltimore — and none of us could fault those founders for choosing to go to a more active startup place. Several others in Columbia banded together to occupy SOCO, in a new real estate development, planting seeds.

Atlanta almost has it all right now — talent, experienced angels, role model founders who actively mentor rookies, and quality of life (the BeltLine felt like what the High Line wishes it were). Atlanta has that most-important and elusive startup quality: momentum. (Fund LPs may actually have some of the best opportunities there, because just a couple of slightly bigger local venture funds would smooth the transition between different stages in a companylife. More investors might get to bet on a Mailchimp before it prides itself on not needing them.)

In our country, where everyone is supposed to have a real chance at extraordinary opportunity, one question hung over our trip: is geography… destiny Can a kid at Benedict College in Columbia create one of the worlddefining startups Fast forward the clock, and we believe we may see that. Our goal is to participate and support it. Some of the places we visited — with their combination of diversity and overcoming adversity — are irresistible bets on the future of startups in America, maybe even on the future of America.

Additional credit to Karin Klein, Bloomberg Beta; Shiyan Koh, Hustle Fund; and Scott Shane, Comeback Capital.

- Details

- Category: Technology

Read more: Placing bets beyond the venture hubs of New York and Silicon Valley

Write comment (94 Comments)Mattereum, perhaps the world’s weirdest and most daring startup, intends to own literally everything

Howthis for eyebrow-raising In London, for the last year and a half, a team of lawyers, cryptographers, software engineers, and/or former military consultants have been brewing a bizarre and/or brilliant plan for a bridge between the blockchain and the real world — a system whose success is directly proportional to the extent to which it achieves legal title over every physical object in the world.

Wait. Let me explain. Their name is Mattereum, and they are not Bond villains seeking to conquer the planet. Rather, they are trying to bridge the gap between programmable blockchain &smart contracts& and actual legal contracts. As you might imagine, that gap consists of an almost infinitely knotty tangle of legal precedents, gray areas, and jurisdictions.

Mattereum has came up with a remarkable way to sever this Gordian knot. A legal concept universal across almost all jurisdictions is that assets have owners, who can decide (within legal limits) how to dispose of them. If registrars of the Mattereum network are granted legal title over assets, the thinking goes, they can then establish on-chain smart contracts with which physical assets can be programmatically bought, sold, rented, assigned, and partitioned — and use their ownership of these assets to resolve disputes and enforce those resolutions.

That all sounds pretty abstract. Lettalk about some real-world examples. Their flagship object right now is a Stradivarius violin valued at $9 million. Assigning legal title over that violin to one of Mattereumregistrars (say, Mattereum itself) which then licenses control via a set of smart contracts (say, on the Ethereum blockchain) means the violin instantly becomes not just a physical asset but a digital one, which can now be programmatically tokenized and sold to multiple investors — and also means that other contractual restrictions regarding its use can be required and enforced, such as that it be played for the public X times a year in Y countries, rather than locked perpetually into a vault.

Similarly, artists could sell their work to consortiums of investors with the enforceable requirement that their art be displayed in galleries open to the public for at least 25% of every year, built-in digital interfaces for galleries and museums to book that time, income percentages allocated for foundations and to the artist themselves, and so forth. And, of course, in passing, the artprovenance is maintained, too.

Could you do all this already, via a whole lot of legal paperwork followed by a whole lot of glacially-paced lawsuits when disputes inevitably arose Sure. But to quote their summary white paper (PDF), which is very worth reading:

Clichés like &data is the new oil& conceal a fundamental truth: efficient discovery of availability and price radically changes the value of assets. Auctions on eBay gave value to enormous seas of illiquid assets … Some classes of illiquid assets, such as idle cars and briefly empty flats, found markets through Uber and Airbnb, liberating billions in value … the pattern is very clear: assets with a proper digital interface and history are more valuable than assets without them.

Mattereum boasts an impressive team led by Vinay Gupta, the mad-or-visionary-depending-on-who-you-talk-to global resilience guru turned Ethereum launch coordinator turned CEO, and including Ian Grigg, inventor of the Ricardian contract. And, of course, a lawyer or three. Obviously whole clouds of question marks still hover around them, notably regarding just how these smart contracts will intersect with the existing legal world(s), and how to establish trust in asset registrars to not abuse their legal title, or neglect their responsibilities — a trust which will need to rival or exceed that which accountholders have in banks.

But, like Ethereum itself, this is still a wildly ambitious, genuinely innovative, and deeply weird project; thatmuch to admire. Restructuring the concept of physical asset ownership to include programmatic contracts may seem like a subtle change, but itone which could conceivably have massive structural repercussions and unlock enormous amounts of currently untapped potential. Itearly baby-iterative-steps yet, of course, with a panoply of pitfalls on all sides; but itbig and bold and hopeful, and it just might do a lot of good.

- Details

- Category: Technology

Page 3686 of 5614

14

14