Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

AfricaVC landscape is becoming more African with an increasing number of investment funds headquartered on the continent and run by locals, according to Crunchbase data summarized in thisTechCrunch feature.

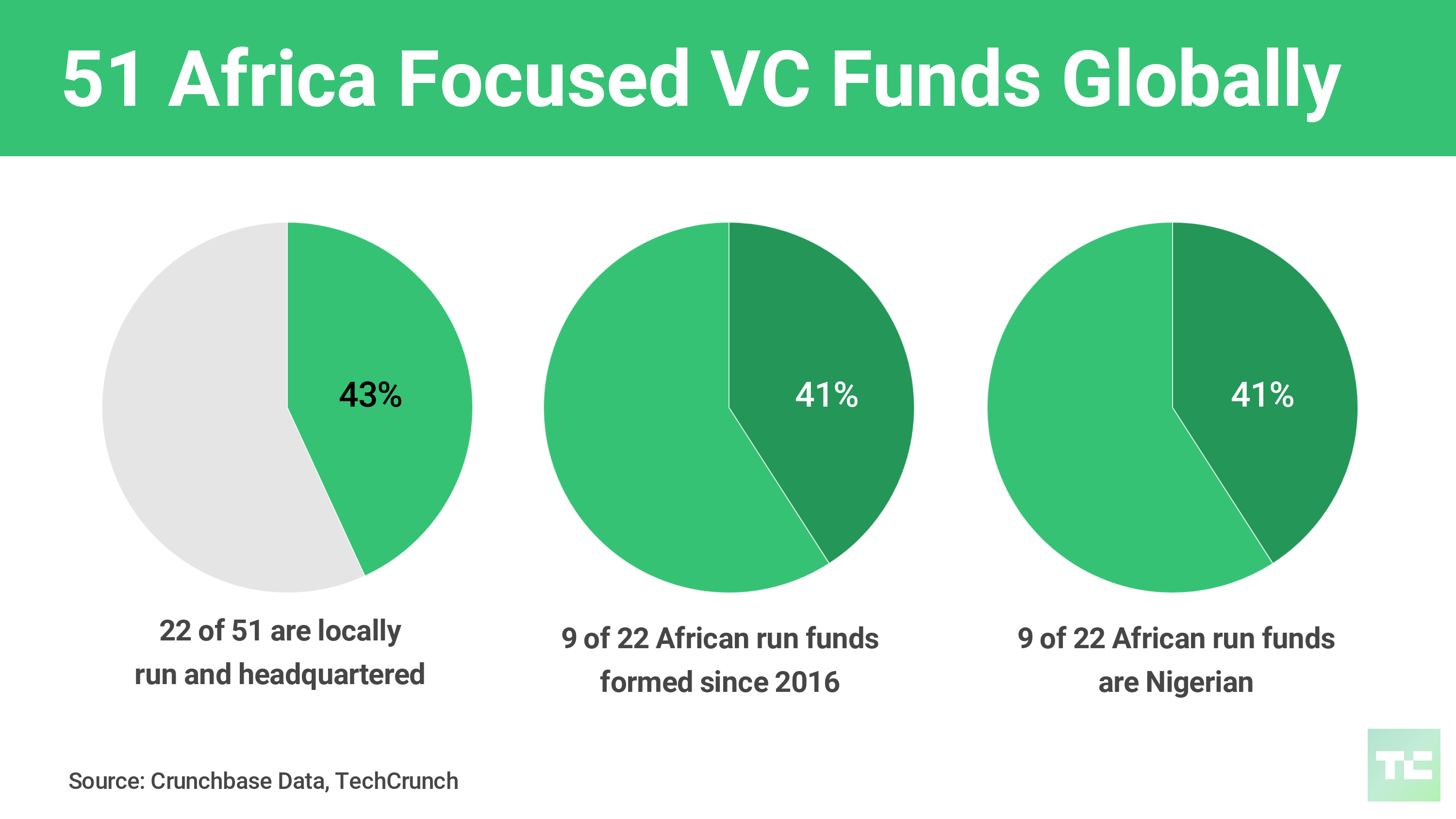

Drawing on its database and primary source research, Crunchbase identified 51 &viable& Africa-focused VC funds globally—defining viable as formally established entities with 7-10 investments or more in African startups, from seed to series stage.

Of the 51 funds investing in African startups, 22 (or 43 percent) were headquartered in Africa and managed by Africans.

Of the 22 African managed and located funds, 9 (or 41 percent) were formed since 2016 and 9 are Nigerian.

Four of the 9 Nigeria located funds were formed within the last year:Microtraction, Neon Ventures, Beta.Ventures, and CcHubGrowth Capital fund.

The Nigerian funds with the most investments were EchoVC (20) andVentures Platform (27).

Notably active funds in the group of 51 included Singularity Investments (18 African startup investments) GhanaGolden Palm Investments (17) and Musha Ventures (36).

The Crunchbase study also tracked more Africans in top positions at outside funds and the rise of homegrown corporate venture arms.

One of those entities with a corporate venture arm, Naspers, announced a massive $100 million fund named Naspers Foundry to support South African tech startups.This is part of a $300 million (1.4 billion Rand) commitment by the South African media and investment company to support South Africatech sector overall. Naspers Foundry will launch in 2019.

The initiatives lend more weight to Naspers& venture activities in Africa as the company has received greater attention for investments off the continent (namely Europe, India and China), as coveredin this TechCrunch story.

&Naspers Foundry will help talented and ambitious South African technology entrepreneurs to develop and grow their businesses,& said a company release.

&Technology innovation is transforming the world,& said Naspers chief executive Bob van Dijk. &The Naspers Foundry aims to both encourage and back South African entrepreneurs to create businesses which ensure South Africa benefits from this technology innovation.&

After the $100 million earmarked for the Foundry, Naspers will invest≈$200 million over the next three years to &the development of its existing technology businesses, includingOLX,Takealot, and Mr D Food…& according to a release.

In context, the scale of this announcement is fairly massive for Africa.According to recently summarizedCrunchbase data, the $100 million Naspers Foundry commitment dwarfs any known African corporate venture activity by roughly 95x.

The $300 million commitment to South Africatech ecosystem signals a strong commitment by Naspers to its home market. Naspers wasn&t ready to comment on if or when it could extend this commitment outside of South Africa (TechCrunch did inquire).

If Naspers does increase its startup and ecosystem funding to wider Africa— given its size compared to others—that would be a primo development for the continenttech sector.

If mobile money was the first phase in the development of digital finance in Africa, the nextphaseis non-payment financial apps in agtech, insurance, mobile-lending, and investech,according to a report by Village Capital coveredhere at TechCrunch.

In &Beyond Payments: The Next Generation of Fintech Startups in Sub-Saharan Africa,& the venture capital firm and their reporting partner, PayPal, identify 12 companies it determined were &building solutions in fintech subsectors outside of payments.&

Village Capitalwork gives a snapshot of these four sub-sectors — agricultural finance, insurtech, alternative credit scoring and savings and wealth — including players, opportunities and challenges, recent raises and early-stage startups to watch.

The report highlights recent raises by savings startupPiggybankNGand Nigerian agtech firmFarmCrowdy. Village Capital sees the biggest opportunities for insurtech startups in five countries: South Africa, Morocco, Egypt, Kenya and Nigeria.

In alternative credit scoring and lending it sees blockchain as a driver of innovation in reducing &both transaction costs and intermediation costs, helping entrepreneurs bypass expensive verification systems and third parties.&

TheFounders Factoryexpanded its corporate-backed accelerator to Africa, opening an office in Johannesburg with the support of some global and local partners.

This is Founders Factory first international expansion and the goal is &to scale 100 startups across Sub-Saharan Africa in five years,& according the acceleratorcommunications head, Amy Grimshaw.

Founders Fund co-founder Roo Rogers will lead the new Africa office. Standard Bank is the first backer, investing &several million funds over five years,& according to Grimshaw.

The Johannesburg accelerator will grow existing businesses through a bespoke six-month program, while an incubator will build completely new businesses focused on addressing key issues on the continent.

Founder Funds will hire over 40 full-time specialists locally, covering all aspects needed to scale its startups including product development, UX/UI, engineering, investment, business development and, growth marketing. ThisTechCrunch featurehas more from Founders Fund management on the outlook for the new South Africa accelerator.

More Africa Related Stories @TechCrunch

How a Ugandan prince and a crypto startup are planning an African revolution

Marieme Diop and Shikoh Gitau to speak at Startup Battlefield Africa

Flutterwave and Ventures Platform CEOs will join us at Startup Battlefield Africa

African Tech Around the Net

A lot is happening at Flutterwave right now—[E departs]

Amazon Web Services to open data centres in Cape Town in 2020

Vodacom Business expands its fixed connectivity network in Africa

SASun Exchange raises $500k from Alphabit

IBM, AfriLabs partner to expand digital skills across 123 hubs in 34 countries

Victor Asemota to lead VC firm Alta Global Venturesbusiness in Africa

Bank, local hub launch $1-million fund for Somali startups

- Details

- Category: Technology

Read more: Africa Roundup: Local VC funds surge, Naspers ramps up and fintech diversifies

Write comment (90 Comments)London and LA-based Engineer.ai launched in an invite-only manner two and a half years ago, bootstrapped by its founders. Its platform combines AI with crowdsourced teams of designers and developers to build bespoke digital products at & they say & twice the speed and less than a third of the cost of traditional software development.

Today itannounced at Web Summit that its raised one of Europelargest Series A investments at $29.5 million, led by Lakestar and Jungle Ventures with participation from SoftbankDeepCore. The round is among Europelargest A-rounds to date.

Engineer.ai&Builder& product breaks projects into small ‘building blocks& of re-usable features that are customized by human engineers all over the world, making the process cheaper than the average process.

Sachin Dev Duggal, founder, said in a statement: &We created Engineer.ai so that everyone can build an idea without learning to code. This investment round validates our approach of making bespoke software effortless. The capital comes at a time of rapid growth and will propel the platform into the mainstream, allowing Builder to open the door for entire categories of companies that could not consider it before.&

Dev Duggal added: &At a certain level we compete with Gigster albeit we have really taken a very different approach (assembly line and buying excess capacity from over 100 Dev shops in 10 timezones) whereas they are a modern day consulting shop. This means we have massive scale with access to 32,000 devs and designers, we have over 500 building blocks that save our customers paying for features (code and designs) that we have already done. The dev shops thus also don&t compete with us as we buy capacity from them and will soon be offering them a way to partner on goto market.&

Amit Anand, Co-Founder - Managing Partner at Jungle Ventures said: &We&re believers in Engineer.aitotal ecosystem; making Bespoke Software like the iPhone with aftercare and a marketplace for all recurring services.&

&Software is the centre of every business today and the market has been waiting for a solution that eliminates technical barriers to build software so that everyone can engage in the new economy,& said Manu Gupta, Partner at Lakestar. &By creating an AI powered assembly line combined with the best global human talent, Engineer.aiBuilder bridges the gap between an idea and a software product to enable it.&

Launched in June 2018, Engineer.ai has been used to create products like BBC, DiditFor, Manscore, and ZikTruck.

- Details

- Category: Technology

Read more: Engineer.ai raises $29.5M Series A for its AI+Humans software building platform

Write comment (98 Comments)

The UK government and the National Cyber Security Centre (NCSC) has reportedly written to mobile operators urging them to ensure their suppliers for 5G network equipment are secure.

The Financial Times says the letter suggested the supply chain may be affected by an ongoing review into the security of the UK’s telecoms infrastructure launched in J

- Details

- Category: Technology

Read more: UK operators urged to 'consider' 5G equipment suppliers

Write comment (96 Comments)

We think it's finally official - the Black Friday 2018 sales season is underway. How else can you explain this incredible offer on mobile phone deals from EE. The network is showing other retailers how to play the freebie game by throwing in a free Nintendo Switch with selected phone contracts for the next two weeks.

Yes, you heard us right.

- Details

- Category: Technology

Read more: Nintendo Switch giveaway bonanza - get one FREE with EE phone deals including P20 Pro

Write comment (92 Comments)

It’s been quite a journey for Diablo 3. After a rocky start on PC way back in May of 2012 that saw online server crashes and criticism of the series’ famed addictive loot cycle, the game was overhauled in time for a last-gen console version in 2013 and a current-gen release on Xbox One and PS4 in 2014. Two excellent expansion packs and a host of

- Details

- Category: Technology

Read more: Diablo 3 (Nintendo Switch) review: Battling hell's demons, while on the toilet

Write comment (95 Comments)

Microsoft has begun selling a new configuration of its divisive Surface Go tablet that was, until now, exclusive to Costco in the US. The model features the enhanced storage of the high-end model, but the memory of the entry-level device.

While it's available on the Microsoft Store it's still only on sale in the US for now, and we don't yet know if

- Details

- Category: Technology

Read more: New, middle-road Surface Go model appears on US Microsoft Store

Write comment (90 Comments)Page 3733 of 5614

5

5