Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Former TokBox head Ian Small is replacing Chris O&Neill as CEO of Evernote, the note-taking and productivity app company said this morning. In a blog post, Small said that the leadership change was announced to employees this morning by Evernoteboard. &We are all hugely appreciative of the energy and dedication Chris has shown over the last three years, and in particular for putting Evernote on solid financial footing so we can continue to build for the future,& he wrote.

Small added, &When Stepan Pachikov founded Evernote, he had a vision for how technology could augment memory and how an app could change the way we relate to information at home and at work. Evernote has been more successful at making progress towards Stepandreams than he could have imagined, but Stepan and I both think that there is more to explore and more to invent.&

O&Neill had been EvernoteCEO since 2015, when he took over the position from co-founder Phil Libin. Small previously served as CEO of TokBox, which operates the OpenTok video calling platform, from 2009 to 2014, and then as its chairman from 2014 to July of this year.

O&Neilldeparture as CEO is the latest significant leadership shift for Evernote, which has withstood several key executive departures over the last few months. In early September, we reported that the company had lost several senior executives, including CTO Anirban Kundu, CFO Vincent Toolan, CPO Erik Wrobel, and head of HR Michelle Wagner, as it sought funding in a potential down-round from the unicorn valuation it hit in 2012. According to TechCrunchsources, Evernote had struggled to grow its base of paid users and active users, as well as enterprise clients, for the last six years.

Then a few weeks later, Evernote announced that had to lay off 54 people, or about 15 percent of its workforce. O&Neill wrote a blog post about the companyfuture growth strategy, including streamlining specific functions like sales so it could focus on product development and engineering.

- Details

- Category: Technology

Read more: Ian Small, former head of TokBox, takes over as Evernote CEO from Chris O’Neill

Write comment (97 Comments)Social e-commerce startup Goxip raised $5 million in January, and now the Hong Kong-based business has brought in more cash with a strategic $1.4 million investment from financial services company Convoy. Existing backers including Chinese photo app company Meitu also took part.

Convoy offers a range of services that include asset management, insurance and other investment options. Hong Konglargest financial advisory with over 100,000 customers, Convoy isn&t in great shape now. It has been in crisis over legal action and a corruption investigation that is centered around a former company director.

The companyshares remain suspended on the Hong Kong Stock Exchange although it recently made appointments aimed at modernizing its business and this deal is likely another part of that strategy. Convoyportfolio of strategic investments includes Nutmeg in the UKand IrelandCurrencyfair, which bought up Convoypayments arm.

Goxip said it will use the capital and the new relationship with Convoy to offer more installment-based financing options on its service, which is akin to a ‘shoppable Instagram& that has a focus on high-end fashion.

The company already counts major retailers likeNet-a-Porter, Harrods, and ASOS and brands that includelike Nike, Alexander McQueen and Topshop. To date, Goxip has helped customers find outfits and buy them but now, with Convoy, it wants to offer payment plans using a virtual credit card, Goxip co-founder and CEO Juliette Gimenez told TechCrunch.

With 600,000 monthly users and average orders of $300, Goxip is getting close to breaking even,Gimenez said, but she is hopeful that offering staggered payment options over varying periods such as 6-12 monthswill serve Goxip well as it expands in Southeast Asia where typical consumers spend less. That&ll happen soon after the company opened an office in Bangkok ahead of an imminent launch in Thailand, its second expansion after Malaysia.

Goxip has just opened an office in Bangkok ahead of an upcoming launch in Thailand

Beyond geographical additions,Goxip has also branched out into influencer marking this year with recently launchedRewardSnap service. Similar to Rewardstyle in the U.S, it will enableinternet influencers — and particularly those on Instagram — to partner with brands and make money through referrals to their audience.Gimenez said that 150 influencers with a total following of over 14 million have signed up, including Elly Lam who has 140,000 followers on Instagram

Instagram is beefing up its commerce focus — with the addition of a shopping tab and new management at the wheel — butGimenez said she isn&t phased. She points to the fact that Facebook, which owns Instagram, hasn&t been able to make e-commerce work in Asia, while the simplicity of Rewardsnap and its connection to the Goxip service, makes it highly defensible even asInstagram ups its shopping game.

Update: The original version of this article has been updated to reflect that RewardSnap has already launched, and that Elly Lam has 140,000 followers.

- Details

- Category: Technology

Read more: Social commerce startup Goxip lands $1.4M investment to add flexible payments

Write comment (94 Comments)Google and a group of game cetologists have undertaken an AI-based investigation of years of undersea recordings, hoping to create a machine learning model that can spot humpback whale calls. Itpart of the companynew &AI for social good& program thatrather obviously positioned to counter the narrative that AI is mostly used for facial recognition and ad targeting.

Whales travel quite a bit as they search for better feeding grounds, warmer waters and social gatherings. But naturally these movements can be rather difficult to track. Fortunately, whales call to each other and sing in individually identifiable ways, and these songs can travel great distances underwater.

So with a worldwide network of listening devices planted on the ocean floor, you can track whale movements — if you want to listen to years of background noise and pick out the calls manually, that is. And thathow we&ve done it for quite a while, though computers have helped lighten the load. Googleteam, in partnership with NOAA, decided this was a good match for the talents of machine learning systems.

These AI (we employ the term loosely here) models are great at skimming through tons of noisy data for particular patterns, which is why they&re applied to voluminous data like that from radio telescopes and CCTV cameras.

In this case the data was years of recordings from a dozen hydrophones stationed all over the Pacific. This data set has already largely been investigated, but Googleresearchers wanted to see if an AI agent could do the painstaking and time-consuming work of doing a first pass on it and marking periods of interesting sound with a species name — in this case humpbacks, but it could just as easily be a different whale or something else altogether.

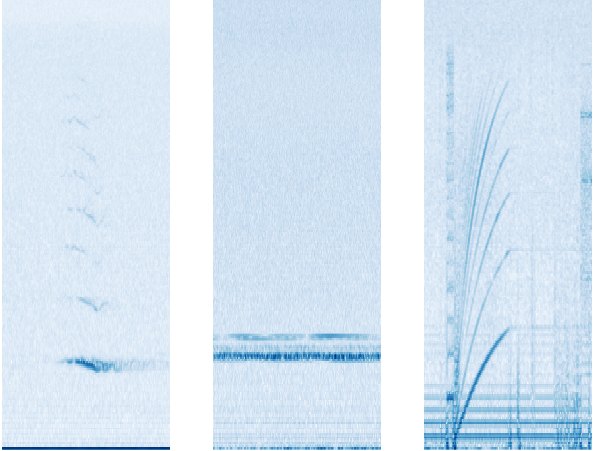

Spectrograms of whale song, left, an unknown &narrow-band& noise, center, and the recorderown hard disk drive, right.

Interestingly, but not surprisingly in retrospect, the audio wasn&t analyzed as such — instead, the audio was turned into images it could look for patterns in. These spectrograms are a record of the strength of sound in a range of frequencies over time, and can be used for all kinds of interesting things. It so happens that they&re also well studied by machine learning and computer vision researchers, who have developed various means of analyzing them efficiently.

The machine learning model was provided with examples of humpback whale calls and learned how to identify them with reasonable accuracy in a set of sample data. Various experiments were conducted to suss out what settings were optimal — for instance, what length of clip was easy to process and not overlong, or what frequencies could be safely ignored.

The final effort divided the years of data into 75-second clips, and the model was able to determine, with 90 percent accuracy, whether a clip contained a &humpback unit,& or relevant whale sound. Thatnot a small amount of error, of course, but if you trust the machine a bit you stand to save quite a bit of time — or your lab assistanttime, anyway.

A second effort relied on whatcalled unsupervised learning, where the system sort of set its own rules about what constituted similarity between whale sounds and non-whale sounds, creating a plot that researchers could sort through and find relevant groups.

Visualization of how the unsupervised model classified various sounds. The blue ones represent humpback calls.

It makes for more interesting visualizations but it is rather harder to explain, and at any rate doesn&t seem to have resulted in as useful a set of classifications as the more traditional method.

As with similar applications of machine learning in various scholarly fields, this isn&t going to replace careful observation and documentation but rather augment them. Taking some of the grunt work out of science lets researchers focus on their specialties rather than get bogged down in repetitive stats and hours-long data analysis sessions.

- Details

- Category: Technology

Read more: Google AI listens to 15 years of sea-bottom recordings for hidden whale songs

Write comment (95 Comments)iHeartMedia announced today that its streaming radio app iHeartRadio is coming to Mexico. In fact, a beta version of the app is already live, with plans for an official launch on November 3.

As part of this launch, the company is partnering with Mexican broadcaster Grupo ACIR, which owns the Amor, Mix and La Comadre radio brands. iHeartRadio México will include all 56 Grupo ACIR and 850 iHeartMedia broadcast radio stations.

The app will also offer digital-only stations from both companies, as well as English- and Spanish-language podcasts. (iHeartMedia is getting more serious about podcasts, as indicated by its recent acquisition of the parent company behind HowStuffWorks.)

The launch is timed to coincide with iHeartRadio Fiesta Latina in Miami, and the broadcasters are promoting the partnership with a contest for one Grupo ACIR listener to win a VIP trip to the event.

&This partnership will allow us to better connect with our audience by delivering an incredible free music listening experience and providing amazing technology to our users and partners,& said Grupo ACIR CEO Antonio Ibarra in the announcement.

At launch, the app won&t include some of iHeartRadioother features, like on-demand music streaming. Chief Product Officer Chris Williams said this follows the roadmap the company used when launching in markets like Australia, Canada and New Zealand — it starts out with live radio and podcasts, because negotiating for international streaming rights takes time.

&Itfaster for me to develop and release the app, get it out there and get adoption, establish what we are and who we are,& Williams said. &Then we can get the rights and add the functionality.&

- Details

- Category: Technology

Read more: iHeartRadio is coming to Mexico

Write comment (96 Comments)She may not have the name recognition of former colleague Beth Seidenberg, but Lynne Chou-O&Keefe, who has spent the last five-plus years investing in healthcare on behalf of the venture firm Kleiner Perkins, is raising her own debut fund.

According to a newly processed SEC filing, the firm is called Define Ventures, and it has already locked down $50 million in capital commitments from a handful of investors. (The filing says it is targeting $65 million.)

Chou-O&Keefe had joined Kleiner Perkins in 2013 as a partner in its small life sciences group, to focus ondigital health and connected devices.

Before becoming a VC, she spent six years with Abbott Vascular, a division of the healthcare giant Abbott, first as a global product manager and later as a global marketing director. She also logged a couple of years with Guidant (which is part of Boston Scientific and Abbott Labs) and before that, worked in venture with Apax Partners.

Chou-O&Keefefund comes on the heels of that of Seidenberg, who joined Kleiner Perkins back in 2005 and left earlier this year in order to co-found her own, L.A.-based venture firm, Westlake Village BioPartners. Seidenbergfirm has since closed its debut fund with $320 million in capital commitments.

Define Ventures looks a part of a continuing trend of Kleiner investors creating their own firms, in fact.Earlier investing partners Aileen Lee andTrae Vassallo have gone on to createCowboy VenturesandDefy Ventures, respectively.

Other former Kleiner Perkins investors to helm their own funds includeChi-Hua Chien, who today runs the consumer-tech focused venture firm Goodwater Capital; Brook Porter, David Mount, Benjamin Kortlang and Daniel Oros, who together worked on KleinerGreen Growth Fund and have since launched a firm called G2VP thatfocused on cloud computing, machine learning, computer vision and mobility; and star venture investor Mary Meeker, who announced last month that she, too, is leaving Kleiner Perkins, along with her team (Mood Rowghani, Noah Knauf and Juliet de Baubigny) to create a new fund that will officially launch early next year.

Very notably, in a Bloomberg piece about Meekerdeparture, Chou-O&Keefe was named as Kleiner Perkinslast remaining female investor. Following what we expect will be an attenuated transition out of the firm (these things always take time, at least on paper), that no longer looks to be the case.

Chou-O&Keefe declined to comment for this story.

- Details

- Category: Technology

Read more: Another Kleiner investor has just raised her own fund

Write comment (94 Comments)Kodak isn&t feeling very well. The company, which sold off most of its legacy assets in the last decade, is licensing its name to partners who build products like digital cameras and, most comically, a cryptocurrency. In that deal, Wenn Digital bought the rights to the Kodak name for an estimated $1.5 million, a move that they hoped would immediately lend gravitas to the crypto offering.

Reader, it didn&t. After multiple stories regarding the future of the coin it still has not hit the ICO stage. Now Kodak is talking about another partnership, this time with a Tennessee-based video and film digitization company.

The new product is essentially a rebranding of LegacyBox, a photo digitization company that has gone through multiple iterations after a raft of bad press.

&The Kodak Digitizing Box is a brand licensed product from AMB Media, the creators of Legacy Box. So yes, we&ve licensed the brand to them for this offering,& said Kodak spokesperson Nicholas Rangel. Not much has changed between Kodakoffering and LegacyBox. The LegacyBox site is almost identical to the Kodak site and very similar to another AMB media product, Southtree.

The product itself is a fairly standard photo digitization service, although Southtree does have a number of complaints, including a very troubling case of missing mementos. The entry-level product is a box into which you can stuff hundreds of photos and videos and have them digitized for a fee.

Ultimately itbeen interesting to see Kodak sell itself off in this way. Like Polaroid before it, the company is now a shell of its former self and this is encouraging parasitical partners to cash in on its brand. Given that Kodak is still a household name for many, itno wonder a smaller company like AMB wants hitch itself to that star.

- Details

- Category: Technology

Read more: The corpse of Kodak coughs up another odd partnership

Write comment (99 Comments)Page 3809 of 5614

18

18