Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

These 14 startups — endorsed by the seed-stage investment firm Pear — just hit the fundraising trail

Earlier this week, in a beautiful garden in Woodside, Ca., the team at the five-year-old, seed-stage venture firm Pear hosted it fifth annual demo day. Itan event thatlimited to roughly 100 VCs who year after year happily fill the space to see what Pear — which has written early checks to the &unicorn& delivery serviceDoorDash and newly public Guardant Health, among others — has up its sleeve.

As with last year, what those investors wound up seeing on Tuesday was 15 teams, most of them six months old or younger and led by current students or recent graduates who&d been invited by Pear to build companies over ten weeks in its Palo Alto offices. These ranged from a startup with ambitious plans to build a new commercial space station, to a machine learning-powered cloud video platform that makes it far easier to edit video clips, to a startup that uses AI to negotiate salary discussions on behalf of its clients.

But in a bit of a twist, this time around, Pear also featured a sprinkling of young companies that are now ready for Series A funding, including asolar design and sales platform for residential and commercial photovoltaic systems, and a company that thinks its check-out free shopping technology could help all kinds of Amazon rivals compete with the giantgrowing number ofsurveillance-powered, no-checkout convenience stores.

In case you&re an investor or just someone interested in keeping your thumb on the pulse of whathappening in emerging tech, herewith is a quick snapshot of each of the companies that were featured as part of the program. (Well, all but one that expressly asked us not to write about what itworking on. We&ll just tell you that ita kind of social network and, remarkably, it feels fresh.)

If you&re interested in reaching out to any of these folks, you can find of all of their email addresses here.

Pre-Seed / Seed

Orion Span

Tagline: The WorldPrivate Space Station

Describes itself as: What was once the domain of governments is now the domain of private industry. So it was with aviation and now, too, it is with space travel. SpaceX revolutionized the launch business and is worth $27 billion today. Orion Span will do the same with the destination business. Orion SpanAurora Stationpatented IP and operational concepts emphasize simplicity, cutting costs in extraordinary ways and improving accessibility in ways never seen before in space station design.

Location: San Mateo, Ca, and Houston, Tx.

Employees: 5

Metrics: Twenty-six space tourists have agreed to put $80,000 each to be on the waitlist; 1,578 media outlets worldwide have covered us; and four partners are signed with three more on the way.

Team: Orion Span includes some of the folks who built the International Space Station. Its CEO is a marketer and entrepreneur with a few startups under his belt. Its architect designed the ISS Enterprise module. It CTO designed and built spacecraft systems for the ISS. And its COO oversaw the build of NASA Orion spacecraft as a former general manager.

Young Alfred

Tagline: Home Insurance Marketplace

Describes itself as: Young Alfred turns the nightmare experience of shopping for home insurance online into an informed, 15-minute transaction. As a customer, you get your top three curated home insurance options from a list of more than 20 carriers and can purchase with just one click. A marketplace model drives transparency, saves money, and leads to five times higher purchase conversion than a single-carrier model.

Locations: Philadelphia and New York

Employees: 6

Metrics: Thousands of applications for home insurance a month, with 24 direct carrier relationships across 13 states.

Team: The founders met during their first week at Wharton Business School. David comes from private equity and has experience acquiring and growing businesses. Jason is an engineer turned high frequency trader who has built trading systems for the likes of Citadel and DRW.

Aligned Carbon

Tagline: Next 1000x computing revolution using carbon nanotube

Describes itself as: Aligned Carbon is the first company to sell carbon nanotube wafers in a way that seamlessly fit into the nanofabrication requirements of the integrated circuit industry. The large historical gains in performance due to continued shrinking of silicon transistors are now only realizing marginal improvements with exponentially increasing costs. This has come at a time with the push for faster and lower power computing capabilities continue to grow rapidly due to AI, AR, big-data analytics and other memory-starved workloads. Monolithic 3D integration is the nanoelectronics industrynext paradigm for computing and the sequential integration of carbon nanotube logic with traditional silicon logic and memory is the leading technology. Performance and efficiency improvements of over 1000x are anticipated, and Aligned Carbonproducts solve the carbon nanotube materials problem to revolutionize a $500B industry.

Location: Silicon Valley

Employees: 3

Metrics: Aligned Carbon has worked with over a dozen companies and universities while developing their unique carbon nanotube products of interest to the largest chip manufacturers in the world.

Team: Co-founded in 2018 by J Provine, Greg Pitner, and Cara Beasley, three Stanford scientists who met over a shared love for nanotechnology. Collectively they have over 35 years of nanofabrication research experience with universities, start-ups, and corporate giants.

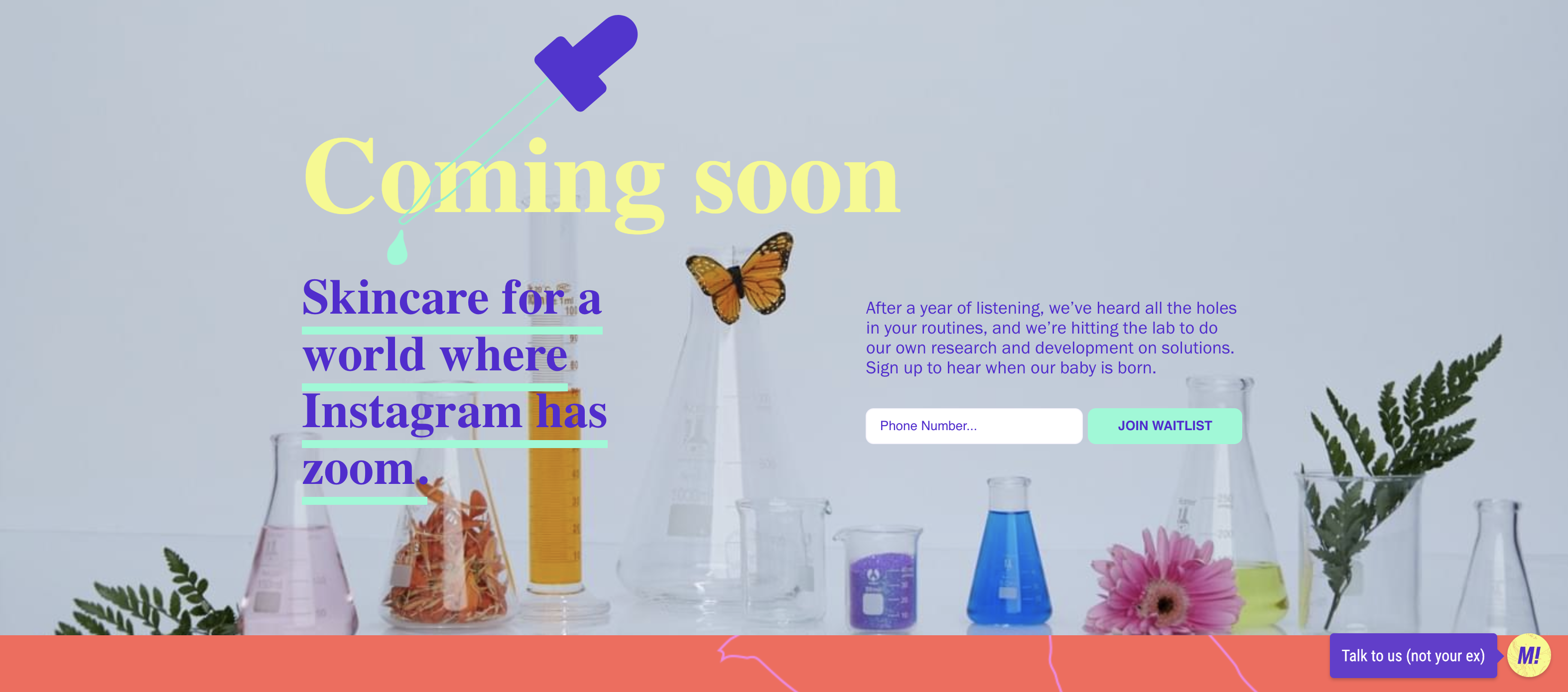

Mirra

Tagline: Mirra creates products and experiences to make no-bullshit skincare easily accessible.

Describes itself as: Mirra is a skincare platform of more than 100,000 beauty nerds who believe that the most important ingredient is transparency. By marrying content, community and commerce, Mirra empowers millennial women with the tools they need to decode the unregulated, $14 billion skincare industry. After releasing a weekly skincare newsletter that grew to more than 100,000 subscribers without ad spend, Mirra is now launching an exclusive line of skincare products.

Location: San Francisco

Employees: undisclosed

Metrics: Mirrafirst product is a weekly skincare newsletter which has grown exponentially without ad spend. Now, after listening to the holes in its readers& routines, Mirra is launching its own exclusive line of skincare products next year.

Team:Mirra is founded by Katia Ameri, a 26-year-old Stanford alumna with a background in venture capital and consumer products.

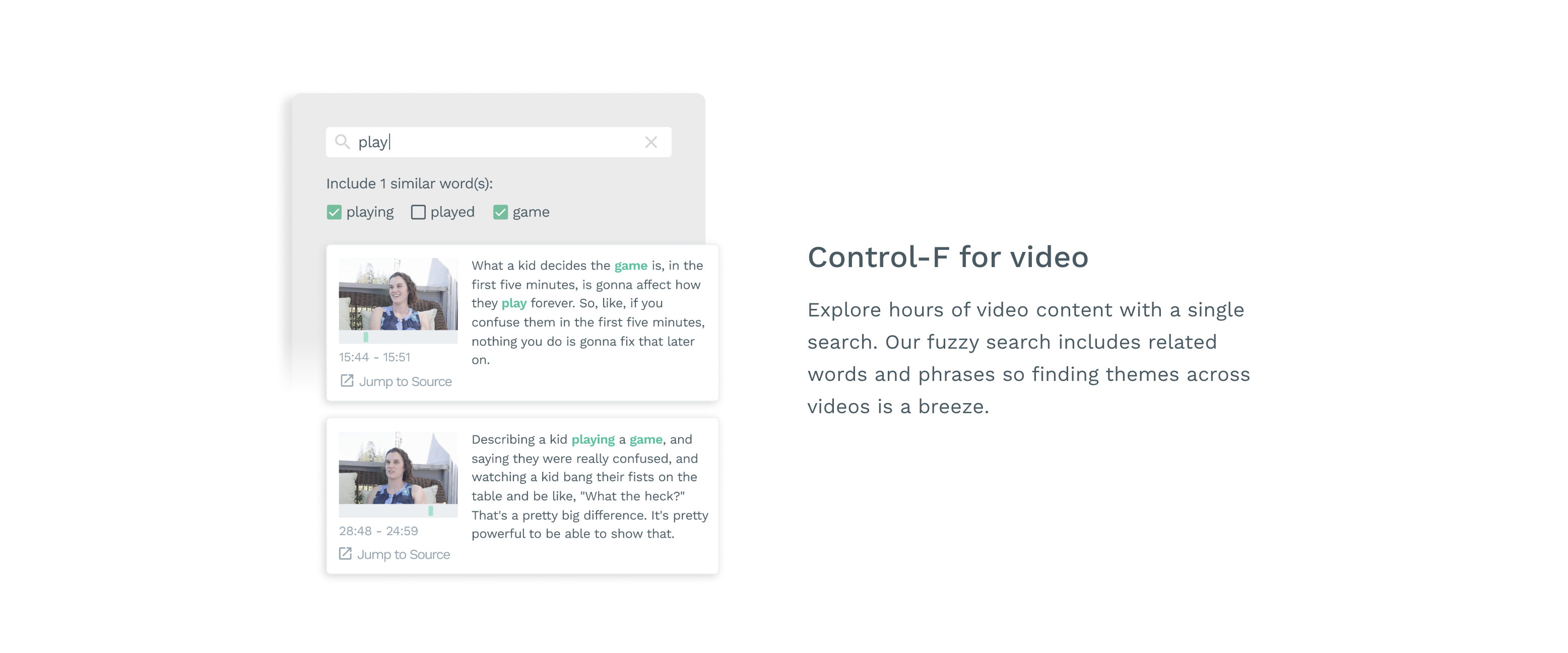

Reduct

Tagline: AI-powered cloud video: the power of video, with the ease of text.

Describes itself as: Reduct makes a machine learning-powered cloud video platform that anyone can use. If you can write a text document, you can search, edit, and share video with Reduct. By making tools for video creation accessible to everyone, the company aims to turn everyonefavorite medium of consumption (the average American watches six hours of video a day) into a ubiquitous mode of communication. The company is currently enabling design - UX research teams to incorporate video into workflows and will create a horizontal product targeting professionals whose profession isn&t video editing.

Location: San Francisco

Employees: 4

Metrics: Since January, the company has acquired 35 paying business customers, including Fortune 500 companies and several technology companies valued at more than $1 billion. It says it has also processed more than 50,000 minutes of video, and customers report time savings of more than ten times what they experience when using traditional video tools.

Team: CEO Prabhas Pokharel studied computer science at Harvard and product design at Stanford, and has spent the last decade creating human-centered products. CTO Robert Ochshorn is a machine learning researcher who has given talks at Google Brian, Apple and Stanford. He is an alum of Cornell CS, and has held research positions at MIT, Harvard, and Alan Kay-initiated CDG Labs.

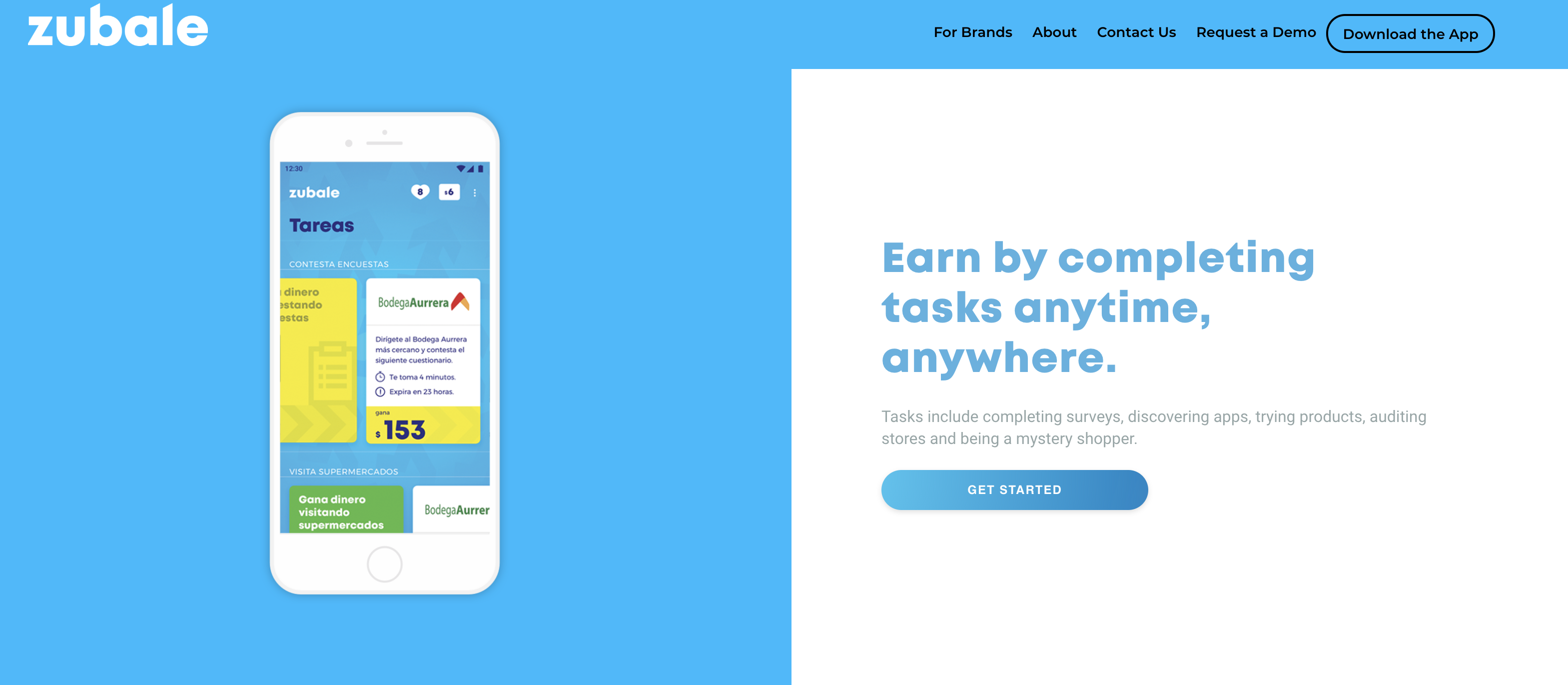

Zubale

Tagline: A platform that empowers companies to make better product decisions in emerging markets.

Describes itself as: Zubale connects companies directly with consumers on their smartphones to crowdsource multiple digital tasks in exchange for rewards. Companies can crowdsource tasks like in-store audits, product trial activations, and market research studies, and receive real-time intelligence from consumers to make faster and more confident decisions. Consumers complete tasks and earn mobile phone credit and other digital rewards that they can redeem through making online purchases.

Location: Mexico City, Mexico

Employees: 10

Metrics: Zubale launched its mobile app three weeks ago and says it has had more than 20,000 branded tasks completed already by consumers.

Team: The founders, Allison Campbell and Sebastian Monroy, have over 15 years of expertise developing and selling new products to consumers at Walmart and Procter and Gamble. Allison launched and ran businesses for Walmart in India and led strategic initiatives across 25 countries. Sebastian led sales teams for P-G in Mexico and across Latin America to distribute products to reach the millions of mom and pop shops that make up 50 percent of spend.

Riva

Tagline: Your career advocates & helping the $2.3T job changer market

Describes itself as: Riva builds automation to help the 41 million people who changing jobs every year — and the 5 million college seniors who graduate — negotiate their job offers. Nearly two-thirds of people do not negotiate their job offers. And research shows that women especially tend to suffer in the negotiation process, furthering the gender pay gap. Riva builds software that can predict an employeeworth and generate negotiation emails and phone scripts that can be used by the employee to negotiate with the employer.

Location: Palo Alto, California

Employees: 7

Metrics: The average increase per negotiation is $23,000. The company is already working with several large partners including schools, engineering communities, and nursing associations to get its product to the mass market.

Team: CEO Stephanie Young has four degrees from Stanford, including an MBA and graduate degree in computer science. She previously helped launch Google AdWords Express& first ever mobile app.

LivingLab

Tagline: A shared living community offering per-room leases in furnished property.

Describes itself as: LivingLab is a platform that enables co-living in any rental property, making it easy for professionals to find community in shared housing. Our technology matches individuals to bedrooms in beautiful homes and then configures those properties to include furnishings, WiFi, utilities, housekeeping and community events. We can complete this process in 48 hours. By individually pricing rooms and offering flexible lease lengths, LivingLab is able to collect 30 percent of rent for its services.

Location: Durham, North Carolina

Employees: 6

Metrics: LivingLab says it has placed 500 users into 45 residents across 10 properties, generating on average $2,280 in recurring revenue per customer per year.

Team: CEO Mitchel Gorecki, CTO Patrick Wickham, and COO Colin Tai.

Kick It Labs

Tagline: Building consumer apps for high schoolers and college students inspired by youth culture.

Describes itself as: A creative lab thatlaunching new consumer social experiences every week, inspired by youth culture, for high schoolers and college students in the pursuit of building the next billion person consumer product.

Location: Palo Alto

Employees: Undisclosed

Metrics: The company says its most promising and exciting experiments to date have centered around street wear, high school social products, and menfashion.

Team:Cofounders Akshar Bonu and Sathish Nagappan among others have graduated from Harvard, Cornell, and Stanford and have been building apps for high schoolers and college students for over a decade, they say. They have also spent time at Andrew NgAI Lab, Nervana Systems, Amazon, Google and Intel.

Series A

Aurora Solar

Tagline: Building the operating system of the power source of the future.

Describes itself as:More than $200 billion per year is spent on developing solar projects through a fragmented network of solar installers, who work with financiers, equipment manufacturers, engineering service providers and more. Aurorasoftware is used by thousands of solar installers to precisely quote, design and sell solar projects, without visiting the site. With the solar industry forecasted to grow over five times its curren size over the next decade, Aurora will be the platform through which every new solar project is designed, sold, financed and serviced.

Location: San Francisco, CA

Employees: 43

Metrics: More than 50,000 solar projects a month (totaling $3 billion in value) are created on the platform each month. More than1,500,000 solar projects have been created in the companysoftware, it says.

Team: CEO/CTO: Christopher Hopper, is a Stanford MBA and MEng from Imperial College; COO/CRO Samuel Adeyemo, is a Stanford MBA/MSc and former portfolio manager for JPMorgan&s Chief Investment Office.

Thinknum

Describes itself as: Thinknum creates datasets from a broad array of public online sources, capturing ephemeral information on the products, operating markets and labor markets of 400,000-plus global companies across sectors, and provides rich toolsets for extracting intelligence. Data sets include pricing trends for individual products at specific retailers, such as electronics and restaurant menu items, to hiring activity across macro industries and particular companies down to the location.

Location: New York, NY

Employees: 18

Metrics:The company says itcurrently seeing $3 million in ARR, thanks to its work with more than 150 corporations and investment firms.

Team: The founders met at Princeton University and worked at Goldman Sachs and a hedge fund before starting Thinknum.

EmCasa

Tagline: Real estate tech brokerage in Brazil

Describes itself as: EmCasa is the only brokerage in Brazil that offers 3D tours in the vast majority of its listings, helping buyers and sellers avoid unnecessary visits. Also, EmCasa is the only brokerage in Brazil that built a proprietary algorithm that offers online property valuations, better managing customer price expectations and providing more accurate listing recommendations. Finally, EmCasa is the only brokerage in Brazil that charges a 3 percent commission on full-service, which is half of what other companies charge.

Location: Rio de Janeiro, Brazil

Employees: 18

Metrics: The company says it has 650 active listings currently, versus just 20 in January; it also says its revenue growth rate of 118 percent CQGR.

Team: EmCasaCEO, Gustavo Vaz, is a Harvard MBA and was formerly COO of Easy Taxi and Chief Strategy of Frontier Car Group; Gabriel Laet, the companyCTO/CPO, founded and sold Doubleleft, a gaming and software development company; and Lucas Cardozo, EmCasaCOO, was a former Bain - Company consultant and the VP of strategy at Brasil Brokers, the second largest Brokerage firm in Brazil.

Polarr

Tagline: Big brains in small devices

Describes itself as: Polarr is a computational photography company thatfocused on computer graphics, computer vision and artificial intelligence. The company has created one of the most successful and two-time best of Apple App Store winning pro photography app; in the meantime, itdeveloping its own Polarr Vision Engine for internal usage, as well as helping others to build immersive C.V. experiences on the edge.

Location: San Jose, CA, Beijing, China

Employees: 25

Metrics: Profitable, tripling revenue every year.

Team: PolarrCEO, Borui Wang has an M.S. in AI and HCI from Stanford, and is an ex-Googler at Youtube. PolarrCTO, Derek Yan, has an M.S. in EE from Stanford, and is an ex-Googler in ATAP.

Zippin

Tagline: Checkout-free shopping for every store.

Describes itself as: Zippinvision is to transform retail by banishing checkout lines and self-scanners for good using patent-pending AI, machine learning and sensor future technology. Its technology platform provides checkout-free shopping experience for retailers looking for a solution rivaling Amazon Goapproach.

Location: San Francisco, CA

Employees: 10

Metrics: Working store in downtown San Francisco, and POCs with several globally recognized retail brands and real estate owners.

Team: CEO Krishna Motukuri has spent more3 than 20 years in retail and e-commerce, including with Amazon and Naspers. Chief Scientist Motilal Agrawal is a computer vision expert from SRI International, where he led and contributed to several products used by U.S. Defense and intelligence agencies. The companyhead of engineering, Abhinav Katiyar, previously spent more than 15 years with VMware.

Pictured above: Pear founders Pejman Nozad and Mar Hershenson.

- Details

- Category: Technology

With its latest $34 billion acquisition of Red Hat, IBM may have found something more elementary than &Watson& to save its flagging business.

Though the acquisition of Red Hat is by no means a guaranteed victory for the Armonk, N.Y.-based computing company that has had more downs than ups over the five years, it seems to be a better bet for &Big Blue& than an artificial intelligence program that was always more hype than reality.

Indeed, commentators are already noting that this may be a case where IBM finally hangs up the Watson hat and returns to the enterprise software and services business that has always been its core competency (albeit one that has been weighted far more heavily on consulting services — to the detriment of the companybusiness).

Watson, the business division focused on artificial intelligence whose public claims were always more marketing than actually market-driven, has not performed as well as IBM had hoped and investors were losing their patience.

Critics — including analysts at the investment bank Jefferies (as early as one year ago) — were skeptical of Watsonability to deliver IBM from its business woes.

As we wrote at the time:

Jefferies pulls from an audit of a partnership between IBM Watson and MD Anderson as a case study for IBMbroader problems scaling Watson. MD Anderson cut its ties with IBM after wasting $60 million on a Watson project that was ultimately deemed, ¬ ready for human investigational or clinical use.&

The MD Anderson nightmare doesn&t stand on its own. I regularly hear from startup founders in the AI space that their own financial services and biotech clients have had similar experiences working with IBM.

The narrative isn&t the product of any single malfunction, but rather the result of overhyped marketing, deficiencies in operating with deep learning and GPUs and intensive data preparation demands.

Thatnot the only trouble IBM has had with Watsonhealthcare results. Earlier this year, the online medical journal Statreported that Watson was giving clinicians recommendations for cancer treatments that were &unsafe and incorrect& — based on the training data it had received from the companyown engineers and doctors at Sloan-Kettering who were working with the technology.

All of these woes were reflected in the companylatest earnings call where it reported falling revenues primarily from the Cognitive Solutions business, which includes Watsonartificial intelligence and supercomputing services. Though IBM chief financial officer pointed to &mid-to-high& single digit growth from Watsonhealth business in the quarter, transaction processing software business fell by 8% and the companysuite of hosted software services is basically an afterthought for business gravitating to Microsoft, Alphabet, and Amazon for cloud services.

To be sure, Watson is only one of the segments that IBM had been hoping to tap for its future growth; and while it was a huge investment area for the company, the company always had its eyes partly fixed on the cloud computing environment as it looked for areas of growth.

Itthis area of cloud computing where IBM hopes that Red Hat can help it gain ground.

&The acquisition of Red Hat is a game-changer. It changes everything about the cloud market,& saidGinni Rometty, IBM Chairman, President and Chief Executive Officer, in a statement announcing the acquisition. &IBM will become the worldnumber-one hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.&

The acquisition also puts an incredible amount of marketing power behind Red Hatvarious open source services business — giving all of those IBM project managers and consultants new projects to pitch and maybe juicing open source software adoption a bit more aggressively in the enterprise.

As Red Hat chief executive Jim Whitehurst told TheStreetin September, &The big secular driver of Linux is that big data workloads run on Linux. AI workloads run on Linux.DevOpsand those platforms, almost exclusively Linux,& he said. &So much of the net new workloads that are being built have an affinity for Linux.&

- Details

- Category: Technology

Read more: Forget Watson, the Red Hat acquisition may be the thing that saves IBM

Write comment (95 Comments)At a price typically reserved for semiconductor companies, telecoms, and pharmaceutical giants, IBM announced today it would pay a record $34 billion in cash and debt to acquire enterprise open source provider Red Hat. Eclipsing Microsoft$26.2 billion acquisition of LinkedIn, this is the biggest software acquisition in history. Itnot the biggest tech acquisition ever, though, as that title belongs to Dell$67 billion buyout of data storage business EMC.

You can learn about what IBM is buying Red Hat to become a hybrid cloud company in TechCrunch editor Ingrid Lundendeep dive here:

So how does the IBM-Red Hat deal (if it closes), stack up against the other largest acquisitions of all time

Top Tech Acquisitions

- $67 billion & Personal computer company Dell buys EMC data storage

- $37 billion & Semiconductor company Avago Technologies buys and renames as semiconductor giant Broadcom

- $34 billion (pending) & IBM computers buys open source software provider Red Hat

- $31.4 billion & Japanese conglomerate SoftBank buys semiconductor company ARM Holdings

- $26.2 billion & Software company Microsoft buys professional social network Linkedin in 2016

Top Software Acquisitions

- $34 billion (pending) & IBM computers buys open source software provider Red Hat in 2018

- $26.2 billion & Software company Microsoft buys professional social network LinkedIn in 2016

- $22 billion & Social network Facebook buys messaging app WhatsApp in 2014

- $13.5 billion & Security software maker Symantec buys storage management software maker Veritas in 2004 ($18 billion adjusted for inflation)

- $11 billion & Database company Oracle buys human resources software company PeopleSoft in 2004 ($14.7 billion adjusted for inflation)

Top Acquisitions Ever

- $202 billion & British telecom Vodafone buys German telecom Mannesmann in 2000 ($296 billion adjusted for inflation)

- $165 billion & ISP AOL buys media conglomerate Time Warner in 200 ($241 billion adjusted for inflation)

- $111.8 billion & Pharmaceutical giant Pfizer buys pharmaceutical company Warner Lambert in 1999 ($164 billion adjusted for inflation)

- $130 billion & Telecom Verizon Communications buys Vodafone and Bell AtlanticVerizon Wireless in 2013

- $130 billion & Dow Chemical buys chemical company DuPont in 2015

The Red Hat deal is proof that the scalability of software can massively concentrate wealth. Unlike industrial giants of old that split their fortunes with the physical resource providers that supplied and distributed their oil, chemical, or packaged good empires, software requires almost no material cost to create or distribute. The aggregation of value to software giants and their leaders offers both a great incentive to build a world-changing busines, but also a drastic shift of capital out of the hands of labor. While itfine to celebrate Red Hataccomplishment, society must inevitably grapple with the poverty and populism fueled by how software funnels money to the few.

- Details

- Category: Technology

Read more: The largest software acquisition ever: IBM to buy Red Hat for $34B

Write comment (93 Comments)

With the introduction of self-driving vehicles, developers behind their decision-making AI have had to re-think some age-old ethical dilemmas, specifically who should the car choose to save in the event of a crash.

An article published by Nature: International Journal of Science details the results of The Moral Machine experiment, which confronted

- Details

- Category: Technology

Read more: Self-driving cars should prioritise young lives, says new global study

Write comment (98 Comments)

It’s tempting to think that hard drives have become a commoditised item, where only speed and capacity matter, but this is not so. One of the most important considerations when choosing a hard drive is the workload it faces – because different drives are optimised for different uses.

Seagate’s new BarraCuda Pro packs a massive 14 terabyte capacity i

- Details

- Category: Technology

Read more: Think hard drives are dead Think again

Write comment (100 Comments)

Microsoft announced the first Surface Laptop range in May 2017, offering a clamshell version of its popular Surface Book. And while everyone agreed the first-gen Surface Laptop was a great piece of hardware, the pricing was a point of contention, with the base model selling for $1,099.

The Microsoft Surface Laptop 2 was announced recently, but that

- Details

- Category: Technology

Read more: eBay Australia is offering huge discounts on Microsoft’s first-gen Surface Laptops

Write comment (97 Comments)Page 3821 of 5614

15

15