Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

As we near the end of patching&C Week& (which is to say, the week that contains the third Tuesday of the month), there are no show-stopping bugs in the Windows and Office patches and just a few gotchas. As long as you avoid Microsoftpatches for IntelMeltdown/Spectre bugs, you should be in good shape.

[ Related: Windows 10 October 2018 Update: Key enterprise features ]Why a Patch Monday

On Sept. 17, Microsoft released two very-out-of-band cumulative updates for Windows 10:

- Details

- Category: Technology

The coolest mission you haven&t heard of just hit a major milestone: the Japanese Hayabusa 2 probe has reached its destination, the asteroid Ryugu, and just deployed a pair of landers to its surface. Soon it will touch down itself and bring back a sample of Ryugu back to Earth! Are you kidding me Thatamazing!

Hayabusa 2 is, as you might guess, a sequel to the original Hayabusa, which like this one was an asteroid sampling mission. So this whole process isn&t without precedent, though some of you may be surprised that asteroid mining is essentially old hat now.

But as you might also guess, the second mission is more advanced than the first. Emboldened by and having learned much from the first mission, Hayabusa 2 packs more equipment and plans a much longer stay at its destination.

That destination is an asteroid in an orbit between the Earth and Mars named Ryugu. Ryugu is designated &Type C,& meaning it is thought to have considerable amounts of water and organic materials, making it an exciting target for learning about the possibilities of extraterrestrial life and the history of this (and perhaps other) solar systems.

That destination is an asteroid in an orbit between the Earth and Mars named Ryugu. Ryugu is designated &Type C,& meaning it is thought to have considerable amounts of water and organic materials, making it an exciting target for learning about the possibilities of extraterrestrial life and the history of this (and perhaps other) solar systems.

It launched in late 2014 and spent the next several years in a careful approach that would put it in a stable orbit above the asteroid; it finally arrived this summer. And this week it descended to within 55 meters (!) of the surface and dropped off two of four landers it brought with. Herewhat it looked like as it descended towards the asteroid:

These &MINERVA& landers (seen in render form up top) are intended to hop around the surface, with each leap lasting some 15 minutes due to the low gravity there. They&ll take pictures of the surface, test the temperature, and generally investigate wherever they land.

Waiting for deployment are one more MINERVA and MASCOT, a newly developed lander that carries more scientific instruments but isn&t as mobile. It&ll look more closely at the magnetic qualities of the asteroid and also non-invasively check the minerals on the surface.

The big news will come next year, when Hayabusa 2 itself drops down to the surface with the &small carry-on impactor,& which it will use to create a crater and sample below the surface of Ryugu. This thing is great. Itbasically a giant bullet: a 2-kilogram copper plate mounted in front of an explosive, which when detonated fires the plate towards the target at about two kilometers per second, or somewhere around 4,400 miles per hour.

Hayabusa 2impactor in a test, blowing through targets and hitting the rubble on the far side of the range.

The orbiter will not just observe surface changes from the impact, which will help illuminate the origins of other craters and help indicate the character of the surface, but it will also land and collect the &fresh& exposed substances.

All in all ita fabulously interesting mission and one that JAXA, JapanNASA equivalent, is uniquely qualified to run. You can bet that asteroid mining companies are watching Hayabusa 2 closely, since a few years from now they may be launching their own versions of it.

- Details

- Category: Technology

Read more: Japan’s Hayabusa 2 mission lands on the surface of a distant asteroid

Write comment (98 Comments)From its glass-lined offices in San Franciscoleafy Presidio national park, six-year-old Mithril Capital Management has happily flown under the radar. Now itleaving altogether and relocating its team to Austin, a spot that, among others the firm had considered, has &enough critical mass of a technical culture, an artisanal culture, an artistic culture, and [is] not necessarily looking to Silicon Valley for validation,& says firm cofounder Ajay Royan.

The move isn&t a complete surprise. Royan, who cofounded the growth-stage investment firm in 2012 with renowned investor Peter Thiel, hasn&t done much in the way of public relations outside ofannouncing MIthrilexistence. Thiel and Royan —who&d previously been a managing director at Clarium Capital Management, Thielhedge fund — largely travel in social circles outside of Silicon Valley.

The firm has always prided itself on finding startups that don&t fit the typical ideal of a Silicon Valley startup, too. One of its newer bets, for example, is a nine-year-old dental robotics company in Miami, Fla. that says it performs implant surgery faster and more effectively, which is a surprisingly big market. More than500,000people now receive implants each year. &It was a hidden team, because itin Miami, and it was a field that was under invested in,& says Royan, noting that one of the few breakthrough companies in the dental world in recent years, Invisalign, which makes an alternative to braces, caters to a much younger demographic.

Even still, Mithrildeparture is interesting taken as a data point in a series of them that suggest that Silicon Valley may be losing some of its appeal for a variety of reasons. One of these is so-called groupthink, which had already driven Thiel to make Los Angeles his primary home. An even bigger factor: the unprecedentedly high costof living. As The Economist recently reported about the Bay Areanarrowing lead over other tech hubs, a median-priced home in the region costs $940,000, which is four-and-a-half times the American average. &Ithard to imagine doing another startup in Silicon Valley; I don&t think I would,& said Jeremy Stoppelman, who cofounded the search and reviews site Yelp, took it public in 2012, and continues to lead the San Francisco-based company, to The Economist.

Late last week, to learn more about Mithrilmove out of California and to get a general sense of how the firm is faring, we sat down with Royan at the space the firm will formally vacate next year, when its lease expires. We talked for several hours; some outtakes from that conversation, lightly edited for length, follow.

TC: You and I haven&t sat down together in years. When did you start thinking about re-locating the firm

AR: In 2016. I started seeing a lot more correlation in the companies that we were seeing; they were looking more similar to each other than before, and the volume was going up as well. So to put that in context, 2017 was our largest volume in the pipeline, meaning the number of companies coming through the system. And it was also the year that we did the least number of investments. We made one investment, in Neocis [the aforementioned dental robotics company].

TC: You don&t think this owes to a lack of imagination by founders but rather serious flaws in the overarching way that startups get funded.

AR:The problem iswhat I call time horizon compression. Soa pension fund is supposed to invest on a 30-year time horizon, but if you look at the internal incentives, the bonuses are paid on an annual basis [and the investors making investing decisions on behalf of that pension] areevaluated every six months or every quarter. So you shouldn&t be surprised when people do really short-term things.

There are very short-term versions of investing in the private markets, as well. Itthe 15th AI company, or the 23rd big data company, or the 256thonline-to-offline services company. Alot of the people making these investments are very smart. Thequestion is:why are they funding these companies And why are people starting themI would suggest itbecausebothareunder tremendous timepressure, and pressurenot to take real risk. If you&re really smart, and you&re toldthatyou&ve got to make returns tomorrowand you can&t take a lot of risk, then you do a me-toocompany and you look for momentum fundingand you try to get out as quickly as possible. It&sa perfectly rational response to bad incentives, andthat&spart of what we started to see a lot of inSilicon Valley. I think you have a lot of it going on right now.

TC: It feels like the &getting out& part has become a problem. The IPO market has picked up, but itnot exactly vibrant. Do you buy the argument that going public limits what a team can do because of public shareholder expectations

AR:I think thatfake. Private investors are maybe even more demanding than public investors, because we have material amounts invested generally. Certainly, we do at Mithril. When it comes to governance at our companies, itpretty tough, and we get a lot of insight into their activities. Itnot like a public board, where you get a quarterly meeting and a pretty presentation and then people go home.

I do think itrisk budget and time horizon, bottom line. So the ability to take risks in ways that are not supported by historical models would be: if it goes well, people are happy; if it goes south, the public markets I don&t think will forgive you.

TC: What about Amazon, which went out early, lost money for years, was hammered by analysts, yet is now flirting with a $1 trillion market cap

AR: Amazon is like the sovereign exception that proves the rule. Itlike [Jeff Bezos] was structured to basically not care both in terms of governance, or he cared in the way that was actually constructive to building Amazon, which is, ‘I&m just going to keep reinvesting all my profits into things that I think are important, and you all can just wait,& right And not a lot of people have the intestinal fortitude to do that or the governance structure to sustain it.

TC: You&ve made some big bets on companies that have been around a while, including the surveillance technology company Palantir, which I recall is one of your biggest bets. How patient are your own investors

AR: Palantir is still doing extremely well as a company. Whatinteresting is 80 percent of our capital in [our first of three funds] is concentrated in, like, 10 companies. Our two biggest investments were Palantir and [the antibody discovery platform] Adimab [in New Hampshire], and I&d argue that Adamab is even bigger than Palantir. We actually helped them not go public in 2014 when they were thinking about it.

TC: How, and why was it better for the company to stay private

AR: Adimab was founded in 2007, so it was already seven years old when we encountered them. And I was looking for a company that would be not a drug company but instead [akin to] a technology company in biotech, and Adimab is that.The&ve built a custom-designed yeast whose DNA was redesigned based on the inputs from a multi-year study of about 120 human beings, I think at Harvard, where they assessed the immune responses of the humans to various diseases, then encoded what they understood about the human immune system into the yeast. So the yeast essentially are humanized proxies for the immune system.

TC: Which means . . . .

AR: You can attack the yeast with disease, and the antibodies the yeast produces are essentially human antibodies. Think of it as a biological computer that responds to disease vectors. We now have a database of 10 billion antibodies that we can use to figure out how best to interrogate the yeast for the next generation of diseases that needed an immunotherapy solution.

TC: Is the company profitable

AR: It is. They don&t need any new money. We&ve just begun a program to help them restructure their cap table so they can take out early investors.

TC: An 11-year-old company. What about employees who are waiting to cash out

AR: They want more stock, so we&ve created the equivalent of stock options that are tied to value creation.

A lot of biotech companies go public very early on. If Adimab had, they would have been under tremendous pressure to actually build a drug company.People would have said, ‘Hey, if you&re discovering all these antibodies and they&re empowering other peopledrugs, why don&t you just make your own drug& But the founder, Tillman Gerngross, whoalso the head of bioengineering at Dartmouth, he doesn&t want to be in the position of having to sell or be under tremendous pressure [to create a drug company] when he thinks the full impact of what Adimab is building won&t be realized for another decade.

TC: In Austin, you&ll be closer to this company and some of your other portfolio companies. But are you really certain you want to leave sunny California

AR: The cost of trying is what I&m worried about [here]. Itthat simple. That applies to people who are starting jobs in someonecompany, or trying to start a company themselves. If itexpensive for the company to take risk, itgoing be expensive for you to take risk inside the company, which means your career will take a different path than than otherwise

After [I was an] undergrad at Yale, New York was a natural place to go, but I never worked there. It just felt like a place that was externally very pressurized. You had to conform to the external pressures that dictated your daily life. Your rent was $4,000 to $6,000 a month for craziness for like a walk-up in HellKitchen. Social structures were fairly set, like, you had to go to the Hamptons in the summer or something. There were these weird things that felt very dictated and you had to fit and you had to climb the pyramid schemes that people had established for you. Otherwise, you were out.

What made [Silicon Valley] really attractive was it was a one giant incubator as a society, with a lot of pay-it-forward forward culture and a low cost of trying. Now I&m worried about all three of those.

I&m not saying that just by moving, that gets fixed. Thatfacile. But if you conclude that this is an issue that you need to think through, and try to find thoughtful ways to get around, you have to enlist every ally you can. And one of those allies might be reducing unidirectional environmental noise, and having more voices that you can listen to and being exposed to more lived experiences that are varied. . . Itbuilds your capacity for empathy, and I think thatimportant for good investing and being a good founder.

TC: What are your early impressions of Austin

AJ: Ita great town. Everyonebeen super friendly. I get to wear my cowboy boots. You can actually do a four-hour tour of food trucks without running out of food trucks. Also, most of the people I&ve met are registered Democrats and like, half of them own really nice guns. And these are not considered contradictory at all.

- Details

- Category: Technology

In the days leading up to TechCrunch Disrupt SF 2018, The Economist published the cover story, ‘Why Startups Are Leaving Silicon Valley.&

The author outlined reasons why the Valley has &peaked.& Venture capital investors are deploying capital outside the Bay Area more than ever before. High-profile entrepreneurs and investors,Peter Thiel, for example, have left. Rising rents are making it impossible for new blood to make a living, let alone build businesses. And according to a recent survey, 46 percent of Bay Area residents want to get the hell out, an increase from 34 percent two years ago.

Needless to say, the future of Silicon Valley was top of mind on stage at Disrupt.

&Ithard to make a difference in San Francisco as a single entrepreneur,& said J.D. Vance, the author of ‘Hillbilly Elegy& and a managing partner at RevolutionRise of the Rest Fund, which backs seed-stage companies based outside Silicon Valley. &Itnot as a hard to make a difference as a successful entrepreneur in Columbus, Ohio.&

In conversation with Vance, Revolution CEO Steve Case said henoticed a &mega-trend& emerging. Founders fromcities like Pittsburgh, Detroit or Portlandare opting to stay in their hometowns instead of moving to U.S. innovation hubs like San Francisco.

&The sense that you have to be here or you can&t play is going to start diminishing.&

&We are seeing the beginnings of a slowing of what has been a brain drain the last 20 years,& Case said. &Itnot just watching where the capital flows, itwatching where the talent flows. And the sense that you have to be here or you can&t play is going to start diminishing.&

Farewell, San Francisco

&Ittoo expensive to live here,& said Aileen Lee, the founder of seed-stage VC firm Cowboy Ventures, amid a conversation with leading venture capitalistsSpark Capital general partner Megan Quinn and Benchmark general partner Sarah Tavel .

&I know that there are a lot of people in the Bay Area that are trying to work on that problem and I hope that they are successful,& Lee added. &Itan amazing place to live and we&ve made it really challengingfor people to live here and not worry about making ends meet.&

One of Cowboyportfolio companies opted to relocate from Silicon Valley to Colorado when it came time to scale their business. That kind of move would&ve historically been seen as a failure. Today, it may be a sign of strong business acumen.

Quinn said that of all 28 of Sparkgrowth-stage portfolio companies, Raleigh, North Carolina-based Pendo has the easiest time recruiting folks locally and from the Bay Area.

She advises her Bay Area-based late-stage companies to open a second office outside of the Valley where lower-cost talent is available.

&We often say go to [flySFO.com], draw a three-hour circle around San Francisco where they have direct flights, find a city that has a university and open up a second office as quickly as possible,& Quinn said.

Still, all three firms invest in a lot of companies based in San Francisco. Of Benchmark10 most recent investments, for example, eight were based in SF, according to Crunchbase.

&I used to believe really strongly if you wanted to build a multi-billion dollar company you had to be based here,& Tavel said. &I&ve stopped giving that soap speech.&

Underestimatedtalent

A lot of Bay Area VCs have been blind to the droves of tech talent located outside the region. Believe it or not, there are great engineers in Americasmall- and medium-sized markets too.

At Disrupt, Backstage Capital founder Arlan Hamilton announced the firm would launch an accelerator to further amplify companies led by underestimated founders. The program will have cohorts based in four cities; San Francisco was noticeably absent from that list.

Instead, the firm, which invests in underrepresented founders and recently raised a $36 million fund, will work with companies in Philadelphia, Los Angeles, London and one more city, which will be determined by a public vote. Aniyia Williams, the founder of Tinsel and Black - Brown Founders, will spearhead the Philadelphia effort.

&For us, itabout closing that wealth gap to address inequity in tech,& Williams said. &There needs to be more active participation from everyone.&

Hamilton added that for her, the tech talent in LA and London is undeniable.

&There is a lot of money and a lot of investors … it reminds me of three years ago in Silicon Valley,& Hamilton said.

Silicon Valley vs. China

Silicon Valleydemise may not be just as a result of increased costs of living or investors overlooking talent in other geographies. It may be because of heightened competition abroad.

Doug Leone, an early- and growth-stage investor at Sequoia Capital, said at Disrupt that henoticed a very different work ethic in China.

Chinese entrepreneurs, he explained, are more ruthless than their American counterparts and they&re putting in a whole lot more hours.

&I&ve had dinner in China until after 10 p.m. and people go to work after 10 p.m.,& Leone recalled.

&We don&t see that in the U.S. I&m not saying the U.S. founders oughta do that but those are the differences. They are similarin character. They are similar in dreams. They are similar in how they want to change the world. They are ultra-driven … The Chinese founders have a half other gear because I think they are a little more desperate.&

Much of this, however, has been said before and still, somehow, Silicon Valley remained the place to be for investors and startup entrepreneurs.

The reality is, those engaged in tech culture are always anxiously awaiting for the bubble to pop, the market to crash and for &peak Valley& to finally arrive.

Maybe, just maybe, Silicon Valley is forever.

Heremore of our coverage of Disrupt 2018.

- Details

- Category: Technology

Read more: VCs say Silicon Valley isn’t the gold mine it used to be

Write comment (99 Comments)Polestardebuted its first production EV and previewed its electric car line in New York with the CEO squarely taking aim at Tesla.

The Volvo subsidiary pulled the cover off its Polestar 1, which it positioned less as a hybrid and more as a fully electric (gas optional) car to attract fence sitters to EVs.

The $155,000 auto—that will hit streets in 2019—has 3 electrical motors powered by twin 34kWh battery packs and a turbo and supercharged gas V4 up front (more detailshere).

All electric range is up to 100 miles—which the company claims gives the Polestar 1 the longest all electric range of any production hybrid.

Polestar drivetrain

The Polestar 1 brings 600 horsepower and 738 ft-lbs of torque. It is the first in a series, with an all electric Polestar 2 to debut in 2019 and a Polestar 3 SUV after that.

&Polestar 2 will be a direct competitor to the Tesla Model 3…& CEO Thomas Ingenlath said on the launch stage.

He told TechCrunch the company will focus more on creating converts to EVs than pulling away Teslaexisting market share.

Thomas Ingenlath, chief executive officer, Polestar

One advantage Ingenlath described was using Polestar 1 as a gateway car for getting laggards to go all electric. &There are many people out there who still think a car has to have a combustion engine,& he said. &Polestar 1 is an extremely good vehicle to get people across that line and once they drive it…understand what an amazing experience an electric car is.&

Polestar converts shouldn&t get too attached to that gasoline/voltage combo, however.

Polestar 1 will be the companyfirst and last electric and gas vehicle, according to Ingenlath. &The future is electric. We will not do a hybrid car again,& he told TechCrunch.

At their New York Polestar 1 debut, the company devoted about as much time to the Polestar sales and service experience as the actual car. It will be multi-channel—from app to physical—leveraging parts of Volvodealer network for certain things and staying completely separate for others. For one, Polestar will not have dealers or use Volvo dealers to showcase their cars, according to Ingenlath.

The buyer experience will start on the companyapp, then move into what it refers to as a network of &Polestar Spaces& across the U.S., Europe, and China where buyers can view and test cars. Purchased cars can be delivered to onehome and service coordinated by app and home pickup—though Polestar will use Volvo dealers (not their spaces) on the service end.

&We will become a company that produces around a 100,000 cars a year and this will definitely scale-up,& said Ingenlath.&We&ll never become a Volvo, but we certainly need a certain scale to come in to a profitable range.&

The company oversubscribed orders for the Polestar 1 with 200 cars coming to North American buyers.

While PolestarHQ is in Gothenburg, Sweden, it will manufacture cars at a plant inChengdu China.

The companyEV debut comes as Tesla&s$49,000 to $64,000Model 3 earned theNHTSAtop safety ratingand Audi introduced it $74,800 all electric e-tron SUV (covered here atTechCrunch)

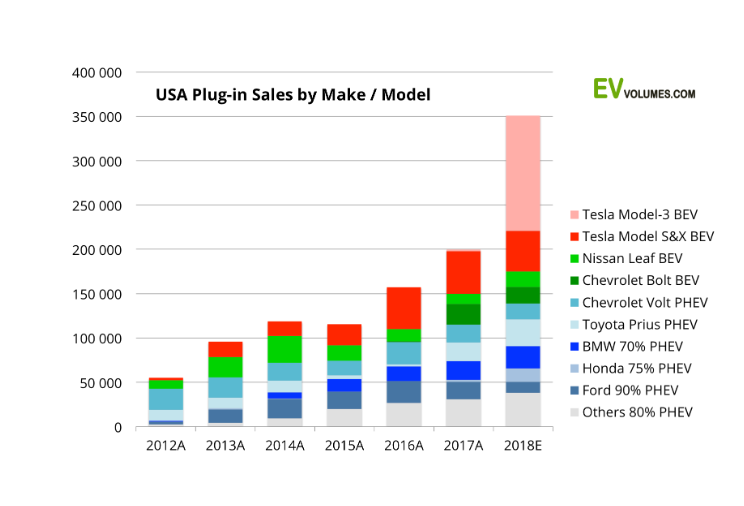

In the U.S. market Tesla still dominates plugin sales by make and model and its Model 3 is expected to boost that lead, according toEV Volumes.

- Details

- Category: Technology

Read more: Polestar unveils first production EV with aim to overtake Tesla

Write comment (100 Comments)Twitter said that a &bug& sent userprivate direct messages to third-party developers &who were not authorized to receive them.&

The social media giant began warning users Friday of the possible exposure with a message in the app.

&The issue has persisted since May 2017, but we resolved it immediately upon discovering it,& the message said, which wasposted on Twitterby a Mashable reporter. &Our investigation into this issue is ongoing, but presently we have no reason to believe that any data sent to unauthorized developers was misused.&

A spokesperson told TechCrunch that it&highly unlikely& that any communication was sent to the incorrect developers at all, but informed users out of an abundance of caution.

Twitter said in a notice that only messages sent to brand accounts — like airlines or delivery services — may be affected. In a separate blog post, Twitter said that itinvestigation has confirmed &only one set of technical circumstances where this issue could have occurred.&

Thebug was found on September 10, but took almost two weeks to inform users.

&If your account was affected by this bug, we will contact you directly through an in-app notice and on twitter.com,& said the advice.

The company said that the bug affected less than 1 percent of users on Twitter. The company had 335 million users as of its latest earnings release.

&No action is required from you,& the message said.

Itthe second data-related bug this year. In May, the company said it mistakenly logged users& passwords in plaintext in an internal log, used by Twitter staff. Twitter urged users to change their password.

- Details

- Category: Technology

Read more: Twitter says bug may have exposed some direct messages to third-party developers

Write comment (93 Comments)Page 4113 of 5614

19

19