Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Nio, the Tesla -wannabe electric vehicle firm from China, enjoyed a mixed start to life as a public company after it raised $1 billion through a listing on the New York Stock Exchange on Wednesday.

The firm went public at $6.26 — just one cent above the bottom of its pricing range — meaning that it raised a little over $1 billion. Thatsome way down on its original goal of $1.8 billion, per an initial filing in August, and for a while it looked like even that price was optimistic. Early trading saw Niostock fall as low as $5.84 before a wave of optimism took it to $6.81.

The stock closed its first day at $6.60, up 12 percent overall, to give Nio a total market cap of $7.1 billion.

Nio sells in China only, although its tech and design teams are based in the U.S, UK and Germany.

Its main model, the ES8, is designed for the masses and is priced at 448,000 RMB, or around $65,000. That makes it cheaper than Tesla vehicles in China but it has only just got to making money. Nio has accrued some 17,000 orders for the vehicle, but it only began shipping in June. As a result, it has posted some pretty heavy losses in recent times — including minus$759 million in 2017.

Ultimately, the firm raised $1 billion but its leadership may be disappointed that the final sum is well short of its original target.

Reasons behind lukewarm investor interest may include:

- General concerns around the performance of Chinese firms, bellwether Tencent just had a rare profit drop, for example

- A crackdown on 30 other EV firms from the Chinese government, which followed a number of incidents including the reported explosion of a vehicle from WM Motor

- A knock-on effect from poor results from Tesla, which remains Niomain rival and carded wider-than-expected losses last month

- While there is also the ongoing spectacle that is the Trump administrationongoing trade war with China, which resulted in a range of new tariffs being issued last week

Meanwhile, Nio is far from the newest kid on the block. Byton, another Chinese EV firm with global operations, is preparing to send prototype SUVs to the U.S. for the first time, as TechCrunch reported earlier this month. Byton, which raised $500 million from investors in June, is one of a number of competitors to Nio which also include BYD — a startup backed by Warren BuffetBerkshire Hathaway— Youxia, MW Motor and others.

- Details

- Category: Technology

Read more: Chinese electric vehicle maker Nio makes bumpy start following $1B IPO

Write comment (99 Comments)Instacart has teamed up with Walmart Canada to bring shoppers in Toronto and Winnipeg same-day grocery delivery.

The agreement is part of a pilot program for the two companies that will allow Instacart users to order groceries from 17 different Walmart locations across the two cities. This is the first time shoppers in Winnipeg will have access to the grocery delivery service and the first time Toronto residents will have the option for same-day delivery.

Interestingly, Instacart doesn&t have a partnership with Walmart in the U.S. Walmart, rather, has relationships with several other grocery delivery companies including DoorDash and Postmates. Instacart does have a deal with SamClub, a subsidiary of Walmart. Thatpartnership wasannounced in February and gives SamClub members same-day delivery via Instacart.

Instacart initially launched in Canada in September 2017 and will continue expanding throughout the country to meet demand.

The company, which has raised$350 million at a $4.3 billion valuationthis year alone, is available in 15,000 different stores in the U.S. and Canada and in more than 4,000 cities. As of late August, the business says itavailable to 70 percent of U.S. households.

This week, Instacart hired Mark Schaaf as CTO. He joined from Thumbtack where he held the same role. That announcement came one day after the company confirmed its chief growth officer and former VP of product Elliot Shmukler was leaving to pursue early-stage opportunities.

- Details

- Category: Technology

Read more: Instacart links up with Walmart Canada to expand its same-day delivery service

Write comment (90 Comments)IndonesiaMoka, a startup that helps SMEs and retailers manage payment and other business operations, has pulled in a $24 million Series B round for growth.

The investment is led by Sequoia India and Southeast Asia — which recently announced a new $695 million fund — with participation from new backersSoftBank Ventures Korea, EDBI — thecorporate investment arm of SingaporeEconomic Development Board — and EV Growth, the later stage fund from Moka seed investor East Ventures. Existing investorsMandiri Capital, Convergence and Fenox also put into the round.

The deal takes Moka to $27.9 million raised to date, according to data from Crunchbase.

Moka was started four years ago primarily as a point-of-sale (POS) terminal with some basic business functionality. Today, it claims to work with 12,500 retailers in Indonesia and its services include sales reports, inventory management, table management, loyalty programs, and more. Its primary areas of focus are retailers in the F-B, apparel and services industries. It charges upwards of IDR 249,000 ($17) per month for its basic service and claims to be close to $1 billionin annual transaction volume from its retail partners.

Thatthe companycore offering, a mobile app that turns any Android or iOS device into a point-of-sale terminal, but CEO and co-founderHaryanto Tanjo — who started the firm with CTO GradyLaksmono — said it harbors larger goals.

&Our vision is to be a platform, we want to be an ecosystem,& he told TechCrunch in an interview.

Thatwhere much of this new capital will be invested.

Tanjo said the company is opening its platform up to third-party providers, who can use it to reach merchants with services such as accounting, payroll, HR and more. The focus is initially on local services that cater to SMEs in Indonesia, but as Moka targets larger enterprises as clients, he said that it will integrate larger, global solutions, too.

Moka offers services beyond point-of-sale, but the core offering is turning any smart device into a cash machine

Moka itself is expanding its capabilities on the payment side.

Indonesia, the worldfourth largest country based on population and Southeast Asialargest economy, is in the midst of a fintech revolution with numerous companies pioneering mobile-based wallet services aimed at ending the countryfixation on cash-based transactions. Thatmean that there are a plethora of options available today. Tanjo said Moka is working to support them all in order to help its merchants grow their businesses and consumers to have easier lives.

There are so many wallets here in Indonesia,& he said. &There are more than 10 right now and maybe in the next few months there&ll be 15-20, we want to be the platform that works with all of them.&

Already it works with the likes ofOVO, T-Cash and Akulaku, and e-wallets including DANA and Kredivo.The startup is also working in another area of fintech: loans.

As an extension of its platform, it has tied up with SME loan companies who can reach out to Moka businesses using its platform. With the merchantconsent, Moka can provide business data — including revenue, profit, etc — to help provide data to assess a loan application. Thatimportant because the process is particularly challenging in Southeast Asia, where few organized credit checking facilities exist — it makes sense that Moka — which has built its business around encouraging business growth and management — uses the information it has access to help its partners.

Tanjo said the company takes an undisclosed cut of the loan in cases where it has successfully connected the two parties. He said that he doesn&t expect that to initially become a major revenue stream, but over time he anticipates it will help its customer base grow and become a more important source of income for the startup.

Sequoia India has some experience in POS startups having backed Pine Labs in India, which recently landed a big $125 million round from PayPal and Singapore sovereign fund Temasek. Still, there are plenty of local players across various markets in Southeast Asia, including StoreHub, which is backed by Temasek subsidiary Vertex Ventures, and MalaysiaSoftSpace.

While those two competitors have established a presence in multiple markets in Southeast Asia, Tanjo — the Moka CEO — said there are no plans to venture overseas for at least the next 12 months.

&We&restill scratching the service,& he said. &So [it] doesn&t make sense to expand too soon.&

- Details

- Category: Technology

Read more: Indonesian fintech startup Moka raises $24M led by Sequoia India

Write comment (90 Comments)

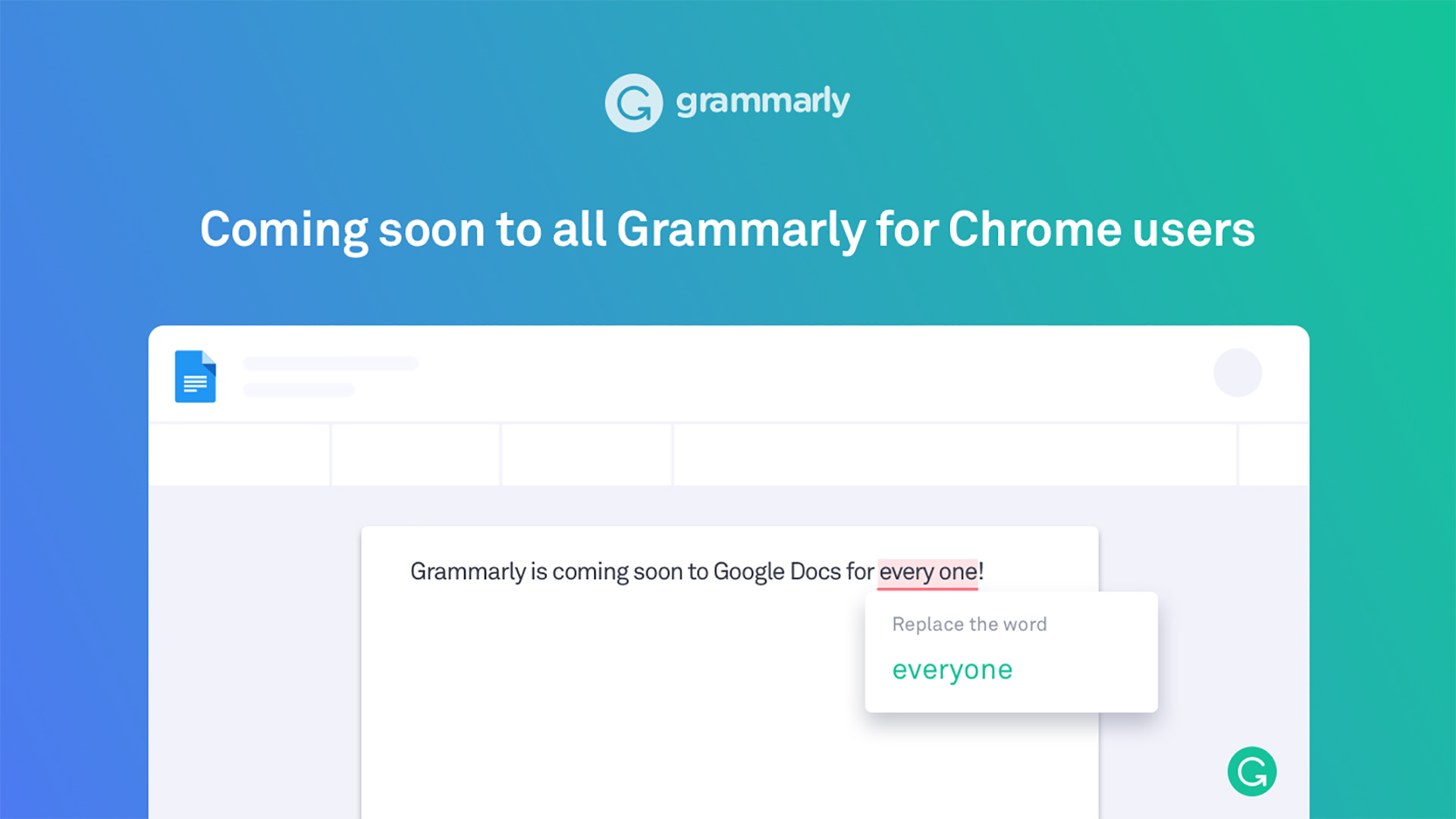

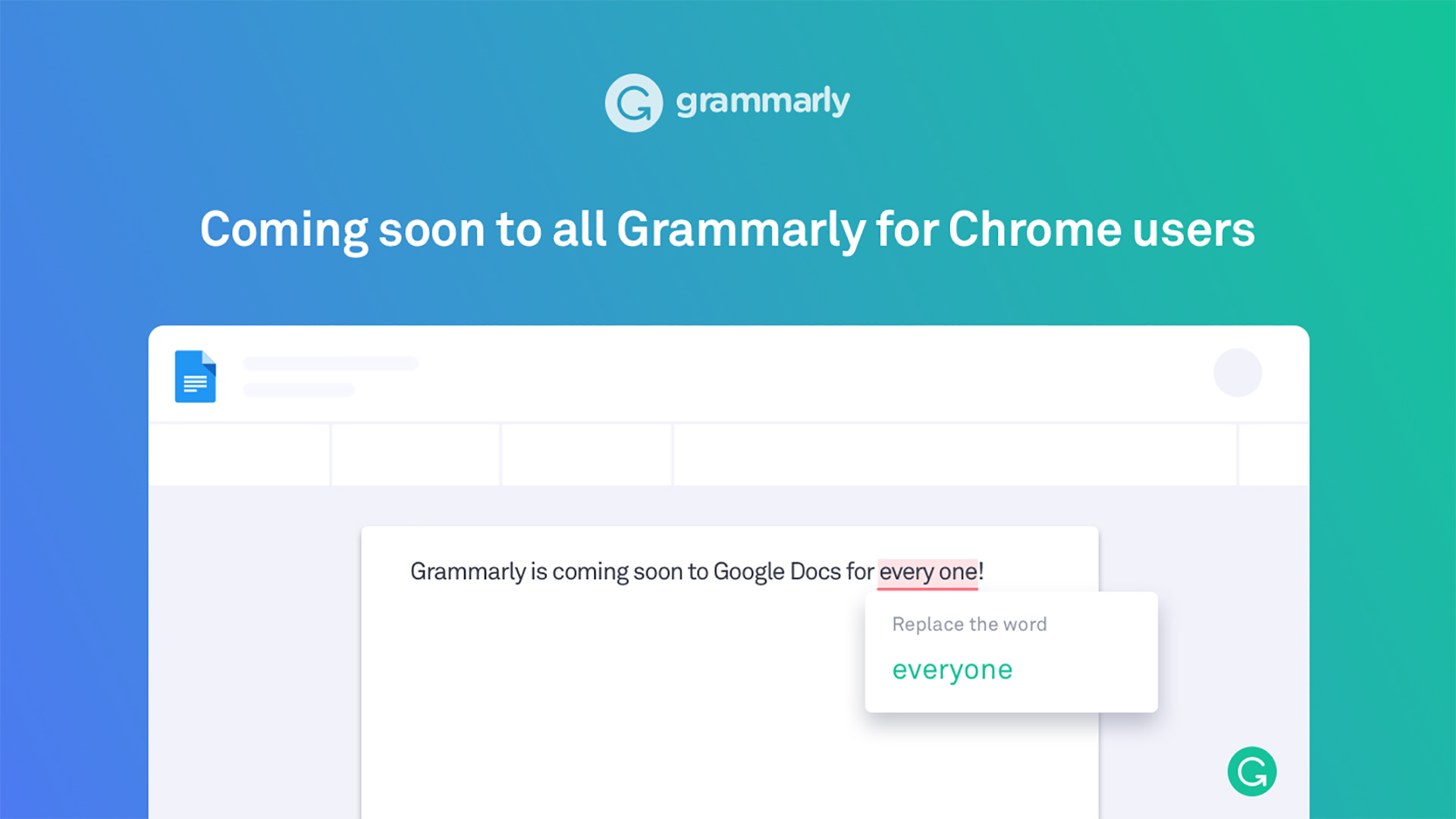

Google Docs has always been a fairly competent, free alternative to Microsoft Word and now it’s getting a bit smarter with a grammar checker by way of Grammarly.

Grammarly, which spots typing and grammar errors as you type, is officially coming to Google Docs. The service has been in a closed beta for some time now, but now it’s coming to all C

- Details

- Category: Technology

Read more: Google Docs just became smart enough to fix your grammar errors

Write comment (98 Comments)

UK mobile operators could be subject to caps on how much they can charge customers for roaming within the EU, but will not be obliged to offer inclusive data roaming within the EU in the event of a “no-deal” Brexit.

All roaming fees were abolished across the EU in June 2017 following several years of price cuts, as per European law. However, these

- Details

- Category: Technology

Read more: UK operators would be free to charge for EU roaming in 'no-deal' Brexit

Write comment (98 Comments)

Let’s be honest. If you’re running an e-commerce store, you’re probably competing against Amazon, Walmart or the likes of Best Buy. That makes your job pretty tough.

Or if you’re selling your own wares or offering something exclusive, you’ve got a different but equally hard problem: Looking reputable enough for someone to give you their money.

Either

- Details

- Category: Technology

Read more: How to make your ecommerce store look more reliable

Write comment (93 Comments)Page 4184 of 5614

13

13