Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

When Cisco bought Ann Arbor, Michigan security company, Duofor a whopping $2.35 billion earlier this month, it showed the growing value of security and security startups in the view of traditional tech companies like Cisco.

In yesterdayearnings report, even before the ink had dried on the Duo acquisition contract, Cisco was reporting that its security business grew 12 percent year over year to $627 million. Given those numbers, the acquisition was top of mind in CEO Chuck Robbins& comments to analysts.

&We recently announced our intent to acquire Duo Security to extend our intent-based networking portfolio into multi- cloud environments. DuoSaaS delivered solution will expand our cloud security capabilities to help enable any user on any device to securely connect to any application on any network,& he told analysts.

Indeed, security is going to continue to take center stage moving forward. &Security continues to be our customers number one concern and it is a top priority for us. Our strategy is to simplify and increase security efficacy through an architectural approach with products that work together and share analytics and actionable threat intelligence,& Robbins said.

That fits neatly with the Duo acquisition, whose guiding philosophy has been to simplify security. It is perhaps best known for its two-factor authentication tool. Often companies send a text with a code number to your phone after you change a password to prove ityou, but even that method has proven vulnerable to attack.

What Duo does is send a message through its app to your phone asking if you are trying to sign on. You can approve if ityou or deny if itnot, and if you can&t get the message for some reason you can call instead to get approval. It can also verify the health of the app before granting access to a user. Ita fairly painless and secure way to implement two-factor authentication, while making sure employees keep their software up-to-date.

Duo Approve/Deny tool in action on smartphone.

While Cisco security revenue accounted for a fraction of the companyoverall $12.8 billion for the quarter, the company clearly sees security as an area that could continue to grow.

Cisco hasn&t been shy about using its substantial cash holdings to expand in areas like security beyond pure networking hardware to provide a more diverse recurring revenue stream. The company currently has over $54 billion in cash on hand, according to Y Charts.

Cisco spent a fair amount money on Duo, which according to reports has $100 million in annual recurring revenue, a number that is expected to continue to grow substantially. It had raised over $121 million in venture investment since inception. In its last funding round in September 2017, the company raised $70 million on a valuation of $1.19 billion.

The acquisition price ended up more than doubling that valuation. That could be because ita security company with recurring revenue, and Cisco clearly wanted it badly as another piece in its security solutions portfolio, one it hopes can help keep pushing that security revenue needle ever higher.

- Details

- Category: Technology

Read more: Cisco’s $2.35 billion Duo acquisition front and center at earnings call

Write comment (95 Comments)Arm, the company that designs the chips that power virtually every smartphone and IoT device, published its roadmap for the next two years today. Thatthe first time Arm has done so and the reason for this move, it seems, is that the company wants to highlight its ambitions to get its chips into laptops.

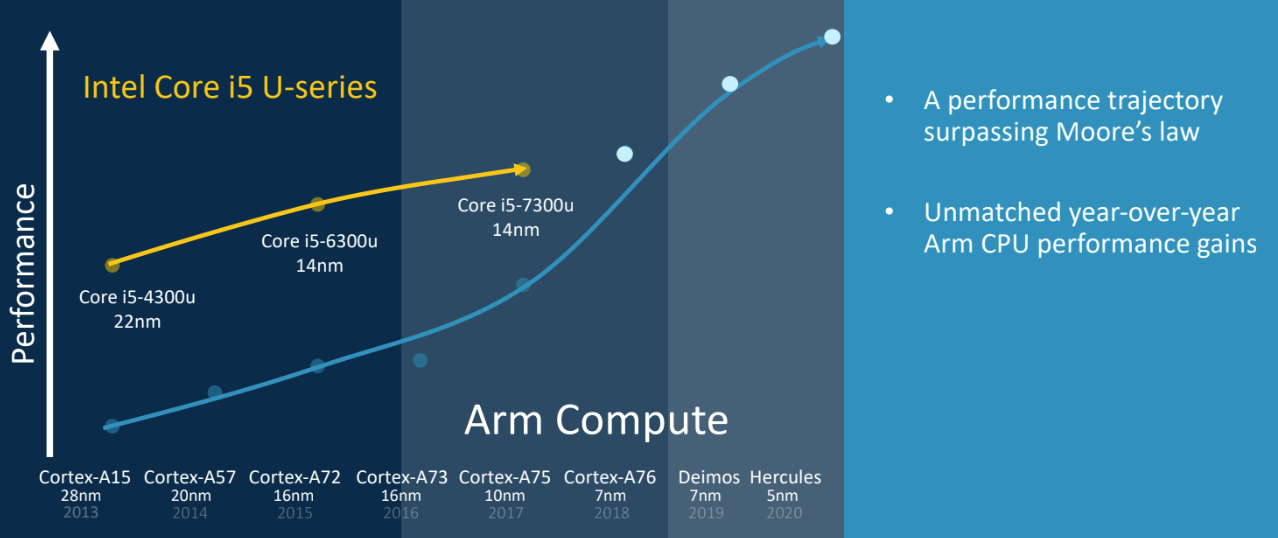

So far, Arm-based laptops are far and in-between, though Microsoft recently made a major move in this direction thanks to its push for always connected Windows laptops. While that sounds great in theory, with laptops that only need a single charge to run all day, therestill a performance penalty to pay compared to using an x86 chip. Arm says that gap is closing quickly, though, while offering a better performance/battery life balance.

Indeed, Ian Smythe, Armsenior director of its marketing programs, doesn&t shy away from comparing the next generations of its architectures with Intel mid-tier Core i5 processors.

&I think itclear that we&re on a transformative path,& Smythe said during a press conference ahead of todayannouncement. &Ita compute journey that is changing the way that computers are able to be delivered in large screen form factor devices. And our vision is very much around how we&re going to be driving laptop performance from that mobile innovation base and how we&re going to be working with foundry partners to deliver that performance in todayand tomorrowleading processes.&

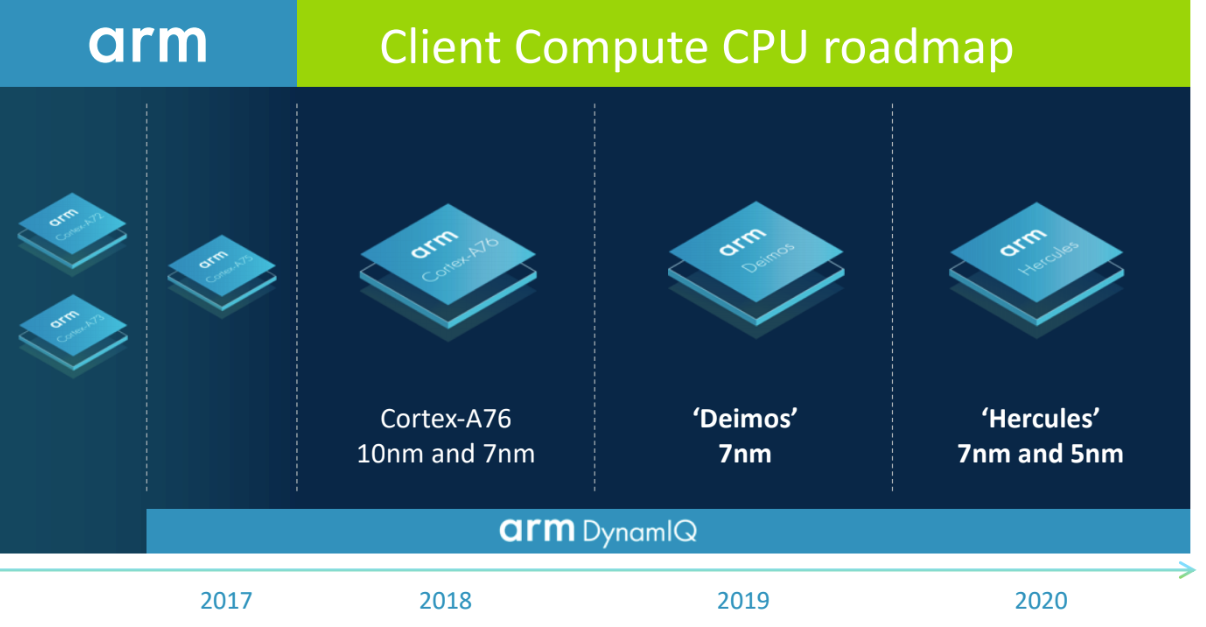

So what does Armroadmap look like The details are still quite sparse, but this year, the company will deliver its Cortex-A76 architecture that its partners will likely build using both 10nm and 7nm processes. Next year, it&ll launch its Deimos CPUs, which will most likely all be built using 7nm processes. Come 2020, it&ll launch its Hercules processors for both 7nm and 5nm processes.

In terms of raw compute performance, the A76 can compete with some Intel i5 chips and Arm promises less than 5W TDP. Raw compute power based on a single benchmark isn&t all there is to making a computer run smoothly, of course, but this signals Armambitions (and those of its partners) in competing for the laptop market — while at the same time making smartphones far more powerful, too.

Can Arm-based processors really make a dent in the laptop market, though Smythe surely thinks so. ‘I think with every disruption we created an opportunity,& he said. &That toehold [in the laptop market] can grow when you can demonstrate the benefits. I think that with the first Windows on Arm devices we&re sharing that capability and as we move towards Cortex A76-based devices and beyond, I think that capability and disruption offers opportunity beyond where we are today.&

- Details

- Category: Technology

Read more: Arm wants to power your next laptop

Write comment (92 Comments)Bark, the company behind the BarkBox subscription for dog treats and toys, is planning to open what it calls its first BarkPark in Nashville.

It sounds like the goal is to create a space that combines a dog park with a coffee shop or other hangout spot for humans.

&I was out with friends, we&re drinking wine, ita really cool restaurant … it was like a poster for people having a good time in the city,& said Bark co-founder Henrik Werdelin in a company blog post. &But my dog Molly was left out. And I realized: she deserves a space like this. We should be here together.&

At BarkPark, dogs will be able to play off-leash, and also try out Bark toys and treats (a selection will also be available for purchase). Their owners, meanwhile, will get free WiFi, access to a little coffee shop and the ability to ask questions of Bark staff.

Plus, both the dog and their owners will be able to attend weekly dog-friendly programming, like live music and beer tastings.

Day passes cost $19, and you can also buy four-week ($49) or seasonal ($78) passes. The memberships are designed to be dog-centric — while you (the human) will presumably be paying the bill, your dog is the actual BarkPark member, and can be accompanied by any two humans. So if you&re out-of-town, you don&t need to worry about getting access for, say, your dogwalker or dogsitter.

Bark is currently building out the Nashville BarkPark location (which is why all the illustrations in this story are either renderings or sketches), with plans to open on September 8. And while the company is treating this as a three-month pop up initially, with BarkPark closing for the winter on November 18, the idea could be extended in Nashville and expanded elsewhere.

Why start in Nashville While the city has many virtues, Bark said it was ultimately because it&ahead of the curve& as a pet-friendly city.

&Therea fast-growing population of modern dog parents who want to take their dogs everywhere & they&re totally obsessed! & which perfectly describes our vision for BarkParkmembership,& the company said.

- Details

- Category: Technology

Read more: The company behind BarkBox is opening an ‘outdoor clubhouse’ for Nashville’s dogs

Write comment (90 Comments)Self-driving car startup Nuro is ready to put autonomous vehicles on the road in partnership with Kroger to deliver groceries in Scottsdale, Arizona.This comes a couple of months after Nuro and Kroger announced their partnership to offer same-day deliveries.

This pilot will serve a single FryFood and Drug location in Scottsdale starting today. Customers can shop for groceries and place either same- or next-day delivery orders via the grocerwebsite or mobile app. Thereno minimum order but there is a flat delivery fee of $5.95.

&We&re proud to contribute and turn our vision for local commerce into a real, accessible service that residents of Scottsdale can use immediately,& Nuro CEO Dave Ferguson said in a statement. &Our goal is to save people time, while operating safely and learning how we can further improve the experience.&

Nurointent is to use its self-driving technology in the last mile for the delivery of local goods and services. That could be things like groceries, dry cleaning, an item you left at a friendhouse or really anything within city limits that can fit inside one of Nurovehicles. Nuro has two compartments that can fit up to six grocery bags each.

In Scottsdale, however, Nuro will initially use Toyota Prius cars before introducing its custom self-driving vehicles. Thatbecause the main purpose of this pilot is to learn, and using the Prius self-driving fleet can help to accelerate those learnings, a Nuro spokesperson told TechCrunch.

&The Priuses share many software and hardware systems with the R1 custom vehicle, so while we compete final certification and testing of the R1, the Prius will begin delivering groceries and help us improve the overall service and customer experience,& the spokesperson said.

When it came to going to market, Ferguson previously told me groceries were most exciting to him. And Kroger particularly stood out because of its smart shelf technology and partnership with Ocado aroundautomated fulfillment centers.

&With the pilot, we&re excited about getting more experience interacting with real customers and understanding exactly what they want,& Ferguson told me. &The things they love about it, the things they don&t love as much. As an organization for us, italso very valuable for us to have to exercise our operational muscle.&

Throughout the pilot program, Nuro will be looking to see how accurate its estimated delivery times are, how the public reacts to the vehicles and how regular, basic cars interact with self-driving ones.

- Details

- Category: Technology

Read more: Nuro and Kroger are deploying self-driving cars for grocery delivery in Arizona today

Write comment (91 Comments)Pantera Capital, a San Francisco firm that has made its mark in recent years by investing early and often in a wide variety of digital assets, is looking to raise up to $175 million for its third venture fund — an enormous jump from the $25 million it deployed for its second venture fund and its $13 million debut venture fund, which it closed in 2013.

Firm partner Paul Veradittakit says the target amount is a &function of how fast the space is moving, the talent coming in, the opportunities, and the sizing of rounds. With more interesting later-stage investments [on our radar], too, we want to be flexible and able to move with the market.&

Whether the firm closes with $175 million or another number is an open question. A newly processedSEC filingshows it has so far rounded up more than $71 million in capital commitments from 90 investors, an amount that Veradittakit calls a first close.

Certainly, Pantera is accustomed to managing meaningful sums of money. In addition to its venture funds, which are structured like most traditional venture funds — they feature a 10-year investing period, similar economics, and involve good old-fashioned checks to startups in exchange for some amount of equity — the firm is also juggling three other strategies.

As we reported last year, one of its newest funds is a hedge fund thatfocused exclusively on initial coin offerings. As firm founder Dan Morehead told us at the time, Pantera buys pre-sale ICOs, &basically getting a discount to the ICO price by getting in early, when itjust a team and a white paper.& Meanwhile, Morehead had added, &We help provide the right connections, whether in terms of marketing or recruiting or business development.

The vehicle is evergreen, says Veradittakit, meaning it has an indefinite fund life that lets investors come and go.

The other two other funds that Pantera currently oversees are also structured like hedge funds. One is a Bitcoin fund that has attracted plenty of investors over the years, and returned a lot to them, too, according to the calculations of Morehead. In fact, he wrote two weeks ago that the fund, launched five years ago, has enjoyed a lifetime return of 10,136.15 percent net of fees and expenses.

The very last fund invests in cryptocurrencies that are already trading on exchanges — an approach that includes machine learning to algorithmically invest in crypotcurrencies, as well as allows for some discretionary input by Panteratop brass, which includes Morehead,Veradittakit, and Joey Krug, who joined Pantera last year after cofounding the market forecasting startup Augur. (It went on to orchestrate the first ICO on the ethereum network.)

Explains Veradittakit of this last pool, itfor &if you are&t sure that Bitcoin will remain the dominant cryptocurrency, or you&re interested in other use cases that may arise, or you just want to build a diversified portfolio of assets that have asymmetrical returns as bitcoin, or maybe return even more because they feature lower valuations.&

In some ways, the venture efforts of Pantera — which employs 38 people altogether in San Francisco and Menlo Park, Ca. — may be its most challenging given the nature of VC. Investors in the asset class are typically willing to wait a handful of years for a firm to produce returns; in Panteracase, because it is bettingexclusively on ventures, tokens, and projects related to blockchain tech, digital currency, and crypto assets, some of those returns could potentially take even longer.

Veradittakit doesn&t sound concerned. Rattling off some of Panteraventure investments to date, including inBitStamp, Xapo, Ripple, and Circle, not to mention more recent investments in Chain, Abra, Veem Polychain, and Z Cash, he sounds more like a proud parent. Pantera has invested in &lotsof wallets and exchanges focused around the world, in Coinbases of different geographies, in enterprise-related blockchain companies. More recently, we&ve funded everything from big data to decentralized application platforms.&

Itstill very early days, he acknowledges. But &in terms of returns, there will be companies that create something completely disruptive. There will be M-A [opportunities] more often and that [come together] more quickly than other companies.&

If everything goes as planned, Pantera will be there when they do, and it will have more resources to deploy than ever.

- Details

- Category: Technology

Read more: Crypto firm Pantera Capital is looking to raise up to $175 million for a new venture fund

Write comment (97 Comments)Messaging company Line is continuing to burrow deep into the crypto space after it announced the launch of a $10 million investment fund.

The fund will be operated by LineKorea-based blockchain subsidiaryUnblock Corporation, which is tasked with research, education and other blockchain-related services. The fund will be called Unblock Ventures and it&ll initially have a capital pool of $10 million but Line said that is likely to increase over time.

The company said the fund will be focused on early-stage startup investments, but it didn&t provide further details.

Line is listed in Tokyo and on the NYSE. This fund makes it one of the first publicly traded companies to createa dedicated crypto investment vehicle. The objective,it said, is &to boost the development and adoption of cryptocurrencies and blockchain technology.&

Line claims nearly 200 million users of its messaging app, which is particularly popular in Japan, Taiwan, Thailand and Indonesia. The company also offers a range of connected services that include payment, social games, ride-hailing, food delivery and more.

This marks Linesecond major crypto move this year following the launch of its BitBox exchange last month. It isn&t available in the U.S. or Japan right now but Line envisages closes ties with its messaging service and other features further down the line.

These moves into crypto come despite some serious downturn in the valuation of the space this year following record highs in January which saw the value of one Bitcoin touch nearly $20,000 and Ethereum, among others, surged. In the months since then, however, many cryptocurrencies have seen their valuations decline. This week, Ethereum dropped below $300 in what is its first major price crisis. Bitcoin has, for many years, risen and fallen although Januaryvaluations took the extremes to a new level.

Note: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

- Details

- Category: Technology

Read more: Messaging firm Line launches a dedicated crypto fund

Write comment (95 Comments)Page 4434 of 5614

14

14