Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Emerging markets credit startupMines.iohas closed a $13 million Series A round led by The Rise Fund, the global impact fund formed by private equity giant TPG, and 10 others, including Velocity Capital.

Mines provides business to consumer (B2C) &credit-as-a-service& products to large firms.

&We&re a technology company that facilitates local institutions — banks, mobile operators, retailers — to offer credit to their customers,& Mines CEO and co-founder Ekechi Nwokah told TechCrunch.

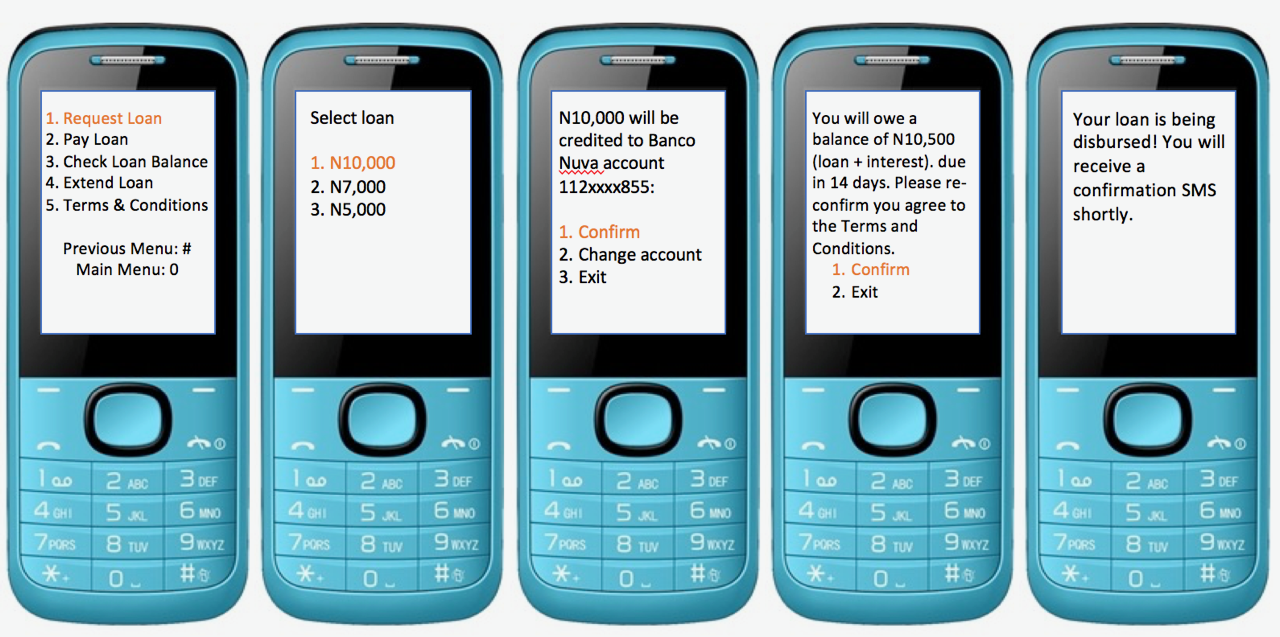

Most of Mines& partnerships entail white-label lending products offered on mobile phones, including non-smart USSD devices.

With offices in San Mateo and Lagos, Mines uses big-data (extracted primarily from mobile users) and proprietary risk algorithms &to enable lending decisions,& Nwokah explained.

&We combine a strong AI technology with full…deployment services — disbursement…collections, payments, loan management, and regulatory — wrap it up in a box, give it to our partners and then help them run it,& he said.

Mines& typical client is a company &that has a large customer base and wants to avail credit to that customer base,& according to Nwokah. The startup generates revenue from fees and revenue share with partners.

Mines started operations in Nigeria and counts payment processorInterswitchand mobile operator Airtel as current partners. In addition to talent acquisition, the startup plans to use the Series A to expand its credit-as-a-service products into new markets in South America and Southeast Asia &in the next few months,& according to its CEO.

Mines sees itself as a &hardcore technology company based in Silicon Valley with a global view,& according to Nwokah. &At the same time, we&re very African,& he said.

The startup&sleadership teamis led by three Nigerians — Nwokah, Chief Scientist Kunle Olukotun and MD Adia Sowho. The company came together after Olukotun (then and still a Stanford professor) and Nwokah (a then-AWS big data specialist) met in Palo Alto in 2014.

Looking through the lens of their home country Nigeria, the two identified two problems in emerging markets: low access to credit across large swaths of the population and insufficient tools for big institutions to put together viable consumer lending programs.

Due to a number of structural factors in these markets, such as low regulatory support, lack of credit data and tech support, &thereno incentive for many banks and institutions to take risk on a retail lending business,& according to Nwokah.

Nwokah sees Mines& end user market as &themore than 3 billion adults globally without access to credit,& and its direct client market as big &banks, retailers and mobile operators…who want to power digital credit tailored to these markets.&

Mines views itself as different from the U.S.controversial payday lenders by serving different consumer needs. &If you live in a country where your salary is not guaranteed every month, where you don&t have a credit card…where you have to pay upfront cash for almost everything you do, you need cash,& he said

The most common loan profile for one of Mines& partners is $30 at 15 percent flat for a couple of weeks.

Nwokah wouldn&t name specific countries for the startuppending South America and Southeast Asia expansion, but believes &this technology is scalable across geographies.&

As part of the Series A, Yemi Lalude from TPG Growth (founder of The Rise Fund) will join Mines& board of directors.

On a call with TechCrunch, Lalude named the companyability to &drive financial inclusion within a matter of seconds from mobiles devices,& their &local execution on the ground& and model of &partnering with many large organizations with their own balance sheets& as reasons for the investment commitment.

With Mines& pending Asia and South America move they join Nigerian tech companiesMallforAfrica.comand data analytics firmTerragon Group, who have expanded or stated plans to expand internationally this year.

- Details

- Category: Technology

Read more: Offering a white-labeled lending service in emerging markets, Mines raises $13 million

Write comment (96 Comments)The 1960s were a beautiful time for watches. Horology was in its prime and the great names we know and love today & Rolex, Omega, Cartier & were just one of many watchmakers churning out commodity products to a world that needed to tell the time. Their watches & simple, elegant, and mechanically complex & were the ultimate in mechanical efficiency and design and no one did it quite as well as Seiko. This mechanical golden age ended in the late 1970s with the rise of the quartz watch but Seiko is resurrecting it with their Grand Seiko line of luxury pieces.

Grand Seiko is special for a few reasons. First, itSeikohaute horlogerie skunkworks, allowing the company to experiment with all the fancy materials and techniques that Swiss watchmakers have worked with for years. The watches are made of precious metals and feature Seiko Hi-Beat movements. These watches &vibrate& 36,000 times an hour or ten times a second. This means that the balance wheel inside the watch is moving back and forth far faster than, say, an Omega Co-Axial 8500/1 series which is clocked at 25,200 vibrations per hour. What this means in practice is that the seconds hand moves with an almost uncanny smoothness.

The rest of the watch I tested, the euphoniously-named SBGH263G, is based on a piece from 1968 that came from Seikomechanical hey-day. The $6,200 watch has a 39mm case and, according to Seiko, is style for maximum elegance. They write:

The dial has elegant and easy-to-see Arabic numeral for the hour mark. The concept color &Shironeri& is a reflection of Japanese tradition. The color and texture of the dial come from the glossy white silk of the outfit worn by the bride in a Japanese wedding. It symbolizes purity and innocence.

This watch is a formal piece for wearing, presumably, to your own wedding. That said, italso very reminiscent of 1960s style watches. The size, case shape, and polished hands and numerals all hearken back to a simpler time in watchmaking when everything didn&t have to look like a robotgoiter or a pie plate.

It is quite small and if you&re used to Panerais or Nixons you&ll definitely notice a grandpa vibe about this piece. Because it is not very complex & that is it does not have any real complications like a stopwatch & it is very pricey. However, knowing Grand Seikodedication to a very lost art of non-Swiss horology, itwell worth a look.

I&ve been following Grand Seiko for years now and the quality and care the company has been putting into these watches is palpable. This watch is no commodity product. The case is polished to a high sheen and everything & from the screws to the beautiful domed sapphire crystal & is put together with great care. Seiko also makes lower end pieces & my favorite is the Orange Monster & but this is far above that in terms of build quality and price.

Pieces like this Grand Seiko remind us that, before Apple Watches and Fitbits, there was an entire universe of truly striking timepieces made for the absolutely sole purpose of telling the time. I love pieces like this one because they are no frills and yet they are full of frills. The watch is as simple as can be & three hands and a date window without any lume or extraneous buttons & and yet it shows amazing technical skill. It is expensive but this is a handmade watch by a storied manufacturer and itwell worth the price of admission if you&re a lover of the elegantly antiquated.

[gallery ids="1689595,1689594,1689593,1689592"]- Details

- Category: Technology

Read more: Grand Seiko is an homage to watchmaking’s past

Write comment (92 Comments)During a gold rush, Silicon Valleyline is to always invest in picks and shovels instead of mining. Sometimes it pays just to do both.

TechCrunch has learned through a company fundraise overview that Beijing-based mining equipment seller Bitmain hit a quarterly revenue of approximately $2 billion in Q1 of this year. Despite a slump in bitcoin prices since the beginning of the year, the company is on track to become the first blockchain-focused company to achieve $10 billion in annual revenue, assuming that the cryptocurrency market doesn&t drop further.

Fortune previously reported that the company had $1.1 billion in profits in the same quarter, a number in line with these revenue numbers, given a net margin of around 50 percent.

That growth is extraordinary. From the same source seen by TechCrunch, Bitmain revenues last year were $2.5 billion, and around $300 million just the year before that. The company reportedly raised a major venture round of $300-400 million from investors, including Sequoia China, at a valuation of $12 billion.

For comparison, popular cryptocurrency wallet Coinbase made $1 billion in revenue in 2017. In addition, Nvidia, a company based out of California that also makes computer chips, generated revenues of $9.7 billion in its 2018 fiscal year (2017 calendar year). Nvidiarevenues were $3.21 billion in Q1 fiscal year 2019 (February-April 2018), and historical revenue figures show a general seasonal uptrend in revenue from Q1 through Q4.

The same overview also shows that Bitmain is exploring an IPO with a valuation between $40-50 billion. That would represent a significant uptick from its most recent valuation, and is almost certainly dependent on the vitality of the broader blockchain ecosystem.

Several of Bitmaincompetitors have filed for IPO since the beginning of 2018, but most of them are significantly smaller in size. For example, Hong Kong-basedCanaan Creative filed for an IPO in May, and the latest was that it was aiming for $1 billion to $2 billion in fundraising with 2017 revenue of US$204 million.

When contacted for this story, Bitmain declined to comment on the specific numbers TechCrunch has acquired.

A brief overview ofBitmain

Bitmain is the worlddominant producer of cryptocurrency mining chips known asASICs, or Application-Specific Integrated Circuit. It was founded by Jihan Wu and Micree Zhang in 2013, and the company is currently headquartered in Beijing.

As the story goes, back in 2011, when Wu read Satoshi Nakamotowhitepaper on Bitcoin, he emptied his bank account to buy them. Back then, one bitcoin could be purchased for less than a dollar. And by 2013, Wu and Zhang decided to build an ASIC chip specifically for bitcoin mining and founded Bitmain. Wu was just 28 at the time.

Cryptocurrency mining is the process of checking and adding new transactions to bitcoinimmutable ledger, called the blockchain. The blockchain is formed by digital blocks, where transactions are recorded. The act of mining is essentially using math to solve for a cryptographic hash, or a unique signature if you will, to identify new blocks.

The general mining process requires massive processing power and incurs hefty energy costs. In exchange for those expenses, miners are rewarded with a number of bitcoins for each block they add onto the blockchain. Currently, in the case of Bitcoin, the reward for every block discovered is 12.5 bitcoins. At the current average trailing bitcoin price of approximately $6,500, that$81,250 up for grabs every 10 minutes, or $11.7 million dollars a day.

Bitmain has several business segments. The first and primary one is selling mining machines outfitted with Bitmainchips that are usually a few hundred to a few thousand dollars each. For example, the latest Antminer S9 model is listed as $3,319. Secondly, you can rent Bitmainmining machines to mine cryptocurrencies.

Third, you can participate to mine bitcoin as part of Bitmainmining pool. A mining pool is a joint group of cryptocurrency miners who combine their computational resources over a network. Bitmaintwo mining pools, BitmainAntPool and BTC.com, collectively control more than 38 percent of the worldBitcoin mining power per BTC.com at the moment.

The future of Bitmain is closely tied with the crypto market

Bitcoin mining is a massive business with influence over energy prices across the world. (LARS HAGBERG/AFP/Getty Images)

Despite its rapid rise to success, Bitmain is ultimately dependent on the price of cryptocurrencies and overall crypto market fluctuations. When there is a bull crypto market, investors would be willing to give a different valuation multiple to the company than if it were in a bear market. In a bear market, the margins are reduced for both the company as well as for its customers, as the economics of mining cryptocurrencies are no longer as compelling. For example, at the end of 2014, Mt. Gox, a famous Bitcoin exchange at the time, was hacked, spurring a crash in cryptocurrency prices.

Subsequently, Bitmain went through a bitcoin drought as Bitcoin prices hit low points, and its ASIC chips did not see much demand. It was not appealing to miners to pay for expensive electricity bills to mine a digital currency that was falling in value. But fast-forward to now; we have gone through several bull and bear crypto market cycles. According to Frost - Sullivan, in 2017, Bitmain is estimated to have ~67 percent of the market share in bitcoin mining hardware, and generated 60 percent of computing power.

Canaan Creative IPO filing. Company A is Bitmain.

One of the fundamental challenges facing any cryptocurrency mining manufacturer such as Bitmain is that the valuation of the company is largely based off the price of cryptocurrencies. The market in the first half of 2018 has shown that no one really knows when bitcoin prices and the cryptocurrency market will start picking up again. Additionally, according to Frost - Sullivan, the ASIC-based blockchain hardware market, which is the market segment that includes Bitmain and Canaan, will see its compound annual growth rate (CAGR) slow to around 57.7 percent annually between 2017 to 2020, down from 247.6 percent between 2013 and 2017.

Nonetheless, it seems that Bitmain has planned well ahead to prepare for these macro risks and exposures. The company has raised significant private funding and has been expanding its business into mining new coins and creating new chips outside of cryptocurrency applications.

First, with itexisting mining rigs, Bitmain can essentially broaden into all SHA256-related coins. So coins such as Bitcoin, Bitcoin Cash and Litecoin can all be mined on Bitmainequipment. The limitation here is largely how fast they can build up more mining equipment and mining centers. The company has broadened its geographic reach by developing new mining centers. Most recently, Bitmain revealed that it will build a $500 million blockchain data center and mining facility in Texas as part of its expansion into the U.S. market, aiming for operations to begin by early 2019.

Secondly, Bitmain is also looking to launch their own AI chips by the end of 2018. Interestingly, the AI chips are called Sophons, originated from the key alien technology in the famous trilogy, the Three-Body Problem, by Liu Cixin. If things go as planned, BitmainSophon units could be training neural networks in data centers around the world. BitmainCEO Wu once said that in five years, 40 percent of revenues could come from AI chips.

Lastly, Bitmain has been equipping itself with cash. Lots of it, from a number of the top and largest investors in Asia. Two months ago, China Money Network reported that Bitmain raised a Series B round, led by Sequoia Capital China, DST, GIC and Coatue in a $400 million raise, putting the company at a value of $12 billion. Just last week, Chinese tech conglomerate Tencent and JapanSoftBank, another tech giant whose 15 percent stake in Uber makes it the drive-hailing applargest shareholder, also joined the investor base.

For Bitmain, there are many reasons to stay private as a company, including keeping its quarterly financials private as well as dealing with market fluctuations and the ongoing volatility and uncertainty in the cryptocurrency world. However, the con is that early employees may not get liquidity in their stock options until much later.

Wu has said that a Bitmain IPO would be a &landmark& for both the company and the cryptocurrency space. However, with the current rich crypto private market financing, itnot so bad of an idea to continue to raise private money and stay out of the public eye. Once Bitmainfinancials become more diversified and cryptocurrency becomes more widely adopted worldwide, the world may then be ready for this $10 billion revenue blockchain company.

- Details

- Category: Technology

Read more: Crypto mining giant Bitmain on target for $10B revenue this year

Write comment (92 Comments)When Fortnite Battle Royale launched on Android, it made an unusual choice: it bypassed Google Playin favor of offering the game directly from Epic Games& own website. Most apps and games don&t have the luxury of making this choice & the built-in distribution Google Play offers is critical to their business. But Epic Games believes its game is popular enough and has a strong enough draw to bring players to its website for the Android download instead. In the process,itcosting Google around $50 million this year in platform fees, according to a new report.

As of its Android launch date, Fortnite had grossed over $180 million on iOS devices, where it had been exclusively available since launching as an invite-only beta on March 15th, before later expanding to all App Store customers.

According to data from app store intelligence firm Sensor Tower, the game has earned Apple more than $54 million thanks to its 30 percent cut of all the in-app spending that takes place on apps distributed in its store.

Thatmoney Epic Games isn&t apparently willing to give up to Google, when thereanother way.

Unlike Apple, which only allows apps to be downloaded from its own storefront, Googleplatform is more open. Therea way to adjust an Android devicesettings to download apps and games from anywhere on the web. Of course, by doing so, users are exposed to more security risks, malware infections, and other malicious attacks.

For those reasons, security researchers are saying that Epic Games& decision sets a dangerous precedent by encouraging people to remove the default security protections from their devices. They&re also concerned that users who look for the game on Google Play could be fooled into downloading suspicious copycat apps that may be trying to take advantage of Fortniteabsence to scam mobile users.

Google seems to be worried about that, too.

For the first time ever, the company is informing Google Play users that a game is not available for download.

Now, when users search for things like&Fortnite& or &Fortnite Battle Royale,& Google Play will respond that the app is ¬ available on Google Play.& (One has to wonder if Googlemisspelling of &Royale& as &Royal& in its message was a little eff u to the gamemakers, or just a bit of incompetence.)

In any event, itan unusual response on Googlepart & and one it can believably claim was done to serve users as well as protect them from any potential scam apps.

However, the message could lead to some pressure on Epic Games, too. It could encourage consumer complaints from those who want to more easily (or more safely) download the game, as well as from those who don&t understand therean alternative method or are confused about how that method works.

In addition, Google is serving up the also hugely popular PUBG Mobile at the top of Fortnite search results followed by other games. In doing so, itsending users to another game that can easily eat up users& time and attention.

For Google, the move by Epic Games is likely troubling, as it could prompt other large games to do the same. While one odd move by Epic Games won&t be a make or break situation for Google Play revenue (which always lags iOS), if it became the norm, Googlelosses could climb.

At present, Google is missing out on millions that will now go directly to the game publisher itself.

Over the rest of 2018, Sensor Tower believes Fortnite will have gained at least $50 million in revenues that would otherwise have been paid out to Google.

The firm expects that when Fortnite rolls out to all supported Android devices, its launch revenue on the platform will closely resemble the first several months of Apple App Store player spending.

It may even surpass it, given the gamepopularity continues growing and the standalone download allows it to reach players in countries where Google Play isn&t available.

Meanwhile, there have been concerns that the download makes it more difficult on users with older Android devices to access the game, because the process for sideloading apps isn&t as straightforward. But Sensor Tower says this will not have a large enough impact to affect Fortniterevenue potential in the long run.

- Details

- Category: Technology

Read more: Google will lose $50 million or more in 2018 from Fortnite bypassing the Play Store

Write comment (100 Comments)Grabacquisition of UberSoutheast Asia service in May has actually been embroiled in regulatory scrutiny, however the ride-hailing firm has some positive news after the Philippines & regulator gave the offer the all-clear. It did so, nevertheless, whilst laying out terms to avoid the business from becoming extremely dominant. Singaporewatchdog stated in July that competitors issues may see it loosen up the offer, which saw Grab get and then shutter Uberride-hailing and food delivery business while the U.S. company got a 27.5 percent stake in its current. Competition is likewise an issue in the Philippines, butthe Philippine Competition Commission (PCC) ruled today that Grab will send to & service quality and rates requirements & in order to guarantee consumers are treated relatively. Singapore and the Philippines have actually been the most strong private investigators of the offer, so todaynews is a significant increase for Grab, which just recently scored $2 billion in funding from Toyota and a variety of other financiers. Despite the fine, the PCC is keeping a firm eye on the scenario after it concluded that & Grab runs as a virtual monopolist. &. The commission saidthat, post-Uber, Grab has devoted to a series of terms that consist of more consistent and transparent rates, the removal of exclusivity deals for chauffeurs, and more. Here is the complete list of stipulations from the PCC site:. Service Quality Commitment: Grab shall devote to bring back market averages for acceptance and cancellation rates before the transaction, and action time to rider complaints. Fare Transparency Commitment: Grab will revise its trip invoice to show the fare breakdown per trip, consisting of distance, fare rises, discounts, promo reductions, and per-minute waiting charge (if renewed by LTFRB). Commitment on Pricing: Grab shall not have prices that have an & amazing deviation & from the minimum allowed fares. Grab will be penalized equivalent to 5% of Grabcommissions, or as much as P2 million, in the recognized journeys withextraordinary variance that do not have sufficient justification. Elimination of & See Destination & Feature: Grab will remove & see location & function for motorists with low trip approval rate. Driver/Operator Non-Exclusivity Commitment: Grab will not introduce any policy that will result in motorists and operators being special to Grab. Existing Grab drivers/operators are permitted to register/operate under other Transport Network Companies (TNCs) through a multi-homing plan. Rewards Monitoring Commitment: Since rewards may lead to drivers remaining unique to Grab, and therefore impact its competitors & conditions of entry and the capability to expand, the Commission will keep an eye on and evaluate Grabincentives on the basis of obligatory quarterly reports. Enhancement Plan Commitment: Grab will execute the following: (1) enhance chauffeur efficiency standards, (2) adopt a Driver Code of Conduct, (3) develop a Grab Driver Academy; (4) embrace an emergency SOS function, help center, and passenger no-show feature; (5) embrace a Passenger Code of Conduct; (6) maintain devoted service lines subject to prevailing labor policies; (7) adopt a Driver Welfare Program; and (7) carry out a Driver Rewards Program. The PCC stated it will designate a third-party to monitor Grabprogress in adhering to these terms, which it hopes will hold the business to account in the very same way Ubercompetition did. & The PCCCommitment Decision holds Grab to a basic as if Uber existed in the market. In impact, while Grab operates as a virtual monopolist, the dedications assure the public that quality and cost levels that would prevail are those that had actually been when they still faced competitors from Uber. The dedications guarantee that the merger will not make it more difficult for brand-new gamers to enter and grow, & PCC Chairman Arsenio M. Balisacan stated in a statement. The rates part is particularly essential. Considering that Uberdeparture lots of users, particularly those in the Philippines, have complained about increasing costs on Grab given that the exit of Uber. The company previously brushed that concern aside, declaring that it hasn & t increased rates but the distinctions in between its expenses and Uberare down to an alternative prices design. In Grabcase, the company informed TechCrunch it has & always maintained a competitive per KM fare with 2.0 rise max. & Ubersurge, it stated, could reach 4X. Thatbeen dismissed by lots of users however those in the Philippines can at least take hope from the truth that their regulator is pressing the problem. Therealso extremely legitimate issue that Grabposition has made it difficult for new entrants to challenge its company. Indonesia$ 5 billion startup Go-Jek remains in the process of expanding its company regionally after it went reside in Vietnam this month.The Philippines and Thailand are also on its brand-new market list for 2018. Go-Jek has actually had to raise over $1 billion to get its shot, and thereno guarantee it will reproduce its dominance in Indonesia in other countries. The truth remains thatother ride-hailing rivals of scale are near-impossible to discover in Southeast Asia even though Grab co-founder Hooi Ling Tan said openly that & therestill a lot of existing competitors. & In the majority of cases, Grabstiffest competition is local market taxi firms, a number of which have actually added app-based reservations to strengthen their business. Grab stated in a statement that it has made the dedications voluntarily and that it supports competition:. We enjoy that the Philippine Competition Commission (PCC) has actually identified the legality of Grabdeal with Uber in Philippines and accepted Grabvoluntary dedications. PCCpro-innovation technique and positive choice sets a strong example for other regulators analyzing the Grab-Uber deal, and motivates reasonable competition and a level playing field that ultimately benefits customers and motorists. As we move on to become a daily app that serves the everyday essential needs of individuals in Southeast Asia, we will continue to remain concentrated on serving the very best interests of our customers and partners. Aside from its brand-new financing, which takes the company to $6 billion raised to date and offers it a valuation of $11 billion, Grab has been busy broadening its reach. The business broadened its GrabFood service across the area thanks in no little part to the UberEats, while it is rolling out a revamped variation of its app that stresses its collection of services that include deliveries, payments and ride-hailing. Part of that method consisted of the launch of a platform that allows third-parties to tap the Grab platform and bring their services into its app. The launch partner for that was food delivery service HappyFresh, which is reported to have picked up funding from Grab. Investment is another area where Grab is stepping up. It recently announced Grab Ventures, a division that will deal with tactical investments and handle anaccelerator programcalled ‘& lsquo; Velocity.

- Details

- Category: Technology

Read more: Grab-Uber offer wins Philippines approval but 'virtual monopolist' concern remains

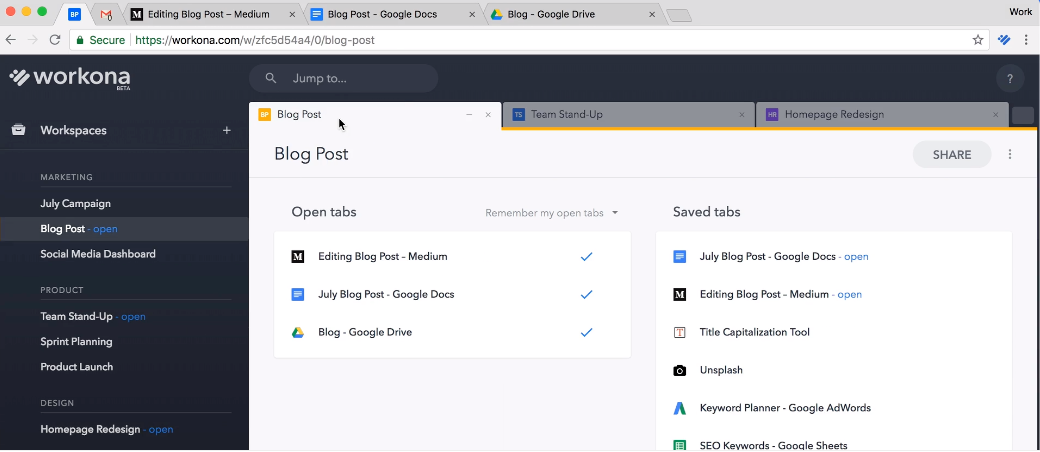

Write comment (95 Comments)A new startup, Workona, this week launched software designed for those who primarily do their work in a browser. The companygoal is to become the OS for web work & and to also save web workers from the hell that is a million open tabs. To accomplish this, Workona offers smart browser windows you set up as workspaces, allowing you a place to save your open tabs, as well as collaborate with team members, search across your tabs, and even sync your workspace to different devices.

The Palo Alto-based company was founded in fall 2017 by Quinn Morgan (CEO), previously the founding product manager at Lucidpress, and Alma Madsen (CTO), previously the first employee and Director of Engineering at Lucid Software, the makers of Lucidpress.

&Last year, Alma and I decidedwe wanted to build something together again, and initially began working on a different startup idea,& explains Morgan, as to how Workona began. &As a remote team at the time, we were using cloud apps like Google Docs, Asana, Slack, and Zoom to stay connected.Both of us were wearing multiple hats and juggling ten different projects at once.&

&One late night, with ten windows open for each project, the idea just struck us: ‘Why doesn&t the browser & the tool that we actually do most of our work in & not have a good way to manage all of our projects, meetings, and workflows'&

Of course, there are already browser add-ons that can help with taming the tab chaos, like OneTab, toby, Session Buddy, The Great Suspender, TooManyTabs and others.

But the co-founders didn&t want just another tab manager; they wanted a smart browser window that would save the work you do, automatically. That way, you wouldn&t have to keep all the tabs open all the time, which can make you stressed and less focused. And you wouldn&t have to remember to press a button to save your tabs, either.

With Workona, the software guides users to create workspaces for each of the projects, meetings, and workflows they&re currently working on. (Working on…Workona…get it).

You can also take a browser window that represents one project and save it as a workspace.

These workspaces function like a folder, but instead of holding a set of files, they can save anything on the web & cloud documents, task lists, open websites, CRM records, Slack sessions, calendars, Trello boards, and more. In each workspace, you can save a set of tabs that should reappear when that workspace is re-opened, as well as set of &saved tabs& you may need to use later.

After creating a workspace, you can use Workona to re-open it at any time. What that means is you can close the browser window, and later easily pick up where you left off without losing data.

A list of workspaces will also appear in the left-side navigation in the Workona browser tab. Within this tab, you can click to open a workspace, switch between workspaces in the same browser window, search for tabs or workspaces from the included search bar, or open workspaces from their URL.

In a shared workspace, you can also collaborate with others on things the team is working on & like everything needed for a project or meeting.

&Our vision is to build the missing OS for work on the web and workspaces are just the start,& says Morgan.

The company is currently working on making the workspaces and its search features more powerful, he adds.

Workona will be sold as a freemium product, with a free tier always available for moderate use. Pro accounts will be introduced in the future, removing the limit of 10 workspaces found in the free version.

The company has been beta testing with users from tech companies like Twitter, Salesforce and Amazon, as well as NASA.

The company is still pre-seed stage, with funding from K9 Ventures.

Traditional OSspent a lot of time and effort in designing the ‘desktop experience& and switching between applications. But in a browser, all we have is tabs,& said K9 Ventures& Manu Kumar, as to why he invested. &There are tab managers but none of them really solved my problem well enough, and none of them allowed me to maintain a shared context with other people that I&m collaborating with,& he added.

Workona is available for Chrome as a plugin you download from its website.

- Details

- Category: Technology

Read more: Workona helps web workers finally close all those tabs

Write comment (92 Comments)Page 4486 of 5614

18

18