Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Did you know Segway is making a pair of self-balancing roller shoes It is! The company has been tinkering with all sorts of new form factors since it was acquired by Ninebot in 2015, from half-sized Segways to kick scooters. Next up: inline… shoe… platform things.

Called the Segway Drift W1s, they sorta look like what would happen if you took a hoverboard (as in the trendy 2016 hoverboard-that-doesn&t-actually-hover &hover&board, not Marty McFlyhoverboard), split it in two and plopped one half under each foot.

It released a video demonstrating the shoes a few weeks back. Just watching it makes me feel like I&ve bruised my tailbone, because I&m clumsy as hell.

Pricing and availability was kept under wraps at the time, but the company has just released the details: a pair will cost you $399, and ship sometime in August. Oh, and they&ll come with a free helmet, because you&ll probably want to wear a helmet.

A new product page also sheds some light on a few other previously undisclosed details: each unit will weigh about 7.7lbs, and top out at 7.5 miles per hour. Riding time &depends on riding style and terrain,& but the company estimates about 45 minutes of riding per charge.

I look forward to trying these — then realizing I have absolutely no idea how to jump off and just riding forever into the sunset.

- Details

- Category: Technology

Read more: Segway’s whacky new roller shoes will cost $399

Write comment (94 Comments)FinAccel, a Southeast Asia-based startup that offers a digital credit card service in Indonesia, has closed a $30 million Series B round as it begins to consider overseas expansion.

The company launched its ‘Kredivo& service two years agoto help consumers pay online in Southeast Asia, where credit card penetration is typically low,and it is essentially the combination of a digital credit card and PayPal. The service is available in Indonesia, Southeast Asialargest economy, where it uses a customerregistered phone number — there is no physical credit card — and a dedicated checkout on online retail websites.

For consumers, the service offers a 30-day payback option and then more longer-term options of three, six and 12-month payback windows. The 30-day option is interest-free, but other plans come with a2.95 percentper month charge on the reducing principle, which effectively makes it 25 percent flat.

FinAccel says it has credit scored close to two million consumers in Indonesia, while on the retail side it has partnered with200 online sales platforms including large names such as AlibabaLazada, Shopee (which is owned by U.S.-listed Garena), and unicorn Tokopedia, which counts SoftBank and Alibaba among its investors.

This new investment, by the way, is a notable one for Southeast Asia, which has generally been considered to have a gap in Series B funding, so $30 million for a two-year-old business is quite something.

The round itselfis led by Australia&sSquare Peg Capital — in what is one of its highest-profile overseas deals to date — alongside new investors MDI Ventures, which is affiliated with Telkom Indonesia, and UK-based Atami Capital. Existing investors Jungle Ventures, Openspace Ventures, GMO Venture Partners, Alpha JWC Ventures and 500 Startups also took part in the round.

FinAccel founders (left to right)Umang Rustagi (COO), Akshay Garg (CEO) andAlie Tan (head of product engineering)

The startup raised a seed round of over $1 million in 2016, before quietly raising a $5 million Series A last year, FinAccelco-founder CEO Akshay Garg revealed in an interview with TechCrunch.

Garg,who founded ad tech firm Komli, said the company is processing &hundreds of millions& in U.S. dollars per year and the immediateplan is to keep growing in Indonesia.Already, however, it is eyeing up potential expansions with its first move overseas is likely to be in Southeast Asia in early 2018, although he declined to provide more details.

&Our goal is to become the preferred digital credit card for millennials in Southeast Asia,& he told TechCrunch. &Those are consumers who are mobile-first and already bankable. The credit gap in this market is huge, thereno electronic verification and other things that we take for granted in the West just don&t work here.&

FinAccel isn&t going after the unbanked in the region, but it also isn&t going after banks either. Garg said that it is possible that the company might try to work with banks in the future in order to grow its market share and offer new products.

One area it is looking at is financial products — such as loans for personal, educational and emergency purposes — but there could be ways to leverage its online presence and adoption among young people and work with existing financial institutions, which hebelieves simply aren&t equipped to reach out in the same way.

&We don&t see ourselves disrupting the banks, we are more partners,& he explained. &We could partner on balance sheet and onissuing credit cards to offer more efficient and seamless financial inclusion at best possible rates.&

- Details

- Category: Technology

Read more: FinAccel raises $30M to build a digital credit card for Southeast Asia

Write comment (94 Comments)Just a month ago, Valve announced Steam Chat — an overhaul to its aging chat system, and the companyanswer to rapidly growing competition from apps like Discord. At the time, it was a beta limited only to those who were granted access.

Today itopening up to all.

As Devin put it when the beta features rolled out, the previous chat system &may as well be ICQ.& It was useful for a quick chats, but it felt much too limited for anything beyond that.

The new Steam Chat, meanwhile, takes a huge step toward being a modern chat offering. It groups contacts by the game they&re playing, shows whether or not they&re currently in-game or in a match, offers easy access to your &favorite& contacts and allows for big group chats and persistent channels. It supports inline media (GIFs! SoundCloud! YouTube!), encrypted voice chat and has both a browser-based client and a client built into Steam.

Will it kill Discord Probably not.

While it might stymie the losses of the more casual players who might otherwise find their way over to Discord, it&ll be tough to sway anyone who has already come to call Discord home. Many Discord gaming groups have deep roots, with many of them having elaborate channel setups and relying on bespoke customizations like bots that help them schedule matches or raids.

If you want to check out the new chat system and already have Steam installed, just pop into Steam and tap the &Friends and Chat& button in the bottom right.

- Details

- Category: Technology

Read more: Valve’s answer to Discord is now live for everyone

Write comment (94 Comments)Because cryptocurrency prices are almost comically volatile owing to challenges involved in valuing them, ithard to know when or why to sell.

Enter crypto-asset backed loans, around which a small but growing number of startups is beginning to spring up. The idea is to lend money to cryptocurrency holders who don&t want to offload their holdings but also don&t necessarily want so much of their assets tied up in cryptocurrencies.

Among these is Lendingblock, a London-based startup that enables holders of crypto assets to lend them out and accrue interest on their holdings.Other outfits — and we aren&t vouching for these so much as letting you know they exist — includeCoinLoan, a 1.5-year-old outfit in Estonia that is itself trying to raise money through an initial coin offering;Nexo, a Switzerland-based platform powered by a Bulgarian consumer finance company called Credissimo; and SALT Lending, a Denver-based outfit that started crypto lending earlier this year, and recently told American Banker that it has already made just shy of $40 million in loans and has had no losses. (AB notes that the companyfounder, Blake Cohen, refers to himself at &The Blockchain Cowboy.&)

Still, italready looking like if there is one to watch in this new world, it might beBlockFi, a year-old, 12-person, New York-based non-bank lender that had raised roughly $1.5 million in seed funding earlier this year from ConsenSys Ventures, SoFi and Kenetic Capital, and just today quietly announced a massive infusion of capital — $52.5 million — led by Galaxy Digital Ventures, the digital currency and blockchain tech firm founded by famed investor Mike Novogratz.

Most of the capital — $50 million — will be used to loan to BlockFicustomers. The rest — $2.5 million — is an equity investment in the company from Galaxy and earlier backers, including ConsenSys.

Founder Zac Prince comes from a background of consumer lending, having worked recently as a senior vice president with the company Cognical (now operating asZibby). He&d also logged time as a vice president at the broker dealer OrchardPlatform (since acquired by the lending company Kabbage).

As he told us of BlockFiorigins earlier today, Prince started personally investing in crypto in early 2016 and also started attending related events. It was there that he &watched the crowd shift from purely computer scientists and anarchists to [also] VCs and bankers.&

As it happens, he was in the process of getting a loan for an investment property around the same time. instead of using a traditional bank, he decided to list his crypto holdings to see what would happen, and the response was overwhelming. It was, he says, a &lightbulb moment. I realized that there was no debt or credit outside of [person-to-person] margin lending on a few exchanges and I had the feeling that this was a big opportunity that I was well-suited to go after.&

Clearly, Novogratz agrees. So does former Bank of America managing director Rene van Kesteren, who ran a seven-person equity-structured financing business before joining BlockFi in May as its chief risk officer.

Currently, BlockFi allows investors to take out a loan as high as $10 million using either bitcoin or ethereum as collateral.

Prince wouldn&t say how much money the company has lent to its retail, corporate and institutional clients. He did offer that the number is &seven figures,& adding half-kiddingly that it &may be eight& figures by later today.

- Details

- Category: Technology

The promises of VR are heavily focused on the idea that users can grow more enveloped in the digital environments they explore, but also central to the experience is that they become more connected with their virtual representations.

BinaryVRcentral focus has been on a system of computer vision face-tracking particularly focused on the mouth that can translate a userfacial input to a virtual reality avatar.

The startup has just closed a $4.5 million Series A with investment fromAtinum Investment, KT Investment, Pearl Abyss and Kakao Ventures. BinaryVR has now raised about $5.8 million to date.

The goal is all around making avatars less creepy and more representative of their user. Some existing social VR titles use microphone input to kind of move the mouth open and closed, which is better than not trying at all, but therenot much immersion. Another approach lies in inferring emotions based on muscle movement measured in a VR headsetface pad, an approach that both Samsung and MindMaze have experimented with, but the technology only measures certain emotions and is far from a live feed of a userfacial expressions.

BinaryVRvision is going to rely heavily on the rest of the virtual reality market maturing a bit; their work kind of assumes that headset manufacturers are going to start integrating eye-tracking controls sooner rather than later.

Being a VR peripheral company in 2018 is no small task. VR platform makers like Facebook, Google and HTC are more focused on making their systems easy to use rather than integrating far-flung novice-centric add-ons. HTC has made some efforts to build integrations with startupproducing their own hardware, but for the most part these add-ons have only proven how difficult it is to market a specialized product that sits beyond the estuary of mainstream VR content.

The company released its $349 developer kit in early 2017.

BinaryVR has seen some early success with partners looking further down the road. High Fidelity, an SF-based social VR startup, which has raised $72 million, has been working with BinaryVR to let its users go as deep down the VR rabbit hole as they would like. Everything is still a bit odd-looking because todayGPUs can only deliver so much at VRscale, but these are all technologies that will probably find integrations into headsets at some point — ita question of scaling todaymarket when the benefits aren&t as apparent that is the companybig challenge.

Fortunately, there are obviously more approachable verticals for the company to tackle in the meantime. BinaryVR has been working to bring facial-tracking to smartphones with built-in sensors. Their &HyprFace& tracking tech seems to be pretty capable and the Animoji-like demos they&ve shown off are impressive. There are certainly plenty of players in the consumer mobile space; BinaryVR is also exploring what integrations would be possible inside vehicles, though the logical use cases perhaps aren&t as readily apparent there.

The Bay Area-based startup certainly has some interesting challenges as it navigates a space filled with tech giants shifting their weight and creating waves of potential as a result, but as users aim to drag themselves further into the digital worlds that VR game studios are creating, itbecoming clear that new sensors are necessary to make this a reality.

- Details

- Category: Technology

Read more: BinaryVR raises $4.5M to bring you face-to-face with your digitized self

Write comment (96 Comments)For 50 years, space innovation meant scaling Apollo-era technologies into ever larger, more durable satellites parked above their terrestrial clients in geosynchronous orbit. Exotic space-ready parts, militarized defenses and layered redundancies ballooned into multi-billion-dollar systems designed to last 40 years or more beyond their conceptions. Only vast organizations with thousands of aerospace engineers could participate.

By the turn of the century, it didn&t matter that geosynchronous orbit resembled a stadium parking lot on Super Bowl Sunday. The internet had upended and bankrupted the commercial space industry, whose expensive, decades-old satellites could no longer compete with terrestrial means of moving information. And when a financial crisis gripped the global economy one decade ago, constricting the government budgets that funded most space exploration, NASAcancellation of its flagship programs seemed to ring the death knell for our colonization of the cosmos.

The space community was dispirited; no one expected an imminent, explosive emergence of a new entrepreneurial ecosystem that now promises unprecedented opportunities in space and vanishing barriers to extra-terrestrial commerce. The prospect of colonizing the moon, Mars and beyond now seems likely and even palpable.

The new mindset

Space colonization began in 1957 with the launch of Sputnik, followed by the monumental Apollo program that landed humans on the moon. Both Sputnik and Apollo had to develop their entire missions and supply chains from scratch: rocket engines, spacecraft, avionics software, space suits, ground stations, mission control software and more.

This monolithic approach dominated space missions for decades… until recently. In 2010, Brooklynite Luke Geissbühler and his son Max heralded a new model for space exploration when their amateur weather balloon ferried an iPhone 19 miles above the surface of the Earth, capturing beautiful space images as expensive satellites do. The father-son duofun experiment exploited the low cost of mass-produced cell phones, whose batteries, antennas, radios, accelerometers and cameras constitute the most fundamental components of commercial satellites.

Meanwhile, students at Cal Poly and Stanford were using those same cell phone components to assemble what they called CubeSats— 10x10x10 cm buses designed to cheaply ferry their science experiments to low Earth orbit (LEO). (In LEO, where satellites naturally de-orbit within five years because of drag from atmospheric particles, they don&t need exotic radiation-proof parts.) Standard modules for DIY CubeSats can now be procured on hobbyist sites as easily as buying a book on Amazon.

Like the DARPA engineers who coded the internet protocol, these students hadn&t appreciated the impact of their invention. CubeSats sparked a realization that true scalability comes not from bigger satellites, but many cheap small ones, and suddenly five accumulated decades of MooreLaw turned the space industry upside down.

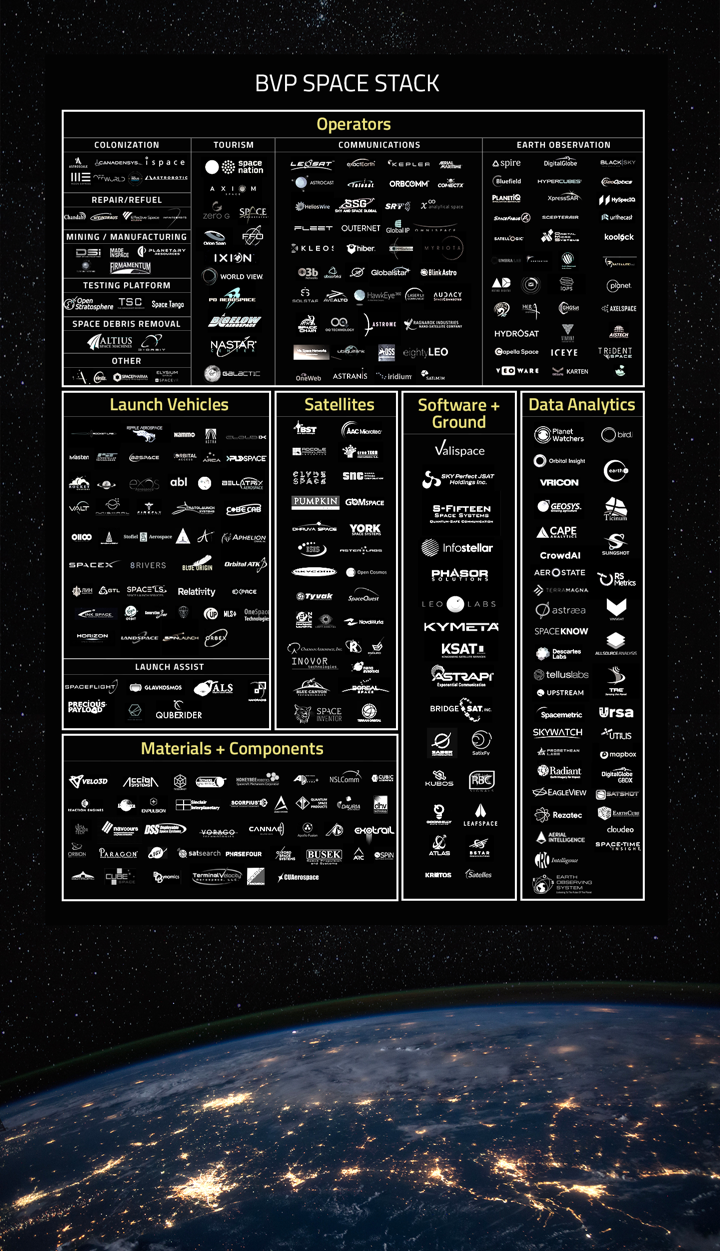

This new space stack promises a virtuous cycle of innovation, diversity and growth.

Venture-backed startups like Planet Labs and Skybox (now merged) developed constellations of micro-satellites to image the Earth far faster than enormous, lumbering incumbents. Other ventures like SpaceX and OneWeb are deploying massive constellations to serve the planet with internet and IoT communications.

The Silicon Valley teams behind all these constellations naturally focus on software-driven designs with commodity hardware, enabling satellite operators to quickly launch new apps as we do on our smartphones. The largest general purpose CubeSat constellation — roughly 60 &Lemurs& operated by Spire Global — already monitor ships, planes and weather.

The new mindset that space is best colonized by smaller, cheaper and faster computers favors entrepreneurial engineering teams. Hundreds of other startups are now exploiting the 100X cost savings of microsat constellations to colonize space.

A new ecosystem

The microsat revolution demands a new ecosystem to support the operators of these constellations. By far the most important and difficult input to procure is launch, because all mature rocket programs were designed long ago to carry enormous, expensive payloads to geosynchronous orbit (~36,000 km altitude) with five to 10 years of advance notice; new players like Virgin Orbitand Rocket Lab promise cheap and frequent carriage to LEO (less than 2,000 km altitude).

Next-gen operators also need ground stations, mission control software, satellite tracking, data analysis, space Wi-Fi and more. Satellite and rocket manufacturers, in turn, need specialized subsystems, amplifiers, phased array antennas, miniaturized propulsion, materials, extensible solar panels and batteries. And innovators in additive manufacturing like Velo3D enable SpaceX and Rocket Lab to design and 3D print far more efficient engines.

Space companies now assemble cheaper, better and faster constellations by mixing and matching off-the-shelf elements from this emerging fragmented ecosystem. This new space stack (see illustration) promises a virtuous cycle of innovation, diversity and growth akin to the explosion of datacom startups sparked in the 1980s when the OSI 7-Layerinternet working similarly disrupted an oligopoly of proprietary networks from IBM, Digital HP and Sun.

Atop the space stack sit the microsat operators that create value for people on Earth. They are extraterrestrial mining companies, agricultural intelligence businesses, pharma manufacturers, internet service providers, weather forecasters, marine tracking companies and new ones every month. As the space stack grows, these companies look less like scientific research labs and more like their terrestrial competitors.

In other words, space is open for business. Entrepreneurs are flocking to the final frontier, where MooreLaw has unleashed massive, enduring opportunities. This is how humanity will colonize cis-lunar, the moon, asteroids, Mars and beyond — through the emergence of a distributed, commercial ecosystem infinitely more powerful than any single company or government.

Thanks to Quilty Analytics for their help in building the Space Tech Stack.

- Details

- Category: Technology

Read more: Space is open for business

Write comment (100 Comments)Page 4631 of 5614

8

8