Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Tech CEOs and founders are disrupting everything from travel to food, to space, to sleep. Now ittime to disrupt a process that so many of us have relied on to get where we are today: immigration. According to a study by theNational Foundation for American Policy, immigrants have founded more than half of U.S. startup companies that are valued at more than one billion dollars.

With all that is happening around us, now is the time for entrepreneurs to use their playbook for disrupting markets and apply it to immigration as a space — not for a financial upside, but for a more social, human upside.

Turning a problem into an opportunity

One of the most important lessons you learn as an entrepreneur is outlining the problem you are trying to solve and turning it into an opportunity.

Economistsgenerally agreethat immigration has net positive effects on both the sending and receiving countries. Contrary to popular belief, immigration doesn&t increase crime rates ortake jobs away from native workers. In fact, according toThe Silicon Valley Competitiveness and Innovation Project Report, almost every major tech hub has more foreign-born workers than domestic ones.

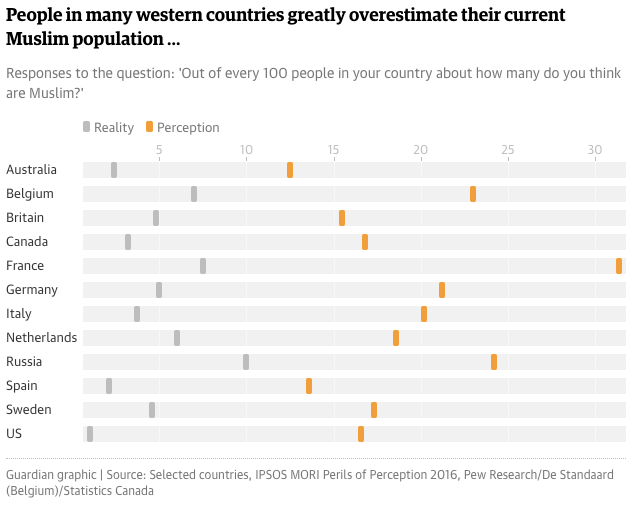

Before solving a problem, we have to agree on the facts. Research shows that people in many western countries greatly overestimate the number of immigrants — in this case, Muslim immigrants — coming into their country. Misinformation makes it difficult to pursue effective solutions.

Source:The Guardian

Therean opportunity to educate ourselves and instead highlight the economic and innovation opportunity that immigration offers. Immigrants provide access to more talent, more diverse thinking and more creativity.

Dr. Adrian Furnham, a professor of psychology at University College London who studies immigrants and entrepreneurshipsaid, &What I&ve found is that immigrants not only have the qualities that help any entrepreneurs succeed—including aggressiveness and creative thinking—but they get a big boost because many of the skills they picked up coping with a new world are transferable to the entrepreneurial world.&

Rebranding the word &immigrant&

Another important step in an entrepreneurplaybook relates to changing perceptions. Airbnb, for example, had to challenge peopleassumption that opening their home to strangers was a dangerous and risky endeavor. Now, facilitating these types of interactions is an act of hospitality and the beginning of a friendship.

More and more recently, the word &immigrant& has become a bad word. We have the responsibility to rebrand it to mean&maker& not &taker.& Look at HamdiUlukaya, the Turkish immigrant who created the Chobani yogurt empire. He employs 3,000+ people and has given them10 percentof the shares in the company.

When people research the word &immigrant& online, they need to find Ulukayastory. They need to find images of successful, eloquent and positive entrepreneurs and leaders. Thatwhy itso important to speak as immigrants. To tell the story of how we came here and the challenges we&ve had to overcome. Ittempting to try to blend in, but we have to infuse the word &immigration& with more positive visuals.

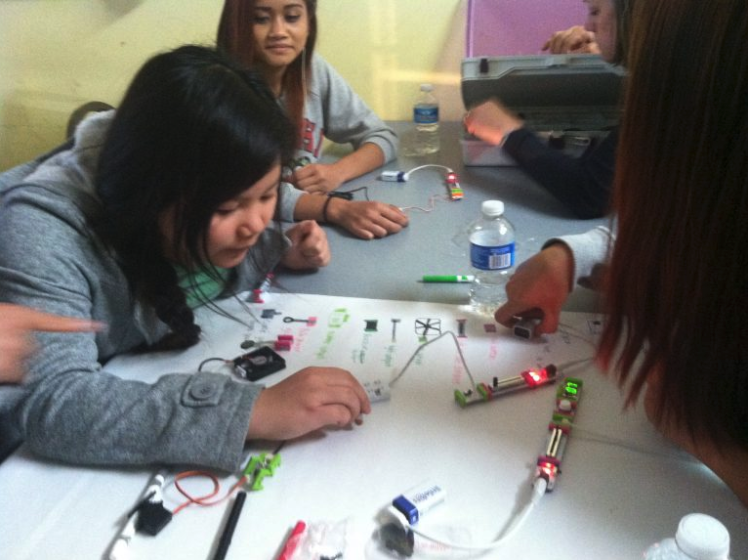

The University of North Carolina at Greensboro (UNCG) established the Center for New North Carolinians (CNNC), with the aim of supporting refugees and immigrants living in the local community. CNNC piloted a STEM club program for female refugees and immigrants using littleBits& electronic building blocks. Photos from the CNNC STEM Club, courtesy of littleBits

Taking [commercial] risks

In January 2017 when the Trump administrationtravel ban was first implemented, littleBits posted abillboard in Times Squarethat said in English and Arabic: &We Invent the World We Want to Live In.& We wanted people to associate Arabic script with a positive, inclusive message. It was the first time I decided to speak to my background as an Arab and Muslim immigrant. The public response, the impact on our team culture and the feeling of having stood up for whatright made me bolder about using my platform to speak out.

Thatwhy, when the debate around immigration rose up again in response to family separation at the border, I knew I had to say something.

At littleBits, being from &another& place is a reality; we are a company built on diversity. We have close to 20 languages in the office, a multitude of religions and about 20 percent of us have visas or green cards or were born in other countries. I myself know firsthand the struggle that immigrants face — I&ve had to flee my country of Lebanon three times for my own safety.

So, last week Ijoinedleaders from Facebook, Twitter, Airbnband Microsoft and made my voice heard. I announced a donation program and wrote ablog postthat opened with: &We at littleBits strive to separate politics from our work. But when something touches human rights, it is no longer about politics. It becomes about justice.&

And you know what Like most things in America today, the reaction we received was polarizing. Some people said that speaking out was an &admirable move& and that it was clear we were focused on &making a big difference.& On the other hand, 27 percent of respondents explicitly told us they would be less likely to purchase littleBits products as a result of us speaking out. One loyal customer told us they would now &actively discourage& their children from buying or using our products. Another said they would &throw [their] Bits in the trash.&

And yet, I stand by our statement.

The business risks involved with speaking out are real. But to me, putting a flag in the ground is always worth it. One email, one blog post, one donation at a time, I protect the diversity of my team, my company, and the country in which I reside. History will judge us if we quietly allow our government to strip us of the diversity and innovation that make America so amazing.

As entrepreneurs, we have a platform. Despite the potential costs, we must use this platform to put ourselves out there, to speak out on the issues that matter to our country, our businesses and ourselves. There may be financial downside and yes, it will be more difficult to quantify the human upside, but I for one am willing to take a gamble that net, it will be a positive.

- Details

- Category: Technology

Read more: The hottest new space to disrupt is immigration

Write comment (91 Comments)Sixteen months ago, I predicted 2017 would be &the best year for tech IPOs since the dot-com heyday almost two decades ago.&

Well, that was not exactly what happened — though 2017 was a good year for IPOs compared to previous years. Despite strong public markets, where we saw the NASDAQ jump 28 percent and the Dow by 25 percent — there were 59 VC-backed IPOs, which was an improvement over the 41 we had in 2016 (2018 NVCA Yearbook) — last year was far from the torrent I expected. One key reason was concerns by private companies that public valuations might not give private investors a solid gain. At the same time, there was abundant private capital for those companies, so IPOs were not critical for raising capital.

2018 IPOs are off to a strong start

The highly anticipated and successful IPO by Dropbox (DBX) in March and Spotify(SPOT) direct listing in April have put a spotlight on the U.S. tech IPO market. Four recent tech IPOs — Avalara (AVLR),Carbon Black (CBLK), Smartsheet (SMAR) and DocuSign (DOCU) — all revised the filing ranges upward, priced at or above the high-end of the new range, and are trading up an average of 79 percent since their debuts in late April through mid June. This is consistent with tech IPOs so far this year, which have traded up 92 percent.

Halfway through 2018, VC-backed IPOs in the U.S. have reached $6.9 billion, second only to 2012 when Facebook made its debut. I am feeling bullish about the IPO environment over the next 18 to 24 months, with some new factors that merit close attention. As IPOs take off, we will also see an acceleration of M-A.

So whatin store for the rest of 2018

We see a pipeline of later-stage companies with strong fundamentals, and pent-up investor demand for fast growth investments. The pipeline of later-stage companies seems larger than ever, and tech IPOs are the strongest among industry sectors so far this year — and at double the pace of last year, according to Renaissance Capital. High-profile companies like Lyft, Sonos, Eventbrite and Airbnb are all in various stages that signal they may go public.

When venture-backed U.S. technology companies go public, it opens the doors for others.

Valuations, though still sky-high in some cases, may not be a roadblock. Some people were worried about whether these companies could sustain the valuations and be able to achieve a strong exit. We have quite a few vivid examples of highly valued private companies that marched forward to an IPO and trade at levels giving good returns to their private investors.

More companies are starting to realize that it is a good time to go public. Even with some temporary pullbacks like Facebook after the Cambridge Analytica incident, Zuck and team went on to blow out first quarter earnings. The markets are still at great levels by historic standards.

A very strong exit environment is good for the VC ecosystem. When venture-backed U.S. technology companies go public, it opens the doors for others.

Strong IPO market will fuel M-A

Robust M-A and IPO cycles tend to flow together, and we seem to be riding that wave already. The last strong joint cycle was in 2014, which saw 124 IPOs and 941 acquisitions (NVCA).

The new tax laws have lowered corporate tax rates, encouraged repatriation of massive offshore cash held by tech companies and brought the cash positions of large tech companies up to the highest levels they have ever been. Not only will there be an uptick in the number of acquisitions, but in the size of transactions as large tech companies become active buyers. Salesforce$6.5 billion acquisition of MuleSoft, which had gone public last year, and Microsoftacquisition of GitHub for $7.5 billion, are good examples. Expect Amazon, Facebook, Google and Microsoft to continue to be active.

We are seeing a number of acquisitions of private tech companies that are realistic IPO candidates. The most vivid example of this was the acquisition of AppDynamics by Cisco last year for $3.7 billion, which was announced at the &11th hour& before what would have been a successful IPO by AppDynamics (which had completed its roadshow and was poised to price).

An IPO filing, even the prepping for an IPO, can serve as a catalyst for an acquisition. The big tech acquirers are tracking all the great young private tech companies, and when an IPO is imminent, it can motivate them into action to acquire a company that is a great strategic fit.

Just recently, Glassdoor was acquired by Recruit Holdings for $1.2 billion and Walmart bought 77 percent of Flipkart for $16 billion — either company could have gone public, but once companies are either on file and preparing for an IPO or make a confidential filing, it becomes a catalyst for potential buyers that have been tracking them for a while to make an acquisition.

Not only will we see acquisitions by the big technology companies, but more traditional-sector companies as well. For example, in October, General Motors acquired Strobe, a startup focused on driverless technology, building on its earlier buy of Cruise Automation. Walmartacquisition of Flipkart, the Indian e-commerce giant, is another example.

Technology opportunity follows public demand

Growing concerns about privacy and security have created a lot of interesting opportunities, and emerging companies in those sectors are achieving scale rapidly. We are seeing a lot of demand for companies using technology to solve cybersecurity issues; for example, Zscaler saw its shares more than double on its first day of trading back in March. 2018 is projected to be a strong year for cybersecurity IPOs, with companies like Cloudflare, Illumio and Lookout.

Startups now have more options, including remaining private.

We have seen this movie before — back in the early 2000s when the tech industry was climbing its way out of the dot-com bust, cybersecurity companies were among the first to gain traction, along with startups using technology to help Fortune 500 companies cut costs — an early standout was VMware, which pioneered server virtualization and was quickly gaining market share before it was acquired by EMC in 2004.

Regulatory easing

The current administrationrelaxation of the JOBS act has made the regulatory environment more benign than it has been for a long time, which could make things easier for companies to go public.

Larger private companies can now use the confidential filing provision of the JOBS Act that smaller tech companies have had access to over the last few years. The SEC is also proposing to allow the larger private equity companies to use the test-the-waters provision of the JOBS Act. These provisions dramatically reduce any perceived risk of a disappointing IPO.

New exit opportunities via private equity and direct listings

Startups now have more options, including remaining private. That said, times are even more interesting for private companies looking for liquidity. Private equity firms and sovereign wealth funds are coming into the game and buying up tech startups, thereby providing another exit opportunity.

Recently, Spotify turned heads with its unusual IPO by doing a direct listing. For companies that do not need primary capital and are already well-known by investors, the direct listing is a realistic option. For a company with these characteristics, the biggest reason a company would do a direct listing is to save on fees and redirect who benefits from the first day pop.

There is a lot of speculation whether more companies will choose a direct listing over the traditional IPO and how it impacts VC. I believe it is beneficial for the VC ecosystem as it is another way for companies to go public. However, I do not expect too many companies will follow the direct listing approach Spotify took, as they were in a somewhat unique position.

Itexciting to see alternatives to the traditional IPO, and the second half of this year into 2019 will likely see a boom of IPOs. Going public enables startups to provide liquidity for employees and investors, as well as generate much-needed publicity and credibility, which in turn bring customers and revenue. Itan exciting time to be in the technology VC space following a year of unexpected drama.

- Details

- Category: Technology

Read more: The state of the IPO market

Write comment (97 Comments)Our Startup Battlefield pitch competition may be legendary, but itnot the only throw-down going on at TechCrunch Disrupt SF 2018on September 5-7. This year, in honor of the largest Disrupt event ever, we&ve launched theVirtual Hackathon. Thousandsof the best developers, coders and hackers will compete — from anywhere in the world — to build tech products that address and solve a range of challenges.

And we have even more contests, cash and prizes to share with you — more on that in a minute. Right now, you better sign up and get moving, because the deadline to submit your hacks is August 2.

Our team of judges will review every eligible project and assign each submission a score between 1-5. Score criteria include the idea quality, technical implementation and potential market impact.

The 100 highest-scoring teams will receive up to five Innovator Passes to attendTechCrunch Disrupt SF 2018. They can enjoy everything the show has to offer, including (for starters) Startup Alley, incredible speakers from four unique stages, Startup Battlefield, Q-A sessions and the TC After Party — the perfect place to network in a fun atmosphere.

The teams who make the top 30 will move on to compete in the semifinals at Disrupt SF, where they will demo their creation to a team of judges. Those judges will then select 10 teams to go on to the finals, where they will step onto The Next Stage and showcase their baby to an audience of thousands of Disrupt SF attendees.

Finally, one team will rise above the rest, win the $10,000 grand prize and become the first-ever TechCrunch Disrupt Virtual Hackathon champ.

OK, letget back to the bit about more contests, cash and prizes. You also can win some sweet cash from contests sponsored by BYTON, TomTom and Viond, plus Visa and HERE Mobility.

The Virtual Hackathon takes place atTechCrunch Disrupt SF 2018on September 5-7, but you have only until August 2 if you want your hack to be eligible. Don&t miss the fun and excitement. Sign up to participate in the Virtual Hackathonand start hacking today.

- Details

- Category: Technology

Read more: Win cash and prizes in the Virtual Hackathon at Disrupt SF 2018

Write comment (91 Comments)Postie, a new Los Angeles-based startup, has a vision for the future of advertising and marketing — and itdirect mail.

Founded by some of the men responsible for the biggest hits in online marketing (like the Dollar Shave Club commercial that launched what becamea billion-dollar acquisition) think that ittime to take technology where itnever gone before — into targeted, direct mail campaigns using the best ad-targeting that money can buy.

Postie uses a combination of online data collection and an on-demand print and mail technology to give its customers turnaround times on print orders in as little as 24 hours, and what the company boasts is the equivalent of online ad-targeting.

Using the service, customers can access demographic, interest and behavioral data of more than 320 million people; can use retargeting to provide direct mail campaigns; and integrate with existing customer relationship management tools.

The company was founded by Dave Fink and Jonathan Neddenriep, two former principals at the startup studio and early-stage investor, Science.At the early-stage investment firm, Fink said he was responsible for marketing activities for companies including Dollar Shave Club, DogVacay, SpringRole, Wishbone and Hello Society over the six years he worked at the company. Neddenriep served as the chief technology officer for Science — a role hecontinuing at Postie.

Where once Fink focused on reaching the widest possible audience with a viral message that could cut through the noise of online advertising, the scale of his messaging is now much smaller, even if the scope of the market hetrying to capture remains just as vast.

&A highly targeted physical piece of mail, especially in todayephemeral world, elicits an emotional response that goes above and beyond what is possible online,& says Fink, in a statement. &Itnow possible to open up a whole new scalable media channel by leveraging the same data driven insights and quantitative approach as digital.&

According to study from the Direct Marketing Association, direct mail campaigns rang up $46 billion from advertisers and companies in 2014, and Fink and his co-founder are hoping that number will climb.

They aren&t the only ones. Postie has raised $3.5 million in seed funding from the Los Angeles-based firms Bonfire Ventures and Crosscut Ventures to expand its business (maybe through direct marketing).

- Details

- Category: Technology

Some Spotify users were so annoyed by the recent Drake promotion that they asked for and were granted refunds, according to a report from Billboard. The streaming service had heavily promoted the artistlatest album, &Scorpion,& even using his image on playlists that didn&t even contain his music, like &Massive Dance Hits,& &Best of British& and &Happy Pop Hits,& for example.

The promotion, dubbed &Scorpion SZN,& was the first-ever global artist takeover of Spotifyservice and the first time an artist took over multiple Spotify playlists on the same day.

While itnot uncommon for artists to receive promotion on Spotify, some felt that the Drake promotion had gone too far — the album and Drakeimage were everywhere in sections like Browse and Playlists.

One Reddit user shared how they were able to obtain a refund from customer service, and that post soon went viral. The screenshot of their chat with the support rep has, to date, been viewed nearly 12,000 times. That transcript doesn&t indicate any official policy on Spotifypart here, but was instead the efforts of a customer service rep helping retaining an individualbusiness.

However, a few other people then tried similar tactics, and were also able to get refunds, they said.

Spotify isn&t officially commenting on the pushback from users, but Billboard claims the number of refunds were minimal.

Itclear that the streaming service noticed the complaints, however, as it was responding to users on Twitter to clarify that things would soon be back to normal.

While Spotify has never refunded customers unhappy over a promotion — the larger news here is not the financial loss of those refunds, or even that they happened at all, but rather the damage this has done to Spotifyreputation.

For those who complained, the problem wasn&t just that they weren&t Drake fans (though thatobviously a part of it), but rather that they felt they were viewing advertisements when they were paying for a Premium, ad-free version of Spotifyservice.

In addition, a heavy-handed promotional effort like this flies up against Spotifydesire to position itself as a service thatpersonalized to its subscribers& musical tastes.

With Drake showing up all over Spotify playlists and recommendations, the overall effect was one of discounting users& own interests — those who complained were likely not Drake fans or perhaps not even heavy listeners of hip-hop in general. As a result, they felt like Spotify was trying to push them to listen to music they didn&t like.

Though Drake is a hugely popular artist, there may not be an artist out there who could withstand a promotion like this. Itjust too much. After all, therea fine line between being excited about an album release and promoting it, and shoving something in peoplefaces. Spotify crossed that line.

Billboardnoted that some people had even compared this to the Apple/iTunes scandal when the company gave away U2&Songs of Innocence& back in 2014 by downloading it without consent to users& iTunes libraries. But itnot quite as bad as that. The issue was not one of stealthily downloading content to your device, which is far more of a violation.

That said, the user outrage feels similar:I don&t like this music, why are your forcing it on me

Spotifyoriginal intention was to promote Drakealbum and the artist in a more playful way. It put Drake on the cover of its biggest Rap, R-B, Pop and Mood playlists, includingRapCaviar,Beast Mode,Are - Be,Summer Party,TodayTop Hits,Morning Commuteand others.

In those cases where Drakeimage was used on the playlist but not his music, the idea was that it would showcase the artistpersonality. But these efforts clearly fell flat. Users were confused as to why Drake was appearing on playlists that didn&t make sense — like those featuring a different genre of music.

From a sheer numbers standpoint, meanwhile, Spotifypromotional efforts were successful.

The album broke the U.S. one-week streaming record for an album in three days, Billboard also reported, and the album was being streamed more than 10 million times per hour the weekend of its release, Spotify said.The album is estimated to reach more than 700 million streams in the U.S. by the end of the tracking week on July 5.

Not everyone thought the promotion was that big of a deal.

Some people said that while they noticed the suggestions, they just bypassed them and listened to their own music as usual. But even then, some sympathized with those who complained that this felt like an advertisement on whatsupposed to be an ad-free service.

Spotify collaborates with artists on promotions — the details of Draketakeover weren&t dictated. (In fact, itnot even the biggest promotion from a financial investment standpoint.) So Spotify will likely chalk this up to a learning experience that may help it craft better promotions in the future that don&t involve as much overreach.

- Details

- Category: Technology

Read more: Spotify users push back at the over-the-top Drake promotion

Write comment (90 Comments)At the end of last November, Google announced that Diane Bryant, who at the time was on a leave of absence from her position as the head of Inteldata center group, would become Google Cloudnew COO. This was a major coup for Google, but it wasn&t meant to last. After only seven months on the job, Bryant has left Google Cloud, as Business Insider first reported today.

&We can confirm that Diane Bryant is no longer with Google. We are grateful for the contributions she made while at Google and we wish her the best in her next pursuit,& a Google spokesperson told us when we reached out for comment.

The reasons for Bryantdeparture are currently unclear. Itno secret that Intel is looking for a new CEO and Bryant would fit the bill. Intel also famously likes to recruit insiders as its leaders, though I would be surprised if the companyboard had already decided on a replacement. Bryant spent more than 25 years at Intel and her hire at Google looked like it would be a good match, especially given that Googleposition behind Amazon and Microsoft in the cloud wars means that it needs all the executive talent it can get.

When Bryant was hired, Google Cloud CEO Diane Greene noted that &Dianestrategic acumen, technical knowledge and client focus will prove invaluable as we accelerate the scale and reach of Google Cloud.& According to the most recent analyst reports, Google Cloudmarket share has ticked up a bit — and its revenue has increased at the same time — but Google remains a distant third in the competition and it doesn&t look like thatchanging anytime soon.

- Details

- Category: Technology

Read more: Google Cloud’s COO departs after 7 months

Write comment (99 Comments)Page 4848 of 5614

14

14

(@viniciuscsena) June 30, 2018

(@viniciuscsena) June 30, 2018 (@tanncap) June 29, 2018

(@tanncap) June 29, 2018