Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Amazon has acquired Health Navigator, a startup that develops APIs for online health services. According to CNBC, which first reported the deal, Health Navigator will become part of Amazon Care, its pilot healthcare service program for employees.

This is the second health startup acquired by Amazon. The first was online pharmacy PillPack, purchased by the company in 2018 for slightly less than $1 billion. PillPackservices have also been integrated into Amazon Care, which offers deliveries of prescriptions with remotely communicated treatment plans.

Health Navigator platform was created to be integrated into online health services, including telemedicine and medical call centers, to standardize the process of working with patients. Its platform includes natural language processing-based tools for documenting health complaints and care recommendations, and is integrated into apps with APIs.

The startup, founded in 2014 by physician David Thompson, has not made a public statement about the acquisition yet, but CNBC reports that the company telling customers that their contracts will not be renewed.

- Details

- Category: Technology

Read more: Amazon acquires Health Navigator for Amazon Care, its pilot employee healthcare program

Write comment (98 Comments)

Microsoft posted quarterly results today that were well ahead of analysts& expectations, but Azuregrowth rate continues to decline as it competes with AWS.

The companyrevenue for the first quarter of the fiscal year rose 14% year-over-year to $33.1 billion. Net income increased 21% to $10.7 billion, or $1.38 per share.

Revenue from MicrosoftProductivity and Business Processes segment, which includes its Office products and LinkedIn, grew 13% to $11.1 billion. LinkedInrevenue increased by 25%.

Meanwhile, its Intelligent Cloud segmentrevenue increased 27% to $10.8 billion, with revenue from server products and cloud services growing 30%. The company said Azurerevenue grew by 59%, but that represents a decline in growth rate that began a year ago, when Azure clocked quarterly growth of 76%. The rate has fallen more since then, with todayreport representing a drop from the 64% growth reported in the previous quarter.

Revenue from Microsoftpersonal computing segment grew 4% to $11.1 billion.

The company said it expects second-quarter revenue to be in the range of $35.15 billion to $35.95 billion.

- Details

- Category: Technology

PayPal reported third-quarter results today that were slightly ahead of analysts& expectations, driven by an increase in total payment volume.

The companyquarterly revenue grew 19% year-over-year to $4.38 billion. Its GAAP net income was 39 cents per share, or $462 million, a 7% year-over-year increase. On a non-GAAP basis, net income was 61 cents a share, a 5% increase.

These figures included a negative impact from strategic investments in MercadoLibre and Uber; without that, GAAP net income would have increased 48% to 54 cents per share, and non-GAAP net income would have rose 31% to 76 cents per share.

During the third quarter, PayPal added 9.8 million active accounts, increasing the total number by 16% to 295 million. Total payment volume (TPV) increased 25% to $179 billion. Venmo processed more than $27 billion in TPV during the quarter, an increase of 64%.

For its full-year results, PayPal said it expects earnings per share ranging from $3.06 to $3.08 per share, on revenue of $17.7 billion to $17.76 billion.

In September, PayPal announced it will acquire a 70% equity interest in GoPay (Guofubao). The deal is expected to close during the fourth quarter and will make PayPal the first foreign payments company licensed to provide online payment services in China, an important potential driver of future growth.

- Details

- Category: Technology

Read more: PayPal reports solid third-quarter results, with total payment volume growing 25%

Write comment (99 Comments)A couple of years ago, the cofounder and CEO of a blood-testing company was publicly taken to task for implying in articles and professional profiles that he has a PhD when in reality, he&d left a prestigious graduate group three years after enrolling, without a degree.

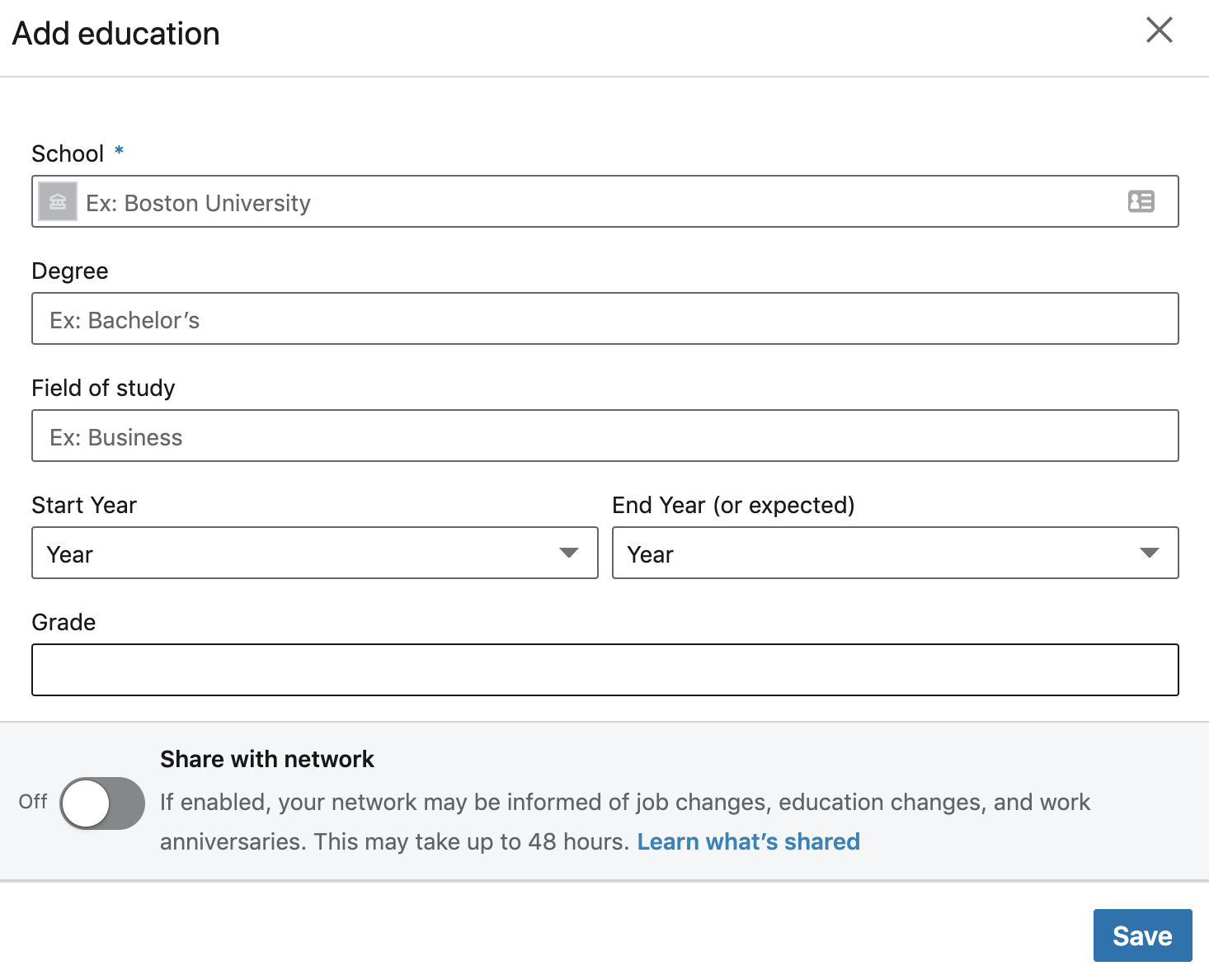

The CEO is hardly alone in intentionally or otherwise sowing confusion around his credentials, however. Over the years, we&ve mistakenly believed that a number of founders have obtained specific college degrees based on their LinkedIn bio, only to learn offline that they enrolled for some period of time in a particular program that they didn&t complete.

It happened most recently with the cofounder of a startup who one would might surmise based on his LinkedIn profile has a masterdegree from Harvard but does not. We also misunderstood the CEO of a robotics company to have a PhD based on her LinkedIn. It was our fault; it mentioned under the credit that she&d left to start a company. But anyone scanning the site might have come to the same wrong conclusion. (We pointed this out to her team, and mention of the PhD was deleted.)

In a higher-profile case, James Damore, the fired Google engineer who authored that infamous memo about the companydiversity practices and whose LinkedIn page cited under &Education& a &PhD, Systems Biology,& removed mention of those doctoral studies after Wired confirmed with Harvard that he was enrolled in the program but didn&t complete the doctorate.

Damore tried to defend his own LinkedIn profile, tweeting at the time, &I never told anyone I have a PhD. LinkedIn can&t distinguish between being in the PhD program and having a PhD (I forgot to update it).&

Though few on Twitter found him credible, he wasn&t mistaken on this front. In creating a profile on LinkedIn, the choices one is given are to a.) list a completed degree and leave off anything partially completed, no matter how much time was invested in a program (or minuscule its acceptance rate) or b.) list an incomplete degree without a clear way of explaining that itno longer being pursued or whether it will ever be obtained.

LinkedIn doesn&t view the issue as its fault. Asked whether LinkedIn members might be posting incomplete degrees because of the companyuser interface, a spokesperson emailed us today, writing that LinkedInuser agreement and &professional community policy& guidelines are &clear that members should provide factual information about themselves on LinkedIn.&

Added this person: &People should definitely add their education details to their LinkedIn profile. The education section includes ‘Start Year& and ‘End Year (or expected)& fields. If a member has a partial degree, we recommend they clearly state the status of their degree within the ‘Degree& and/or ‘Description& fields.&

Still, that &description& field isn&t easy to find. And why LinkedIn — which has more than 600 million users — hasn&t added fields for partially completed degrees is a bit of a mystery, particularly given that so many people drop out.

Cynically we will note that LinkedIn makes a lot of its revenue off recruitment services. Before it was acquired by Microsoft, and the companies& financials were consolidated, 65 percent of LinkedInrevenue came from recruitment services. And often the more distinguished the degree, the more people will pay to associate themselves with the ostensible degree holder. (LinkedIn itself strongly encourages loading up oneprofile with education-related details, saying these attract &11x& more profile views.)

A much bigger factor, however, is human nature, argues Stanford professor Jeffrey Pfeffer, a renowned professor at StanfordGraduate School of Business who has written extensively about organization theory. Asked if he has reason to think that more students are listing incomplete degrees on LinkedIn — or even dropping out of school with less compunction, knowing they might — he points us to numbers published in 2001 by the payroll and benefits managing company ADP.

What they show: of 2.6 million background checks that the company performed that year, 44 percent of applicants were discovered to have lied about their work histories, 41 percent lied about their education, and 23 percent falsified credentials or licenses.

&People lie about everything all the time,& says Pfeffer. &I&m not sure that itany worse now than it was 10 or 20 or 30 years ago.&

Itsomething recruiters anticipate, he says. He recalls a conversation with a top executive from the search giant Heidrick - Struggles, who Pfeffer had interviewed for one of the many books he has authored. &He said to me, ‘So many people make up credentials that we no longer use fudged credentials as a reason to disqualify a candidate.& He said recruiters will correct what they find wrong with someoneresume. But he said if they used exaggerated — even made-up — credentials as a reason to disqualify people, they would never have enough candidates.&

LinkedInlimited menu of options may give more cover to people. But Pfeffer cautions not to assign the company too much blame, no matter its reach. Ita little like shooting the messenger, he suggests. &Sure, LinkedIn could play some role. But they could change the way they operate tomorrow, and people would still find a way to make themselves look more accomplished than they are.&

Maybe so. We&d rather see some changes to find out.

- Details

- Category: Technology

Read more: LinkedIn’s degree problem

Write comment (92 Comments)

Tesla CEO Elon Musk forecast that the companyenergy business will eventually be the same size as— or even bigger than — its automotive sector, the latest sign that the company plans to put more time and resources to scaling up its solar and storage products.

&It could be bigger, butit willcertainly be of asimilar magnitude,& Musk said during an earnings call Wednesday. The company surprised Wall Street by reporting a return to profitability in the third quarter.

The bulk of Teslarevenue is generated from sales of its Model S, Model X and Model 3 electric vehicles. In the third quarter, automotive revenues were $5.35 billion. The company doesn&t break out revenue generated from solar, energy storage or other products and services. However, the total revenue in the third quarter was $6.3 billion, which gives some indication of the size of automotive compared to its other businesses.

Teslaenergy and solar businesses languished for nearly two years as attention and resources were directed to the Model 3. That diversion of resources included redirectingbattery cell production linesmeant for its home Powerwall and commercial Powerpack energy storage products to the car because the company didn&thave enough cells.

&We had to do itbecause if we didn&t solve the Model 3, Teslawouldn&tsurvived,& he said. &So, unfortunately thatshorted other parts of the company.&

Now, the company is committed scaling up energy storage and solar. Kunal Girotra, who initially joined Tesla in 2015 as a senior product manager for Powerwall, was promoted to senior director of the companyenergy operations.

In the third quarter, Tesla installed 43 megawatts of solar, a 48% increase from the previous quarter. Solarinstallations are still 54% lower than the same period last year.

Energy storage deployments have continued to grow, reaching an all-time high of 477 MWh in the third quarter, according to earnings posted Wednesday.

Part of this new effort includes its solar roof tile product, which was originally unveiled in 2016. Musk said that a new, third iteration of its solar roof tile will debut Thursday afternoon.

- Details

- Category: Technology

Read more: Elon Musk predicts Tesla energy could be ‘bigger’ than its EV business

Write comment (97 Comments)

Tesla continues to produce the Model S and Model X more for &sentimental reasons than anything else,& CEO Elon Musk said Wednesday during a call with investors, calling the electric vehicles &niche& products.

&They are really of minor importance to future,& Musk added.

Sales of Tesla Model 3 vehicles far outpace its the companyolder Model S and Model X vehicles. Tesla delivered 17,483 Model S and Model X vehicles in the third quarter, compared to 79,703 Model 3 cars. And Musk anticipates the Model Y, which has yet to be produced, could surpass Model 3 sales.

Still, while the Model S and X are more expensive and lower volume than the Model 3, the vehicles have been important to the financial health of the company for years. Teslaautomotive gross margins have been buffeted in the past by sales of the higher-priced (and better margin per vehicle) Model S and X vehicles.

The vehicles might not be part of the companylong-term future. But for now, Tesla is sticking with the two vehicles.

Tesla is increasing production on Model S and X lines for this quarter in response to increasing demand for the electric vehicles, CFO Zach Kirkhorn noted during the call.

As Tesla has launched, ramped and stabilized Model 3, the company is nowable to focus its attention on the rest of its products, Kirkhorn said.

Tesla continues to see astrengthenedorder rate, which the company anticipates will be reflected in Model S and X deliveries in the fourth quarter, Kirkhorn added.

Musk did take time to rave about the Model S, particularly the newer version, which has a new &Raven& power train.

&It&s so easy to drive, it makes you feellike Superman driving that car,& he added. &And it&sincredibly safe.&

Musk then described the X as &the faberge of cars,& before adding that &itan art piece basically.&

- Details

- Category: Technology

Read more: Elon Musk: Model S, Model X production continues for ‘sentimental reasons’

Write comment (99 Comments)Page 550 of 5614

7

7