Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

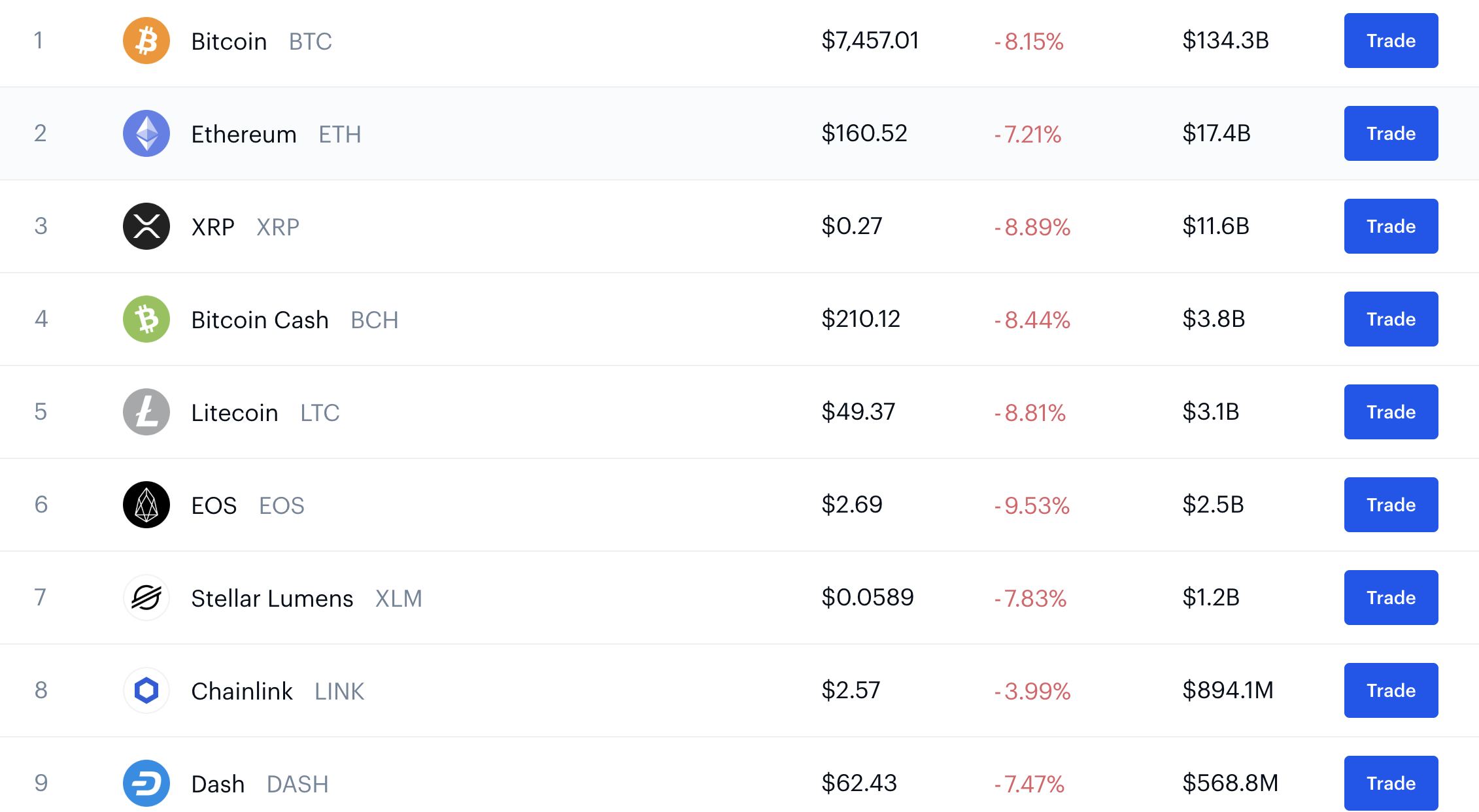

The price of Bitcoin and other cryptocurrencies tanked today, continuing a months-long slide that has seen the value of the digital currency slide by more than $2,000 from highs of above $10,000 earlier in the year.

Investors are still speculating about the cause of the crash, but hopeful cryptocurrency bulls before today had hoped that $8,000 would be the new floor for Bitcoin.

No longer. Today the price of Bitcoin dropped to $7,448.75, down from around $8,000 earlier in the day.

Investors aren&t sure whatbehind the crash, but Bitcoincommentariat pointed to two likely culprits.

One was the underwhelming performance of Facebookchief executive Mark Zuckerberg in testimony before Congress on the Libra cryptocurrency that his company is leading the charge to create.

However, an underwhelming performance from Zuckerberg and the potential fate of Libra, which cryptocurrency purists have scoffed at anyway, may be less concerning for the Bitcoin crowd than developments happening in Google quantum computing research labs around the world.

Earlier today, Google declared quantum dominance, indicating that it had solved a problem using quantum computing that a supercomputer would have taken years to solve. Thatgreat news for theoretical physicists and quantum computing aficionados, but less good for investors who&ve put their faith (and billions of dollars) into a system of record whose value depends on its inability to be cracked by computing power.

When news of Googleachievement first began trickling out in late September (thanks to reporting by the Financial Times), Bitcoin experts dismissed the notion that it would cause problems for the cryptocurrency.

&We still don&t even know if itpossible to scale quantum computers; quite possible that adding qbits will have an exponential cost,& wrote early Bitcoin developer Peter Todd, on Twitter.

The comments, flagged by CoinTelegraph, seem to indicate that the economic cost of cracking Bitcoincryptography is far beyond the means of even Alphabetmultibillion-dollar budgets.

Still, it has been a dark few months for cryptocurrencies after steadily surging throughout the year. The real test, of course, of the viability of Bitcoin and the other cryptographically secured transaction mechanisms floating around the tech world these days is whether anyone will build viable products on their open architectures.

Aside from a few flash-in-the-pan fads, the jury is very much still out on what the verdict will be.

That uncertainty affects more than just Bitcoin, and, indeed, the rest of the market also tumbled, as Coindesk pricing charts indicate.

- Details

- Category: Technology

Read more: Bitcoin and cryptocurrencies are having a very bad day

Write comment (97 Comments)Founders start a company because they have an idea they want to bring to market. As their company gains traction and matures, the way in which they manage their business needs to evolve to enable strategic decisions for growth.

Developing and properly managing acapitalization table(cap table) is one such necessary business evolution. In this context, capitalization is the sum and itemization of all those who hold equity in the company or the right to receive equity in the future. Tracking these items through a central means helps illustrate the ownership stakes in the business and what securities the company has outstanding.

For a first-time founder, it can be overwhelming to develop a cap table and make all related decisions. However, with the right resources and adoption of best practices, founders can better manage, maintain and leverage their cap table to provide actionable business intelligence and management.

For better business intelligence, look to your cap table

In many ways, the cap table is akin to the balance sheet in the sense that it represents the companyposition as of a certain point in time. The balance sheet shows the companyassets and liabilities. The cap table shows the companyownership and accompanying economic and voting rights. The cap table includes factors such as shareholder information, ownership position, rights to purchase additional equity in the future, vesting schedules, voting percentages and purchase price. It takes all of the material information related to capitalization and summarizes it into a digestible format to help founders make executive-level decisions for soliciting stockholder approvals, issuing grants to new hires, raising additional rounds of financing, calculating liquidation waterfalls for a liquidity event, etc.

When it comes to how much founders need to own the cap table, think about it this way: Not every CFO needs to build out the financial statements. However, every CFO needs to have a high degree of confidence that their financial statements are accurate — with systems in place to ensure accuracy so they can spend their time using the financial statements to make strategic decisions. The same is true for founders& involvement with their cap tables. Most companies rely on competent legal counsel to maintain their cap table and provide their executive team with actionable information in a digestible format.

Here are six best practices that help founders improve and maintain an effective cap table management process.

1. Familiarize yourself with its basic elements and formats

There are many different elements and formats of a cap table. Viewed as a spreadsheet, table or chart, the cap table can look different for every company at every stage of its growth. While the cap table tends to be simple in the beginning stages of the company, it will naturally evolve and become much more complicated as the company matures.

At a basic level, the cap table should list the equity stakes in a company, including common stock,preferred stock and stock options, and outline all of the ownership details for these securities. Other elements include transaction history and legal restrictions, such as sales, transfers, exercises of options, transfer restrictions and the conversion of debt to equity, among others.

The cap table should show the companyoverall capital structure at a glance, as well as detailed ownership information for each class and series of stock outstanding (see an example at the end of this article). Most importantly, it should always be accurate and up to date.

2. Recognize the importance of executive alignment

At its core, the cap table should be designed to help solve business issues for you. If you&re not using it to make decisions as an executive team, then itnot serving a core purpose. The cap table is also critical to your legal team, so certain aspects may be primarily for their use, but if the companymanagement doesn&t find the cap table helpful, that is a problem.

Creating good habits early on will serve you well as the business grows.

A good example of this is its role in the hiring process. Equity is a key consideration in talent recruitment and retention packages. Without an accurate cap table, you&ll find yourself in situations where you have to routinely ask yourself how many shares you can offer to a new hire, which can unnecessarily slow down the hiring process.

However, if you can use the cap table as a way to gain alignment on such matters, you can begin to use it to solve actual business problems. Rather than argue about which equity package to grant a new employee, your HR team can provide routine feedback on standardized equity packages to help improve or maintain competitive compensation.

3. Evaluate and implement tools to help you manage it

When it comes to understanding how detailed your cap table needs to be, compare it once again to the financial statements. In the early days of the business, financial statements don&t necessarily feel as valuable as they do in later stages of growth. They aren&t as critical to the business — yet — because itnot hard to recreate it whenever you need information to make a decision.

However, as the business matures and grows, it becomes more difficult to recreate the financial statement on an ad hoc basis, and virtually impossible to hold the information accurately in your mind. The same holds true with the cap table: In the beginning, you might be able to rattle it off the top of your head or have it documented simply in Excel, but as you grow, the information becomes more complex and you need better, automated systems in place. As with financial statements, creating good habits early on will serve you well as the business grows.

Using cap management software provides better capabilities and version control than spreadsheets to manage this process. Free software, such ascaptable.ioand Carta are great starting places for early-stage founders. Carta also provides additional features to manage your more complex cap table. Because the cap tableultimate purpose is to enable the executive and legal teams to make informed decisions, safeguards on administrative access and version control are critical features to consider when choosing which tool or application to use.

4. Determine and delegate ownership of the cap table

As you model new rounds of financing and analyze the impact on stakeholders, cap table management becomes a significantly valuable activity. This is where your legal team or outside counsel becomes even more advantageous to you as a founder. Delegating cap table management to your lawyer can further help you stay on top of critical changes and minimize errors, while enabling you to focus more on building and scaling the business. Creating and maintaining an accurate cap table requires an ability to read, understand and translate legal documents into numbers and formulas. It is best to rely on the expertise of your legal team for this to ensure the most accurate business decisions are made.

Your cap table should be well-managed, well-understood and up-to-date.

We frequently see founding teams make seemingly small mistakes, such as adding an individualname to the cap table before an equity grant has legally been made. This may lead one to believe that more stock is outstanding than is technically the case and can create errors when calculating the number of shares to be granted to subsequent stockholders — or miss making the grant altogether, which can have unfortunate tax consequences for the stockholder and potential liability for the company. Order of operations is critical to legal workflows and itbest to leave the day to day cap table maintenance to your legal team.

5. Decide how much information to share with investors

When it comes to how much cap table information you should disclose to your investors, there isn&t a right or wrong answer. Commonly, providing investors with a summary cap table is a fairly standard practice. That allows investors to calculate their ownership position for their internal tracking and audit purposes. More often than not, investors don&t receive an itemized list of every shareholder or investor in the company. While preferences differ on this point, many of our clients prefer that any company-related discussions are directed to the executive team so they can address and control messaging. Of course, in many instances investors will know which of their peers have also invested, but sharing detailed equity positions, contact information and individual employees& equity stakes is less common.

In Carta, investors generally have portfolio views with visibility into all of their companies. They might send you a request for access to your cap table so they can add you to their portfolio. In this scenario, the summary cap table is the most common approach people default to for the investors. If an investor feels strongly about receiving detailed cap table viewing privileges, they can make their case to the company, which may consider the request on an individual basis.

Major investors will typically have specific, private contractual rights to get regular financial statements and cap table updates. They might even have a representative who is a board observer or board member, in which case, they will have access to the information they want, as agreed to in the equity financing paperwork.

6. Choose how much to share with employees

Understanding the appropriate levels of information about your cap table to share with employees is another top consideration for founders. The key to this is determining the balance that you, as a founder, feel comfortable with in terms of employer transparency.

Some founders choose to be transparent about their cap tables and others opt not to disclose much and provide equity information on a need-to-know basis. The important part here is determining how you can best use the cap table to help your employees understand what they need to know.

For example, employees with equity want to understand what their payout is if the company sells. Regular communication or resources that provide employees with access to their holdings and options is a great approach to help motivate employees and improve talent retention, but can have unintended consequences.

For example, most companies will have their common stock valued after each round of financing. Some founders will want to share this number with the team so that people can understand that their stock is appreciating. That is very exciting and motivating — so long as everything is going well. However, if the stockappreciation is not meeting the teamexpectation (whether reasonable or not), then providing that information can significantly decrease morale. For this reason, the vast majority of companies choose not to disclose this information to the broader team.

Get proactive with your cap table

Your cap table should be well-managed, well-understood and up-to-date. Fortunately, the management process doesn&t need to become just another headache: With the proper considerations, communication, resources and ownership, you can put the correct processes and legal team in place efficiently, and effectively manage your cap table so it continues to help you scale your business — rather than slow it down.

Sample cap table

This table represents a simple cap table showing a hypothetical breakdown of seed preferred stock, Series A preferred stock, common stock and the available option pool.

All content presented herein is for informational purposes only. Nothing should be construed as legal advice. Transmission and receipt of this information is not intended to create, and does not constitute, an attorney-client relationship with Atrium LLP. There is no expectation of attorney-client privilege or confidentiality of anything you may communicate to us in this forum. Do not act upon any information presented without seeking professional counsel.

- Details

- Category: Technology

Read more: 6 considerations for managing your cap table

Write comment (90 Comments)

Koan, a three-year-old online platform that aims to help teams achieve their objectives and stay engaged, has raised $3 million in seed funding led by Uncork Capital and Crosslink.

Koan, co-founded and led by CEO Matt Tucker — who previously co-founded Jive Software, an outfit that made social software for businesses and went public in 2011, then sold in 2017 — is trying to set itself apart from the many other performance management tools in the world by catering less to HR departments and targeting instead the chief operating officer or chief of staff.

Though these individuals today rely heavily on emails and spreadsheets — static products that can slow down execution — Koan tries to make them more efficient by providing them with a dashboard that makes it easier to track goals, provide feedback and execute other people-management tasks.

The company is also targeting leaders of small to mid-size companies. The broader idea is to help them with goal management, and to make it easier for them to make progress against their own metrics and goals.

Koan, which integrates with a wide number of third parties, from Salesforce to Slack, employs just 10 people at this point and is based in Portland, Ore., though Tucker works from Palo Alto, where, interestingly, he and his wife also operate a company called Blind Tiger Ice.

Inspired by their international travels to upgrade in some way their local dining (and drinks) experience, the couplenearly two-year-old company is becoming known in some tech circles for its &high-quality cocktail ice,& as Tucker describes it. Among its customers: Netflix, Facebook, Google and the world-famous Yountville, Calif.-based restaurant French Laundry.

Every once in a while, too, says Tucker, his worlds collide. Recently, for example, the venture firm CRV called Blind Tiger to order ice for a party it was throwing. The portfolio company it was celebrating: Iterable, a growth marketing startup and also a Koan customer.

Koan has now raised $5 million. Earlier investors include the Webb Investment Network, SV Angel and Spider Capital, all of which participated in the companynewest round.

Above, left to right: Co-founders Matt Tucker and Scott Campbell, an early salesperson at Jive Software.

- Details

- Category: Technology

Read more: Koan, launched by a co-founder of Jive Software, has raised $3 million in seed funding

Write comment (95 Comments)

Tesla returned to profitability in the third quarter after two periods of losses surprising Wall Street and sending shares higher in after-market trading, according to earnings reported after the market closed Wednesday.

The automakerthird-quarter results included $143 million in net income, or 80 cents a share, compared with $311 million, or $1.82 a share, in the same year-ago period. Tesla earned $342 million, or $1.91 a share, in the third quarter when adjusted for one-time items.

Analysts had expected a loss of 46 cents per share and revenue of $6.42 billion, according to data compiled by FactSet.

Tesla reported revenue of $6.3 billion, slightly lower than the $6.35 billion generated in the previous period and more than 7.5% lower than the same quarter last year. But it was in line with analysts expectations.

Tesla said it is &highly confident& deliveries will exceed 360,000 deliveries this year.

The third-quarter report sent Tesla shares as high as 17% in after-market trading.

Tesla was also able to improve its automotive gross margins, an important sign of its financial health. The automotive gross margin widened to 22.8% in the third quarter, from 18.9% in the previous period. The automotive gross margin has not yet recovered to the 25.8% of the same quarter in 2018.

Tesla also reported free cash flow (operating cash flow less capital expenditures) of $371 million. The companycash and cash equivalents balance increased to $5.3 billion.

&We continue to believe our business has grown to the point of being self-funding,& Tesla said in its earnings report.

The third-quarter report contained a number of positive signs for the automaker and marked a reversal from several consecutive quarters of losses. Tesla said its factory in Shanghai is ahead of schedule and trial production has started.

The Model Y is also ahead of schedule, Tesla said. Production of the Model Y is expected to begin by summer 2020.

Last quarter, Tesla reported a wider-than-expected loss of $408 million, or $2.31 per share, and generated $6.3 billion in revenue in the second quarter despite record deliveries of its electric vehicles.

Other important highlights from the third quarter:

- The average selling price of Teslavehicles have fallen. Tesla noted that the mix of Model 3 variants had increased.

- Automotive revenues were flat at $5.35 billion compared to the previous quarter. The company was able to reach profitability in large part due to cost-cutting measures. Operating expenses were 15% lower than the previous quarter.

- Tesla said it plans to &gradually release nearly $500 million of accumulated deferred revenue tied to Autopilot and Full Self Driving features.&

- Solar installations rebounded 48% to 43 megawatts in the third quarter. However, installations are still 54% lower than the same period last year.

- Energy storage deployments has continued to grow, reaching an all-time high of 477 MWh in the third quarter.

- Details

- Category: Technology

Read more: Tesla surprises with a profit in the third quarter

Write comment (96 Comments)

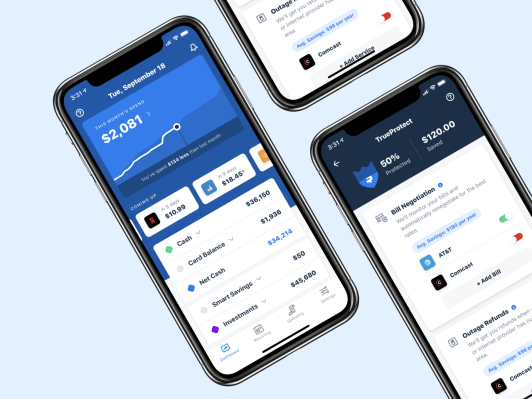

Personal finance startupTruebill announced today that it has raised $15 million in Series B funding.

The new funding was led by Eldridge Industries, with participation from Evolution VC and previous investors, including Cota Capital, Lucas Venture Group and YouTube co-founder Jawed Karim.

When the Y Combinator-backed startup raised seed funding back in 2016, it was focused on what Chief Revenue Officer Yahya Mokhtarzada now describes as &a single function& — helping users track all their subscriptions and recurring expenses, and then to cancel them when desired.

Mokhtarzada said the Truebill team subsequently saw an opportunity, given &the increasing degree of financial complexity in peoplelives,& to take &a more holistic view of personal finance.&

Truebill still offers subscription tracking, and Mokhtarzada said thatusually what brings new users in. But italso added capabilities like automated budgeting, automated saving and bill negotiation. And this fall, it plans to launch additional features, including bill pay, credit score monitoring and a rewards program.

Consumers have plenty of other personal finance tools to choose from, but Mokhtarzada said most of them are focused on fulfilling a specific need and will likely become less relevant as your financial situation changes.

&The other half is, if you look at the App Store, itfilled with single point solutions,& he said. &As your financial life gets more sophisticated and complex, the consumer is ending up with five or more different point solutions. All of that needs to be consolidated into one place.&

Truebill says it currently has 500,000 active users. The basic product is free, then users can pay a price of their choosing for premium features like custom budget categories; Truebill also takes a cut of the savings when it negotiates lower bills.

The company recently opened new headquarters in Silver Spring, Md. Mokhtarzada said Truebill still has an office in San Francisco, but he noted that he and his co-founders/brothers previously built Webs.com in Silver Spring.

&San Francisco obviously has a very competitive market — itharder to hire and very difficult to retain talent,& he added. &With the D.C. area, it feels like we&ve found an untapped market, with very talented engineers working for the government, working in an area of technology thatnot very exciting for them.&

- Details

- Category: Technology

Read more: Truebill raises $15M to build a comprehensive platform for personal finance

Write comment (100 Comments)

Natalie Massenet, the fashion entrepreneur who founded the designer fashion portal Net-a-Porter, chaired the British Fashion Council for four years and today runs Imaginary Ventures, a venture firm thatfocused on consumer startups, took the stage a bit ago at Vanity FairNew Establishment Summit. There, she was asked why Imaginary has funded more women founders than men (it has just happened that way, suggested Massenet). She was also asked about starting a brand and enumerated the ways that it has become dead simple to do it, from services like Shopify that make launching a storefront easy, to third party logistics companies that make shipping product a cinch, to services like Affirm that make it easier to get paid.

Massenet, of course, noted the challenges of operating in a sea of other brands, many of which are inclined to copy one another. In fact, she recounted that when Net-a-Porter launched, it did so, to her great aggravation, with copy published sideways and upside down on its website — a move that was then replicated by rivals that believed the mistake was by design.

But she also underscored the reasons that direct-to-consumer brands should, if they can swing it, set up actual brick-and-mortar spaces, which a growing number are doing.

- Details

- Category: Technology

Read more: Founder-investor Natalie Massenet on how new brands win

Write comment (90 Comments)Page 552 of 5614

20

20