Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

As access to top deals becomes more competitive, venture capital firms are creating new roles to attract top entrepreneurs. Now, in addition to recruiting top dealmakers, firms are bringing in culture experts and allocating roles to individuals who better understand and empathize with the founder journey.

In keeping with this trend, Redpoint Ventures, a venture capital firm with roots in Silicon ValleySand Hill Road, has hired a partner and its first-ever &head of founder experience.& Travis Bryant, who joined the firm one year ago as an entrepreneur-in-residence, will be focused on how founders perceive the Redpoint brand, ensuring each individual moment a founder spends with the firm is as founder-friendly as possible.

Historically, VC firms hired investment partners to network, invest in companies and help foster those companies& growth over a years-long period. Increasingly, these same firms are identifying new talent to provide to founders more attention, resources and support through the company-building process as a means to win access to top deals.

Earlier this month, True Ventures hired its first-ever vice president of culture, Madeline Kolbe Saltzman, who explained she would be guiding &the company and the founder to being the best they can be.& Bryant, for his part, will have a host of responsibilities, including supporting existing programs and services tailored to the needs of portfolio founders, and even remodeling the office to create a better &flow& for founders. Basically, Bryant will think through all the ways Redpoint can leave a positive, lasting impression on the companies it invests in and even the companies it rejects.

&The founder is the center of the solar system,& Bryant tells TechCrunch. &Itnot about them coming to pitch us. Ithow do we help them develop their idea and how do we give them the confidence to get it out in the world.&

One might have thought venture capitalists would steer away from the cult of the founder mentality amid the WeWork saga of 2019. Arguably, tech-founder worship allowed WeWork to garner a baseless $47 billion valuation as a result of the billions in equity funding its founder used to purchase a private jet, make several poorly thought-out acquisitions and commit other irresponsible acts that resulted in a delayed initial public offering, hundreds of layoffs and more to come.

Redpointlatest hire, if anything, suggests tech-founder worship is far from being erased. To that point, Bryant says his role is less about the founder and more about creating an environment that fosters more human-to-human relationships, bidding adieu to the traditional startup-VC dynamic.

&In the past, a founder might have just wanted to work with a VC because of their prior performance with a goal to just get money, but now itmoney-plus-plus,& Bryant said. &What are you going to do actively? What can you do to help them cross this chasm and get their idea out and make it successful.&

&The expectation of investors is much more significant,& Bryant added. &Itnot about writing a check and hoping to turn that check into something. Itabout adding value.&

- Details

- Category: Technology

Read more: Venture capital firm Redpoint hires a ‘head of founder experience’

Write comment (96 Comments)

When Bill McDermott announced he was stepping downas CEO at SAP a couple of weeks ago, it certainly felt like a curious move — but he landed on his feet pretty quickly. ServiceNow announced he would be taking over as CEO there. The transition will take place at year-end.

If you&re wondering what happened to the current ServiceNow CEO, John Donahoe, well he landed a job as CEO at Nike. The CEO carousel goes round and round (and painted ponies go up and down).

Jeff Miller, lead independent director on the ServiceNow board of directors, was &thrilled& to have McDermott fill the void left by Donahoedeparture. &His global experience and proven track record will provide for a smooth transition and continued strong leadership. Bill will further enhance ServiceNowmomentum and reputation as a digital workflows leader committed to customer success, and as a preferred strategic partner enabling enterprise digital transformation,& Miller said in a statement.

Jennifer Morgan and Christian Klein replaced McDermott as co-CEOs at SAP, and during the announcement, McDermott indicated he would stay until the end of the year to help with the transition. After that, no vacation for McDermott, who will apparently start at ServiceNow after his obligations at SAP end.

As Frederic Lardinois wrote regarding McDermottresignation:

I last spoke to McDermott about a month ago, during a fireside chat at our TechCrunch Sessions: Enterprise event. At the time, I didn&t come away with the impression that this was a CEO on his way out (though McDermott reminded me that if he had already made his decision a month ago, he probably wouldn&t have given it away).

ServiceNow is a much different company than SAP. SAP was founded in 1972 and was a traditional on-premises software company. ServiceNow was founded in 2004 and was born as a SaaS company. While McDermott was part of a transition from a traditional, on-premises enterprise software company to the cloud, working at ServiceNow he will be leading a much smaller organization. Published estimates have SAP at around 100,000 employees, while ServiceNow now has around 10,000.

Itworth noting that the company made the announcement after the market closed and it announced its latest quarterly earnings. Wall Street did not appear to the like news, as the stock was down $13.34, or 5.84%, in early after-hours trading.

- Details

- Category: Technology

Read more: Former SAP CEO Bill McDermott taking over as ServiceNow CEO

Write comment (92 Comments)

After erasing more than $30 billion in projected shareholder value, Adam Neumann could walk away from the We Company with a windfall of as much as $1.7 billion, according to a report in The Wall Street Journal.

This is how the company will end, not with the pop of a successful public offering, but with a whimper from defeated investors probably tired after the months-long saga of trying to make sense of how a clever real estate plan ballooned into one of the greatest swindles in venture capital history.

Already ousted as the companychief executive, Neumann controlled shares of the company that gave him what amounted to significant control even after his removal.

The We Company drama has it all. Complacent directors, horrible management, rapacious greed — wrapped in a package of holistic spirituality and the invention of a new kind of conscious capitalism. Even if it was ultimately a capitalism that was conscious only of its ability to deceive.

As Neumann leaves, SoftBank will gain control of the company it had once valued at $47 billion, but at a far more modest $8 billion figure. Still, the bid was more attractive to The We Companyboard of directors than a competing offer from JPMorgan Chase, according to the Journalreporting.

Under the terms of the deal, SoftBank will buy nearly $1 billion in stock from Neumann, who was already forced out from the company he co-founded as public markets balked over his managerial acumen. The Japanese conglomerate, which had pushed up the private market valuation of WeWork through its $100 billion Vision Fund, will also stake Neumann $500 million in credit to repay a loan facility and give him a $185 million consulting fee. As a result, Neumann will now be on the hook to Softbank for the loan.

Even with the Hindenburg-level catastrophe that Neumann piloted as the chief executive of the money-losing real estate venture, the former chief executive will still retain a stake in the company and remain an observer on the board of directors.

In all, SoftBank is putting in a tender offer for as much as $3 billion to go to the companyemployees and other investors. In fact, WeWork needs the money to be able to afford the layoffs it reportedly wants to make as it tries to right the ship.

People with knowledge of the companyplans said the decision could be announced today, according to the Journalreporting.

Part of the reason for the $500 million loan was that Neumannremoval from the executive role at the company risked putting him in default with his JPMorgan loans.

WeWorkrevealedan unusual IPO prospectus in August after raising more than $8 billion in equity and debt funding. Despite financials that showed losses of nearly $1 billion in the six months ending June 30, the company still managed to accumulate a valuation as high as $47 billion, largely as a result of Neumannfundraising abilities.

&As co-founder of WeWork, I am so proud of this team and the incredible company that we have built over the last decade,& Neumann said in a statement confirming his resignation last month. &Our global platform now spans 111 cities in 29 countries, serving more than 527,000 members each day. While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive. Thank you to my colleagues, our members, our landlord partners, and our investors for continuing to believe in this great business.&

- Details

- Category: Technology

In a working environment obsessed with metrics dashboards, key performance indicators, and objectives and key results, the legal function presents an elusive target. Compared to sales, marketing and product, &legal& in a growing tech company can seem an inaccessible alchemy of risk, contracting and policy.

But interviews with general counsels attechcompanies and a survey conducted byTechGC — a private community of top lawyers at technology companies across the United States — reveal how innovative in-house attorneys measure both productivity and quality and position their teams as central to advancing enterprise-wide goals.

The Status Quo

Legal lags behind other departments in the metrics game. While more than three-quarters of general counsels surveyed said their companies collected regular, department-specific metrics,only 29% indicated that the metrics regime extended to the legal department.

Many point to the unpredictable and reactive nature of a GCwork as a key barrier to collecting informative metrics. As Sarah Feingold, former general counsel at Etsy and Vroom, explains, &if therea dispute or therean employment issue, everything else drops.& Absent an established operating history against which to measure, it can be hard to identify trends and put those disputes in context. &I could say, ‘oh we didn&t get sued this quarter,& but thatnot necessarily so indicative of my performance as the general counsel,& adds Katherine Hooker, Head of Legal at Greenhouse.

Productivity - Quality

Faced with these challenges, many general counsels first turn to a &goal cadence& — a set of time-bound, objectively measurable goals against which to report progress. Goal Cadences come in many forms including &Objectives and Key Results [OKRs],& &Management by Objective [MBOs],& and &Goals/Signals/Metrics [GSMs].&

&At the beginning of the planning period, I map out key projects — closing a financing, data security audits, updating TOS and privacy policies — and lay those out across the period. Then itsimply: did I finish projects on time yes or no,& says David Pashman, former GC at Meetup and current GC at JW Player . More than 40% of GCs surveyed collect OKRs or something similar (the second-most commonly collected metric after legal spend [74%]).

Measuring outputs and productivity has its rewards, as Colin Sullivan, head of legal at Patreon explains. &When you measure, there are two purposes: one is to improve and the other is to demonstrate the value you are providing to the company.& Many GCs stressed the power of metrics collection and presentation as key in characterizing how the company at large viewed the legal department.

But over-reliance on OKRs risks treating productivity as a proxy for quality, which can be more challenging to pin down. A full 45% of GCcharacterized the method they use to judge the performance of their own direct reports as &kind of a Potter Stuart Thing (‘I know it when I see it&),& a phrase famously used by Supreme Court Justice Potter Stuart to characterize hardcore pornography in Jacobellis v. Ohio.

To to penetrate the qualitative side, GCs turn primarily to flash surveys of internal clients (e.g. the sales team) and to &360 reviews& — recurring professional feedback from both direct reports, lateral colleagues and managers. Regular reviews offer minimal disruption and a cost-effective method for generating metrics that can be compared over time to illustrate trends. As Ben Alden, GC at Betterment assesses it, 360 reviews offer an efficiency play. &A fully-scoped procurement process could include metrics on speed, cost and comparisons against benchmarked best practices. But that takes a lot of overhead to set up; versus a solid 360 review process makes sure that people are performing at their best and is ready out of the box.&

Version 2.0

More sophisticated metrics regimes yield more granular measures. In addition to core financial metrics like spend on outside counsel and performance against budget and spend as a percentage of overall operating expense, general counsels focus on tracking items like deal terms and risk exposure.

- Details

- Category: Technology

Read more: How tech companies measure ‘legal’

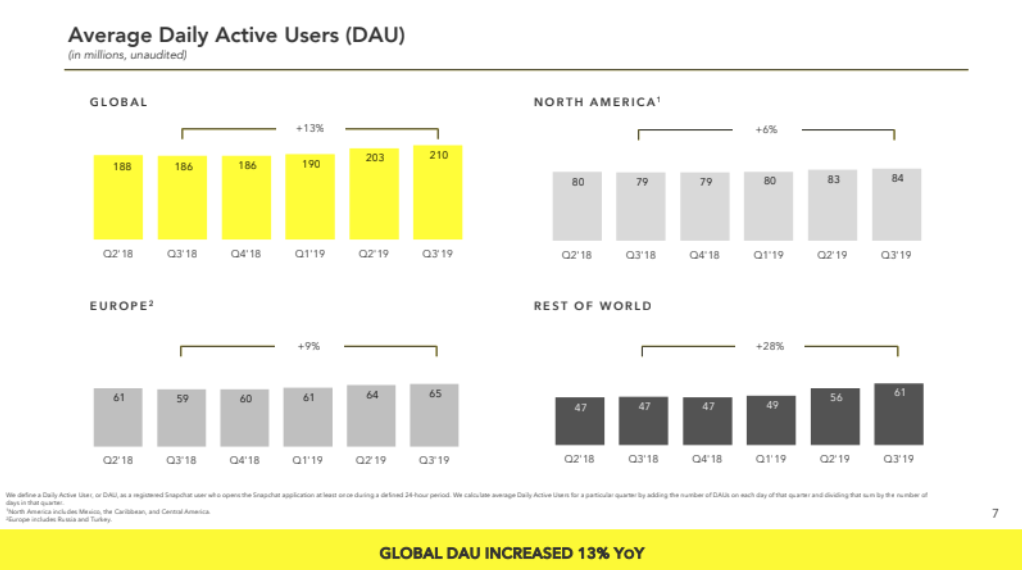

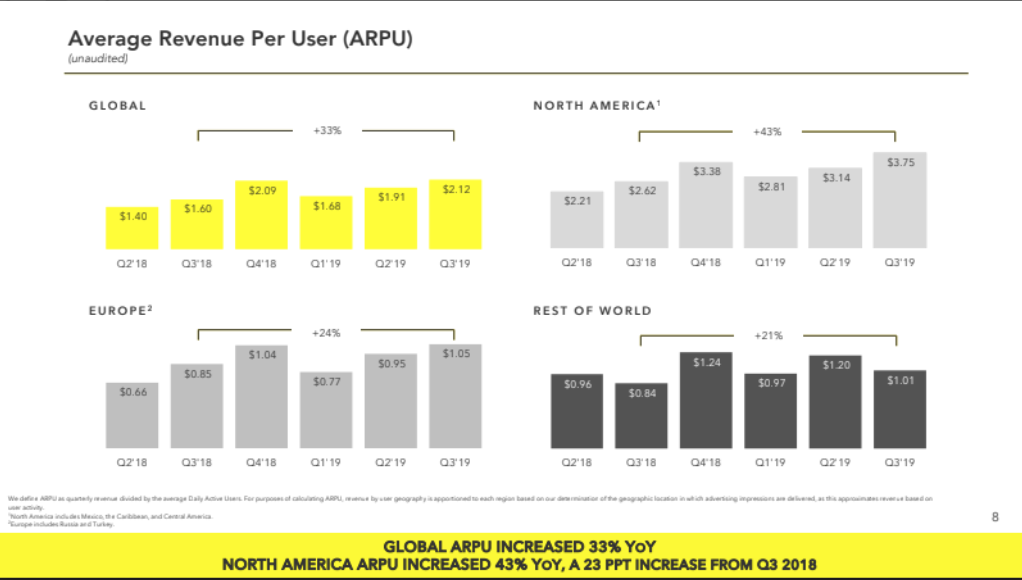

Write comment (93 Comments)The Snap-back continues. Snapchat blew past earnings expectations for a big beat in Q3, as it added 7 million daily active users this quarter to hit 210 million, up 13% year-over-year. Snap also beat on revenue, notching $446 million, which is up a whopping 50% year-over-year, at a loss of $0.04 EPS. That flew past Bloombergconsensus of Wall Street estimates that expected $437.9 million in revenue and a $0.05 EPS loss.

Snap has managed to continue cutting losses as it edges toward profitability. Net loss improved to $227 million from $255 million last quarter, with the loss decreasing $98 million versus Q3 2018.

CEO Evan Spiegel made his case in his prepared remarks for why Snapchatshare price should be higher: &We are a high-growth business, with strong operating leverage, a clear path to profitability, a distinct vision for the future and the ability to invest over the long term.&

Snapchatshare price had closed down 4% at $14, and had fallen roughly 4.6% in after-hours trading as of 1:50 pm Pacific, to $13.35, despite the earnings beat. It remains below its $17 IPO price but has performed exceedingly well this year, rising from a low of $4.99 in December.

Thatpartially because of the high cost of Snapchatgrowth relative average revenue per user. While it notes that it saw user growth in all regions, 5 million of the 7 million new users came from the Rest of World, with just 1 million coming from the North America and Europe regions. Thatin part thanks to better than expected growth and retention on its re-engineered Android app thatbeen a hit in India. But since Snapchat serves so much high-definition video content but it earns just $1.01 average revenue in the Rest of World, it has to hope it can keep growing ARPU so it becomes profitable globally.

Some other top-line stats from Snapchatearnings:

- Operating cash flow improved by $56 million to a loss of $76 million in Q3 2019, compared to the prior year.

- Free Cash Flow improved by $75 million to $84 million in Q3 2019, compared to the prior year.

- Cash and marketable securities on hand reached $2.3 billion.

Interestingly, Spiegel noted that &We benefited from year-over-year growth in user activity in Q3 including growth in Snapchatters posting and viewing Stories.& Snapchat hadn&t indicated Stories was growing in at least the past two years, as it was attacked by clones, including Instagram Stories that led Snapchat to start shrinking in user count a year ago before it recovered.

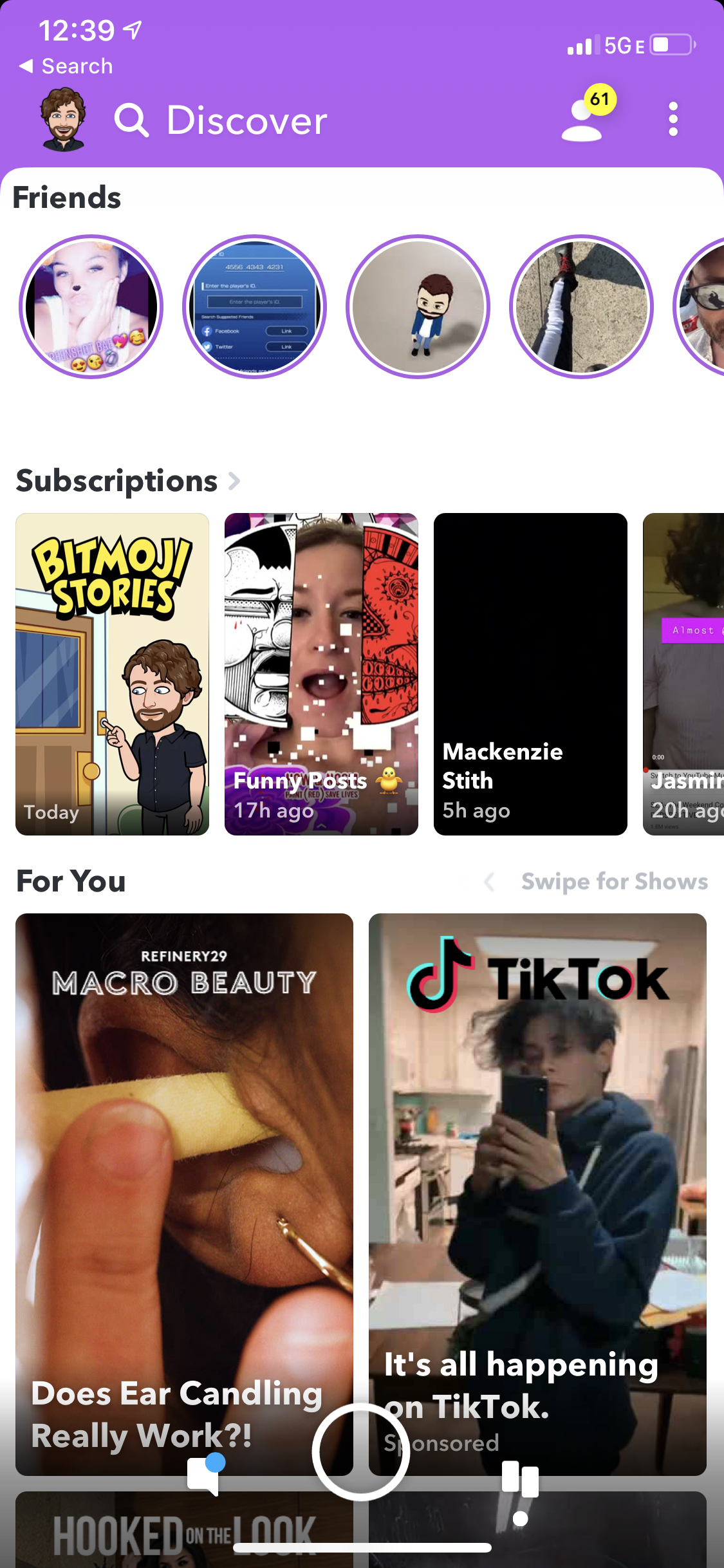

Since Stories viewership is critical to total ad view on Snapchat, we may see analysts insisting to hear more about that metric in the future. Snap also said users opened the app 30 times per day, up from 25 times per day as of July 2018, showing itstill highly sticky and being used for rapid-fire visual communication.

The other major piece of Snapchatad properties is Discover, where total time spent watching grew 40% year-over-year. And rather than being driving by just a few hits, more than 100 Discover channels saw over 10 million viewers per month in Q3. With InstagramIGTV a flop, Discover remains Snapchatbest differentiated revenue driver, and one it needs to keep investing in and promoting. With Instagram trying to compete more heavily on chat with its new close friends-only Threads app, Snapchat can&t rely on ephemeral messaging to keep it special.

TikTok buys ads on Snapchat that could steal its users

Surprisingly, Spiegel said that &We definitely see TikTok as a friend& when asked about why it allowed the competitor to continue buying ads on Snapchat. The two apps are different, with Snapchat focused on messaging and biographical social media while TikTok is about storyboarded, premeditated social entertainment. But this could be a dangerous friendship for Snapchat, as TikTok may be taking time away that users might spend watching Snapchat Discover, and its growth could box Snapchat out of the social entertainment space.

Looking forward, in Q4 Snap is estimating 214 to 215 million daily active users and $540 million to $560 million in revenue. Itexpecting between break even and positive $20 million for adjusted EBITDA. That revenue guidance was below estimates for the holiday Q4, contributing to the share price fall.

Snap has a ways to go before reaching profitability. That milestone would let it more freely invest in long-term projects, specifically its Spectacles camera-glasses. Spiegel has said he doesn&t expect augmented reality glasses to be a mainstream consumer product for 10 years. That means Snap will have to survive and spend for a long time if it wants a chance to battle Apple, Facebook, Magic Leap and more for that market.

- Details

- Category: Technology

Read more: Snapchat beats in Q3, adding 7M users revenue up 50%

Write comment (98 Comments)There is no bigger industry on our planet than food and agriculture, with a consistent, loyal customer base of 7 billion. In fact, the World Bank estimates that food and agriculture comprise about 10% of the global GDP, meaning that, food and agriculture would be valued at about $8 trillion globally based on the projected global GDP of $88 trillion for 2019.

On the food front,a record$1.71 trillion was spent on food and beverages in 2018 at grocery stores and other retailers and away-from-home meals and snacks in the United States alone. During the same year, 9.7% of Americans& disposable personal income was spent on food — 5% at home and 4.7% away from home — a percentage that has remained steady amidst economic changes over the past 20 years.

However, despite a stalwart customer base, the food industry is facing unprecedented challenges in production, demand and regulations stemming from consumer trends. Consumer demands and focus have changed in recent years. An increasing focus by consumers on sustainability, health and freshness has placed significant pressure on the food industry to innovate.

Innovation imperative

In recent years, agtech innovators have created exciting new ways to harness the power of technology to enhance the worldfood supply. Agtech innovations are protecting crops and maximizing outputs — enabling structural changes in the agriculture system that could achieve important sustainability goals of lowering greenhouse gasses, reducing water use, ending deforestation and potentially even sequestering carbon back into soil.

But this is just the beginning. As everyone needs to eat (multiple times a day!), there remains a huge opportunity for investments in innovative food and beverage technology, or food tech, that better the health of our food ecosystem through novel ingredients and improved diets via better food distribution, preservation and access.

The opportunity to use technology to improve food is massive and extends to improving food usage and decreasing waste — a key to minimizing the environmental impacts of a growing human population. Cognizant of this huge opportunity, venture capitalists are closely tracking this space. According to PitchBook, funding for food tech has skyrocketed from about $60 million in 2008 to more than $1 billion in 2015. And unique investments from VCs and private equity funds have doubled from 223 in 2015 to 459 in 2017, according to CB Insights. In examining total investments made, along with exit activity, food tech has now surpassed agtech on both fronts. This is still relatively small, given the food tech sectorlarge potential customer base globally of more than 7 billion people (and growing).

Key drivers of food tech investments

Consumers are getting pickier about what they eat. They are juggling hectic work and personal lives, and demand convenience when it comes to their meals. But this convenience cannot come at the expense of quality. Now more than ever, people want to know whatin their food, where it came from and how its production and sourcing impacts the environment.

An increasing focus by consumers on sustainability, health and freshness has placed significant pressure on the food industry to innovate.

In years past, consumer packaged goods (CPG) incumbents rushed to deliver on these heightened demands — promising convenient, superior-quality food. But falling margins on commodity ingredients, coupled with industry consolidation, have discouraged these efforts, and many have refocused their attention — leaving the door open for a new wave of hungry (pun intended) innovators and startups.

Todayconsumers are not only looking for convenience and consistency, but are also seeking nutritious food that can be accessed with ease, limits waste creation and aligns with their personal brands. In reality, it has never been more difficult to be a food company. Consumer demands have expanded to include ethical mantras but have not given way to requirements of convenience. However, spending trends show that consumers are ready and willing to pay a premium for food tech innovations that can meet their ever-increasing needs of convenience, health and low environmental impact. The opportunity for food innovators to capitalize on these market demands is growing!

Food tech present

Today, grocery ordering and delivery represents the largest food tech category, while meal ordering comprises the greatest number of privately held, venture-backed startups in food tech globally. Last year was an exceptional year for food tech, with a record-breaking $16.9 billion in funding recorded. According to Crunchbase, the three biggest deals of the year included $1 billion for Swiggy, Indialeading online restaurant marketplace; $600 million for Instacart, a U.S. grocery delivery service; and $590 million for iFood, a Brazil-basedrestaurant marketplace.

While consumers still have an appetite (again with the puns!) for grocery ordering and delivery plays, investors are becoming increasingly cautious in the wake of meal kit service Blue Apronhigh-profile failure (among others), which emphasized challenges like scalability, the inability to patent food and spoilage and contamination concerns across the supply chain. These missteps have led many investors to turn their attention to new food tech frontiers.

Food tech future

There are three key areas in which food tech innovations are beginning to deliver completely new and novel approaches along the value chain. These areas represent technological approaches addressing serious pain points within the food industry, and we anticipate that these sectors will experience significant growth and investment attention in the coming years.

Consumer food tech

Consumer food tech is the segment within food technology investment that focuses on development of technologies primarily marketed toward the consumer. Be it plant-based meats, novel distribution systems or nutrition-based tech, this segment aims to assuage consumer-driven demands. Examples of consumer food tech innovators include alternative protein/diary, nutrition and meal kit distribution companies.

As the organic food trend reached its peak and began to commoditize, another food trend has risen to take its place. Plant-based, meatless, animal-free … regardless of the moniker given, it seems like everyone is getting into the meatless craze. News or ads trumpeting the arrival of &meatless meat& are unavoidable.

Fast food giants Burger King (via Impossible Foods) and McDonald(via Beyond Meat) are now serving meatless burgers on their menus, attracting new customers that typically shop for food at Trader Joeor Whole Foods.Memphis Meats is another example, as is the retail giantIkea, which is working on a vegetarian version of its infamous Swedish meatballs.

But it doesn&t end there. Other innovative companies are working on the commercialization of alternative proteins such asClara Foods (egg whites from cell cultures), andRipple Foods andOatly that are focused on developing dairy and nut-free milk alternatives.UBS estimates that the market for plant-based proteins alone could expand from just under $5 billion at present to some $85 billion over the next decade, at a roughly 28% growth rate year-over-year.

Meanwhile, companies likeBrightseed,Just andRenaissance Bioscienceare blazing new trails on the biological and nutraceuticals front, seeking ways to produce food and nutritional supplements in cleaner, smarter and more sustainable ways.

Industrial food tech

While some companies focus on the food itself, many others are exploring how to process, package and distribute this new wave of sustainable, healthy and innovative food. Industrial food tech is the sub-segment of food tech that focuses on addressing fundamental business model and B2B pain points within the food industry. The companies include innovators in novel processing and packaging technology and new/functional ingredients that have improved nutritional, labeling or formulation characteristics.

Investments in food tech will continue to increase to help deliver on the promise of healthier, more sustainable food systems.

Food preservation technology companies likeApeel Sciences andHazel Technologies are leading the way in reducing food waste, while improving produce quality during transportation. This is a massive issue ripe for innovation, aspre-consumer food waste comprises 40% of all food wasted in the U.S. Improved food-waste profiles could enable an overall reduction in required arable land.

Food processing/grading technologies will also be at the forefront of this segment; for example, food inspection startup P-P Optica has received financing to develop their food quality and foreign object detection technology. This hyperspectral tech has the potential to provide not only food-safety improvements in automated foreign object detection, but also to enable meat quality grading to be standardized and improved over time.

Coupled with a burgeoning sector in industrial ingredients like emulsifiers, sweeteners and firming agents, among other additives, this segment is growing quickly as large-scale food producers are facing consumer pressure to not only innovate, but also to do so sustainably. Companies likeAromyx are working to quantify things like taste and smell to help enhance production processes across a range of industries, from pharmaceuticals and chemicals to agriculture, food and beverages and consumer packaged goods.

Supply chain - procurement

The Chipotle contamination crisis (and others like it) underscores the importance of improving visibility into food supply chains. Safe Tracesand other startups are helping to increasing food traceability by commercializing new modes of tracking food provenance. Consumer awareness regarding food fraud and requirements for food traceability, as well as records of provenance, are increasing. This has created a strong business case for innovation in the food supply chain to satisfy these demands. Changing consumer preferences for quality, convenience and gourmet products in food service has led to a rise in the category of fast-casual restaurants and placed pressure on fast food restaurants to rethink their delivery models.

Startups likeFarmerFridge (a Finistere portfolio company) andBingoBox package chef-curated meals and snacks in conveniently placed vending machines or unmanned, automated convenience stores.6D Bytes uses AI and machine learning to prepare healthy food, like smoothies, while Starship Electronics has, in partnership with local stores and restaurants, introduced a fleet of robots that deliver food to people.

Innovators in this segment are focused on traceability, sustainability, improving freshness and eliminating food waste. For example, Good Eggs andFarmdrop deliver fresh and sustainably sourced grocery food in reusable packaging, whileFull Harvest encourages the food supply chain to &shop ugly& by using imperfect or surplus produce that would have otherwise gone to waste.

Technology will continue to play an increasingly critical role in how the food we eat is produced, how it is packaged, how it is delivered, how it tastes, feels and smells and how it is reused and repurposed. Investments in food tech will continue to increase to help deliver on the promise of healthier, more sustainable food systems for the world. After all, we are what we eat.

- Details

- Category: Technology

Read more: The present and future of food tech investment opportunity

Write comment (90 Comments)Page 562 of 5614

13

13