Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Chris Dixon, a general partner at Andreessen Horowitz, announced a new crypto-related startup school at TechCrunch Disrupt today in San Francisco.

Dixon says that the firm is not looking for equity, but really wants to provide a way to teach some best practices in the emerging field of crypto currency. &We are going to run a startup school for crypto-specific startups and what we&ve learned over the last 7 years as best practices in this category,& Dixon told TechCrunchJosh Constine on stage today.

The company doesn&t intend to charge any money, nor will it take any equity in the companies that participate. In Dixonwords, they are doing this to push the category forward and help crypto startups get going. He hopes that based on the good will of offering this education for free, that startups who participate may end up having a conversation with a16z about possibly getting an investment, but he made clear that this absolutely was not a requirement.

Last year, the firm made its commitment to crypto clear when it established a crypto fund run by Katie Haun. Dixon told TechCrunch at the time of that announcement that his firm had already invested in 20 crypto companies over the previous five years, including Ripple and Coinbase way back in 2013, prior to establishing a fund devoted to crypto.

The company has set up a page on the company website for companies interested in signing up for the crypto startup school.

- Details

- Category: Technology

Read more: Chris Dixon from a16z announces free crypto startup school at TechCrunch Disrupt

Write comment (97 Comments)

Actor and Hollywood media mogul Will Smith surprised the TechCrunch Disrupt SF 2019 audience this afternoon by announcing he would invest $10K in a startup that pitched to him onstage as part of an &elevator pitch& contest, where the winner would get to take a selfie with the star. The company, Socionado.com, helps companies with their social media presence. However, what got Smithattention was their well-delivered pitch, he said.

The startups didn&t get much time to prepare, having been plucked from the Startup Alley earlier in the day.

In addition to responding well to the pitch itself, Smith also liked the concept and the business model.

&As I built out my social media team, that was the idea — I wanted to take back my storytelling,& said Smith. &I think thathugely important.&

&That was really the best pitch so we&re gonna rock a selfie,& Smith said, jumping up to snap a photo with the founder.

Smithinvestment strategy isn&t usually this off-the-cuff, however.

Speaking onstage at the Disrupt conference, he also offered more details on his plans for Dreamers VC, the investment firm founded with Japanese soccer star Keisuke Honda, which was announced last year by Hondamanagement firm KSK Group.

Smith noted the firm has an interest in &doing good& with its funds — pointing, in particular, to an investment in &Boring tech.& (He actually means The Boring Company, per the Dreamers VC website, where itlisted alongside a host of others.)

He also offered a little background on how Dreamers VC came to be in the first place.

&Well, you know, I met with [Keisuke Honda] and we just hit it off immediately. And, you know, we felt like there was a beautiful intersection between being able to create businesses, but also to stay focused on solving problems of the world,& Smith explained. Honda already had banking relationships in Japan that were looking to make their way into the U.S.

&So the relationship worked out well,& he said.

Plus, Smith adds, &I had already been investing and he had already been investing and our values were in alignment. We want to solve some of the worldproblems. We want to do well by doing good.&

- Details

- Category: Technology

Read more: Will Smith just dropped $10K on a startup that pitched him on stage at Disrupt

Write comment (96 Comments)

It was a big day for startup Render, which participated in the TechCrunch Disrupt Startup Battlefield today. It also announced some upgrades to its managed cloud platform.

First of all, it announced the ability to spin up object storage in the cloud, while greatly simplifying the tasks associated with adding storage. CEO and founder Anurag Goel says that the storage option is something customers have been requesting, and as with their other services, they handle a lot of the heavy lifting for them.

&One of the things that our users want us to do next is to build out object storage. Even though they can use things like Amazon S3 and other cloud storage options, they know that Render is going to be easier for them to use. So they really want object storage, and they want everything in one place,& Goel explained.

If you want to do that today without Render, you would have to spin up a virtual machine in the cloud, attach the storage, set up backup schedules and take care of all of these other associated tasks, and what Render is doing with Render Disk is stripping that all away and managing the process for them.

While the startup was at it, it also developed a concept called infrastructure as code. This allows developers to define their infrastructure requirements in a YAML file. When the developer sends the file to GitHub, Render can build the infrastructure for the customer on the fly based on the contents of this file.

Finally, they are offering a one-click launch to customers. This could come in handy for companies that are offering free trials or open-source tools to enable users to launch their applications with a single click from GitHub and it will load all of the required files.

- Details

- Category: Technology

Read more: Render announces object storage service at TechCrunch Disrupt

Write comment (98 Comments)Brex, a Silicon Valley fintech darling, has lofty plans to battle big banks —and Stripe.

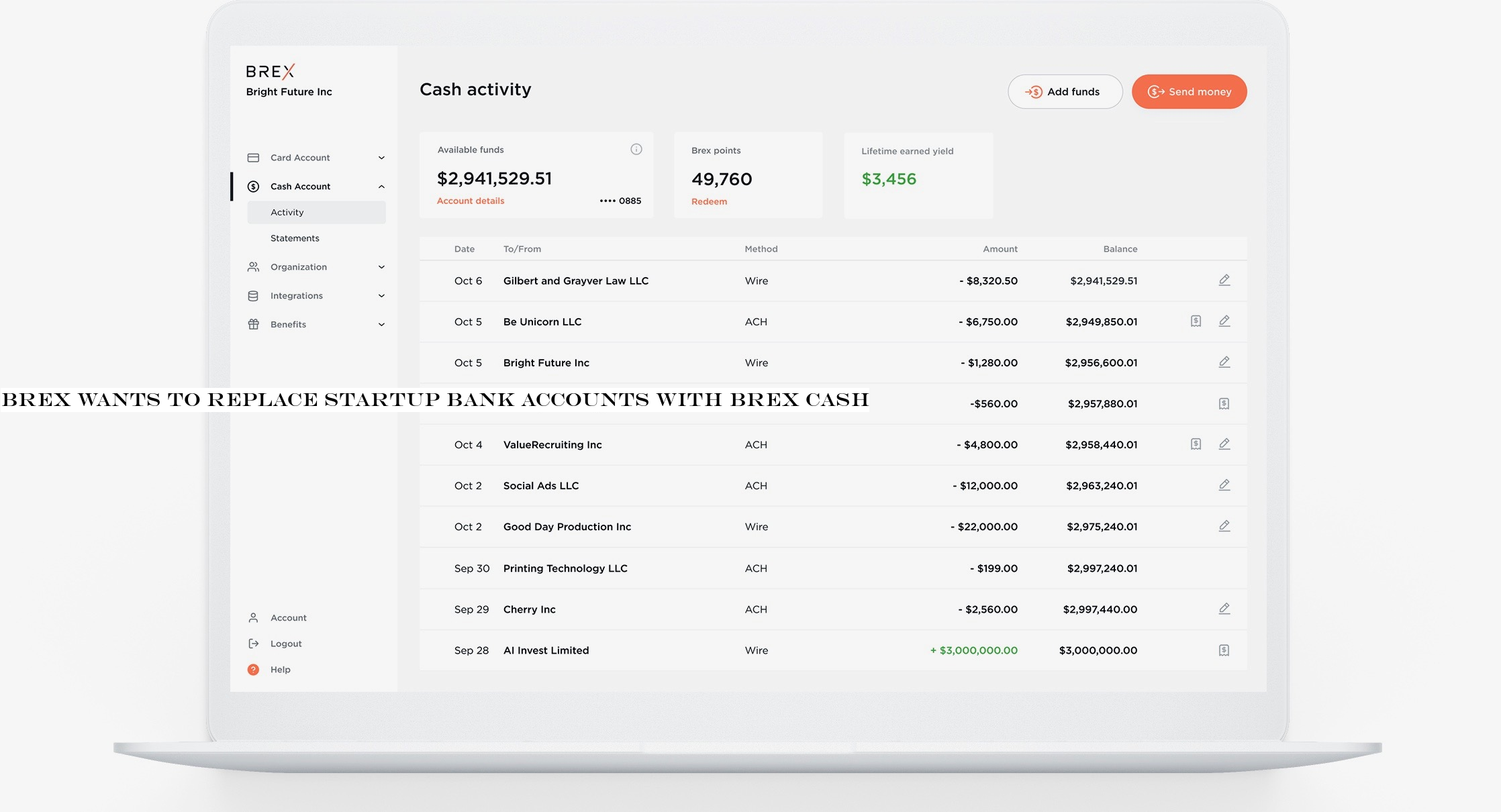

Code-named &Gemini,& Brex today announced a new product designed to replace and improve the functionality of traditional bank accounts. Brex Cash, as it will be known publicly, is a business cash management account integrated with the Brex Card, a corporate card for startups launched in 2018.

Brex tells us they&ve built the core banking infrastructure from scratch, allowing the company to forgo third-party processing fees and provide a much-needed tech infusion to antiquated banking systems. In partnership with BostonRadius Bank, Brex Cash will allow customers to send payments quickly and easily with no transaction fees attached. Rather, Brex plans to reward its users for making or receiving payments using Brex Cash with points redeemable for cash back, travel and air miles. Customers will also receive 1.6% yield on deposits.

Itnot a bank, but in practice, it can replace a bank, says Brex co-founder and co-chief executive officer Henrique Dubugras .

&Our idea is that new businesses —the new Y Combinator companies —we hope a big percent of them never open a bank account,& Dubugras tells TechCrunch.

Brex now has many similarities to a bank. What differentiates it is its lack of physical branches — itexclusively digital — and itinsurance. Traditional banks are insured by the Federal Deposit Insurance Corporation (FDIC), which protects up to $250,000 per depositor. Brex Cash users are protected by the Securities Investor Protection Corporation (SIPC), a nonprofit agency overseen by the U.S. Securities and Exchange Commission that protects up to $500,000 and specializes in protecting customers of brokerage firms from the loss of cash and securities.

Additionally, Brex invests its customers& money in a money market mutual fund of U.S. treasury bonds. &If Brex goes out of business, customers& money will be safe,& the company writes in a press statement. &The only scenario where money could be lost is if the U.S. government defaults.& [Update 10/2/2019: Brex says this quote alone is taken out of context, rather, the company was trying to communicate that it would take something like the U.S. government defaulting in order for Brex customers& money to become unsafe.]

Brex Cash user interface

&Itnot that we are inventing this — this model exists with Fidelity,& says Dubugras. &Fidelity isn&t necessarily a bank — we are bringing that concept to businesses to give lower fees, better interest rates, better experiences and more security.&

Brex, a graduate of the winter 2017 Y Combinator cohort, has quickly become a Silicon Valley success story for the ages. The rapid adoption of its startup credit card, which doesn&t require a personal guarantee, and its ability to issue cards instantly and provide higher limits than other options on the market has attracted thousands of customers and venture capitalists. The business, led by a pair of young Brazilian repeat entrepreneurs, including Dubugras and co-CEO Pedro Franceschi, has collected more than $300 million in equity funding, including a $100 million C-2 financing that valued the company at $2.6 billion earlier this year.

&There will always be customers that are skeptical, but I think by starting out with a card, we built a lot of trust,& Dubugras said. &It was us giving them money instead of them giving us money. A few years in … We think we&ve won a lot of credibility. Before, who was going to give their money to a random-ass startup called Brex?&

In the weeks ahead of TechCrunch Disrupt San Francisco, where Dubugras announced Brex Cash on Wednesday, the CEO told TechCrunch that Brex had no immediate fundraising plans and that they were &waiting for the right time& to raise again. As for whatnext, he said the company is discussing the launch of a debit card and plans to add another 100 employees in the next year, bringing the Brex headcount to 400.

The Brex news follows thelaunch of Stripe Capital, a new offering from payments behemoth Stripe that will make instant loan offers to customers on its platform, and the announcement of the Stripe Corporate Card. Akin to Brex, Stripe will issue a no-fee, no interest rate credit card intended for Stripe customers. Brex and Stripe, two Y Combinator grads, will go head-to-head in a battle for customers, particularly YC grads looking for friendly financial tools.

Immediately following Stripeannouncements, the business announced a $250 million funding at a $35 billion valuation. Brex may be following a similar playbook, announcing a major product on the heels of a large capital infusion.

Brex Cash represents a new era for the company. Though the product may be costly for Brex, it opens the business up to thousands more potential customers. Now, any startup, regardless of funding, can create a Brex account to store cash, explains Dubugras, and all companies using Brex Cash will be immediately issued a Brex corporate credit card.

&If you&re starting out, if you don&t have funding yet, you can still receive your payments using Brex,& Dubugras said. &Thata super big deal for us.&

Brex Cash was built under product lead Ritik Malhotra, who joined the team as part of an acquisition of his startup, Elph. Brex poached the company, which was focused on blockchain infrastructure, right out of YC for an undisclosed amount. In retrospect, the deal looks much more like an acqui-hire of Malhotra, who had the digital payments infrastructure acumen necessary to complete this project.

&Itan easy way to move money, which is the lifeblood of a business,& Malhotra tells TechCrunch of the new product.

Brex Cash is itself not a cash cow for Brex; rather, the startup makes money on purchases made on its corporate card, in which it charges the merchant, not the customer. This model is particularly beneficial when its customers are spending a lot of money, growing quickly and raising capital. In a downturn, however, this model isn&t as attractive.

Brex seems unconcerned with the possibility of an impending recession. Brex writes that even in downturns, entrepreneurs will start companies and attempt to raise money. The Brex Cash product, regardless of the economy, will help Brex better underwrite Brex Cards, as it gives them better access to a customerfinancial health.

In a battle against Stripe, Brex is at a disadvantage. At only two years old, the company may have garnered a lot of credibility in a short time but it doesn&t have the decade of experience building fintech products that Stripe has and, more importantly, it doesn&t have 10 years of customer loyalty.

- Details

- Category: Technology

Read more: Brex wants to replace startup bank accounts with Brex Cash

Write comment (97 Comments)

Tesla said Wednesday it delivered a record 97,000 electric vehicles in the third quarter, a nearly 2% increase from the previous period, but still short of analysts& expectations.

Tesla shares fell nearly 6% in after market trading on the news.

The company reported Wednesday that it produced 96,155 vehicles in the third quarter, a 10% increase from the previous period. Tesla has shown steady improvement in its production numbers over the past several quarters. Tesla produced 86,555 vehicles in the fourth quarter of 2018 and then dropped to 77,100 in the first period of the year. Numbers rebounded to 87,048 vehicles in the second quarter of 2019.

Analysts expected Tesla to deliver 99,000 vehicles during the third quarter, according to estimates compiled by FactSet.

Despite hitting record numbers and showing the ability to push production higher, the numbers still weren&t able to meet CEO Elon Musk lofty targets. Musk had said in a leaked email that the company could produce 100,000 vehicles in the third quarter.

Tesla said Wednesday it received record net orders in the third quarter and is entering the fourth quarter with an increase in its order backlog. Tesla added that were received from customers who did not hold a reservation.

Herea look back at the past several quarters of deliveries.

Tesla delivered 95,200 vehicles in the second quarter, a dramatic pop from the companyfirst-quarter delivery numbers when it reported deliveries of 63,000 vehicles, nearly a one-third drop from the previous period. The low first-quarter delivery numbers signaled what was to come: wider-than-expected lossof $702 million driven by disappointing delivery numbers, costs and pricing adjustments to its vehicles.

- Details

- Category: Technology

Read more: Tesla delivers a record 97,000 electric vehicles in third quarter

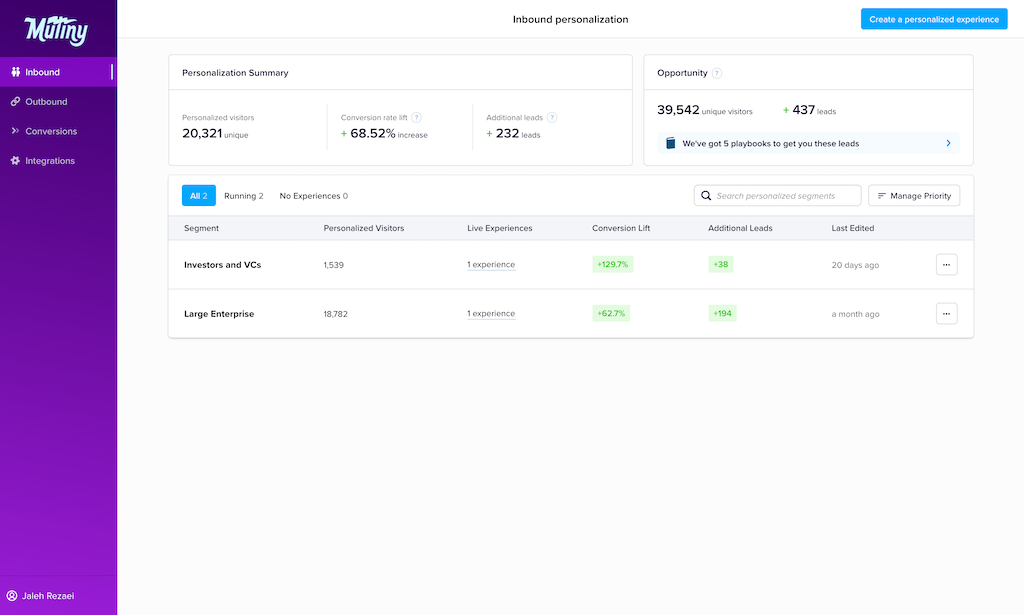

Write comment (92 Comments)Mutiny, a personalized marketing startup for businesses that sell to other businesses, is taking the stage today at TechCrunchStartup Battlefield, where itannouncing new funding and new features.

CEO Jaleh Rezaei told me that she and co-founder Nikhil Mathew created Mutiny to solve a problem they saw as early employees at HR services company Gusto — trying to personalize their messages to different sales prospects.

With Mutiny, they&ve built easy-to-use tools allowing marketers to show different landing pages to different customers. To do this, the product draws on pre-built data integrations to identify customer segments, then allows customers to use a visual editor to build different versions of landing pages for those segments.

&When we think about the B2B journey, it has changed quite a bit,& Rezaei said. &Today, 67% of that B2B buyerjourney is online. Without engineering, itreally hard to change that journey and have an impact. Whatexciting about Mutiny is we empower these great marketers to improve their customer experience without that constant dependence on technical teams.&

Mutiny waspart of the Summer 2018 class at accelerator Y Combinator. Rezaei said that shortly after demo day, the startup raised $3 million in funding from Cowboy Ventures, Uncork Capital and various angel investors.

Itsince added features to support targeted, account-based marketing. Rezaei said Mutiny pulls account data from Salesforce, cleaning it up and surfacing it, so that when a prospective customer responds to your marketing, they could end up on a landing page showing their own name, title and company.

For example, Brex is creating landing pages for its email marketing campaigns, where each page shows the recipientname and company; Gusto is tailoring landing pages based on the AdWords search terms that brought a prospective customer to that page; and Amplitude is customizing landing pages based on company size and other attributes.

As a result, Mutiny saysBrex has seen a 200% lift in outbound leads, while Amplitude has increased all inbound leads by more than 40%. (Other customers include Segment, Carta, TripActions and Elastic.)

Today, Mutiny is also announcing that it will offer personalized recommendations to marketers. So if all these ideas are new to you, the product can recommend specific customer segments that you should consider personalizing for based on things like your traffic data and conversion data.

Mutiny can also create entire &playbooks,& recommending not just the segment to personalize, but what that personalized experience should look like for that segment.

&The goal of Mutiny is always to make personalization really easy and really guided,& Rezaei said.

- Details

- Category: Technology

Read more: Mutiny creates personalized plans for B2B marketing

Write comment (96 Comments)Page 740 of 5614

14

14