Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Render, a participant in the TechCrunch Disrupt SF Startup Battlefield, has a big idea. It wants to take on the worldbiggest cloud vendors by offering developers a cheaper alternative that also removes a lot of the complexity around managing cloud infrastructure.

Render goal is to help developers, especially those in smaller companies, who don&t have large DevOps teams, to still take advantage of modern development approaches in the cloud. &We are focused on being the easiest and most flexible provider for teams to run any application in the cloud,& CEO and founder Anurag Goel explained.

He says that one of the biggest pain points for developers and startups, even fairly large startups, is that they have to build up a lot of DevOps expertise when they run applications in the cloud. &That means they are going to hire extremely expensive DevOps engineers or consultants to build out the infrastructure on AWS,& he said. Even after they set up the cloud infrastructure, and move applications there, he points out that there is ongoing maintenance around patching, security and identity access management. &Render abstracts all of that away, and automates all of it,& Goel said.

Itnot easy competing with the big players on scale, but he says so far they have been doing pretty well, and plan to move much of their operations to bare metal servers, which he believes will help stabilize costs further.

&Longer term, we have a lot of ideas [about how to reduce our costs], and the simplest thing we can do is to switch to bare metal to reduce our costs pretty much instantly.& He says the way they have built Render will make that easier to do. The plan now is to start moving their services to bare metal in the fourth quarter this year.

Even though the company only launched in April, it is already seeing great traction. &The response has been great. We&re now doing over 100 million HTTP requests every week. And we have thousands of developers and startups and everyone from people doing small hobby projects to even a major presidential campaign,& he said.

Although he couldn&t share the candidatename, he said they were using Render for everything including their infrastructure for hosting their web site and their back-end administration. &Basically all of their cloud infrastructure is on Render,& he said.

Render has raised a $2.2 million seed round and is continuing to add services to the product, including several new services it will announce this week around storage, infrastructure as code and one-click deployment.

- Details

- Category: Technology

Read more: Render challenges the cloud’s biggest vendors with cheaper, managed infrastructure

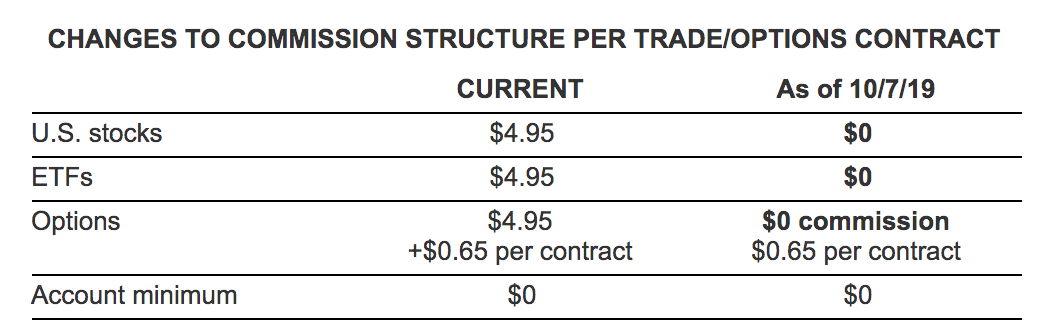

Write comment (93 Comments)The biggest players in online stock trading all just copied Robinhood by removing their fees for stock and ETF trading. Charles Schwab announced yesterday it would drop its $4.95 fee, leading to plummeting share prices for it as well as competitors. By the end of yesterday, Ameritrade announced it too would axe its $6.95 fees, and then E*Trade followed suit this morning killing off its own $6.95 fee. However, none of their share price recovered.

From yesterday before Schwabannouncement through now, Schwab fell 12%, from $41.84 to $36.54; E*Trade fell 19%, from $43.69 to $35.20; and Ameritrade fell 28%, from $46.70 to $33.54. Clearly investors aren&t thrilled that these financial giants are bowing to pressure from a measly startup.

Yet the move could definitely hurt growth for the $7.6 billion-valued fintech upstart Robinhood. It has relied on the free stock trades to pull in users that it then monetizes with its Robinhood Gold subscription to premium services, including the ability to trade on margin by temporarily borrowing money from the company.

Schwab drops its fees

&The changes taking place across the brokerage industry reflect a focus on the customer that‘s been inherent to Robinhood since the beginning,& said a spokesperson for the startup. &We remain focused on offering intuitively designed products that reduce barriers to our financial system, including account minimums and commission fees.&

Robinhood was hoping a high 3% interest rate checking account feature announced in December might help differentiate it from online stock brokerages. But after it prematurely launched the checking product without proper insurance, massive backlash ensued and the company announced it would shelve and rethink the idea. But that hiccup didn&t stop it from raising another $323 million this July to bring its total raised to $862 million. Its young user base and cryptocurrency exchange could give it potential that aged trading platforms lack.

- Details

- Category: Technology

Read more: Lookout, Robinhood. E*Trade, Schwab, Ameritrade go zero-fee

Write comment (98 Comments)Meet Sendmi, a fintech startup that is launching today in the Startup Battlefield at TechCrunch Disrupt SF. Sendmi works pretty much like a 401k or a Flexible Spending Account. But instead of saving money for later, you set it aside to send it to your family abroad.

And this mix of payroll and remittance is what sets Sendmi apart from the countless foreign exchange services out there. It could be particularly valuable for people living paycheck to paycheck as you don&t have to take money out of your bank account to send it abroad.

Sendmi wants to sell its service to companies directly. When companies choose to partner with Sendmi, they can then offer Sendmi as a perk to their employees. And theresome form of trust between an employer and its employees.

After that, employees can make a payroll election and decide the amount of post-tax payroll that they move to their Sendmi account.

And because all funds come from your paycheck directly, Sendmi reduces exposure to money laundering mechanisms. Many services, such as TransferWise or Western Union, have to ask you where the money is coming from to make sure that it wasn&t generated from illegal activities.

You can then connect to your Sendmi account at any time from the companymobile app to transfer some money. Right now, Sendmi supports transfers between the U.S. and Mexico, but the startup is already working on adding support to more corridors.

Sendmi has set up partnerships in the U.S. and Mexico so that your recipient receives money in just a few minutes. Eventually, the startup wants to offer additional financial services in the Sendmi app, such as insurance services, consumer lending, etc.

The company currently has 9 employees. It is officially launching its product today, but Sendmi has been testing it with a few clients already. The startup has raised $3.1 million so far.

- Details

- Category: Technology

Read more: Sendmi lets you allocate part of your paycheck for remittance

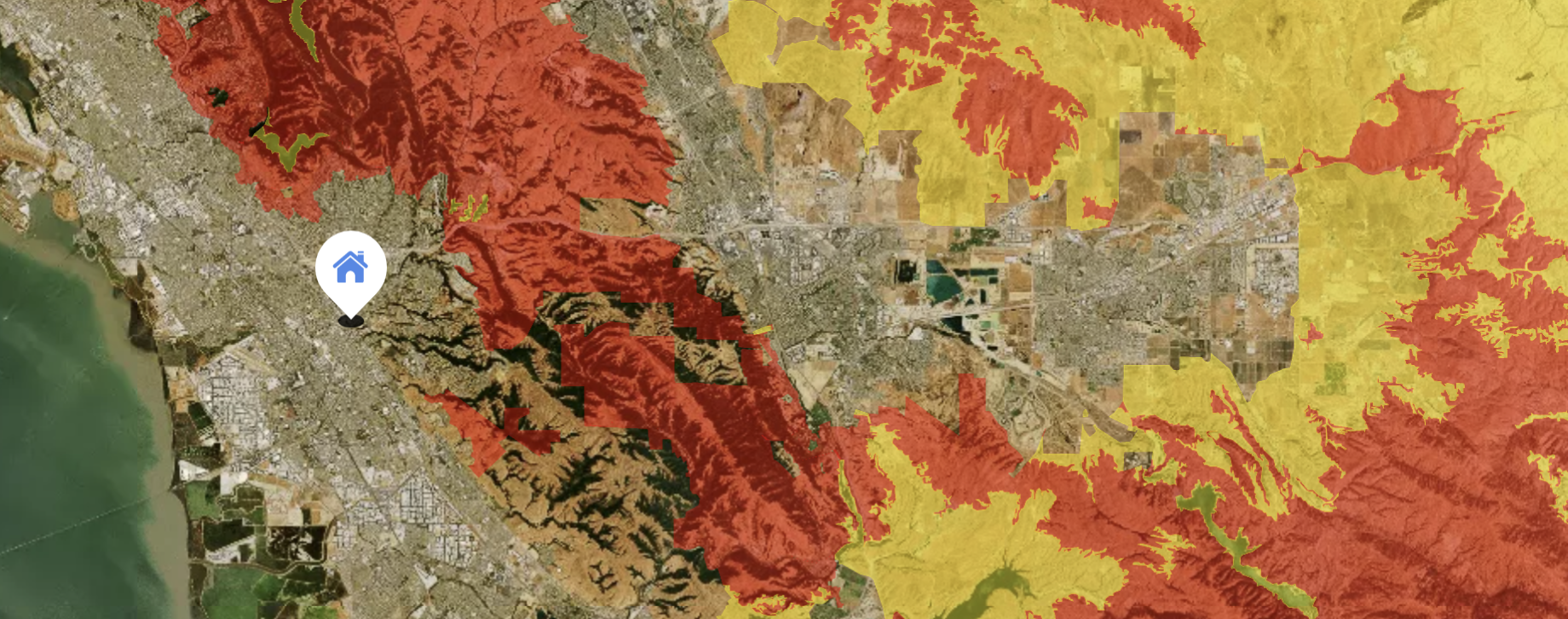

Write comment (95 Comments)If your home is in a wildfire area, insurance companies tend to not want to go anywhere near it.

But &wildfire areas& tend to be pretty broad. What if companies could evaluate the risk on a more granular level — tapping things like satellite imagery and machine learning combined with wind, weather and topology data, to better define the riskiest zones? Could more home owners be offered policies, and at more affordable rates?

Thatthe idea behind Delos, a company presenting at the TechCrunch Disrupt SF Startup Battlefield today.

Delos itself doesn&t act as the insurer; instead, it acts as a Managing General Agent (or MGA) for a bunch of major carriers. They analyze regions that have been broadly swept into the &wildfire area& label, with their proprietary models looking for houses that they believe have been mis-categorized. Delos reaches out to these customers, receiving a commission/profit share on any policies they sign.

The company is focusing on California first, noting that the one state accounts for half of the countrywildfires. According to CalFire, there have been over 5,000 fires in California in 2019 alone. After wildfires, Delos plans to expand to modeling hurricane risk.

Delos also regularly sends policy holders a list of things they can do to harden and protect their homes against wildfires, such as cutting back trees that overhang your home, or switching to ignition-resistant building materials. If their latest satellite imagery shows dry vegetation creeping up the hillside behind your house, they can give you a heads up of the increasing risk.

Co-founders Kevin Stein and Shanna McIntyre both have rich backgrounds in aerospace. Kevin got a Masters in Aerospace Engineering from Stanford before working as a Mechanical Systems Engineer at Space Systems/Loral, while Shanna studied physics at Berkeley before spending 11 years as an engineer at Lockheed Martin.

Stein says that he believes about 18 million homes in the U.S. are mis-categorized.

- Details

- Category: Technology

Read more: Delos uses satellite imagery and AI to help homeowners in wildfire areas get insurance

Write comment (99 Comments)At some unspecified time, somewhere down the road, Traptic would love to expand its robots to pick a wide variety of crops. For now, however, the South Bay-based team is focused solely on strawberries.

With roughly 88 percent of the fruittotal U.S. yield occurring in California, the berries represent ample opportunity for disruption. A manual labor shortage exacerbated by tightening immigration policies has contributed to a good deal of waste. Farmers apparently lose around one-fifth of crops, due to a lack of hands.

Automation has, of course, been applied to a number of different staple crops. Things like wheat and corn are routinely harvested by machines — and have been for a long time. Strawberries and other fruits, on the other hand, present a unique challenge. They&re just too delicate for most machines, requiring instead the deft touch of human pickers.

Traptic, one of the startups competing in this yearDisrupt Battlefield, however, is tackling the issue head on with a purpose-built robot. Comprising an off-the-shelf robotic arm and custom gripper and software, the companydevice is for the function of helping to improve strawberry yields.

The arm is housed inside a space on a cart surround on five of six sides. The vision system utilizes 3D cameras and neural networks to spot strawberries and distinguish ripe from unripe. Itcapable of determining their position within a millimeter and then goes about plucking.

The custom gripper, however, is probably the most unique element on board. Sure, there are plenty of off-the-shelf grippers available to roboticists, but for the aforementioned reasons, Traptic needed one that was rigid enough to pluck the berries, but gentle enough to not smash a ripe one in the process.

What the company ultimately settled on was a gripper that was neither fully rigid, nor soft. The metal base of the claws is augmented by rubberized bands that have enough give to conform to the fruits& irregular shapes, while holding them snuggly enough to remove them from the plant.

Trapticcurrent machine is Ceres, a large enclosure towed behind a tractor. Itcurrently being tested by growers in both Northern and Southern California — distinct climates that allow for year-round strawberry growing.

To start, at least, the company anticipates that the robot will augment, rather than replace, pickers. Ultimately, however, such a device could replace human workers in the field. Traptic is certainly working to make that a tempting proposition by leasing the machine (&harvesting-as-a-service&) at a per-pound rate similar to what is currently paid out to human workers. Between a growing population and a strained workforce, however, such a promise could still be a ways away.

Traptic also has its sights set on a number of other potential crops — oranges, melons and peppers are all currently on the list.

- Details

- Category: Technology

Read more: Traptic uses 3D vision and robotic arms to harvest ripe strawberries

Write comment (99 Comments)

Thousands of miles away from the U.S., where technology giants, cable networks, and studios are locked in an intense multi-billion dollar battle to court users to their video streaming services, a startup in Bangladesh has already won the local video streaming market.

And it did all of this in six years with just $10 million. And italso profitable.

Ahad Mohammad started Bongo in 2013. The on-demand video service began life as a channel on YouTube in 2014 before expanding as a standalone app to users a year later.

Of the 96 million people in Bangladesh who are online today, 75 million of them are subscribed to either BongoYouTube channel or to its app, Ahad said.

Bongodomination in Bangladesh is second to none in the nation. iFlix, which raised $50 million a few months ago to expand its presence in several Asian markets, and IndiaZee5 are among the players that Bongo competes with, though their market share remains tiny in comparison.

TechCrunch caught up with Ahad to get an insight into the early days of building Bongo and what holds next for the &Netflix of Bangladesh& as it increasingly expands to international markets.

- Details

- Category: Technology

Page 741 of 5614

20

20